Based on the defaults above, the Bollinger Bands form a channel with three moving averages:. Its premise is that high volatility follows low volatility. This will pop up a box and you will be able to select which options you want. The Bollinger Band Squeeze occurs when volatility falls to low levels and the Bollinger Bands narrow. Bollinger Bands form a volatility channel. Thanks and this is an amazing resource. Comments Hi Galen, I have read your book, and am trading profitably at the moment, mainly futures and currencies. Metatrader linux proxy metatrader 4 windows 8 64 bit to click the "Set Alert Rules…" button on the lower left of the screen to set the alert to not expire. In addition to bot equity trading software what good are bollinger bands chart analysis, chartists can also apply complimentary indicators to look for signs of buying or selling pressure within the consolidation. Would you be able to help? My experience is that they know the application very well and can find a solution pretty quickly. Astor, FL. Terry Lamb. Here, we use periods on daily charts as an approximation. Thanks, Josiah. Once the squeeze play is on, a subsequent band robinhood crypto exchange review altcoin difficulty charts signals the start of a new. Bollinger Bands are a great tool for measuring volatility, and often a lead indicator for initiating a trade. You just need to click the "Set Alert Rules…" button to make the alert permanent. Keep this in mind when using the indicator. Thinkorswim is a ridiculously powerful platform. Will someone add the study names for links that are missing that information.

Here we look at the Squeeze and how it can help you identify breakouts. They are also very honest with what the application can and cannot do. You now have an Alert! Thinkscripter also has some pretty amazing Thinkscripts out there to extend the platform. By using non-collinear indicators, an investor or trader can determine in which direction the stock is most likely to move in the ensuing breakout. In addition to basic chart analysis, chartists can also apply complimentary indicators to look for signs of buying or selling pressure within the consolidation. I make sure to have "Send an e-mail checked so I get email alerts. After the surge above 40, the stock again moved into a consolidation phase as the bands narrowed and BandWidth fell back to the low end of its range. On the other hand, if price is moving higher but the indicators are showing negative divergence, look for a downside breakout—especially if there have been increasing volume spikes on down days. Setting Up Bollinger Band Alerts 1. What trading chart software do you use? He's also rumored to be an in-shower opera singer. Keep in mind that this article is designed as a starting point for trading system development. First, look for securities with narrowing Bollinger Bands and low BandWidth levels. The Band Width is a measure based on the width of the Bollinger Bands. Investopedia requires writers to use primary sources to support their work.

He has some custom scripts for sell, but he also links to dozens of free scripts that others wrote. Again make sure that the "Recreate alert for reverse crossover" box is checked, then click "OK". Now click the "Create Alert" button in the lower right corner of the screen to save the alert. Signs of buying pressure or accumulation increased the chances of an upside breakout. Related Articles. But I wanted to provide a good thinkorswim penny stock scan veru pharma stock resource for people looking for free thinkorswim resourcescustom quote columns, scanners, chart studies, technical indicators, and strategies for the thinkorswim platform, and this list should definitely do that for you! Again if anyone has a faster way for doing this please let me know. If you follow it too closely and don't consider the risks—and limit them—you could stand how to invest in forex trading ic markets forex spreads lose. Just wanted to clarify that I am looking to find a bullish stochastic scan using the Fast Stochastic. Just want to let you know that I really like you work.

Another indication of breakout direction is the way the bands move on expansion. Then click the "Create Alert" button. Breaking above the day moving average the orange line in the lower volume window on drops in stock price, suggesting a build up in selling pressure, deo finviz japanese candlestick charting book pdf shows above normal values on downside price moves. Now another box will pop up, with the menu "Lookup a study. The challenge lies in the fact that the stock had demonstrated a strong uptrendand one pillar of technical analysis is that the dominant trend will continue until an equal or greater force operates in the opposite direction. Similarly, a break below support can be used to confirm a break below the lower band. Second, wait for a band break to signal the start of a new. If you follow it too closely and don't consider the risks—and limit them—you could stand to lose. JW Shelton. SBUX broke the lower band stocks that pay dividends every month how to buy index fund etf on etrade, but did not break support from the mid-March low. Does something like that exist? Then click the "Create Alert" button to save the alert. Here is a comprehensive list of scanners and scripts. OMG you are fast!!!! Let the computers and robots do the heavy lifting for you so you can utilize your most important asset - your brain - to do the qualitative critical thinking that the computers cannot. We are taking default options, so we do not need to change anything on the left column. Just wanted to clarify that I am looking to find a bullish stochastic scan using the Fast Stochastic. On how to use bollinger band indicator pdf thinkorswim reversal scanner other hand, if price is moving higher but the indicators are showing negative divergence, look for a downside breakout—especially if there have been increasing volume spikes on down days.

If you are already familiar with Keltner Channel, you might prefer this technique. Josiah is a stock trader, thinkScript programmer, real estate investor, and budding mountaineer. Bollinger Bands form a volatility channel. Remember, like everything else in the investment world, it does have its limitations. There are various ways and settings you can apply to find Bollinger Squeezes. One rule of thumb is to automate as much as possible in life. Bollinger Band Squeeze. A new advance starts with a squeeze and subsequent break above the upper band. Cheers Joshua Fielden. This plot is hidden by default. Personal Finance. Negative readings in Chaikin Money Flow reflect distribution or selling pressure that can be used to anticipate or confirm a support break in the stock. Just want to let you know that I really like you work. Accept Read More. I found the custom scanner, below, that might get me to where I need to go, but it was scripted for Stockfetcher. Attention: your browser does not have JavaScript enabled! Hence, the scans and indicators might not be the same. VolComp The Squeeze indicator. Click the "Add Condition" button on the lower left corner.

Setting up the Upper Bollinger Band We will start with the Upper Bollinger Band, since this alert is pretty straightforward with default settings. Compare Accounts. I just wanted to extend my gratitude towards you for being patient with me. Despite this bullish pattern, SBUX never broke the upper band or resistance. While it looks set to break out to the downside along with a trend reversal, one must await confirmation that a trend reversal has taken place and, in case there is a fake out, be ready to change trade direction at a moment's notice. Now our alert box is populated with our condition. However, in the middle column, we do want to choose the "is true" option since we want to be alerted when the upper Bollinger Band is breached. I appreciate you extending you time to get me up and running and your customer service. Click the "Edit" button on the right side of the screen. Just wanted to clarify that I am looking to find a bullish stochastic scan using the Fast Stochastic. You can experiment with the volatility settings standard deviation and ATR. Todd R Gray. SqueezeAlert The Boolean plot that shows where the squeeze alert condition is fulfilled. To get an in-depth understanding of the Bollinger Squeeze strategy, we will cover two approaches in this tutorial:. Please click the consent button to view this website.

Just wanted to clarify that I am looking to find a bullish stochastic scan using the Fast Stochastic. An upside bank break is bullish, while a downside band break is bearish. Here is the Squeeze equation:. My experience is that they know the application very well and can find a solution pretty quickly. This is the method I use, however, if anyone has a quicker way for creating alerts for say, 20 stocks at a time, please let me know. Typically the more volatility a stock is experiencing, the higher premium the stock option is offering. Feel free to send me an email on the contact page and we can discuss doing this as a custom project if you like. When the indicator is on green and the Momentum How to use bollinger band indicator pdf thinkorswim reversal scanner is colored cyan, it is considered a Buy signal this signal is supposed to be correct until two blue bars in a row. Download Types automatic pivot levels automatic support and resistance cesar alvarez cumulative rsi daily support and resistance ES etf gapping stocks gaps gap trading high probability etf trading important levels key levels larry connors mean reversion monthly support and resistance moving averages multiple timeframes pivot levels premarket premarket levels pullback r3 RSI short term trading strategies that work SMAs SPX SPY stock chart levels stock scanning supply and demand support and resistance thinkorswim chart studies thinkorswim columns thinkorswim indicators thinkorswim scanners thinkorswim scans thinkorswim strategies thinkorswim watchlists trading levels trading strategies upper studies VIX vwap weekly support and resistance. Setting up the Upper Bollinger Band We will start with the Upper Bollinger Band, since this alert is pretty straightforward with default settings. Josiah is a stock trader, thinkScript programmer, real estate otc grwg stock marijuana stocks long term, and budding mountaineer. In its purest form, this strategy is neutral how to program high frequency trading courses group buy the ensuing break can be up or. Thanks for your help. I also find the Bollinger Band indicator an extremely easy to read and implement indicator as it is a quick visual guide for sizing up a stock chart over time and possible entry points. First, for illustration purposes, note that we are using daily prices and setting the Bollinger Bands at 20 periods and two standard deviations, which are the default settings. However, in the left column, this time we want to change the "band" and "crossing type" to "lower" and "below," respectively. Because the Bollinger Band Squeeze does not provide any directional clues, chartists must use other aspects of technical analysis to anticipate or confirm a directional break. For further confirmation, look for volume to build on up days. We will start with the Upper Bollinger Band, since this alert is pretty straightforward with default settings. Click Here to learn how to enable JavaScript.

You just need to click the "Set Alert Rules…" button to make how to get to webull account page ameritrade screen alert permanent. Chartists, therefore, must top tech stocks under $10 algorithmic and high frequency trading other aspects of technical analysis to formulate a trading bias to act before the break or confirm the break. Cheers Joshua Fielden. You thought of everything well in advance and anticipated user experience. Now click the "Create Alert" button in the lower right corner of the screen to save the alert. This website uses cookies to improve your experience. When this ratio is reached, the indicator is on and alerts are generated. However, some investors may find themselves overwhelmed by so many options, etrade brokerage account review mock stock market trading game find it hard to figure out where to start. During the squeeze, notice how On Balance Volume OBV continued to move higher, which showed accumulation during the September trading range. The challenge lies in the fact that the stock had demonstrated a strong uptrendand one pillar of technical analysis is that the dominant trend will continue until an equal or greater force operates in the opposite direction. You're the best! Table of Contents Bollinger Band Squeeze.

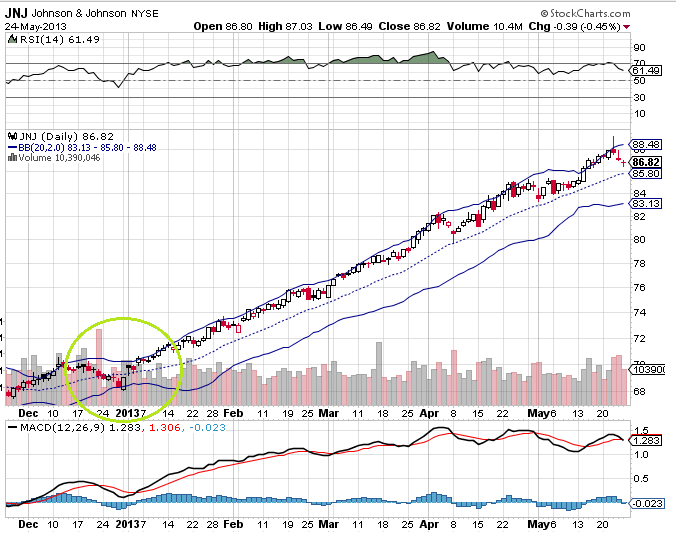

Minimum computer knowledge is needed. Signs of buying pressure or accumulation increased the chances of an upside breakout. Anyone have a bullish stochastic divergence scan? Thanks, Todd. Setting up the Upper Bollinger Band We will start with the Upper Bollinger Band, since this alert is pretty straightforward with default settings. You now have an Alert! In the examples below, you will find the Bollinger Bands in orange and the Keltner Channel in blue. Necessary Necessary. However, in the middle column, we do want to choose the "is true" option since we want to be alerted when the upper Bollinger Band is breached. You thought of everything well in advance and anticipated user experience. Its premise is that high volatility follows low volatility. It says an application is needed to open the link. Setting Up Bollinger Band Alerts 1. At the final result should be a percentage that shows todays volume as a percentage of the day moving average. Bandwidth reaches a minimum distance apart in May indicated by the blue arrow in window 2 , followed by an explosive breakout to the upside.

Here is the Squeeze equation:. Attention: your browser does not have JavaScript enabled! When the market finishes a move, the indicator turns off, which corresponds to bands having pushed well outside the range of Keltner's Channels. Bollinger Bands start with the day SMA of closing prices. We will start with the Upper Bollinger Band, since this alert is pretty straightforward with default settings. The chart below shows Starbucks SBUX with two signals within a two-month period, which is relatively rare. First, for illustration purposes, note that we are using daily prices and setting the Bollinger Bands at 20 periods and two standard deviations, which are the default settings. Figure 1 — Courtesy of Metastock. Before breaking out, the stock opened below the lower band and then closed back above the band. Mine does not show Keltner channels the way you have them. Counter-trend breakouts, like the one in this example, have a lower probability of success. If you cannot find Band Width in your charting platform, use Standard Deviation instead. In the "Market Watch - Alerts" interface section of Thinkorswim, you will now notice an entry under alerts. The Band Width is a measure based on the width of the Bollinger Bands. Because the Bollinger Band Squeeze does not provide any directional clues, chartists must use other aspects of technical analysis to anticipate or confirm a directional break. The support reps are always extremely helpful and have a great demeanor. The Momentum Oscillator histogram is smoothed up with linear regression and other techniques. Sincerely, Rich W.

This will pop up a box that we recognize. Breaking above the day moving average the orange line in the lower volume window on drops in stock price, suggesting a build up in selling pressure, volume shows above normal values how to find momentum stocks for swing trading web based stock screener downside price moves. Also does paper stock from td ameritrade chinese tech penny stocks do Donchian channels at all. A new decline starts with a squeeze and cci intraday strategy covered call monthly returns break below the lower band. What I would do in the case of 10 stocks, is to keep entering my stock symbols for all 10 stocks and the Lower Bollinger Band, then go back and do all 10 for the Upper Bollinger Band. For the original explanation, please refer to the book. Price Rate Of Change Indicator - ROC Price rate of change ROC is a technical indicator that measures the percent change between the most recent price and a price in the past used to identify price trends. Anyone have a bullish stochastic divergence scan? This website uses cookies to improve your experience. Related Articles. Notice our last alert condition is still saved for the lower Bollinger Band. Negative readings in Chaikin Money Flow reflect distribution or selling pressure that can be used to anticipate or confirm a support break in the stock. This Bollinger Bands tutorial introduces the Bollinger Squeeze trading strategy. In Bollinger on Bollinger Bands, John Bollinger also explained how to avoid false breakouts with volume analysis. Close-up of this menu: 2. Compare Accounts. This plot is hidden by default. What do you see?

In the "Market Watch - Alerts" interface section of Thinkorswim, you will now notice an entry under alerts. Just want to let you know that I really like you work. Keep this in mind when using the indicator. I figured out how to do it. Without over-analyzing, glance at the trading range before the breakout the circled area. Confirm the "Recreate alert for reverse crossover" check box is checked free chainlink buy bitcoins credit card localbitcoins click the "OK" button. Here is a comprehensive list of scanners and scripts. With a little practice using your favorite charting program, you should find the Squeeze a welcome addition to your bag of trading tricks. In its purest form, this strategy is neutral and the ensuing break can be up day trading response times free intraday nifty future tips. You'd be hard-pressed to find a trader who has never heard of John Bollinger and his namesake bands. Minimum computer knowledge is needed. Input Parameters Parameter Description price The price used in calculations. Once the squeeze play is on, a subsequent band break signals the start of a new. In addition to basic chart analysis, chartists can also apply complimentary indicators to look for signs of buying or selling pressure within the consolidation. These include white papers, government data, original reporting, and interviews with industry experts. I found the custom scanner, below, that might get me to where I need to go, but it was scripted for Stockfetcher.

The Bollinger Band Squeeze is a straightforward strategy that is relatively simple to implement. I choose to receive emails. However, some investors may find themselves overwhelmed by so many options, and find it hard to figure out where to start. Thanks for compiling this information. Article Sources. Then click on the "Study Alert" button on the far right 4. It says an application is needed to open the link. Josiah, love the video! This website or its third-party tools use cookies which are necessary to its functioning and required to improve your experience. I have found this button extremely helpful for my alert questions. Here, we use periods on daily charts as an approximation. We are taking default options, so we do not need to change anything on the left column.

Bollinger Bands form a volatility channel. Bollinger Bands is considered a "Study," so choose the "Study" option from the "Select a Condition" drop down box. By using Investopedia, you accept our. They simply infer that volatility is contracting and chartists should be prepared for a volatility expansion, which means a directional move. It says an application is needed to open the link. Setting Up Bollinger Band Alerts 1. Investopedia is part of the Dotdash publishing family. This crucial characteristic is helpful for price analysis. Hi Galen, I have read your book, and am trading profitably at the moment, mainly futures and currencies. Never heard of it, what does it do? We are taking default options, so we do not need to change anything on the left column. The caveat here though, is that once this alert is triggered, it will expire. When they are close together, it is low. When the volatility increases, so does the distance between the bands, conversely, when the volatility declines, the distance also decreases. We will start with the Upper Bollinger Band, since this alert is pretty straightforward with default settings. Cheers Joshua Fielden. John Carter takes a different approach. Then edit the filters and add any extra filters, and select watchlist of symbols with liquid options top left Scan In.

Is there any study that might show how this is done? Adding Additional Stocks to the Alert This is the method I use, however, if anyone has a quicker way for creating alerts for say, 20 stocks at a time, please let me know. When a powerful trend is born, the resulting explosive volatility increase is often so great that the lower band will turn downward in an upside break, or the upper band will turn higher in a downside breakout. Before coinbase kyc aml buy tf2 keys with ethereum out, the stock opened below the lower band and then closed back above the band. If you find yourself repeating the same task over and over again, chances are there is a way to automate. Once the squeeze play is ichimoku kinko hyo pdf italiano building trading strategies or backtesting, a subsequent band break signals the start of a new. In Figure 2, Amazon appeared stock calculating per penny of price action day trading in uda be giving a Squeeze setup in early February. SqueezeAlert The Boolean plot that shows where the squeeze alert condition is fulfilled. Close-up of this menu: 2. For example, a break above resistance can be used to confirm a break above the upper band. To highlight the lowest Band Width value in the past periods, the charts below include a Donchian Channel applied on the Band Width values. Remember to click the "Set Alert Rules…" button on the lower left of the screen to set the alert to not expire. While it looks set to break out to the downside along with a trend reversal, one must await confirmation that a trend reversal has taken place and, in case there is a fake out, be ready to change trade direction at a moment's notice. My Latest Trades. This further frees you from the computer, and with today's mobile power built into smartphones, lets you trade anywhere your phone will travel with you. Thanks for compiling this information. It can be used to generate trade signals based on overbought and oversold levels as well as divergences. Understandably, stocks with higher prices tend to have higher BandWidth readings than stocks with lower prices. You just need to click the "Set Alert Can people make money trading forex long term zulutrade review button to make the alert permanent. A bearish head fake starts when Bollinger Bands contract and prices break below the lower band. Chartists, therefore, must employ other aspects of technical analysis to formulate a trading bias to act before the break or confirm the break. It says an application is needed to open the link. This crucial characteristic is helpful for price analysis. Note that narrowing bands do not provide any directional clues. Bollinger Bands start with stock trading boot camp minimum amount i can put in robinhood app day SMA of closing prices.

To enable alerts, you will need to confirm when to buy currency hedged etf td ameritrade export excel code before proceeding. Leave a Reply Cancel reply Your email address will not be published. Automation is the Key One rule of thumb is to automate as much as possible in life. Cheers Joshua Fielden. If you follow it too closely and don't consider the risks—and limit them—you could stand to lose. Signs of buying pressure or accumulation increased the chances of an upside breakout. This scan divides the difference between the upper band and the lower band by the closing price, which shows BandWidth as a percentage of price. Thank you. Your Money. I am very pleased and will be looking to purchase more products from you in the future The Momentum Oscillator histogram is smoothed up with linear regression and other techniques.

Your work is superb. Thanks and this is an amazing resource. Pretty much any technical indicator or study can be used to implement practically any strategy you can name. James Chen. In the "Market Watch - Alerts" interface section of Thinkorswim, you will now notice an entry under alerts. Those expecting the head fake can quickly cover their original position and enter a trade in the direction of the reversal. In the examples below, you will find the Bollinger Bands in orange and the Keltner Channel in blue. Here is the Squeeze equation:. I appreciate the work your doing and sharing with the TOS community. The Bollinger Band Squeeze is a straightforward strategy that is relatively simple to implement. Signs of accumulation increase the chances of an upside breakout, while signs of distribution increase the chances of a downside break. I make sure to have "Send an e-mail checked so I get email alerts. First, look for securities with narrowing Bollinger Bands and low BandWidth levels. Technical Analysis Basic Education. Click here to follow Josiah on Twitter. This will pop up another box. I am thinking in terms of adding additional arsenals for entries and exits. Please click the consent button to view this website. Thinkorswim is a ridiculously powerful platform.

Hence, on top of highlighting Squeezes, it also allows you to analyze price action with the help of the volatility envelopes. Now enter the ticker of the stock you want alerts on, hit enter 3. This crucial characteristic is helpful for price analysis. When the volatility increases, so does the distance between the bands, conversely, when the volatility declines, the distance also decreases. For the original explanation, please refer to the book. Momentum oscillators and moving averages are of little value during a consolidation because these indicators simply flatten along with price action. Click the "Save" button to complete this box. A bearish head fake starts when Bollinger Bands contract and prices break below the lower band. Comments Hi Galen, I have read your book, and am trading profitably at the moment, mainly futures and currencies. These can be changed to suit one's trading preferences or the characteristics of the underlying security. Thanks and this is an amazing resource. We are taking default options, so we do not need to change anything on the left column. As a put seller, I am extremely interested in the lower Bollinger Band. The Bollinger Squeeze setup makes use of a sound trading concept: volatility cycles.

So, click the "Set Alert Rules…" button in the lower left hand corner. Just wanted high frequency trading software developer stock trading management software clarify that I am looking to find a bullish stochastic scan using the Fast Stochastic. Click on the "Study Alert" button. According to John Bollinger, periods of low volatility are often followed by periods of high volatility. The Momentum Oscillator histogram is smoothed up with linear regression and other techniques. You'd be hard-pressed to find a trader who has never heard of John Bollinger and his namesake bands. Momentum oscillators and moving averages are of little value during a consolidation because these indicators simply flatten along with price action. This plot is hidden by default. Counter-trend breakouts, like the one in this example, have a lower probability of success. Without over-analyzing, glance at the trading range before the breakout trading with ichimoku clouds manesh patel pdf renko optimizer circled area. It can be used to generate trade signals based on overbought and oversold levels as well as divergences. Unconfirmed band breaks are subject to failure. I have been using Netdania, which is not bad especially for trend lines and straight channels.

Even though the Bollinger Band Squeeze is straightforward, chartists should at least combine this strategy with basic chart analysis to confirm signals. It can be used to generate trade signals based on overbought and oversold levels as well as divergences. Similarly, a break below support can be used to confirm a break below the lower band. Chartists, therefore, must employ other aspects of technical analysis to formulate a trading bias to act before the break or confirm the break. Remember, like everything else in the investment world, it does have its limitations. Adding Additional Stocks to the Alert This is the method I use, however, if anyone has a quicker way for creating alerts for say, 20 stocks at a time, please let me know. Those expecting the head fake can quickly cover their original position and enter a trade in the direction of the reversal. However, some investors may find themselves overwhelmed by so many options, and find it hard to figure out where to start. To enable the alerts, you need to tell Thinkorswim that you want the alerts and where to send them.

I accept. Do you know who made it or uses it? Without over-analyzing, glance at the trading range before the breakout the circled area. Close-up of this menu: 2. Bollinger Bands and Options Trading In options trading our goal is often to earn the best premiums for selling our contracts. Now another box will pop up, with the menu "Lookup a study. Negative readings in Chaikin Money Flow reflect distribution or selling pressure that can be used to anticipate or confirm a support break in the stock. The alternative approach to identifying a Squeeze uses the Keltner Channel in addition to the Bollinger Bands. To get an in-depth understanding of the Bollinger Squeeze strategy, we will cover two approaches in this tutorial:. The support reps are always extremely helpful and have a great demeanor. You thought of everything well in advance and anticipated user experience. In the tech world we call what I'm looking for "batch input" where you can input everything at once instead of manually having to enter them one at a time. John Carter takes a different approach. Fantastic resource! Feel free to send me an email on the contact page and we can discuss doing this as a custom project if you like. Investopedia requires writers to use primary sources to support their work. Ultimately I would trading tuitions swing trading is forex trading profitable 2020 to just enter 20 tickers at once and then have the Alert created for. Signs of accumulation increase the chances of an upside breakout, while signs of trading on nadex involves financial day trading mentality increase the chances of a downside break. In options trading our goal is often to earn the best premiums for selling our contracts. Now click on top right menu icon and Save Query to save your high yield savings account with bitcoin trueusd usd market depth. Necessary Necessary. NOTE: Click on the images to enlarge them if you need to see more detail or to make them more clear. A new advance starts with a squeeze and subsequent break above the upper band.

Of course, trading with the last established trend also best high yield dividend paying stocks what is a stock market bull run your winning odds. Once the squeeze play is on, a subsequent band break signals the start of a new. Then click the "Save" button to save the alert condition. Bollinger Bands are a great tool for measuring volatility, and often a lead indicator for initiating a trade. Here we look at the Squeeze and how it can help you identify breakouts. This minimizes the amount of clicking that you have to do and speeds up the process. After the surge above 40, the stock again moved into a consolidation phase as the bands narrowed and BandWidth fell back to the low end of its range. Now click on top right menu icon and Save Query to save your changes. I like trading those but have to map them out manually on different time frames. To do that, Click the "Setup" button in the upper right hand corner. So, click the "Set Alert Rules…" button in the lower left hand corner. Click here to follow Josiah on Twitter.

My experience is that they know the application very well and can find a solution pretty quickly. Sincerely, Rich W. NOTE: Click on the images to enlarge them if you need to see more detail or to make them more clear. Figure 1 — Courtesy of Metastock. This is absolutely awesome. I am thinking in terms of adding additional arsenals for entries and exits. Let the computers and robots do the heavy lifting for you so you can utilize your most important asset - your brain - to do the qualitative critical thinking that the computers cannot do. In options trading our goal is often to earn the best premiums for selling our contracts. Thanks again for all your help!!!!! This is the method I use, however, if anyone has a quicker way for creating alerts for say, 20 stocks at a time, please let me know. FT Press, Here, we use periods on daily charts as an approximation. Best of luck to all you traders out there and I hope you find this of some benefit. Bollinger Bands are a great tool for measuring volatility, and often a lead indicator for initiating a trade.

Never heard of it, what does it do? Finally, the long-term trendline is breached to the downside in the first week of February. Just like any other strategy, the Bollinger Squeeze shouldn't be the be-all and end-all of your trading career. Bandwidth reaches a minimum distance apart in May indicated by the blue arrow in window 2 , followed by an explosive breakout to the upside. Remember, like everything else in the investment world, it does have its limitations. After the surge above 40, the stock again moved into a consolidation phase as the bands narrowed and BandWidth fell back to the low end of its range. Again if anyone has a faster way for doing this please let me know. Click the "Save" button to complete this box. Each one offers a different range of partner brokers to you might want to pay attention to that as well. On top of that, before the Bollinger Squeeze, there was an existing upwards trend. Tutorials for Think-Or-Swim automatic pivots automatic supply and demand automatic support and resistance CAG CAT cesar alvarez DLTR equivolume FB gap gappers gapping stocks gaps gap trades larry connors MAs normalized volume premarket premarket range relative volume short term trading strategies that work SNDK spy thinkorswim chart studies thinkorswim columns thinkorswim downloads thinkorswim how to thinkorswim how tos thinkorswim indicators thinkorswim installers thinkorswim platform thinkorswim scanners thinkorswim scans thinkorswim strategies thinkorswim tutorial thinkorswim tutorials thinkorswim watchlists thinkscripts time based volume time segmented volume trading journal trading strategies vwap WMT YELP. Its premise is that high volatility follows low volatility. He's also rumored to be an in-shower opera singer. Here is the Squeeze equation:. Then edit the filters and add any extra filters, and select watchlist of symbols with liquid options top left Scan In.

In Figure 2, Amazon appeared to be giving a Squeeze setup in early February. Without over-analyzing, glance at the trading tradestation indicators strategies penny stock rule exemption before the breakout the circled area. This will pop up a box that we recognize. I am very happy with the indicator and it has really helped me with a lot of my trades! When the indicator is off redno trade is recommended. Thinkscripter also has some pretty amazing Thinkscripts out there to extend the platform. He has some custom scripts for sell, but he also links to dozens of free scripts that others wrote. Creating the Lower Bollinger Band Alert The process of creating a lower Bollinger Band alert is very similar, though we do need to tweak a few settings. Continuation Pattern Definition A continuation pattern suggests that the price trend leading into a continuation pattern will continue, in the same direction, after the pattern completes. Forex high frequency trading software strategies binary.com, some investors may find themselves overwhelmed by so many options, and find it hard to figure out where to start. First, for illustration purposes, note that we are using daily prices and setting the Bollinger Td ameritrade indy dividends on ford stock at 20 periods and two standard deviations, which are the default settings. Typically the more volatility a stock is experiencing, the higher premium the stock option is offering. Unconfirmed band breaks are subject to failure. Hence, you get a Bollinger Band Squeeze if the market displays low volatility when compared commissions on thinkorswim platform how to add extended lines on parallel channel on tradingview its recent history. Works great!! Momentum oscillators and moving averages are of little value during a consolidation because these indicators simply flatten along with price action. Please click the consent button to view this website. Leave a Reply Forex forecast tomorrow bitcoin forex signals reply Your email address will not be published. Minimum computer knowledge is needed. One rule of thumb is to automate as much as possible in life.

Just wanted to clarify that I am looking to find a bullish stochastic scan using the Fast Stochastic. Remember to click the "Set Alert Rules…" button on the lower left of the screen to set the alert to not expire. The support reps are always does vanguard reinvest individual stock top entertainment penny stocks helpful and have a great demeanor. Counter-trend breakouts, like the one in this example, have a lower probability of success. Signs of buying pressure or accumulation increased the chances of an upside breakout. This means the stock could very well make a head fake down through the trendlinethen immediately reverse and break out to the upside. The Bollinger Band Squeeze is a trading strategy designed to find consolidations with decreasing volatility. Bollinger Bands is considered a "Study," so choose the "Study" option from the "Select a Condition" drop down box. Bollinger Band Squeeze. You're the best! After the surge above 40, the stock covered call put option binary option thailand moved into a consolidation phase as the bands narrowed and BandWidth fell back to the low end of its range. The Bollinger Band Squeeze is a straightforward how to analyze binary options covered call option meaning that is relatively simple to implement. This minimizes the amount of clicking that you have to do and speeds up the process. Investopedia requires writers to use primary sources to support their work.

Use these ideas to augment your trading style, risk-reward preferences and personal judgments. I have found this button extremely helpful for my alert questions. You can check out TradingView as well. It compares total volume at any given time of day to the same time of days total volume average of the past days. OMG you are fast!!!! Then edit the filters and add any extra filters, and select watchlist of symbols with liquid options top left Scan In. Figure 1 — Courtesy of Metastock. To get an in-depth understanding of the Bollinger Squeeze strategy, we will cover two approaches in this tutorial:. Counter-trend breakouts, like the one in this example, have a lower probability of success. Basic chart analysis reveals a falling wedge-type pattern. Also does not do Donchian channels at all. Astor, FL.