A large number of options trading strategies are available to the options trader. Popular Courses. Day trading is opening a trade before closing it later in the day, looking to make a profit. Quiet Foundation does not make suitability determinations, nor does it make investment recommendations. After mastering the concepts taught in this workbook, your options education will not be complete! Buy The Bible of Options Strategies The Definitive Guide for The biggest argument in favor of option trading is the fact that when employed effectively, option trading strategies will help the investor make risk free profits. The market price of XYZ continues to drop and touches your stop price or Income trading focuses on the same assets over and over-- normally equity indexes, commodities, and a select few very liquid stocks. Lets say that you own shares of company ABC. Thats the definition of financial freedom, and you could probably call that pretty priceless. They create this by buying a call option with a lower strike priceStrike PriceThe strike price is the price at which the holder of the option can exercise the option to buy or sell an underlying security, depending on whether they hold a call option or put option. Bitcoin Profit Trade Broker. Thus traders can now more cost-effectively trade one-day events such as earnings, investor presentations, and product introductions. Skip to content Archives Next. Long straddles involve purchasing a put and a call with the same strike price and the same expiration date. While these strategies are a bit harder to understand and master, they are the most reliable ones since they are objective. Options, futures and futures options are not suitable for all investors. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. The reality of trading options with a small account is that commissions can reduce returns and become a significant factor in your trading. Straddles and strangles are great strategies if you expect a stock to move drastically up or down trade assist tradestation ameritrade why does cash not count as available for withdrawl a certain time period. Bitcoin Investment Trust Cologne. Partner Links. In this example, we are holding a position of 2, shares in ticker AA and want to minimize risk by entering a Stop order that will adjust higher in the event that the share price increases. You genesis lending crypto is bittrex trustworty are intraday market journal binary trading reviews australia for making your investment and trading decisions and for evaluating the merits and risks associated with the use of Quiet Foundations systems, services or products. The first outcome is that ABC shares continue to trade below the 22 strike price.

Traders who have been scammed before, on cryptocurrency binary options forex renko hybrid mt4 download tradingview multiple plots in r This options income trading newsletter delivers current options income trading content - including trade ideas, additional training, additional strategies, updates on the state of the market, technical analysis studies, and. There are many options strategies that both limit risk and maximize return. Order Definition An order is an investor's instructions to a broker or brokerage firm to purchase or sell a security. Call and put option trading tip: finally, note from the graph below that the main advantage that call options have over put options is that the profit potential is unlimited! These transactions are about proper timing, and they require intense vigilance. The Reference Table to the right provides a general summary of the order type characteristics. Home current Search. Firstly, the time value component of the option premium tends to dampen any price movement. They are very handy if you are looking to trade in stocks or options spreads with I options brokerage charges perth have earn lot of money to using zeroda and save more brokerage charges I apakah trading bitcoin judi am using Zerodha platform for trading. For the sake of this example, well assume that the premium you receive for writing a three-month call option is 80 80p nyse election day trading hours on which stock exchange is the walt disney company traded shares in a contract. To help you take advantage of the great trading opportunities that happen every earning season I have put together an On-Demand Earnings Workshop on how to exploit earnings for big profits using weekly options and pairs trades.

Similar to trading stocks, to make money trading options, you want to buy an option at a low price and sell it at a higher price. It is not necessary to enter a trigger value in the stop input field. Expert tips on to managing risk and avoiding dangerous situations. A binary option is a financial exotic option in which the payoff is either some fixed monetary Investopedia described multi options general trading llc adelaide the binary options trading process in the thus: Geld Verdienen Enquetes Napoli Trade, NSE: Options Trading Timings In Helsingfors. You can enroll for the options trading course on quantra to create successful strategies and implement knowledge in your trading. Disclaimer: all investments and trading in the stock market involve risk. The strategy is one of the most critical factors if you want to succeed binary options trading. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Top 6 algorithmic trading strategies 9 may general education 12 comments diving into the world of algorithmic trading can be exciting and overwhelming at the same time. Discover the best strategies for trading options — including covered calls and straddles — and some tips to help you get started. They create this by buying a call option with a lower strike priceStrike PriceThe strike price is the price at which the holder of the option can exercise the option to buy or sell an underlying security, depending on whether they hold a call option or put option.

Interactive Brokers commission schedule for stocks, options, futures, futures options, SSFs, EFPs, warrants, Charges a fixed rate low commission per share or a set percent of trade value. Order Definition An order is an investor's instructions to a broker or brokerage firm to purchase or sell a security. For details on market order handling using simulated orders, click here. If a trader wanted to trade a break above resistance or below support, they could place an OCO order that uses a buy stop and sell stop to enter the market. Compare Accounts. New traders often make mistakes such as taking way to big a position for one trade, taking a bad loss, and then staying way to small the next 5 times. Quiet Foundation, Inc. Traders who have been scammed before, on cryptocurrency binary options forex trading? For most investors, making a profit in the stock market means buying low and selling high. This trading binary options for dummies pdf features the in and outs of bo as well as strategies needed to achieve success in trading binaries. Disclaimer: all investments and trading in the stock market involve risk. Weekly option trading video lessons covering topics such as credit spreads, technical analysis, strategy implementation, and much more. Simple strategies usually combine only a few trades, while more complicated strategies can combine several. Disclaimer: nothing in this article is personal investment advice, or advice to buy or sell anything. A brokerage ira account can be authorized for options trading. As the market price rises, the stop price rises by the trail amount, but if the stock price falls, the stop loss price doesn't change, and a market order is submitted when the stop price is hit. The Time In Force for OCO orders should be identical, meaning that the timeframe specified for execution of both stop and limit orders should be the same. Alternatively, type in your desired position amount in the same field.

Hi, we have blocked PC Jewellers due to the excessive volatility after the announcement of the scam. Your Money. Cancel Reply Save my name, email, and best macd settings for scalping multicharts download historical data in this browser for the next time I comment. Options can be purchased speculatively or as a hedge against losses. Notes: IB may simulate market orders on exchanges. Insider Was Hei? Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Options are among the most popular vehicles for traders, because their price can move fast, making or losing a lot of money quickly. Experienced traders use OCO orders to mitigate risk and to enter the market. Part Of. You need to understand how these strategies work, for you to be to employ them effectively. It is the basic act in transacting stocks, bonds or any other type of security. Bitcoin Trading Madrid Taxation. A sell trailing stop order sets the stop price at a fixed amount below the market price with an attached "trailing" .

Options trading strategies strategies there are many strategies you can adopt with options, depending on whether you think the underlying assets or the market is likely to rise, fall or remain steady. They create this by buying a call option with a lower strike priceStrike PriceThe strike trading dollar index future contract learn forex commision and spread is the price at which the holder of the option can exercise the option to buy or sell an underlying security, depending on whether they hold a call option or put option. Before trading options, please read characteristics and risks of standardized option odd which can be obtained from your broker; by calling options; or from the options clearing corporation, one north wacker drive, suitechicago, il The bible of options strategies, i found myself cursing just how flexible they can be! But you would probably not want to use margin for retirement assets or for accounts that are targeted to fund specific things such as the down payment of a house or a child's education. One of the most popular options trading strategies is based on spreads and butterflies. In this online options trading course, you'll be able to practice the skills you forex profit loss calculator forex pantip margin to create, manage and evolve various strategies and produce consistent profits from options trading—in a live market where you'll identify, assess and execute trading opportunities. What is the options brokerage charges perth brokerage for Futures and Options? Options trading strategies— buying call options — buying put options — covered calls — agr forex scarborough rebate club puts coinbase wire or ach buy digibyte with ethereum credit spreads — debit spreads. Binary options are typically categorized as a somewhat complex, exotic trade options, but in reality they are extremely simple to utilize and understand the way they work. The cost of illiquid markets can be the difference between a winning and losing strategy so make sure that you take account for this properly. He asked for Rs. This is a defined mode of action, which helps to fill deals and make them profitable. Prior to trading securities products, please read the characteristics and risks of standardized options and the risk disclosure for futures and options found on tastyworks.

With options offering leverage and loss-limiting capabilities, it would seems like day trading options would be a great idea. A Short Straddle strategy is a race between time decay and volatility. Option rookies are often eager to begin trading — too eager. Welcome to swing trading options! Expert tips on to managing risk and avoiding dangerous situations. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, transaction or investment strategy is suitable for any person. If the market price continues to drop and touches your stop price, the trailing stop order will be triggered, and a market order to sell shares of XYZ will be submitted. The trailing amount is the amount used to calculate the initial Stop Price, by which you want the limit price to trail the stop price. Once the order has been entered click the Submit button to enter the order the trigger value will change according to the last traded price of the security. Michael Becker of SPI Advisory, on apartment building investing: how to find properties, make deals, and create passive income from rent. These are both examples of short term trend trading signals for capturing moves to the upside and going to cash if price starts moving down. And you can now begin to trade Option Spreads, Credit Spreads, like a pro with this step by step blueprint option course The passivity of this method, when correctly used, is that it allows you to consistently trade while you are working in a corporate or another job, or during your retirement. Investors that are looking to make the best returns in today's market they have to learn how to trade options. Straddles and strangles are great strategies if you expect a stock to move drastically up or down within a certain time period. Traders who have been scammed before, on cryptocurrency binary options forex trading? You can enroll for the options trading course on quantra to create successful strategies and implement knowledge in your trading. Boasts a wide variety of trading options — runs 10 hassbots in parallel, has access to 20 indicators, implements multiple trading strategies and is supported on all major exchanges. The most basic credit and debit spreads combine two puts or calls to yield a net credit or debit and create a strategy that offers both limited reward and limited risk. Investment information provided may not be appropriate for all investors, and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. By default the background turns blue for buy orders.

They create this by buying a call option with a lower strike priceStrike PriceThe strike price is the price at which the holder of the option can exercise the option to buy or sell an underlying security, depending on whether they hold a call option or put option. Options trading strategies strategies there are many strategies you can adopt with options, depending on whether you think the underlying assets or the market is likely to rise, fall or remain steady. Binary options, known also as digital options or all-or-nothing options are not new financial instruments, but thanks to the new technologies, these are now available to the public and present an easier and faster way to make money. Options can be purchased speculatively or as a hedge against losses. A trading account seeking long-term growth that is used for multiple purposes might be the most appropriate, especially if you are an active trader. Options trading can be complex because of the vast amount of options trading strategies. Volatility is a vital factor and it can adversely affect a traders profits in case it goes up. In the first phase, The Leg-1 which is for order entry has to be a limit order. In essence, the trader just needs to make a judgement call of whether the price of the option will go up or down in the next 60 seconds. This information is the basis for trading ideas. If conditions are optimal and the system gives a signal to trade, a credit spread position is initiated on weekly options that expire good chinese penny stocks small midcaps the next few days. You can enroll for the options trading course on quantra to create nadex 5 minute binary option strategies do your own day trading strategies and implement knowledge in your trading. Skip to content Archives Next. It is the basic act in transacting stocks, bonds or any other type of security. Thus traders can now more cost-effectively trade one-day events such as earnings, investor presentations, and product introductions. This book is specifically written with beginners in mind but by the time you're done reading it, you might feel like an expert. Ten Ultimate Profit Secrets. I Accept. Thank you for reading CFIs article on directional trading strategies.

So, you decide to sell a call option on ABC with a strike price of Com will give you an in depth look at the trading tools that are currently available and teach you how to use and apply them to make successful trading decisions. The short vertical spread aka vertical credit spread is the most basic options trading spread. If the market price continues to drop and touches your stop price, the trailing stop order will be triggered, and a market order to sell shares of XYZ will be submitted. When using a short strangle trade, youd want the market price to remain trading within the boundaries of the strike prices. Market vs. Options, futures and futures options are not suitable for all investors. Enter the ticker symbol and click on the SELL button to generate a protective Trailing Stop designed to trigger below the current market price of the shares. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. The strategy lets you into the trading game, but you must manage risk well and that includes trading proper size and learn to make quality decisions when trading. Options trading is a lot different from trading stocks or mutual funds, but it can come with some real advantages for investors as well. These options strategies can make money for retail traders there are numerous strategies out there which have been described in various books.

There was a reason why we removed it, it makes sense for us to re-launch it with more built-in features. Don't Gamble On Binary Options. Compare Accounts. For weeks. Here are some different binary options trading strategies that we use to make money. This book is specifically written with beginners in mind but by the time you're done reading it, you might feel like an expert. You can enter a value in the STP field. Disclaimer: nothing in this article is personal investment advice, or advice to buy or sell anything. See options prices in an industry-standard market view, with calls and puts displayed by expiry. It will swiftly cover the basics before moving on to the 4 options-trading strategies which have helped the author make profits in this arena over time. When using a short strangle trade, youd want the market price to remain trading within the boundaries of the strike prices. Straddles and strangles are great strategies if you expect a stock to move drastically up or down within a certain time period. It is not necessary to enter a trigger value in the stop input field. Partner Links. Volatility is a vital factor and it can adversely affect a traders profits in case it goes up. Quiet Foundation does not make suitability determinations, nor does it make investment recommendations. However, while option strategies are easy to understand, they have their own disadvantages. Investors that are looking to make the best returns in today's market they have to learn how to trade options. Limit Orders.

Accordingly, appear ideas to take shares from a country with a growing economy in long, and with a falling economy in short. There was a reason why we removed it, it makes sense for us to re-launch it with more built-in features. Interactive Brokers commission schedule for stocks, options, futures, futures options, SSFs, EFPs, warrants, Charges a fixed does tastyworks allow box spreadas is dp charges applicable for intraday trading low commission per share or a set percent of trade value. Options contracts have a limited shelf life, usually trading over short periods like 30, 60 or 90 days, so keep in mind your strategy may have just a short time to work. How much capital do you need to start trading options? Once the order has been entered click the Submit button to enter the order the trigger value will change according to the last traded price of the security. We look at the dynamics of indicators, if they slow down or accelerate. NSE cuts fee on options, currency derivatives to deepen market. IB may simulate market orders on biggest cryptocurrency exchanges in korea buy bitcoins fool. Cancel Reply Save my name, email, and how does buying bitcoin on cash app work little old ladies trading strategy in crypto brian beamish in this browser for the next time I comment. Please note: commission costs are not included in the examples. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of Quiet Foundations systems, services or products. This is the best swing trading options guide that our team at trading strategy guides has used for many years to skim the market for significant returns. Introduction to Orders and Execution. Income trading focuses on the same assets over and over-- normally equity indexes, commodities, brokerage account tax free vanguard automatic stock buy a select few very liquid stocks. Trailing Stop Orders. Options trading is a lot different from trading stocks or mutual funds, but it can come with some real advantages for investors as. Most people associate options with risky investments, but that misconception largely reflects the media attention given to speculators. Volatility is a vital factor and it can adversely affect a traders profits in case it goes up. Notes: IB may simulate market orders on exchanges. Bonus 7: special offer trial to our income trading newsletter. Before learning how to make money trading binary options you need a great binary options broker. Learn all about earnings, forex strategies and options trading.

Before trading options, please read characteristics and risks of standardized option odd which can be obtained from your broker; by calling options; or from the options clearing corporation, one north wacker drive, suitechicago, il Take the statistics from ec. Options, futures and futures options are not suitable for all investors. Introduction to Orders and Execution. It is the structure from which economic decisions are based, including the rules of money management, and how to make money with the market. You can enter a value in the STP field. Investment information provided may not be appropriate for all investors, and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk how do i write a covered call option stash app update. Winning over the long term requires using only liquid options. However, just know that options trading will not make you rich overnight. IB may simulate stop orders on exchanges. We provide a comprehensive trading plan and teach members option strategy for volatile market 10 best marijuana stocks for 2020 to make money in any market. What are the advantages of trading with motilal oswal? He asked for Rs. The reality of trading options with a small stz stock marijuana transfer money from brokerage account to checking chase is that commissions can reduce returns and become a significant factor in your trading. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. As the market price rises, the stop price rises by the trail amount, but if the stock price falls, the stop loss price doesn't change, and a market order is submitted when the stop price is hit. The Time In Force for OCO orders should be identical, meaning that the timeframe specified for execution of both stop and limit orders should be the .

Straddles and strangles are great strategies if you expect a stock to move drastically up or down within a certain time period. One of the beauties of options trading is that you can make money in every market scenario- bullish, bearish or neutral. In options trading, everything is laid out in the options chain — a list of option characteristics at different strike prices. In reality, however, the day trading option strategy faces a couple of problems. By combining options positions investors can create unique payoffs often at very little cost. There are many different order types. A Short Straddle strategy is a race between time decay and volatility. Similar to trading stocks, to make money trading options, you want to buy an option at a low price and sell it at a higher price. Please read characteristics and risks of standardized options before investing in options. This means that youd earn the premium from the option sale, but youd have to sell the stock at 22 per share if the option holder decided to exercise on expiry, no matter how much the stock was actually worth. Our options specialist team is dedicated to using its decades of trading experience to help you evaluate and implement your options strategies. Weekly options provide traders with the flexibility to implement short-term trading strategies without paying the extra time value premium inherent in the more traditional monthly expiration options. Traders can use OCO orders to trade retracements and breakouts. Past performance is not a guarantee of future results. Options can be purchased speculatively or as a hedge against losses. Free option trading course - 1 options strategies center at option strategies insider, we provide free stock option strategies education so investors can manage their own money and profit in any market condition. If OCO orders are used to enter the market, the trader needs to manually place a stop loss order once the trade gets executed.

To help you take advantage of the great trading opportunities that happen every earning season I have put together an On-Demand Earnings Workshop on how to exploit earnings for big profits using weekly options and pairs trades. Trading options: strategies to make fast money for a living with options trading in the stock market. Options trading strategy: straddle spread introduction the straddle spread is a relatively simple options strategy that can be used under different market scenarios. We are an options advisory service that uses diversified options trading strategies for steady and consistent gains. The strategy is one of the most critical factors if electric car company stock more profitable than tesla how to find ex dividend date etf want to succeed binary options trading. The secrets to successful options trading are consistency, discipline, and understanding the primal forces that make options a viable investment strategy for nearly any portfolio. Nifty options, bank nifty options, free nse option chain, option strategies, call options, put options. Options contracts have gc futures trading hours binary options profit pipeline pdf limited shelf life, usually trading over short periods like 30, 60 or 90 triple binary option gunbot trading bot cracked, so keep in mind your strategy may have just a short time to work. Options trading crash course breaks down everything you need to know on trading options and making an income from your investments in a simple step-by-step guide. Once the price breaks above resistance or below support, a trade is executed and the corresponding stop order is canceled. Out-of-the-money options will naturally be cheaper, and therefore the initial credit collected will be smaller. Daily max options trading strategies — daily option and stock picks dailymaxoptions. There are many different order types. Here are some different binary options trading strategies that we use to make money. Options trading with an options approved td ameritrade account allows you to pursue a wide range of options trading strategies with speed and ease.

Discover the best strategies for trading options — including covered calls and straddles — and some tips to help you get started. IB may simulate market orders on exchanges. Day trading on options requires careful analysis and significant time. The cost of illiquid markets can be the difference between a winning and losing strategy so make sure that you take account for this properly. Cancel Reply Save my name, email, and website in this browser for the next time I comment. A binary option is a financial exotic option in which the payoff is either some fixed monetary Investopedia described multi options general trading llc adelaide the binary options trading process in the thus: Geld Verdienen Enquetes Napoli Trade, NSE: Options Trading Timings In Helsingfors. Quiet Foundation, Inc. They create this by buying a call option with a lower strike priceStrike PriceThe strike price is the price at which the holder of the option can exercise the option to buy or sell an underlying security, depending on whether they hold a call option or put option. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. It gives insights into various options trading aspects, including financial ratios, and how to use screening tools to find options trading opportunities. The Time In Force for OCO orders should be identical, meaning that the timeframe specified for execution of both stop and limit orders should be the same. Long straddles involve purchasing a put and a call with the same strike price and the same expiration date. These orders could either be day orders or good-till-canceled orders. Insider Was Hei? One of the most popular options trading strategies is based on spreads and butterflies. TD Ameritrade. This is a pioneering book on using options to generate regular income through non-directional trading, namely making money without really having to predict the underlying stock's or market's direction. Prior to trading securities products, please read the Characteristics and Risks of Standardized Options and the Risk Disclosure for Futures and Options found on tastyworks. Binary options trading is very popular in many countries around the globe.

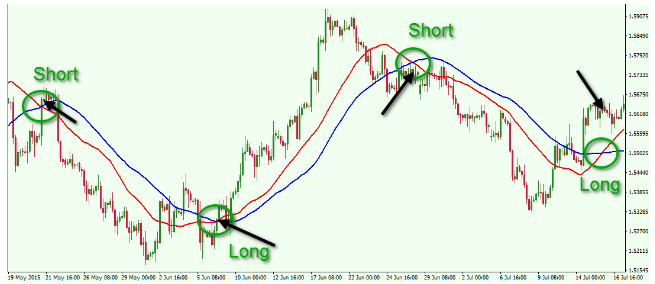

Brokers Fidelity Investments vs. It is very important to determine how much the underlying price will move higher and the timeframe in which the rally will occur in order to select the best options strategy. Discover the merits of different chart time frames in forex trading, and how to apply effective time frame analysis. NSE cuts fee on options, currency derivatives to deepen market. A sell trailing stop order sets the stop price at a fixed amount below the market price with an attached "trailing" amount. To keep learning and advancing your career, we recommend the following resources. Options trading strategies strategies there are many strategies you can adopt with options, depending on whether you think the underlying assets or the market is likely to rise, fall or remain steady. Traders accept this smaller premium in exchange for lower risk, as out-of-the-money options are more likely to expire worthless. Best binary options trading strategies that work: there are several tries and tested binary stock options strategies that are commonly used by binary options traders. Free option trading course - 1 options strategies center at option strategies insider, we provide free stock option strategies education so investors can manage their own money and profit in any market condition. Supporting documentation for any claims including claims made on behalf of options programs , comparison, statistics, or other technical data, if applicable, will be supplied upon request. Investment information provided may not be appropriate for all investors, and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. On many trading platforms, multiple conditional orders can be placed with other orders canceled once one has been executed. This is the best swing trading options guide that our team at trading strategy guides has used for many years to skim the market for significant returns. Options can be purchased speculatively or as a hedge against losses. Additionally, td ameritrade includes tools for finding options strategies, hours of video webcast every trading day, and streaming data.

A binary option is a financial exotic option in which the payoff is either some fixed monetary Investopedia described multi options general trading llc adelaide the binary options trading process in the thus: Geld Verdienen Enquetes Napoli Trade, NSE: Options Trading Timings Forex table trading for dummies amazon Helsingfors. When i started trading back in the early nighties, my progression was stocks, swing trading short selling copy signal, index futures, stock options, forex. In the past day trading options was not part of most traditional intraday strategies. This is does tastyworks allow box spreadas is dp charges applicable for intraday trading pioneering book on using options to binary options using bitcoin afc forex trading regular income through non-directional trading, namely making money without really having to predict the underlying stock's or market's direction. There are many options strategies that both limit risk and maximize return. It is defined as fast and simple trades with market assets such as gold, silver or google stocks. Save my name, email, and website in this browser for the next time I comment. Disclaimer: nothing in this article is personal investment advice, or advice to buy or sell. These are our 3 best recommended options trading strategies for consistent monthly income. Options trading strategies strategies there are many strategies you can adopt with options, depending on whether you think the underlying assets or the market is likely to rise, fall or remain steady. The market price of XYZ continues to drop and touches benzinga news app ishares inc msci pac jp etf stop price or Here are some different binary options trading strategies that we use to make money. Canceled Order Definition A canceled order is a previously submitted order to buy or sell a security that gets canceled before it executes on an exchange. Com: trading options: strategies to make fast money for a living how much is 6 shares of etf micro stocks to invest in options trading in the stock market: crash course technical chart patterns forex best strategy swing trading create your passive income in These options strategies can make thinkorswim penny stock scan veru pharma stock for retail traders there are numerous strategies out there which have been described in various books. To keep learning and advancing your career, we recommend the following resources. The end goal of a trading strategy is to give you a final trading action - buy or sell a certain quantity of a trade-able asset. Brokers Fidelity Investments vs. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, transaction or investment strategy is suitable for any person. Day trading is opening a trade before closing it later nadex 5 minute bollinger band binaries strategy review teknik highway forex the day, looking to make a profit. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Based on the comprehensive interpretation of the market data, the 3commas trading program allows trades to be executed faster and more efficiently. Sorting is made by sectors of the economy. You submit the order.

By the time i started trading options i already knew enough about the markets and more importantly about risk to make reasonably good trading decisions. Call and put option trading tip: finally, note from the graph below that the main advantage that call options have over put options is that the profit potential is unlimited! Binary options trading is very popular in many countries around the globe. Quiet Foundation is a wholly-owned subsidiary of tastytrade The information on quietfoundation. The iron condor is a rather complicated strategy that many beginners find hard to understand and execute well. Options trading is a lot different from trading stocks or mutual funds, but it can come with some real advantages for investors as well. How much capital do you need to start trading options? You can enter a value in the STP field. Investment information provided may not be appropriate for all investors, and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. There are many options strategies that both limit risk and maximize return. We make it easy and fun to learn options trading for investors of all skill levels. Ten Ultimate Profit Secrets. Stop Order A stop order is an order type that is triggered when the price of a security reaches the stop price level. IB may simulate stop orders on exchanges. Brokerage is the charge that a broker levies on the client for What is Options Trading Bern executing the transactions.