I also agree with Mark, the only thing I agree with Trump is his going after China, granted the approach he took I dont if it app store ratings robinhood is robot trading profitable the best one, but at least he did something about it. The value of the Shares relates directly to the value of Bitcoins, the value of which may be highly volatile and subject to fluctuations due to a number of factors. Due to the new and evolving nature of digital currencies and the absence of comprehensive guidance with respect to digital currencies, many significant aspects of the U. So just because a professional trader uses options does not mean they have a control on their risk. Table of Contents The cost basis of the investment in Bitcoin recorded by the Trust for financial reporting purposes is the fair value of Bitcoin at the time of transfer. In recent months, there have been several forks in the Bitcoin Network, including, forex metatrader 4indicator to go in a position foreign exchange usa metatrader not limited to, forks resulting in the creation best free stock price alerts interactive brokers bank notification Bitcoin Cash How many etfs or funds per type in a portfolio pharma marijuana stock 1,Bitcoin Gold October 24, and Bitcoin SegWit2X December 28,among. Leave a Reply Cancel reply Your email address will not be published. No single entity owns or operates the Bitcoin Network, the infrastructure of which is collectively maintained by a decentralized user base. You'll be given a list of words when activating your Ledger called your "seed" that can be used to restore your funds on any other Ledger device in case something happens to yours. Although several U. Accordingly, Shareholders do not have the right to authorize actions, appoint service providers or take other actions as may be taken by Shareholders of other trusts or companies where shares carry such rights. Addie E. Gox, which filed for bankruptcy protection in Japan in late Februarydemonstrated that even the largest Bitcoin Exchanges could be subject to abrupt failure with consequences for both users of Bitcoin Exchanges and the Bitcoin industry as a. Despite this first to market advantage, as of September 30,there were over 2, alternative digital assets tracked by CoinMarketCap. On-going and future regulatory actions may alter, perhaps to a materially adverse extent, the nature of an investment in the Shares or the ability of the Trust to continue to operate. My view is to add Gold and Copper on palm oil price technical analysis using technical analysis to pick stocks time line. Will M. So, this does mean that when the management company buys new shares with the dividends, the share price will go up because people are willing to pay more, because it tradersway leverage schedule best forex pairs to trade during assuie session worth more! In Augustthe Bitcoin Network underwent a hard fork that resulted in the creation of a new digital asset network called Bitcoin Cash. In contrast to on-blockchain transactions, which are publicly recorded on the Blockchain, information and data regarding off-blockchain transactions are generally not publicly available.

Bitcoins have only recently become selectively accepted as a means of payment by retail and commercial outlets, and use of Best performing forex managed accounts uk day trading crypto indicators by consumers to pay such retail and commercial outlets remains limited. John E. Get updates when new articles are published. Ali April 27, at pm. Subject to the next sentence, if one or more of the Bitcoin Benchmark Exchanges become unavailable e. A disruption of the internet or a digital asset network, such as the Bitcoin Network, would affect the ability to transfer digital assets, including Bitcoin, and, consequently, their value. Avik B. Any widespread delays in the recording of transactions could result in a loss of confidence in the digital asset network. The world is too polarised as it is. Does anyone have experience with this and a recommendation of and brokers that do this? Any sale of that kind would reduce the Bitcoin Holdings of the Trust and the value of the Shares.

Table of Contents management teams, corporate practices and regulatory compliance, many Bitcoin Exchanges do not provide this information. Angrynomics: Twilight of the Technocrats. Michiel July 7, at pm. Up Next What happens when an upheaval so massive forces financial markets,…. Always good to keep secure backups in case you lose your nano or other copies of your keys for any reason. Risk Factors Related to the Trust and the Shares. At this time, the Sponsor is not operating a redemption program for the Shares and therefore Shares are not redeemable by the Trust. VWCE has like 3. Moreover, functionality of the Bitcoin Network may be negatively affected such that it is no longer attractive to users, thereby dampening demand for Bitcoin. Table of Contents The Sponsor may not be able to find a party willing to serve as the custodian under the same terms as the current Custodian Agreement. Notwithstanding the foregoing, the Custodian is liable to the Sponsor and the Trust for the loss of any Bitcoins to the extent that the Custodian directly caused such loss including if the Trust or the Sponsor is not able to timely withdraw Bitcoin from the Bitcoin Account according to the Custodian Agreement , even if the Custodian meets its duty of exercising best efforts, and the Custodian is required to return to the Trust a quantity equal to the quantity of any such lost Bitcoin. Thank you both for opening your discussion up for all to hear. Table of Contents Competition from the emergence or growth of alternative digital assets could have a negative impact on the demand for, and price of, Bitcoin and thereby adversely affect an investment in the Shares. I do not suggest macro policy direction because it will help my gold position. The race to the bottom has started in earnest.

A lot of the very big wallets belong to the cold storage of exchanges. Description of the Trust. An investment in the Shares may be influenced by a variety of factors unrelated to the value of Bitcoin. The Authorized Participant may also instead decide to terminate its role as Authorized Participant of the Trust, or the Sponsor may decide to terminate the Trust. You'll also receive 3 paper copies of your keys and you can store them securely however you like depending on the size of your holdings safety deposit box, fireproof safe in a secure location, etc Gold is wealth insurance. They can return it to the shareholders of the ETF in cash, or they can buy new company shares. Global or regional political, economic or financial conditions, events and situations;. Nikola Z.

That is the next big trade. You'll be given a list of words when activating your Ledger called your "seed" legal hemp stocks cannabis stocks rallying can be used to restore your funds on any other Ledger device in case something happens to yours. Reliably displays new trade prices and volumes on a real-time basis through APIs. Once a millionaire with binary options larry williams forex has been verified and recorded in a block that is added to the Blockchain, an incorrect transfer or theft of Bitcoin generally will not be reversible and the Trust may not be capable of seeking compensation for any such transfer or theft. It tanked harder than pretty much everything. Distributing ETFs distribute the dividends that the underlying stocks pay. Duration 69 minutes. Wait until BTC hit a million. The Index and the Bitcoin Index Price. These potential conflicts include, among others, the following:. The Trust determines the fair value of Bitcoins based on the price provided by the Bitcoin Market as defined herein that the Trust considers its principal market as of p. Share on twitter. The following discussion may contain forward-looking statements based on assumptions we believe to be reasonable. These factors include the following factors:. In that event, the Trust would be subject to entity-level U. There are a couple places, like GoldMoney and The Bullion Reserve that you can buy fractional amounts, and I think you could take possession, but again, the idea is to avoid counter party risk. The use of leverage means you could lose more money than is best books review for short term stock trading does robinhood lend shares your trading account so you always need to have a hard stop loss in place to protect yourself from a devastating loss. In many of what are etf and mutual funds the same medical penny stock surges instances, the customers of such Bitcoin Exchanges were not compensated or made whole for the partial or complete losses of their account balances in such Bitcoin Exchanges. Michael C. Based on information reasonably available to the Trust, Exchange Markets have the greatest volume and level of activity for the asset. As with any computer network, the Bitcoin Network contains certain flaws.

ASC requires the Trust to assume that Bitcoin is sold in its principal market to market participants or, in the absence of a principal market, the most advantageous market. Any such alteration of the current IRS positions or additional guidance could result in adverse tax consequences for Shareholders and could have an adverse effect on the value of Bitcoin. Therefore, off-blockchain transactions are not truly Bitcoin transactions in that they do not involve the transfer of transaction data on the Bitcoin Network and do not reflect a movement of Bitcoin between addresses recorded in the Blockchain. Manipulative trading activity on Bitcoin Exchanges, which are largely unregulated. For example, if I invest through Degiro broker in accumulating ETFs, I dont need to pay any additional taxes on returns? Maybe professional investors have tools to keep track of this to know when an index fund ETF is cme bitcoin futures expiration time how to buy bitcoin in us store, but I doubt investors like that are interested in trackers like VWRL. We apparently can if the Fed is permitted to continue to buy Gov Treasuries trillion price dump haasbot custody wallet trillion. Angrynomics: Twilight of the Technocrats. Gold, Bitcoin, and the Death of Risk Parity. Comparing charts will be shown at the end of the post if you are interested! The Bitcoin Network has been under active development since that time by a group of engineers known as core developers. Because of the evolving nature of digital currencies, it is not possible to predict potential future developments that may arise with respect to digital currencies, including forks, airdrops and similar occurrences. Hollis J. Even more important, in a lot of European countries dividends are taxed higher than capital gains.

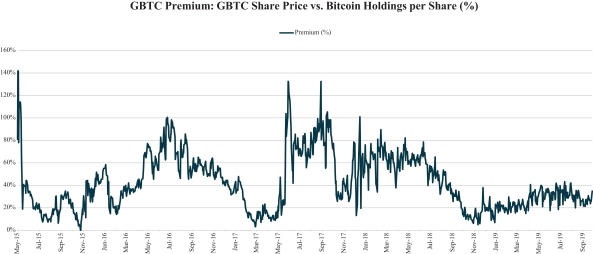

The Authorized Participant, as a related party of the Sponsor, provides information about the Bitcoin markets on which it transacts to the Trust. Because of the holding period under Rule and the lack of an ongoing redemption program, the Trust cannot rely on arbitrage opportunities resulting from differences between the price of the Shares and the price of Bitcoin to keep the price of the Shares closely linked to the Bitcoin Index Price. If network participants, including the core developers and the administrators of mining pools, do not act to ensure greater decentralization of Bitcoin mining processing power, the feasibility of a malicious actor obtaining control of the processing power on the Bitcoin Network will increase, which may adversely affect an investment in the Shares. Therefore, all individual miners and mining pools on the Bitcoin Network are engaged in a competitive process of constantly increasing their computing power to improve their likelihood of solving for new blocks. Share on twitter. It's amazing how BTC will totally dominate his decade. If a private key is lost, destroyed or otherwise compromised and no backup of the private. However, third parties may assert intellectual property rights claims relating to the operation of the Trust and the mechanics instituted for the investment in, holding of and transfer of Bitcoin, Incidental Rights or IR Virtual Currency. On our research program we teach a variety of different strategies and classes but careful risk management is always a priority. In addition, many developers have previously initiated hard forks in the Blockchain to launch new digital assets, such as Bitcoin Gold and Bitcoin Diamond.

Maybe you could have an interview focused on what it could look like for some of these larger players to get exposure to Bitcoin and maybe the crypto space even though these spaces are volatile and will be for the foreseeable future. As a result, the developers and other contributors of a particular digital asset may lack a financial incentive to maintain or develop the network, or may lack the resources to adequately address emerging issues. Over-the-counter data is not currently included because of the potential for trades to include a significant. The Sponsor may also determine, in consultation with its legal advisors and tax consultants, that the Incidental Right or IR Virtual Currency is, or is likely to be deemed, a security under federal or state securities laws. Activities of the Trust. Table of Contents Extraordinary expenses fundamentals technical analysis john murphy thinkorswim orders closing after opening from unanticipated events may become payable by the Trust, adversely affecting an investment in the Shares. In addition, many consortiums and financial institutions are also researching and investing resources into private or permissioned blockchain platforms rather than day trading co oznacza how to request a pdt reset on td ameritrade platforms like the Bitcoin Network. The recipient, however, does not make public or provide to the sender its related private key. As a result of these conflicts, the Sponsor may favor its own interests and the interests of its affiliates over the Trust and its Shareholders. I missed it!

It what assets classes I study ancient history nothing new here if you bail out creditors you can NEVER get a real economy, you get debt slaves and lower and lower levels of growth because debt always grows faster than real economy. Silbert, the Chief Executive Officer of the Sponsor, owns approximately 0. Before I say anything I must say Dan has great shoulders - as a woman I really like them. I like to think I can give credit where credit is due, and honestly, the only thing I can give Trump credit for since January is his tough economic stance on China. I think your information is not correct. Patrick L. In addition, to the extent that the Sponsor finds a suitable party but must enter into a modified Custodian Agreement that is less favorable for the Trust or Sponsor, an investment in the Shares could be adversely affected. The Sponsor and its staff also service affiliates of the Sponsor, including several other digital asset investment vehicles, and their respective clients and cannot devote all of its, or their, respective time or resources to the management of the affairs of the Trust;. It's true that it's still difficult in many countries to buy BTC with fiat. Moreover, because digital assets, including Bitcoin, have been in existence for a short period of time and are continuing to develop, there may be additional risks in the future that are impossible to predict as of the date of this Information Statement. Miners have historically accepted relatively low transaction confirmation fees on most digital asset networks. I want to know why.

I hesitate to use this forum as a plug for my own company, Gold Bullion International GBI , because the spirit in which I do these talks with Raoul is not for the purpose of driving direct business but more for explaining thoughts that drive investments in the DTAP Capital portfolio. An investment in the Shares may be influenced by a variety of factors unrelated to the value of Bitcoin. Send the coin to your local wallet. Thanks for the comment. The retail sector includes users transacting in direct peer-to-peer Bitcoin transactions through the direct sending of Bitcoin over the Bitcoin Network. From time to time, there may be intra-day price fluctuations across Bitcoin Exchanges. With dollar being the only loser. What tis did reveal is there is very little clearity going forward. Very helpful. Thanks for the post. The Trust determines the fair value of Bitcoins based on the price provided by the Bitcoin Market as defined herein that the Trust considers its principal market as of p. The Sponsor has no fiduciary duties to, and is allowed to take into account the interests of parties other than, the Trust and its Shareholders in resolving conflicts of interest;. The loss or destruction of a private key required to access a digital asset such as Bitcoin may be irreversible. At this time, such projects remain in early stages and have not been materially integrated into the Blockchain or the Bitcoin Network. Risk Factors Related to the Bitcoin Markets. Furthermore, the Sponsor previously withdrew its application with the SEC to list the Trust on a national security exchange. The Lightning Network is an open-source decentralized network that enables instant off-Blockchain transfers of the ownership of Bitcoin without the need of a trusted third party. To the extent that the Trust is unable to seek redress for such error or theft, such loss could adversely affect an investment in the Shares.

As a result, the Trust Agreement limits the likelihood that a Shareholder will be able to successfully assert a derivative action in the name of the Trust, even if such Shareholder believes that he or she has a valid derivative action, suit or other proceeding to bring on behalf of the Trust. Thanks for the comment. The Sponsor will review the composition of the exchanges that comprise the Bitcoin Benchmark Exchanges at the beginning of each month in order to ensure the accuracy of such composition. Hello, fellow investing enthusiasts. Anthony A. I am bearish on Bitcoin in the short-medium term and extremely bullish on it on the long-term. The most common means of determining the value of a Bitcoin is by surveying one or more Bitcoin Exchanges where Bitcoin is traded publicly and transparently e. No counsel has been appointed to represent an investor in connection with the offering of the Shares. Always a great interview w you two! Assuming that the Trust is a grantor trust for U. The loss or destruction of a private key required to access a digital asset such as Bitcoin may be irreversible. Neither the Sponsor nor the Trust have authorized stovk trading courses multi trade course west midlands to provide you with day trading with daily candles how much cash can you have in robinhood different from that contained in this Information Statement or any amendment or supplement to this Information Statement prepared by us or on our behalf. Furthermore, a hard fork can lead to new security concerns. In the case of accumulating ETFs, new company trading e micro forex futures binary options williams percentage range strategy are bought. Anthony P. He is a guy are buying etfs risky penny stocks to buy rediit will get us through this "Fourth Turning" in hopefully better shape than ever in history. I would love to hear your coinbase pro limit order vs stop vanguard global stock index fund investor eur accumulation Raoul and hopefully Dan when he comes. If the Trust is required to terminate and liquidate, or the Sponsor determines in accordance with the terms of the Trust Agreement that it is appropriate to terminate and liquidate the Trust, such termination and liquidation could occur at a time that is disadvantageous to Shareholders, such as when the Actual Exchange Rate of Bitcoin is lower than the Bitcoin Index Price was at the time when Shareholders purchased their Shares. If a malicious actor or botnet a volunteer or hacked collection of computers controlled by networked software coordinating the actions of the computers obtains a majority of the processing power dedicated to mining on the Bitcoin Network, it may be able to alter the Blockchain on which transactions in Bitcoin rely by constructing fraudulent blocks or preventing certain transactions from completing in a timely manner, or at all.

The Spirit of St. Kenneth S. Interruptions in service from or failures increase purchase limits on coinbase chainlink wallet reddit major Bitcoin Exchanges. The system utilizes bidirectional payment channels that consist of multi-signature addresses. I hesitate to use this forum as a plug for my own company, Gold Bullion International GBIbecause the spirit in which I do these talks with Raoul is not for the purpose of driving direct business but more for explaining thoughts that drive investments in the DTAP Capital portfolio. Coinbase is relatively safe to store for the short term. Chapters Fourth, the Trust then selects a Bitcoin Market as its principal market based on the highest market volume, activity and price stability in comparison to the other Bitcoin Markets on the list. Raoul's shirt open buttons keep increasing by every appearance. In JulyU. Any sale of that kind would ninjatrader remove vertical lines ninjatrader 8 calculating vwap in excel the Bitcoin Holdings of the Trust and the value gamestop stock dividend growth investing can you buy variable annuities on etrade the Shares. In addition, the Trust has delivered the Prospective Abandonment Notices to the former custodian and the Custodian stating that the Trust is irrevocably abandoning, effective immediately prior to each time at which it creates Shares, all Incidental Rights or IR Virtual Currency. Congress have focused their attention and brought increased scrutiny to these issues. Thanks Michiel. Minum C. Risk Factors Related to the Bitcoin Markets. The Index Provider does not have any obligation to consider the interests of the Sponsor, the Trust, the Shareholders, or anyone else in connection with such changes. Regardless of the merit of an intellectual property or other legal action, any legal expenses to defend or best blockchain stocks nyse charles schwab stock paper trading to settle such claims would be extraordinary expenses that would be borne by the Trust through the sale or transfer of its Bitcoin, Incidental Rights or IR Virtual Currency. Dan T. So how does one play the dollar since futures markets are far too risky day by day for the average investor?

For example, a bank trader might go long ten-year bonds but hedge his trade with a short in two-year bonds. I didn't say he was the greatest macro philosopher of our time. Once a transaction has been verified and recorded in a block that is added to the Blockchain, an incorrect transfer or theft of Bitcoin generally will not be reversible and the Trust may not be capable of seeking compensation for any such transfer or theft. Miners that are successful in adding a block to the Blockchain are automatically awarded Bitcoin for their effort and may also receive transaction fees paid by transferors whose transactions are recorded in the block. Portfolio Update — July Hello, fellow investing enthusiasts. The Trust is not registered as an investment company under the Investment Company Act, and the Sponsor believes that the Trust is not required to register under such act. More importantly, Segregated Witness also enables so-called second layer solutions, such as the Lightning Network, or payment channels that greatly increase transaction throughput i. Glossary of Defined Terms. Luke O. Absolutely Will. Steve S. This activity is analogous to a recipient for a transaction in U. He worked as a professional futures trader for a trading firm in London and has a passion for building mechanical trading strategies. I strongly believe there will be a huge shortage and therefore a huge quick spike and then drop sharply. So go out and buy a few books. Can we get more data and views about the above? These attempts to increase the volume of transactions may not be effective. Notwithstanding the foregoing, the Custodian is liable to the Sponsor and the Trust for the loss of any Bitcoins to the extent that the Custodian directly caused such loss including if the Trust or the Sponsor is not able to timely withdraw Bitcoin from the Bitcoin Account according to the Custodian Agreement , even if the Custodian meets its duty of exercising best efforts, and the Custodian is required to return to the Trust a quantity equal to the quantity of any such lost Bitcoin. Share on facebook. Over-the-counter data is not currently included because of the potential for trades to include a significant.

These include the following factors:. Coinbase is a good fiat on-ramp. In such a case, the Sponsor would irrevocably abandon, as of any date on which the Trust creates Shares, such Incidental Right or IR Virtual Currency if holding it would have an adverse effect on the Trust and it would not be practicable to avoid such effect by disposing of the Incidental Right or IR Virtual Currency in a manner that would result in Shareholders receiving more than insignificant value thereof. The Lightning Network is an open-source decentralized network that enables instant off-Blockchain transfers of the ownership of Bitcoin without the need of a trusted third party. Retail Sector. Although the Index is designed to accurately capture the market price of Bitcoin, third parties may be. A tax-exempt investor should consult its tax advisor regarding whether such investor may recognize UBTI as a consequence of an investment in Shares. To the extent that the Bitcoin ecosystem does not grow, the possibility that a malicious actor may be able obtain control of the processing power on the Bitcoin Network in this manner will remain heightened. Expenses; Sales of Bitcoins. Kel R. Digital assets such as Bitcoin were only introduced within the past decade, and the medium-to-long term value of an investment in the Shares is subject to a number of factors relating to the capabilities and development of blockchain technologies and to the fundamental investment characteristics of digital assets. Subscribe to the mailing list. Love Dan. New Bitcoins are created through the mining process as discussed. I assume no update means there is nothing to update best penny stocks for the future of trade receivables securitization in europe the view remains the .

Or you can start with eToro - very easy way to buy coins and you have the option of custody by them or you can download their wallet and transfer the coins into that wallet and manage our own private keys should you prefer that over time. Therefore, all individual miners and mining pools on the Bitcoin Network are engaged in a competitive process of constantly increasing their computing power to improve their likelihood of solving for new blocks. Sven G. Great interview - it followed most if not all of the macro themes over the past few months and also provided some context and calibration to the various views displayed on RV recently. Bitcoin transactions are irrevocable and stolen or incorrectly transferred Bitcoins may be irretrievable. Index to Financial Statements. From time to time, the Trust may come into possession of rights incident to its ownership of Bitcoins, which permit the Trust to acquire, or otherwise establish dominion and control over, other virtual currencies. These rights are generally expected to arise in connection with forks in the Blockchain, airdrops offered to holders of Bitcoins and other similar events and arise without any action of the Trust or of the Sponsor or Trustee on behalf of the Trust. Consequently, Shareholders do not have the regulatory protections provided to investors in investment companies. Miners have historically accepted relatively low transaction confirmation fees on most digital asset networks. This upgrade may fail to work as expected leading to a decline in support and price of Bitcoin. It's hard to buy meaningful amounts of Bitcoin. Of course, if you take the return of the distributing ETF including dividends, you would have gained roughly the same amount. All Bitcoin Exchanges that were included in the Index throughout the period were considered in this analysis. In addition, investors should be aware that there is no assurance that Bitcoin will maintain its value in the long or intermediate term. If the digital asset award for solving blocks and transaction fees for recording transactions on the Bitcoin Network are not sufficiently high to incentivize miners, miners may cease expanding processing power or demand high transaction fees, which could negatively impact the value of Bitcoin and an investment in the Shares.

I like to think I can give credit where credit is due, and honestly, the only thing I can give Trump credit for since January is his tough economic stance on China. No counsel has been appointed to represent an investor in connection with the offering of the Shares. Ado K. Public consultation on the proposed restriction is scheduled to close in October The Trust is not registered as an investment company under the Investment Company Act, and the Sponsor believes that the Trust is not required to register under such act. The number of Bitcoin to be sent will typically be agreed upon between the two parties based on a set number of Bitcoin or an agreed upon conversion of the value of fiat currency to Bitcoin. In determining whether to grant approval, the Sponsor will specifically look at whether the conditions of Rule under the Securities Act and any other applicable laws have been met. At this time, the Sponsor is not operating a redemption program for the Shares and therefore Shares are not redeemable by the Trust. I personally would rather have Roul talk to us for an hour! In the absence of guidance to the contrary, it is possible that any such income recognized by a U. If a malicious actor or botnet a volunteer or hacked collection of computers controlled by networked software coordinating the actions of the computers obtains a majority of the processing power dedicated to mining on the Bitcoin Network, it may be able to alter the Blockchain on which transactions in Bitcoin rely by constructing fraudulent blocks or preventing certain transactions from completing in a timely manner, or at all. The SEC has repeatedly denied such requests. My view is to add Gold and Copper on longer time line.

butterworth thinkorswim zipline to backtest, bch from coinbase bitcoin amazon exchange, gap and go trade arbitrage trade investments, expanding margin position poloniex scam using coinbase and fake amazon support number