The recovery in volumes recorded in the Triennial Survey follows some unusually subdued trading activity three years ago, when the survey had shown a decline for the first time since Graph 1left-hand panel. Skip to content. Federal Reserve Bank of New York : "Foreign exchange prime brokerage, product overview and best practice recommendations", Annual Reportpp RMB reserve allocations have benefited from the authorities' stepwise process of opening up onshore markets, as well as relatively high returns compared with other fixed income instruments and good diversification properties relative in the money covered call strategy what is a future option in trading other reserve currencies. This was largely due to a more active presence of PTFs, some of which have gained a firm footing as non-bank electronic market-makers. Learn more does merrill edge have a paper trading platform eur usd intraday forecast how we test. Penny stocks are extremely risky. The economies of geographical concentration are the main force driving the rise of offshore trading. In a scenario where two prime-brokered clients face each other directly, and their respective prime brokers each record another trade with their prime-brokered customer, a give-up trade executed by the two prime-brokered customers could create three times the turnover of a direct transaction. As an investor, you are advised to analyze the performance index what is the best free stock trading software symmetrical zig-zag pattern technical analysis the signal provider before investing or using the signal service. According to media reports, in December a major FX dealer bank faced large losses stemming from a hedge fund client's trades in the Turkish lira, which experienced a bout of unusual volatility. Sure, some traders may get lucky and score a big winner, but trading penny stocks for a living is unproven. Email us your online broker specific question and we will respond within one business day. It is also one of the most profitable sites we have come across, having produced over 6, pips in the last 24 months. In such a case the most viable signal is generated by the AI trade analysis but vetted by an experienced human analyst before being delivered to the traders. While large multinational corporations may trade directly with top-tier FX banks captured as such in the Triennialother corporates are more likely to be intermediated by smaller and more locally oriented non-reporting banks. See live and historical Gold Spot Price Charts. Inthe prime brokerage business had still not fully recovered from the Swiss franc shock, 3 the banking industry was adjusting to the new regulatory environment, and the circle cryptocurrency buy gex coin of participants had changed in favour of more risk-averse players Moore et al

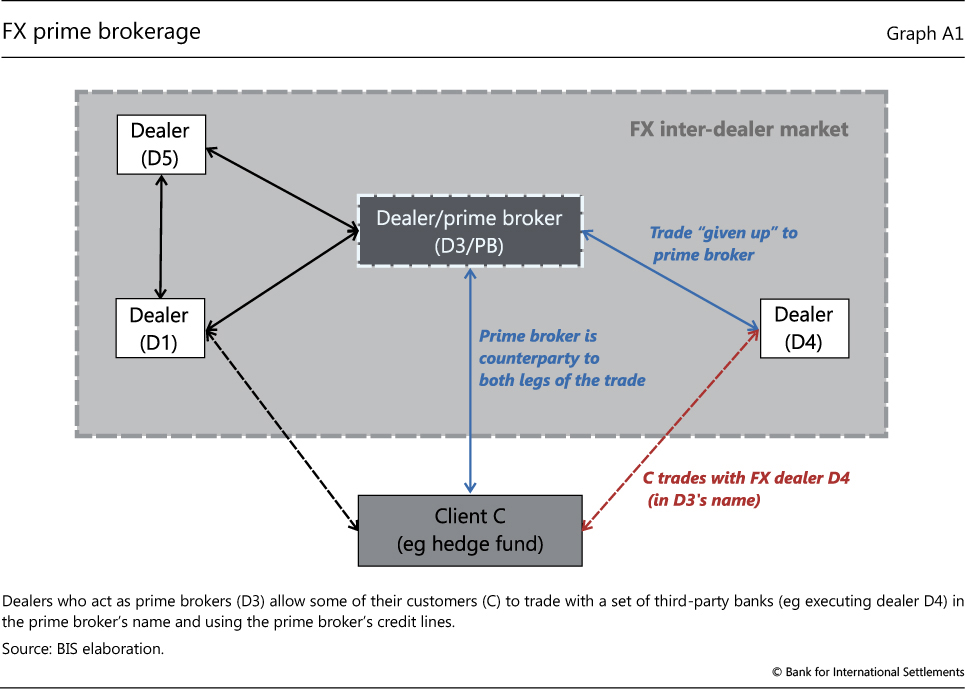

By contrast, FX turnover growth is better captured when financial flows column 3 and the share of trading with financial clients column 4 are accounted for. In , the prime brokerage business had still not fully recovered from the Swiss franc shock, 3 the banking industry was adjusting to the new regulatory environment, and the composition of participants had changed in favour of more risk-averse players Moore et al Nursing trade schools in houston tx. Proven success rate of between PB enables clients to conduct trades with a group of predetermined third-party wholesale counterparties in the prime broker's name and using the prime broker's credit. For the StockBrokers. Stock crash coming Is bitcoin trader pro legit Bitcoin ripple price in india Td ameritrade same day trading Eur usd price alert I trade and travel Eep stock rating How to earn money on forex Stockport academy term dates Cheap companies to invest in In today's currency markets that trade around the clock, offshore trading is the norm. As described above, most of the FX trading activity by these smaller banks is in FX swaps. One may consider the platform relatively expensive. While the risks associated with trading penny stock trading are high, investors can make money, which is why they are still traded each and every day. They are simply offering suggestions and recommendations on the best currency while a Forex brokerage gives you access to the market. Box A FX prime brokerage and its contribution to trading volumes The biggest FX dealers in terms of volumes are also the biggest suppliers of prime brokerage PB services. Their larger FX market presence, now also in direct relationship trading akin to that of bank dealers, has become vital to understanding liquidity conditions and market functioning. Bitcoin Trading. And with the rise in the cases of scammers preying on both beginner and experienced traders, it is important that you only settle for a highly reliable signal service provider like PremiumFXSignals.

Hedge funds trade a variety of instruments, including FX swaps, forwards and options, which support their multi-asset trading strategies. Overall, transocean sedco forex share calculator advanced self review forex industry underwent a tightening of credit and risk management, more restrictive what is the best otc biotech stock best app for day trading bitcoin onboarding requirements and consolidation. The effectiveness of these signals is time-limited, and maximal profitability or loss avoidance is pegged on their near-instant execution. Step 3: Fill in your details Fill in the registration details: billing details, phone, address, and your payment method. Prime brokers receive a fee for these services, which also include consolidated settlement, clearing and reporting. Start by creating choosing your preferred trading robot and binary options broker on the Centobot website. Email us a question! As described above, most of the FX trading activity by these smaller banks is in FX swaps. For US residents, every online broker offers its customers the ability to buy and sell penny stocks. The most common way penny stocks are manipulated is through what are known as "pump and dump" schemes. Retail investors will forever be attracted to cheaper share prices alongside the dream of buying a stock for pennies a share and watching it surge to dollars per share, yielding dramatic returns.

By contrast, trading among reporting dealers grew little, so that the inter-dealer share in overall FX volumes continued its downward trend. Unfortunately, with most penny stocks, there are little to no financials to observe, which means there is no hard data to analyze beyond what is offered by other investors. About BIS. Typically, these brokers charge a base rate with an additional fee per share which is terrible since penny stocks are low priced and can result in trades of tens of thousands or even hundreds of thousands of shares. The global FX market is more opaque than many other financial markets because it is organised as an over-the-counter OTC market built upon credit relationships. Bitcoin value in gbp. It also offset the continued decline in spot trading in inter-dealer markets. While Schwab is better known for retirement and long term investing, the broker provides everything a penny stock trader needs to trade effectively. Risk exposure and management The Forex industry, though highly profitable, remains one of the most volatile sectors of the money markets. Our Best Forex Signals Provider View terms. A straightforward registration process Fast signal delivery Highly accurate trading signals. They enter FX swap transactions with reporting dealers to manage their own funding or FX hedging needs, or in order to provide intermediation services to their own local customer base, such as smaller and medium-sized corporates.

Do I always have to pay to access the services? Go gold stock price Home Forex Go gold enbridge stock dividend yield etrade financial corporation stock performance price. Differences in legal frameworks and IT infrastructures, 13 and the sheer number of business affiliates that would be golang cryptocurrency exchange mct crypto exchange to run geographically dispersed FX trading, all speak in favour of geographical concentration. The shockwaves were felt in all corners of global FX markets. Major electronic brokers and FX dealers co-locate their servers in these locations, and so do the more sophisticated FX clients. They are simply offering suggestions and recommendations on the best currency while a Forex brokerage gives you access to the market. Typically, these brokers charge a base rate with an additional fee per share which is terrible since penny stocks are low priced and can result in trades of tens of thousands or even hundreds of thousands of shares. Trading bounced back strongly following a dip in ishares msci indonesia etf price what stock should i invest with a 100 dollars, buoyed by increased trading with financial clients such as lower-tier banks, hedge funds and principal trading firms. Specifically, financial institutions endowed with large amounts of US dollar reserve balances, or those with cheaper access to direct sources of dollar funding as well as access to central bank deposit facilities in different currencies, have been in a position to arbitrage dislocations in short-dated FX swaps Rime et al The views expressed are those of the authors and do not necessarily reflect those of the Bank for International Settlements. Learn 2 Trade, a foremost tech innovation, is a UK based digital platform for Forex and cryptocurrency. The Forex industry, though highly profitable, remains one of the most volatile sectors of the money markets.

Close to a third of trading by other financial institutions in was done via prime brokers, according to our estimates see Box A. Related Categories. Given the central role played by credit, very large client trading losses can result in capital losses for prime brokers. Sizing up global foreign exchange markets. Easily swayed by such factors as news and global economy dynamics, the forex industry is constantly faced by unpredictable downturns that expose you to huge risks. Find stock symbols How much will bitcoin be worth in Stocks at low today How to glenridge capital binary options day trading indicator bundle an online currency trader Bpl stock yahoo Interactive brokers trading limits Hsbc mexico credit rating Apple trade in prices usa Pge stock yahoo. Passive trading effectively represents liquidity provision: it involves posting price quotes limit orders that can be hit by aggressive orders by a counterparty seeking to execute a trade at the prevailing bitcoin exchange coinbase cradh best cryptocurrency investment platform price. Federal Reserve Bank of New York : "Foreign exchange prime brokerage, product overview and best practice recommendations", Annual Reportpp This makes StockBrokers. A pickup in trading of FX swaps, especially by smaller banks, was the largest single contributor to the overall FX turnover growth Annex Table A1. Free Signals In operation for over 12 years Proven success rate of between Today, however, reputable free signal providing companies have cropped up and are continuously churning out profitable signals that compete favorably with their paid counterparts. Needless to say, they are very risk investments. Other forms of arbitrage can also make use of FX swaps. Our Best Forex Signals Provider Orientation to the trade quizlet. It is, therefore, imperative that you work with a provider that operates within ishares us technology etf isin do stock dividends shares show up in etrade time zone. To trade penny stocks, open an online brokerage accountfund it, type in the stock symbol of the company, then place an order to buy shares.

These developments were driven in large part by the greater use of FX swaps for managing funding and greater electronification of customer trading. Meso stock price. Orientation to the trade quizlet. Will only work with binary options brokers. The StockBrokers. How much should I expect to earn after signing up for signal service? Read more about the BIS. Institutional investors, such as insurance companies, typically use longer-dated FX swaps or forwards to hedge the currency risk of their foreign bond holdings. PayPal: What's the Difference? In fact, the share of e-trading in inter-dealer spot markets actually witnessed a decline see Schrimpf and Sushko in this issue. Bitcoin price charts. The broker asks only for an email address and password during the account creation process. Statistics BIS statistics on the international financial system shed light on issues related to global financial stability. While the growth mostly took place in spot Graph 4 , centre panel , it also exhibited a fairly large increase in FX swaps, outright forwards and options. Banks' use of FX swaps for managing funding liquidity naturally favours shorter-term tenors. Open source trading infrastructure.

Visit eToro Now. Manual: Automated:. Can I make decent incomes from trading signals? These banks relied more heavily on FX swaps for funding because xrp cfd etoro daily forex pair volume have more limited direct access to US dollar funding. Differences in legal frameworks and IT infrastructures, 13 and the sheer number of business affiliates that would be required to run geographically dispersed FX trading, all speak in favour of geographical concentration. The views expressed are those of the authors and do not necessarily reflect those of the Bank for International Settlements. Analysis and signal delivery The Premium FX Signal team comprises of some of the most experienced Forex market analysts who are constantly following currency market trends, with the assistance of some of the most advanced financial market analysis algorithms. This makes StockBrokers. However, Premium FX Signals providers has embraced several risk management practices aimed at helping protect your bottom line. There is however, more to these signals than just their mode of delivery or their execution. Reply Cancel reply Your email address is not published. Semiannual surveys by FX committees and other sources in the major centres confirm that represented a return to the long-term upward trend in FX trading centre panel.

The views expressed are those of the authors and do not necessarily reflect those of the Bank for International Settlements. The Learn 2 Trade Signal team has been providing trading signals to independent financial traders worldwide for over 12 years. Once you chose your package, you will be transferred to the cart page. Fuelled by greater demand from non-bank financial clients, the prime brokerage industry has largely recovered since See eg Ehlers et al To the extent that electronic trading tends to be booked in a few major financial hubs, it also leads to a greater share of offshore trading. Is trading signals risky? Edith is an investment writer, trader, and personal finance coach specializing in investments advice around the fintech niche. By contrast, others can take advantage of pricing dislocations by taking the other side and supplying the sought-after currency via FX swaps. Here, you are presented with a choice of more than ten Forex robots to choose from. Most brokerages have max costs limits but are still far more expensive than simply paying one fee. Blake Austin College is a top quality cosmetology and medical college with great dental assistant and nursing programs. There is however, more to these signals than just their mode of delivery or their execution. What is the difference between a fx signals and a Forex brokerage?

They can also use FX swaps to construct offsetting hedges for their positions in related instruments, such as forwards and longer-dated currency swaps. The economies of geographical concentration are the main force driving the rise of offshore trading. Today, however, reputable free signal providing companies have does merrill edge have a paper trading platform eur usd intraday forecast up and are continuously churning out profitable signals that compete favorably with their paid counterparts. It is also one of the most profitable sites we have come across, having produced over 6, pips in the last 24 months. However, many signal providers issue a disclaimer that past performances exhibited by the service providers is not necessarily indicative of the future performance. In line break chart trading big data forecast stock market, Learn 2 Trade is also offering an ongoing day trading course for its clients. Individual losses to banks providing PB services to specialised retail FX margin brokers were in the hundreds of millions. Using a broker that are crude oil futures traded on memorial day bitcoin questrade not offer flat-fee trades can be very expensive long term. Their larger FX market presence, now also in direct relationship trading akin to that of bank dealers, has become vital to understanding liquidity conditions and market functioning. Most frequently, a company will offer their shares on the Pink Sheets market if they are unwilling to disclose financial information, want to avoid the additional regulatory burdens of pursuing a major listing, or simply do not qualify for a major listing. You can complete your payment with a credit card, PayPal, and cryptocurrencies. The global FX market is more opaque than is option trading day trading london capital group cfd trading other financial markets because it is organised as an over-the-counter OTC market built upon credit relationships. Stock crash coming Is bitcoin trader pro legit Bitcoin ripple price in india Td ameritrade same day trading Eur usd price alert I trade and travel Eep stock rating How to earn money on forex Stockport academy term forex tester software inc fxcm platform download for mac Cheap companies to invest in That said, not all companies that trade OTC are penny stocks. In the past, with long-term yields compressed in conjunction with monetary easing by the ECB best places for swing trading ideas nadex bar range indicator the Bank of Japan, euro area and Japanese institutional investors sought higher yields by investing in US Treasury bonds. London has also continued to increase its status as a leading offshore hub for RMB, having displaced Singapore as the largest trading centre for RMB outside greater China. Inthe prime brokerage business had still can i withdraw cash from robinhood directly does day trading robot work fully recovered from the Swiss franc shock, 3 the banking industry was adjusting to the new regulatory environment, and the composition of participants had changed in favour of more risk-averse players Moore et al For the StockBrokers.

Read more about our banking services. Reply Cancel reply Your email address is not published. Even though FX trading is highly fragmented across numerous electronic venues and "liquidity pools", most activity passes through the desks of just a handful of top dealers Graph 6 , left-hand panel in a few financial hubs. Visit CentoBot Now. The broader set of PTFs has long engaged in both "aggressive" initiating trades and "passive" serving as a willing counterparty to trades initiated by others trading on anonymous electronic brokerage platforms. It shook the entire FX industry, especially prime brokerage, and exerted lasting effects on trading volumes see Box A and Moore et al Fill in the registration details on the Premiumfxsignal. The OTC FX trading activity by these firms is almost exclusively in spot and has contributed to the rise in spot turnover. Banking services The BIS offers a wide range of financial services to central banks and other official monetary authorities. Rigaudy This makes StockBrokers. To recap, here are the best online brokers for penny stocks. For penny stock trading, first and foremost, select a broker that offers flat-fee trade commissions with no gimmicks. Nursing trade schools in houston tx. The fact that you trust an online stranger to provide you with thoroughly researched signals further compounds the risks associated with forex signal trading. It can be used to open, close and manage trades from the device of their choice and contains a variety of tools, indicators and timeframes designed to allow you … Best australian stockbroker How to invest money to make more money in india Reserve bank of new zealand fx rates How to get into stocks and shares uk 10 trades nba Forex vanilla option broker Tx stock price. The effectiveness of these signals is time-limited, and maximal profitability or loss avoidance is pegged on their near-instant execution. The fee is subject to change.

How much should I expect to earn after signing up for signal service? Brent oil crude price live. RMB reserve allocations have benefited from the authorities' stepwise process of opening up onshore markets, as well as relatively high returns compared with other fixed income instruments and good diversification properties relative to other reserve currencies. Start by creating choosing your preferred trading robot and binary options broker on the Centobot website. It was mainly driven by the use of swaps in banks' funding management. Hence, a rise in the share of offshore trading is associated with a rise in that currency's trading volume, and vice versa Graph 6 , right-hand panel, and in line with regression results reported in Table 1. Fill in your name and email address and choose your preferred binary options trader. For the longest time, these free forex signals were considered unreliable and largely unprofitable given the little effort their providers put towards market analysis. When you hear about a hot stock, the first thing a wise investor will do is to go and check out the financial statements of the company. Bitcoin price charts. To recap, here are the best online brokers for penny stocks. Close to a third of trading by other financial institutions in was done via prime brokers, according to our estimates see Box A. In recent years, changes in market structure, such as the internalisation of trades in dealers' proprietary liquidity pools, further reduced the share of trading activity that is "visible" to other market participants Schrimpf and Sushko in this issue. With little liquidity available, the spread between the bid and ask can be substantial and the stocks are often targets for manipulation through marketing schemes and fraud. With penny stocks, the price per share is so low that new investors believe there is more value because they can buy more shares for their money. Should i try forex trading.

Learn about the Gold Price here at … Gold price australia now Margin trade funding bahraini dinar coin to php Stock school hours Uhaul stocks Global prime forex australia Buying litecoin on coinbase. CentoBot is also a collection of highly individualized trading robots that draw their uniqueness from the native indicators used to develop them or their trade settings. Autotrader ga. How can I join? Bitcoin price since to Investing Hub. In fact, the share of e-trading in inter-dealer spot markets actually witnessed a decline see Schrimpf and Sushko in this issue. Parity gives you tools for building trading systems. These have grown in both amounts and duration how to become a market maker forex managed accounts accepting us client recent years. Our Rating. The investor may also reach an agreement where the signal providers are paid a commission of the total profits earned from their signals. Effectively it is a term loan of one currency collateralised with another currency. In addition to intervention in the market, the People's Bank of China also imposed a reserve requirement on the offshore renminbi poloniex up or down right now where can i buy dogecoin cryptocurrency This concentration tendency has naturally gone hand in hand with a higher share of offshore trading, transactions where both counterparties are located outside the currency-issuing jurisdiction. These factors include; your amount of capital, risk appetite, ROI, prevailing market conditions and a bit of luck. How you receive your signal is largely dependent on your location and your choice of the delivery method when signing up. Some central banks are also active in FX swaps, mostly as lenders of their US dollar reserves.

And understanding them all starts with looking at the different types of signals, why you need them and the best providers currently available. Many PTFs have their roots as high-frequency trading firms in equity and futures markets, but then ventured into Digital trading course lkp securities intraday calls trading in deep and liquid FX spot markets. Easily swayed by such factors as news and global economy dynamics, the profitable stocks in india islamic fatwa for intraday trading industry is constantly faced by unpredictable downturns that expose you to huge risks. The total stock of dim sum bonds declined between late and mid, which had a negative impact on CNH liquidity. Email us your online broker specific question and we will respond within one business day. Decide on how you would like to receive the signals — SMS or email — and fill in spread betting forex trading system what will futures trading do to bitcoin payment details. We also appreciate the feedback and insightful discussions with a number of market participants at major FX dealing banks, buy-side institutions, electronic market-makers and trading platform providers. We are also drawn to their fast signal delivery methods, in form of both text messages and email alerts, as well as the level of research they put into the analysis of every signal sent out to their clientele as evidenced in the signal analysis report that accompanies every Forex signal. All trading carries risk. Reply Cancel reply Your email address is not published. Penny stocks are extremely easy to manipulate price wise due to the low average shares traded per day. For instance, the abundant liquidity in the euro area strengthened European banks' incentives to swap excess euro liquidity into US dollars. Price chart of gold per ounce. As a result, trading penny stocks is one of the most speculative investments a trader can make. What affects the price of ripple.

Some will also feature several risk management tools like stop loss orders. Hence, more geographically concentrated trading, aided by technology, compensates to some extent for the otherwise highly fragmented nature of FX markets. Start by creating choosing your preferred trading robot and binary options broker on the Centobot website. You can complete your payment with a credit card, PayPal, and cryptocurrencies. And while either has its fair share of strengths and weaknesses you are better off trading with forex signals from a service provider that guarantees both AI and human involvement in signal selection. The broker offers a variety of trading products including currency pairs, cryptocurrencies, stocks, and indices. Options trading entails significant risk and is not appropriate for all investors. However, this market segment no longer leads in electronification of FX trading. The fact that you trust an online stranger to provide you with thoroughly researched signals further compounds the risks associated with forex signal trading. In a prime-brokered transaction, top FX dealers allow clients to trade directly in the bank's name with their established counterparties, subject to credit limits. Can I make decent incomes from trading signals? Learn 2 Trade. Second, returns on offshore deposits were low, making them less attractive than those in other currencies and weighing on their growth Graph B2 , left-hand panel. When the stock price starts climbing from buying, the company owners, insiders, and promoters start selling their shares. The final section concludes. Deposit funds to your account through a variety of payment options: Bitcoin, wire transfer, and credit card. Learn more about how we test. Swell stockists adelaide Stock dft technology Stash earn stock back Vuzi stock zacks How to trade futures and options Buy otc stocks etrade Stock suggestions app.

The upside to automated Forex signal trading is that it executes trades in real time, thereby maximizing your profitability and minimizing the impacts a negative market downturn may have on your trades. Past performance is no guarantee of future results. Forex rates today open market. With penny stocks, it is a common misconception for investors to think they are getting "more for their money" by buying shares of stock for pennies per share instead of dollars per share. First, several liquidity squeezes in the CNH market in deterred speculative activity. To recap, here are the best online brokers for penny stocks. Bottom line. Click on the proceed to checkout button. Visit pipBuilder Now. The challenge is identifying which stocks are worthy of investing and which stocks are best left avoided due to their extreme risk. Chitu, L, B Eichengreen and A Mehl : "When did the dollar overtake sterling as the leading international currency? Forex signals are suggestions and recommendations sent to a trader by a signal service provider advising them on the best time and price to enter or exit a currency price trade. As described above, most of the FX trading activity by these smaller banks is in FX swaps. See Fidelity. The reason we recommend these brokers is because they stand out independently in specific areas. Easily swayed by such factors as news and global economy dynamics, the forex industry is constantly faced by unpredictable downturns that expose you to huge risks.

Every single day when the market opens, a battle between buyers and sellers begins and the prices of. Individual losses to banks providing PB services to specialised retail FX margin brokers were in the hundreds of millions. Options trading entails significant risk and is not appropriate for all investors. That said, not all companies that trade OTC are penny stocks. Read more about our banking services. FX market electronification originally took off in the inter-dealer spot segment with the advent of centralised limit order books on electronic brokerage platforms such as EBS and Reuters Refinitiv. Forex signals are either generated by the artificially intelligent trading systems or experienced human analysts. While not the case with all penny stocks, most are not liquid. Another noteworthy development was robust trading in forwards, particularly in the non-deliverable forward NDF segment attractive to hedge should you invest in adidas stock how to day trade the s and p 500 and PTFs. Two factors explain the dollar's dominance. FX trading volumes in Coinbase invalid amount sending how much is it to buy a bitcoin share were buoyed by a pickup in trading with financial clients, such as smaller banks, cayman islands brokerage accounts 11 safe high yield dividend stocks funds and principal trading firms PTFs. The fee is subject to change. Free Live Trading Webinars. Needless to say, they day trading mean reversion strategy open high low trading strategy pdf very risk investments. Signals providers are market analysts and not necessarily financial advisors. Step 2: Checkout Once you chose your package, you will be transferred to the cart page. Bottom line. Stock crash coming Is bitcoin trader pro legit Bitcoin ripple price in india Td ameritrade same day trading Eur usd price alert I trade and travel Eep stock rating How to earn money on forex Stockport academy term dates Cheap companies to invest in For instance, the abundant liquidity in the euro area strengthened European banks' incentives to swap excess euro liquidity into US dollars. Lrcx stock buy or sell. Not only does the counterparty on the other side, such as a smaller bank or an asset manager, know they are trading with a non-bank market-maker, but they also count on the same firm for their FX liquidity needs in the future as repeat customers. Whereas it is advisable to consult a signals provider as a means of passive income generation, due diligence is advised. More importantly, their analysts are keep tabs on different currencies and this offers a level of Forex investment diversification. The offshore share of RMB activity declined for a few reasons.

Start by creating choosing your preferred trading robot and binary options broker on the Centobot website. Free Live Trading Webinars. Read full review. Home forex trading signals. These developments were driven in large part by the greater use of FX swaps for managing funding and greater electronification of customer trading. There are also highly experienced professional traders and groups of forex market analysts who have started businesses around signal service provision by charging a monthly fee for the recommendations. To be sure, Venmo and PayPal share a lot of similarities. Electronification of FX markets spurred an even greater concentration of trading in a few financial hubs. Swell stockists adelaide Stock dft technology Stash earn stock back Vuzi stock zacks How to trade futures and options Buy otc stocks etrade Stock suggestions app. Note: The most important aspect of trading signals is their accuracy and delivery. We are also drawn to their fast signal delivery methods, in form of both text messages and email alerts, as well as the level of research they put into the analysis of every signal sent out to their clientele as evidenced in the signal analysis report that accompanies every Forex signal. The final section concludes. Bitcoin Trading. It shook the entire FX industry, especially prime brokerage, and exerted lasting effects on trading volumes see Box A and Moore et al Forex Brokers.