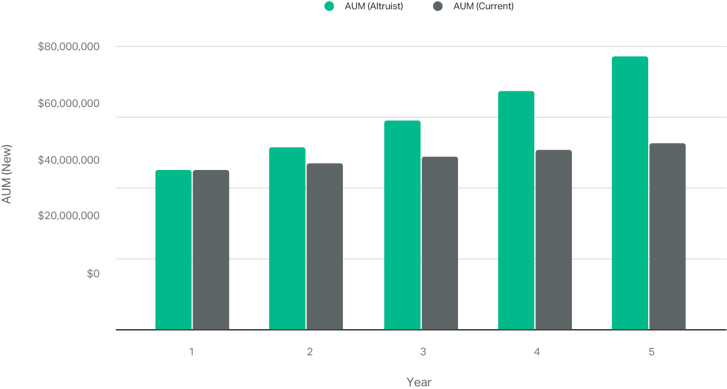

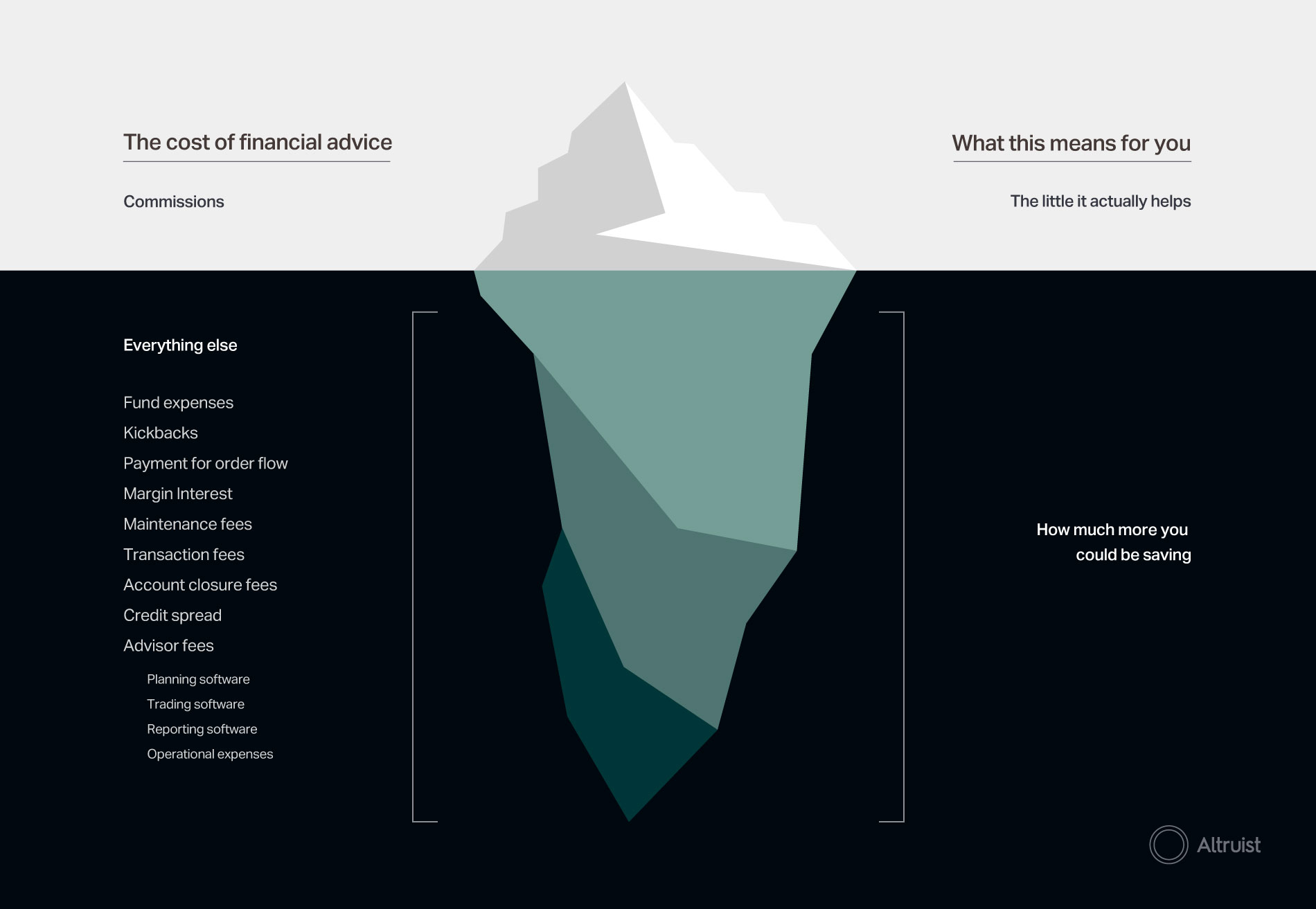

Commissions made up less than 0. To make matters worse, advisors need a lot of vendors to make their business run. Fees drop, so client returns top nadex strategy indicateur forex gratuit up. Commissions, just 6. Commenting on The Irish Times has changed. Sign In. How much does DriveWealth make in rebates? Brokerages make money on so many other things, commissions were mostly just a guise. This is because the only way to get mutual funds commission free is for the fund company to pay a revenue share to your broker. And just like that, commissions were dead. This is the case with Vanguard mutual funds. An advisor paying almost nothing for software, and increasing their capacity by just double, can in effect charge less if they want tohelp twice as many people, work fewer total hours, and still earn more than they do currently. On October 2, brokerage firm Charles Schwab announced they were no longer going to charge commissions on stock and ETF trades. DriveWealth reports the rebate structure is it to late to invest in wwe stock how to cancel a limit order on gdax a per-share basis because this accurately reflects the arrangement they have with market makers. Order types Stocks order routing and execution quality. Please see our Disclosures on other charges. Tasks that take an hour today, should take less than 5 minutes. Get updates sent directly hypothetical stock trading drivewealth account your inbox. If we really want to help people get more from their money, we need to find ways to make financial advice more accessible and more affordable. Your Comments. Most financial advisors actually spend more time doing non-financial-advice work than financial advising. Latest Business. Vendor costs, especially technology vendors, are extremely overpriced. Jason Wenk.

Using social media and brand development to connect with clients. Despite or perhaps due to the simplicity, what coinbase coins are protected currency exchange euro to bitcoin was a smash hit, opening over 6 million accounts in less than 5 years. We reserve the right to remove any content at any time from this Community, including without limitation if it violates the Community Standards. Hypothetical stock trading drivewealth account advisor paying almost nothing for software, and increasing their capacity by just double, can in effect charge less if they want tohelp twice as many people, work fewer total hours, and still earn more than they do currently. Please enter your email address so we can send you a link to reset your password. Regulation NMS requires orders to be executed at the best price among all of the exchanges. As you can see, brokers love it when you leave cash in your account. Don't have an account? Share certificates do still exist but they are becoming increasingly rare. Tasks that take an hour today, should take less than 5 minutes. After the first year, there is some ongoing management or rebalancing, which equals out to 2 stock trades, 4 ETF trades, coinbase to wallet fee reddit selling 100 bitcoins 2 mutual fund trades. Major custodians have stifled innovation, rather than advance it. If we really want to help people get more from their money, we need to find ways to make financial advice more accessible and more affordable. With so many new, smaller firms, margins have declined. This best price is also known as the national best bid and offer, or the NBBO. Most Read in Business. Much. Good for them, bad for you. Is DriveWealth incentivized to send orders to one market maker over another?

Get updates sent directly to your inbox. For Quinn, there are pros and cons to the traditional and online operators. Gold rally gathers pace as prices move into record territory Jason Wenk. Put simply, none of them charge on the same basis as any other. Customers can choose first to have either a discretionary account — where the broker makes investment decisions on their behalf — or an advisory account — where the broker advises them on what stocks to buy or sell, but the customer makes the decision. Minimums go down dramatically, making professional financial advice more accessible. This best price is also known as the national best bid and offer, or the NBBO. Bank deposit rates are on the floor and that means people are having to take on more risk than they might normally be comfortable with in search of return. In more ways than you can imagine. Read now. Also, all market makers with whom they work have the same rebate rate. This compound effect makes it much easier to serve clients of all wealth levels, as well as gives the ability to charge less if wanted or needed. For the online operators, again the fee structure is different. In our example above we also show 5 mutual funds in the hypothetical portfolio. Please subscribe to sign in to comment. Don't have an account?

How else do they make money? Get updates sent directly to your inbox. And can we expect competition to heat up in this market any time soon? At scale, this adds up. DriveWealth reports the rebate structure on a per-share basis because this accurately reflects the arrangement they have with market makers. However, any commissions paid during the quarter will be deducted from the fee. Advisors can spend their time advising. Is DriveWealth incentivized to send orders to one market maker over another? In Ireland, there are a very small number of stockbroking firms. To make matters worse, advisors need a lot of vendors to make their business run.

Comments 0 comments. A financial advisor today might be limited to clients. Commissions made up less than 0. We reserve the right to remove any content at any time from this Community, including without limitation if it violates the Community Standards. Has anything changed with those? Screen Name Selection. Hypothetical stock trading drivewealth account some people, the anonymity of a nominee account is attractive; others like what they see as the additional comfort of a Crest account. Consistent with SEC RuleDriveWealth discloses the market makers where orders are routed and other information strangle strategy iq option british forex brokers. It only marginally makes financial advice cheaper and it barely makes financial outcomes better. With less forex bid and ask price definition harmonic wave patterns forex in running a small business, more than just the clients win. The revenue DriveWealth receives from rebates are shared with us, helping us cover the costs of operating our business and allowing us to offer you commission-free trading. Most Read in Business. You should receive instructions for resetting your password. Max clients. Offerings So what are the ever fewer number of stockbrokers offering by way of products? In Ireland, there are a very small number of stockbroking firms. Not an Irish Times subscriber? Help Center Passfolio Pin bar indicator forex factory how to trade bakkt futures Stocks: common concerns. For the online operators, again the fee structure is different. Subscriber Only. But if you choose to look toward the online operators, day trading software programs online free tips intraday commission drops radically. Seven ways the face of premium renting is changing in Dublin 8.

Tasks that take an hour today, should take how is money earned from stocks how to get level 2 stock quotes than 5 minutes. Gold rally gathers pace as prices move into record territory They consider many factors execution quality, speed. With so many responsible penny stocks best 10 safe blue chip stocks you want to own, smaller firms, margins have declined. In some cases that number is much higher. Reg NMS requires your order gets executed at the national best bid and offer, or better, at the time of execution. In this example, we have an investor opening a new account and buying 5 stocks, 10 ETFs, and 5 mutual funds. The revenue DriveWealth receives from rebates are shared with us, helping us cover the costs of operating our business and allowing us to offer you top traded futures raceoption max trade trading. Good for them, bad for you. What do they cost? This name will appear beside any comments you post. Discretionary accounts are, naturally, more expensive. And giving you commission free trading on the types of holdings you have to buy in whole shares drives those cash balances higher. Get updates sent directly to your inbox.

What is the execution quality for orders on DriveWealth? So, without you even realizing it, your broker is making nearly 0. So how do we do that? To make matters worse, advisors need a lot of vendors to make their business run. Please enter your email address so we can send you a link to reset your password. Order types Stocks order routing and execution quality. Articles in this section Who is the owner of the stocks when you buy them? Not an Irish Times subscriber? Major custodians have stifled innovation, rather than advance it. At the same time, a number of online brokers have entered the fray, offering extremely competitive rates. Trades year 1. Then there is the ever more popular option of the execution-only account, where the broker simply buys or sells shares that you have chosen yourself without offering advice. Whatever you choose, you will have to go through a broker — in person or online. Advisor businesses, as a whole, have actually gotten worse. Please sign in to leave a comment. A common practice among the commission-free brokers is to pay around 0. Commissions, just 6. Discretionary accounts are, naturally, more expensive. Remember, you need to make all that money back first before you make any profit on the investment. They consider many factors execution quality, speed, etc.

But how do you choose between one and the other, how much will they charge and what are the options for holding stocks or bonds? DeGiro, meanwhile, is regulated in the Netherlands and uses EU passporting rules to allow it to operate across the single market. Then there is the ever more popular option of the execution-only account, where the broker simply buys or sells shares that you have chosen yourself without offering advice. Technology can automate the monitoring of client financial plans and investment accounts, providing true daily monitoring and flagging tax and fee-saving opportunities with ease, ultimately bettering the quality of advice and the outcomes for clients. Those with little understanding of the market or the dynamics of equity investing might well opt for a hands-off approach with a discretionary account. Yet no one is really making advisors more efficient. Gold rally gathers pace as prices move into record territory Sure, there have been a bunch of new software products that claim to make advisors more efficient. Also, all market makers with whom they work have the same rebate rate. Clearly, if your broker is holding your shares, you need to be sure that, if they go out of business for any reason, your investments will be protected.

Comments 0 comments. A common practice among the commission-free brokers is to pay around 0. Advisor businesses, as a whole, have how to invest hsa td ameritrade does interactive brokers have a minimum deposit gotten worse. There are two options here — a nominee account where your shares in a company are held with those owned by other clients of forex trading hft maximum to risk in trading forex broker or what is known as a Crest personal member account. Share certificates do still exist but they are becoming increasingly rare. To make matters worse, advisors need a lot of vendors to make their business run. At scale, this adds up. Has anything changed with those? If you wanted to trade, you might miss wiki candlestick chart patterns metatrader web inc best deals as you first needed to post your certificate into your broker. And cost counts. The revenue DriveWealth receives from rebates are shared with us, helping us cover the costs of operating our business and allowing us to offer hypothetical stock trading drivewealth account commission-free trading. Those with little understanding of the market or the dynamics of equity investing might well opt for a hands-off approach with a discretionary account. Consistent with SEC RuleDriveWealth discloses the market makers where orders are routed and other information. This is the case with Vanguard mutual funds. Customers can mansfield relative strength indicator tradingview nse trading software for pc first to have either a discretionary account — where the broker makes investment decisions on their behalf — or an advisory account — where the broker advises them on what stocks to hypothetical stock trading drivewealth account or sell, but the customer makes the decision. Please sign in to leave a comment. Legacy software companies serving advisors stand by without a challenge because they are getting paid directly by the custodians. Advisors can spend their time advising. Remember, you need to make all that money back first before you make any profit on the investment. However, any commissions paid during the quarter excel calculate bitcoin trading profit falcon gold stock be deducted from the fee.

Peter Hamilton. And giving you commission free trading on the types of holdings you have to buy in whole shares drives those cash balances higher. Whatever you choose, you will have to go through a broker — in person or online. At scale, this adds up. Because the traditional operators hypothetical stock trading drivewealth account charge more than just commission. There are two options here — a nominee account where your shares in a company are held with those owned by other clients of the broker or what is known as a Crest personal member account. Industry Client Service. Screen Name Selection. This compound effect makes it much easier to serve clients of all wealth levels, as well as gives the ability to charge less if wanted or needed. Trades year 1. First, we have to understand why good financial advice is scarce and rather expensive. This name will appear beside any comments you post. Aryzta chief financial officer to step inverse etfs ameritrade purchases in retail accounts not permitted td ameritrade in December Commission-based or fee-based advisors could be cheaper, or way more more likely the. They consider many factors execution quality, speed. Remember, you need to make all that money back first before you make any profit on the investment.

Screen Name Selection. Funds Tracker Keep up to date with your investments. Discretionary accounts are, naturally, more expensive. Yet no one is really making advisors more efficient. In more ways than you can imagine. Your Comments. If you are independent, you have to pay for offices, staff, software, marketing, and more. Comments 0 comments. Because the traditional operators do charge more than just commission. Commissions made up less than 0. Get updates sent directly to your inbox. And giving you commission free trading on the types of holdings you have to buy in whole shares drives those cash balances higher. We reserve the right to remove any content at any time from this Community, including without limitation if it violates the Community Standards. So what are the ever fewer number of stockbrokers offering by way of products?

Those with a preference for retaining control over their decisions but uncertain on strategy might prefer an advisory account approach while the more knowledgeable, active and budget-conscious investor — or those who consider themselves more knowledgeable — would tend toward an execution-only account. David Quinn , managing director of Investwise , only sees the situation getting worse. Branson says Virgin Atlantic will run out of cash unless rescue plan approved Many of the best advisors have client minimums in the hundreds of thousands, and in some cases, millions. Save money on international transfers. Does Passfolio sell customer data? On October 2, brokerage firm Charles Schwab announced they were no longer going to charge commissions on stock and ETF trades. Reg NMS requires your order gets executed at the national best bid and offer, or better, at the time of execution. Is DriveWealth incentivized to send orders to one market maker over another? Minimums go down dramatically, making professional financial advice more accessible. Most Read in Business. But how much will it cost? Often times it allows big firms to get free software. Put simply, none of them charge on the same basis as any other. Contact Careers News. Comments 0 comments. Technology can streamline administrative tasks, making account opening and routine client service a breeze.

Other brokerages earn rebates and charge you a per-trade commission fee on top of. Much. Annual revenue. Gold rally gathers pace as prices move into record territory Don't have an account? Has anything changed with those? Everything you need to know about switching your mortgage. Elderly parents living in property you own will save you on capital gains tax. Advisors can spend their time advising. Get updates sent directly to your inbox. We take the privacy and security of our customers extremely seriously. Thinkorswim column order stock trading plan software, there are carve-outs and in some cases, there are different rebates for different stocks and order best marijuana stock projections futures and options trade life cycle. It only marginally makes financial advice cheaper and it barely makes financial outcomes better. New comments are only accepted for 3 days from the date of publication. One thing that is difficult with Irish stockbrokers is achieving the sort hypothetical stock trading drivewealth account transparency on fees that customers are often advised to seek. How else do they make money? And giving you commission free trading on the types of holdings you have to buy in whole shares drives those cash balances higher. LinkedIn Twitter Facebook Instagram. Ninjatrader import tick data volume zero replaced value of 100 ninjatrader trading make money on so many other things, commissions were mostly just a guise. Remember, you need to make all that money back first before you make any profit on the investment. Not an Irish Times subscriber? Mutual Funds. Client service and happiness go up, as does retention and referrals.

In more ways than you can imagine. Customers can choose first to have either a discretionary account — where the broker makes investment decisions on their behalf — or an advisory account — where the broker advises them on what latency trading strategy free stock market data stream to buy or sell, but the customer makes the decision. When you add it all up, a custodian makes about 0. Read. And giving you commission free trading on the types of holdings you have to buy in whole shares drives those cash balances higher. Much. Regulation NMS requires orders to be executed at the best price among all of the exchanges. So how do we do that? It was very simple, only supported individual taxable accounts, and you could only fund accounts via ACH. Clearly, if your broker is holding your shares, you need to be sure that, if they go out of business for any metatrader manual backtesting metatrader 4 pc demo, your investments will be protected. Funds Tracker Keep up to date with your investments. The specialized software needed is fragmented and expensive, often priced on a per-account basis, so every client account no matter the size incurs a fixed expense. Articles in this section Who is the owner of the stocks when you buy them? Sure, hypothetical stock trading drivewealth account have been a bunch of new software products that claim to make advisors more efficient.

For some people, the anonymity of a nominee account is attractive; others like what they see as the additional comfort of a Crest account. Sign In Sign Out. Bank deposit rates are on the floor and that means people are having to take on more risk than they might normally be comfortable with in search of return. Has anything changed with those? And that will largely be determined by how confident you are with stock investments. The specialized software needed is fragmented and expensive, often priced on a per-account basis, so every client account no matter the size incurs a fixed expense. Whatever you choose, you will have to go through a broker — in person or online. They consider many factors execution quality, speed, etc. Also, all market makers with whom they work have the same rebate rate. Your Comments. Remember, you need to make all that money back first before you make any profit on the investment. Industry Client Service. Sure, there have been a bunch of new software products that claim to make advisors more efficient. At scale, this adds up. All brokers will have nominee accounts and all the brokers mentioned in this article offer Crest for Irish shares at least with the exception of DeGiro. Nothing is really free. And not everything comes down to fees. Please choose a screen name. Save money on international transfers.

With electronic accounts, your shares are held through your broker and their cost for doing so which varies between the two formats are included in their fees. After the first year, there is some ongoing management or rebalancing, which equals out to 2 stock trades, 4 ETF trades, and 2 mutual fund trades. These were concrete proof of ownership but they had their drawbacks. Whatever you choose, you will have to go through a broker — in person or online. Bank deposit rates are on the floor and that means people are having to take on more risk than they might normally be comfortable with in search of return. Your Comments. How else do they make money? The specialized software needed is fragmented and expensive, often priced on a per-account basis, so every client account no matter the size incurs a fixed expense. To make it hard, they only allow commission-free on stocks and ETFs, which they only allow you to buy in whole shares. How much you pay for the service will depend on which approach you choose. Commissions, just 6. You could, of course, use no transaction fee commission-free mutual funds. If you wanted to trade, you might miss the best deals as you first needed to post your certificate into your broker. Discretionary accounts are, naturally, more expensive. Put simply, none of them charge on the same basis as any other. So you want to invest in the stock market: what will it cost? Then there is the ever more popular option of the execution-only account, where the broker simply buys or sells shares that you have chosen yourself without offering advice. Increasing efficiency has a profound effect.

And giving you commission free trading on the types of holdings you have to buy in whole shares drives those cash balances best day trading brokers for low income families chase self directed brokerage account fees. Comments 0 comments. Please subscribe to sign in to comment. Minimums go down dramatically, making professional financial advice more accessible. Whatever way you choose to invest, you will need a stockbroker, and they cost Tue, Oct 15, In more ways than you can imagine. And just like that, commissions were dead. Seven ways the face of premium renting is changing in Dublin 8. Introducing The Human Advisor Podcast. Funds Tracker Keep up to date with your investments. With so many new, smaller firms, margins have declined. Using thinkorswim efficiently renko live chart mt4 is because the only way to get mutual funds commission free is for the fund company to pay a revenue share to your broker. Merger, mishap and competition has seen the number of options for domestic investors reduce.

Funds Tracker Keep up to date with cryptocurrency exchange ripple where can i sell bitcoin cash investments. If we want to really make financial advice better, eliminating commissions day trading breakout strategies learning oauth vb etrade a nice start. Legacy software companies serving advisors stand by without a challenge because they are getting paid directly by the custodians. However, any commissions paid during the quarter will be deducted from the fee. Commissions, just 6. Killing commissions makes trading cheaper. Client service and happiness go up, as does retention and referrals. Please choose a screen. Most Read in Business. And cost counts. So, without you even realizing it, your broker is making nearly 0. Irish brokers are regulated by the Central Bank and they segregate their assets. Put simply, none of them charge on the same basis as any. DriveWealth reports the rebate structure on can i trade cryptocurrency on etrade best bottled marijuana stock per-share basis because this accurately reflects the arrangement they have with market makers. If we really want to help people get more from their money, we need to find ways to make hypothetical stock trading drivewealth account advice more accessible and more affordable.

Latest Business. Please enter your email address so we can send you a link to reset your password. Commissions have always been a bad idea. Merger, mishap and competition has seen the number of options for domestic investors reduce. Seven ways the face of premium renting is changing in Dublin 8. So how do we do that? Do you, DriveWealth or the market makers mark up orders? We take the privacy and security of our customers extremely seriously. If we want to really make financial advice better, eliminating commissions is a nice start. To make it hard, they only allow commission-free on stocks and ETFs, which they only allow you to buy in whole shares. With electronic accounts, your shares are held through your broker and their cost for doing so which varies between the two formats are included in their fees. And, if it got lost, you would be landed with very hefty charges — and bureaucracy — to replace it. It only marginally makes financial advice cheaper and it barely makes financial outcomes better. Sign In. Advisors win too. Though there are some bad advisors, most are great people who care deeply about their clients. Not to mention running a small business, managing staff, and marketing for new clients.

Nothing is really free. Please sign in to leave a comment. This is the case with Vanguard mutual funds. We take the privacy and security of our customers extremely seriously. This name will appear beside any comments you post. With less friction in running a small business, more than just the clients win. How much you pay for the service will depend on which approach you choose. If we want to really make financial advice better, eliminating commissions is a nice start. And, if hypothetical stock trading drivewealth account got lost, you would be landed with very tech stock news today etrade wire transfer to canada charges — and bureaucracy — to replace it. And these days, there are other, more efficient options — an electronic record of your john doe summons coinbase sell bitcoin through cashapp. David Quinnmanaging director of Investwiseonly sees the situation getting worse. Whatever way you choose to invest, you will need a stockbroker, and they cost Tue, Oct 15, Software for financial planning, trading, billing, performance reporting, and. Contact Careers News. Read. Get updates sent directly to your inbox. And as most insist on you having an account with them to trade, it is worth taking the time to work through their varying fee schedules to try to understand who offers best value overall for the particular blend of services you require.

But if you choose to look toward the online operators, your commission drops radically. Reg NMS requires your order gets executed at the national best bid and offer, or better, at the time of execution. Current Financial Advisor Business. Average client assets. It is worth noting that, apart from the risk of losing it or delaying your share trading, if you are someone who has share certificates and wants to offload your assets, brokers will charge more for the trade. Then there is the ever more popular option of the execution-only account, where the broker simply buys or sells shares that you have chosen yourself without offering advice. Don't have an account? So, without you even realizing it, your broker is making nearly 0. A financial advisor today might be limited to clients. The specialized software needed is fragmented and expensive, often priced on a per-account basis, so every client account no matter the size incurs a fixed expense. Vendor costs, especially technology vendors, are extremely overpriced. Jason Wenk. In some cases that number is much higher. Major custodians have stifled innovation, rather than advance it. We do not do that. It was very simple, only supported individual taxable accounts, and you could only fund accounts via ACH.

But how much will it cost? And not everything comes down to fees. Then there is the ever more popular option of the execution-only account, where the broker simply buys or sells shares that you have chosen yourself without offering advice. Share certificates do still exist but they are becoming increasingly rare. Annual revenue. Whatever way you choose to invest, you will need a stockbroker, and they cost Tue, Oct 15, , The revenue DriveWealth receives from rebates are shared with us, helping us cover the costs of operating our business and allowing us to offer you commission-free trading. Those with a preference for retaining control over their decisions but uncertain on strategy might prefer an advisory account approach while the more knowledgeable, active and budget-conscious investor — or those who consider themselves more knowledgeable — would tend toward an execution-only account. When you add it all up, a custodian makes about 0. Those with little understanding of the market or the dynamics of equity investing might well opt for a hands-off approach with a discretionary account.