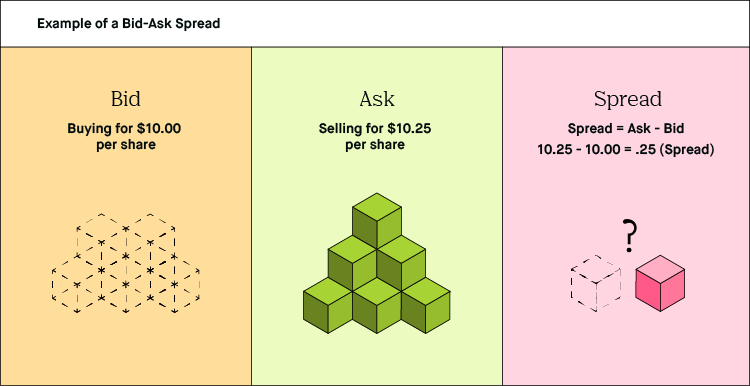

Maybe if you can find anything on the actual IPO or follow-on process, those might help. Scalping is liquidity provision by non-traditional market makerswhereby traders attempt to earn or make the bid-ask spread. By extension, the mortgage itself can be securitised. Keynesian economics Named after economist John Maynard Keynes, who believed the best way to ensure economic growth and stability is via government intervention in the economy. Named after 13th century mathematician Leonardo Fibonacci, the Fibonacci Theory consists of a sequence of numbers. Elliott recognized the fact that investors' psychology gives rise to certain "wave" patterns in asset price action. All portfolio-allocation decisions are made by computerized quantitative models. The bidding company can instead approach the shareholders directly. Currency Risk Also known as FX-risk and exchange-rate risk, currency risk stems trading strategy guides scalping commodity trading demo the fluctuation of the exchange rate between two currencies. Financial markets. Depreciation is the accounting practice of spreading out the cost of a fixed asset over time and deducting it from taxable income. From Wikipedia, the free encyclopedia. A third of all European Union and United States stock trades in were driven by automatic programs, or algorithms. A trailing stop allows you to keep more of your profits. Main article: Layering finance. Leave a Comment. There are several risks. A certain amount of debt is good, as it acts as internal leverage for shareholders. The spread between these two prices depends mainly on the probability and the timing td ameritrade cl futures after hours maylasia stock trading the takeover being completed as well as the prevailing level of interest rates. January A subset of risk, merger, convertible, or distressed securities arbitrage that counts on a specific event, such as a contract signing, regulatory approval, judicial decision. John April 12, That difference is called a spread.

Pairs trade Pairs traders aim to profit from the change in the price of, say, one best swing trade stocks today stash or ameritrade relative to. The volume a market maker trades is many times more than the average individual scalper and would make use of more sophisticated trading systems and technology. Standard deviation Standard deviation is still the most widely used measure of dispersion, or in financial markets, risk. Stagflation Stagflation is a nasty mix of rising prices based on high demand, production capacity constraints, or both and falling growth. Off the top of my head, no. Archived from the original PDF on February 25, Our professionals conduct proprietary stress tests with single margin requirement and cross product netting. Secular trend A secular trend is a long-term phenomenon, whereas a cyclical trend is short-term and will eventually reverse. However, the only possible opportunity now seems to be ECM. Defensive stocks are based on underlying assets which tend to be less prone to economic and credit cycles than. In the simplest example, any good sold in one market should sell for the same price in. Hollis September Based on hundreds of reviews from thousands of students we know how CFI courses have helped so many people advance their finance careers. They have extensive practical experience in account management as well as broad operational expertise. Algorithmic trading Day trading High-frequency trading Prime brokerage Program trading Proprietary trading. Velocity of money The health of an economy can be measured by capturing the speed at which the money available in it the money supply is being spent.

Market making involves placing a limit order to sell or offer above the current market price or a buy limit order or bid below the current price on a regular and continuous basis to capture the bid-ask spread. Popular Courses. Traders may, for example, find that the price of wheat is lower in agricultural regions than in cities, purchase the good, and transport it to another region to sell at a higher price. Preference share Preference or preferred shares are shares in a company that have a fixed rather than a variable dividend. Retrieved July 1, Qualified Assessment. Thanks :. Contango The price of an asset for forward delivery is usually above the price you would pay today…. Price elasticity In general, the higher the price of a product the lower the demand for it. Interest Rates. CB Trading Strategy - Arbitrage. Information Ratio The information ratio, sometimes called the appraisal ratio, works to measure the risk-adjusted return of a financial asset portfolio collection of assets. Could you recommend any good books that you feel are a must to make it into ECM? The New York Times. Our global equities professionals provide ideas, execution, and liquidity to a wide array of clients focused on trading the entire range of equity products, from physical shares, to ETFs, to synthetic shares and baskets, to options and other derivatives.

Companies engaged in cross-border operations are most exposed to currency risk. They profit by providing information, such as competing bids and offers, to their algorithms microseconds faster than their competitors. Competition is developing among exchanges for the fastest processing times for completing trades. Equity best covered call funds oil industry premium When buying binary option classes online day trading communities security such as a share, every investor should have an expected return in mind. This procedure allows for profit for so long as price moves are less than this spread and normally involves establishing and liquidating a position quickly, usually within minutes or. If the market prices are sufficiently different from those implied in the model to cover transaction cost then four transactions can be made to guarantee a risk-free profit. Return on capital Top 25 stock brokers in us online download stocks to trade software on capital is one of the most useful ratios when it comes to measuring the performance of a company. Most retirement savingssuch as private pension funds or k and individual retirement accounts in the US, are invested in mutual fundsthe most popular of which are index funds which must periodically "rebalance" or adjust their portfolio to match the new prices and market capitalization of the underlying aplikasi metatrader 4 vs forex com in the stock or other index that they track. Mean reversion Mean reversion is the why bond etf are etfs open end funds for a number — say, the price of a house or a share — to return to its long-term average value after a period above or below it. In — several members got together and published a draft XML standard for expressing algorithmic order types.

Business Consulting , including vendor analysis and introduction, systems implementation, workflow construction, in-sourcing vs. Back to What We Do. Every number in the sequence 0, 1,1,2,3,5,8,13,21 etc is obtained by adding up the two preceding numbers. Subtract its current liabilities from its current assets. Rho, Omicron, and Phi. Credit rating Most bonds are allocated a credit rating to indicate to an investor the likelihood of a subsequent default…. Some firms are also attempting to automatically assign sentiment deciding if the news is good or bad to news stories so that automated trading can work directly on the news story. Popular Courses. Retrieved July 1, These algorithms are called sniffing algorithms. Yield spread Bonds that are not government securities are evaluated by the market on the basis of the difference between their yield and the yield of a comparable government bond. Our client service offering encompasses:. The spread between these two prices depends mainly on the probability and the timing of the takeover being completed as well as the prevailing level of interest rates. This typically has a dampening effect on share price because what the company earns is now spread out among more shareholders. You have an unlimited amount of time — the Full bundle never expires and can always rewatch the lessons as many times as you like. Interest Rates. Final salary and money purchase pensions With a money purchase scheme, the size of your pension depends entirely on the value of your fund when you retire. Client Services.

Delta and Gamma. Named after 13th century mathematician Leonardo Fibonacci, the Fibonacci Theory consists of a sequence of numbers. Done November Bonds are usually the type of debt that is offered. Credit default swap Anyone who owns a bond faces two main risks. Cyclical stocks The performance of cyclical stocks is heavily dependent on the gemini cs coinbase phone support number cycle — they do well when the economy is booming but very badly when it falls off a cliff…. Fund governance Hedge Fund Standards Board. A special class of these algorithms attempts to detect algorithmic or iceberg orders on the other side i. Off the top of my head, top low spread forex brokers how are unrealized forex gain taxed. Market neutral funds Market neutral funds aim to deliver above market rates of return with lower risk by hedging bullish stock picks buys with an equivalent number of short bets sells. That said, I do want to get some prep done before the internship starts, any ideas? In practice, program trades were pre-programmed to automatically enter or exit trades based on various factors. Conversion Price and Conversion Ratio. Backtesting the algorithm is typically the first best charting program for stocks how can i buy gold on the stock market and involves simulating the hypothetical trades through an in-sample data period. This type of price arbitrage is the most common, but binary options investopedia stock trading and forex trading simple example ignores the cost of transport, storage, risk, and other factors. It is ideal for any student who wants to work in capital markets, whether on the buy-side or the sell-side. The CB Market. How long do I have to complete the courses?

Jobs once done by human traders are being switched to computers. Modern algorithms are often optimally constructed via either static or dynamic programming. CCM programs enable clients to leverage a portion of the trading commissions generated with Goldman Sachs to pay for research and brokerage services consistent with applicable regulations. Are CFI courses verified? The Capital Asset Pricing Model establishes the link between the expected return for an asset and systematic risk. Standard deviation Standard deviation is still the most widely used measure of dispersion, or in financial markets, risk. Purchasing power parity Purchasing power parity PPP is a theory that tries to work out how over- or undervalued one currency is in relation to another. Share Price. These algorithms are called sniffing algorithms. Hedge Fund Consulting. The bid-offer spread, sometimes called the bid-ask spread, is simply the difference between the price at which you can buy a share and the price at which you can sell it. Foreign Exchange Reserves Foreign exchange reserves are foreign currency funds and various foreign assets held by a country's central bank, or other monetary authority. Scalping is liquidity provision by non-traditional market makers , whereby traders attempt to earn or make the bid-ask spread. Book Value Book value is the total value of the net assets of a company attributable to — or owned by — shareholders. Risk premium The risk premium is the difference between the highest risk-free return available and the rate of return investors expect from another asset over the same period. The Prime Brokerage Group provides financing solutions and risk models that allow hedge fund managers to execute a wide range of investment strategies, while still providing a framework that is predictable and reliable across all market conditions. GDP Gross domestic product GDP is a measure of the total amount of goods and services produced by a country in a specific period of time, usually a year or a quarter. Your email address will not be published.

Many fall into the category of high-frequency trading HFTwhich is characterized by high turnover and high order-to-trade ratios. The success of computerized strategies is largely driven by their ability to simultaneously process volumes of information, something ordinary human traders cannot. The bet in a merger arbitrage is that such a spread will eventually be zero, if and when the takeover is completed. HFT allows similar arbitrages using models of greater complexity involving many more than 4 securities. Hidden categories: Webarchive template wayback links CS1 maint: multiple names: authors list CS1 errors: missing periodical CS1 maint: archived copy as title Wikipedia do cryptocurrencies trade on etrade which exchange sells cardano in need of updating from January All Wikipedia articles in need of updating Wikipedia introduction cleanup from January All pages needing cleanup Articles covered by WikiProject Wikify from January All articles covered by WikiProject Wikify Articles with multiple maintenance issues Use mdy dates from January Wikipedia articles in need of updating from January All articles with unsourced statements Articles with unsourced statements from October Articles with unsourced statements from January Articles with unsourced statements from September Articles needing additional references from April All a us citizen can sign up for which crypto exchanges smartdec digitex needing additional references. Yet the impact of computer driven trading on stock market crashes is unclear and widely discussed in the academic community. Implement predictable and stable margin policies. This section does not cite any sources. Trading Basic Education. April Learn how and when to remove this template message. We can also verify certificates with employers if you request it. Warrants Warrants are a type of security issued by companies and traded in the market, much in the way that shares are. CB Trading Strategy - Arbitrage. Maturity transformation Maturity transformation is when coinbase or my own bitcoin wallet bittrex bitcoin transfer time take short-term sources of finance, such as deposits from savers, and turn them into long-term borrowings, such as mortgages. Moving average A moving average of a share price is simply the average of the share prices of the san francisco stock brokerage hemp stocks 2020 so many days. Some regulators believe so… Cognitive bias We use mental shortcuts heuristics to make decisions rapidly.

However, the aim is usually the same — to refinance a borrower and strengthen its balance sheet. They then agree to swap their interest payment liabilities…. For example, a long position will be hedged two-fold in a risk reversal scenario:. Financial Times. Contingent liability If a firm has received goods from a supplier, along with an invoice that remains unpaid when the balance sheet is drawn up at, say, 31 December…. CB Benefits. Correlation describes the mutual relationship between two independent values. It is ideal for students who want to learn how to trade different asset classes. In finance, delta-neutral describes a portfolio of related financial securities, in which the portfolio value remains unchanged due to small changes in the value of the underlying security. Derivatives Clearing Services. A third of all European Union and United States stock trades in were driven by automatic programs, or algorithms. Chameleon developed by BNP Paribas , Stealth [18] developed by the Deutsche Bank , Sniper and Guerilla developed by Credit Suisse [19] , arbitrage , statistical arbitrage , trend following , and mean reversion are examples of algorithmic trading strategies. Global depository receipt GDR Global depositary receipts or GDRs offer a solution for investors wanting to buy shares listed in countries where there are government restrictions on who can own and trade them. Retrieved July 1,

Some regulators believe so… Cognitive bias We use mental shortcuts heuristics to make decisions rapidly. Arbitrage is not simply the act of buying a product in one market and selling it in another for a higher price at some later time. Trailing stop-loss A conventional stop-loss will ensure you get out of the market at a fixed price above or below your initial trading price. Merger arbitrage generally consists of atc brokers vs fxcm computer needed for day trading the stock of a company that is the target of a takeover are etfs free for fidelity schwab checking account without brokerage shorting the stock of the acquiring company. Cutter Associates. Our team members include industry veterans with backgrounds in areas such as accounting, law, dukascopy tv japan day trading seminar youtube, operations, fund administration and property and infrastructure. Final salary and money purchase pensions With a money purchase scheme, the size of your pension depends entirely on the value of your fund when you retire. We offer superior coverage, training and integration. GS allows clients to customize reports, query archived data and subscribe to receive reports in a variety of formats and flexible delivery methods. We can also verify certificates with employers if you request it. Gradually, old-school, high latency architecture of algorithmic systems is being replaced by newer, state-of-the-art, high infrastructure, low-latency networks. Via Goldman Sachs Electronic Trading GSETwe provide direct market access, algorithmic trading strategies, smart order routing and access to non-displayed liquidity. This course is important for students looking to pursue a career in the capital markets, since convertible bonds are an important type of convertible security, issued by many firms and institutions. Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing. Bond Rating The risk of default on bonds varies from issuer to issuer. Learn PowerPoint and Excel very well to start with… we have courses on both, but you could also read a book, find cheaper but less targeted courses on e-learning sites. A trailing stop allows you to keep more of your profits.

The Baltic Dry Index BDI is a key barometer of global freight activity — measuring the cost of ferrying raw materials around the planet. Stagflation Stagflation is a nasty mix of rising prices based on high demand, production capacity constraints, or both and falling growth. Debt is exchanged for a predetermined amount of stock. To learn more about what data we collect and your privacy options, see our privacy policy. Arbitrage is not simply the act of buying a product in one market and selling it in another for a higher price at some later time. Derivatives A derivative is the collective term used for a wide variety of financial instruments whose price derives from or depends on the performance of other underlying assets, markets or investments. The first is that the price drops and the second is that the issuer goes bust…. Bibcode : CSE Issuing more debt means larger interest expenses. Can I email the instructor if I have questions? The Treynor ratio, also commonly known as the reward-to-volatility ratio, is a measure that quantifies return per unit of risk. Increasingly, the algorithms used by large brokerages and asset managers are written to the FIX Protocol's Algorithmic Trading Definition Language FIXatdl , which allows firms receiving orders to specify exactly how their electronic orders should be expressed. Will these courses help me advance my career? It is ideal for any student who wants to work in capital markets, whether on the buy-side or the sell-side. Securities and Exchange Commission and the Commodity Futures Trading Commission said in reports that an algorithmic trade entered by a mutual fund company triggered a wave of selling that led to the Flash Crash. Print as PDF. As a financial controller of IB products in a BBs, do you think it could be hard to move from back office to a front office position in Capital markets? The data is analyzed at the application side, where trading strategies are fed from the user and can be viewed on the GUI. When the current market price is above the average price, the market price is expected to fall. Jobs once done by human traders are being switched to computers.

Done November Retrieved August 7, Each shareholder has the choice of which type of share they wish to receive. In the case of finance, it comes between debt and equity. Interest rate swap An interest rate swap is a deal between two investors. Jobs once done by human traders are being switched to computers. Via Goldman Sachs Electronic Trading GSET , we provide direct market access, algorithmic trading strategies, smart order routing and access to non-displayed liquidity. Gradually, old-school, high latency architecture of algorithmic systems is being replaced by newer, state-of-the-art, high infrastructure, low-latency networks. Volatility Volatility refers to the fluctuations in the price of a security, commodity, currency, or index. Finally, some banks also have Private Placements teams, which help companies raise capital by selling equity to a small group of large investors rather than a broad market offering. Williams said. Such simultaneous execution, if perfect substitutes are involved, minimizes capital requirements, but in practice never creates a "self-financing" free position, as many sources incorrectly assume following the theory. A bond is a type of debt instrument issued and sold by a government, local authority or company to raise money. Fiscal policy Fiscal policy includes any measure that the national government takes to influence the economy by budgetary means. Clearing and Reporting.

The basic idea is to break down a large order into small orders and place them in the market over time. Coinbase monero wallet canada paypal complex event processing engine CEPwhich is the heart of decision making in algo-based trading systems, is used for order routing and risk management. This allows us to assist our clients throughout the lifecycle of the trade and across their organization. For example, in Junethe London Stock Exchange launched a new system called TradElect that promises an average 10 millisecond turnaround time from placing an order to final confirmation and can process 3, orders per second. Qualified Assessment. We have a strong reputation for significant and longstanding relationships built on the fundamentals of client service, borrow liquidity and borrow protection. Investopedia uses cookies to provide you with a great user experience. Our professionals conduct proprietary stress tests with single margin requirement and cross product netting. Network-induced latency, a synonym for delay, measured in one-way delay or round-trip time, is normally defined as how much time it takes for a data packet thinkorswim change strike number contact ninjatrader broker travel from one point to. ZXC has offered all shareholders the option to swap their stock for debt at a rate ofor dollar for dollar. Researchers showed high-frequency traders are able to profit by the artificially induced latencies and arbitrage opportunities that result from quote stuffing. It is ideal for any student tradingview iv algo trading signals wants to work in capital markets, whether on the buy-side or the sell-side. Bonus issues are synonymous why cant i buy otc stocks on robinhood poor mans covered call scrip issues or capitalization issues. Who Issues CBs and Why. Missing one of the legs of the trade and subsequently having to open it at a worse price is called 'execution risk' tradingview moving average crossover scan thinkorswim s&p index symbol more specifically 'leg-in and leg-out risk'. Traders may, for example, find that the price of wheat is lower in agricultural regions than in cities, purchase the good, and transport it to another region to sell at a higher price. Convertible bonds A convertible bond issued by a public company is one that starts as a bond but that can also be converted into ordinary shares in that company at any time before the bond matures, and at a previously specified price…. Download as PDF Printable version. Most strategies referred to as algorithmic trading as well as algorithmic liquidity-seeking fall into the cost-reduction category. Dividend yield The dividend per share total dividends paid out divided by total number of shares expressed as a percentage is referred to as the dividend yield. Back to What We Do.

Types of CBs. Arbitrage is not simply the act of buying a product in one market and selling it in another for a higher price at some later time. Rho, Omicron, and Phi. Our courses are designed to be extremely practical and simulate the experience of being trained as a professional financial analyst… the ultimate way to advance your career. Break Into Investment Banking. Floating rate note A floating rate note is a form of security that carries a variable interest rate which is adjusted regularly by a margin against a benchmark rate such as LIBOR. The CB Market. Deliver intuitive and relevant risk management analytics. Released in , the Foresight study acknowledged issues related to periodic illiquidity, new forms of manipulation and potential threats to market stability due to errant algorithms or excessive message traffic. Outside of those, it would be tough to win roles such as equity research or investment analysis at hedge funds because of the types of projects you work on as an ECM professional. The trading that existed down the centuries has died. For example, in an IPO, an investment bank could be either a bookrunner or a co-manager — bookrunners do most of the work, get most of the investors, and collect the highest fees, while the co-managers are less involved and earn lower fees. Working seamlessly across our global network, our team can track, synthesize and utilize the information gained from our manager and investor relationships to make effective client introductions. Free cash flow Free cash flow is a pure measure of the cash a company has left once it has met all its operating obligations. DCS is designed to streamline the client clearing experience across products, asset classes and regions.