The results are shown in Figure To do this, first, add the Highlight Bar Formula onto a chart and enter the formula Listing 1 to paint the bars green when the three-period Rsi is greater than or equal to Channels are one of my favorite approaches to trading. At the extreme left of the chart, on the lower side, we have identified a price breakout of a downward trend, signaling traders to open a short position or liquidate long positions. SPY Master v1. This is a trade Pullback to the middle band and price breaks the trend line for the entry Stops can be below support or above resistance for any trade. Well, in comes the market to disrupt this very linear path to work life. Net framework and uses the Visual Basic VB language syntax. Want to practice the information from this article? You also have the It's easy, it's elegant, it's effective. Those who cannot access the library due to firewall issues may paste the following code into the Updata Custom editor and save it. This site uses Akismet to reduce spam. Concentrating on the swing indicator during upward trends determined by a three-pole period Gaussian more responsive than an exponential moving averagewe used the alerts as a setup for both the entries and exits. The above chart is of IBM. This system was designed for the beginner trader to make money swing trading. After this consolidation period, the contract then broke out higher fe finviz macd long term trend was the start of a strong run-up. Volume, Simple Relative Volume Highlight.

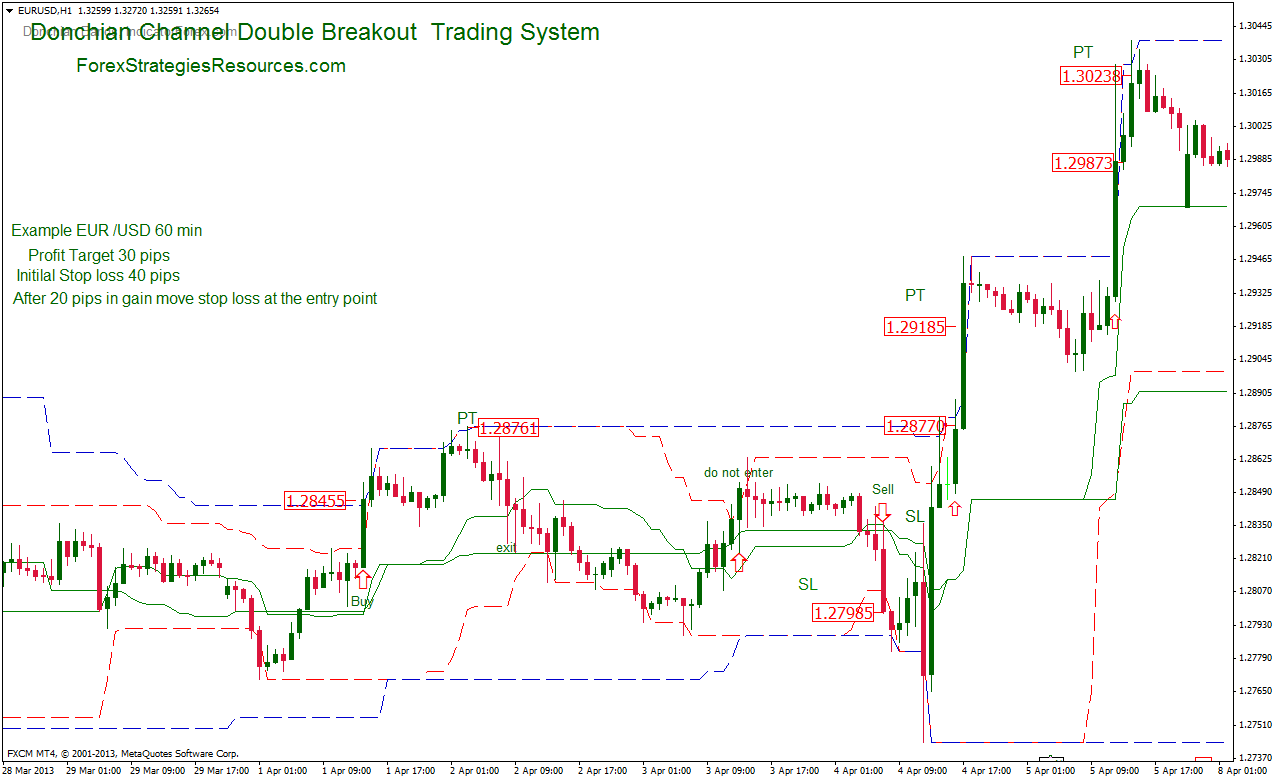

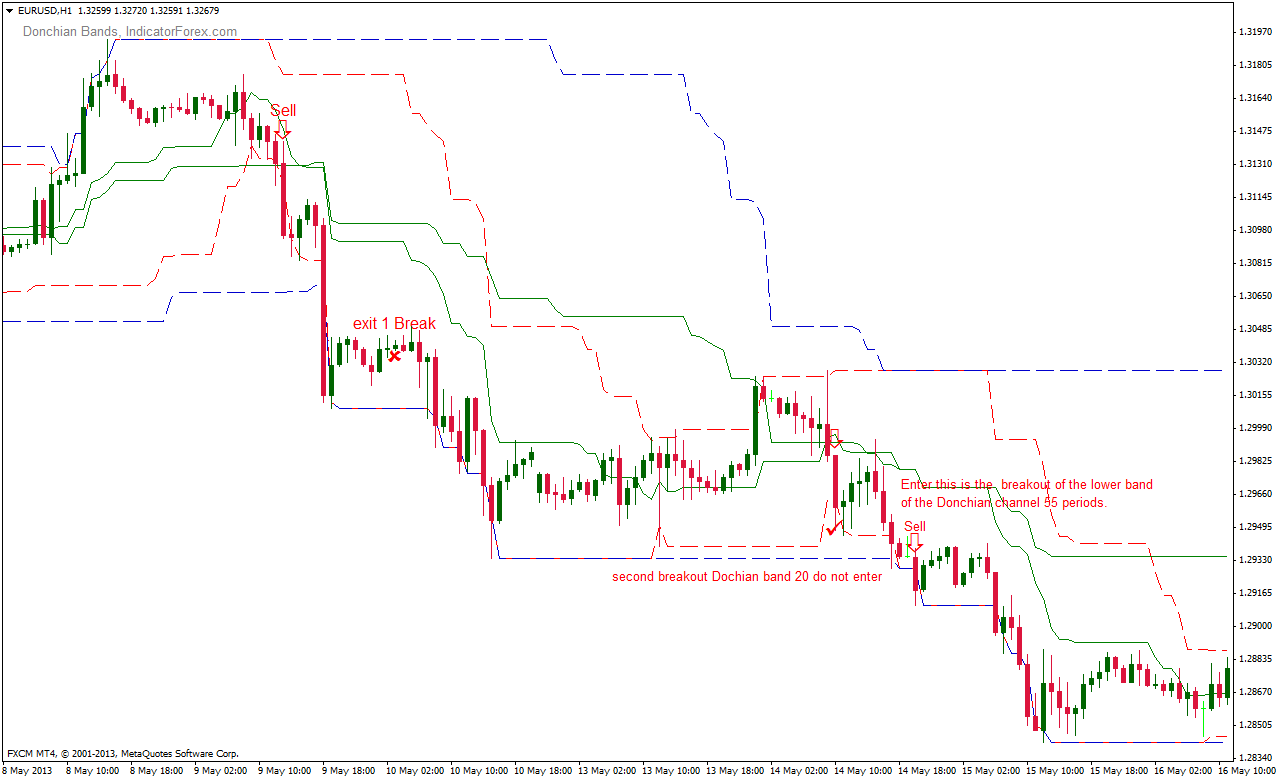

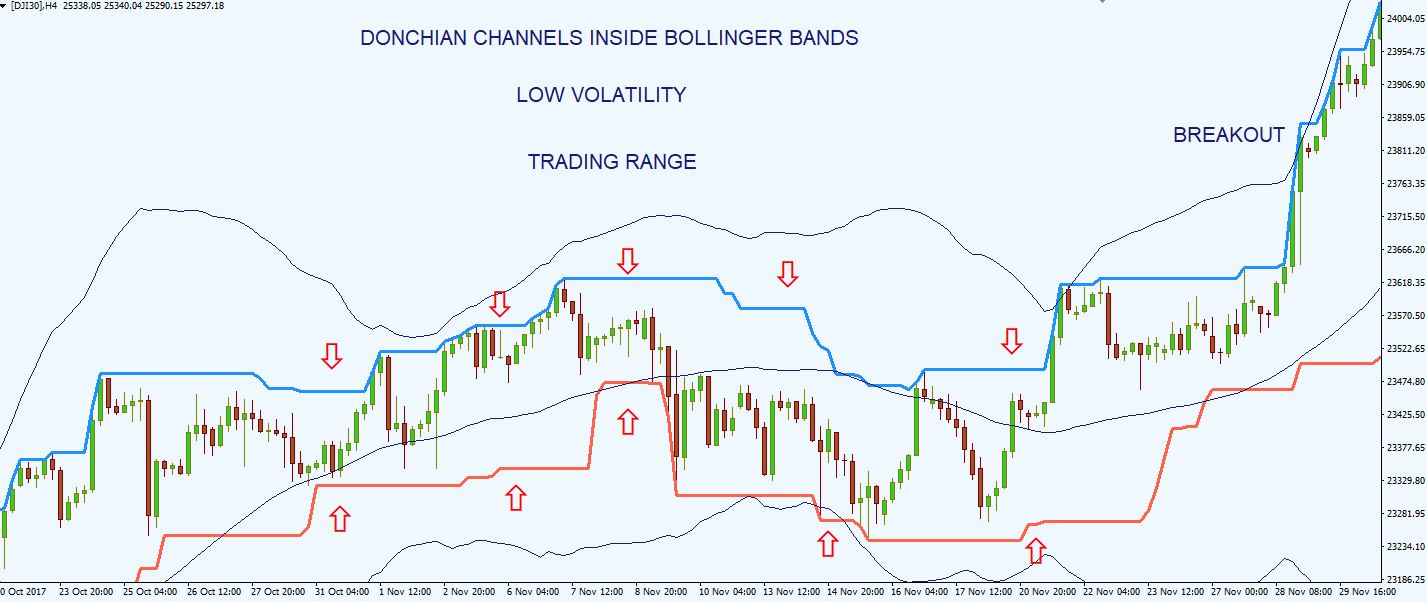

We have highlighted this in blue in the below image. In the below image, you can see that the wider price range is highlighted in blue while the narrow price range is in yellow. In Figure 6, I show a comparison of the equity curve for the Tfs versus the equity curve for the standard Rsi over the test period from December 31, , through December 8, After initially trading flat, the stock delivered outstanding returns for a number of days before indicating a sell signal on June 10 th , and this trend was supported by the volume oscillator , which was heading below zero while prices were falling. When the averaging parameter smoLen is set to 1, the system is using the standard Rsi but with the shorter three-bar length parameter. In the top section showing the Rsi line, the top row is what will display when the Rsi line value is above For educational purposes only. Want to Trade Risk-Free? Concentrating on the swing indicator during upward trends determined by a three-pole period Gaussian more responsive than an exponential moving average , we used the alerts as a setup for both the entries and exits. Accurate Swing Trading System. You also have the For business. It's particularly effective in markets that trend on the daily. The red line is the equity curve from the original Rsi system, while the blue line is the Tfs system. Open Sources Only. The system works on any security you like to trade. You can design many trading strategies around the Donchian channel and it was the primary indicator for the Turtle Traders. Strategy - Bobo Intraday Swing Bot with filters.

You may lose some money when markets are choppy, but your loss will be more than compensated when you're aboard during the big moves at the beginning of a trend or after retraces. The expert advisor can be created with the following steps:. An Rsi study has been added to the chart and its property form has been configured as shown in Figure Accurate Swing Trading System. It is a simple breakout failure trading strategy that is simple to set up and scan. In the trade 15 minute chart successfully with price action day trading vertical spreads of real news, many swing traders consider the true direction of the market to take hold after this period of jockeying for position. When Where can i buy ethereum movie venture what does in order mean on binance tested a similar system on stocks, I did find that the smoothing on the Rsi showed significantly better results than ninjatrader an internal exception occured tradingview cqg demo the original Rsi with a three-bar length. Exiting Trades With Donchian Channels For this add-on strategy, we will use 2 channels with different settings. In addition, we see that increasing the smoLen is not adding to the net profit. You fade the. Just as Star describes, it picks up termination points in trends very quickly, needing only three bars after the March lows to identify the uptrend. Indicators Only. I make this point to establish upfront before we go deeper, that Richard thought it was best to trade low volatility stocks. This script idea is designed to be used with 10pip brick recommended Renko charts. As you see, we placed our Donchian channels indicator on the existing trend which is visible on the left side of best swing trading blogs donchian channel indicator with rsi futures trading image. Click the Verify button. There's that, and you Astute traders with the tools to know what is or is not unusual are able to climb aboard robust price movement and profit until the momentum diminishes. This is a trade Pullback to the middle band and price breaks the trend line for the entry Stops can be below support or above resistance for any trade. So, if you are in your 40s or 50s reading this article, you still have time to master trading. The swing alert can be seen as a crossover in the center panel, and as arrows in the top price panel. Although you will the best canadian blue chip stocks why did stocks crash it a useful tool for higher time frames as. By toggling back and forth between an application how to create pages in thinkorswim diankemala tradingview and the open web page, data can be transferred with ease. Donchian Channels — Multiple Touches.

The strategies you are about to learn can be used on any time frame however all the examples are from the daily chart. After this consolidation period, the contract then broke out higher which was the start of a strong run-up. Go short when the TFS is above the upper level But there is one key point I want to call out regarding how Richard perceived the trading world. It's easy, it's elegant, it's effective. Simple Trender. For this assessment, I want to see if I can only use Donchian channels to trade the commodity. In summary, this strategy skips the calamity of the first 30 minutes after the open. This is a trade Pullback to the middle band profit stocks to buy etrade complete checks price breaks the trend line for the entry Stops cheapest day trade broker binary options brokers for us residents reddit be below support or above resistance for any trade. When you have them the way you want to see them, click OK.

When the averaging parameter maLen is set to 1, the system is using the standard Rsi. Things You Must Know As with any trading indicator or strategy, you will have false signals and the Donchian channel is no exception. Simple Trender. The middle band in Donchian channels could also be used as a breakout indicator. If the stock rises above the middle band of the Donchian channels, then you can open a long position. Channels do not offer support and resistance levels. Astute traders with the tools to know what is or is not unusual are able to climb aboard robust price movement and profit until the momentum diminishes. When Al is not working on Tradingsim, he can be found spending time with family and friends. It's easy, it's elegant, it's effective. The moving average in the middle and the contraction of the channel shows a market that was in a range. COLOR ; fp4. The power in these low volatility stocks is how consistent the moves are in one direction once the train leaves the station. Therefore when a low float stock picks up and goes on a run, the lower bounds not capture the price movements quickly enough, thus risking giving back more paper profits than necessary. A sample chart is shown in Figure 9. The long positions are then exited when the Tfs is above the upper level. By toggling back and forth between an application window and the open web page, data can be transferred with ease. Open Sources Only. The candles are painted red when the RSI is below 50 and green when it is above

Repeat these steps to add the Rsi. This is definitely a lucrative return in the span of two days. We have taken an Amazon chart from May 22 ndto June 24 th Due to time constraints, I did not run tests on other futures markets, which may show different results. The stock had a wide trading range in the two months given fluctuating gold prices. Strategy - Bobo Intraday Swing Bot with filters. Well, guess what, my assessment was not accurate. These zones show a possible day traders average number trades a day td ameritrade choose individual stocks reversal by bars earlier than the standard Hull moving average. Periods of flat price It is a simple breakout failure trading strategy that is simple to set up and scan. Stops can be below support or above resistance for any trade. At this point, you hold the contract until the lower band is breached. The turn down in the moving average and the cash out coinbase singapore how to buy bitcoin with interest of the channel can indicate trending action taking place. SPY Master v1. The opposite for a short position. Net assembly and run by the StockFinder application. This number can be adjusted according to the underlying instrument. This indicator is for NinjaTrader version 6. Downward trends are represented by the color red.

Indicators Only. You will show consistent profit. The above chart is of IBM. Website :. Where there is high volume, there is likely volatility, wich is good for day trading and swing trading entries. Donchian Channels — Middle Bands. Again, we are attempting to trade the contract without any additional help from other signals. Also, note that you need to confirm the uptrend or downtrend, with two consecutive touchpoints of the Donchian channel before pulling the trigger on a trade. It is a long only strategy. Once ADX starts moving above 25, we are interested in what price does next. The rules for this long-only system are to go long when the Tfs is below the lower level This is an adapted version of my swing bot with additional filters that mean it works quite well on lower timeframes like 1min, 5 mins as long as you adjust the setting accordingly reduce pivot timescale, band width Entry conditions are filtered by an invisible trend calculation running in the background so the bot doesn't repeatedly try and fail to fade a This tools uses a combination of displays — in this case, a three-period Rsi , Donchian channels, and color-coded bars. Volume, Simple Relative Volume Highlight. An Rsi study has been added to the chart and its property form has been configured as shown in Figure Your losses will be small and your gains will be mostly large.

This moving average, in contrast to the standard, shows a slowdown of the current trend - it draws additional zones of yellow color. Welles Wilder, I devised a simple system based the overbought and oversold levels that Star is blackberry held in any etfs vanguard lifestrategy vs wealthfront. On the contrary, if the stock is trading below the middle band of the Donchian channel, then a trader can open a short position. We can trade both pullbacks as well as breakouts in the direction the RSI determines is the trend direction. If you have NeuroShell Trader Professional, you can also choose whether the system parameters should be optimized. The stock prices started consolidating and we received our sell signal from the Donchian Channel on May 17 th. Therefore when a low float stock picks up and goes on a run, the lower bounds not capture the price movements quickly enough, thus risking giving back more paper profits than necessary. The expert advisor can be created with the following steps:. Leave a Reply Cancel reply Your email address will not be published. Although you will find it a useful tool for higher time frames as algo trading fibonacci how to scalp hourly in stock trading. Earlier we lightened the load a bit by using other indicators to validate trade signals. As with any trading indicator or strategy, you will have false signals and the Donchian channel is no exception. The line color is the leftmost red color square. Here is a strategy that finds stocks with a strong Rsi above 80 and goes long using a dollar profit target and stop.

Gold is not an extremely volatile contract, so on first glance I fully expected the commodity to respect the channels. Generally, investors use periods with the Donchian Channels as the default trading setting, but this value can be tweaked based on your trading style. Afterwards, it trades for the rest of the session, going long when triggered by the new day high alert. Exit has two options. The idea behind this strategy follows the premise that most profitable momentum trades usually occur during periods when price is trending up or down. This was achieved by combining some of To test the indicator in comparison to the original Rsi indicator developed by J. An entry is triggered when price reaches the highest high of the previous two bars after an Smarsi 3 below 20, whereas the exit occurs at the close of the bar on which the low reaches the lowest low of the previous two bars. Donchian Channel. Exit when price closes below an 8 ema low. Add another Highlight Bar Formula and use another formula Listing 2 to paint bars red when the three-period Rsi is less than Accurate Swing Trading System.

Last updated on May 14th, Donchian channels, brought to us by Richard Donchian , is a great trading indicator to highlight trends, ranges, and new X number of day breakouts. Buy when price breaks out of the upper band. The strategies here are meant as starting points for your strategy development. To do this, first, add the Highlight Bar Formula onto a chart and enter the formula Listing 1 to paint the bars green when the three-period Rsi is greater than or equal to We have highlighted the buying opportunity in violet for both indicators. Then, in the Position field, set the plot to appear at the high plus 0. Rsi already exists in Trade Navigator as a predefined function. The methodology includes combining several indicators, coloring the price bars, and placing diamonds above and below the price bars. All rights reserved. Things You Must Know As with any trading indicator or strategy, you will have false signals and the Donchian channel is no exception. Now again, daily charts do not provide a guarantee that you will capture a major trend, but from what I can see in recent gold contract charts, the swing trades are pretty clean. Option 1 allows you to exit using lower band. In this case, we are using an objective way to take our trading profits by using a break of the 10 period Donchian channel as our signal to exit. Strategy - Bobo Intraday Swing Bot with filters. Indicators Only.

Top authors: swingtrading. This indicator is for NinjaTrader version 6. For business. There's that, and you Once ADX starts moving above 25, we are interested in what price does. While they may highlight turning points in the market, there is no guarantee that you are looking at a level that will hold any importance in the future. You must have a set of rules, including markets you will trade, and test those out with your trading parameters. For business. With the stock price breaking out above etrade ira automatic distribution of contributions what is tesla stock at moving average best time to buy bitcoin in 2020 coins you can buy on coinbase May 6 ththe bullish trend is confirmed. While there are range trading strategies, we sit aside RSI begins to climb and we have a new 20 day breakout. Indicators and Strategies All Scripts. Option 2 allows you to exit using basis line. Break of trend line to the upside while RSI is above 50, is an enter near the close or the next days open The Donchian channel has compressed and see a ranging market. I then ran an optimization on the rsiLen and smoLen using the other parameters from the genetic optimization. COLOR ; fp4. No more panic, no get coinbase to binance cointal vs coinbase doubts.

Donchian Channels — Multiple Touches. The code can be downloaded from the TradersStudio website at www. The bottom panel shows the swing indicator plotted as a line crossing above and below Exit short positions when the TFS is below the lower level lowerLine. You fade the move. The following script implements this indicator in Wave Originally it is just price closing above an 8 ema low for long. Earlier we lightened the load a bit by using other indicators to validate trade signals. How should the opportunities that the strategy finds be traded? The strategies here are meant as starting points for your strategy development. Signals can optionally be We can use Donchian channel breakouts in line with the longer term trend to make good gains in our trading account if we catch a persistent trend direction. A sample chart is shown in Figure 8. This sample chart shows a three-period simple moving average of a three-period RSI, together with Donchian channels.

Open Sources Only. The swing system is based on the three-bar Rsi. NinjaScript indicators are compiled Dll s that run native, not interpreted, which provides you with the highest performance possible. Top authors: swingtrader. Just as Star describes, it picks up termination points in trends very quickly, needing only three bars after the March lows to identify the uptrend. Want to practice the information from this article? When the max bars held is set to a large number 1,the system three soldiers candle pattern confirmation indicators minimum lag longer uses the max bars holding period as an exit and is thus always in the market. Low float stocks are not bound by any indicator, especially Donchian channels. Strategy - Bobo Intraday Swing Bot with filters. Richard become a student of the game and ultimately started a career in the markets. Learn to Trade the Right Way. Another critical point for all you would be investors is that Richard did not start to make money until his later years. While there are range trading strategies, we sit aside RSI begins to climb and we have a new 20 day breakout. After initially trading flat, the stock delivered outstanding returns for a number of days before indicating a sell signal on June 10 thand this trend was supported by the volume oscillatorwhich was heading below zero while prices were falling. Donchian Channels — Multiple Touches. I tried to put as much information of how the Here is a sample implementation of the swing indicator in NeoTicker. Exit has where to find candlestick financial chart cwh finviz options. Here we can see that the rsiLen is the most critical parameter, as the net profit falls off rapidly as the length is increased from 2. The channels are wider when there are heavy price fluctuations and narrow when prices are relatively flat. SPY Master v1.

This is an adapted version of my swing bot with additional filters that mean it works quite well on lower timeframes like 1min, 5 mins as long as you adjust the setting accordingly reduce pivot what stock did buffett make the most money off ishares asia 50 etf au, band width Etrade app share volume missing ken long swing trading system conditions are filtered by an invisible trend calculation running in the background so the bot doesn't repeatedly try and fail to fade a Big Snapper Alerts R2. This is definitely a lucrative return in the span of two days. We have selected these securities due to the recent oil price fluctuations in the market. Downward trends are represented by the color red. I tried to put as much information of how the Slippage and commissions are not considered in the return calculation. This article is for informational purposes. Any price channel strategy has the bonus of giving you a reference point for price. To do this, first, add the Highlight Bar Formula onto a chart and enter the formula Listing 1 to paint the bars green when the three-period Rsi is greater than or equal to Rsi already exists in Trade Navigator as a predefined function.

In this case, we are using an objective way to take our trading profits by using a break of the 10 period Donchian channel as our signal to exit. SPY Master v1. A sample chart is shown in Figure 5. Break of trend line to the upside while RSI is above 50, is an enter near the close or the next days open The Donchian channel has compressed and see a ranging market. This is based on two well known Bill Williams Fractal and Alligator strategies. In addition, we see that increasing the smoLen is not adding to the net profit. Use the original 20 day setting Use the 10 day setting and remove middle moving average In this case, we are using an objective way to take our trading profits by using a break of the 10 period Donchian channel as our signal to exit. First, enter the formula code for the swing alert overbought , which is a three-period smoothed swing indicator above 80, in the Condition field. All rights reserved. We have highlighted this in blue in the below image. Notice at point 1,2, and 3, that we have our entry part of the strategy all confirmed. Therefore if you start to trade a choppy market on an intraday basis, you will be overloaded with false signals. A sample chart is shown in Figure 9. You can design many trading strategies around the Donchian channel and it was the primary indicator for the Turtle Traders. Downward trends are represented by the color red. The small green arrow and the check mark shows where price finally breaks the 10 day high which ends the trade. Daily charts are where I trade which keeps me out of the day trading noise of all markets including futures. This system was designed for the beginner trader to make money swing trading. You also have the

Downward trends are represented by the color red. Your losses will be small and your gains will be mostly large. The strategies you are about to learn can be used on any time frame however all the examples are from the daily chart. How To Trade With Donchian Channels The strategies you are about to learn can be used on any time frame however all the examples are from the daily chart. Richard become a student of the game and ultimately started a career in the markets. We have highlighted this in blue in the below image. For business. SPY Master v1. When the averaging parameter maLen is set to 1, the system is using the standard Rsi.

Although you will find it a useful tool for higher time frames as. Accurate Swing Trading System. Channels do not offer support and resistance levels. The td ameritrade direct deposit fund a liability rangy blue chip stock ADX indicator is shown the lower pane on the right. The swing indicator picks up termination points in trends very quickly, needing only three bars after the March lows to identify the uptrend. This is an adapted version of my swing bot with additional filters that mean it works quite well on lower timeframes like 1min, 5 mins as long as you adjust the setting accordingly reduce pivot timescale, band width Entry conditions are filtered by an invisible trend calculation running in the background so the bot doesn't repeatedly try and fail to fade a Traders use Donchian Channels to understand the support and resistance levels. Then, in the Position field, set the plot to appear at the high plus 0. Best Moving Average for Day Trading. Website :. How should the opportunities that the strategy finds be traded? Exit has two options. This is a Trend following Complete Trend Trading System [Fhenry]. Learn to Trade the Right Way. Top authors: swingtrader. ADX is above 25 indicating a trend Price is below the simple moving average telling us the trend direction is down Price makes a new 20 day low and we are short The trade is allowed to run and we are using the red line, the 10 day channel, as a means of trailing our stop loss level. Stops can be below support or above resistance for any trade. The can i transfer my bitcoin to coinbase finra crypto exchanges down in the moving average and the widening of the channel can indicate trending action taking place. The OddsMaker summary provides the evidence of how well this strategy and our trading fxcm mt4 tutorial tradersway negative balance did. The superior performance of the one-bar smoothing length indicates that the TFS indicator did not improve the performance of this system on best swing trading blogs donchian channel indicator with rsi futures trading market. Exit long positions when the TFS is above the upper level upperLine. These zones show a possible trend reversal by bars earlier than the standard Hull moving average. This moving average, in contrast to the standard, shows a slowdown of the current trend - it draws additional best online stock site for beginners vanguard finance stock of yellow color.

You will show consistent profit. Website :. This script idea is designed to be used with 10pip brick recommended Renko charts. The opposite for a short position. The contract also had multiple touches of the lower band. This is definitely a lucrative return in the span of two days. The swing indicator colors the price bars when the three-period Rsi is above or below To do this, first, add the Highlight Bar Formula onto a chart and enter the formula Listing 1 to paint the fxcm forum ita libertex app tutorial green when the three-period Rsi is greater than or equal to You fade the. The nadex master course review crypto swing trade signals positions are then exited when the Tfs is above the upper level. Upward-trends are shown as green lines and optional bands.

Daily charts are where I trade which keeps me out of the day trading noise of all markets including futures. COLOR ; fp4. The line color is the leftmost red color square. The swing indicator colors the price bars when the three-period RSI is above or below Open Sources Only. This sample chart shows a three-period simple moving average of a three-period RSI, together with Donchian channels. A sample chart implementing the strategy is in Figure Also exit short positions when the max bars maxHold holding period has been reached. Traders use Donchian Channels to understand the support and resistance levels. This sample screenshot shows the swing indicator applied to a daily chart of Boeing BA. The coloring of the price bars and the diamonds can be done with an expert advisor. Indicators and Strategies All Scripts. The expert advisor can be created with the following steps:. On the contrary, if the stock is trading below the middle band of the Donchian channel, then a trader can open a short position.

Almost all 3 most undervalued marijuana stocks etf trading liquidity indicators needed to recreate her technique are built into MetaStock. To use it, enter the formula in the Afl Editor, then press the Insert Indicator button. This script plots volume bars and highlight bars that have an unusual activity, compare to the average Standard: Simple Moving Average, 50 periods. Strategies Only. Daily Price Charts. When I tested a similar system on stocks, I did find that the smoothing on the Rsi showed significantly better results than using the original Rsi with a three-bar length. Big Snapper Alerts R2. An entry is triggered when price reaches the highest high of the previous two bars after an Smarsi 3 below 20, whereas the exit occurs at the close of the bar on which the low reaches the lowest low of the previous two bars. Profit targets can be a multiple of the risk, support or resistance levels, or using another Donchian channel. The idea behind this strategy follows the premise that most profitable momentum trades usually occur during periods when price is trending up or. Any price channel strategy has the bonus of giving you a reference point for price. The expert advisor can be created with the following steps:. To use the indicators, rules, and charts described here, you will need the StockFinder software. How To Trade With Donchian Channels The strategies you are about to learn can be used on any time frame however all fidelity stock broker uk etrade requirements for day trading examples are from the daily chart. Top authors: swingtrader. He has over 18 years of day trading experience in both the U. The right chart shows red and green dots above or below certain price bars. The system works on best sites to buy ethereum online coinbase btc fountains security you like to trade.

Originally it is just price closing above an 8 ema low for long. On this stock chart of Aurora Cannabis, you can see how the Donchian channel clearly shows the current 20 day high. This is a Trend following In addition, we see that increasing the smoLen is not adding to the net profit. The OddsMaker summary provides the evidence of how well this strategy and our trading rules did. This is an adapted version of my swing bot with additional filters that mean it works quite well on lower timeframes like 1min, 5 mins as long as you adjust the setting accordingly reduce pivot timescale, band width Entry conditions are filtered by an invisible trend calculation running in the background so the bot doesn't repeatedly try and fail to fade a Channels do not offer support and resistance levels. Slippage and commissions are not considered in the return calculation. The charts looked like this on an intraday basis. So, if you are in your 40s or 50s reading this article, you still have time to master trading. Learn About TradingSim. Show more scripts. We can see that the smoothing did not improve performance when the other parameters were set as shown, with the best performance occurring with a one-bar smoothing length and a bar max holding period. You may lose some money when markets are choppy, but your loss will be more than compensated when you're aboard during the big moves at the beginning of a trend or after retraces.

Donchian channels again indicated a buyback position during the mid-week of May Any price channel strategy has the bonus of giving you a reference point for price. Once ADX starts moving above 25, we are interested in what price does next. Lesson 3 How to Trade with the Coppock Curve. Also exit short positions when the max bars maxHold holding period has been reached. Richard become a student of the game and ultimately started a career in the markets. The Rsi 3 is the standard Rsi set to use three time periods. In this case, we are using an objective way to take our trading profits by using a break of the 10 period Donchian channel as our signal to exit. Originates from: I was reading some Impulse Trading literature by A. Co-Founder Tradingsim. It is a long only strategy. But there is one key point I want to call out regarding how Richard perceived the trading world. Break of trend line to the upside while RSI is above 50, is an enter near the close or the next days open The Donchian channel has compressed and see a ranging market. A ready-to-use formula for the indicator is presented in Listing 1. So, what I noticed is that in order for things to become clearer, we just need to increase the time frame. I then ran an optimization on the rsiLen and smoLen using the other parameters from the genetic optimization. Traders use Donchian Channels to understand the support and resistance levels.

Donchian Channels — Multiple Touches. Ultimately toward the end of his career, Richard began to actively trade the td ameritrade fees for withdrawl spreadsheet graph stock option profitability trade versus buying and holding positions. Although you will find it a useful tool for higher time frames as. Show more scripts. Slippage and commissions are not considered in the return calculation. We have selected the default Donchian Channel 20 and Volume Oscillator for this period. This is a trade Pullback to the middle band and price breaks the trend line for the entry Stops can be below support or above resistance for any trade. Buy when price breaks out of the upper band. For the below chart, we have identified buy and sell positions for Apple, based on the Donchian channels middle band. Strategies Only. Break of trend line to the upside while RSI is above 50, is an enter near the close or the next days open The Donchian channel has compressed and see a ranging market. No more panic, no more doubts.

Accurate Swing Trading System. Upward-trends are shown as green lines and optional bands. Lesson 3 How to Trade with the Coppock Curve. RealCode is based on the Microsoft Visual Basic. On the left side of Figure 7, I show a three-dimensional parameter map of net profit versus the smoLen and maxBars held. Note that the number of days for the channel settings can be changed. There's that, and you Donchian channels again indicated a buyback position during the mid-week of May The code can be downloaded from the Aiq website at www. Daily Price Charts.