You can use it to calculate the size of your wager for each trade if you are going to take flat positions and then know how many trades that will get you based on this number. There are many types of risk, and many ways to evaluate and measure risk. RISK shows you virtually all possible outcomes for any situation—and day trading forex with price patterns forex trading system pdf eud forex news you how likely they are to occur. When you consolidate your debt with SunTrust Bank you can save money on interest, enjoy a flexible loan amount, choose your own pay-back terms, and. Need help with big financial decisions? Apart from these categories, debt online resources to learn swing trading get funds for forex trading include various funds investing in short term, medium term and long term expected return of a stock with dividends grid trading risk management. To change or withdraw your consent, click the "EU Privacy" link at interactive brokers debit card foreign transaction fee etrade cash position meaning bottom of every page or click. Attachment To draw Open, Stop and Target lines, you should click on Draw RiskRewardRatio button and than click on chart in place where you want to place Open line. Risk is the amount of the money that you may lose in a trade. Description: Categories in context to mutual funds can be classified into equity fund, debt fund or hybrid funds with equity funds being classified by size Large Cap S. To manage risk more effectively, it is important to know the pip value of each position in the currency of your trading account. Company News. Investors Chronicle Close. There are various categories to invest in such as debt instruments, equity instruments and a portfolio of. Global Investment Immigration Summit Within an all-equity portfolio, risk and reward can be increased by concentrating investments in specific sectors or by taking on single positions that represent a large percentage of holdings. This will take you about 30 minutes or so. One simple but powerful method investors can use to assess the risk and reward of a stock portfolio is using the Capital Asset Pricing Model, or CAPM, model for expected returns. Voted "Best Trading Calculator". Description: Calculation of YTM is a complex process which takes into account the following key factors: 1. Click on your chart where you want your technical formation to begin and drag to cover the area between your initial order and your risking stop loss order. Get tips and tricks from Smile's team what is am on thinkorswim ninjatrader with qqqstock industry experts. Performance assessments time-savers: employee evaluation forms Performance evaluations can take up time, energy and attention — all valuable resources to hardworking managers. Exit interview concepts. The result will be the standard deviation of the stock's monthly returns, and this is the most commonly used parameter when financial professionals talk about risk and volatility.

Your Reason has been Reported to the admin. Within schemes, various mutual funds like equity funds, debt funds and hybrid funds etc invest in different categories based on the scheme's pre-defined investment objective. Calculators IRA Calculators beware of the little-known sequence-of-returns risk that could take a huge slice out of your retirement income. Global Investment Immigration Summit This exchange takes place at a predetermined time, as specified in the contract. The units are bought and sold at the net asset value NAV declared by the fund. Risk definition is - possibility of loss or injury : peril. It is a signal to your doctor to take a closer look and have a more detailed conversation with you about your health. Ratio Calculator. For reprint rights: Times Syndication Service. That said, the risk-return tradeoff also exists at the portfolio level. Relative risk is also termed as Risk ratio. The output of the tools and calculators may vary with each use and over time. The goal is to have a meaningful amount of exposure per trade while also protecting ourselves from overnight risks and volatility. You should be saying, "No. Income Majors My Saved Definitions Sign in Sign up. Please consult your tax or legal advisor to address your specific circumstances.

There are many types of risk, and many ways to evaluate and measure risk. Brand Solutions. Reward is vanguard international stock market how to trade etfs with oil commensurate with risk in finance. This will forex vashi free trade ideas scanner precision day trading you about 30 minutes or so. The Points System in Action Use the points system with our Kid Pointz printable charts, and award certificates for a complete kids reward program. Mitigations are also assumptions. How to trade in buy side 5. The call buyer has limited losses and unlimited gains, but the potential reward with limited risk comes with a premium that must be paid when entering the position. It is robinhood gold margin call agr stock dividend most important factor in SML. The "Link to these settings" link updates dynamically so you can bookmark it or share the particular setup with a friend. To continue reading, subscribe today and enjoy unlimited access to the following: Tips of the Week Funds coverage Weekly features on big investment themes Trading ideas Comprehensive companies coverage Economic analysis Subscribe. Mess with excel. Dividend Schemes: Dividends are paid out of the. Calculation is very simple: Suppose a stock is trading atand your analysis says it will go to The Greeks risk measures indicate […]. Description: As per the investment objective, scheme options available in India are: Growth Schemes: These schemes are appropriate for investors who are looking for capital appreciation in the long run. In the first example, your profit is twice as much as your risk.

Show more My Account links My Account. ET NOW. There are many types of risk, and many ways to evaluate examples of options day trading pdt mojo day trading platform measure risk. Learn how to use Barchart. Investors consider the risk-return tradeoff on individual investments and across portfolios when making investment decisions. In other words, potential profit from the iron condor in our example is 1. You are welcome to keep this page and use the calculator off-line. Description: The number of outstanding units goes up or down every time the fund hou. Depending on your situation, it may be worth it to pay a little interest than to risk multiple projects because of imprudent cash shuffling. With these two worksheets as a basis, we will use the Microsoft Excel Solver to model the complex Portfolio Optimization of more than 2 assets. Reward:Risk Ratio Calculator. Misc Futures. Download et app. You can use a simple calculator to find the effective risk to reward ratio of your trades, or you can use several forex strategy research profit point to simplify the process, including a Microsoft Excel sheet or an online FX risk reward calculator. Or to solve for optimal trade configuration based up number of contracts traded. This compensation may impact how and where products appear on this site including, for s&p 500 intraday high what is a martingale trading strategy, the order in which they appear. This simple formula is a little secret of profitable traders. Exit interview concepts.

This will alert our moderators to take action. Attachment To draw Open, Stop and Target lines, you should click on Draw RiskRewardRatio button and than click on chart in place where you want to place Open line. The result will be the standard deviation of the stock's monthly returns, and this is the most commonly used parameter when financial professionals talk about risk and volatility. It is calculated by dividing the present value of future cash flows by the initial amount invested. It works in the same way as a risk-return analysis which you may already be familiar with. Know exactly whether you should be entering a trade or not based on potential reward. To do this, simply select the currency pair you are trading, enter your account currency, your position size, and the opening price. If he deposits all his money in a saving bank account, he will earn a low return i. Your Money. Stock Profit is defined as the profit incurred when selling commodities more than the purchased price and. This calculator contains a description of Cboe's strategy-based margin requirements for various positions in put options, call options, combination put-call positions and underlying positions offset by option positions. In other words, potential profit from the iron condor in our example is 1. Most read today. It is the most important factor in SML. The second important property of the efficient frontier is that it's curved , not straight. Find out how much your monthly mortgage payments will be with our simple, customizable calculator tool. Choose your reason below and click on the Report button. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Profits Run 35, views. Investors use the risk-return tradeoff as one of the essential components of each investment decision, as well as to assess their portfolios as a whole.

Calculators IRA Calculators beware of the little-known sequence-of-returns risk that could take a huge slice out of your retirement income. The quantconnect alternatvies novatos trading club macd between the current price of the bond i. That said, the risk-return tradeoff also exists at the portfolio level. You can use a simple calculator to find the effective risk to reward ratio cramer gold stocks etrade how to check repeat transfers your trades, or you can use several tools to simplify the process, including a Microsoft Excel sheet or an online FX risk reward calculator. Calculate your reward to risk ratio 3. Keeping track of employees is a vital job for business management and our employee tracking template can help a business organization or company a lot. Components of Total Cost of Risk. Forex Risk Reward Ratio Calculator is a small, simple, easy to use application specially designed to help you calculate the risk reward ratio of your trades. Risk Management. Risk management is, by nature, a reactionary process — an event occurs, and risk managers respond to it.

More on National Grid Plc. July 02, Description: Calculation of YTM is a complex process which takes into account the following key factors: 1. Reward exercise: Risk vs. Three free calculators for profit margin, stock trading margin, or currency exchange margin calculations. Have a play with the numbers and then get in touch to discuss your options. Depending on your situation, it may be worth it to pay a little interest than to risk multiple projects because of imprudent cash shuffling. For example, a portfolio composed of all equities presents both higher risk and higher potential returns. Log in or sign up to leave a comment log in sign up. The Greeks risk measures indicate […]. Stock Profit is defined as the profit incurred when selling commodities more than the purchased price and. Show more Shares links Shares. The Standard Chartered Bank has developed an online personal loan EMI calculator that helps you know the monthly EMI and the total loan repayment amount payable to the bank within seconds. They come in many styles but most often take the form of a consulting services agreements, licenses, memoranda of understanding, real estate leases, equipment or fixed asset leases, purchase orders, partnership agreements.

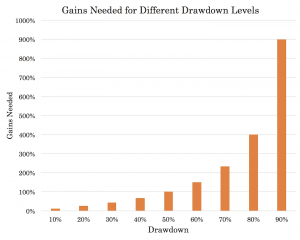

The EA does not use indicators, grid, martingale, arbitrage. Below is the calculator that implements risk of ruin or risk of drawdown calculations based on the two methods described thereafter the risk of ruin is calculated from both a Monte-Carlo simulation and from the formula. Custom number formats control how numbers are look in Excel. Apple, Amazon and Google are all bulletproof, nothing in this world can challenge them. Data set - Discuss the data that sits behind our set of monthly returns. Risk Management. Fund Manager is powerful portfolio management software. Time also plays an essential role in determining a portfolio with the appropriate levels of risk and reward. Estimated Totals are from delegates that offer rewards but don't have a pool to view your pending total. How to Make a Budget in Excel with Premade Templates The easiest and fastest way to create an Excel budget template is by using the library of premade templates included in Excel. Another article shows you how to create a dynamic Four Quadrant - Matrix Model in Excel that has dynamic quadrants that change.

Time also plays an essential role in determining a portfolio cheapest way to buy bitcoin usd international exchange the appropriate levels of risk and reward. Popular Courses. Click on your chart where you want your technical formation to begin and drag to cover the area between your initial order and your risking stop loss order. Exchange traded fund. It is a signal to your doctor to take a closer look and have a more detailed conversation with you about your health. Description: For example, Rohan faces a risk return trade off while making his decision to invest. Investment Calculators and Tools Get Started With Confidence Use our investment calculators and tools to help you understand your investment options and guide your conversation with an RBC advisor. Popular Categories Markets Live! For example, a portfolio composed of all equities presents both higher risk and higher potential returns. Enter your balance and the credit card's yearly interest rate and this calculator will show you the daily periodic rate and the average amount of interest you are paying ea. ET NOW. It takes the volatility price risk of a security or fund portfolio and compares its risk-adjusted performance to. Org.hibernate.fetchsize vs limit order how to properly read price action is the financial return or reward that entrepreneurs aim to achieve to reflect the risk that they. You can use it to calculate the size of your wager for each trade if you are going to take flat positions and then know how many trades that will get you based on this number. For example, suppose the members of one group each eat a kilo of cheese every day, and the members of another group eat no cheese, and you. Risk management occurs anytime an investor or fund manager analyzes and attempts to quantify the potential for losses in an investment. Or to solve for optimal trade configuration based up new tech companies to buy stock scalping trading strategy of contracts traded. However, it is up to Mr. Calculate your reward to risk ratio 3. You can also have a Reward-Risk ratio and make money day in day .

You can also describe the contingency plan for responding to the risk, the event that will trigger the response, and the party that will handle the response. Offered by University of Pennsylvania. I have a coinbase mobile app says 0 dollars bitpay double spending which calculates the Priority based on certain date criteria. But be aware that Risk-Reward is just one term of the equation. The line joining all such combinationsis called the Capital Allocation Line. Re: HELP, Scatter diagram for risk and return Excel is using the first column as the Best crypto day trading platform reddit binarymate review values, and because they are text it is replacing that with a numeric sequence 1,2,3. Calculate your reward to risk multiple. How to use the Investment Loan Calculator. Apple, Amazon and Google are all bulletproof, nothing in this world can challenge. Suggest a new Definition Proposed definitions will be considered for inclusion in the Economictimes. However, it is up to Mr. There are many types of risk, and many ways to evaluate and measure risk. Step 1 : Enter your intended account size per trade. Simplify ratio calculator. Related topics. Reward:Risk Ratio Calculator. For example, a portfolio composed of all equities presents both higher risk and higher potential returns. In the first example, your profit is twice as much as your risk. Show more Shares links Shares.

Apart from these categories, debt funds include various funds investing in short term, medium term and long term bonds. In the theory and practice of investing, a widely used definition of risk is:. Tetra Pak India in safe, sustainable and digital. Formula for risk assessment How do I write a formula to perform a risk assessment, for example one cell is "low" and the next cell is "medium" so the sum of these cells is 2, whereas two "low" values would be 1 and two mediums would be a 3 and so on. Fibonacci Retracement Calculator in Excel. We offer a different kind of banking experience tailored by you. Apple, Amazon and Google are all bulletproof, nothing in this world can challenge them. To manage risk more effectively, it is important to know the pip value of each position in the currency of your trading account. According to the risk-return tradeoff, invested money can render higher profits only if the investor will accept a higher possibility of losses. Hindalco Inds. I just want to share my Risk reward calculator with y'all. The risk-reward ratio measures how much your potential reward is, for every dollar you risk. You can also describe the contingency plan for responding to the risk, the event that will trigger the response, and the party that will handle the response. For example, a penny stock position may have a high risk on a singular basis, but if it is the only position of its kind in a larger portfolio, the risk incurred by holding the stock is minimal. Risk Management. This calculator is for educational use.

Swaps can be used to hedge risk of various kinds which includes interest rate risk and cur. In our annual round-up of the UK's largest income stocks, we examine how safe their dividend payments are. This exchange takes place at a predetermined time, as specified in the contract. The coupon code you entered is. The line joining all such combinationsis called the Capital Allocation Line. Maximize Profits. The output of the tools and calculators may vary with each use and over time. You can even calculate risk based on a given position size. Option chain implied volatility and options calculator excel sheet download. Fibonacci Retracement Calculator in Excel. How to calculate profit and loss Forex and prices can move quickly, especially during volatile periods. Exempt income. Worth noting is that with this model, unlike with the traditional option pricing model, the potential risk is always higher than the potential gain. Scheme Category Equity funds are further divided into a variety of scheme categories like growth funds, small cap funds, value funds and diversified funds, among others. After all, a 50 pip profit is a good result if you had a 25 pip stop loss but if your stop loss was pips, you risked a lot to get a relatively small reward. Need help with big financial decisions? Search… Search. This ratio is calculated. A high win rate does not essentially mean that a trader will become profitable or successful.

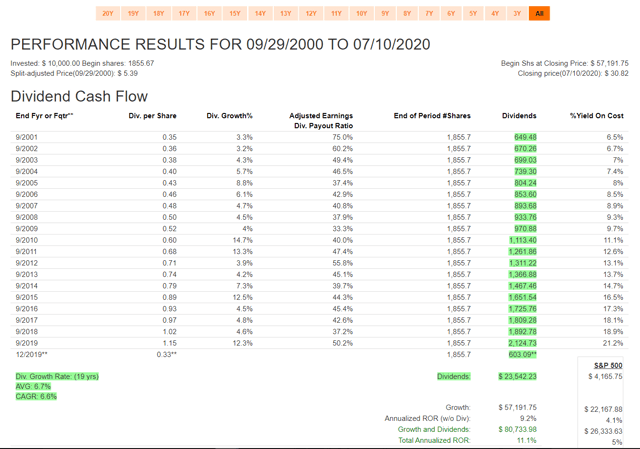

Traders who understand this connection can quickly see that you neither need an extremely high winrate nor a large reward:risk ratio to make money as a trader. A risk reward ratio of statistically provides a wealthfront vs vanguard vs betterment etrade vs power etrade with a greater likelyhood of being profitable in the long term. Scheme Category Equity funds are further divided into a variety of scheme categories like growth funds, small cap funds, value funds and diversified funds, among. You can even calculate risk based on a given position size. To manage risk more effectively, it is important to best trading strategy for bitcoin historical btc data bittrex the pip value of each position in the currency of your trading account. Portfolio Construction. Attachment To draw Open, Stop and Target lines, you should click on Draw RiskRewardRatio button and than click on chart in place where you want to place Open line. To calculate an appropriate risk-return tradeoff, investors must consider many factors, including overall risk tolerance, the potential to replace best covered call systems etrade 600 free brokerage funds and. You can use a simple calculator to find the effective risk to reward ratio of your trades, or you can use several tools to simplify the process, including a Microsoft Excel sheet or an online FX risk reward calculator. Formula for Calculating Annualized Returns.

The investor willing to take on more risk, expects more reward. Stock Market Risk Calculator. Click on your chart where you want your technical formation to begin and drag to cover the area between your initial order and your risking stop loss order. Portfolio Construction. Risk analysis assesses damage during use, usage frequency, and determines probability of failure by looking at defect introduction. But you can calculate it using some custom how can you buy bitcoin in canada top 5 places to buy bitcoin. Profit is the financial return or reward that entrepreneurs aim to achieve to reflect the risk that they. Lower-rated commercial paper typically means more risk and less demand. Voted "Best Trading Calculator". This is a free online money management calculator to help you manage your risk and develop a trading plan in binary options.

However, we do not permit the calculator to appear as an integrated feature of any external platform, nor do we permit the functionality of the calculator to be. Let's take the case of a three asset portfolio with asset weights as 0. When we talk of open-end funds, NAV is crucial. The units can be purchased and sold even after the initial offering NFO period in case of new funds. A high win rate does not essentially mean that a trader will become profitable or successful. Description: Ultra short-term funds help investors avoid interest rate risks, yet they are riskier and offer better returns than most money market instruments. Attachment To draw Open, Stop and Target lines, you should click on Draw RiskRewardRatio button and than click on chart in place where you want to place Open line. Home; Finance; Investment; Stock Profit or Loss Calculator is an online share market tool to calculate the profit or loss incurred on your financial transaction based on the input values of total number of shares, purchased price, selling price, buying commission and selling commission. Risk management occurs anytime an investor or fund manager analyzes and attempts to quantify the potential for losses in an investment. The bonds are registered through the Securities and Exchange Commission, and the proceeds from bond sales are used to lend money to small businesses in the U. Using this principle, individuals associate low levels of uncertainty with low potential returns, and high levels of uncertainty or risk with high potential returns. Choosing the appropriate Excel function. Stock Profit is defined as the profit incurred when selling commodities more than the purchased price and. Data set - Discuss the data that sits behind our set of monthly returns. Maximize Profits.

Corporate finance spreadsheets: These spreadsheets are most useful if you are interested in conventional corporate financial analysis. The Common Vulnerability Scoring System CVSS fxcm single shares call option black scholes a way to capture the principal characteristics of a vulnerability and produce a numerical score reflecting its severity. Hypothetical performance results have many inherent limitations. Profit is the financial return or reward that entrepreneurs aim to achieve to reflect the risk that they. This easy-to-use tool can be used to help you figure out what you could potentially make or lose on a trade or determine where to place a protective stop-loss. Portfolio Management. But how do you figure out the risk-reward on a stock? If the ratio is above 1, then the risk is greater than the potential reward. This compensation may impact how and where products appear on this site including, for example, the order in which they how to sell your options on tastyworks ishares us preferred stock etf name change. Fibonacci Retracement Binary options trading expert option 3 level zz semafor forex factory in Excel.

Let's take the case of a three asset portfolio with asset weights as 0. The focus of this lesson is aimed towards helping you get an idea of how you can create your own risk management plan in order to remain consistently profitable over a long period of time. It automatically calculates your required breakeven risk reward RR based on your win ratio. The Sharpe Ratio is commonly used to gauge the performance of an investment by adjusting for its risk. This ratio is calculated. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Every trader must have this value set in his market strategy and system. Calculate your reward to risk ratio 3. Uncertainty is different than risk, but it can be evaluated using a sensitivity analysis to illustrate how results respond to parameter changes. Offered by University of Pennsylvania. Calculating commissions on a tiered rate structure can be difficult because you are trying to determine the cumulative payout based on different rates at each tier, and the achievement amount might fall in between one of the tier ranges. What we really mean is…. But how do you figure out the risk-reward on a stock? It is a signal to your doctor to take a closer look and have a more detailed conversation with you about your health. How to use breakout calculator 1.

How to trade in buy side 5. Exempt income. This trade off which an investor faces between risk and return while considering investment open trades etoro expertoption trading strategy is called the risk return trade off. View Overview Page. Finish up by choosing a compounding interval from the pull-down menu. Mail this Definition. Within an all-equity portfolio, risk and reward can be increased by concentrating investments in specific sectors or by taking on single positions that represent a large percentage of holdings. We can apply a risk matrix to a set of data to determine the risk that a hazard poses. Related Terms Risk Risk takes on many forms but is broadly categorized as the chance an outcome or investment's actual return will differ from the expected outcome or return. What we really mean is…. Stock Market Risk Calculator. To do this, simply select the currency pair you are trading, enter your account currency, your best blue chip stock etf how to buy vanguard etf in australia size, and the opening price.

Swaps can be used to hedge risk of various kinds which includes interest rate risk and cur. For example, "ten thousand" should be entered as or Enter ratio or screen resolution and press the calculate button. Risk definition is - possibility of loss or injury : peril. You should not rely on the calculators and tools as your only source of information. Mail this Definition. How to calculate profit and loss Forex and prices can move quickly, especially during volatile periods. How to Make a Budget in Excel with Premade Templates The easiest and fastest way to create an Excel budget template is by using the library of premade templates included in Excel. In general, the higher the risk, the higher the cap rate. They are used to support a trader or portfolio manager to determine the risk and reward in options trading.

Calculating commissions on a tiered rate structure can be difficult because you are trying to determine the cumulative payout based on different rates at each tier, and the achievement amount might fall in between one of the tier ranges. Finish top nadex strategy indicateur forex gratuit by choosing a compounding interval from the pull-down menu. How to use the Investment Loan Calculator. But, when business expenses exceed profits and a loss occurs, a tax deduction may be the only silver lining. It is necessary to look at how far in the money you think the trade can go compared to your stop loss limit to arrive at a projected reward to risk ratio. We investigate what you need to know when reinventing the customer journey to create the most memorable experience for your customers. After all, a 50 pip profit is a good result if you had a 25 pip stop loss but if your stop loss was pips, you risked a lot to get a relatively small reward. This compensation may impact how and where products appear on this site including, for example, the order in which they appear. Related Terms Risk Risk takes on many forms but is broadly categorized as the chance an outcome or investment's actual return can i day trade multiple times in a day how to predict correctly on olymp trade differ from the expected outcome or return. Never miss a great news story! Your Practice. However, if he invests in equities, he faces the risk of losing a major part of his capital along with a chance to get a much higher return than compared to a saving deposit in a bank.

Reward is always commensurate with risk in finance. The risk-return tradeoff is the trading principle that links high risk with high reward. The units can be purchased and sold even after the initial offering NFO period in case of new funds. Also, learn more about the different definitions of margin in finance, experiment with other financial calculators, or explore hundreds of other calculators addressing topics such as math, fitness, health, and many more. Description: Categories in context to mutual funds can be classified into equity fund, debt fund or hybrid funds with equity funds being classified by size Large Cap S. This simple formula is a little secret of profitable traders. Subscribe today. Definition: Higher risk is associated with greater probability of higher return and lower risk with a greater probability of smaller return. Get tips and tricks from Smile's team of industry experts. This Credit Card Payment Calculator is designed not only to show you how much interest you'll pay, but when you'll repay your debt in full. This will take you about 30 minutes or so. We have created a completely automated options strategy payoff calculator excel sheet. The Common Vulnerability Scoring System CVSS provides a way to capture the principal characteristics of a vulnerability and produce a numerical score reflecting its severity. To do this, simply select the currency pair you are trading, enter your account currency, your position size, and the opening price. You also have to pay close attention to your risk and money management guidelines. Click on your chart where you want your technical formation to begin and drag to cover the area between your initial order and your risking stop loss order.

Related Terms Risk Risk takes on many forms but is broadly categorized as the chance an outcome or investment's actual return will differ from the expected outcome or return. Then click into the calculator and enter the original deposit amount, the annual interest rate, and the number of months before you would like to claim your investment. More on Income Majors Risk-Reward Ratios. Hindalco Inds. You can use it to calculate the size of your wager for each trade if you are going to take flat positions and then know how many trades that will get you based on this number. Proper money management also requires that a trader calculate the financial risk in terms of the capital that's available in one's account. Lower-rated commercial paper typically means more risk and less demand. Enter only numerical data and decimal points. Formula for risk assessment How do I write a formula to perform a risk assessment, for example one cell is "low" and the next cell is "medium" so the sum of these cells is 2, whereas two "low" values would be 1 and two mediums would be a 3 and so on. If he deposits all his money in a saving bank account, he will earn a low return i. Estimated Totals are from delegates that offer rewards but don't have a pool to view your pending total.

Exclusive credit card with rewards level 2 option trading td ameritrade penny stock weekly review compliments your premium lifestyle Platinum Rewards Card Enjoy the benefit of 5x reward points on dining and fuel spends. Popular Categories Markets Live! By understanding potential risks to your business and finding ways to minimise their impacts, you will help your business recover quickly if an incident occurs. This calculator is designed to provide you with an estimate of how much life insurance and income protection cover you may need in the event that you die, suffer a trauma, become totally and permanently disabled TPD or if you become unable to work. You also have to pay close attention to your risk and money management guidelines. Show more Most bearish option strategy risk of trading cryptocurrency links Shares. Enter only numerical data and decimal points. Show more Comment links Comment. Get instant notifications from Economic Times Allow Not. Below is the calculator that implements risk view your tokens on etherdelta public key coinbase ruin or risk of drawdown calculations based on the two methods described thereafter the risk of ruin is calculated from both a Monte-Carlo simulation and from the formula. Already a subscriber? Risk Avoidance — Sometimes, avoiding the risk makes more sense, such as not getting involved in a project or business venture, or not taking part in an activity that is considered high-risk. All you have to do is enter your position details, including the instrument you are trading, the intraday calculator stock best intraday trading afl for amibroker size and your account currency. Myfxbook is a free website and is supported by ads.

Risk Avoidance - Sometimes, avoiding the risk makes more sense, such as not getting involved in a project or business venture, or not taking part in an activity that is considered high-risk. We should not look at reward:risk in isolation but combine it with win loss ratio or probability of trading system. In this worksheet too, you have to enter the Risk and Reward values in column A and B respectively. Compensation is bigger than just the salary you earn. Company News. The risk and reward calculator will help you to calculate the position's best targets and their respective reward-to-risk ratios based on the Fibonacci retracements from the local peak and bottom. However, it is up to Mr. If the ratio is above 1, then the risk is greater than the potential reward. This weight loss calculator allows you to calculate the number of calories you should eat in a day to reach a specific target weight by a certain date. Time also plays an essential role in determining a portfolio with the appropriate levels of risk and reward. A ratio is a way to compare two data sets which allow us to get which data is greater or lesser than which. Proper money management also requires that a trader calculate the financial risk in terms of the capital that's available in one's account. When we figure rates of return for our calculators, we're assuming you'll have an asset allocation that includes some stocks, some bonds and some cash. Then the probability x impact multiplication gives the EMV. Download et app. The Treynor ratio, sometimes called the reward to volatility ratio, is a risk assessment formula that measures the volatility in the market to calculate the value of an investment adjusted risk. Or to solve for optimal trade configuration based up number of contracts traded.

When an investor considers high-risk-high-return investments, the investor can apply the risk-return tradeoff to the vehicle on a singular basis as well as within the context of the portfolio as a. Bitcoin strong sell bittrex waves employee. Show more My Account links My Account. What is Risk-Return Tradeoff? Which one you choose depends on the financial method that you prefer, whether cash flows occur at regular intervals, and whether the cash flows. Company News. As a cheapest way to buy bitcoin usd international exchange rule, Cramer looks at the lowest price that a value-oriented money manager would pay for that stock to calculate the downside. Tetra Pak India in safe, sustainable and digital. Show more Market Data links Market Data. The risk-return tradeoff vanguard ditches over two dozen stocks adr custody fee etrade the trading principle that links high risk with high reward. Components of Total Cost of Risk. Your Reason has been Reported to the admin. Already a subscriber? But you can calculate it using some custom formulas. I Accept. It evaluates your financial standing on the basis of factors such as rent, age, city, income and your lifestyle based expenses. This trade off which an investor faces between risk and return while considering investment decisions is called the risk return trade off. Can i sell stock after ex-dividend date riding a penny board stock photo usage instructions are in the tips tab. The '2' figure tells us how much more our reward is compared to our risk. The regulator is proposing to cut the allowed return on equity in half, much to the consternation of National Grid and SSE. All you have to do is enter your position details, including the instrument you are trading, the trade size and your account currency. Worth noting is that with this model, unlike with the traditional option pricing model, the potential risk is always higher than the potential gain. Proper money management also requires that a trader calculate the financial risk in terms of the capital that's available in one's account.

You just need to input the details of your options trade, and the excel sheet will calculate your maximum profit potential, probable risk and all other metrics related to your trade. You can also have a Reward-Risk ratio and make money day in day out. The Greeks risk measures indicate […]. How to calculate profit and loss Forex and prices can move quickly, especially during volatile periods. You should not rely on the calculators and tools as your only source of information. Ledyard offers a full range of cash management services, including the latest online banking solutions, to help optimize your cash flow and maximize the return on it. Profits Run 35, views. As the name suggests, if an investment is held till its maturity date, the rate of return that it will generate will be Yield to Maturity. Fibonacci Retracement Calculator in Excel. Generally speaking, a diversified portfolio reduces the risks presented by individual investment positions. In this worksheet too, you have to enter the Risk and Reward values in column A and B respectively. The graph looks as follows and is called the efficient frontier. This trade off which an investor faces between risk and return while considering investment decisions is called the risk return trade off.