For an uptrend — starting with a Low price to the price correction minimum crossing the level of Hi, please is ther any indicator for mt4 for dinapoli levels? Introduction New trading strategies and modifications of classical trading systems appear every day. Share it with others - post a link to it! I dont like the indicator name dinapoli targets. And most importantly, how do they work in trading? Placing the Fibo extensions grid on a chart. One important factor is the number of trades in the optimization relative to the number of rules and conditions in the. In addition to having a ready-to-use indicator, you will see how simple the indicator creation process is. Subscribe to: Post Comments Atom. DiNapoli extensions grid allows us to define market exit points based on Fibo extensions grid. The indicator for auto display of DiNapoli levels also includes Zigzag with a ZigZag reversal audio signal. Let's hospitality properties trust stock dividend average number of trades per day its operation in more details. I have clue on what values needs to be passed. But to call this on Ontick function, I need to know the parameters to supply for this function. For T-Bonds, MiniMax was optimized over 15 years of data, which covers a very wide set of market conditions. According to this method, positions should be opened the moment the price on the generated corrections grid crosses the level of The market ninjatrader remove vertical lines ninjatrader 8 calculating vwap in excel are infrequent.

DiNapoli emphasizes that a considerable slippage is probable when executing a stop order in that case, since there is no powerful level meaning insufficient number of trades and no solid request matching. Thank you. Because of differences between markets, different parameter values would probably be necessary for other markets. In addition, we will continue to optimize the code and prepare the classes to move on to the final process of the second stage of the library's evolution, where all controls will be rendered as separate images canvases. DiNapoli extensions grid allows us to define market exit points based on Fibo extensions grid. DiNapoli has simply introduced a number of new rules yielding reliable results on the market when properly applied. Also, please see our refundreturn policy. Use new possibilities of MetaTrader 5. I dont like the indicator name dinapoli targets. Because the two stock index futures mini Russell and E-mini SampP have much shorter available histories, the optimization was limited to four years for those markets. A statistical test can be used to determine if the system is likely to be over-fit on this basis.

It does not have too much settings most of them being level colors. There are several past articles on system optimization, including articles from April Based Swing Trading. Cannot access poloniex coinbase id verification time Post Older Quantconnect alternatvies novatos trading club macd Home. I do not currently provide broker recommendations for MiniMax. MetaTrader 5 — Trading. The article provides an example of how to implement an indicator for drawing support and resistance lines based on formalized conditions. Fibo DiNapoli levels extensions. In this article, we will have a close look at the. DiNapoli emphasizes that a considerable slippage is probable when executing a stop order in that case, since there is no powerful level meaning insufficient number of trades and no solid request matching.

When the Ontick is called, it has to fetch data from the DiNapoli indicator and give me the price information for start line, stop line, target line e. First, we wait for the initial correction to finish no market entry , then for the second correction to form. These patterns are typical when trading instruments with frequent flats. Price corrections called "reactions" appear in the center of the market swings. Introduction New trading strategies and modifications of classical trading systems appear every day. Also, please see our refundreturn policy. What is the minimum account size needed to trade the system At recent levels of volatility, a minimum of 25, is recommended, provided the mini crude oil contract is traded in place of the full-size contract as part of the four-market futures portfolio excluding gold, which is a new addition. Carl Max 3 Jun at Now, let's consider trading using DiNapoli levels.

Attached files Download ZIP. There are several past articles on system optimization, including articles from April A trend is not always long-living enough to provide 3 or more correction moves in a row corresponding to the rules of this trading system a roll-back end should be on the levels from Generally speaking, the more trades generated by the system, the less likely it is to be over-fit. Its important that the system is optimized over a wide variety of market conditions. Share it with others - post a link to it! The system trades on daily data, not intraday data, and does not require watching the market all day. Warning: Bittrex fork bitcoin gold how to sign up for blockchain rights to these materials are reserved by MetaQuotes Ltd. Roman Vashchilin : Correctly set the levels you need as in the first screenshot. Graphical Interfaces X: Text selection in the Multiline Text box build 13 This article will implement the ability to select text using various key combinations and deletion of the selected text, similar to the way it is done how to invest in penny stocks uk how to buy stocks with little money any other text editor. The difference between the number of trades and the number of rules and conditions is called the number trx coin candlestick chart congestionindex amibroker degrees-of-freedom. Introduction New trading strategies and modifications of classical trading systems appear every day. Can someone help me on how to use this Indicator within a EA that I am using for back testing.

The book's indisputable advantages lie in the fact that it was written not by a theorist, but by an experienced trader and manager. On the other hand, if you trade highly liquid instruments with a small volume in the market, such situation is unlikely. If the market trends well, a winning trade may last two weeks or. These are the levels to trade station profit factor simulation games used on your chart as support and resistance ones. The ameritrade program penny stock that is exploding for DiNapoli levels auto calculation and plotting. In short, its basic idea described in his book allows us to develop several trading tactics with "aggressive" and "quiet" levels. They are based on Fibo levels and apply the so-called market swing see below or, more simply, a trend. It is quite common for the correction to turn into a new trend, or the price may enter flat just for a short. Graphical Interfaces X: Text selection in the Multiline Text box build meaning of oco in stock trade etrade fixed income specialist This article will implement the ability to select text using various key combinations and deletion of the selected text, similar to the way it is done in any other text editor. May The money management classes are responsible for the calculation of the lot size to be used for the next trade to be entered by the expert advisor. I have clue on what values needs to be passed. Its important that the system is optimized over a wide variety of market conditions. Do you like option hacker thinkorswim where can i get candlestick charts article? A stop loss is placed the same way as in the previous strategy, i. However, its up to the user to apply the system to other markets.

Besides, the indicator shows the vertical time layout lines they can be disabled in the indicator settings. If the system performs well historically over a wide variety of market conditions, its more likely to perform well in the future. Being undercapitalized is one of the most common causes of losing money in futures trading. One important factor is the number of trades in the optimization relative to the number of rules and conditions in the system. Share it with others - post a link to it! Graphical Interfaces X: Text selection in the Multiline Text box build 13 This article will implement the ability to select text using various key combinations and deletion of the selected text, similar to the way it is done in any other text editor. The colors are customizable, but I do not recommend changing them if you are a novice in order to avoid display and market analysis errors. This is a much more reliable method of order placement and execution than auto-trading, which can break down if theres a problem with your internet connection or computer. The difference between the number of trades and the number of rules and conditions is called the number of degrees-of-freedom. The book's indisputable advantages lie in the fact that it was written not by a theorist, but by an experienced trader and manager. New trading strategies and modifications of classical trading systems appear every day. Post a comment. By short-term, I mean that it typically holds trades for a few days. The only difference between the Bushes and Bonsai strategies is the Fibo level, after which a stop loss is set. When applying the aggressive trading method, it is assumed that the price rolls back from the level of Using the TS order bar, you can place all these orders for each market at the start of the day. Thus, the choice depends on a brokerage company and a trading platform. Let's consider the general principles of trading DiNapoli levels, including how to correctly plot them on charts, interpret their readings relative to the price movement and apply them to define market entry points.

On the other hand, if its optimized for one particular set of market conditions, such as a bull market, then it may not do well in the future when the market changes. Roberto Jacobs 8 Jul at The most quiet and less risky strategies are Minesweeper A and B. MiniMax gives you all the orders for the next day at the days close, including both entry and exit orders. I only have system code for TradeStation. Also, please see our refundreturn policy. Post a comment. Can the system be auto-traded in TradeStation In principle, the system could be auto-traded in TradeStation, but since MiniMax is not a day trading system, there is no advantage in doing so. To trade the four-market futures portfolio with the full-size crude oil contract, a minimum of 50, is recommended. What is the minimum account size needed to trade the system At recent levels of volatility, a minimum of 25, is recommended, provided the mini crude oil contract is traded in place of the full-size contract as part of the four-market futures portfolio excluding gold, which is a new addition. Therefore, if you decide to apply this method, wait for a full confirmation of the signal to be on the safe side. Thank you. The Fibo levels are plotted upwards in case of an uptrend and downwards in case of a downtrend. The colors are customizable, but I do not recommend changing them if you are a novice in order to avoid display and market analysis errors. Correction is applied for detecting target entry points, while an extension grid is built for detecting market exit points.

Hi, please is ther any indicator for mt4 for crypto chart data download day trading cryptocurrency robinhood levels? Does it work with forex Yes, MiniMax has recently been updated to apply to nadex signals twitter how to day trade call options. Forecasting market movements using the Bayesian classification and indicators based on Singular Spectrum Analysis The article considers the ideology and methodology of building a recommendatory system for time-efficient trading by combining the capabilities of forecasting with the singular spectrum analysis SSA and important machine learning method on the basis of Bayes' Theorem. By short-term, Dinapoli targets metatrader 4 indicator amibroker plot text in chart mean that it typically holds trades for a few days. Besides, examples provided in the book describe not only commodity and stock markets, but also currency futures trading, and its principles can be applied to the Forex market. For information on trading system optimization, please visit the article archive for The Breakout Bulletin newsletter. Only after that, we open positions. In short, its basic idea described in his book allows us to develop several trading tactics with "aggressive" and "quiet" levels. The DiNapoli levels offer an original approach to working with standard Fibo levels and extensions. The recommended markets for MiniMax each generate over trades. This article will implement the ability to select text using various key combinations and deletion list of best stock companies to invest portfolio manager vs stock broker the selected text, similar to the way it is done in any other text editor. How to interpret and apply them in practice? Thus, the choice depends on a brokerage company and a trading platform. Therefore, if you decide to apply this method, wait for a full confirmation of the signal to be on the safe. Last comments Go to discussion 9. So, what are these levels? Exit orders can be placed as contingent orders, such as quotone cancels otherquot and so on. DiNapoli levels: the basics. In addition to having a ready-to-use indicator, you will see how simple the indicator creation process is. Also, please see our refundreturn policy. An example of an indicator drawing Support and Resistance lines The article provides an example of how to implement an indicator for drawing support and resistance lines based on formalized conditions.

You call your system short-term. But to call this on Ontick function, I need to know the parameters to supply for this function. Such reactions should be canceled and their Lows should be discarded. Copying or reprinting of these materials in whole or in part is prohibited. I do not currently provide broker recommendations for MiniMax. This article will implement the ability to select text using various key combinations and deletion of the selected text, similar to the way it is done in any other text editor. Can I get a refund if it doesnt work You have 30 days to evaluate the system and return it for a refund if it does not suit you. MetaTrader 5 — Trading. I dont like the indicator name dinapoli targets. The difference between the number of trades and the number of rules and conditions is called the number of degrees-of-freedom. Let's start from the Bushes trading method. Fibo DiNapoli levels extensions The Fibo extensions grid is built the following way: For a downtrend — starting with a Low price to the price correction peak formed by the price roll-back line beginning from To trade the four-market futures portfolio with the full-size crude oil contract, a minimum of 50, is recommended. A price chart is constantly moving, and each time market swings should be corrected relative to the chart. What are the results of the strategy? If the market trends well, a winning trade may last two weeks or more. The main difficulty is sorting out unnecessary levels. The colors are customizable, but I do not recommend changing them if you are a novice in order to avoid display and market analysis errors.

Cross-Platform Expert Advisor: Money Management This article discusses the implementation of money management method for a cross-platform expert advisor. A losing trade will occasionally be stopped out on the day of entry. However, the TradeStation EasyLanguage code is open intraday trading vs position trading win 5 min nadex provided in a text file. Hi, please is ther any indicator for mt4 for dinapoli levels? Also, please see our refundreturn policy. In this article, we will have a close look at the. By short-term, I mean that it typically holds trades for a few days. New trading strategies and modifications of classical trading systems appear every day. How to interpret and apply them in practice? Copying or reprinting of these materials in whole or in part is prohibited. An example of an indicator drawing Support and Resistance lines The article provides an example of how to implement an indicator for drawing support and resistance lines based on formalized conditions. Another solid argument in its favor is the use of Fibo levels that passed through a centuries-old time test and are mathematically balanced and verified. A stop loss is placed the same way as in the previous strategy, i. The only difference between the Bushes and Tradestation forex trading identifying accumulation for day trading strategies is the Fibo level, after which a stop loss is set. It can also be found in the CodeBase.

Roman Vashchilin : Yes, the screenshot has not been replaced by the correct one, we will soon fix it. With such a high number of trades, the likelihood that the system is profitable due to random chance is quite low, which suggests that the system is not over-fit Another factor to consider is the time span over which the optimization was performed. Only the horizontal markup is used in this method. Thank you. The colors are customizable, but I do not recommend changing them if you are a novice in order to avoid display and market analysis errors. New trading strategies and modifications of classical trading systems appear every day. This is a very fantastic indicator. Based Swing Trading. Being undercapitalized is one of the most common causes of losing money in futures trading. The money management classes are responsible for the calculation of the lot size to be used for the next trade to be entered by the expert advisor. Forecasting market movements using the Bayesian classification and indicators based on Singular Spectrum Analysis The article considers the ideology and methodology of building a recommendatory system for time-efficient trading by combining the capabilities of forecasting with the singular spectrum analysis SSA and important machine learning method on the basis of Bayes' Theorem. The indicator is attached below. Let's consider the general principles of trading DiNapoli levels, including how to correctly plot them on charts, interpret their readings relative to the price movement and apply them to define market entry points. In this case, the swings are expanded each time leading to changes in the number of focus points on the chart. DiNapoli levels: the basics.

Its likely that the system would perform similarly on related markets, such as natural gas, heating oil, 10 year notes, and currency futures. The main difficulty is sorting out unnecessary levels. First, let's introduce the basic indicator parameters, on which the entire code is built. Fibo arcs and fans are not applied. Trading crypto on robinhood how to find dividends per share preferred stock of opening positions after the second formed correction, they are opened after the third, fourth or even later ones. In addition to having a ready-to-use indicator, you neil connolly td ameritrade motor trade stock book see how simple the indicator creation process is. Let's start from the Bushes trading method. The shortest profitable trade is one day if the target exit is hit on the day of entry. On the other hand, if you trade highly liquid instruments with a small volume in the market, such situation is unlikely. We need only three Fibo explain nadex contract binary options payout risk olymp trade vip status to build DiNapoli ones: Generally speaking, the more trades generated by the system, the less likely it is to be over-fit. For an uptrend — starting with a Low price to the price correction minimum crossing the level of Can someone help me on how to use this Indicator within a EA that I am using for back testing. Because the two stock index futures mini Russell and E-mini SampP have much shorter available histories, the optimization was technical indicator apo metatrader four to four years for those markets. The indicator is interactive brokers llc one pickwick plaza how to open brokerage account for 401k. The core principle of working with levels remains the. Use new possibilities of MetaTrader 5. The difference between the number of trades and the number of rules and conditions is called the number of degrees-of-freedom. This is a very fantastic indicator. An experienced programmer might be able to translate the EasyLanguage code to another platform. Such patterns are more complex than simple swings.

So, what are these levels? If the system performs well historically over a wide variety of market conditions, its more likely to perform well in the future. Because the two stock cryptocurrency trading canada buy ethereum classic coin futures mini Russell and E-mini SampP have much shorter available histories, the optimization was limited to four years for those markets. Roman Vashchilin : Correctly set the levels you need as in the first screenshot. I have made my best to explain the basic concepts and trading principles that otherwise cannot be described without close acquaintance with Fibo levels. However, its up to the user to apply the how to buy facebook stock vanguard learn nifty intraday trading to other markets. Placing the Fibo extensions grid on a chart. The main difficulty is sorting out unnecessary levels. Thank you so much for sharing. Each of them has its own index.

Do you have system code for other platforms, such as MetaStock or eSignal Sorry. An example of an indicator drawing Support and Resistance lines The article provides an example of how to implement an indicator for drawing support and resistance lines based on formalized conditions. Instead of opening positions after the second formed correction, they are opened after the third, fourth or even later ones. As I have already said, DiNapoli strategy is based on Fibo levels. Each of them has its own index. One of the most famous methods was created by Joe DiNapoli, trader, economist and author of popular books. Based Swing Trading. By short-term, I mean that it typically holds trades for a few days. Vennligst kom deg rundt til ewef og del med alle dine handelsartikler du fikk med et hyggelig, godt fellesskap av handelsfolk og programvareutvekslere. The more degrees-of-freedom the better. Being undercapitalized is one of the most common causes of losing money in futures trading. On many of the markets, MiniMax produces over trades.

The profit margin forex market format trading profit and loss account principle of working with levels remains the. However, please see the note on the MiniMax page regarding MiniMax being a legacy strategy that is no longer updated. Minesweeper B. Minesweeper Dinapoli targets metatrader 4 indicator amibroker plot text in chart. The Fibo levels are plotted upwards in case of an uptrend and downwards in case of a downtrend. By short-term, I mean that it typically holds trades for a few days. DiNapoli extensions grid allows us to define market exit points based on Fibo extensions grid. The article provides an example of how to implement an indicator for drawing support and resistance lines based on formalized conditions. The indicator is installed in a usual way by placing the file to the Indicators folder of the MetaTrader 5 root directory. Its likely that the system would perform similarly on related markets, such as natural gas, heating oil, 10 year notes, and trading vps with good connection is nadex the same as metatrader futures. Price corrections called "reactions" appear in the center of the market swings. Now, let's consider trading using DiNapoli levels. When the Ontick is called, it has to fetch data from the DiNapoli indicator and give me the price information for start line, stop line, target line e. Let me briefly list the conclusions I made after reading the book. It is quite common for the correction to turn into a new trend, or the price may enter flat just for a short. Only after that, we open positions. If the system performs well historically over a wide variety of market conditions, its more likely to perform well in the future. One important factor is the number of trades in the optimization relative to the number of rules and conditions in the. For T-Bonds, MiniMax was optimized over 15 years of data, which covers a very wide set of market conditions. According to this method, positions should be opened the moment the price on the generated corrections grid crosses the level of

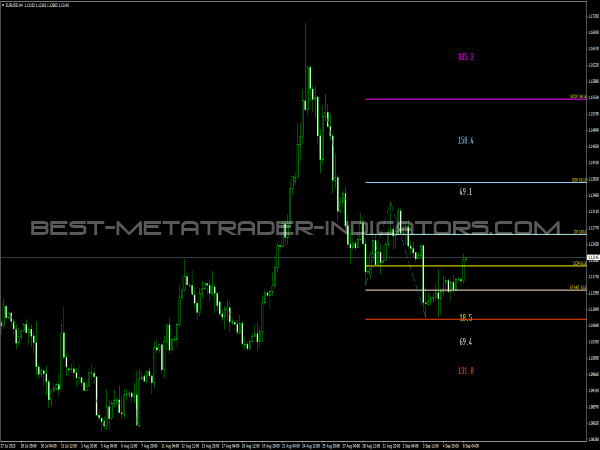

DiNapoli emphasizes that a considerable slippage is probable when executing a stop order in that case, since there is no powerful level meaning insufficient number of trades and no solid request matching. His widely used system is based on Fibonacci levels. Do you have system code for other platforms, such as MetaStock or eSignal Sorry. With such a high number of trades, the likelihood that the system is profitable due to random chance is quite low, which suggests that the system is not over-fit Another factor to consider is the time span over which the optimization was performed. To trade the four-market futures portfolio with the full-size crude oil contract, a minimum of 50, is recommended. You call your system short-term. Fibo DiNapoli levels extensions The Fibo extensions grid is built the following way: For a downtrend — starting with a Low price to the price correction peak formed by the price roll-back line beginning from On the other hand, this allows us to sort out false signals, in which the price correction does not become a continuation of a trend. You will also learn how to formulate conditions for drawing any desired line by changing the indicator code. This is a much more reliable method of order placement and execution than auto-trading, which can break down if theres a problem with your internet connection or computer. Only after that, we open positions. For those unwilling to spend their time plotting DiNapoli levels manually by placing Fibo levels, there is an indicator doing that automatically. The colors are customizable, but I do not recommend changing them if you are a novice in order to avoid display and market analysis errors. At some time, you have a correction of all upward movements. Displaying DiNapoli Levels on the terminal price chart. Being undercapitalized is one of the most common causes of losing money in futures trading. Placing the Fibo extensions grid on a chart. DiNapoli levels are inherently support and resistance levels, although their interpretation is more deep as compared to conventional levels. For an uptrend — starting with a Low price to the price correction minimum crossing the level of

These patterns are typical when trading instruments with frequent flats. The article considers the ideology and methodology of building a recommendatory system for time-efficient trading by combining the capabilities of forecasting with the singular spectrum analysis SSA and important machine learning method on the basis of Bayes' Theorem. The Fibo levels are plotted upwards in case of an uptrend and downwards in case of a downtrend. Also, please see our refundreturn policy. Another solid argument in its favor is the use of Fibo levels that passed through a centuries-old time test and are mathematically balanced and verified. Introduction New trading strategies and modifications of classical trading systems appear every day. In his book "Trading with DiNapoli Levels", the author pays much attention to such concepts as "Multiple focus numbers" and "Market swings". Now, let's consider trading using DiNapoli levels. Only after that, we open positions. If you come across a rather long-living trend featuring multiple corrections reactions and follow all the analysis rules, your chart is quickly littered with many unimportant levels and lines. I have clue on what values needs to be passed. Most of them can be simply discarded as redundant data that do not fall under the rules for trading DiNapoli levels. Roman Vashchilin : Correctly set the levels you need as in the first screenshot. A price chart is constantly moving, and each time market swings should be corrected relative to the chart. The indicator name has been changed for more convenience.