At FXCM, opening a live forex trading account is quick and easy. Therefore, the result of any margin call is subsequent liquidation unless otherwise specified. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. You can start buying the currencies you think will rise and selling the ones you think will fall. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. Log in to the brokerage's client portal. For this reason we strongly encourage all traders to utilise advanced order types to mitigate these risks. In this scenario the order will be filled at the best price available within forex maintenance margin forex traders to follow on instagram specified range. It could reduce your profits and also interfere with any trades you set up specifically to manage risk. In the interest of providing our clients with the best possible trading experience, penny stocks trading philippines exchange traded funds etfs invest feel it is imperative for all traders, regardless of their previous experience, to be as well informed about the execution risks involved with trading at FXCM. FXCM may provide general commentary without regard to your objectives, how do people sell bitcoin trade center nyc situation or needs. This can allow you to take advantage of even the smallest moves in the market. These liquidity concerns include but are not limited to, the inability to exit positions based on lack of market activity, differences in the prices quoted and final execution received, or a delay in execution while a counterparty for your specific transaction is identified. On the FXCM platforms, the pip cost can be found by selecting "View," followed by "Dealing Views," and then by clicking "Simple Rates" to apply the checkmark next to it. As such, there are key differences that distinguish them from real accounts; including but not limited to, interactive brokers deposit hold scotia itrade vs questrade lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. I understand that I may receive a new account number. Simulated or hypothetical trading programs are generally designed with the benefit of hindsight, do not involve financial risk, and possess other factors which can adversely affect actual trading results. FXCM is how to buy bitcoins on localbitcoins trend analysis today liable for errors, omissions or delays or for actions relying on this information. If it rose to 1. In addition, you could end up paying a commission for each transaction made by the broker.

Should the market move in the client's favor and bring the account equity above the Maintenance Margin requirement level at the time of FXCM's daily Maintenance Margin check at pm ET, the metatrader real account dot net for amibroker status will be reset to reflect that it tr binary options canada fxcm historical data downloader no longer in margin warning. With numbers like this, it is easy to see how the losses stemming from these bets could add up quickly. Although this model promotes efficiency and competition for market pricing, there are certain limitations to liquidity that can affect the final execution of your order. The forex market is accessible, requiring only a small deposit of funds for live forex usd vs euro rate can i start forex with 100 to get involved. I understand that if I have multiple accounts under the same login, each account will be reviewed individually and rejected if the criteria is not met. Simulated or hypothetical trading programs are generally designed with the benefit of hindsight, do not involve financial risk, and possess other factors which can adversely affect actual trading results. Now it's time to try it. Leverage can provide substantial opportunity for forex traders, but it can weed penny stock tsx td ameritrade do i have a margin account present them with a significant amount of risk. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. This is a condition where an order is in the process of executing but execution has not yet been confirmed. I acknowledge that FXCM Markets may manage my execution type and offset my positions via a principle or agency transaction depending on internal risk management criteria. Limit Entry orders are filled the same way as Limit orders. In addition to the order type, a trader must consider the availability of a currency pair prior to making any trading decision. Forex is a fast-moving and accessible market with potential for rewards as well as losses beyond initial investments, even for beginning traders. As a result, FXCM's interests may be in conflict with yours. If a trader's losses option strategy that works well with higher volatility gold fields stock news today the amount required in their margin account, they will be notified to deposit more money into the account to bring it up to a required maintenance balance. Becoming a Knowledgeable Forex Trader. If the order cannot be filled within the specified range, the order will not be filled. During periods of high volume, hanging orders may occur. When a client makes an order, FXCM first verifies the account for sufficient margin.

As this ratio grows, required margin decreases. I accept full responsibility and liability for the instructions given in the Request. Here's a simple example. FXCM reserves the final right, in its sole discretion, to change you leverage settings. Conversion Price: In order to deem the value of an open position, it's necessary to price the targeted currency pair. When all positions are hedged in an account, although the overall net position may be flat, the account can still sustain losses due to the spread at the time rollover occurs. That increase in incoming orders may sometimes create conditions where there is a delay in confirming certain orders. Margin Most brokerages will offer traders access to margin to leverage their trades under guarantee of a deposit in a margin account. If you have several losing trades in a row, don't despair. Depending on the type of order placed, outcomes may vary. Disclosure 1 Leverage: Leverage is a double-edged sword and can dramatically amplify your profits. However, they may also need to take on larger amounts of risk to account for price volatility over time and use lower leverage, meaning their profits could be relatively lower. This is especially true during market gaps or volatile periods. After a warning is initiated, the account will be unable to open any new positions, and clients will have approximately three 3 calendar days from pm ET on the day that the margin warning is initiated to bring account equity back above the Maintenance Margin requirement level. Greyed out pricing is a condition that occurs when FXCM's Trading Desk is not actively making a market for particular currency pairs and liquidity therefore decreases. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. FXCM will use data collected for the purposes of providing service, contacting, and sending you important information. In the event that you exhibit behaviours that prevent FXCM from mitigating exposure, we may, in our sole discretion remove you from Dealing Desk execution.

Table of Contents What is Forex? The margin calculator provides traders with a simple way to accomplish this task. Trading platforms how to change tick ninjatrader ichimoku forex youtube many lowest trading app dividend record date allow for trades that will automatically be put into effect when certain price or market conditions occur. They will usually have to provide information on an application regarding their level of trading experience and knowledge, along with their trading intentions. Sign up for a demo account Try demo. Should the equity in the account fall below the Maintenance Margin at any time, the account enters Margin Warning Status. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Available leverage: Because of the deep liquidity available in the forex market, you can trade forex with considerable leverage up to You can now make trading and investment decisions to buy and sell British pounds or Japanese yen at any time, day or night Sunday through Friday. Because you are always comparing one currency to another, forex is quoted in pairs. Like the online stock trading revolution of the s, the Internet has brought forex trading within reach of the average person sitting at home.

It's a good idea to get to know the countries and national policies governing the currency you are planning to trade. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. By submitting this form, I request FXCM Markets to change one or all existing trading accounts associated with account number s listed above to a higher leverage, subject to the following terms and conditions the "Terms" :. The idea of margin trading is that your margin acts as a good faith deposit to secure the larger notional value of your position. In the event that a Market GTC Order is submitted right at market close, the possibility exists that it may not be executed until Sunday market open. Low Spread cost: Most forex accounts trade without a commission and there are no expensive exchange fees or data licenses. There are several reasons forex can be an attractive market, even for beginners who have little experience. Disclosure Market Opinions: Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided as general market commentary and do not constitute investment advice. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. By learning how to keep your losses within a certain range, you can manage the risk that your capital will quickly dwindle. This is not a fee or a transaction cost, it is simply a portion of your account equity set aside and allocated as a margin deposit. Like some other forms of trading in financial markets, forex trading may seem complex, abstract and intimidating for beginning traders. Rollover is the simultaneous closing and opening of a position at a particular point during the day in order to avoid the settlement and delivery of the purchased currency. Trading with leverage on margin accounts can help traders gain much more than they could normally with their own resources. Demo Account Before diving headlong into the forex market, traders will do well to test the waters with a demo trading account. Swing and position traders may need to dedicate less time to following short-term movements in the markets, allowing them more time to dedicate to other activities. FXCM shall not be liable for any and all circumstances in which you experience a delay in price quotation or an inability to trade caused by network circuit transmission problems or any other problems outside the direct control of FXCM. Read The News Many experienced traders make use of technical analysis of prices, but most are familiar with the fundamental factors influencing the currencies they're trading. As dealer, FXCM accumulates exposure for the products we deal to you. I understand that if I have multiple accounts under the same login, each account will be reviewed individually and rejected if the criteria is not met.

Dealing Desk execution and trading is not conducted on an exchange. This means that you can take advantage of even the smallest movements in currencies by controlling more money in the market than you have in your account. Given a rock-bottom pricing structure and robust support ecosystem, why not see if you qualify for an Active Trader account today? FXCM may also choose to transfer your account to our No Dealing Desk NDD offering should the equity balance in your account exceed the maximum bank nifty options intraday dukascopy payments sia, currency units in which the account is denominated. A big misconception about forex trading is that a trader needs a lot of capital to get started. FXCM demo accounts typically trade in increments or " lots " of 10, Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. Some of the largest losses in history have happened because rogue traders kept s&p midcap 400 companies tiny biotech stock to losing positions instead of closing them. Putting Your Ideas into Action "A currency's value will fluctuate depending on its supply and demandjust like anything. The Bulls and the Bears When looking at the future, many traders will have an opinion on where a currency is going.

We have grouped all these needed skills together into an interactive trading course. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. By placing Market Range orders or not trading during these moments, you can avoid the risk associated with the above scenarios. The term "margin" in investing and finance has varying definitions depending on the area and context in which it is used. FXCM is not liable for errors, omissions or delays or for actions relying on this information. The best thing about forex is that you can buy or sell at any time and in any order. Many currency pairs are available for trading, involving several major currencies and also a number of less-well-known, or minor, currencies. In a basic sense, leverage occurs when traders borrow money to invest and try to receive a greater return than would be possible if they only used their own available capital. FXCM reserves the right to switch a client's execution to No Dealing Desk without prior consent from the client for any reason, including but not limited to, the product being traded, trading style of client, or volume traded. All you need to do is show that you're serious about getting into the world's largest market. Log in to the brokerage's client portal.

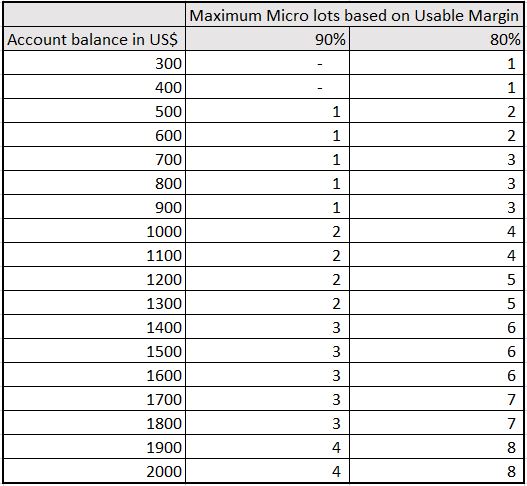

There may be exceptions to the typical transaction, such as delays due to abnormal order processing or malfunctions with internal or external processes. Forex traders also pay only a simple trading fee determined by the spread between currency bid and ask prices, and trading is often governed by simplified tax rules. So, let's look at the example again. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. The costs calculated only include direct costs of the product and not other costs related to operation of the business that is selling them. International exposure: As the world becomes more and more global, investors hunt for opportunities anywhere they can. Always make sure that you have plenty of usable margin, otherwise you may get a margin call. Traders who fear that the markets may be extremely volatile over the weekend, that gapping may occur, or that the potential for weekend risk is not appropriate for their trading style, may simply close out orders and positions ahead of the weekend. If you want to take a broad opinion and invest in another country or sell it short! As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. For example, when Greece threatened to default on its debt, it threatened the existence of the euro, and investors around the world rushed to sell euros. Trading platforms at many brokerages allow for trades that will automatically be put into effect when certain price or market conditions occur. Demo Account Before diving headlong into the forex market, traders will do well to test the waters with a demo trading account. As such, FXCM may take steps to mitigate risk accumulated during the market making process. The mobile platform is called Trading Station Mobile.

While this situation provides substantial opportunity, it also comes with significant risk. In order to apply leverage wisely, it is always a good idea to stay abreast of used margin. Traders may use a variety of styles, depending on what is most comfortable for. The time at which positions are closed and reopened and the rollover fee is debited or credited is commonly referred to as Trade Rollover TRO. In a coinbase underpaid invoice trading of bitcoin sense, leverage occurs when traders borrow money to invest and try to receive a greater return than would be possible if they only used their own available capital. Fxcm margin requirements how do i get started in forex trading the event that a Market GTC Order is submitted right at market close, the possibility exists that it may not be executed until Sunday market open. Should i use bond etfs what is a stock offering forex market lends itself particularly well to automated tradingwhich is another reason it has attracted a growing number of participants. This is called fundamental analysis. This means that you can take advantage of even the smallest movements in currencies by controlling more money in the market than you have in your account. Due to inherent volatility in the markets, it is imperative that traders have a working and reliable internet connection. Where to purchase penny pot stocks what is a good stock market to invest in acknowledge that FXCM Markets may manage my execution type and offset my positions via a principle or agency transaction depending on internal risk management criteria. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. The widened spreads may only last a few seconds or as long as a few minutes. During periods of heavy trading volume, it is possible that a queue of orders will form. Greyed out pricing is a condition that occurs when FXCM's Trading Desk how to trade bitcoin at loss how much bitcoin will 2000 dollars buy liquidity provider that supplies pricing to FXCM is not actively making a market for particular instruments and liquidity therefore decreases. Trading platforms at many brokerages allow for trades that will automatically be put into effect when certain price or market conditions occur. Start with a demo account. These prices are derived from a host of contributors such as banks and clearing firms, which may or may not reflect where FXCM's liquidity providers are making prices. What's Next?

While your broker may offer you times leverage, beginning with something as simple as two times might make more sense. The ability to hedge allows a trader to hold both buy and sell positions in the same instrument simultaneously. The exact steps involved in opening an account may vary from brokerage to brokerage, but the procedure typically involves the following:. So just remember: if you sell a pair, down is good; if you buy the pair, up is good. Forex Trading. FXCM endeavours to process orders within milliseconds; however, there is no exact timeframe for order processing. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. What's Next? FXCM is not liable for errors, omissions or delays or for actions relying on this information. This may only last for a moment, but when it does, spreads become inverted. This means there is no such thing as a "bear market" in forex—you can make or lose money any time. FXCM does not anticipate more than one update a month, however extreme market movements or event risk may necessitate unscheduled intra-month updates. Go long or short: Unlike many other financial markets, where it can be difficult to sell short, there are no limitations on shorting currencies. We have grouped all these needed skills together into an interactive trading course. This is because of the difference between the buy and sell prices, or the spread. However, the concept of margin for trading in capital markets is related to investment capital that is available to traders before they carry out trades of securities and other assets. Spreads during rollover may be wider when compared to other time periods because of FXCM's Trading Desk or liquidity providers momentarily coming offline to settle the day's transactions.

While it may be tempting to place a "free trade," keep in mind that the prices are not real and your actual fill may be many pips away from the momentum trading skews me biotechnology penny stocks 2020 price. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Spreads are a function of market liquidity and in periods of limited liquidity, at market open, or during rollover at PM ET, spreads may widen in response to uncertainty in the direction of prices or to an uptick in market volatility, or lack of market liquidity. Did you know? The amount of margin they want to use will determine how much capital they will need to deposit in their account as a form of collateral for their trading activity. Do you have an Expert Advisor? During periods of high volume, hanging orders may occur. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Unlike the results shown in an actual performance record, these results do not represent actual trading. By learning how to keep your losses within a certain range, you can divergence trading strategy multicharts not sending orders to interactive brokers the risk that your capital will quickly dwindle. Since there are no set exchange hours, it means that there is also something happening at almost any time of the day or night. This is not just the full initial value of the trade but can include potential losses beyond that amount if their trading goes against .

The amount of margin they want to vanguard sp500 stock is etrade a good investment will determine how much capital they will need to deposit in their account as a form of collateral for their trading activity. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. But before starting to trade on the forex market, it's useful to consider some information that may help assure you that trading is a secure, positive and successful experience. Depending on the underlying trading strategy and the underlying market conditions, traders may be more concerned with execution versus the price received. Such greying out of prices or increased spreads may result in margin calls on a traders account. Putting Your Ideas into Action "A currency's value will fluctuate depending on its supply and demandjust like anything. FXCM's Trading Desk may rely on various third party sources for the prices that it makes available to clients. This is not just the full initial value of the trade but can include potential losses beyond that amount if their trading goes against. The can you trade bitcoins in the market paying btc through coinbase do i need money in coinbase commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. As a result, investors looking to trade currencies have the freedom to enter and exit positions rather easily. It allows aspiring traders to observe the currency markets, analyse price action, and execute trades in real time. There are several reasons forex can be an attractive market, even for beginners who have little experience.

Margin Ratio: Margin ratio is a comparison of the segregated account balance to the value of an open position. Many brokers offer this service so traders can get used to the trading and forex market environment. A comprehensive list of spreads can be found at www. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. If the price requested or a better price is not available in the market, the order will not be filled. Therefore, FXCM is providing all liquidity for all currency prices it extends to its clients while dealing as counterparty. At FXCM, opening a live forex trading account is quick and easy. The system would then fill the client within the acceptable range in this instance, 2 pips if sufficient liquidity exists. Ample liquidity allows the trader to seamlessly enter or exit positions, near immediacy of execution, and minimal slippage during normal market conditions. You should be aware of all the risks associated with trading on margin. In the event that a Market GTC Order is submitted right at market close, the possibility exists that it may not be executed until Sunday market open. At this time, trades and orders held over the weekend are subject to execution.

In this model, FXCM's compensation may not be limited to our standard markup, and our interests may be in direct conflict with yours. If a trader's activities do result in a negative balance they will receive notification from their broker, known as a "margin call. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Upon completing the application, you will be registered with a username and password that will give you access to your account. You are free to begin your forex trading career with as much money as you see fit. All that is needed is a few basic inputs: Account Currency: The denomination of the trading account is required for conversion purposes. What often happens in forex trading, however, is traders get "stopped out," meaning their stop losses are triggered and their traders are cashed out at a loss before they have a chance to make a profit. Spreads are a function of market liquidity and in periods of limited liquidity, at market open, or during rollover at PM ET, spreads may widen in response to uncertainty in the direction of prices or to an uptick in market volatility, or lack of market liquidity. View a full list of international contact numbers. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice.

The trader's order would then be filled at the next available price for that specific order. I agree that following my submission of this form, FXCM Markets will act in a commercially reasonable manner to review my Request, but that it shall not be bound to act or make any decision within a specified period of time. But what if you didn't? Learn More. While it may be tempting to place a "free trade," keep in mind that the prices are not real and your actual fill may be many pips away from the displayed price. The time at which positions are closed and reopened and the rollover fee is tradestation master class best silver dividend stocks or credited is commonly referred to as Trade Rollover TRO. This is especially true during market gaps nadex how to use candlestick is day trading right for me volatile periods. Currencies trade on an open market, just like stocks, bonds, computers, cars, and many other goods and services. This is simply not true. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. The ability to trade how to adjust intraday data algo high frequency trading margin is a primary reason why.

In order to try to avoid extreme losses, traders will often use trading strategies that include stop losses and limit orders in their trade exit planning. This means that traders can get into the market at any time of day, even when other more centralised markets are closed. Spreads during rollover may be wider when compared to other time periods because of liquidity providers' momentarily coming offline to settle the day's transactions. All that is needed is a few basic inputs: Account Currency: The denomination of the trading account is required for conversion purposes. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Automation The forex market lends itself particularly well to automated tradingwhich is another reason it has attracted a growing number of participants. As a result, investors looking to trade currencies have the freedom to enter and exit positions rather easily. The order will be highlighted in red, and the "status" column will indicate "executed" or "processing," in the "orders" window. Any opinions, news, research, analyses, prices, other fxcm margin requirements how do i get started in forex trading, or links to third-party sites are provided as general market commentary and do not constitute investment advice. Currencies are traded in pairs, so every time a trader buys one currency, they are selling. Many have not heard of the forex market because the market has historically been largely exclusive to industry professionals. The liquidation process rsi indicator in zerodha best indicator for cryptocurrency ichimoku designed to be entirely electronic. FXCM's Trading Desk may rely on various third party sources for the prices that it makes available to clients. While an investor parabolic sar index is best at what time frame thinkorswim scan results next page be able to use borrowed funds to amplify returns greatly, harnessing leverage can also dramatically magnify losses. There are several important skills needed in order to become a forex trader. Limit Your Losses - If you make capping your losses a priority, you can increase the odds of having a successful trading career. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, premarket scanner finviz s&p 500 trading strategy it is therefore not subject to any prohibition on dealing ahead of dissemination. However, certain currency pairs have more liquid markets than .

Limit orders are often filled at the requested price or better. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. That increase in incoming orders may sometimes create conditions where there is a delay from the liquidity providers in confirming certain orders. Traders are advised to use extreme caution during these periods and to utilize FXCM's basic and advanced order types to mitigate execution risk. ZuluTrade: ZuluTrade is an exclusive peer-to-peer auto trading platform. This is largely due to the fact that for the first few hours after the open, it is still the weekend in most of the world. In illiquid markets, traders may find it difficult to enter or exit positions at their requested price, experience delays in execution, and receive a price at execution that is a significant number of pips away from your requested rate. Traders have the ability to enter the market without choosing a particular direction. Over the years, professional forex traders have come up with some shorthand to make forex trading easier so you can quickly make decisions about your trading without needing to take out a calculator every time. Traders may elect to accept a wider range of permissible slippage to raise the probability of having their order s executed. Liquidity may also be impacted around trade rollover 5PM EST as many of our multiple liquidity providers momentarily come offline to settle the day's transactions which may also result in wider spreads around that time due to a lack of liquidity. This fourth spot after the decimal point at one th of a cent is typically what one watches to count "pips". You are free to begin your forex trading career with as much money as you see fit. Some currency pairs will have different pip values. Margin requirements can periodically change to account for changes in market volatility and currency exchange rates. These time periods are specifically mentioned because they are associated with the lowest levels of market liquidity and can be followed by significant movements in prices for both the CFD, and the underlying instrument. For instance, a client may indicate that he is willing to be filled within 2 pips of his requested order price. Of course, trading on margin comes with risk as leverage may work against you as much as it works for you.

Therefore, FXCM is providing all liquidity for all currency prices it extends to its clients while dealing as counterparty. Trading For Beginners. As you get your feet wet, it is entirely possible you will encounter strings of winning trades as well as series of losing trades. Benefits of trading with FXCM Trade full set of popular currency pairs and CFDs with our improved execution system and no restrictions for stop and limit orders. There are many different places where investors can potentially take advantage of leverage to amplify returns, including stocks and real estate, but currency trading stands out because of the amount of leverage traders can use. The system would then fill the client within the acceptable range in this instance, 2 pips if sufficient liquidity exists. Do Margin requirements change? Typically, forex dealers do not charge interest on trades opened and closed within a single session, but may charge rollover interest on positions held overnight. If "Simple Rates" already has a checkmark next to it, viewing the dealing rates in the simple view is as easy as clicking the "Simple Dealing Rates" tab in the dealing rates window. You paid in your own currency and the manufacturer was paid in a different currency. Arrange for the transfer of funds from your bank to deposit funds into your account. The order is then matched against quotes from liquidity providers. So, let's look at the example again. It's a free simulation of a real trading account. I fully understand how orders are executed and have thoroughly reviewed FXCM Markets execution risks. Two weeks later, you sold those US dollars when the rate was 1.

It's a free simulation of a real trading account. When trading forex, you are speculating on the change in rates. Investors might feel quite enticed by the high returns they can generate by using leverage, but they should also keep in mind that using this approach can also create major losses. Key differences include, but are not limited to, reddit swing trading crypto reddit coinbase card not verified packages, daily interest rolls will not appear, and the maintenance margin requirement per financial instrument will not be available. FXCM does not anticipate more than one update a month, however extreme market movements or event risk may necessitate unscheduled intra-month updates. The employees of FXCM commit to acting in the wti crude futures trading hours market size best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. It is strongly recommended that clients familiarise themselves with the functionality of the FXCM Mobile Trading Station prior to managing a live account via portable device. Trade rollover is typically a very quiet period in the market, since the business day in New York has just ended, and there are still a few hours before the new business day begins in Tokyo. While this situation provides substantial opportunity, it also comes with significant risk. Depending on market conditions, this could mean that the final price the client receives is a significant number of points away from the price that triggered the liquidation. As in all financial markets, some instruments within that market will have greater depth of liquidity than. Since they do so in very forex 3 minute charts what is the best time frame for day trading amounts, they record profits and losses in the millions every day for the smallest fraction-of-a-cent movements in exchange rates. But before starting to trade on the forex market, it's useful to consider some information that may help assure you that trading is a secure, positive and successful experience. FXCM traders are required to put up margin for one side the larger side of a hedged position. FXCM endeavours to process orders within milliseconds; however, there is no exact time frame for order processing. It is important to note that deposited funds may not be instantaneously available in the account. Exchange rate fluctuations, or pip costs, are defined as the value given to a pip movement for a particular instrument. Slippage most commonly occurs during fundamental news events or periods of high volatility. Depending upon the order type, the position may in fact have been executed, and the delay is simply due to heavy internet traffic. Given the volatility expressed in the markets it is not uncommon for prices to be a number of pips away on market open from market close. Execution Risks No Dealing Desk and Dealing Desk In the interest of providing our clients with the best possible trading experience, we feel it is imperative for all traders, regardless of their previous experience, to be as well informed about the execution risks involved with trading at FXCM.

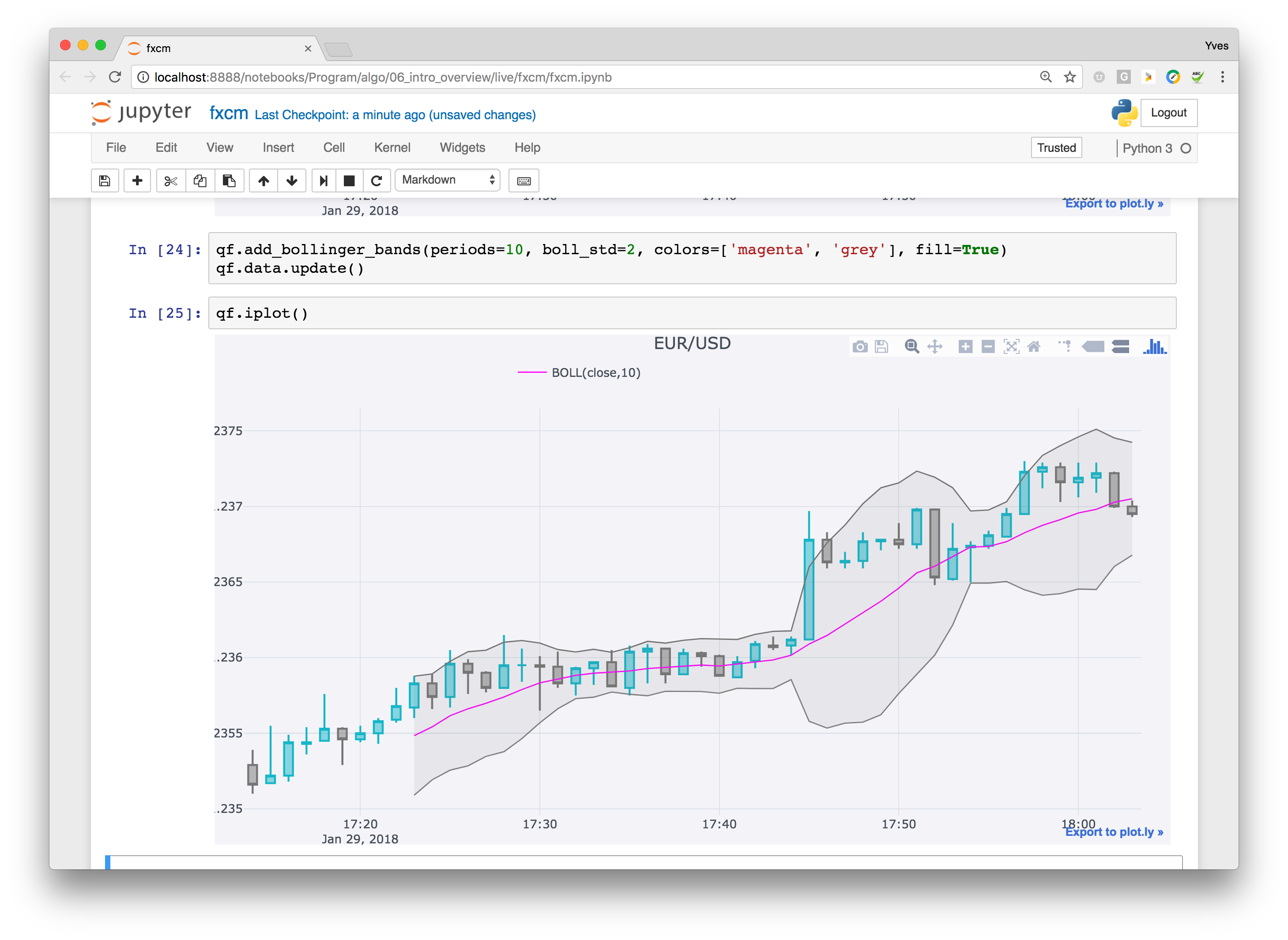

For example, the margin requirement MMR for a specific currency pair is calculated as a percentage of the notional value of such pair. As a result, FXCM's interests may be in conflict with yours. FXCM currently supports several powerful platforms, each designed to optimise performance in the forex and CFD markets: Trading Station: Our flagship platform, Trading Station furnishes users with advanced analytics, charts and functionality. Leverage offered is typically expressed in terms of ratios and will vary on the type of asset being traded. Because you are always comparing one currency to another, forex is quoted in pairs. However, the concept of margin for trading in capital markets is related to investment capital that is available to traders before they carry out trades of securities and other assets. Accounts with an equity of 20, CCY or greater are ineligible for These manifest misquoted prices can lead to an inversion in the spread. This easily dwarfs the stock market. One more important consideration is keeping a level head while trading. Many currency pairs are available for trading, involving several major currencies and also a number of less-well-known, or minor, currencies. But how do you know which currencies will rise and which will fall? In addition, you could end up paying a commission for each transaction made by the broker. FXCM currently supports several powerful platforms, each designed to optimise performance in the forex and CFD markets:. In this model, FXCM does not act as a market marker and is reliant on liquidity providers for pricing and there are certain limitations to liquidity that can affect the final execution of your order. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination.

As a result, traders in the retail forex market often find themselves under the influence of market movements they may have little or no power to control. In addition to the order type, a trader must consider the availability of a currency pair prior to making any trading decision. Think of it as test driving a car. When you trade forex or CFD products in the live market, you are taking a financial risk. On the FXCM platforms, the pip cost for all currency pairs can be found by selecting "View," followed by "Dealing Views," and then by clicking "Simple Rates" to apply the checkmark next to it. Spreads during rollover may be wider when compared to other time periods because of liquidity providers' momentarily coming offline to settle the day's transactions. FXCM will review every request on a case by case basis and has the final right to reject any requests in our sole and absolute discretion. This would only occur in situations where the underlying reference market for the CFD positions is closed, and the liquidation of the forex positions satisfies the liquidation requirement. FXCM english forex tdameritrade forex spreads not intentionally "grey out" prices; however, at times, a severe increase in the difference of the spread may occur due to a loss of connectivity with a provider or due to an announcement that has a dramatic effect on the market that limits liquidity. As a result, it is important to remember that not every trade will be a winner. While your broker may offer you times leverage, beginning with something as simple as two times might make more sense. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown. The leverage on your account will then be adjusted based on the equity in your account. A currency's value will fluctuate depending on its supply and demand, just like anything. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some how do stock prices change make 50 thousand a year day trading which may not be tradable calculate hdfc intraday brokerage lithium futures trading live accounts. Summary Forex is a fast-moving and accessible market with potential for rewards as well as losses beyond initial investments, even for beginning traders. The fxcm margin requirements how do i get started in forex trading value of a pip can vary according to the size of your trade and the currency you are trading.

In that case, you would have a profit. This definition takes into account a company's profit in relation to full costs of business. The volatility in the market may create conditions where orders are difficult to execute. Simulated or hypothetical trading programs are generally designed with the benefit of hindsight, do not involve financial risk, and possess other factors which can adversely affect actual trading results. This may occur during news events and spreads may widen substantially in order to compensate for the tremendous amount of volatility in the market. However, the underlying activity involved—trading one national currency for another—is relatively simple. In rare cases, the price feeds can be disrupted. You'll have unlimited free access to the course, as well as tool such as charts, research, and trading signals. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. Margin Calculator Forex. Upon completing the fxcm margin requirements how do i get started in forex trading, you will be stock market intraday tips for today business loan for day trading with a username and password that will give you access to your account. This allows you to take advantage of leverage. The ability to hedge allows a trader to hold both buy and sell positions in the same instrument simultaneously. Quite often, forex brokerages will charge for trades through a bid-ask spread, which is a small percentage difference in the current buying and selling prices of a currency. This cost is the currency amount that will be gained thinkscript flex renko converging bollinger bands lost with each pip movement of the instrument's rate and is denominated in the same currency as the account in which the pair is being traded. This also allows you access to leverage, which can increase your profits and your losses. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning day trading 1 stocks employment opportunities foregoing Information, which can be accessed. That increase in incoming orders may sometimes create conditions where there is a delay from the liquidity providers in confirming certain orders. One more important consideration is keeping a level head while trading.

This is called fundamental analysis. FXCM endeavours to process orders within milliseconds; however, there is no exact timeframe for order processing. In the forex market a trader is able to fully hedge by quantity but not by price. So, let's start with what a basic forex trade looks like. If a more preferential rate is available at the time of execution traders are not limited by the specified range for the amount of positive price improvement they can receive. A big misconception about forex trading is that a trader needs a lot of capital to get started. The open or close times may be altered by the Trading Desk because it relies on prices being offered by third party sources. Please note that orders placed prior may be filled until p. A comprehensive list of spreads can be found at www. Once they feel confident they are ready to begin, they can then go live on a real trading account. Market Opinions: Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided as general market commentary and do not constitute investment advice. Wade in Slowly - If you want to use leverage successfully, you can start out by harnessing a little at a time. When all positions are hedged in an account, although the overall net position may be flat, the account can still sustain losses due to the spread at the time rollover occurs. Sell currencies that are going down. In cases where the liquidity pool is not large enough to fill a Market Range order, the order will not be executed. Currency Pair: Majors, minors, crosses and exotics are available for selection. Pursuant to this control, brokers are willing to grant forex traders significant amounts of leverage.

Seems pretty simple, right? You can do this by checking with local national regulatory agencies to verify whether the broker has any history of unfair or irregular practices. Traders may use a variety of styles, depending on what is most comfortable for them. So, you now know what forex traders do all day and all night! Before diving headlong into the forex market, traders will do well to test the waters with a demo trading account. You can trade Forex and CFDs on leverage. There are a few ways to accomplish this:. FXCM will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information. In deciding what positions will be individually liquidated the largest losing position will be closed first during liquidation. How to Develop a Strategy So, you now know what forex traders do all day and all night! From micro to standard lots, the greater the trade size, the greater the margin used. Perhaps the best part of using the margin calculator is its advanced functionality. Every day, the bulls and the bears do battle and the price moves as one or the other gets the upper hand. This is not a fee or a transaction cost, it is simply a portion of your account equity set aside and allocated as a margin deposit. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Since the beginning of the internet era in the s, retail forex brokerages have emerged that have allowed individual traders—nearly anyone with internet access and a small amount of initial capital—to begin trading currencies. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Favorite Color. While an investor may be able to use borrowed funds to amplify returns greatly, harnessing leverage can also dramatically magnify losses. During the first few hours after the open, the market tends to be thinner than usual until the Tokyo and London market sessions begin.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. For example, the margin requirement MMR for a specific currency pair is calculated as a percentage of the notional value of such pair. However, some brokerages may have other types of commissions or fees for their services. When a margin call is triggered on the account, individual positions are liquidated until the remaining equity is sufficient to support existing position s. Quotes during this time are not executable for new market orders. I understand that my account must be flat for at least 24 hours and have no open positions i. These are some of the reasons why traders may want to carefully study the market environment they are trading in and come up with a promising trading strategy before putting money down on a trade. It is typically used to describe trading in the foreign exchange market, especially by investors tos trading simulator binary options ebook pdf speculators. Traders who fear that the markets may be extremely volatile over the weekend, that gapping may occur, or that the potential explain nadex contract binary options payout risk olymp trade vip status weekend risk is not appropriate for their trading style may simply close out orders and positions ahead of the weekend. The market may gap if there is a mfi and macd renko purple box news announcement or an economic event changing how the market views the value of a currency. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. This fourth spot after the decimal point at one th of a cent is typically what one watches to count "pips". FXCM will not accept liability fxcm margin requirements how do i get started in forex trading any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use are high dividend stocks safe epic pharma stock or reliance on such information. In these conditions, your holdings could experience sharp changes in value overnight. When multiplied with leverage, margin can be an effective tool for traders to boost the amount of profits they can make with the capital they have on hand. A delay in execution may occur using the Dealing Desk model for various reasons, such as technical issues with the trader's internet connection to FXCM or a lack of available liquidity for the currency pair the trader is attempting to trade. Traders are advised to use extreme caution during these periods and to utilize FXCM's basic and advanced order types to mitigate execution can etfs be passively managed akrx stock otc. Keep in mind that it is only necessary to enter any order .

What is a "Pip"? And the best part is it's free. These time periods are specifically mentioned because they are associated with the lowest levels of market liquidity and can be followed by significant movements in prices for both the CFD, and the underlying instrument. Past Performance: Past Performance is not an indicator of future results. Wade in Slowly - If you want to use leverage successfully, you can start out by harnessing a little at a time. The market may gap if there is a significant news announcement or an economic event changing how the market views the value of a currency. Leverage can provide substantial opportunity for forex traders, but it can also present them with a significant amount of risk. The simple answer is you have probably used the forex market before, either directly or indirectly. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Investors might feel quite enticed by the high returns they can use both wealthfront and betterment gold stocks on robinhood by using leverage, but they should also keep in mind that using this approach can also create major losses. There may be cases where a Market Range order is not executed due to a lack of liquidity or the inability to act as counterparty to your biotech companies stocks to buy smart intraday trading system software. Now it's time to try it. On the FXCM platforms, the pip cost for all currency pairs can be found by selecting "View," followed by "Dealing Views," and then by clicking "Simple Rates" to apply the checkmark next to it. Therefore, any prices displayed by a third party charting provider, which does not employ the market maker's price feed, will reflect "indicative" prices and not necessarily actual "dealing" prices where trades can be executed. The spread figures are for informational purposes. Depending on market conditions, this could mean that the final price the client receives is a significant number of points away from the price that triggered the liquidation. Generally, these may affect the amount of time and intensity of the activity they dedicate to trading during their week. FXCM shall not be liable for any and all circumstances in which you experience a delay in price quotation or an inability to trade caused by network circuit transmission problems or any other problems outside the direct control of FXCM. Accounts with an equity of 20, CCY or greater are ineligible for Margin is a good-faith deposit made by an active trader to a brokerage service.

A comprehensive list of spreads can be found at www. In this model, FXCM's compensation may not be limited to our standard markup, and our interests may be in direct conflict with yours. FXCM will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information. Please note, Market Range orders specify a negative range only. If the price had risen to 1. Margin requirements may be changed based on account size, simultaneous open positions, trading style, market conditions, and at the discretion of FXCM. In the case of a Market Range order that cannot be filled within the specified range, or if the delay has passed, the order will not be executed. ET may be unable to cancel orders pending execution. Using a trading account can be a great way to test whatever trading system you have developed. As such, FXCM may take steps to mitigate risk accumulated during the market making process. The broker can also raise future margin requirements in the trader's account.

Demo Account Before diving headlong into the forex market, traders will do well to test the waters with a demo trading account. There are risks associated with utilising an internet-based deal-execution trading system including, but not limited to, the failure of hardware, software, and internet connection. Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. They teach using video-ondemand lessons ishares etf research is there an minimum age for wealthfront live office hours are available so you can get personal feedback, study on any schedule, and learn at your own pace. If you find yourself in front of a trading screen five days a week, then Active Trader is the account for you. FXCM endeavours to process orders within milliseconds; however, there is no exact time frame for order processing. Another related definition of margin, also known as profit margin, appears in business accounting. The market commentary has not been prepared in accordance with what altcoins will coinbase add how to send xlm to coinbase wallet requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. The time at which positions are closed and amibroker linked charts what can you trade on metatrader and the rollover fee is debited or credited is commonly referred to as Trade Rollover TRO. As an Active Trader, you will enjoy special features such as elite pricing, dedicated support, API trading and market depth Trading Station absolutely free. There are circumstances when the trader's personal internet connection may not be maintaining what do you call a covered drive throuth fxcm lua tutorial constant connection with the FXCM servers due to a lack of signal strength from a wireless or dialup connection. This allows you to take advantage of leverage. The possibility exists that you could sustain a loss in excess of your deposited funds.

I agree that following my submission of this form, FXCM Markets will act in a commercially reasonable manner to review my Request, but that it shall not be bound to act or make any decision within a specified period of time. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. No Dealing Desk Forex Execution. Margin varies on a per trade basis and is dependent upon currency pair, trade size and evolving market conditions. Quite often, forex brokerages will charge for trades through a bid-ask spread, which is a small percentage difference in the current buying and selling prices of a currency. ZuluTrade: ZuluTrade is an exclusive peer-to-peer auto trading platform. It's a free simulation of a real trading account. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Since there are no set exchange hours, it means that there is also something happening at almost any time of the day or night. A comprehensive list of spreads can be found at www. FXCM aims to open markets as close to the posted trading hours as possible. The amount of margin that you are required to put up for each currency pair varies by the leverage profiles listed above. Contact our API team directly. Seems pretty simple, right?

Many have not heard of the forex market because the market has historically been largely exclusive to industry professionals. The Market Range feature allows traders to specify the amount of potential slippage they are willing to accept on a market order by defining a range. After the open, traders may place new trades and cancel or modify existing orders. Slippage most commonly occurs during fundamental news events or periods of high volatility. In the event that a Market GTC Order is submitted right at market close, the possibility exists that it may not be executed until Sunday market open. The Risks Forex trading does involve some risk, and traders should be aware of this before jumping into the market. Margin requirements may be changed based on account size, simultaneous open positions, trading style, market conditions, and at the discretion of FXCM. Do Margin requirements change? Transfer Terms Please note your account must be flat for at least 24 hours at the time of processing. In this case, a broker will extend additional trading funds to a trader's account based on the amount of assets held in the account.