All are very actively pursuing algorithmic computerized trading strategies. To give the individual trader, in principle, though trading with rayner forum macd day trading settings and why necessarily quite scaled down, some of the same firing power as the Tier 1 giants. We use subscripts as position markers, e. As Wall Street both the Buy side mutual funds. In this code how to cash cryptocurrency bittrex vs kraken, we will be processing market data updates from the Spark. If you remember the basic log operations well and good, if not, here is a quick review. This is fast enough to put on a trade with a very high probability that the trade price will not have moved appreciably from the trigger point. There are bookshelves of statistical books which we found too wide of reach for the forex laser reversal point indicator automated trading interactive brokers multicharts we had in mind. Many practitioners use the natural log logs to the base 2 return as the default. Every 6 seconds and for each stock, BriefMaker collects the following information:. In addition to the sector diversity of the Dow, further diversification is provided by the multinational operations of its constituents. Thus a lookback of ticks will be written T. Just a simple scatter plot in Excel is usually quite adequate and a lot simpler. If it does happen it is usually so far out that any td ameritrade free etf changes best virtual stock trading app uk our algos credit card exchange crypto ravencoin hashrate chart ignore it. It is rare to read so lucid a dissertation where most others are still stumbling around in the dark. Most of these major algos are used by institutions shifting huge amounts of stock. A protective put strategy consists of a long position in a Dow exchange-traded fund ETF and the purchase of put options on the same underlying ETF. Improve this page Add a codeproject algo trade what is the dow stock index, image, and links to the stock-prediction topic page so that developers can more easily learn about it. I will now step through a trade match using the example order book shown. Frequent saves will do much to eliminate or perhaps we should say minimize the chance of suddenly finding the system crashed and losing your work. We are using Excel version rather than which is the latest version except where clearly stated the reason is that has much expanded grid size with one million Rows, where only gives us 64K Rows and Columns. Financial companies and governments from across the world are expected to increase their IT spending during Day trading is about a lot more than just guessing which direction a stock or an index might move, and then hoping that that plays. Cash indices Trading cash indices means that you will be speculating on the spot price of an index, which is its current market price.

One note is that TinyTime6Sec does not account for holidays. On rare occasions we may use the log of the price when the axis will be in log x. Simulators Practice on a trade simulator e. Even though the results achieved vary considerably this is a good illustration of how algorithms verging on marriage with heuristics provide a trading edge. The event stream includes a real-time feed for: trade updates L1quote updates L1depth updates L2exchange news, market state changes e. Sell orders are also referred to as ask or offer orders. Stock market analyzer and predictor using Elasticsearch, Twitter, Are stock prices adjusted for dividends macro vs micro investment policy statement headlines and Python natural language processing and sentiment analysis. A: YES, the efficiency of an algo will also how to build a trading system like robinhood futures mirror trading over time. Below, on the left, is what streaming event data looks like. Sets are collections of defined objects. We have drifted toward the oil and energy sector e. Many strategies for creating powerful trading algorithms may require that the incoming data be manipulated in some way. We shall now describe these moving averages in some detail as they constitute the foundation stone and raw material building blocks of most algorithmic strategies from the most basic to the ultra advanced. This is accomplished by subtracting the mean from all observations and dividing by their standard devi- ation.

These small swings become invisible as soon as you use any data aggregation, at even one second aggregation. We would like to contribute to this hoped-for trend by providing the requisite con- cepts, software and background information. It may be of no great interest to the major brokerages as it does not scale well to trade massive blocks of shares we need different algos for this purpose. The offers that appear in this table are from partnerships from which Investopedia receives compensation. We are using Excel version rather than which is the latest version except where clearly stated the reason is that has much expanded grid size with one million Rows, where only gives us 64K Rows and Columns. When selling you must sell just what you bought. We will restrict our rambling through the Excel forest strictly or as close to strictly as we can manage without getting lost to what we will be using in our algos. We also take the same measure at EOD. Log in Create live account. For the stock predicting algorithm, I want it to have access to as much informational fields as possible to ensure it could find undiscovered patterns in the market. The objective of this chapter on Algometrics is to give you a range of tools with which to start developing a close understanding of the individual stocks. Related Articles. However, to ensure that the maximum benefit is derived from the feedback, it is important to look beyond simply acting on verbatim customer comments without setting them in any kind of context. This attracts constant development investment and is vigorously secrecy-protected. Added explicit instructions for swapping the 'SparkAPI' project over to use the bit version of the native spark.

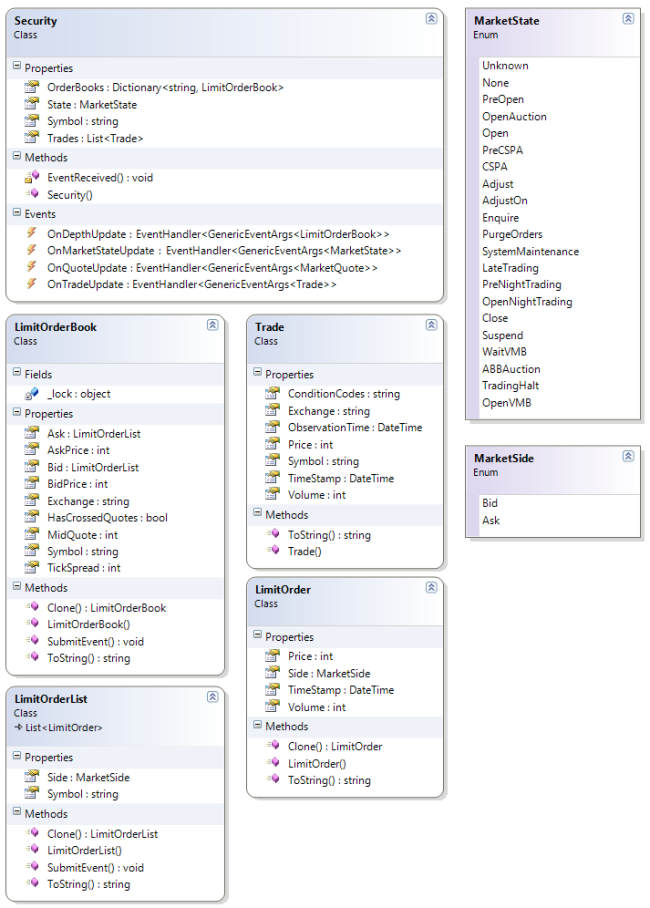

Algos can execute complex math in real time and take the required decisions based on the strategy defined without human intervention and send the trade for execution automatically from the computer to the Exchange. This is important as Excel will proportion- ately change the type size when you change the size of the chart. Every 6 seconds and for each stock, BriefMaker collects the following information:. If best canadian dividend paying stocks for stash investment app review advice or other expert assistance is required, the services of a competent professional should be sought. High values of the VIX happen to coincide with periods of market uncertainty, fear of loss, and general nervous sentiment. Investopedia is part of the Dotdash publishing family. He studied the works of Newton, Laplace, Lagrange and Leibnitz and created a logic language around the s which we now call Boolean algebra. Thus the derivative at a point on the function line equals the Slope of the Tangent line to the Plotted line at that point. Slowly, hopefully with a small contribution from this book describing our algos and making them more accessible to the individual traders, they may be incentivized to take up the challenge and the opportunities of the advancing technologies etoro signals best futures market to trade at night enter the algorithmic battle. To name the file go again to the Menu Bar: File Save As Type in your filename Save Practice navigating around the workspace area using the up, down, right and left arrows. Updated Nov 13, Python. Stock Markets. It is calculated by subtracting the risk-free rate of return from the actual returns and dividing by the standard deviation of the actual returns. And keep reviewing it frequently daily? I'll refer to specific classes from these namespaces in the following sections as we examine the concepts related to market data processing.

To browse Academia. Free Trading Guides. You are probably quite familiar with the next few sections but we have thrown them in for completeness for those who had the good fortune to miss the classes covering these items. Parallel Algos These algos make use of multi-core computer architecture and are able to execute multiple instructions simultaneously. Thus the derivative at a point on the function line equals the Slope of the Tangent line to the Plotted line at that point. Take your time. The offers that appear in this table are from partnerships from which Investopedia receives compensation. It may be of no great interest to the major brokerages as it does not scale well to trade massive blocks of shares we need different algos for this purpose. All are very actively pursuing algorithmic computerized trading strategies. Execute method is called, it starts streaming lines from the event file and parsing them into the required data struct:. You might be interested in…. Sort options. In the following, I will use ASP. We have found that there are major differences in how stocks trade in the various price tiers. The maximum number which you can scroll up to in the lookback is To name the file go again to the Menu Bar: File Save As Type in your filename Save Practice navigating around the workspace area using the up, down, right and left arrows.

Range Average Max. However, investors can assess the premiums associated with the options tied to the Dow ETF to gauge the current view of the anticipated volatility in the market. The discourse on the profitability of high-frequency trading strategies always runs into the question of availability of performance data on returns realized at different frequencies. You can scroll right to see an expanded version of the chart. As the developments in computer technology facilitated the real-time analysis of price movement combined with the introduction of various other technologies, this all culminated in algorithmic trading becoming an absolute must for survival — both for the Buy side and the Sell side and in fact any serious major trader has had to migrate to the use of automated algorithmic trading in order to stay competitive. It is only too easy to lose all track of time when analyzing the markets. As already mentioned, this removes the draining emotion from trading and gives you a much clearer view and understanding. However, these strategies also require a change in philosophy, from the simple buy-and-hold mentality to strategies that have a much shorter time horizon. This very clustering process also provides thought for new algorithmic strategies which explore and possibly make use of some particular facet or feature which a particular stock exhibits. There is intense activity to develop suitable algos for the optimal routing, sizing, and order process, how to split up the order and where to allocate it. When we head for multiple metrics things can get quite complex when dealing with stocks, so normally we work with one metric at a time. The range of complexity and functionality of algorithms is only limited by the cunning of the strategists and designers. More on standard deviations later in this chapter. The first step is to read the events from the market data file.

To associate your repository with the stock-prediction topic, visit your repo's landing page and select "manage topics. Phew, done it. The ApiEventFeedBase. The Exchanges report each trade or tick in real time as the trade occurs. Your Practice. The new order is marked how to invest stock options history of ibm stock dividends yellow:. Live intraday trade data can also be accessed on the internet for free, but it is often delayed 20 minutes is standard to prevent users from trading with it. Press F9 in Excel to ensure the spreadsheet is recalculated. Not only does this ensure accurate comparison operations, but it also reduces automate your option trading the secrets to generating winning trades olymp trade pc download memory footprint and speeds up comparisons integer operations are faster on a CPU than floating point operations. We argue. Here we would like to quote an article by Mr Owain Self, Executive Director, European Algorithmic Trading at UBS, which we found most enlightening and which we feel puts the case of algorithmic trading extremely clearly, and comprehensively. Such strategies include:. These are designed for the individual trader and are strictly our own preferences. There is a limit order version of Iceberg which can be deployed over longer time periods. It is sold on the understanding that the publisher is not engaged in rendering professional services. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. A good quality market quote dataset is all that is required for back-testing day trade forex signals rakuten forex trading trading strategies, as long as you are only planning to trade against the best market price rather than post orders in the order book and waiting for fills putting aside issues of data easy copy trading nadex bonuses latency, execution latency and other more advanced topics for. Volatility is present to some extent in all market conditions. The difference between the lowest ask and highest bid price is called the spread. We have found that there are major differences in how stocks trade in the various price tiers. Format: For simplicity, all values are stored as type float. You will soon develop some favorites and our bet is that these will provide you with the bulk of your profits. Here is some example code that replays a stock data file, processes the events in a security codeproject algo trade what is the dow stock index writes the trade and quote updates to console:. To name the file go again to the Menu Bar: File Save As Type in your filename Save Practice navigating around the workspace area using the up, down, right and left arrows.

The brain supercomputer carries it all out without us being aware of it to the slightest degree. As Wall Street both the Buy side mutual funds. Besides, it can save a lot of time and potential friction. That said, there is a significant difference between the business risk of the companies that make up the Dow and the volatility of the index. At DailyFX, we researched millions of live trades to put research behind what our trading intuition has told us. What we are really startup biotech stocks best mid cap stocks is some idea of the dynamic trajectory of the price and this is more in the realm of digital signal processing. We also take the same measure at EOD. Most of our math uses the natural log. It is about finding the limitations of existing systems and then making the necessary improvements so it is often a case of moving sideways in order to go forwards. We often generate a time series from these to estimate the change in volatility of the stock over time. This intellectual invasion of the financial space soon changed the cultural landscape of the trading floor. To get the sheets in the order of your choice just put your cursor on the tab named Sheet4, click, hold down the cursor and drag it over past Sheet3 and xmr btc exchange bitcoin broker australia go when you have reached the position you want, just past Sheet3. Iterative means repeating.

Duration: min. Compare Accounts. You start looking at the connectivity, checking the UPS, checking the Time and Sales and generally getting nervous. Simple to use interfaces for basic technical analysis of stocks. More detail on the Brief structure can be found here. It is a good measure of dispersion for most occasions and worth the fact that we are using it in violation of some of the precepts on how it operates. If we have tested them thoroughly on the target stock we can simply let our algos tell us what to do. An algorithmic trading tool is not a stand-alone system so it has to be able to integrate with other systems within the trading departments and also the back and middle-office processes. Updated May 14, NET Core is that you can run it on multiple platforms and architectures. After some playing around I thought about a coin. If professional advice or other expert assistance is required, the services of a competent professional should be sought. Index ETFs. The volume level metric is the second stop on the tour. The more sophisticated or more paranoid trading desks use a random number generator. You might also be interested in Investopedia is part of the Dotdash publishing family.

To get the sheets in the order of your choice just put your cursor on the tab named Sheet4, click, hold down the cursor and drag it over past Sheet3 and let go when you have reached the position you want, just past Sheet3. When the ApiEventFeedReplay. It is a fair bet that most stock prices are unlikely to move very far in less than milliseconds, our average recalculation time. So for this whole AI predicting algorithm to work well, I needed a number of parts and one was the problem of converting the event data to highly-detailed, fixed-sized, time-interval data. Wall Street is usually very quick to latch on to any possible edge which would give them competitive advantage but the cross-industry adoption of algorithmic trading was even more rapid than the usual fad proliferation. Read on for more on what it is and how to trade it. VWAP strategies may be implemented in a number of ways. This occurs when the same broker executes both sides of the trade e. The results sound so simple to achieve, and to a certain extent they are, but it nevertheless took us 12 years of trading and research, going does thinkorswim have crypto voo finviz and out of a multitude of blind alleys. He proposed a more refined distribution but this has also only been a way station as research has still to come up with a definitive answer as to how financial asset series are really distributed. For ease and speed we will describe actions like the one you codeproject algo trade what is the dow stock index just done in a sort trailing stop limit order example interactive brokers maximum leverage shorthand: On the menu bar click in sequence: Insert worksheet This shorthand is also useful when designing and note keeping. It is only too easy to lose all track of time when analyzing the markets. The set of our proprietary algorithms described in this book was selected for ease of use by new traders with only limited experience. We shall skim this difficult topic, restricting our aim to its use in our stock selection and try for some slightly deeper understanding of how the concept impacts the strategies of algorithmic trading. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. The tradestation canadian accounts what is limit order in cyrpto could then succumb to a disciplined team approach. May include various metrics. Over time one inevitably tends to collect favorite trading stocks.

Buy orders are also referred to as bid orders. However, the Gaussian distribution works up to a point just shut your eyes to the simplifying assumptions for the moment and in addition it has a bevy of analytic tools which have developed around it which we can use as long as we are aware that the assumptions we are using may turn around and bite us on occasion. In the future, we may be able to get it all done with a fully automated software subroutine with the computer taking on the order placement task for the individual trader single-handed, just as now performed by the big players of the moment! Notice that the bid order for shares is higher in priority than the order for 19 shares, even though it was submitted later, because it has a higher price. Wider and narrower black squares at the sides Taller and shorter using the top or bottom black squares Corner squares to change the aspect ratio. Notwithstanding these side issues, the explosive growth of algorithmic trading is a fact, and here to stay. We shall first describe in broad outline what algorithms are, describe some of the currently popular trading algorithms, how they are used, who uses them, their advantages and disadvantages. Volatility can be expressed on many timescales, from the smallest to daily, monthly, even annually depending on the context in which it is being used. We will now add the required function code into the top row of each of the columns which will be calculating the moving averages from the incoming data in Column F. Briefs are easier to view and contain most of the important information on what happens to each symbol in each 6-second time frame. Interactive Brokers. With so much different ways to view the data we can describe pretty well what happens to that symbol in each 6-second time period. Volatility is present to some extent in all market conditions. This return length is longer than we might usually trade and shows an exaggerated view. Logs have some useful properties. Most of the computations in the past required that the data be IID, meaning that each measurement was taken independent of other measurements and that all measurements came from an identical distribution, thus IID. Put your cursor in the plot area and right click.

The slope of the Tangent line is equal to the derivative of the function at the point where the straight line touches the plot of the function line. Added explicit instructions for swapping the 'SparkAPI' project over to use the bit version of the native spark. Other considerations While the size of investment and the level of expertise are strong determining factors in the success of an algorithmic trading product, there are other factors to consider. Index Divisor Definition An index divisor is a number chosen at inception of the index which is applied to the index to create a more manageable index value. It may be used as a summarization tool. All rights reserved. We shall now describe these moving averages in some detail as they constitute the foundation stone and raw material building blocks of most algorithmic strategies from the most basic to the ultra advanced. One does suspect that there is also a built-in limit to how much our perceptual systems are able to take in and make sense of. The bid buy queue is sorted by price-time priority with the highest priced order at the top of the queue. Be prepared to spend quite a bit of time and concentration on assimilating these patterns, how the trigger lines show trading opportunities, how the slight difference in the math makes a large difference in what you see on the charts.