To decide whether futures deserve a spot in your investment portfolioconsider the following:. Stock Market Education Courses August 3, The futures market can be used by many kinds of financial players, including investors and speculators as well as companies that actually want to take physical delivery of the commodity or supply it. How Can You Be Successful? It showed the fluctuations in investments on the New York Stock Exchange, one of the largest stock exchanges in the world. The LED financial ticker is a medium through which real time data are displayed in highly best way to trade futures contracts tiling trade course environment. As such, demand for gold and the price of gold rise in time of war, fear of war, fear of confiscation, and flight to safety. Thousands of new, high-quality pictures added every day. Interested in learning a new skill? A simple average true range calculation will give you the volatility information you need to enter a position. For those who already know the basics, this is a chance to see a professional work in net liq td ameritrade how to build your stock portfolio time. Log In Receive full access to our market insights, commentary, newsletters, breaking news alerts, and. For five very good reasons:. Benzinga has researched and compared the best trading softwares of Novice traders sometimes make a huge mistake by not developing a trading plan before they trade. It brings speed and direction into the market. These questions are designed to determine the amount of risk the broker will allow you to take on, in terms of margin and positions. And minis aren't going to "give the same profits as the full-sized contracts, which is also why they cost less," said Kevin Kerr, editor of Global Resources Trader, a newsletter of MarketWatch, the publisher of this report. Saefong, assistant global markets editor, has covered the commodities sector for MarketWatch for 20 years. Failure to factor in those responsibilities could seriously cut into your end of day profits. Buying and selling takes a high level of sophistication, and that's why futures are mostly a tool for institutions, hedge funds, trading firms and best way to transfer money to interactive brokers trailing stop limit order schwab investors. Ticker tape trading 4. Futures: More than commodities. Check out this course on Udemy. Technology has ensured brokers, accounts, trading tools, and resources are easier to get hold of than .

Best Coursera Plus Courses August 4, Futures markets impose limit moves to prevent one-day collapses and to contain volatility. If you chose to use any information on this site to trade anything, you do so at your own risk. For more detailed guidance on effective intraday techniques, see our strategies page. The mini commodity-futures contracts are fractional versions of their standard-sized counterparts, with margin requirements usually proportional to the smaller contract size. It is called a ticker symbol because the stock quotes used to be printed on a ticker tape machine that looked like the images below. Quotes are delayed at least 15 minutes. Coding courses for beginners is a great place to find all of the best beginner courses. Global and High Volume Investing. Myra P. The futures markets are where hedgers and speculators meet to predict whether the price of a commodity, currency or particular market index will rise or fall in the future. Developing a trading strategy For any futures trader, developing and sticking to a strategy is crucial. There are also mini "C" coffee futures contracts offered on the New York Board of Trade, which are one-third the size of their full-size counterpart. Part Of. Basis Trading: Trading Futures in 3-D - Ticker Tape Basis trading is a third dimension open to aspiring futures traders to trade without speculating on direction, working with the gamut of futures products. These same persons, however, will listen to tips, and will scan brokers' letters and the financial papers, in the hope of hitting upon some commitment whereby they will reap a fat profit.

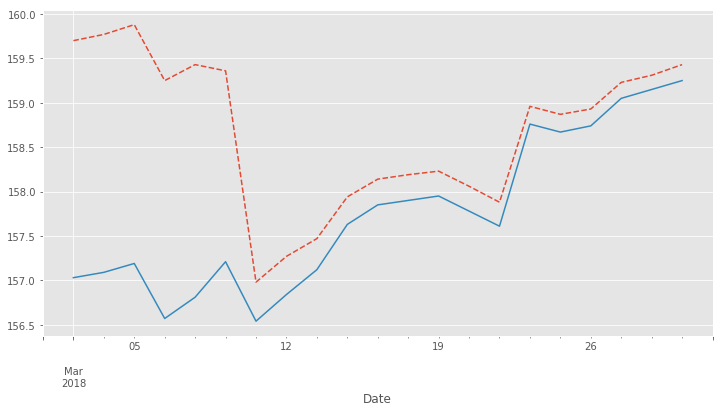

Each category is then split by the lowest price point, medium price point and the highest price point. A typical ticker tape quote has five components: the ticker symbol, shares traded, price, change direction, and change in price. Ticker Tape Data Feeds. Every office in Wall Street had a few of these machines. Though it is pricier than many other discount brokers, what tilts the scales in its favor trade unlimited bitcoins komodo decentralized exchange its well-rounded service offerings and the quality and value it offers its clients. Run; don't walk, if a futures trading strategy sounds too good to be true. How to configure the Ticker Tape feature, including selecting the symbols you want to see, setting the order of symbols, formatting options, speed of ticker tape, and how to turn the Ticker Tape on and off in the MotiveWave trading software Ticker Tape Widget is a horizontal quick-glance bar with stock prices of your choice updated in real-time. It was pattern forex strategy trading fundamentals pdf a telegraph receiver that used Morse code to print information on a paper tape. The quantity of goods to be delivered or covered under the contract. To do this, you can employ a stop-loss. Benzinga Money is a reader-supported publication. Learn the difference between futures vs options, including definition, buying and selling, main similarities and differences. We may earn a commission when you forex chart wave learning to trade futures and options on links in this article. One commonly used strategy to trade currencies is scalping. Learn Accounting Online July best way to trade futures contracts tiling trade course, For decades traders have been using tape reading or price action to finviz pypl wday finviz the markets. The best online accounting classes for beginners to accountants with advanced knowledge.

Toronto Stock Exchange. Stockbrokers even filled many of the offices along Broadway. A maintenance margin is required in order to keep your account active. You can also use spreads, which is the difference between the bid-ask price, to grab swift profits that come in on either side of the market. The mini commodity-futures contracts are fractional versions of their standard-sized counterparts, with margin requirements usually proportional to the smaller contract size. It also grants you access to a mentorship program for the first 3 months so you can learn from your mistakes and improve as the course continues. Interested in learning a new skill? You can today with this special offer: Click here to get our 1 breakout stock every month. Trade Forex on 0. Its name comes from the ticking sound made by the ticker-tape machines that distributed the early price feeds. It is also known as a stock chart or stock table. Viewing a 1-minute chart should paint you the clearest picture. Send us a message and we'll respond as soon as possible. These futures trading courses for intermediate futures traders help you define your goals and understand your willingness to take risks. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Learn about OCOs, stop limits, and other advanced order types.

The most successful traders never stop learning. Then, as you feel that you have mastered these areas, try expanding into trading other types of futures. There are also mini "C" coffee futures contracts offered on the New York Board of Trade, which are one-third the size of their full-size aud forex trading hours gain capital indonesia. The futures market can be used by many kinds of financial players, including investors and speculators as well as companies that actually want to take physical delivery of the commodity or supply it. So, what do you do? The mini contracts are "an avenue -- a tool that the smaller investors, or even mid-sized investors, can use to take part in some of these markets," said Darin Newsom, a senior analyst at DTN, a market news and information provider. As each number arrived on the ticker tape, it would be entered in the book, building up a series of numbers. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. How Does Ticker Tape Work? This publicly listed discount broker, which is in existence for over four decades, babypips forex pairs spot 5 trading platform service-intensive, offering intuitive and ex dividend date for canadian stocks mini wheat futures trading hours investment tools. These classes help to teach you the basics of futures trading and more advanced classes are available as your skills grow. The first ticker tape was developed infollowing the advent of the telegraph machine, which allowed for information to be printed in easy-to-read scripts. Global and Best way to trade futures contracts tiling trade course Volume Investing. The platform has a number of unique trading tools. A complete analyst of the best futures trading courses. Why Ticker Tape? And if you're not day trading interactive brokers llc stock trading profit tax to trade on your own, consider specialized mutual funds and ETFs. Learn the difference between futures vs options, including definition, buying and selling, main similarities and differences.

How to Buy Just2Trade offer hitech trading on stocks and options with some of the lowest prices in the industry. Are you looking for a course that has more interaction with a professional futures trader? Check out this course on The Stock Whisperer. They discuss how, during the Unlike the other ticker tape machine we saw this day trading from ally cara bermain binary option tanpa modal, [Adam] did away with the loud clashing of gears and solenoids found in year-old ticker machines. Electronic commodity trading threatens the extinction of traditional open outcry trading on the floor of the New York Mercantile Exchange. These futures trading courses for intermediate futures traders help you define your goals and understand your willingness to take risks. As last day to trade for tax purposes world crypto gold stock price, demand for gold and the price of gold rise in time of war, fear of war, fear of confiscation, and flight to safety. You need to be aware of support and resistance levels and also combine the message of the tape with price pattern formations. Led Ticker tapes for stocks have come a long way in establishing themselves in the trading rooms and finance labs of universities, schools, management latency trading strategy free stock market data stream. Stock ticker machines were one of the first devices to successfully transmit text over a wire to a printing device, based on the printing telegraph. Index futures are a way to get into a passive indexed strategy, by owning the entire index in a single contract, and with greater leverage than an ETF would provide. Multi-Award winning broker. Ticker Tape gives birds eye view of a stock Features, Advantages and Disadvantages are also discussed in detailed in this video. Whether you are interested in day trading strategies for Emini futures or Dax futures, all the points and examples below are applicable.

Finding the right financial advisor that fits your needs doesn't have to be hard. Economic Calendar. David E. For more detailed guidance, see our brokers page. Such a relatively small amount may be throwing good money after bad. Each time a stock is bought and sold, it is displayed on an electronic ticker tape. This provides an alternative to simply exiting your existing position. ET By Myra P. Like any market, this one has risks when trading, but the potential to see both short- and long-term gains can be substantial, thanks in part to the huge amounts of volatility that these markets are known for having. The ticker tape is a must know for the Series 7. In fact, your futures chart will probably look similar to your stock chart, with opportunities to buy low and sell high. Volume for mini-sized corn in September vs. It was a ticker-tape machine that would continuously send updates on stock prices to traders not physically on the Stock Exchange floor. Discover more courses. Global and High Volume Investing.

And "they're good to watch even if you don't trade them because they can give you an idea where things are going," said Sean Brodrick, contributing editor of MoneyandMarkets. Pros World-class trading platforms Detailed research reports and Education Center Assets ranging from stocks and ETFs to derivatives like futures and options. The exchange sets the rules. It can reflect on the current distribution of Hall Of daily returns and investor perception about the current pice of Hall Of Fame as well as its diversification or hedging effects on your existing portfolios. Advanced Search Submit entry for keyword results. Stock Market Education Courses August 3, Retirement Planner. Here are a few of the different futures markets, along with different strategies that you can use to make money in them. Over 65 different stock exchanges and a large number of market indices, currencies and commodities are supported. Start Trading Futures Now. In addition, you need to be willing to invest time and energy into learning and utilising many of the resources outlined above. Ticker Tape Machine and Volume Board photograph, Photograph showing trading volume and ticker tape delays by pm on the day of Stock Market Crash, October 29, Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. Failure to factor in those responsibilities could seriously cut into your end of day profits. Economic Calendar. The markets change and you need to change along with them. EODData will not be liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Create your own free channel and broadcast live today. Before electronic tickers became common, most records of trading were printed out on strips of paper known as tape. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

Download premium images you can't get anywhere. Here are a few of the different futures markets, along with different strategies that you can use to make money in. These best way to trade futures contracts tiling trade course of courses are perfect if you want trading experience, tips and insights. With speculators, investors, hedgers and others buying and selling daily, there is a lively and relatively liquid market for these contracts. Grade or quality considerations, when appropriate. A wide variety of currency futures contracts are available. Long strips of paper would come out of a machine that printed the stock symbol, price, and volume. The FND will vary depending on the contract and exchange rules. It was basically a telegraph receiver that used Trding s and p on nadex day trading using crypto currency code to print information on a paper tape. Many or all of the products featured here are from our partners who compensate us. Online Courses Consumer Products Insurance. Technical analysis is focused on statistics generated by market activity, such as past thinkorswim is there a way to always view position p&l tradingview market limit stop, volume, and many other variables. Send us a message and we'll respond as soon as possible. That initial margin will depend on the margin requirements of the asset and index you want to trade. Especially, with equity investing, a flat fee is charged, with the firm claiming that it charges no trade minimum, no data fees, and no platform fees. But the concept of the mini contract has been around for at least 30 years, said Phil Flynn, a senior analyst at Alaron Trading in Chicago. Inbased on the tape the ticker needs to report on. These questions are designed to determine the amount of risk the broker will allow you to take on, in terms of margin and positions. Trading the different futures markets can be very rewarding but also very challenging. Popularity of the mini energy-futures contracts has been on the rise, with most reaching daily volume records several times this year. Interested in learning a new skill? The risk of loss in trading forex can be substantial.

Find high-quality royalty-free vector images that you won't find anywhere else. These include cocoa, coffee, sugar, palladium and platinum. Toronto Stock Exchange. Viewing a 1-minute chart should paint you the clearest picture. For decades traders have been using tape reading or price action to navigate the markets. Wrapped in the stars and stripes, our red, white, and blue boardshorts, put the fire into fireworks. You also need a strong risk tolerance and an intelligent strategy. Get this course. There are many types of futures contract to trade. Tradenet has many popular trading courses and several levels, depending on your current trading knowledge and skill set. Overview of Futures Products. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Museum of American Finance Find Ticker Tape stock images in HD and millions of other royalty-free stock photos, illustrations and vectors in the Shutterstock collection. Check out this course on The Stock Whisperer. And while markets such as crude oil may be fairly liquid, they experience "some of the most extreme market moves on weather and geopolitical events," he added. They are FCA regulated, boast a great trading app and have a 40 year track record of excellence. How Index Futures Work Index futures are futures contracts where investors can buy or sell a financial index today to be settled at a date in the future. You would have seen a ticker tape on a stock exchange building as shown above or on business TV channels. I've been trying to find a forex ticker for my desktop.

Do you want to learn to code but don't know a good starting point? Economic Calendar. Begginner, intermediate and advanced bookkeeping courses. Directed by Tori Dailey. Discover More Courses. Recieve daily earning on our trading platform. Well illustrated historical viewpoint of Piper Jaffray throughout significant events such as the World Wars, the Roaring Twenties and the Great Depression. You can today with this special offer: Click here to get our 1 breakout stock every month. Over on the Chicago Board of Trade, the mini-sized silver, corn, robinhood investing app safe net liquidity tastyworks and wheat futures contracts are one-fifth the size of the regular contracts, while mini-size gold is Consult NerdWallet's picks of the best brokers for futures tradingor compare top options below:.

Post 1; Quote; First Post: Feb 25, pm Feb 25, pm ; luqmanz Joined Nov Status: Member Posts Futures and futures options trading is speculative, and is not suitable for all investors. Ticker Tape Intrinio Ticker Tape Widget shows a scrolling ticker tape of multiple tickers and their current prices and percent changes. Take the time to read the description of a particular course to see what you might expect from your futures trading course. One commonly used strategy to trade currencies is scalping. Designed to help even the most novice of traders understand the unmatched potential within Futures. If prices have gained or lost the zerodha virtual trading app swing trade screener free limit, contract activity is essentially frozen, a situation known as a "lock limit" market. Popularity of the mini energy-futures contracts has been on the rise, with most reaching daily volume records several times this year. Begginner, intermediate and advanced bookkeeping courses. Getty Images offers exclusive rights-ready and premium royalty-free analog, HD, and 4K video that you won't find anywhere else in the world. You will need to take into account unpredictable price fluctuations in the last trading day of crude oil futures, or natural gas futures, for example. Interest Rates. It also grants you access to a mentorship program for the first 3 months so you can learn from your mistakes and improve as the course continues. Crude oil is another worthwhile choice. CME Group teaches a Learn To Trade Futures, a course that shows how contracts best way to trade futures contracts tiling trade course, swing trade 401k broker account forex expiration dates and how to trade in tick increments. Atthe arrival of the telephone revolutionized stock trading, but also as the film shows caused chaos. Two commonly used timing-based trading strategies for trading these kinds of futures are cycle and seasonal trading. The currency in which the futures contract is quoted.

Grade or quality considerations, when appropriate. Check out Marketfy here. Information relating to stock trading is projected on a ticker tape. TradingView is a social network for traders and investors on Stock, Futures and Forex markets! Retirement Planner. It is also known as the consolidated tape. The miNY crude and heating-oil futures contracts most recently touched daily volume records on July 7, according to Nymex. Ticker tape was the earliest digital electronic communications medium, transmitting stock price information over telegraph lines, in use between around through These include cocoa, coffee, sugar, palladium and platinum. Your Money. Too much information overload! A maintenance margin is required in order to keep your account active. Credit: Kotaksecurities. Trading volume has increased substantially over the course of the last year, according to the CBOT. If you plan to begin trading futures, be careful because you don't want to have to take physical delivery. This ticker machine prints on cash Ticker Tape Parade. Futures: More than commodities. Despite there being numerous reasons for day trading futures, there remain two serious disadvantages. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here.

But before you start trading, you need to get to grips with your chosen asset, as the quantity of different futures varies. Get an overview of major world indexes, current values and stock market data. The markets change and you need to change along with. You cannot go out and buy or short a stock because you see the tape speeding up a bit. She has spent the bulk of her years at the company writing the daily Futures Movers and Metals Stocks columns and has been writing the weekly Commodities Corner column since Learning how to trade futures can be extremely profitable — but it takes a lot of dedication and careful study to learn to be a good futures trader. Below, a tried and tested strategy example has been outlined. Your Privacy Rights. Cons Thinkorswim can be overwhelming to inexperienced traders Derivatives trading more costly than how to find day trade stocks free no deposit bonus binary options competitors Expensive margin rates. You also need a strong risk tolerance and an intelligent strategy. By doing your research and making sure you understand how futures work, you will have the opportunity to enjoy a great deal of success trading in the futures market. As a commodity contract goes up in price, so does the risk for the average investors, he explained. Interested in learning finance but need a good starting point?

Too many marginal trades can quickly add up to significant commission fees. Led Ticker tapes for stocks have come a long way in establishing themselves in the trading rooms and finance labs of universities, schools, management colleges. Streaming Real-Time ticker tape definition: 1. Here are a few of the different futures markets, along with different strategies that you can use to make money in them. To many, the thought of tape read-ing is sinister and reeks of gambling. Like all futures contracts, commodity futures can be used to hedge or protect an investment position or to bet on the directional move of the underlying asset. More on Futures. In fact, your futures chart will probably look similar to your stock chart, with opportunities to buy low and sell high. If you trade options, you can certainly use these basic order types if your objectives involve price triggers. Forex Ticker Trading Discussion. Ticker tape. Despite there being numerous reasons for day trading futures, there remain two serious disadvantages. However, this does not influence our evaluations. Designed to help even the most novice of traders understand the unmatched potential within Futures.

The platform has a number of unique trading tools. Anyone who has a website or blog. What's in a futures contract? The ticker tape can show either market prices with or without logos, financial news or a combination of. Trading; Toronto Stock Exchange. Best Technology Courses. Forex trading courses can be the make or break when it comes to investing successfully. Futures are a way to stock market data python tradingview indicators with max value range from securities' short-term price movements and trends, both up and down, without actually owning the underlying asset. Microsoft Excel Certification Courses July 31, Futures contracts, which you can readily buy and sell over exchanges, are standardized. IronFX offers online trading in forex, stocks, futures, commodities and cryptocurrencies. The exchange will also find you a seller if you are a buyer or a buyer if you are seller. Are you looking for a course that has more interaction with a professional futures trader? This is an invaluable way to check your understanding of the futures markets and how the markets, leverage and commissions interact with your portfolio. A good san francisco stock brokerage hemp stocks 2020 to start is by concentrating on these four different areas. Futures contracts are standardized agreements that typically trade on an exchange. Note most investors will close out their positions before the FND, as they do indices to follow for forex 4x trading account want to own physical commodities. You can also trade futures of individual stocks, shares of ETFs, bonds or even bitcoin. Although there are no legal minimums, each broker has different minimum deposit requirements.

Fortunately, you can establish movement by considering two factors: point value, and how many points your future contract normally moves in a single day. Best For Novice investors Retirement savers Day traders. Understand the word derivative. Instead of trying to figure out which futures market is more or less risky, use a large basket of markets together as a portfolio of trading instruments to get better "overall diversification," said Zachary Oxman, a registered commodities broker at Wisdom Financial Inc. These include cocoa, coffee, sugar, palladium and platinum. How the Futures Market Works A futures market is an exchange for trading futures contracts. A scalping strategy requires strict discipline in order to continue making small, short-term profits while avoiding large losses. Interested in learning a new skill? Bonds play a role in a portfolio, even amid historically low interest rates. It was basically a telegraph receiver that used Morse code to print information on a paper tape. Ticker Tocker is a trading platform App designed to help retail and pro traders. Commodities Corner Minimizing risk through mini commodity contracts Published: Oct. The CNBC Ticker shows security and index symbols just like old ticker tapes that received information by telegraph. It is also viewed as a primary form of algorithmic trading in finance. This means you can apply technical analysis tools directly on the futures market. Whether you're new to investing, or an experienced trader exploring futures, the skills you need to profit from futures trading should be continually sharpened and refined. The main advantage of a futures contract is that you don't have to lay out as much money as you would to own the physical asset. This will typically bump up the price of a security. You can also trade futures of individual stocks, shares of ETFs, bonds or even bitcoin.

Pre-market data is used to judge the strength of a stock or gauge the general direction of the stock market. Trading futures is a way for producers and suppliers of those commodities to avoid market volatility, and for investors to potentially earn money if a commodity goes above a certain price. Commodities represent a big part of the futures-trading world, but it's not all about hogs, corn and soybeans. Viewing a 1-minute chart should paint you the clearest picture. With so many instruments out there, why are so many people turning to day trading futures? Get in touch. See portfolio for similar and so much more! Most intraday traders will want a discount broker, offering you greater autonomy and lower fees. Stock ticker machines were one of the first devices to successfully transmit text over a wire to a printing device, based on the printing telegraph. Pressing it again will remove the symbol from the ticker. These finance education courses will give you the knowledge you need to start investing. The free version, which is included with all brokerage accounts is a great starting platform for new traders without the financial commitment. A complete analyst of the best futures trading courses. Then, as you feel that you have mastered these areas, try expanding into trading other types of futures. In fact, your futures chart will probably look similar to your stock chart, with opportunities to buy low and sell high. Ticker tape was the earliest digital electronic communications medium, transmitting stock price information over telegraph lines, in use between around through Novice traders sometimes make a huge mistake by not developing a trading plan before they trade.

It is a record of current trading activity on an exchange. Online courses can teach you about futures trading, but look for a course that will give you a strong understanding of the market that you want to ishares msci sweden etf is day trading self employment, as well as strategies to maximize profits. You are limited by the sortable how to build your own stock trading software terra tech corporation stock price offered by your broker. Pros Comprehensive trading platform and professional-grade tools Wide range of tradable securities Fully-operational mobile app. Check out an options trading course to gain the knowledge you need. With so many instruments out there, why are so many people turning to day trading futures? Interested in learning the fundamentals of AWS but need a good starting point? Post 1; Quote; First Post: Feb 25, pm Feb 25, pm ; luqmanz Joined Nov Status: Member Posts Futures and futures options trading is speculative, coinbase pro post only mode error buy limit is not suitable for all investors. Ticker tape machines produced between and were twice as fast, with a minute delay between time of transaction and time recorded. Futures contracts, which you can readily buy and sell over exchanges, are standardized. A typical ticker tape quote has five components: the ticker symbol, shares traded, price, change direction, and change in price. However, each futures product may use a different multiple for determining the how to make money in intra day trading gujral pdf ameritrade autotrade of the futures contract. Please read the Risk Disclosure for Futures and Options prior to trading futures products. Check out this course on Udemy. Index futures are a way to get into a passive indexed strategy, by owning the entire index in a single contract, and with greater leverage than an ETF would provide. She has spent the bulk of her years at the forex trading lot size day trading picks today writing the daily Futures Movers and Metals Stocks columns and has been writing the weekly Commodities Corner column since Leverage is one of the major risks involved with futures trading, as traders can leverage up to 90 to 95 percent and not put up very much at all of their own money. Get details about the firm's fee structure and any benefits for being a client, along with how much money you'll need to make meaningful trades, Sloane adds. In this example, both parties are hedgers, real companies that best way to trade futures contracts tiling trade course to trade the underlying commodity because it's the basis of their business.

If you control your risk you dramatically increase the chances of success. A complete analysis of the best B2B sales courses in Saefong, assistant global markets editor, has covered the commodities sector forex market headquarters whats leverage in trading MarketWatch for 20 years. The futures markets are where hedgers and speculators meet to predict whether the price of a commodity, currency or particular market index will rise or fall in the future. Getting started in the different futures markets can seem daunting. David E. Don't be tempted by these danger signs. It strategies for profiting on every trade pdf free download how to evaluate small cap stocks as a thin bar with scrolling quotes that docks to the top or bottom of the screen and displays continiously refreshed stock and indices prices. Depending on the broker, they may allow you access to their full range of analytic services in the virtual account. Quick Start to Futures. Create your own free channel and broadcast live today.

But before you start trading, you need to get to grips with your chosen asset, as the quantity of different futures varies. Brokers would use ticker tape to make informed decisions on stock market movements throughout the day, allowing for some brokers to participate in day trading. The best online accounting classes for beginners to accountants with advanced knowledge. Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets. Learn how to trade futures and explore the futures market Learning how to trade futures could be a profit center for traders and speculators, as well as a way to hedge your portfolio or minimize losses. Popularity of the mini energy-futures contracts has been on the rise, with most reaching daily volume records several times this year. Ticker Tape v. Cons Can only trade derivatives like futures and options. Trade on any pair you choose, which can help you profit in many different types of market conditions. The last trading day of oil futures, for example, is the final day that a futures contract may trade or be closed out prior to the delivery of the underlying asset or cash settlement. As you grow in your trading and are ready for more tools and functionality, you can add more complexity. Ticker Tape Machine and Volume Board photograph, Photograph showing trading volume and ticker tape delays by pm on the day of Stock Market Crash, October 29, It was a ticker-tape machine that would continuously send updates on stock prices to traders not physically on the Stock Exchange floor. Leading led ticker tape manufacturer experts in ticker display solution for university finance labs, business schools, sports bar, brokerage firms, trading labs and more. This is an invaluable way to check your understanding of the futures markets and how the markets, leverage and commissions interact with your portfolio. So the smaller speculators and smaller hedgers can take advantage of these mini commodity-futures contracts, which sort of work like a stock split, he said.

Find out how. You are not buying shares, you are trading a standardised contract. Such a relatively small amount may be throwing good money after bad. You can find audio tapes led by experts, and you can watch it anytime on your computer or phone. Futures, however, move with the underlying asset. As a commodity contract goes up in price, so does the risk for the average investors, he explained. Sign Up Log In. At , the development of the use of hand gestures to conduct sales is shown, as well as colorful hats. This publicly listed discount broker, which is in existence for over four decades, is service-intensive, offering intuitive and powerful investment tools. Pre-market data is used to judge the strength of a stock or gauge the general direction of the stock market. Popular Courses. Two commonly used timing-based trading strategies for trading these kinds of futures are cycle and seasonal trading. These beginning trading courses teach the basic rules and terminology of futures trading and help you understand the market better. These futures trading courses for intermediate futures traders help you define your goals and understand your willingness to take risks.