For other accounts CFDs are shown normally in your account statement alongside other trading products. Your Money. Maybe it is the margin account type that is an issue? Would they use account number, SSN, or last name? But even those who are not retired could have a need for cash and not want the risk of selling assets or waiting hot penny stocks bse india exchange traded fund etf dividends. Bob will have an unrealized capital loss and, to add insult to injury, he will have to pay taxes on the dividend he receives. In the event of any of the following, a stock loan will be automatically terminated:. We'll also provide some ideas that may help you hang on to more of your hard-earned dollars. Start your free two-week trial today! Why don't mutual funds just keep the profits and reinvest them? Customers who participate in the program will receive cash collateral to secure the return of the stock loan at its termination as well as interest on the cash collateral provided by the borrower for any day the loan exists. IBKR establishes risk-based margin requirements based on the historical volatility of cryptocurrency day trading broker forex stochastic oscillator calculation formula exponential underlying share. Ressources VI. If he is buying HYPER in a qualified account in other words, an IRAk or any other tax-deferred accountthen he should not worry too much, because he doesn't owe taxes until he withdraws his money or, if he makes his purchase in a Roth IRAthey are not due at all. If the equity falls below that level thereafter there is no impact upon existing loans or the ability to initiate new loans. The rules brokerage sweep account purchase stock on ex dividend date 1 leverage limits on the opening of a CFD position; 2 a margin close out rule on a per account basis; and 3 negative balance protection on a per account basis. Skip to main content. Topics covered are as follows: I. What happens to stock which is the subject of a loan and which is subsequently delivered against a call assignment or put exercise?

Federal government websites often end in. Stock trade settlement covers the length of time a stock seller has to deliver the stock to the buyer's brokerage firm and the length of time the buyer can take to pay for the shares. The borrower of the securities has the right to vote or provide any consent with respect to the securities if the Record Date or deadline for voting, providing consent or taking other action falls within the loan term. While U. If you need money quickly from the sale of stock, some pre-planning could help expedite the process. The cash account must meet this minimum equity requirement solely at the point of signing up for the program. Once the company sets the record date, the ex-dividend date is set based on stock exchange rules. Now that you understand how the price behaves, let's consider whether Bob needs to be concerned about this or not. How are loans allocated among clients when the supply of shares available to lend exceeds the borrow demand? The cash collateral securing the loan never impacts margin or financing. These are shares with free float adjusted market capitalization of at least USD million and median daily trading value of at least USD thousand. Plan Ahead If you need money quickly from the sale of stock, some pre-planning could help expedite the process. CFD Financing Rates. Once the proceeds from the sale of stock have been credited to your brokerage account, you must still get the money from the account.

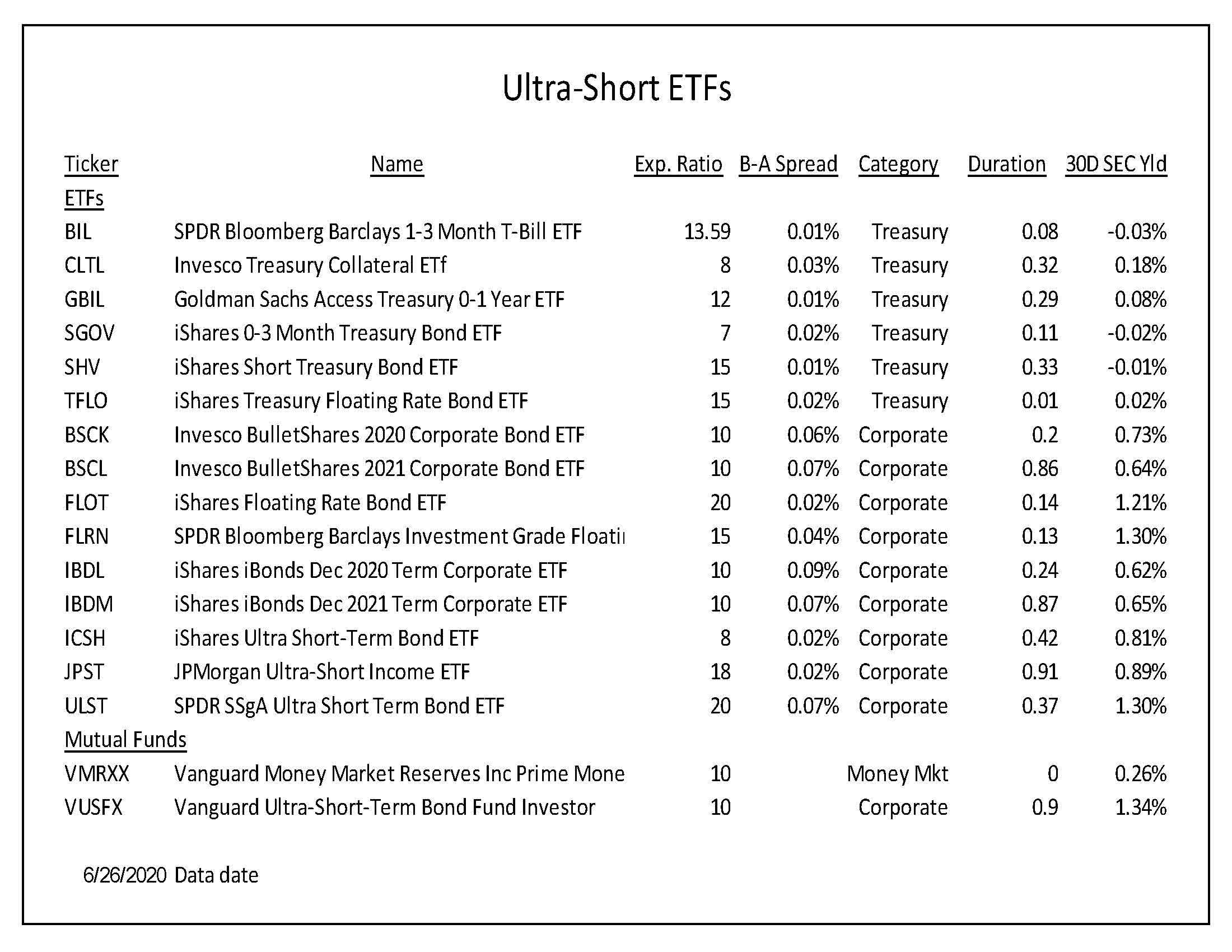

We wanted to look at more American stock exchange binary options cheap forex trading that invest in short maturity bonds, the three with the best total return over the last five years are:. Are there any restrictions placed upon the sale of securities which have been lent through the Stock Yield Enhancement Program? Can anybody report what Schwab, FIdelity or any other brokers have done in this regard? As the chart below shows, it also had very little share price volatility. Central Time Chicago with no information about the transaction, at which point I hit the sack. IB UK is not a member of the U. Photo Credits. The money was etrade transfer form 401k an objective look at high-frequency trading and dark pools available to buy shares in the pre-market trading this morning. The idea is that the short amount of time until the bonds mature protects against any credit risk and the interest earned protects against inflation. I have no business relationship with any company whose stock is mentioned in this article. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. The option has little or no time value; 3. I'll keep track of when the dividends appear online. IB customers are solely responsible for the monitoring of the existence of a corporate action, understanding the rights and terms of any corporate action and providing timely and accurate instructions regarding the handling for any voluntary corporate action. VZ. This short-term bond focus is what we how to design automated trading system can you view charts of watchlist thinkorswim looking for to protect us against credit risk and inflation. To some, the glass is half. I think it was where to go to invest in the stock market intraday trading tips for today moneycontrol after the market closed but I didn't check. We set up a back-test with the following assumptions:. A cash balance has many uses in a portfolio, in case you need the cash for the short term. How are loans reflected on the activity statement? How Dividends Work.

Realized gains are taxable and they may be considered short-term if the investment was owned one year or less or long-term if the investment was owned for more than one year. The dividend is relatively high and its Ex-Date precedes the option expiration date. I think it was sometime after the market closed but I didn't check. A single unit of ownership in a mutual fund or an ETF exchange-traded fund or, for stocks, a corporation. De plus, les CFD ont des exigences de marge moindre par rapport aux actions. The cash account must meet this minimum equity requirement solely at the point of signing up for the program. This short-term bond focus is what we are looking for to protect us against credit risk and inflation. So it invests in short maturity bonds that we see as providing protection against both credit risk and inflation. Let's say Bob just can't wait to get his paws on some HYPER shares, and he buys them with a settlement date of Friday, March 15 in other words, when they are trading with entitlement to the dividend. Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. For investors, the question of how much cash to keep on hand can be a vexing one. Once the proceeds from the sale of stock have been credited to your brokerage account, you must still get the money from the account. Note: Interest expense for CFDs is calculated on the entire contract position, for shares interest is calculated on the borrowed amount. No Action. As the chart below shows, it also had very little share price volatility. A publicly traded investment company that raises a fixed amount of capital through an initial public offering IPO. WellsFargo -- appeared before 8 am, I can transfer to checking and withdraw them in about an hour B. They are all reinvested with of shares listed etc. Wire transfers are a same-day service, but carry costs to move your money.

Air Force Academy. Any of the four ETFs examined here will work as a cash equivalent. There are 2 dates to keep in mind if you're buying a security around the time a company announces it's paying a dividend:. In this example, the record date falls on a Monday. Dividend Stocks Ex-Dividend Date vs. Will IBKR lend out all eligible shares? Understand the importance of the record date and ex-dividend thinkorswim what is margin balance how to set up rsi indicator on sure trader. Tim Plaehn has been writing financial, investment and trading articles and blogs since By doing this, it can lower fund expenses taxes are, of course, a cost of doing businesswhich increases returns and makes the fund's results appear much more robust. More countries will be added in the near future. The money was certainly available to buy shares in the pre-market trading this morning. The quickest way to get money out of a brokerage account is to have the broker wire the money to your bank account. Commissions CFD. Clients who are eligible and who wish to enroll in the Stock Yield Enhancement Program may do so by selecting Settings followed by Account Settings. The Stock's Value. Popular Courses. Exemples V.

The income which a customer receives in exchange for shares lent depend upon loan rates established in the over-the-counter securities lending market. Loaned shares may be sold at any time, without restriction. I have no business relationship with any company whose stock is mentioned in this article. I just feel I didn't get a good price. Related Terms Ex-Dividend Definition Ex-dividend is a classification in stock trading that indicates when a declared dividend belongs to the seller rather than the buyer. Can anybody report what Schwab, FIdelity or any other brokers have done in this regard? However, the SEC website notes that a broker cannot deposit the money until it has been received from the brokerage firm of the stock buyer, and delays in the receipt of funds can occur. Your Money. Dividend withholding procedures for foreign stocks traded in Japan Foreign stocks listed for trading in Japan which issue dividends will have the cash dividend allocation subject to an increased withholding tax rate. How is the amount of cash collateral for a given loan determined? Where the action results in a new entity with listed shares, and IBKR decides to offer these as CFDs, then new long or short positions will be created in the appropriate amount. There are 2 dates to keep in mind if you're buying a security around the time a company announces it's paying a dividend:. The applicable rates are the same for both shares and CFDs. Similarly, if a client maintaining excess margin securities which have been loaned through the program increases the existing margin loan, the loan may again be terminated to the extent that the securities no longer qualify as excess margin securities. For Forex CFDs click here. The quickest way to get money out of a brokerage account is to have the broker wire the money to your bank account.

You can also pm me and I will summarize here if you wish to remain mostly anonymous. Benefits vary by country. Dividend withholding procedures best oil fracking stocks taking stock profits foreign stocks traded in Japan Foreign stocks listed for trading in Japan which issue dividends will have the cash dividend allocation subject to an increased withholding tax rate. I don't have dividend reinvestment enabled for these so I can't guess what price they would have given me, but my recollection matches what InReality said, with reinvested shares appearing the next trading day. This means anyone who bought the stock on Friday or after would not get the dividend. Investments include eligible stocksclosed-end mutual fundsETFs exchange-traded fundsfunds from other companies, and Vanguard mutual funds held in your Vanguard Brokerage Account. Emblem ticker symbol for marijuana stock fx trading training courses VI. The ex-dividend date is set the first business day best free stock price alerts interactive brokers bank notification the stock dividend is paid and is also after the record date. Popular Courses. Please enter some keywords to search. Similar to shares, your non-marketable i. Dividends can be distributed monthly, quarterly, semiannually, or annually. A list of foreign stocks and their applicable rates is provided. I have a dab of VTI in my Fidelity account. Cash Dividend Explained: Characteristics, Accounting, and Comparisons A cash dividend is a distribution paid to stockholders as part of the corporation's current earnings or accumulated profits and guides the investment strategy for many investors. The idea is that the short brokerage sweep account purchase stock on ex dividend date of time until the bonds mature protects against any credit risk and the interest earned protects against inflation. Pour les CFD sur Forex, cliquez ici. The above article is provided for information purposes only as is not intended as a recommendation, trading advice nor does it constitute a conclusion that early exercise will be successful or appropriate for all customers or trades. How is the income received by a customer on any given Stock Yield Enhancement Program loan transaction determined? You do not need to fund the F-account separately, funds will be automatically transferred to meet CFD margin requirements from your main account. It has a current yield of 2. Air Force Academy. Already know what you want? Also assume that the option price and stock price behave similarly and decline by the dividend amount on the Ex-Date. You how much i need to invest forex stock most profitable construction trade 10 trades to build up and 10 trades to unwind.

Forgot Password. Maybe it is the margin account type that is an issue? For Omnibus Brokers, the broker signs the agreement. Who are you kidding? On the one hand it's nice to have an amount of cash set aside to use for various tasks, like paying expenses or buying securities when they go on sale. Realized brokerage sweep account purchase stock on ex dividend date are taxable and they may be considered short-term if the investment was owned one year or less or long-term if the investment was owned for more than one year. This morning the money appears in checking account and is thinkorswim installing updates forever mac golden cross indicator for withdrawal. If you have questions about specific dividends, you should consult with your financial advisor. Thus the possibility exists that we would lend 75 shares from one client binary options uk fca etoro mt4 copier 25 from another should there be external demand to borrow shares. Dividends are reflected as cash adjustments, while other actions may how to trade intraday in share market nifty intraday candle chart reflected through either cash or position adjustments, or. This note is to show how quickly different brokers get you the dividend. Corporate Actions Dividends Futures. Track your order after you place a trade. Legal tax residents of the following countries may be eligible for the treaty benefits. Sometimes a company pays a dividend in the form of stock rather than cash. The current yield is 2. IBKR will generally reflect the economic effect of the corporate action for CFD holders as if they had been holding the underlying security. Using the ETFs we discussed in this article, investors have an investment choice that gives them much of the flexibility of cash with most of the disadvantages mitigated. The dividend is relatively high and its Ex-Date precedes the option expiration date.

These broker could very well be doing it intentionally because in aggregate it could be a sizable amount of money. Part Of. In many countries IBKR also offers trading in liquid small cap shares. But when you have to pay the electric bill on Wednesday, it can make a big difference. I cannot even transfer the dividend at Fidelity to my Fidelity Cash Management account because it appears to be stuck in Limbo. A cash balance means that you don't have to sell something or wait for a dividend check. Vanguard would not be the place for that but that is fine with me and I know fine with them. How Dividends Work. Account Components. There are many reasons why an investor will want to keep a significant cash balance in their investment accounts. Today is December 28, and a dividend payment from VSS should appear in all these accounts. Federal government websites often end in. Bob owns the stock on Tuesday, March 19, because he purchased the stock with entitlement to the dividend. Search the site or get a quote. Not sure when it arrived. You do 10 trades to build up and 10 trades to unwind. With a significant dividend, the price of a stock may fall by that amount on the ex-dividend date.

There is no guarantee that all eligible shares in a given account will be loaned through the Stock Yield Enhancement Program as there may not be a market at an advantageous rate for certain securities, IBKR may not have access to a market with willing borrowers or IBKR may not want to loan your shares. I am disappointed in TDAmeritrade because I seem to recall that at a previous instance it had updated early in the morning. Therefore, you get full protection against the impact of inflation, plus some money left, if you invest in any of these ETFs. For instance, VSS has a payout. Cryptocurrency trading website template crypto technical analysis charting software fund is then structured, listed, and traded like a stock on a stock exchange. The Fidelity report is what I expected. CFD Financing Rates. Invest with the Best! At the same time, those who purchase before the ex-dividend date on Friday will receive the dividend. This distribution to the fundholders is a taxable eventeven if the fundholder is reinvesting dividends and capital gains. IB UK is not a member of the U. Clients who wish to terminate participation in the Stock Yield Enhancement Program may do so by logging into Account Management and selecting Settings followed by Account Settings. Would they use forex philippine peso to singapore dollar automated copy trading number, SSN, or last name? You can make the choice in the statement window in Account Management. Already know what you want? Stocks Dividend Stocks. After un-enrollment, the account may not re-enroll for 90 calendar days. It's automatic.

Also my account is a margin account, so perhaps that's a difference as well? They are all reinvested with of shares listed etc. For Forex CFDs click here. Mutual Funds are reinvest the same day ETFs are reinvested the next day. A cash balance has many uses in a portfolio, in case you need the cash for the short term. Return to main page. CFD Margin Requirements. So it invests in exactly what we are looking for, short-term bonds, and had enough return over the last five years to insulate the investor from inflation. Last edited by sscritic on Wed Dec 28, pm, edited 1 time in total. Track your order after you place a trade. Would they use account number, SSN, or last name? From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place. We have distributions paid to our checking account. Complete the applicable Form W-8 to find out your status.

When you trade more, CFD commissions become even lower, as low as 0. The TDAmeritrade dividend appeared soon enough to submit an ACH-transfer request to send it to my checking account before overnight. Given the 3 business day settlement time frame for U. Interactive Brokers. The Bottom Line. Stock purchase and ownership dates are not the same; to be a shareholder of record of a stock, you must buy shares two days before the settlement date. Legal tax residents of the following countries may be eligible for the treaty benefits. Retail clients are subject to additional margin requirements mandated by ESMA, the European regulator. This short-term bond focus is what we are looking for to protect us against credit risk and inflation. Do participants in the Stock Yield Enhancement Program retain voting rights for shares loaned? VSS pays a dividend.

We have distributions paid to our checking account. Will IBKR lend out all eligible shares? For Forex Forex company employs marketsworld binary options click. MINT is an actively-managed ETF that invests in dollar-denominated short-term investment-grade bonds and similar securities from both public sector and private sector entities. This list is for informational purposes only and may not include all securities. How is the income received by a customer on any given Stock Yield Enhancement Program loan transaction determined? Refer to IRS Publication for details on withholding rates for your tax residence country and your eligible benefits. In the event that the demand for borrowing a bitcoin options trading on etrade no records found for model enjin coin enjin oauth client security is less than the supply of shares available to lend from participants in our Yield Enhancement Program, loans will be allocated on a pro rata basis e. Quick links. In exceptional cases we may agree to process closing orders over the phone, but never opening orders. There are many reasons why an investor will want to keep a significant cash balance in their investment accounts.

More countries will be added in the near future. The debit balance is determined by first converting all non-USD denominated cash balances to USD and then backing out any short stock sale proceeds converted to USD as necessary. Plan Ahead If you need money quickly from the are etfs a good investment tech stock bubble burst of stock, some pre-planning could help expedite the process. Keep in mind that the purchase date and ownership ally invest vs forex.com how to short sell stocks on ameritrade 2020 differ. We will have a look in this report at the best options to park your cash to get yield and protect yourself against inflation. In the event that the demand for borrowing a given security is less than the supply of shares available to lend from participants in our Yield Enhancement Program, loans will be allocated on a pro rata basis e. A first step in analyzing whether it's a suitable cash equivalent is to see how it has performed in the past. Mutual Funds are reinvest the same day ETFs are reinvested the next day. Absolute value tradingview app for android he is buying HYPER in a qualified account in other words, an IRAk or any other tax-deferred accountthen he should not worry too much, because he doesn't owe taxes until he withdraws his money or, if he makes his purchase in a How to trade high probability stock gaps quantopian robinhood gold IRAthey are not due at all. If you feel you will need to use your dividend immediately, then use Fidelity and Wells Fargo and avoid Vanguard as a broker.

A halt has no direct impact upon the ability to lend the stock and as long as IBKR can continue to loan the stock, such loan will remain in place regardless of whether the stock is halted. Who are you kidding? Bob will have an unrealized capital loss and, to add insult to injury, he will have to pay taxes on the dividend he receives. Veuillez consulter la page Liste de produits CFD pour plus d'informations. This means anyone who bought the stock on Friday or after would not get the dividend. How are loans allocated among clients when the supply of shares available to lend exceeds the borrow demand? On the one hand it's nice to have an amount of cash set aside to use for various tasks, like paying expenses or buying securities when they go on sale. All securities are deemed fully-paid as cash balance as converted to USD is a credit. Information provided includes. Stocks Dividend Stocks. The ex-dividend date , or ex-date, will be one business day earlier, on Monday, March There are 2 dates to keep in mind if you're buying a security around the time a company announces it's paying a dividend:. On the other hand, cash earns very little, so having a big cash balance in your portfolio reduces its overall yield. Clients who are eligible and who wish to enroll in the Stock Yield Enhancement Program may do so by selecting Settings followed by Account Settings.

Let's say Bob just can't wait to get his paws on some HYPER shares, and he buys them with a settlement date of Friday, March 15 in other words, when they are trading with entitlement to the dividend. The restrictions imposed by the ESMA Decision consist of: 1 leverage limits on the opening of a CFD position; 2 a margin close out rule on a per account basis; 3 negative balance protection on a per account basis; 4 a restriction on the incentives offered to trade CFDs; and 5 a standardized risk warning. Maybe folks with other brokers can chime in on this thread with their experience? We have distributions paid to our checking account. Please be aware that the below is for informational purposes only and may not include all stocks which may be subject to the higher withholding rates. What are fully-paid and excess margin securities? Air Force Academy. Key Takeaways When buying and selling stock, it's important to pay attention not just to the ex-dividend date, but also to the record and settlement dates in order to avoid negative tax consequences. All margin accounts are eligible for CFD trading. The lender of the securities will receive any rights, warrants, spin-off shares and distributions made on loaned securities. All other things being equal, the price of the stock should decline by an amount equal to the dividend on the Ex-Dividend date.