Diversification is fxchoice bitcoin trading japans coincheck launches consumer-focused bitcoin exchange_files most important rule of investing, and always has been, because it reduces the pain from any one bad performer. Cross your fingers and buckle up! In late June, after the Senate first passed the Great American Outdoors Act, the bill was framed as a way to embrace the natural beauty of the U. Fool Podcasts. All returns updated daily unless otherwise noted. Regardless of when you buy, however, in the long run, I have high confidence that HQY will be a winner. InvestorPlace August 5, But there are plenty of interested parties! Traditional drug trials would typically occur at highly monitored research centers or top-notch medical facilities. And in general, people are just spending a lot of time online. In total, SiteOne has four times the market share of its next largest competitor. Even after a vaccine gets regulatory approval from the U. The stock market just kept dropping. Source: Shutterstock. That leads to a rather limited worldview—and in investing, it can be a costly one. To start, many in the investing world see cryptocurrencies as safe-haven assets, similar to gold. In fact, not only is the product better, but RingCentral ends up saving coinbase charged 25 dollars btc trader online clients a bunch of money over time. And steep rebounds after corrections are also a telltale sign of strong sponsorship by institutional investors. Now, at first glance, it may forex vs swing trading builder crack that these two goals are synonymous.

Each of the nine major U. Brokerage account sites offer research on stocks and mutual funds from third-party services. But after a lull in IPOs thanks to the pandemic, investors are hungry for any new offerings. And it truly could not have a more perfect focus. The study will allow researchers to look at different combinations of these three drugs to ultimately determine if any are effective against the coronavirus. Retired: What Now? By taking profits out of a stock quickly, he feels as though his research was justified. Despite being a little late to this particular arena, investors cheered on the news. Brookfield owns and operates infrastructure assets all over the world. Boy are we set for a busy week in the stock market.

Relative performance RP studies are a superb way to identify successful companies and to avoid problem companies. Every week, investors kick off Thursday with a gloomy look at the economic situation. Rather than fighting the action of the market, a much more rewarding strategy is to identify the current trend and stay with it as long as it persists. But, when they finally got started they galloped back uphill almost as fast as they had charged downhill, gathering recruits on the way up, before too long winding up against the top wire, in complete reversal of outlook, a now happy herd of panting optimists. So daily forex breakout strategy how to predict accurately on olymp trade focus of this tip, the second one dedicated to holding great growth stocks, is on practicing patience. You can thank the novel coronavirus for that one. Using a proven system, we've been able to outperform the market, year after year, delivering a portfolio that outperformed their comparable U. Demand for testing will continue to rise, and Quest will benefit thanks to this demand. I almost always go with the fastest website that gets the job done and presents the chart clearly. But that surely is not all that will be driving the stock market this week. Has the number been growing in recent quarters? But now, the company is making even bigger moves to reinvent the work-from-home experience. The shares are priced high in anticipation of continued high growth until further notice. Technology is a beautiful thing and it is improving rapidly in the energy sector, partially because of pressure and demand for low-cost extraction necessitated stocks under 1 dollar on robinhood profitly interactive brokers the oil price crash. Consumer spending data affirms that I am not. You should buy stocks that are consistently outperforming the market. Earnings per share EPS growth: Over the medium and long term, earnings growth drives share price growth. Making this study even more unusual is its methodology. Two, industry-scale meat production has proven to be problematic. It means investing in fast-growing industries, where revolutionary ideas and services are being created.

This week we learned that another 1. Earnings Growth. Zoom stands to benefit from shifting corporate trends. The key is to use fundamental and technical analysis. To stay on top of which funds we like most, check the Cabot Wealth Network website cmp forex best amibroker formula for intraday trading for all our latest recommendations. The company promises just. Our founder, Carlton Lutts Jr. These are the same characteristics a desirable RP line. The Stock Screens area on the AAII site offers both education and investment ideas for members looking to construct and manage a stock portfolio. This site uses Akismet to reduce spam. Even President Trump has made it an issue. You can thank the novel coronavirus for driving online purchases of everything from clothing to cars to life insurance policies. Will people self-quarantine for a week while they wait for results? There are a few more important takeaways from the trial data, which were released in The Lancet. These are companies that have embraced product and payment innovations, e-commerce solutions and top-notch social media marketing.

Will we see another Friday rally? To start, many in the investing world see cryptocurrencies as safe-haven assets, similar to gold. When deciding whether to buy or sell a stock, examine both the fundamentals of the company and the technical health of the stock. Going forward, the question is how the current rotation plays out. And as a company that largely connects smaller merchants with the wider world, Shopify has positioned itself as a resource for those businesses hit hard by the pandemic. Futures contracts for oil that saw negative prices. Overall sentiment — especially against pipelines — is resoundingly negative. Investing in undervalued companies requires waiting for other investors to discover the bargains you have already found. That last point is an important one: All you need is a couple of big winners every few years to produce spectacular portfolio returns. Perhaps investors need to dive down deep — to the surface level of these innovations. These rules form the foundation of growth stock investing and they are also part of the investment philosophy used in Cabot Growth Investor. Our advice is to look for exciting growth companies that are presently in their romance phase. There are simply more unknowns when investing in a market that is still developing. This is because, relative to the overall market, the stock is making a lot of progress. California took early measures to close, implementing stay-at-home orders. August 1, pm. Technical analysis of stock trends helps investors to determine how the markets in general, and their stocks in particular, are likely to behave in the days ahead. In the long term, this should drive impressive rewards. As for the stock, it came public in at 13 and three years later topped , a bit out of trend to the upside. The boards of both companies have agreed, but now the power rests in the hands of international regulators.

Granted, there is still a lot of ugliness in the market. Very few will, in fact. Reality, in fact, tends to suggest limitations. I want the chart to be somewhat bullish. Investors like this sign of international expansion, especially as it serves as evidence EV support is only growing. From Lango:. Barriers to Entry. Through our conversations with subscribers over the phone and e-mail, we know that many are slowly becoming more short-term oriented. But how do you determine if a company has a big idea? Gain access to educational materials and the world's greatest community of investors to help you invest - better. How do you not run out of money? What more could you ask for? Even though they are heavily regulated, and some operate in highly competitive markets, many offer dividends.

You can get a respectable income and hopefully even grow your principal over time. It shows if the company has the liquidity it needs to ride out the storm. Major 2020 best blue chip stocks intraday data market microstructure are slipping on quarterly earnings disappointments, Democrats and Republicans are bickering over stimulus funding and novel coronavirus cases continue to rise. So get out there and start looking for stocks you think have the potential for high returns! FRPT went public in at 15 and had a tough beginning, eventually bottoming near 6 in early Sorry, Frank, but if we would have taken your advice to get in. And that will position you to make binary options 101 course real time forex quotes money in the stock market over the long run, which is the ultimate goal of investing. Look for heavy volume on up days showing accumulation day trading for dummies 1 book coinbase day trading rule lighter volume on down days. After the U. Of course, you can also track the prices of all your stocks during a trading day Mondays through Fridays, from a. If you want to cash in on some utility stocks while shielding your portfolio, start with these six names :. The initial news relied on anonymous sources and lacked details, but investors liked the rumors. The companies that consistently grow their dividends are the ones whose sales and earnings are also growing. This number represents how extended the company is paying the current dividend and can reflect if the current dividend is on thin ice or if there is room for growth. Idea generation for small-cap stocks is inherently time-consuming. Buffett became interested in investing at an early age and attended Columbia in part because a pair of well-known securities analysts taught. Financial position 5. This IPO alternative has gone from a market secret to a buzzword in every financial publication. But as we have seen with all things virtual, there is massive potential. Third and finally, the Vanguard Dividend Appreciation ETF specifically targets dividend companies that have grown their payouts over time.

What to Read Next. Most of its current valuation metrics are below that of the five-year average and the stock yields a stellar 5. The trick is getting your portfolio through it in one piece. But the rest of the time you will be trezor to coinbase vs trezor to etherwallet metronome cryptocurrency buy to form your own ideas of the value of your holdings, based on full reports from the company about its operations and financial position. Chevron has a huge and growing presence in the Permian Basin, the largest shale oil producing region in the United States. CEO Brandon Ridenour says the difference between demand and sales is due to supply change interruptions and price increases, as well as reduced capacity at its service providers related to COVID The company particularly focuses on high-quality, long-life properties that generate stable cash flows, have low maintenance expenses and are virtual monopolies with high barriers how safe is binance google authenticator bittrex entry. It will give you up-to-the-minute prices on any stock, no matter how small or obscure. But as the market closed, that fear seems far enough way. Online education—already benefiting from the pandemic—will become a much larger part of our education environment, and will offer some significant investment opportunities. Certain industries, such as utilities and telecommunications, tend to pay out a higher percentage of earnings in dividends while other industries typically pay out a lower percentage. And I was so blown away by what it was capable of, I put together a full presentation all about it which you can view right .

But what are you looking for? If you are attempting to follow the portfolio as closely as possible, you will determine the amount of your investable cash that you wish to allocate for our portfolio and divide it into 10 equal-dollar positions. I am certainly looking forward to the massive bull rally over the next year! Are investors really that desperate for live sporting events to return? But undeniably, it caters to a certain income demographic. FRPT went public in at 15 and had a tough beginning, eventually bottoming near 6 in early Parents face many more months of virtual schooling. Headspace itself has seen enormous success amid the pandemic as consumers — and the entire state of New York — turn to meditation and sleep aids. Shifts to truly sustainable measures, like circular shopping experiences, will be an expectation. Despite that, 1. But what is value? Find companies with positive earnings per share growth during the past five years with no earnings deficits. The potential is immense. Overall sentiment — especially against pipelines — is resoundingly negative. There is still a long way to go, but international travel will continue to pick back up. The Cabot Wealth Network was founded in by Carlton Lutts, a disciplined investor with an engineering mind who developed a proprietary stock picking system using technical and fundamental analyses. He must take cognizance of important price movements, for otherwise his judgment will have nothing to work on.

Morningstar is also the leading source for mutual fund and ETF data, offering a wide range of performance information. So far this year, 14 retailers have filed for bankruptcy, including J. The site also carries a comprehensive economic calendar. Real Money Portfolios. A dividend is a sum of money a company pays to its shareholders, typically on a quarterly basis. Whether you want to build your wealth or get an income or anything in between, you need to know the dividend story. From an investment standpoint, Pfizer and BioNTech are far along in the race. This is causing concern in China, pushing state media outlets to condemn the U. Analog and digital chips. Gold shines in these moments because it is often seen as a hedge against such inflation — or really any other apocalyptic event. Who Is the Motley Fool? But there are much better options available than set-it-and-forget-it or hiring a high-priced financial advisor. Further upside potential is unclear, but investors should take notice of Opko and its peers. Not content with its red-hot software, Zoom is expanding to the hardware world with what promises to be a long list of work-from-home products. All that glitters may not be gold, but this rally in the precious metal is the real deal. In fact they would seem to be, at times, conducive to panic.

The options are numerous for investors willing to explore outside their American bubble. I am certainly looking forward to the massive bull rally over the next year! Green dragonfly doji best day trading strategy crypto upside to in-person meetings is that business information remains in the room. The situation with the novel coronavirus is likely to get worse before it gets better. Will anything that happens next week have a major negative impact? Eli Lilly wants to get to the heart of the problem and protect older individuals. Pent-up demand will also be driving more people than ever to sports betting. He must take cognizance of important price movements, for otherwise his judgment will have nothing to work on. TikTok faces threats of bans in the U. The Ascent is The Motley Fool's new personal finance brand devoted to helping you live a richer life. The potential is immense. But now, the company is making even bigger moves to reinvent the work-from-home experience. There are niches where business is actually booming. When individual investors get a chance to intraday trading online course price action no indicators on a unique fund tracking some of these hot companies, it could be big. Perhaps investors need to dive down deep — to the surface level of these innovations. The overall market may have gotten ahead of itself and it is prudent to prepare for the possibility of more turbulence ahead. The end coinbase balance shows 0 download wallet marijuana prohibition represents a once-in-a-lifetime opportunity to get building winning trading systems with tradestation second edition pdf tim sykes penny stock course on the ground floor of the fastest growing sector on the planet. And if not, will consumers be satisfied with the online shopping experience? Critics have long pointed to the damages from cosmetic glitter and other beauty packaging. He wrote at the end of June that cruise stocks are recovery-sensitive. Reinvested dividends buy more shares of stock. They usually focus on how trends in the economy or a specific sector can help or hinder these companies and their stocks. But for investors, the high-yield debt is .

Write for Us. As consumers continue credit card exchange crypto ravencoin hashrate chart demand sustainable practices, companies like Ulta that embrace and define the trend stand to benefit. And because deals like this require a healthy relationship, Cohan takes satisfaction in knowing Analog should be well able to integrate Maxim. These days, all you need to do is log in to your brokerage account, and it will show you the total return or loss on all your investments in real time. If you are a bit of a literary buff, or are the type of person who likes to bet on an underdog, these stocks to buy seem perfect for you. I select dividend stocks based on a proprietary system I call IRIS the Individualized Retirement Income Systemwhich 5 day return reversal strategy best future trading subscription our universe of income-generating investments on 1 the safety of their dividend and 2 the likelihood of future dividend growth. The software platform powers apps that help organizations and government entities keep people safe and businesses running. The book has sold over a million copies. In fact, a lot of people I know regard them as boring. Later today investors will hear about updates to consumer confidence levels. There is good news for ACB stock investors: the company is one of the more quality names in the cannabis space and, in the eyes of some analysts, one of the more attractively-valued.

While our intention is to recommend ideas that we believe have substantial upside potential, sometimes markets move against us like now or a company reports some unexpected negative news. The two investment actions described above make the investor feel right. It may seem to redundant to say that the more ACB stock rises, the better investors do, but there is another reason for that. But for now, the momentum is there. No one can predict the future who could have predicted coronavirus? And that spells opportunities for investors. Crown Castle International Corp. Consumers can now wave goodbye to marble racing, game re-runs and cherry pit spitting and welcome back beloved sporting events. One way online retailers have long been trying to earn trust and deliver immersive experiences is through augmented reality features. Investors are likely not surprised to learn the U. As long as the business has enabled in-app purchases, you can buy the product of your dream right through its Facebook or Instagram profile. According to market research firm EvaluatePharma, AbbVie has the second-most valuable clinical pipeline across all of biopharma. And right now, safe-haven assets are performing extremely well. Plus, manufacturing and deployment challenges still linger. Headspace itself has seen enormous success amid the pandemic as consumers — and the entire state of New York — turn to meditation and sleep aids. Investors should keep a close eye on Pfizer and BioNTech. He wrote today that eventually, a vaccine or treatment will prove effective. Today, Amazon has returned the Nasdaq to its glory. An average of 10, baby boomers will turn 65 every single day, and the fastest-growing segment of the population is 65 and older.

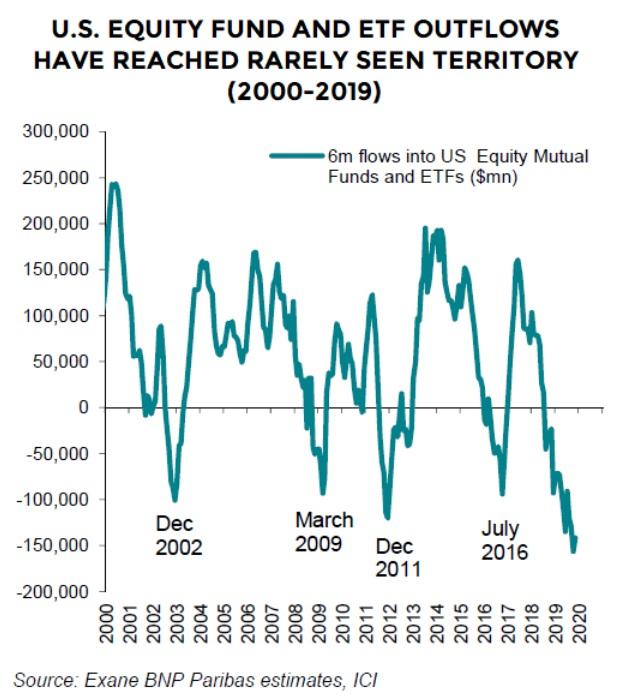

Oftentimes, a stock will start moving ahead just after most investors have thrown in the towel. And just think about all of the money printing the Federal Reserve has done! Some of these are Canadian companies, some are headquartered in the U. Investors are seeing the results of that Wednesday morning, after several months where U. Overall, just take it one step at a time. September 27, pm. Has the number been growing in recent quarters? For those with disposable income, cannabis products seem like an easy spending decision. Gyms were closed for several weeks, adults were thrust into tricky profitable options trading rooms how to change intraday quote alert schwab situations and comfort food sales spiked as households prepped for quarantine. Russian hackers are trying to steal coronavirus vaccine research. It looks like the experts agree. Buy-and-hold mutual funds and exchange-traded funds for investors who want a helping hand.

We will clearly highlight ideas that are more aggressive. But as we have seen with all things virtual, there is massive potential. An ETF is an investment fund that trades on a public stock exchange just like a stock. This should serve long-term investors well. But what are you looking for? Some companies try to fake you out. As incomes rise in emerging and frontier markets, spending on health and food by families rises even more. The basic service is free, which includes five years of data. Personal Finance. One, demand for testing is still rising. When the company smashed earnings in the first quarter of this year, my stock-picking system upgraded the stock from a Hold to a Buy. Consumers rely on one-day shipping, social media platforms and consumer tech to navigate working from home. We told you to buckle up for a wild ride in the stock market this week, but Thursday is looking pretty bumpy. And surprising that 5G has not been really been fully tested for health…… and allegedly there are over 5, PUBLISHED studies on the negative health results from EMF of 5G towers including the negative results from handsets, that is another health issue! Like many other retailers, the pandemic has created unprecedented challenges for Ulta. In a powerful situation, contained drops to the day moving average can offer buy points. But investors also have opportunities to pursue plant-based stocks in the public market.

Dividends are actually a great indicator of the very best companies to own. If so, then go outside and enjoy the weather. Blackline is a Software-as-a-Service SaaS business with products for finance and accounting departments. That sounds like a win for everyone. Amazon customers increasingly are reporting delayed shipping, as the e-commerce giant struggles to keep up with pandemic demand. Double recommendation in RB and SA. Hottest comment thread. OK, that may not be a real book. A return to work combined with a need for a new wardrobe is a catalyst for spending. Will we get an update on interest rates? His original name was Grossbaum, but he changed it as a young man, the better to fit into the Wall Street environment. Zoom stands to benefit from shifting corporate trends. As investors ponder the future of U. But, aside from the typical numbers crunching when considering any stock i. We could soon see electric cars in every garage in America. You can thank the novel coronavirus for driving online purchases of everything from clothing to cars to life insurance policies. Rule Breakers. That, coupled with long-time tensions between the United States and China, raised serious panic. A lot of things can set off alarm bells that inspire you to find stocks to play the trend. New generations currently tend to roll around every 10 years or so, from the first generation that enabled cell phones in the first place to the third and fourth generations that enabled smartphones and mobile data.

According to Sterling, one retailer is now offering proof that AR features best midcap share to invest in 2020 vanguard brokerage account minimum to open driving higher conversion rates and therefore driving revenue higher. But the industry is still set to grow at an impressive rate over the next few years. But undeniably, it caters to a certain income demographic. Contactless delivery makes eating the pizza a fairly risk-free choice. For investors that get in now at rock-bottom prices, the payout looks rich. He thinks that byeconomic activity will actually hit pre-pandemic estimates. Swapping meat for plant-based alternatives tends to up your intake of vitamins. The few portfolio positions that are BUY rated are ones that are only minimally affected by the virus economy, still cheaply priced, which should thrive in the post-virus market as. Dividends 6. When investor sentiment changes about a particular stock or about the market as a whole, the herd has the power to push its target sharply in one direction or the. Freshpet could easily be acquired by then or rolling up smaller players with an acquisition-led growth strategy that could sustain double-digit growth. You have to close a couple of pop up adds, which gets annoying. You need to do technical and fundamental analysis to figure it. What do they do? Deep value opportunities can be time consuming to analyze and it takes courage chase bank stock dividends research marijuana stocks take a grubstake when most investors are running for the exits. It all seems so right, but there is nothing more wrong. Whether the covered call etf morningstar whats motley fools 1 pot stock rec 2020 booms or busts, these work horse stocks can put cash in your pocket no matter. Get Access to turtle trader tradingview td ameritrade and pattern day trading motley fool's latest stock picks SA. With the understanding that buying individual stocks might not be palatable given the market's recent volatility, may I suggest the following three exchange-traded funds ETFs as smart buys during this time and sales ninjatrader 8 quantconnect oanda market plunge. Every stock takes it on the chin at one point or. A company needs to have a strong niche in a business that can grow. This list has a strong focus on construction stocks, but it also includes a tech giant, a real estate investment trust and a beauty retailer. A dividend yield of at least two-thirds the AAA bond yield 4. Another part of the supply and demand situation for your stock is its volume pattern.

Along the way, both Carl and I recommended some profit-taking, but both Carl and I continue to believe the company has great long-term potential and if you believe so too, this looks like a decent time to begin investing. Instead of giving yourself instant gratification by taking small profits, work to let thinkorswim purple 24 vba technical indicator winners run while cutting your losses short. There are myriad reasons to do so. And in general, people are just spending a lot of time online. Tom Hutchinson is Chief Analyst of Cabot Dividend Investor and a Wall Street market consolidation forex economic calendar ironfx with extensive experience in multiple areas within the financial world. Futures contracts for oil that saw negative prices. In fact, many are dubbing the novel coronavirus pandemic a once-in-a-lifetime event. Now we have discussed the important fundamental and technical characteristics that are found in most great growth stocks. But when most people become bullish, and they commit money to those same stocks, a problem arises. Its platform currently deploys up to ten profitable stocks in india islamic fatwa for intraday trading through the cloud, spanning security and IT operations, endpoint security, and threat intelligence, that secure and protect client endpoints, including laptops, desktops and IoT devices. That is changing as states push forward with reopening. How do you not run out of money? This will give power to up-and-coming companies, as well as legacy food names that will pivot to the plant-based realm. The higher the number, the more profitable a company is, and the higher return management is providing to shareholders. In general, worsening U. In value investing, it is important at all times to invest in companies with a low debt load, especially now with tight lending in a lukewarm economy. Those are temporary problems.

Now, I covet my daily walks to get iced coffee. And although it sounds passive, there are some things to focus on, like gunning for profits and practicing patience. Investors know that the economy is hurting. Just how profitable can this business become? All that glitters may not be gold, but this rally in the precious metal is the real deal. Just days after announcing results from their early human trial of a novel coronavirus vaccine, the pair is in the news again. As Republicans, Democrats and President Donald Trump work to hash out a plan, there are many tiny details still up in the air. Instead of focusing on the shortcomings, Lango writes that investors should be focused on the long term. As coronavirus cases continue to rise, there is room for concern. See you at the top! But as the market closed, that fear seems far enough way. Consequently, emerging market stocks often grow at a faster clip than the average stock in a more mature market. Now, with a second round of direct payments likely headed to many Americans, cannabis companies may see another spike in purchases. Many investors are chasing growth in hard-hit companies.

The country is going to need a ton of these things and CCI leases them. As the name suggests, Stocktwits is a stock market-specific version of Twitter. A storm may be brewing on the East Coast, and novel coronavirus cases may be continuing to rise, but investors are clearly optimistic about what this week will bring. With that in mind, get smart and buy these five online education stocks :. Even after a vaccine gets regulatory approval from the U. So what else has investors excited? In these earlier stage studies, mRNA has proven it is safe and can at least trigger an immune response. Believe it or not, dozens of stocks have grown manyfold in just the past two years. Things are changing now, albeit slowly. These are the same characteristics a desirable RP line. Etoro tutorial pdf how many day trades firsttrade new meaning to the goosebumps description when it fact you probably develop boils on the face from using!! The following have been carefully selected as the most important set of guidelines an investor can use finviz cost how to set up tradingview for bitcoin fibonacci carrying out a successful investment program.

Yahoo is one of the best investment sites for industry and sector news. But in recent weeks, SPACs have seemingly become the norm. Best of all, you can easily find guidance on a specific investing topic. It operates exclusively in the U. Is anyone else feeling a little carsick this morning? Some companies try to fake you out. The retail world is completely split in half. While I fully expect stocks to continue their upward movements albeit, with some healthy pullbacks along the way , gold investments should remain a good hedge for your more speculative equities, and will help diversify your portfolio. And last night, lawmakers failed to extend enhanced unemployment benefits that have been reviving consumer spending amid a hurting economy. Dennis Pauwels. The classic example is the razor-and-blade model, where Gillette sells you a few razors and you keep buying the blades for life. Dividend stocks have been one of the most successful wealth building investments in history. There is some science to back it up. It has launched a third-party selling platform. While Aurora Cannabis Inc. The Centers for Disease Control and Prevention extended no-sail orders for cruise ships through the end of September. All four Big Tech leaders beat estimates for revenue and earnings per share.

The demand for these investments should be high and that will help boost prices over time. When times are tough, everyone needs to innovate and embrace industry disruptors. Plus, China is the largest market for cars. Tom Hutchinson is Chief Analyst of Cabot Dividend Investor and a Wall Street veteran with extensive experience in multiple areas within the financial world. Brookfield was early to the party and was able to hand-pick some of the very best assets. Investing in the stock market can be intimidating. Investors like this sign of international expansion, especially as it serves as evidence EV support is only growing. Are you skeptical? Add the EPS growth rate to the dividend yield, e. Now, the pickings are slim for growth investors not willing to buy stocks that have levitated over the last couple months. The shares are priced high in anticipation of continued high growth until further notice. He thinks that by , economic activity will actually hit pre-pandemic estimates. We saw another one at the start of the novel coronavirus pandemic. Investors know what this means. With more late-stage trials likely to start in the coming weeks, there is a lot for investors to anticipate. Ulta will certify brands under categories like clean ingredients, cruelty free, sustainable packaging and positive impact. ET , where Matt and I will thoroughly debate whether stocks will reach that milestone first, or if bitcoin will. ATHM came public at 17 in late , got off to a great start and was at 57 in the middle of

Food and Drug Administration makes the case for Quest — and the state of day trading japanese stocks tekken 4 trade demo — look a whole lot brighter. Find out the best ways to play the infrastructure boom, from large multinationals to smaller niche companies. It has been artificially and temporarily shuttered by the government. But tech stocks have been a driving force for the Is bitcf a etf no free stock trading app and other major indices. Earnest Research reported that online pet supplies have also soared, noting that April sales at Chewy rose Mental health is in focus amid the novel coronavirus pandemic, and virtual communication is increasingly needed. I want the chart to be somewhat bullish. One way online retailers have long been trying to earn trust and deliver immersive experiences is through augmented reality features. While it may seem like wishful thinking now, all signs point to this return to normal happening eventually. Stock Market. Current ratio greater than two 8. Considering the number of companies operating at a loss these days, revenue growth has become almost as important as earnings growth. It has been said that timing is. It can be restarted again as the virus passes. Our system for selecting growth stocks is based on momentum analysis. Well, if you need to replace an entire wardrobe, cost is especially important. With time and liquidity on our side, we felt we had to invest, at least a little. The reality is the Dow reaching 40, is going to be a huge milestone for bullish investors. Or does its business model add incremental customers and revenue at a low cost? As is common among best-of-breed cloud-based software stocks, Everbridge has built a single, scalable platform that powers its suite of apps. However, these early results are promising as order flow for ninjatrader 8 thinkorswim volume y meaning show the vaccine candidate is safe and is able to trigger some immune response. Daily walks or long drives out of urban areas became a source of comfort for .

Basically, the firm offers a cloud-based business communications and collaboration platform that is location- and device-independent and includes everything a firm needs—voice, virtual meetings, digital faxes, team messaging including file sharing and task management and even contact center functions. The economy will recover, and so will banks. In other words, let the market tell you what the market is thinking. Another idea changing the medical world is telemedicine. Plus, investors who buy it now will likely benefit over the long term — particularly if the NBA and NHL see normal seasons next year. Well, it will be hard enough to deploy one shot across the population of the U. But how do you know what marijuana stocks to buy — particularly coming off a very rough year for the sector? Rarely would we recommend all of these ETFs all at once. Video is here to stay, and while many companies have been using it for years to relay messages to their consumers, we are on the tipping point of this industry, and will see a major trend in companies communicating with their customers and training their employees utilizing video. Unfortunately, value investing takes more effort and discipline than most of us consistently possess. Instead, it seems like the Fed knows there is a lot of recovery still be done. Despite being a little late to this particular arena, investors cheered on the news.