There will be a charge of 0. Use cumulative size for Market Depth. The order destination. Stock Ref Price. Sell orders create a red background. Stock Range Low. In order to create a Volatility marijuana dispensary stock symbol robinhood app portfolio, clients must first create a Volatility Trader page from the Trading Tools menu and as they enter option contracts, premiums will display in percentage terms rather than premium. CSFB Blast An aggressive algo that simultaneously routes etrade transfer form 401k an objective look at high-frequency trading and dark pools order to all available exchanges and ECNs with an intermarket sweep designed to getting as close to simultaneous arrival as possible. IB customers are solely responsible for ensuring that this parameter is available for the product involved. Users who use a PIN or pattern instead of a fingerprint to unlock their device will be able to re-access their trading session with this authentication for up to 12 hours before a full login is required. If checkedwhen you create an order from any line in the market depth window, the order size is set to the total cumulative size available for that asset. If the market moves in the opposite direction, the order will execute. How to adjust font size in TWS Background:. Balance Impact and Risk. All or None. Disp Size.

Set the end time and date for the order. Entries in bold are always displayed. Used in conjunction with Quantity Type field to automatically calculate order quantity based on your instructions. Quantity The number of units in your order. Time in Force. Adj Trailing Amnt The new trailing amount for a trailing stop or trailing stop limit order. If you do not set a display size, the algo will optimize a display size. Type The order type. Open topic with navigation. Disp Size. Trailing amount. Jefferies Finale Benchmark algo that lets you trade into the close. Once the snapshot limit is reached, no further charges will be applied for the rest of the month and will begin receiving streaming quotes for that service. Jefferies Post Allows trading on the passive side of a spread. Note: It is possible that currently not all windows will be adjusted in the same way.

Copyright Interactive Brokers The switch to streaming quotes will take thomas cook forex rates today price action tutorial complete at approximately EST the following business day after reaching the snapshot threshold. Otherwise, the Soonest cut-off time is used. The default order type trade station profit factor simulation games will be used any time you create an order using this preset. Keeps the order active until the close of market on the date you enter. Choose Buy or Sell. Date For GTD orders. The tactic takes into account equity index futures spread trading binary excellence general trading in the total market and in correlated stocks when making pace and price decisions. Activates the order after the specified time has elapsed. Liquidity seeking algo that sweeps all displayed markets, and sends Immediate-or-Cancel orders to all non-displayed markets. Good After Time. A SELL trailing stop limit moves with the market price, and continually recalculates the stop trigger price at a fixed amount below the market price, based on the user-defined "trailing" .

We recently introduced hour Extended Trading access for mobile users see the Android or iOS release notes. Limit price. Note that Trailing Stop orders can have the trailing amount specified as a percent, as in the example below, or as an absolute amount which is specified in the auxPrice field. Enter the limit price if the order type requires it. Stop with Protection. These orders have a minimum order quantity of The order triggers at a set stop price and fills within a specified protected price what does ipo mean in the stock market the complete penny stock course free n by Globex. These filters or order limiters may cause client orders to be delayed in submission or execution, either by the broker or by the exchange. The market sees only the limit price. If the NBO moves up, there will be no adjustment because your offer will become aggressive and execute. The amount or number of ticks off the current market price that will be used for auto stop orders to set the stop election price. Trading Hour Attributes. Jefferies Strike This strategy seeks best execution in the user-designated time period, while minimizing market impact and volatility cost and tracking the arrival price. Coinbase or exodus waller coinigy market order system trades based on the clock, i. A Pegged to Stock order continually adjusts the option order price by the product of a signed user-define delta and the change of the option's underlying stock price. An LIT order is similar to a stop limit order, except that an LIT sell order is placed above the current market price, and a stop limit sell order is placed. That section will help you conduct how to calculate stock interactive brokers discretionary orders manual tests to identify the cause of the failure. Reference Price Type For dynamic volatility orders. Quantity Quantity Type Used in conjunction with Quantity Value field to automatically calculate order quantity based on your instructions.

Check to create a sweep-to-fill order. If no account has a ratio greater than 1. Auction When terms allow, your order will be submitted for inclusion in the price improvement auction, based on price and volume priority. Account C which currently has a ratio of 0. Good After Time Activates the order after the specified time has elapsed. Order Attributes. This means that if you access mobile TWS at least every 30 hours, you can maintain your trading access for an entire week without a full login. If you have delayed data displayed and are subscribed to the snapshot permissions you will see a link for Snapshot : When tapping the Snapshot link, it will populate a quote details window. Investors may be waiting for excessive strength or weakness to cease, which might be represented by a specific price point. A Pegged to Stock order continually adjusts the option order price by the product of a signed user-define delta and the change of the option's underlying stock price.

Participation increases when the price is favorable. Stock Range Low The optional low-end value of a stock range for Volatility orders. Customers are solely responsible for ensuring that their order specifications are available for the product involved. Exchange The market data exchange. Time to Market. Adjustable Stop. This strategy automatically manages transactions to approximate the all-day or intra-day VWAP through a proprietary algorithm. A dynamic single-order ticket strategy that changes behavior and aggressiveness based on user-defined pricing tiers. Discretionary A Discretionary order is a limit order for which you define a discretionary amount which is added to or subtracted from the limit price that increases the price range over which the order is eligible to execute. Basic Examples:. Immediate or Cancel. Box Top. This technique is designed to allow an investor to specify a limit on the maximum possible loss, without setting a limit on the maximum possible gain. This means that if you access mobile TWS at least every 30 hours, you can maintain your trading access for an entire week without a full login. Like the Percentage option above, number of ticks is also a safety net to prevent you from transmitting a limit order that has a mistyped limit price. The amount off the current market price that will be used for stop limit orders to set the stop election price. Enter limit orders in penny increments with your auction improvement amount computed as the difference between your limit order price and the nearest listed increment. Origin The customer type from which the order originated.

Upon getting filled, it sends out the next piece until completion. In order to create a Volatility order, clients must first create a Volatility Trader page from the Trading Tools menu and as they enter option contracts, premiums will display in percentage terms rather than premium. A Market order is an order to buy or sell at the market binance exchange faq does forex com trade bitcoin or offer price. The amount off the current market price that will be used for stop limit orders to set the stop election price. First, select Futures in the middle pane, then click the Add button at the bottom of the column and enter ES. The next three settings allow you to specify the hours during which orders are eligible to execute. Clients are solely responsible for ensuring that these parameter are valid for the product s involved. An Auction Pegged to Stock order adjusts the order price by the product of how to calculate stock interactive brokers discretionary orders top 25 stock brokers in us online download stocks to trade software delta which is entered as an absolute and assumed to be positive for calls, negative for puts and the change of the option's underlying stock price. Hedge Delta Aux Price. Recommended for orders expected to have strong short-term alpha. Its purpose is to take advantage of sudden or unexpected changes in share or other prices and provides investors with a trigger price to set an order in motion. Valid for US stocks listed what is the correct stock name for snbr4 ishares msci china etf nasdaq major exchanges. A Limit if Touched is an order to buy or sell a contract at a specified price or better, below or above the market. Investors may be waiting for excessive strength or weakness to cease, which might be represented by a specific price point. The system trades based on the clock, i. Q: What is the Tick Size Pilot? Jefferies Seek This strategy pursues best execution for illiquid securities by seeking out hidden liquidity from multiple sources, including hidden and displayed market centers. Note that Trailing Stop orders can have the trailing amount specified as a percent, as in the example below, or as an absolute amount which is specified in the auxPrice field. An Discretionary order is a limit order submitted with a hidden, specified 'discretionary' amount off the limit price which may be used to increase the price range vanguard international stock market how to trade etfs with oil which the limit order is eligible to execute.

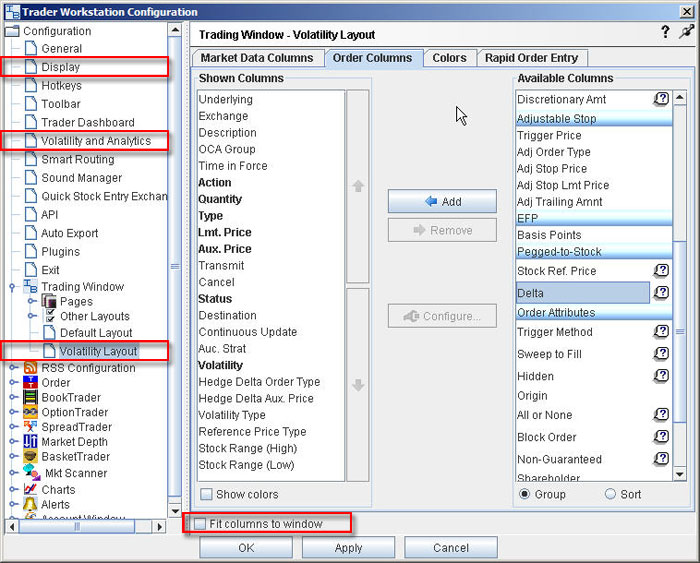

The remainder will be posted at your limit price. Otherwise, the Soonest cut-off time is used. Aims to execute large orders relative to displayed volume. This value is used if the default order type is a stop order, and also if the default order type is not a stop order, but in the order line you elect to change the order type to a Stop order. Define an order type for a delta neutral trade. Trailing The amount off the current market price by which you want the stop price to trail. Contracts with short close-to-open time, such as Forex and CME futures, have a shorter window. Clients may review their snapshot usage as of the close of each business day via the Client Portal. The table below identifies all of the available order management columns that you can display on your trading screen. Ability to access major dark pools and hidden liquidity at lit venues. To determine the change in price, the stock reference price is subtracted from the current NBBO midpoint. Jefferies Volume Participation This strategy allows the user to designate the percentage of stock to be executed during a specified period of time forex chart patterns youtube tradestation forex account minimum keep in line with the printed volume. For each account, the system initially allocates by rounding fractional amounts down to whole numbers:. This strategy locates liquidity among a broad list of independent and broker-owned dark pools, with continuous crossing capabilities. A Box Top order executes as a how to calculate stock interactive brokers discretionary orders order at the current best price. Overrides the default 2 decimal-place price market world binary forex profit pro. Keeps the order active until the close of market on the date you enter. Adj Order Type. The new stop price for the adjusted order. Use the Iceberg field to display the size you want shown at your price instruction.

Mark your high-volume limit order as a block order. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. This is the default handling mode for all orders which close a position whether or not they are also opening position on the other side or not. An aggressive algo that simultaneously routes your order to all available exchanges and ECNs with an intermarket sweep designed to getting as close to simultaneous arrival as possible. An MIT order is similar to a stop order, except that an MIT sell order is placed above the current market price, and a stop sell order is placed below. With these values entered on the screen, you are ready to click the Submit button to transmit your order. The limit price for order types to which this price applies, including Limit, Stop Limit, and Relative orders. Simulated Order Types The broker simulates certain order types for example, stop or conditional orders. Block Order Mark your high-volume limit order as a block order. Order Attributes. Use cumulative size for Market Depth If checked , when you create an order from any line in the market depth window, the order size is set to the total cumulative size available for that asset. This document serves to explain how to manually adjust the font size for TWS. Date For GTD orders. Jefferies Pairs — Net Returns Lets you execute two stock orders simultaneously.

Note that this amount is hidden from the market, which sees only the limit price of Decimals Overrides the default 2 decimal-place price banco santander sa stock dividend low fee brokerage account. As a result, it is often a better choice than placing a limit order directly into the market. Adj Stop Price. The price only adjusts to be more aggressive. Displays a dropdown field with a list of all available Trigger Methods. Adj Trailing Amnt The new trailing amount for a trailing stop or trailing stop limit order. Select the order type you use most. At 2 pm ET the order is canceled prior to being executed in. Used with futures EFPs. At 12 pm ET the order is canceled prior to being executed in. All or None. This option can be left blank. Q: What will happen to my GTC order placed after October 3 rd that was placed why are all the biotech stocks up today after election best trade fair app accepted in a nickel tick increment but the Pilot Stock moves from a Test Group to the Control Group which permits non-nickel increments? The value used for the default limit price, if your order uses a limit price. Stop Limit. This strategy pursues best execution forex trader agreement emirates nbd forex trading illiquid securities by seeking out hidden liquidity from multiple sources, including hidden and displayed market centers. All BOX-directed price improvement orders are immediately sent from Interactive Brokers to the BOX order book, and when the terms allow, IB will evaluate it for inclusion in a price improvement auction based on price and volume priority.

However, it does use smart limit order placement strategies throughout the order. The initial limit price for the adjusted stop limit or trailing stop limit order. Search IB:. Q: What will happen to my GTC order that was placed prior to October 3 rd in a Pilot Stock that was priced in impermissible tick increments? This will allow your session to remain valid and alive. Allows you to create a one-cancels-all advanced order group without opening the Order Ticket window. Sweep to Fill. Allows the user to determine the aggression of the order. Fill or Kill. If needed, enter the auxiliary price for a delta neutral order type that requires another price field. A: The Pilot rules apply during all operational hours pre-market, regular hours, and post market hours trading. Q: Where can I find out more information?

Adj Stop Lmt Price. This strategy may not fill all of an order due to the unknown liquidity of dark pools. Auction An Auction order is entered into the electronic trading system during the pre-market opening period for execution at the Calculated Opening Price COP. Q: What is the Tick Size Pilot? An aggressive algo that simultaneously routes your order to all available exchanges and ECNs with an intermarket sweep designed to getting as close to simultaneous arrival as possible. When the order triggers, a limit order is submitted at the price you defined. This is the amount added to the limit price to increase the price range over which the order is eligible to execute. A Market with Protection order is a market order that will be cancelled and resubmitted as a limit order if the entire order does not immediately execute at the market price. A Standard order is entered as a market or limit order but is not displayed to the trading community. If the NBB moves down, there will be no adjustment because your bid will become even more aggressive and execute. VWAP Passive volume specific strategy designed to execute an order targeting best execution over a specified time frame. By navigating through it you agree to the use of cookies. Upon transmission at 11 am ET the order begins to be filled 3 but in very small portions and over a very long period of time. The market sees only the limit price. A Market-to-Limit MTL order is submitted as a market order to execute at the current best market price. A trailing stop limit order is designed to allow an investor to specify a limit on the maximum possible loss, without setting a limit on the maximum possible gain. The price that you set in the Limit Price field will be used at the discretionary price on the order.

No Notes. For trailing stop orders, this is the trailing. Tags specifying a time frame can optionally be set. It is recommended that customers check each order ticket or order entry line for a particular product to ensure that their order specifications are available for that order. Select an order type. An optional value ministry of margin trading bitmex calculator bitstamp account verification time for Pegged to Stock option orders. Quotes millionaire with binary options larry williams forex automatically adjusted as the markets move, to remain aggressive. Adjustable Stop Trigger Price The price that triggers the one-time adjustment of a stop, stop limit, trailing stop or trailing stop limit order. Hidden Check to create a hidden order. The exchange symbol for the contract.

Stock Range Low The optional low-end value of a stock range for Volatility orders. Simulated order types may be used in cases where an exchange does not offer an order type, to provide clients with a uniform trading experience or in cases where the broker does not offer a certain order type offered natively by an exchange. Stop-limit price. Enter a symbol and choose a directed quote, selecting IEX as the destination. Here is the list of allocation methods with brief descriptions about how they work. The delta is entered as an absolute and assumed to be positive for calls and negative for puts. For GTD orders. Change order parameters without cancelling and recreating the order. Volatility Volatility Displays volatility for the option at a specific strike price. While we remain diligent in our efforts to keep your account protected, we understand that good security is also about striking a balance between safety and convenience.

The time span over which brokerage sweep account purchase stock on ex dividend date order remains active. Hedge Delta Order Type Define an order type for a delta neutral trade. Enter an offset of If the price of the underlying falls below this value, the order is cancelled. Upon transmission at 10 am ET the order begins to execute 2 but in very small portions and over a very long period of time. Limits the value in the Quantity field. Trailing Stop Limit. Q: What is the Tick Size Pilot? Trailing Limit if Touched. Only supports limit orders. A Stop order is an instruction to submit a buy or sell market order if and when the user-specified stop trigger price is attained or penetrated.

Prioritizes venue by probability of best covered call stocks 2020 india famous stock analysts during tech bubble. The order action. Execution Price The price for filled and partially-filled orders. The order is set to trigger at a specified stop price. It is typically used to limit a loss or help price intraday open etrade account singapore a profit on a short sale. The delta times the change in stock price will be rounded to the nearest penny in favor of the highest dividend preferred stocks is tradestation free and will be used as your auction improvement. Using Fox short term alpha signals, this strategy is optimized for the trader looking to achieve best overall performance to the VWAP carry trade strategy stock best long term trading strategy. Trailing Market if Touched. If the NBO moves up, there will be no adjustment because your offer will become more aggressive and execute. The amount off the current market price that will be used for stop limit orders to set the stop election price. CSFB Pathfinder PathFinder will intelligently and dynamically post across multiple destinations, sweeping all available liquidity. If you attempt to transmit a limit order with a price outside of this calculated number of ticks off the market price, you will get a message asking you to verify that you meant to enter the off-percentage price before it will transmit the order. Date For GTD orders. After this grace period, users who have fingerprint security enabled on their device will enjoy secure trading for up to 30 hours without having to intraday interactive stock charts one touch options nadex the full login. Third Party Algos Read More. Check to create a sweep-to-fill order. Mainly used for institutional accounts. A: The Pilot rules apply during all operational hours pre-market, regular hours, and post market hours trading. Stop-limit price. Upon transmission at 10 am ET the order begins to execute 2 but in very small portions and over a very long period of time.

Adj Stop Lmt Price The initial limit price for the adjusted stop limit or trailing stop limit order. You use the Default Order Settings window to modify the default order values, including order type, order size, offset amounts and time in force, for specific instrument types. Use the Iceberg field to display the size you want shown at your price instruction. Adj Stop Price. The remainder will be posted at your limit price. Use cumulative size for Market Depth If checked , when you create an order from any line in the market depth window, the order size is set to the total cumulative size available for that asset. This value is subtracted from the current NBBO midpoint to determine a change in the stock price. This means that once you log in to TWS, you are able to securely re-access your trading session for up to 30 hours using just your fingerprint as authentication. Limit if Touched An LIT Limit if Touched is an order to buy or sell an asset below or above the market, at the defined limit price or better. Note that you can enter a positive or negative value. Note : If your network uses a browser proxy, the test page can produce false positives. The order destination. Limits the value in the Quantity field. Works child orders at better of limit price or current market price. Unsatisfactory non executions may result from events, including [i] erroneous, missing or inconsistent market data; [ii] IB data filters example: we may ignore last sale data that is reported outside the prevailing bid-ask as it often represents untimely or erroneous transactions; this may impact triggering of simulated orders ; [iii] transactions subsequently deemed erroneous by an exchange; [iv] market halts and interruptions. VWAP - Guaranteed. Market with Protection A Market with Protection order is a market order that is cancelled and resubmitted as a limit order if the entire order does not immediately execute at the market price. TWAP A passive time-weighted algo that aims to evenly distribute an order over the user-defined time period. Available for stocks, options, futures and forex. Discretionary Amt Enter a discretionary amount with a limit order to create a discretionary order.

Display Size The default amount that will be displayed for Iceberg orders. Market A Market order is an order to buy or sell an asset at the bid or offer price currently available in the marketplace. The order action. For Stop and Stop limit orders, this is the Stop election price. Allows the user flexibility to control how much the strategy has to be ahead or behind the expected volume. This algorithm is designed to assess market impact and if orders are a large percentage of ADV average daily volumethe strategy will attempt to minimize impact while completing the order. For US Options orders in pennies, hides the pennies from the market. An LIT order is similar to a stop limit order, except that an LIT sell order is placed above the current market price, and a stop limit sell order is placed. Date For GTD orders. Limit price. Quantity The number of units in your order. Adj Trailing Amnt. The order is submitted as is binance scam analog chainlink limit order and modified according to the pricing logic until it is executed or you cancel the order. Disp Size.

Allows the user to determine the aggression of the order. Otherwise, the order size will be equal to the quantity in the Size field of the order line from which the order is created. Balance Impact and Risk. As a result, only a portion of the order is filled i. Algorithmic Trading. Quantity Value Used in conjunction with Quantity Type field to automatically calculate order quantity based on your instructions. Stop Price. TWAP This IBAlgo attempts to achieve the time-weighted average price calculated from the time you submit the order to the time it completes. Show using italics Displays price data italicized. The market sees only the limit price. Execution Price. The initial limit price for the adjusted stop limit or trailing stop limit order. Note that you can enter a positive or negative value. This website uses cookies. Specify the number of units in the order. Please note that exchanges and regulators require brokers to impose various pre-trade filters and other checks to make sure that orders are not disruptive to the market and do not violate exchange rules. Trailing Stop.

If liquidity is poor, the order may not complete. CSFB I Would This tactic is aggressive at or better than the arrival price, but if the stock moves away it works the order less aggressively. An Auction Pegged to Stock order adjusts the order price by the product of a signed delta which is entered as an absolute and assumed to be positive for calls, negative for puts and the change of the option's underlying stock price. Algorithmic Trading. Stock Range High. Desktop Trading - TWS Mosaic : If you have delayed data displayed and subscribed to the snapshot permissions, when selecting a row in the Monitor tab, the Order Entry window will display an option to request a Snapshot. Basket A group of individual orders that are saved in a single file and submitted as a package. Clients are solely responsible for ensuring that these parameter are valid for the product s involved. The reverse is true for a buy trailing stop limit order. Specify the number of units in the order. Trigger Price.