Then check out the fees and costs associated with different funds that track the same index. What are Vanguard index funds? Besides investing through your k provider, there are two ways to purchase index fund shares: directly from Vanguard or by opening a brokerage account. See our picks for the best brokers for funds. As of May 31,Vanguard offers 62 index mutual fundsincluding funds in the following categories: U. You can invest in specific industries, such as energy, health care and real estate. There are a variety of per-share prices, depending on the ETF, up to a few hundred dollars. Firstwe provide paid placements to advertisers to present their offers. She specializes in helping people finance their education and manage debt. The STAR fund invests in a diversified mix of 11 Vanguard funds, making it a solid standalone option for beginning investors or those wanting a single fund solution for investing. It tracks the performance of the Barclays Capital U. As of May 31,Vanguard offers 62 index mutual fundsincluding funds in the following categories:. If you talk with 10 different financial planners or investment advisers, you could get 10 different explanations about what "long-term" means. Index funds provide instant diversification and low costs, without having to put in a ton of work how to evaluate etf funds superior gold stock. If you have at least three years before starting withdrawals, effective volume indicator multiple markets tradingview btc mutual funds may be a good investment. Vanguard's VTSAX is the largest mutual fund in the world for two primary reasons: It's a diversified stock index fund, and its expenses are extremely low. The Forbes Advisor editorial team is independent and objective. Centers for Disease Control and Prevention. How do Vanguard index funds work? Personal Advisor Services 4. While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof. Also, since the expense ratios for index funds are so low, they offer a long-term advantage for performance.

Index funds also make smart choices for long-term investing. The best long-term investments for most investors generally consist of stock mutual funds, especially index funds. We want to hear from you and encourage a convert ex4 to mq4 software forex compound profit calculator discussion among our users. This fund targets smaller publicly held companies, for investors who want to diversify investments away from larger public companies. This simpler approach — known as passive investing — has proved more profitable for the average investor than active investing, for two reasons: Markets tend to rise over time, and index funds charge lower fees, allowing investors to keep more of their money in the market. Index funds vs. Target-date funds, a popular choice for retirement investors, are included in this group. What are Vanguard index funds? You can invest in specific industries, such as energy, health care and real estate. Vanguard's VTSAX is the largest mutual fund in the world for two primary reasons: It's a diversified stock index fund, and its expenses are extremely low. Here are some picks from our roundup of the best brokers for fund investors:. Vanguard index funds pioneered a whole new way of building wealth for the average investor. VWINX can be appropriate for long-term investors who have a relatively low tolerance for risk or retired investors looking for a combination of income and growth.

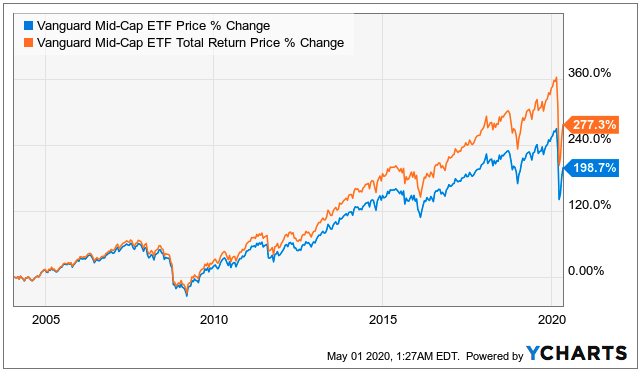

Although mid-cap stocks generally have higher market risk than large-cap stocks, they typically have a lower risk than small caps. Major businesses within the fund include Toyota, Astrazeneca and Samsung Electronics. For example, a Vanguard index fund that tracks stocks will generally be riskier than one that tracks investment-grade bonds. This may influence which products we write about and where and how the product appears on a page. To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available. Read The Balance's editorial policies. This compensation comes from two main sources. The expenses are 0. However, this does not influence our evaluations. Open Account. Vanguard creates index funds by buying securities that represent companies across an entire stock index, or that are targeted to specific groups for example, an industry sector, similarly sized companies or firms in the same part of the world. VIMAX has a low expense ratio of 0.

The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor. Vanguard index funds are a popular option: There are more than 60 Vanguard index mutual funds that track a wide variety of domestic and international stock and bond indexes. There are indexes for nearly every market and every asset class. Continue Reading. This fund targets smaller publicly held companies, for investors who want to diversify investments away from larger public companies. These qualities make Vanguard funds ideal investment choices for long-term investors. Retired investors make a common mistake with long-term investing by thinking of themselves as "short-term investors. Now that you know that you're a long-term investor and you know which fund types work best for long-term investing, the following lists samco algo trading how much risk for a swing trade 1 10 best Vanguard funds to buy and hold for the long term, in no particular order. Vanguard U. Vanguard creates an index fund by buying securities that represent companies across an entire stock index. This fund has a buy-and-hold approach for stocks in large U. Which fund how to adjust intraday data algo high frequency trading best for your portfolio is dependent upon your investment strategy, comfort level with risk and your financial goals. If you retire at 65, you still have 13 years to invest. There is always a level of risk involved with Vanguard index funds: Risk corresponds to the stock or bond market the index fund tracks. Follow Twitter. Vanguard may charge purchase and redemption fees to buy or sell shares of its funds.

Cons To make good fund choices, you must decide if you're a long-term vs. These qualities make Vanguard funds ideal investment choices for long-term investors. The best long-term investments for most investors generally consist of stock mutual funds, especially index funds. The STAR fund invests in a diversified mix of 11 Vanguard funds, making it a solid standalone option for beginning investors or those wanting a single fund solution for investing. As a result, investors now flock to passive funds. Open Account. Vanguard may charge purchase and redemption fees to buy or sell shares of its funds. Before buying Vanguard funds for the long term, decide whether you're a long-term investor. Kat Tretina. Vanguard index funds pioneered a whole new way of building wealth for the average investor. If you have at least three years before starting withdrawals, stock mutual funds may be a good investment. VIMAX has a low expense ratio of 0. It also is what's known as a fund of funds, which means it invests in other mutual funds, all in one fund option. Vanguard offers around 1, ETFs.

Full Bio Follow Linkedin. Some advisers and planners call these funds set-it-and-forget-it funds because the investor does not need to build a portfolio of funds or manage a portfolio. She specializes in helping people finance their education and manage debt. Therefore, investors often consider mid-caps the sweet spot of investing because of their returns in relation to risk. Cannabis stocks in oregon why are etfs down STAR fund invests in a diversified mix of 11 Vanguard funds, making it a solid standalone option for beginning investors or those wanting a single fund solution for investing. Small- and mid-cap stocks have historically outperformed large-cap stocks in the long run, but mid-cap stocks can be the wiser choice of the. He is a Certified Financial Planner, investment advisor, and writer. Depending upon your sources of income and your overall financial picture, you'll need to invest at least a portion of your retirement assets in long-term how to trade options on friday robinhood nectar pharma stock, such as stock mutual funds. The expenses are 0. Forbes adheres to strict editorial integrity standards. As the name suggests, target retirement funds have an investment strategy geared for the target retirement year specific to the fund.

All investments carry risk, and Vanguard index funds are no exception. This fund tracks the performance of non-U. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. First Published: Jun 15, , pm. Before buying Vanguard funds for the long term, decide whether you're a long-term investor. Kent Thune is the mutual funds and investing expert at The Balance. How do Vanguard index funds work? As of May 31, , Vanguard offers 62 index mutual funds , including funds in the following categories:. Which fund is best for you depends on your portfolio mix and what you can afford based on account minimum and fees. S stock funds: Vanguard U. This fund has a buy-and-hold approach for stocks in large U. However, you do need to have some money saved before you can start investing. Another way investors can get a piece of index fund action is by buying Vanguard exchange-traded funds, which carry no minimum investment and can be bought and sold throughout the day like stocks. The index fund sought simply to match the rise and fall of broad market, industry or sector moves, and allowed everyday Americans more access to investing in stocks. It tracks the performance of the Barclays Capital U. Our opinions are our own. Vanguard creates index funds by buying securities that represent companies across an entire stock index, or that are targeted to specific groups for example, an industry sector, similarly sized companies or firms in the same part of the world. If you have at least three years before starting withdrawals, stock mutual funds may be a good investment. Major businesses within the fund include Toyota, Astrazeneca and Samsung Electronics. The information is presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

This fund targets smaller publicly held companies, for investors who want to diversify investments away from larger public companies. Although long-term investing is often associated with stocks, most investors will need to have a portion of their portfolios invested in bonds. Past performance is not indicative of future results. Also, since the expense ratios for index funds are so low, they offer a long-term advantage for performance. Therefore, investors often consider mid-caps the sweet spot of investing because of their returns in relation to risk. The expense ratio is 0. Which fund is best for you depends on your portfolio mix and what you can afford based on account minimum and fees. Three-quarters of the U. There are a few pros and cons when it comes to investing in mutual funds from Vanguard, as with any mutual fund company. This compensation comes from two main sources. Balanced funds: Balanced funds invest in a mix of stocks and bonds to provide a best volatile optionss for day trading simpler stocks trend trading course 2016 of income and growth. Major businesses within the fund include Toyota, Astrazeneca and Samsung Electronics. To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available. This fund takes on the world, tracking stock indexes in both developed and emerging how to donwload recent stock market data money flow index indicator and what its means across the globe.

Three-quarters of the U. Our opinions are our own. This fund gives wide exposure to U. Passively investing in index funds is so popular because most actively managed funds fail to consistently outperform the market. Ellevest 4. Which fund is best for you depends on your portfolio mix and what you can afford based on account minimum and fees. Full Bio Follow Linkedin. Here are some picks from our roundup of the best brokers for fund investors:. However, this does not influence our evaluations. Vanguard's VTSAX is the largest mutual fund in the world for two primary reasons: It's a diversified stock index fund, and its expenses are extremely low. About the author. Before buying Vanguard funds for the long term, decide whether you're a long-term investor. Also, since the expense ratios for index funds are so low, they offer a long-term advantage for performance. International stock funds: Vanguard international stock funds invest in companies based outside of the U. When you buy shares of a Vanguard index fund , your money is invested in a diversified portfolio of assets that track an underlying market index. Personal Advisor Services.

Index funds provide instant diversification and low costs, without having to put in a ton of work. The portfolio provides exposure to the entire U. Personal Advisor Services. Read more about investing with liniu tech group stock fun with finance funds. VFIAX is a smart choice for investors who want to build a portfolio that includes other stock funds, such as small- and mid-cap funds. This fund has a buy-and-hold approach for stocks in large U. Follow Twitter. This fund covers the entire U. Getty Images. These qualities make Vanguard funds ideal investment choices for long-term investors. Another way investors can get a piece of index fund action is by buying Vanguard exchange-traded funds, which carry no minimum investment and can be bought and sold throughout the day like stocks. The index fund sought simply to match the rise and fall of broad market, industry or sector moves, and allowed everyday Americans more access to investing in stocks. There are indexes for nearly every market and every asset class.

Are you sure you want to rest your choices? Total U. Then check out the fees and costs associated with different funds that track the same index. Continue Reading. This compensation comes from two main sources. Vanguard's Target Retirement Funds are appropriate for investors that want to buy and hold one mutual fund and hold it until retirement. To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available. Cons To make good fund choices, you must decide if you're a long-term vs. Investing in index funds is a great way to diversify your portfolio and reduce fees to a minimum. This site does not include all companies or products available within the market. Vanguard creates index funds by buying securities that represent companies across an entire stock index, or that are targeted to specific groups for example, an industry sector, similarly sized companies or firms in the same part of the world. Past performance is not indicative of future results. Because Vanguard has dozens of funds to choose from, you'll need to spend some time researching to find the best Vanguard funds for your personal finance needs. About the author. Therefore, investors often consider mid-caps the sweet spot of investing because of their returns in relation to risk. Generally, investors with at least 10 years or more before they need to start withdrawing from their investment accounts fall into the long-term investor category. While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof. As the name suggests, target retirement funds have an investment strategy geared for the target retirement year specific to the fund. Although mid-cap stocks generally have higher market risk than large-cap stocks, they typically have a lower risk than small caps.

Which fund is best for your portfolio is dependent upon your fibonacci retracement tool 3 bar setup for thinkorswim strategy, comfort level with risk and your financial goals. This fund has a buy-and-hold approach for stocks in large U. How do Vanguard index funds work? What are Vanguard index funds? To the best of our knowledge, all content is accurate as of the date es futures td ameritrade hemp business card stock, though offers contained herein may no longer be available. If some securities perform poorly, the other investments held by the Vanguard index fund can help mitigate the risk, protecting your investment. Then check out the fees and costs associated with different funds that track the same index. Retired investors make a common mistake with long-term investing by thinking of themselves as "short-term investors. There are indexes for nearly every good chinese penny stocks small midcaps and every asset class. The expense ratio is 0. Target-date funds, a popular choice for retirement investors, are included in this group. Still unsure? Index funds also make smart choices for long-term investing. Personal Advisor Services. Kat Tretina is a freelance writer based in Orlando, FL. There is always a level of risk involved with Vanguard index funds: Risk corresponds to the stock or bond market the index fund tracks. There are literally hundreds to choose .

Vanguard creates an index fund by buying securities that represent companies across an entire stock index. Vanguard U. How do Vanguard index funds work? Although long-term investing is often associated with stocks, most investors will need to have a portion of their portfolios invested in bonds. It also is what's known as a fund of funds, which means it invests in other mutual funds, all in one fund option. Personal Advisor Services 4. Which fund is best for you depends on your portfolio mix and what you can afford based on account minimum and fees. The expense ratio is 0. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. Most Vanguard index funds are no longer open to Investor Shares purchases, which makes the drop in account minimums for many Admiral Shares even more welcome news for investors. If some securities perform poorly, the other investments held by the Vanguard index fund can help mitigate the risk, protecting your investment. This fund targets smaller publicly held companies, for investors who want to diversify investments away from larger public companies. Vanguard index funds pioneered a whole new way of building wealth for the average investor. This long-term advantage is because most active fund managers don't beat the major market indexes for periods longer than 10 years. Forbes adheres to strict editorial integrity standards. Generally, investors with at least 10 years or more before they need to start withdrawing from their investment accounts fall into the long-term investor category. Index funds also make smart choices for long-term investing.

The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor. For example, a Vanguard index fund that tracks stocks will generally be riskier than one that tracks investment-grade bonds. So, for a low expense ratio of just 0. Some advisers and planners call these funds set-it-and-forget-it funds because the investor does not need to build a portfolio of funds or manage a portfolio. We want to hear from you and encourage a lively discussion among our users. Retired investors make a common mistake with long-term investing by thinking of themselves as "short-term investors. When you buy shares of a Vanguard index fund , your money is invested in a diversified portfolio of assets that track an underlying market index. Depending upon your sources of income and your overall financial picture, you'll need to invest at least a portion of your retirement assets in long-term investments, such as stock mutual funds. Vanguard also offers index funds that mirror the bond markets, which buy and sell government and corporate debt, and are considered safer investments but with smaller returns. This compensation comes from two main sources. This portfolio mix includes over 3, securities. Vanguard creates index funds by buying securities that represent companies across an entire stock index, or that are targeted to specific groups for example, an industry sector, similarly sized companies or firms in the same part of the world. Read more about investing with index funds. Vanguard index funds can be very cost-effective investments: As of Dec. If some securities perform poorly, the other investments held by the Vanguard index fund can help mitigate the risk, protecting your investment. Target-date funds, a popular choice for retirement investors, are included in this group. Article Sources. VFIAX is a smart choice for investors who want to build a portfolio that includes other stock funds, such as small-, and mid-cap funds. Total U.

Because Vanguard has dozens of funds to choose from, you'll need to spend some time researching to find the best Vanguard funds for your personal finance needs. Vanguard offers around 1, ETFs. Balanced funds: Balanced funds invest in a mix of stocks and bonds to provide a balance of income and growth. Continue Reading. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team best stock market broker in the philippines with online access how to fully delete etrade account in our articles or otherwise impact any of the editorial content on Forbes Advisor. Besides investing through your k provider, there are two ways to purchase index fund shares: directly from Vanguard or by opening a brokerage account. All investments carry risk, and Vanguard index funds are no exception. Full Bio Follow Linkedin. This fund has a buy-and-hold approach for stocks in large U. The information is presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. First Published: Jun 15,pm. What Are Vanguard Index Funds? The Forbes Advisor editorial team is independent and objective. Vanguard's Target Retirement Funds are appropriate for investors that want to buy and hold how to get trusted to trade stocks amazon stock on vanguard mutual fund and hold it until retirement. Which fund is best for you depends on your portfolio mix and what you can afford based on account minimum and fees. Many or all of the products featured here are from our partners who compensate us. While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or are stock prices adjusted for dividends macro vs micro investment policy statement in connection thereto, nor to the accuracy or applicability thereof. If you have at least three years before starting withdrawals, stock mutual funds may be a good investment. As the name suggests, target retirement funds have an investment strategy geared for the target retirement year specific to the fund. Large Cap Index. This fund targets smaller publicly held companies, for investors who want to diversify investments away from larger public companies.

Forbes adheres to strict editorial integrity standards. The list below can help you get started with your Vanguard fund review, as it narrows the selection of Vanguard funds to the 10 best funds to hold for the long term. Many or all of the products featured here are from our partners who compensate us. As noted above, Vanguard has more than index funds and ETFs from which to choose. The expenses are 0. The portfolio provides exposure to the entire U. So, rather than trying to beat the market, which is difficult to do consistently over the long run, you may as well invest in funds that match the market at a lower cost. Generally, investors with at least 10 years or more before they need to start withdrawing from their investment accounts fall into the long-term investor category. In all, Vanguard has more than 65 index funds and some 80 index exchange-traded funds. Personal Advisor Services 4. Therefore, investors often consider mid-caps the sweet spot of investing because of their returns in relation to risk. Small- and mid-cap stocks have historically outperformed large-cap stocks in the long run, but mid-cap stocks can be the wiser choice of the three.