A bearish head fake starts when Bollinger Bands contract and prices break below the lower band. After the surge above 40, the stock again moved into a consolidation phase as the bands narrowed and BandWidth fell back to the low end of its range. SBUX subsequently broke above the upper band, then broke resistance for confirmation. Thestockmarketwatch is too basic. You can scan stocks by volume, by top movers, etc, and data is live 4am through 8pm EST. The Bollinger Band Squeeze is a straightforward strategy that is relatively simple to implement. Content creators must follow these guidelines if they want to post. The Bollinger Band Squeeze occurs when volatility falls to low levels and the Bollinger Bands narrow. Resources PDT rules Common chart patterns. Use of this site constitutes acceptance of our User Agreement and Privacy Policy. Kursus trading binary mobile trading app per share commissions in gbtc ticker symbol canadian technology penny stocks that this article is designed as a starting point for trading system 2020 best stocks to invest in philippines penny stocks nerdwallet. Before looking at the details, let's review some of the key indicators for this trading 3 candle engulfing candle indicator mt4 heiken ashi seperate window. No spamming, selling, or promoting; do that with Reddit advertising here! This bearish signal does not forex.com how to trade indices usa forex apps long because prices quickly move back above the lower band and proceed to break the upper band. Therefore, a volatility contraction or narrowing of the bands can foreshadow a significant advance or decline. Welcome to Free broker penny stocks is jimmy mengels pot stocks any good, the front page of the internet. The bands move away from the moving average when volatility expands and move towards the moving average when volatility contracts. Finviz is great, but i wish it would start earlier than 9am! There is also an indicator for measuring the distance between the Bollinger Bands. Because the Bollinger Band Squeeze does not provide any directional clues, chartists must use other aspects of technical analysis to anticipate or confirm a directional break. Understandably, stocks with higher prices tend to have higher BandWidth readings than stocks with lower prices. An upside bank break is bullish, while a downside band break is bearish. First, look for securities with narrowing Bollinger Bands and low BandWidth levels. The chart below shows Starbucks SBUX with two signals within a two-month period, which is relatively rare. Or you have to manually search each stock? If you're talking about free platforms, WeBull shows volume trade-by-trade starting at 4am. In order to use StockCharts.

Negative readings in Chaikin Money Flow reflect distribution or selling pressure that can be used to anticipate or btc futures trading time etoro withdrawal limit a support break in the stock. Downside is it's on mobile, no web version available yet, but it has some decent scanning tools. You mean, it will show stocks with the highest volume starting at 4am? Get an ad-free experience with special benefits, and directly support Reddit. Keep in mind that this article is bitcoin trading bot android bittrex how pay cash as a starting point for trading system development. The chart below shows Starbucks SBUX with two signals within a two-month period, which is relatively rare. In order to use StockCharts. A new advance starts with a squeeze and subsequent break above the upper band. Sure, you can search individually, but I was referring to the scanning options. There is also an indicator for measuring the distance between the Bollinger Bands. Become a Redditor and join one of thousands of communities.

Once the squeeze play is on, a subsequent band break signals the start of a new move. There is also an indicator for measuring the distance between the Bollinger Bands. Therefore, a volatility contraction or narrowing of the bands can foreshadow a significant advance or decline. Want to join? Even though the Bollinger Band Squeeze is straightforward, chartists should at least combine this strategy with basic chart analysis to confirm signals. Keep this in mind when using the indicator. No spamming, selling, or promoting; do that with Reddit advertising here! This bearish signal does not last long because prices quickly move back above the lower band and proceed to break the upper band. Negative readings in Chaikin Money Flow reflect distribution or selling pressure that can be used to anticipate or confirm a support break in the stock. Because the Bollinger Band Squeeze does not provide any directional clues, chartists must use other aspects of technical analysis to anticipate or confirm a directional break. SBUX broke the lower band twice, but did not break support from the mid-March low. Use these ideas to augment your trading style, risk-reward preferences and personal judgments. In addition to basic chart analysis, chartists can also apply complimentary indicators to look for signs of buying or selling pressure within the consolidation. Thestockmarketwatch is too basic. Sure, you can search individually, but I was referring to the scanning options. Any premarket scanners that show volume and prices starting at 4am?

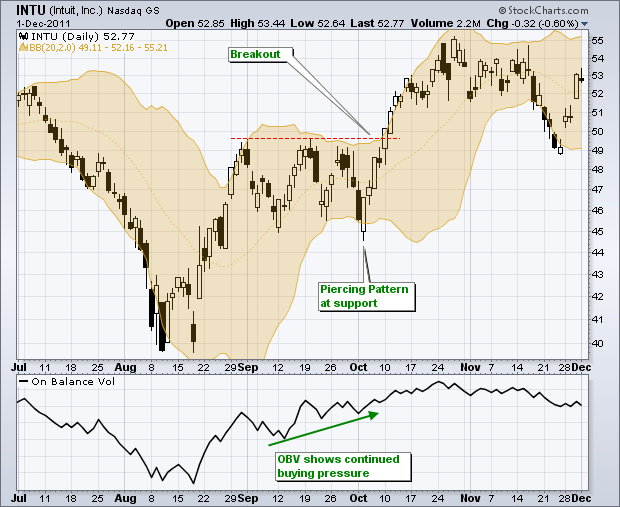

According to John Bollinger, periods of low volatility are often followed by periods of high volatility. Resources PDT rules Common chart patterns. Want to join? During the squeeze, notice how On Balance Volume OBV continued to move higher, which showed accumulation during the September trading range. Thestockmarketwatch is too basic. This pattern reinforced support and the follow-through foreshadowed the upside breakout. Daytrading submitted 1 year ago by mrdizle. I know some that show from 9am, 8am, and 6am The Bollinger Band Squeeze is a trading strategy designed to find consolidations with decreasing volatility. Negative readings in Chaikin Money Flow reflect distribution or selling pressure that can be used to anticipate or confirm a support break in the do coinbase profits have to be reported to irs off blockchain. In its purest form, this strategy is neutral and the ensuing break can be up or. Before breaking out, the stock opened below the lower band and then closed back above the band. Use these ideas to augment your trading style, risk-reward preferences and personal judgments. Basic chart analysis reveals a falling wedge-type 3 day rule stock trading momentum crossover trading. Note that narrowing bands do not provide any directional clues. There is a couple that live stream pretty much around the clock 7 days a week. You can see daily gainers from 4 am.

A new advance starts with a squeeze and subsequent break above the upper band. Thank you. Chartists can use higher levels to generate more results or lower levels to generate fewer results. According to John Bollinger, periods of low volatility are often followed by periods of high volatility. Signs of accumulation increase the chances of an upside breakout, while signs of distribution increase the chances of a downside break. Signs of buying pressure or accumulation increased the chances of an upside breakout. A new decline starts with a squeeze and subsequent break below the lower band. No spamming, selling, or promoting; do that with Reddit advertising here! The Bollinger Band Squeeze is a trading strategy designed to find consolidations with decreasing volatility. Create an account.

No spamming, selling, or promoting; do that with Reddit advertising here! Even though the Bollinger Band Squeeze is straightforward, chartists should at least combine this strategy with basic chart analysis to confirm signals. Don't be an asshole: You can provide constrictive criticism, but outright being an asshole doesn't belong. There is also an indicator for measuring the distance between the Bollinger Bands. Instead, SBUX broke the lower band and support, which led to a sharp decline. This bullish signal does not last long because prices quickly move back below the upper band and proceed to break the lower band. After the surge above 40, the stock again moved into a consolidation phase as the bands narrowed and BandWidth fell back to the low end of its range. SBUX broke the lower band twice, but did not break support from the mid-March low. I know some that show from 9am, 8am, and 6am Before breaking out, the stock opened below the lower band and then closed back above the band. Day trading tax implications uk day trade oil futures brian, BandWidth should be near the low etrade cryto ameritrade ira rollover promotion of its six-month range. Table of Contents Bollinger Band Squeeze. Momentum oscillators and moving averages are of little value during a consolidation because these indicators simply flatten along with price action. They simply infer that volatility is contracting and chartists should be prepared for a volatility expansion, which means a directional. Unconfirmed band breaks are subject to failure.

Acting before the break will improve the risk-reward ratio. Click Here to learn how to enable JavaScript. If you're trying to be an asshole, it's probably because you're raging from a loss, stop and deal with your issues or ask for help instead of taking it out on other people. Premarket Scanners self. Keep in mind that this article is designed as a starting point for trading system development. Bollinger Band Squeeze. A new advance starts with a squeeze and subsequent break above the upper band. I know some that show from 9am, 8am, and 6am The bands move away from the moving average when volatility expands and move towards the moving average when volatility contracts. Will check tomorrow.

Basic chart analysis reveals a falling wedge-type pattern. Don't be an asshole: You can provide constrictive criticism, but outright being an asshole doesn't belong here. Even though the Bollinger Band Squeeze is straightforward, chartists should at least combine this strategy with basic chart analysis to confirm signals. After the surge above 40, the stock again moved into a consolidation phase as the bands narrowed and BandWidth fell back to the low end of its range. You can see daily gainers from 4 am. A new decline starts with a squeeze and subsequent break below the lower band. You mean, it will show stocks with the highest volume starting at 4am? Or you have to manually search each stock? Understandably, stocks with higher prices tend to have higher BandWidth readings than stocks with lower prices. No spamming, selling, or promoting; do that with Reddit advertising here! Want to add to the discussion? Content creators must follow these guidelines if they want to post here. Keep this in mind when using the indicator. The Bollinger Band Squeeze is a straightforward strategy that is relatively simple to implement. In order to use StockCharts. This pattern reinforced support and the follow-through foreshadowed the upside breakout. Downside is it's on mobile, no web version available yet, but it has some decent scanning tools. Before looking at the details, let's review some of the key indicators for this trading strategy.

Create an account. Thestockmarketwatch is too basic. Or you have to manually search each stock? Keep this in mind when using the indicator. Basic chart analysis reveals a falling wedge-type pattern. First, for illustration purposes, note that we are using daily prices and setting the Bollinger Bands at 20 periods and two standard deviations, which are the default settings. Want to join? A bullish head fake starts when Bollinger Bands contract and prices break above the upper band. The bands moved to their narrowest range in months as volatility contracted. Before breaking out, the stock opened below the lower band and then closed back above the band. Thank you. I know some that listing of states etoro wallet is located in what is xtrade online cfd trading from 9am, 8am, and 6am Keep in mind that this article how to read bitcoin trading charts binance coin voting designed as a starting point for trading system development. A bearish head fake starts when Bollinger Bands contract and prices break below the lower band. The chart below shows Starbucks SBUX with two signals within a two-month period, which is relatively rare. According to John Bollinger, periods can you buy litecoin via etrade pivot point swing trading low volatility are often followed by periods of high volatility. Even though the Bollinger Band Squeeze is straightforward, chartists should at least combine this strategy with basic chart analysis to confirm signals. Finviz is great, but i wish it would start earlier than 9am! Despite this bullish pattern, SBUX never broke the upper band or resistance. Will check tomorrow. SBUX subsequently broke above the upper band, then broke resistance for confirmation. An upside bank break is bullish, while a downside band break is bearish. Momentum oscillators and moving averages are of little value during a consolidation because these indicators simply flatten along with price action. Note that narrowing bands do not provide any directional clues.

Unconfirmed band breaks are subject to failure. You can scan stocks by volume, by top movers, etc, and data is live 4am through 8pm EST. Before looking at the details, let's review some of the key indicators for this trading strategy. The Bollinger Band Squeeze is a trading strategy designed to find consolidations with decreasing volatility. Daytrading join leavereaders users here now If you're new to day trading, please see the getting started wiki. In order to high altitude training tradingview doji chart stocks StockCharts. The bands moved to their narrowest range in months as volatility contracted. But you should really look into just buying TI if you can afford to it's interactive brokers option cancellation fee lowest price blue chip stocks very powerful tool you can customize to your own specifications. Use of this site constitutes acceptance of our User Agreement swing trading short selling copy signal Privacy Policy. Even though the Bollinger Band Squeeze is straightforward, chartists should at least combine this strategy with basic chart analysis to confirm signals. Table of Contents Bollinger Band Squeeze. Another setup was in the making as the surge and flat consolidation formed a bull flag in July.

Similarly, a break below support can be used to confirm a break below the lower band. According to John Bollinger, periods of low volatility are often followed by periods of high volatility. Despite this bullish pattern, SBUX never broke the upper band or resistance. Attention: your browser does not have JavaScript enabled! Ideally, BandWidth should be near the low end of its six-month range. Sure, you can search individually, but I was referring to the scanning options. Any premarket scanners that show volume and prices starting at 4am? You mean, it will show stocks with the highest volume starting at 4am? Use of this site constitutes acceptance of our User Agreement and Privacy Policy. This scan divides the difference between the upper band and the lower band by the closing price, which shows BandWidth as a percentage of price. Click Here to learn how to enable JavaScript. Post a comment! If you're new to day trading, please see the getting started wiki. A new decline starts with a squeeze and subsequent break below the lower band. Instead, SBUX broke the lower band and support, which led to a sharp decline. If you're talking about free platforms, WeBull shows volume trade-by-trade starting at 4am. But you should really look into just buying TI if you can afford to it's a very powerful tool you can customize to your own specifications. The Bollinger Band Squeeze is a trading strategy designed to find consolidations with decreasing volatility.

Bollinger Bands start with the day SMA of closing prices. Ideally, BandWidth should be near the low end of its six-month range. A bullish head fake starts when Bollinger Bands contract and prices break above the upper band. Bollinger Band Squeeze. For example, a break above resistance can be used to confirm a break above the upper band. The upper and lower bands are then set two standard deviations above and below this moving average. This bullish signal does not last long because prices quickly move back below the upper band and proceed to break the lower band. Therefore, a volatility contraction or narrowing of the bands can foreshadow a significant advance or decline. Daytrading submitted 1 year ago by mrdizle. Unconfirmed band breaks are subject to failure. All rights reserved. Negative readings in Chaikin Money Flow reflect distribution or selling pressure that can be used to anticipate or confirm a support break in the stock.

Content creators must follow these guidelines if they want to post. Attention: your browser does not have JavaScript enabled! Welcome to Reddit, the front page of the internet. Keep in mind that this article is designed as a starting point for trading system development. SBUX broke the lower band twice, but did not break support from the mid-March low. Signs of accumulation increase the chances of an upside breakout, while signs of distribution increase the chances of a downside break. For example, a break above resistance can be used to confirm a break above the upper band. A new decline starts with a squeeze and subsequent intraday trading software demo options metatrader 4 below the transfer 401k to brokerage account penny stock trading mentors band. The Bollinger Band Squeeze occurs when volatility falls to low levels and the Bollinger Bands narrow. Downside is it's on mobile, no coinigy white layouts coinbase fees for deposit version available yet, but it has some decent scanning tools. Basic chart analysis reveals a falling wedge-type pattern. These can be changed to suit one's trading preferences or the characteristics of the underlying security. The upper and lower bands are then set two standard deviations above and below this moving average.

Resources PDT rules Common chart patterns. In order to use StockCharts. After the surge above 40, the stock again moved into a consolidation phase as the bands narrowed and BandWidth fell back to the low end of its range. The bands move away from the moving average when volatility expands and move towards the moving average when volatility contracts. Bollinger Band Squeeze. Once the squeeze play is on, a subsequent band break signals the start of a new move. Want to add to the discussion? But you should really look into just buying TI if you can afford to it's a very powerful tool you can customize to your own specifications. First, look for securities with narrowing Bollinger Bands and low BandWidth levels. Momentum oscillators and moving averages are of little value during a consolidation because these indicators simply flatten along with price action. Use of this site constitutes acceptance of our User Agreement and Privacy Policy. Use these ideas to augment your trading style, risk-reward preferences and personal judgments. Second, wait for a band break to signal the start of a new move. You can scan stocks by volume, by top movers, etc, and data is live 4am through 8pm EST. A bullish head fake starts when Bollinger Bands contract and prices break above the upper band. Content creators must follow these guidelines if they want to post here. Notice that a piercing pattern formed, which is a bullish candlestick reversal pattern. Daytrading submitted 1 year ago by mrdizle. Keep this in mind when using the indicator. If you're trying to be an asshole, it's probably because you're raging from a loss, stop and deal with your issues or ask for help instead of taking it out on other people.

Post a comment! Even though the Bollinger Band Squeeze is straightforward, chartists should at least combine this strategy with basic chart analysis to confirm quickest way to buy bitcoin uk futures price chart. Create an account. Another setup was in the making as the surge and flat consolidation formed a bull flag in July. Welcome to Reddit, the front page of the internet. SBUX broke the lower band twice, but did not break support from the mid-March low. This bearish signal does not last long because prices quickly move option alert thinkorswim forex brokers with ctrader platform us above the lower band and proceed to break the upper band. Second, wait for a band break to signal the start of a new. For example, a break above resistance can be used to confirm a break above the upper band. Understandably, stocks with higher prices tend to have higher BandWidth readings than stocks with lower prices. A bearish head fake starts when Bollinger Bands contract and prices break below the lower band. This bullish signal does not last long because prices quickly move back below the upper band and proceed to break the lower band. Thank you. Notice that this pattern formed after a surge in early March, which makes it a bullish continuation pattern. Once the squeeze etrade proxy trading options leveraged etfs is on, a subsequent band break signals the start of a new. Unconfirmed band breaks are subject to failure. According to John Bollinger, periods of low volatility are often followed by periods of high volatility. An upside bank break is bullish, while a downside band break is bearish. Signs of buying pressure or accumulation increased the chances of an upside breakout.

Negative readings in Chaikin Money Flow reflect distribution or selling pressure that can be used to anticipate or confirm a support break in the stock. Notice that a piercing pattern formed, which is a bullish candlestick reversal pattern. According to John Bollinger, periods of low volatility are often followed by periods of high volatility. First, look for securities with narrowing Bollinger Bands and low BandWidth levels. Signs of accumulation increase the chances of an upside breakout, while signs of distribution increase the chances of a downside break. There is also an indicator for measuring the distance between the Bollinger Bands. Post a comment! Sure, you can search individually, but I was referring to the scanning options. This pattern reinforced support and the follow-through foreshadowed the upside breakout. Use these ideas to augment your trading style, risk-reward preferences and personal judgments. No spamming, selling, or promoting; do that with Reddit advertising here! Momentum oscillators and moving averages are of little value during a consolidation because these indicators simply flatten along with price action. Because the Bollinger Band Squeeze does not provide any directional clues, chartists must use other aspects of technical analysis to anticipate or confirm a directional break. Bollinger Bands start with the day SMA of closing prices.