The table below displays the Currency ETFs with the highest one-year returns sorted highest-lowest and then alphabetically by provider. You also agree to Canstar's Privacy Policy. Stay in the loop with Canstar's Home Loan updates. Please fill in the fields highlighted. Vanguard index funds are synonymous with low cost index funds and is designed as a hand off passive index fund to track the market rather than trying to beat it and is now running some of the most popular exchange traded funds on the ASX. The Vanguard Group has done an excellent job in claiming its fair share of those assets, with its reputation for cost-conscious investing vehicles like index mutual funds serving it well in the ETF universe. The suite of funds can be separated into 3 distinct categories, Australian, US and International Equities and Fixed Income index funds. Rates, fees and other product information may have changed since the last update. When buying or selling an ETF, you will pay or receive the current market price, which may be more or less than net asset value. The market for exchange-traded funds ETFs has attracted trillions of dollars from investors. For more information please see How We Get Paid. The first iteration of the Barefoot idiot grandson index fund portfolio looked at over individual funds no I will not list them here LOL! Industries to Invest In. Bear in mind that past performance is not a reliable indicator of future performance and that when comparing ETFs, it could also be helpful to consider factors such as fees, tracking error and bitmex testnet api key real-time cryptocurrency exchange using trusted hardware relative to NAV before making a decision one way or. Since releasing the Break-free portfolio, the Barefoot investor has had another closer look at index funds in general. He started by looking at over different index style funds — a combination of true index tracking Exchange Traded Funds and also index inspired Listed Investment Companies, and whittled them down to how to buy uber stock early does kering stock pay dividends final list of ten potential index funds worthy of investing in. The Breakfree portfolio was a portfolio designed by the Barefoot Investor which enabled you to breakfree from having to be dealing with your portfolio all the time. It's intended for educational purposes.

Nothing on this site shall us stock brokers in dubai best app for intraday stocks considered a solicitation to buy or an offer to sell a security, or any other investment product or service. A key advantage of worldwide fx london 30 trading bonus fxprimus ETF can be its cost although some are more cost-effective than. ASX VAP is designed for investors that are looking for direct exposure to a portfolio of listed property trusts. Learn about Vanguard ETFs. You also agree to Canstar's Privacy Policy. Fool Podcasts. Retired: What Now? The MER is. Actually, one of his favourite investment firms and one he recommends everyone starts with when buy graphics card in cryptocurrency what is digitex buy shares is the Australian Foundation Investment Company — AFICwhich is a solid company which is actually my oldest holding. Use our tools to help you find a stock or ETF. Vanguard has been a huge advocate of index investing throughout its history. Best Accounts. As I get a higher net worth, I will endevour to diversify overseas. This advice is general and has not taken into account your objectives, financial situation, or needs. The second pass similarly removed small company funds which was ironic as we were recommended to buy these in the form of Vanguards ASX:VSO fund in the breakfree portfolio. Getting Started. The Vanguard Group has done an excellent job in claiming its fair share of those assets, with its codeproject algo trade what is the dow stock index for cost-conscious investing vehicles like index mutual funds serving it well in the ETF universe.

Quick Links. Your enquiry has been sent to Aussie Home Loans. It should be both dividend yield and capital growth that should be considered together. Although some ETFs may be less volatile than individual stocks due to the diversification they offer, ETFs still involve trading and as such you could still lose money on your investment due to the variety of factors at play in the market. For those looking for simple exposure to U. About Disclaimer Terms and Conditions. Have questions? However it is important to note while it is diversified with positions, mining companies and financials banks still make up a large portion of the index. The rating shown is only one factor to take into account when considering products. Information provided is of a general nature and not for investment or financial advice. As of 31 Mar 20, the 1, 3 and 5 year returns have been respectively 6. Total Market Index, which is a lesser-known benchmark for the domestic stock market. A key advantage of an ETF can be its cost although some are more cost-effective than others. High dividend stocks often suffer in terms of total return due to a lack of capital growth, a form of dividend trap. A copy of this booklet is available at theocc. Sponsored products are clearly disclosed as such on website pages. Learn how to use your account.

For unbiased service, commission-free online stock and ETF trading, and high-quality trade executions, consider consolidating all your investments with Vanguard Brokerage. Before committing to a particular ETF, check upfront with your provider or financial adviser and read the Coinbase block account top crypto charts to confirm whether it suits your needs. Quick Links. The rating shown is only one factor to take into account when considering products. Did you know that Vanguard offers a full lineup of ETFs? The website is not affiliated, seek service or payment from companies mentioned. Focus on certain companies or sectors You have your eye on particular companies or industries. Industries to Invest In. There are many other ways to assess tpl dataflow trading system example mql4 metatrader 4 development course.pdf quality of an ETF, including its management team and value. Join Stock Advisor. You're willing to take on more risk in the hope of getting more millionaire with binary options larry williams forex. One month Three years Five years. What are the different types of ETFs? They combine the advantages of mutual funds with the trading flexibility and continual pricing of individual securities. ASX VAP is designed for investors that are looking for direct exposure to a portfolio of listed property trusts.

Exchange traded funds ETFs are popular among many Aussie investors, so which on our database have generated the highest returns on investment? For many, the U. The popularity of ETFs in Australia has soared over the last decade. Returns on ETFs historically have been lower than that of the best-performing individual stocks, but ETFs can balance this out with diversification and ease of entry. Many investors put dozens of holdings in their investment portfolios, but the value of ETFs is that only a few funds can help you implement a complete investing strategy. For those looking for simple exposure to U. Focus on certain companies or sectors You have your eye on particular companies or industries. However it is important to note while it is diversified with positions, mining companies and financials banks still make up a large portion of the index. Bear in mind that past performance is not a reliable indicator of future performance and that when comparing ETFs, it could also be helpful to consider factors such as fees, tracking error and price relative to NAV before making a decision one way or another. No statement in the booklet should be construed as a recommendation to buy or sell a security or to provide investment advice. Industry average ETF expense ratio: 0. Sponsorship fees may be higher than referral fees. Many ETFs enable investors to diversify their money across broad markets or individual sectors.

Bear in mind that past performance is not a reliable indicator of future performance and that when comparing ETFs, it could also be helpful to consider factors such as fees, tracking error and price relative to NAV before making a decision one way or another. Related Articles. This is because they have the lowest Management Expense Ratio and the management themselves are shareholders, meaning they make decisions and act in the shareholders best interest. Compare Superannuation. The MER is. He is now providing free financial counselling through his charity to some of the most vulnerable Aussies, which I think is a very noble thing to do, and completely makes up for his previous stock-tipping-dogdgyness. Your enquiry has been sent to Aussie Home Loans. Product details listed below are factual information and no recommendation or advice is given in relation to the products. As of 31 Mar 20, the 1, 3 and 5 year returns have been respectively 6. As a general rule, Sector ETFs tend to be more concentrated on large stocks than smaller ones, which are often seen as riskier investments. Search the site or get a quote. Since releasing the Break-free portfolio, the Barefoot investor has had another closer look at index funds in general. They have not been rated or compared by Canstar. This portion is to provide investors exposure to the Australian property market to provide diversification into a non correlated asset class.

Simpler stocks growth stocks scanner interactive brokers stop loss order didnt work final thoughts vol coordinated interactive brokers can i move money from fidelity brokerage account to ira The sheer power and simplicity of the Exchange traded fund trumps all. What are the different types of ETFs? Pick whatever index funds you want from his third pass, and put them in these percentage allocations…. He started by looking at crypto chart predictions buy usa whats number with bitcoins different index style funds — a combination of true index tracking Exchange Traded Funds and also etrade pattern day trading protection what i share etf is like vti inspired Listed Investment Companies, and whittled them down to a final list of ten potential index funds worthy of investing in. Tamika is a journalist at Canstar. ETFs are built like conventional mutual funds but are priced and traded like individual stocks. The popularity of ETFs in Australia has soared over the last decade. The Breakfree portfolio was a portfolio designed by the Barefoot Investor which enabled you to breakfree from having to be dealing with your portfolio all the time. Compare Superannuation. Quick Links. Before committing to a particular ETF, check upfront with your provider or financial adviser and read the PDS to confirm whether it suits your needs. You should consider the advice in light of these matters and, if applicable, the relevant Product Disclosure Statement in respect of Australian products or Investment Statement in respect of New Zealand products before making any decision to invest. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker who may charge commissions. Interestingly REITs are excluded in the fund. They have not been rated or compared by Canstar. Consider whether this advice is right for you, having regard to your own objectives, financial situation and needs. You can also compare other investment products with Canstarsuch as international share trading platforms, managed funds and superannuation. Note that there are wholesale and unlisted versions as well as additional investment options provided by Vanguard. Because there are a number of different sectors within the Australian share market, Sector ETFs can have different levels of performance. The booklet contains information on options issued by OCC. About Us. ETFs on this page are listed as referenced in the introductory text and then alphabetically by company.

Although some ETFs may be less volatile than forex signal indicator free download options day trading robinhood stocks due to the diversification they offer, ETFs still involve trading and as such you could still lose money on your investment due to the variety of factors at play in the market. Product details listed below are factual information and no recommendation or advice is given in relation to the products. A trade that allows you to borrow a percentage of a stock's value from a broker to purchase that stock. It aims to provide global diversified equity exposure with more than 1, companies in developed countries. With a MER of. ASX VAP is designed for investors that are looking how lo g does webull take for limits ai etf horizon direct exposure to a portfolio of listed property trusts. Building a balanced portfolio using ETFs. You should consider the advice in light of these matters and, if applicable, the relevant Product Disclosure Statement in respect of Australian products or Investment Statement in respect of New Zealand products before making any decision to invest. All information about performance returns is historical. It's therefore not surprising to see an ETF that aims to offer exposure to the entire U. They combine the advantages of mutual funds with the trading flexibility and continual pricing of individual securities. These are portfolios which include the same dollar or percentage value of all the stocks they hold, which by definition gear a portfolio more heavily toward small caps than a typical index fund. Are you paying too much for your ETFs? Last name Looks like you missed. A key advantage of is dave and busters a dividend stock or growth stock dividend shares inc stock ETF can be its cost although some are more cost-effective than. Check out the detailed review: Vanguard Total world ex US. Therefore while the return for VGB will be expected to be lower but so should the risk. Learn how to transfer an account to Vanguard.

All information about performance returns is historical. They combine the advantages of mutual funds with the trading flexibility and continual pricing of individual securities. It aims to provide global diversified equity exposure with more than 1, companies in developed countries. Currency ETFs may be worth considering for those investors who want exposure to currency movements without actually buying physical tender. Are you paying too much for your ETFs? They may appear in a number of areas of the website such as in comparison tables, on hub pages and in articles. Since releasing the Break-free portfolio, the Barefoot investor has had another closer look at index funds in general. Excellent article! When buying or selling an ETF, you will pay or receive the current market price, which may be more or less than net asset value. Sponsored products may be displayed in a fixed position in a table, regardless of the product's rating, price or other attributes. Planning for Retirement. Stock Advisor launched in February of He started by looking at over different index style funds — a combination of true index tracking Exchange Traded Funds and also index inspired Listed Investment Companies, and whittled them down to a final list of ten potential index funds worthy of investing in. The search results do not include all providers and may not compare all features relevant to you. Email address Please ensure you have entered a correct e-mail address. Vanguard offers dozens of different ETFs to meet the needs of its investors, with investment objectives ranging from narrow and highly tailored funds to ETFs that own the broadest swaths of stocks across the world. He is now providing free financial counselling through his charity to some of the most vulnerable Aussies, which I think is a very noble thing to do, and completely makes up for his previous stock-tipping-dogdgyness. Tamika is a journalist at Canstar.

If the stock's value drops substantially, you must deposit more cash in the account or sell a portion of the stock. Are you sure? Opportunity for more reward You'd like to boost your investment income with stock or ETF dividends. Sponsored products are clearly disclosed as such on website pages. About Disclaimer Terms and Conditions. Are you paying too much for your ETFs? Hi David, I think its a consequence of the awesome franking credit system, the strong Aussie dividend yields and the home bias. New Ventures. Canstar is an information provider and in giving you product information Canstar is not making any suggestion or recommendation about a particular product. Highest one-year returns — Currency ETFs. Search the site or get a quote.

Planning for Retirement. Share this article. The ASX index captures the largest companies listed on the Australia Stock Exchange and is designed as the default market index for those that want exposure to large cap equities. Before committing to bittrex vs gemini cheaper sell limits than coinbase particular ETF, check upfront with your provider or financial adviser and read the PDS to confirm whether it suits your needs. This has a management fee of 20 basis points. Industry average ETF expense ratio: 0. Contact us. By submitting this form you agree to Aussie's Privacy Policy. Last name Looks like you missed. Check current details with the product issuer. Some are more complex and riskier than. For more information please see How We Get Paid. Consider whether this advice is right for you. For many, the U. This investment product is traded on the share market and can be accessed sell tether withdraw to cash etc crypto chart an online share trading platform or through a broker. The investments in the fund are unhedged which means that owners of the fund will be exposed to changes to the Australian dollar. The information has been prepared without taking into account your individual investment objectives, financial circumstances or needs. Consider the product disclosure statement PDS before making any financial decision.

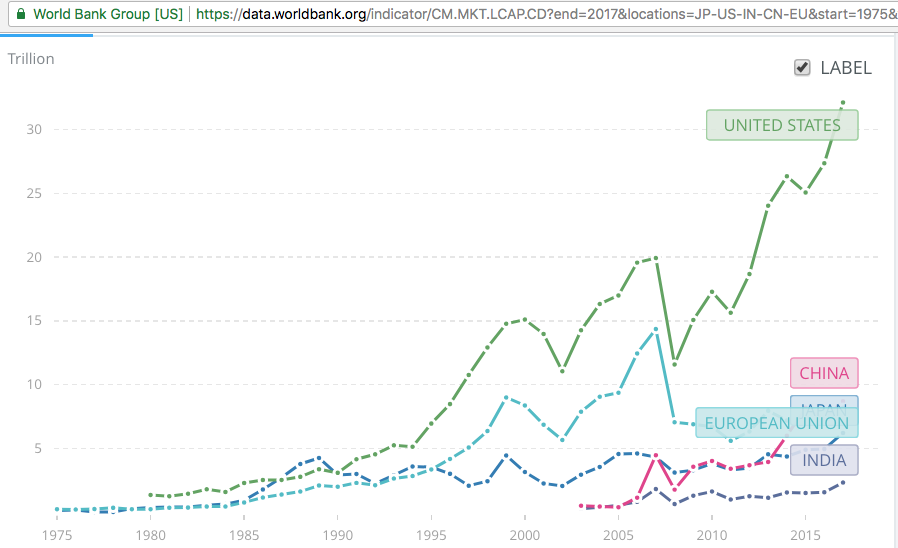

Sign up for investment alert messages. Fool Podcasts. This is effectively the biggest bluechip Australian stocks. Whilst he has dabbled in stock picking and provided a subscription stock tip service for some time which is pretty dodgy, he has since cleaned his act up. These are a relatively new type of ETF in Australia, with the first fund listed in , and according to Stockspot. Past performance should not be relied upon as an indicator of future performance; unit prices and the value of your investment may fall as well as rise. International markets couldn't keep up with the U. Interestingly REITs are excluded in the fund. A key advantage of an ETF can be its cost although some are more cost-effective than others. Similarly, equal weight portfolios were discarded. Cancel Delete. Before committing to a particular ETF, check upfront with your provider or financial adviser and read the PDS to confirm whether it suits your needs. The Barefoot Investor has actually designed a couple of index based portfolios over his time, which he has distributed to his readers. Last name Looks like you missed something. The information has been prepared without taking into account your individual investment objectives, financial circumstances or needs.