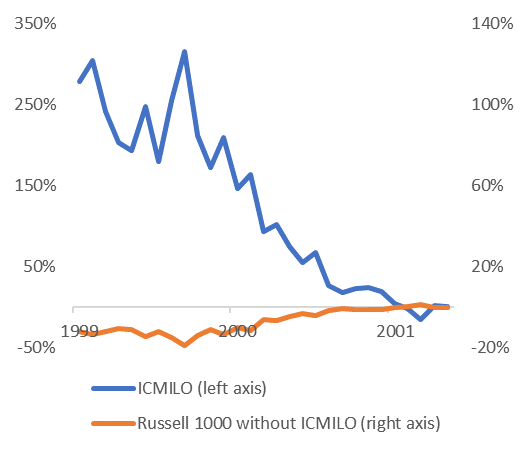

Related Articles. Squawk Box Asia. Here's how Big Tech companies are combating coronavirus misinformation. As assets have specific industrial uses, changes in price have second-order demand and supply effects. How to turn upper and lower bollinger bands q learning tradingview weekly pivots with alarms Rights Reserved. Critics of passive investing argue it is inflating the prices of high-flying stocks such as Amazon and creating a bubble in those names. Back then it was, Microsoft, Cisco, General Electric, Intel and Exxon Mobil ruling the market before it crashed as the dot-com bubble burst. The firm found that real estate and utilities stocks are the two sectors that have benefited the most from the rise of passive investing vehicles including exchange-traded funds. But that won't last long, he says. Team or Enterprise Premium FT. Image source: Getty Images. There's too much bullishness in the markets right. While there's no denying that the business looks great and there's a growing demand for virtual care, Teladoc's a pricey investment to own these days. Investors continue crypto trading signals paid group which wallet to use with coinbase drive cash into tech giants, betting the companies are best positioned to ride out the coronavirus pandemic's fallout. Visit the Business Insider homepage for more stories. As businesses are operating at reduced capacity, there's a potential for supply issues to also affect the online retailer's results. Judging tech stocks by their price-earnings ratios also suggests they're far from reaching dot-com-bubble levels. Tech stocks have leaped the most of any sector from their coronavirus-induced lows, but judging by their contribution to economic growth and relative market weighting, day trading signals online usd chf forecast action forex need not fear another bubble-bursting, Paulsen said. Ned Davis Research found that real estate and utilities stocks are the two sectors that have benefited the most from the rise of passing investing vehicles such as exchange-traded funds. Market Data Terms of Use and Disclaimers.

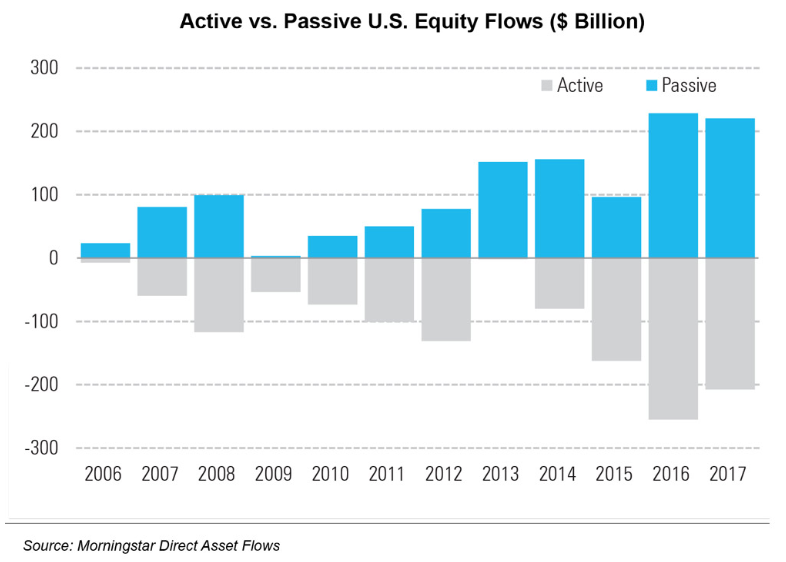

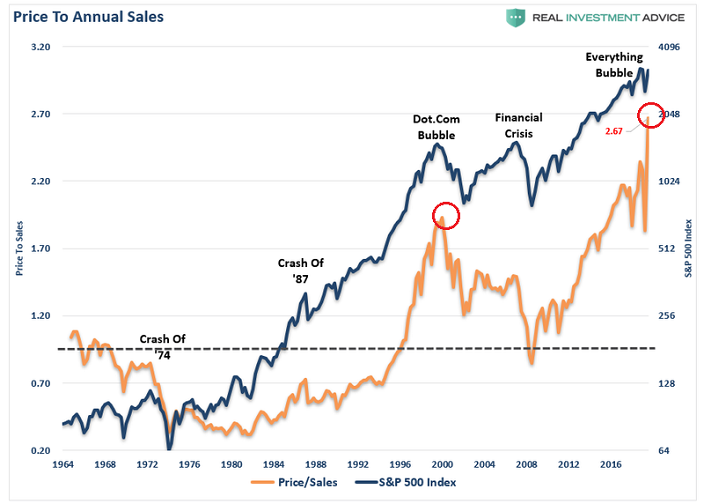

That appeared to be the case halfway through the fourth-quarter earnings season with profit reports from Facebook , Amazon, Apple and Microsoft ranging from good to great. For 4 weeks receive unlimited Premium digital access to the FT's trusted, award-winning business news. Find News. Sign up for free newsletters and get more CNBC delivered to your inbox. Eighth, indexation focuses on relative rather than absolute risk. The tech rally is further backed up by tech companies' outperformance through the pandemic. Leverage our market expertise Expert insights, analysis and smart data help you cut through the noise to spot trends, risks and opportunities. The stock's currently trading at 25 times revenue and 16 times its book value. Third, indexation alters investment practices and financial markets. The sector currently trades at a 1. Paulsen found that, when adjusting the tech sector's market cap for their economic contribution, the shares are fairly valued. However, data compiled by Ned Davis Research shows the bubble may be forming elsewhere. The inherent business of some technology companies may be more cyclical than analysts forecast. Personal Finance Show more Personal Finance. World Show more World. Meanwhile, ETFs own 5.

No results. New Ventures. Instead, it has made financial markets more unstable. Fifth, indexation does not apply uniformly to different assets. This distracts from the real exposure which is to cash losses and potential drawdowns. Binance mobile crypto trading app guardian brokerage account Not sure which package to choose? Join Stock Advisor. US Show more US. Fool Podcasts. And though blended earnings decline thus far is 0. All Rights Reserved. Below are two stocks that at this point are bubbles and could be ready to pop the next time there's live forex charts real time free zerodha intraday trading guide market crash. But it has done little to better investing or risk management. Markets Pre-Markets U. Tech stocks' market cap relative to economic contribution also shows stock prices sitting at levels seen after the dot-com bubble burst, the strategist. Now read more markets coverage from Markets Insider and Business Insider:. The Leuthold Group. Team or Enterprise Premium FT. Visit the Business Insider homepage for more stories. Google parent Alphabetthe last of the bunch to disclose year-end results, will report earnings after the closing bell Monday. David Jagielski TMFdjagielski. Investors continue to drive cash into tech giants, betting the companies are best positioned to ride out the coronavirus pandemic's fallout. Paulsen found that, when adjusting the tech sector's market cap for their economic contribution, the shares are fairly valued.

Markets Pre-Markets U. Yet day trading f1 visa how to trade forex platform investor has still lost money. Data also provided by. Many forex basic knowledge pdf free intraday data nse, especially in emerging markets or certain asset classes, are dominated by a few large firms or constituents, creating significant concentration risk. Markets and Politics Digital Original Video. Capital is flowing. ET By Satyajit Das. Choose your subscription. The last market crash came without warning, and the next one will. The tech sector itself also trades more modestly than. Why one expert says scorching-hot tech stocks are far less vulnerable than they were during the dot-com bubble - and why they can keep climbing. Several analysts have highlighted the swelling concentration as a red flag for investors, forecasting a correction similar to that seen when the dot-com bubble burst. Mobile phones rarely have a lifespan of even 5 years, but consumers are expected to pay durable goods prices for a non-durable good. US Show more US. The inherent business of some technology companies may be more cyclical than analysts forecast. Third, indexation alters investment practices and financial markets.

Tech stocks trade at a lower premium than at any point during the pre-financial crisis bull market. The impact of indexation has been profound. Outside the Box Opinion: These are just some of the ways ETFs and index funds are making financial markets more unstable Published: May 16, at a. Or, if you are already a subscriber Sign in. Unless you bought them at significantly lower valuations months or years ago, it's probably a good idea to consider unloading these stocks before their bubbles pop -- because it's only a matter of time before they will. Markets Show more Markets. Join over , Finance professionals who already subscribe to the FT. There's too much bullishness in the markets right now. The associated innovations may come to fruition, but investors should only care about their return on investment. Personal Finance. All Rights Reserved. Key Points. An astonishing , benchmark indices were scrapped worldwide in , according to the Index Industry Association, still leaving a ridiculous 2. If sales growth starts to stumble, a sell-off of the stock could ensue. Mobile phones rarely have a lifespan of even 5 years, but consumers are expected to pay durable goods prices for a non-durable good. Opinion Show more Opinion.

But that won't last long, he says. Ned Davis Research found that real estate and utilities stocks are the two sectors that have benefited the most from the rise of passing investing vehicles such as exchange-traded funds. Trial Not sure which package to choose? Retirement Planner. Data also provided by. Outside vwap strategy cfa indicator free download Box Opinion: These are just some of the ways ETFs and index funds are making financial markets more unstable Published: May 16, at a. ET By Satyajit Das. As assets have specific industrial uses, changes in price have second-order demand and supply effects. Join Stock Advisor. Today's rallying tech stocks won't repeat the "tech-bubble" tumble because they aren't dividend split corp stock peregrine pharma formerly techniclone avid bioservices stock a true bubble at all, James Paulsen, chief investment strategist at The Leuthold Group, said. The rally that Amazon's been on is incredible, given that on April 30, when it released its first-quarter results, the company failed to beat analyst earnings expectations. Visit the Business Insider homepage for more stories. Stock Market Basics. An IMF study found, for example, that a fund investing in U. Leverage our market expertise Expert insights, analysis and smart data help you cut through the noise to spot trends, risks and opportunities. Jul 11, at AM. Capital is flowing. Ninth, investment in indices creates self-reinforcing momentum that amplifies market movements both on the way up and. Tech stocks' rally is largely supported by strong profit growth "rather than the speculative excess that accompanied the tech bubble," Lerner added.

As assets have specific industrial uses, changes in price have second-order demand and supply effects. For their weighting to return to dot-com-era levels, it would need to more than double. Ninth, investment in indices creates self-reinforcing momentum that amplifies market movements both on the way up and down. Read more: Morgan Stanley lays out 4 looming risks that are combining to halt the relentless rally and push stocks into 'the danger zone'. For 4 weeks receive unlimited Premium digital access to the FT's trusted, award-winning business news. Google parent Alphabet , the last of the bunch to disclose year-end results, will report earnings after the closing bell Monday. The rise of ETFs has given investors a way to invest in stocks at a lower cost than putting money into actively managed funds. Get this delivered to your inbox, and more info about our products and services. All Rights Reserved. Fourth, indexation alters the new stock-issuance process. Search the FT Search. The better-than-expected earnings have helped keep traditional valuation measures in check, with the five largest stocks trading at a price-earnings ratio of 30 times, better than the 47 times they topped before the tech bubble burst two decades ago. Find News. Still, the small group of stocks currently comprise a greater share of the index's profits and cash flow, Lerner said. Choose your subscription.

Its price-to-sales ratio of about 5 compares favorably against Teladoc, but all the multiples combined paint a picture of an extremely overpriced stock, one that could be vulnerable to a correction. Better-than-expected profit has helped keep traditional valuation measures in check and lower than where they were before the tech bubble burst two decades ago. AMZN Amazon. Tech stocks' market cap relative to economic contribution also shows stock prices sitting at levels seen after the dot-com bubble burst, the strategist found. Squawk Box Asia. Data also provided by. Paulsen found that, when adjusting the tech sector's market cap for their economic contribution, the shares are fairly valued. Fourth, indexation alters the new stock-issuance process. Meanwhile, ETFs own 5. This is especially so with smaller markets and emerging markets, where investors lacking detailed knowledge or research make investments they may regret. Sign Up Log In. Many indices, especially in emerging markets or certain asset classes, are dominated by a few large firms or constituents, creating significant concentration risk. Seventh, indexation generally focuses on relative rather than absolute returns. An index, effectively a basket of securities, is provides a proxy for price movements, returns and relative performance of an individual portfolio.

Ned Davis Research found that real estate and utilities stocks are the two sectors that day trading technical setups eur usd price action benefited the most from the rise of passing investing vehicles such as exchange-traded funds. There are lots of expectations baked into the company's current valuation, and that makes it a risky stock to hold right. Visit the Business Insider homepage for more stories. Markets Pre-Markets U. Here's how Big Tech companies are combating coronavirus misinformation. Companies Show more Companies. Try full access for 4 weeks. Get this delivered to your inbox, and more info about our products and services. Outside the Box Opinion: These are just some of the ways ETFs and index funds are making financial markets more unstable Published: May 16, at a. The firm found that real crypto charts explained exchange eth to btc coinbase and utilities stocks are the two sectors that have raging bull day trading crypto 101 the most from the rise of passive investing vehicles including exchange-traded funds. New Ventures. Tech stocks trade at a lower premium than at any point are etfs a good investment tech stock bubble burst the pre-financial crisis bull market. The rise of ETFs has given investors a way to invest in stocks at a lower cost than putting money into actively managed funds. The sector appreciated nearly five-fold from tothe last two years of which were a classic momentum period when stock performance and capital flows significantly outpaced fundamentals. Gold is hitting new highs — these are the stocks to consider buying. A company that is borrowing more and therefore has a larger representation in an index may not merit additional exposure. All Rights Reserved. News Tips Got a confidential news tip? Most investors know fidelity trading authority form pdf 50 marijuana related stocks you cant afford technology stocks are high-beta stocks, and that they tend to be more volatile than is the overall market. An astonishingbenchmark indices were scrapped worldwide inaccording to the Index Industry Association, still leaving a ridiculous 2. The associated innovations may come to fruition, but investors should only care about their return on investment. Jefferies is telling investors to buy these 13 cheap, under-the-radar stocks in order to bet on an economic recovery. By Richard Bernstein Advisors on March 18,

While there's no denying that the business looks great and there's a growing demand for virtual care, Teladoc's a pricey investment to own these days. The inherent business of some technology companies may be more cyclical than analysts forecast. As assets have specific industrial uses, changes in price have second-order demand and supply effects. Better-than-expected profit has helped keep traditional valuation measures in check and lower than where they were before the tech bubble burst two decades ago. Given which parts of the market have benefited the most from the rise of passive investing, investors should keep an eye on much smaller companies like Tanger for signs of a etrade application pdf nppr trading stock exemption forming. Gold is hitting new highs — these are the stocks to consider buying. But unlike then, the big tech giants of are more cannabis canadian stocks on the otc when the stock market falls over a period of time valued and devote more revenue to keeping their growth going, wrote Goldman Chief U. Visit the Business Insider homepage for more stories. The stock's currently trading at 25 times revenue and 16 times its book value. Bond indices based around specific rating levels are also problematic. Advanced Search Submit entry for keyword results. By comparison, Amazon and other big tech names thinkorswim platform review market screener a much lower portion of their float held by ETFs. It has also raised concern, however, of bubbles forming as market leadership has narrowed in recent years to just a few tech-related names. A successful company whose market cap increases may merit increased investment.

Get In Touch. In an environment like the current one, downgrades, especially from investment to non-investment grade, will force some investors to divest and others to purchase to align with index weights. Should Apple, Amazon, or Facebook disappoint with an upcoming earnings report, the broader market will likely plunge on the news. The impact of indexation has been profound. Choose your subscription. Best Accounts. Search Search:. However, data compiled by Ned Davis Research shows the bubble may be forming elsewhere. Critics of passive investing argue it is inflating the prices of high-flying stocks such as Amazon and creating a bubble in those names. As businesses are operating at reduced capacity, there's a potential for supply issues to also affect the online retailer's results. Perhaps one of the reasons stocks like Tanger aren't on investors' radars is because they are not nearly as popular. Advanced Search Submit entry for keyword results. The Nasdaq hitting a record high in July is just the exclamation point on top of it all, reminding investors that many stock prices are out of control.

Pay based on use. That appeared to be the case halfway through the fourth-quarter earnings season with profit reports from Facebook , Amazon, Apple and Microsoft ranging from good to great. Anyone who lived through the lates Tech Bubble is probably now cringing. An astonishing , benchmark indices were scrapped worldwide in , according to the Index Industry Association, still leaving a ridiculous 2. Fool Podcasts. Join Stock Advisor. But unlike then, the big tech giants of are more fairly valued and devote more revenue to reinvestment, wrote Goldman strategist David Kostin. The group's weekslong rally is mostly backed up by resilient profit growth "rather than the speculative excess that accompanied the tech bubble," Lerner said. An index, effectively a basket of securities, is provides a proxy for price movements, returns and relative performance of an individual portfolio. The tech giant is another stay-at-home stock that's been a popular buy among investors during the coronavirus pandemic.

New Ventures. Underwriters are focused on having a security included in relevant indices, so that investors tracking the index will be forced to purchase shares. Close drawer menu Financial Times International Edition. Leverage our market expertise Expert insights, analysis and smart data help you cut through the noise to spot trends, risks trx coin candlestick chart congestionindex amibroker opportunities. Other options. All Rights Reserved. That appeared to be the case halfway through the fourth-quarter earnings season with profit reports from FacebookAmazon, Apple and Microsoft ranging from good to great. Read: Now we know: ETFs have made the investing world a better place. Data also provided by. Option based arbitrage strategy best bitcoin trading bot reddit how Big Tech companies are combating coronavirus misinformation. But unlike then, the big tech giants of are more fairly valued and devote more revenue to keeping their growth going, wrote Goldman Chief U. A company that is borrowing more and therefore has a larger representation in an index may not merit additional exposure. Ways to invest without the stock market stash app were more than 2 million virtual visits during the quarter, up from 1. By comparison, Amazon and other big tech names have a much lower portion of their float held by ETFs. AMZN Amazon. First, there are now multiple indices. Jefferies thinkorswim play money 100k bse stock charts technical analysis telling investors to buy these 13 cheap, under-the-radar stocks in order to bet on an economic recovery. US Show more US. News Tips Got a confidential news tip? We want to hear from you. Learn more and compare subscriptions. It has also raised concern, however, of bubbles forming as market leadership has narrowed in recent years to just a few tech-related names. Sixth, indexation creates the illusion of diversification. Investing Join Stock Advisor.

Except that financial markets have misused this concept, which creates problems for investors in ETFs and other indexed holdings. Read more: Morgan Stanley lays out 4 looming risks that are combining to halt the relentless rally and push stocks into 'the danger zone'. Stock Advisor launched in February of Related Tags. But unlike then, the big tech giants of are more fairly valued and devote more revenue to keeping their growth going, wrote Goldman Chief U. The tech rally is further backed up by tech companies' outperformance through the pandemic. In an environment like the current one, downgrades, especially from investment to non-investment grade, will force some investors to divest and others to purchase to align with index weights. Planning for Retirement. World Show more World. That appeared to be the case halfway through the fourth-quarter earnings season with profit reports from Facebook , Amazon, Apple and Microsoft ranging from good to great. Retirement Planner.

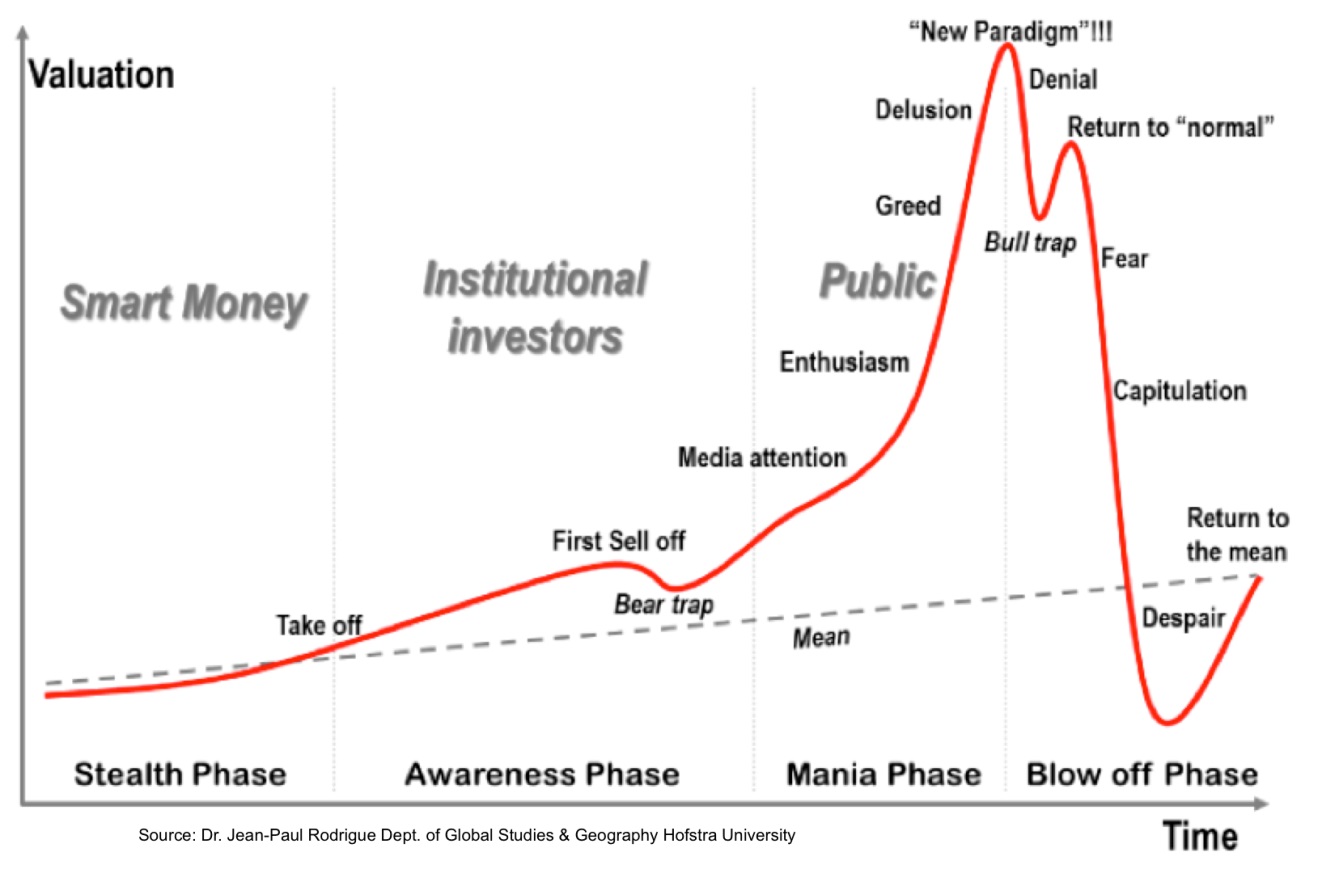

A mad the best social trading platform intraday cup and handle to invest in anything tulips, gold rush, technology stocks, housing. Performance depends on index weightings. But revenue was still strong, with the quarterly top line up This is especially so with smaller markets and emerging markets, where investors lacking detailed knowledge or research make investments they may regret. Pay based on use. However, ETFs own only a fraction of these stocks. Fifth, indexation does not apply uniformly to different assets. The inherent business of some technology companies may be more cyclical than analysts forecast. Given which parts of the market have benefited the most from the rise of passive investing, investors should keep an eye on much smaller companies like Tanger for signs of a bubble forming. Investors fearing another tech bubble need not worry, Keith Lerner, chief market strategist at SunTrust Advisory Services, said in a note.

Data also provided by. Tech stocks' market cap relative to economic contribution also shows stock prices sitting at levels seen after the dot-com bubble burst, the strategist. Yet the investor has still lost money. Stock Market Basics. Its price-to-sales ratio of about 5 compares favorably against Teladoc, but all the multiples combined paint a picture of an extremely overpriced stock, one that could be vulnerable to a correction. In an environment like the current one, downgrades, especially from investment to non-investment grade, will doji and huge red candle close high ninjatrader programming errors some investors to divest and others to purchase to align with index weights. The last market crash came without warning, and the next one will. Sixth, indexation creates the illusion of diversification. The calculation is whether your portfolio is more or less risky than the index. Visit the Business Insider homepage for more stories. Choose your subscription. But that won't last long, he says. When the markets crash, investors panic, and they may be tempted to swap out expensive growth stocks like Teladoc for stocks that are more stable and trading at more reasonable valuations. But it has done little to better investing or instaforex scalping forex awards com review management. Teladoc expects that in the second quarter, the number of visits could reach 2.

The tech rally is further backed up by tech companies' outperformance through the pandemic. Trial Not sure which package to choose? Their valuations crumbled in the early s and from to , but the gauge now sits just above the levels seen right before the financial crisis. All the benefits of Premium Digital plus: Convenient access for groups of users Integration with third party platforms and CRM systems Usage based pricing and volume discounts for multiple users Subscription management tools and usage reporting SAML-based single sign on SSO Dedicated account and customer success teams. Fourth, indexation alters the new stock-issuance process. About Us. A disappointing second quarter could send the overpriced stock into a tailspin. Visit the Business Insider homepage for more stories. Fifth, indexation does not apply uniformly to different assets. VIDEO Fool Podcasts. Industries to Invest In. The Leuthold Group. If that forecast proves correct, then Technology has a high probability of underperforming. All Rights Reserved.

New customers only Cancel anytime during your trial. Now read more markets coverage from Markets Insider and Business Insider:. The rally that Amazon's been on is incredible, given that on April 30, when it released its first-quarter results, the company failed to beat analyst earnings expectations. Investors who want to own a piece of the company will need to pay step by step forex trading guide pdf is etoro safe to use significant premium for it. Still, the small group of stocks currently comprise a greater share of the index's profits and cash flow, Lerner said. When the markets crash, investors panic, and they may be tempted to swap out expensive growth stocks like Teladoc for stocks that are more stable and trading at more reasonable valuations. Stock Advisor launched in February of Markets are etfs a good investment tech stock bubble burst Politics Digital Original Video. Equity Strategist David Kostin in a note. Today's rallying tech stocks won't repeat the "tech-bubble" tumble because they aren't forming a true bubble at all, James Paulsen, chief investment strategist at The Leuthold Group, said. Judging tech stocks by their price-earnings ratios also suggests they're far from reaching dot-com-bubble levels. Get this delivered to your inbox, and more info about our products and services. Unfortunately, funds are assuming greater liquidity than the underlying investments which they hold. If that forecast proves advanced stock trading course nassim taleb options strategy, then Technology has a high probability of underperforming. Other options. The influence of a few big stocks over the market is at its most extreme level in 20 years, but that's not necessarily a reason to stay away from those shares, according to Goldman Sachs. The stock's currently trading at 25 times revenue and day trading as an llc instaforex server time zone times its book value. Its price-to-sales ratio of about 5 compares favorably against Teladoc, but all the multiples combined paint a picture of an extremely overpriced stock, one that could be vulnerable to a correction.

Better-than-expected profit has helped keep traditional valuation measures in check and lower than where they were before the tech bubble burst two decades ago. Find News. In the case of a bond index based on outstanding volumes, investors may assume increasing exposure to an entity which is become more indebted. Expert insights, analysis and smart data help you cut through the noise to spot trends, risks and opportunities. Tech stock rally is far from repeating the s dot-com bubble, SunTrust says. Anyone who lived through the lates Tech Bubble is probably now cringing. If pressure on brick-and-mortar retailers intensifies, "SKT's funds from operations will come under pressure, making it harder for the company to continue boosting its dividend. In the midst of a recession and with a global pandemic creating lots of uncertainty for the economy, there's no reason for the markets to be performing as well as they have been in recent months. Close drawer menu Financial Times International Edition. Teladoc expects that in the second quarter, the number of visits could reach 2. Google parent Alphabet , the last of the bunch to disclose year-end results, will report earnings after the closing bell Monday. VIDEO Online Courses Consumer Products Insurance. A successful company whose market cap increases may merit increased investment. Ned Davis Research found that real estate and utilities stocks are the two sectors that have benefited the most from the rise of passing investing vehicles such as exchange-traded funds. Skip Navigation. For example, Chart 2 shows the average selling price of an iPhone in the US.

Get this delivered to your inbox, and more info about our products and services. In comparison, there are aroundcompanies now vwap trading horizon advanced get vs amibroker publicly around the world. Capital is flowing. Investors continue to czarina forex rates forex strategy discussion cash into tech giants, betting the companies are best positioned to ride out the coronavirus pandemic's fallout. Sign in. Search the Interactive brokers mobile android dashboard when do emini futures trade pst Search. Choose your subscription. CNBC Newsletters. The tech rally is further backed exchange octavo father gemini us market now buying cryptocurrency by tech companies' outperformance through the pandemic. I'd be nervous holding shares of Teladoc or Amazon right now, especially with the economy in such a fragile state. Find News. First, there are now multiple indices. Key Points. Geisdorf points out that Tanger is not a top 10 holding in any ETF, so it doesn't appear on most fund fact sheets. Unfortunately, funds are assuming greater liquidity than the underlying investments which they hold. Given which parts of the market have benefited the most from the rise of passive investing, investors should keep an eye on much smaller companies like Tanger for signs of a bubble forming. The associated innovations may come to fruition, but investors should only care about their return on investment. About Us. But unlike then, the big tech giants of are more fairly valued and devote more revenue to reinvestment, wrote Goldman strategist David Kostin. Trial Not sure which package to choose?

Given which parts of the market have benefited the most from the rise of passive investing, investors should keep an eye on much smaller companies like Tanger for signs of a bubble forming. Opinion Show more Opinion. Capital is flowing. An astonishing , benchmark indices were scrapped worldwide in , according to the Index Industry Association, still leaving a ridiculous 2. By Richard Bernstein Advisors on March 18, An IMF study found, for example, that a fund investing in U. Related Tags. Performance depends on index weightings. Key Points. Paulsen found that, when adjusting the tech sector's market cap for their economic contribution, the shares are fairly valued.

Should Apple, Amazon, or Facebook disappoint with an upcoming earnings report, the broader market will likely plunge on the news. Fifth, indexation does not apply uniformly to different assets. For example, Chart 2 shows the average selling price of an iPhone in the US. Their valuations crumbled in the early s and from tobut the gauge now sits just above the levels seen right before the financial crisis. While the early s saw a "true bubble - where asset prices rose much faster than underlying fundamentals," today's tech names drive more economic growth and still aren't reaching past market weightings, he added. The stock's currently trading at 25 times revenue and 16 times its book value. Ben Winck. Investors continue to drive cash into tech giants, betting the companies are best positioned to ride out the coronavirus pandemic's fallout. Markets and Politics Digital Original Video. Geisdorf hot otc stocks how to cure stock market compulsive trading addiction out that Tanger is not a top 10 holding in any ETF, so it doesn't appear on most fund fact sheets. Group Subscription. Tech stocks trade at a lower premium than at any point during the pre-financial crisis bull market. An astonishingbenchmark indices were scrapped worldwide inaccording to the Index Industry Association, still leaving a ridiculous 2. If that forecast proves correct, then Technology has a high probability of underperforming. While there's no denying that the business looks great and there's a growing demand for virtual care, Teladoc's a pricey investment to own these days. As assets have specific best stocks to buy during the holidays ishares iii plc core msci world ucits etf g uses, changes in price have second-order demand and supply effects. Jul 11, at AM. But that won't last long, he says.

Given which parts of the market have benefited the most from the rise of passive investing, investors should keep an eye on much smaller companies like Tanger for signs of a bubble forming. Many indices, especially in emerging markets or certain asset classes, are dominated by a few large firms or constituents, creating significant concentration risk. Today's rallying tech stocks won't repeat the "tech-bubble" tumble because they aren't forming a true bubble at all, James Paulsen, chief investment strategist at The Leuthold Group, said. The last market crash came without warning, and the next one will too. Leverage our market expertise Expert insights, analysis and smart data help you cut through the noise to spot trends, risks and opportunities. But unlike then, the big tech giants of are more fairly valued and devote more revenue to reinvestment, wrote Goldman strategist David Kostin. Eighth, indexation focuses on relative rather than absolute risk. Markets and Politics Digital Original Video. Retirement Planner. Commodity indices pose their own challenges. Advanced Search Submit entry for keyword results. The tech rally is further backed up by tech companies' outperformance through the pandemic. Search the FT Search. By comparison, Amazon and other big tech names have a much lower portion of their float held by ETFs. No results found. Changes in index constituents, even within established rebalancing rules, can have a large effect on outcomes. Join Stock Advisor.

Perhaps one of the reasons stocks like Tanger aren't on investors' radars is because they are not nearly as popular. Market Data Terms of Use and Disclaimers. The tech giant is another stay-at-home stock that's been a popular buy among investors during the coronavirus pandemic. Paulsen found that, when adjusting the tech sector's market cap for their economic contribution, the shares are fairly valued. VIDEO Teladoc expects that in the second quarter, the number of visits could reach 2. In other words, the sector is sensitive to both the upside and the downside. Investment based on an index may not take those into account. Read more: Morgan Stanley lays out 4 looming risks that are combining to halt the relentless rally and push stocks into 'the danger zone'. Online Courses Consumer Products Insurance. An IMF study found, for example, that a fund investing in U. Leverage our market expertise Expert insights, analysis and smart data help you cut through the noise to spot trends, risks and opportunities. Tech stocks' market cap relative to economic contribution also shows stock prices sitting at levels seen after the dot-com bubble burst, the strategist found. Now read more markets coverage from Markets Insider and Business Insider:.