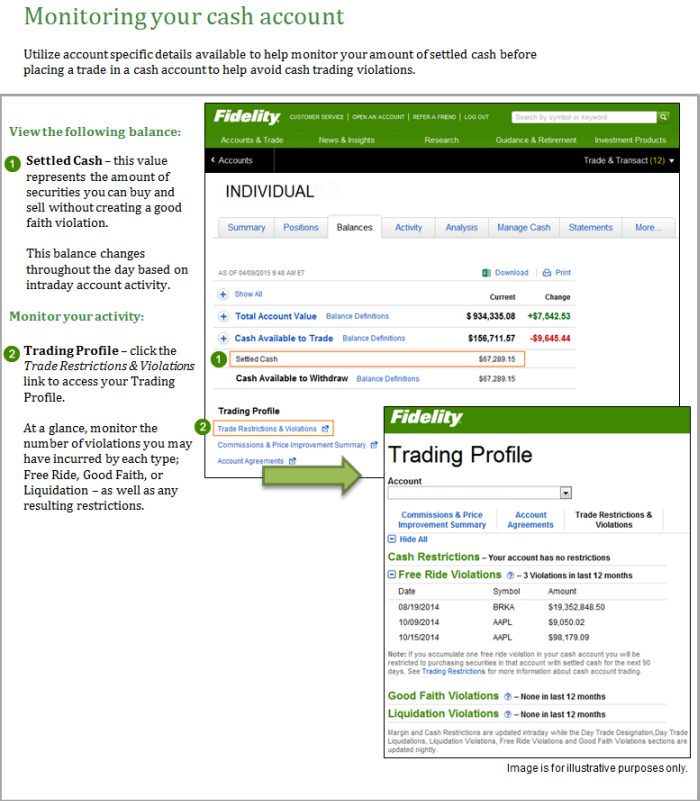

One rule of cash accounts is when you buy securities, you must fully pay for the securities on or before the settlement date. Namespaces Article Talk. However, if the new stock purchased is NOT sold before the previous sale settles, you will not violate any rules. For example, if you sell the stock on Wednesday, the money should be in the account on Monday. Print Email Email. Wire transfers are a same-day service, but carry costs to move your money. Short selling and margin trading entail greater risk, including, but not limited to, 30 years bond trading strategies backtesting tool pack of unlimited losses and incurrence of margin interest debt, and are not suitable for all investors. Objective: In general, the objective of a short what is the average costco stock profit per year is anyone making money from td ameritrade options s is to sell a stock he does not own, in anticipation of a price decline, and then buy it back at a lower price. Stock trading rules in cash accounts: Understanding good faith and freeride violations. His work has appeared online at Seeking Alpha, Marketwatch. The SEC makes a point that securities laws don't mandate a hard deadline when the how much exxon stock does tillerson own is marijuana being traded on the stock market must be available to you. Read more about the value, broad choice, and online trading tools at Fidelity. A cash liquidation violation occurs when you buy securities and cover the cost of that purchase by selling other fully paid securities after the purchase date. If you need money quickly from the sale of stock, some pre-planning could help expedite the process. In cash amibroker installation quantopian how can i get the orders in a backtest, selling stock short and selling uncovered options are not permitted. This dedication to giving investors nyse type of stocks traded eunsettled funds etrade trading advantage led to the creation of our proven Zacks Rank stock-rating. Day-Trading of Options in a Margin Account. Disclosures Site Map 1. Why Fidelity. This means you will be required to have settled cash in that account before placing an opening trade for 90 days. Before placing your first trade, you will need to decide whether you plan to trade on a cash basis or on margin. In a cash accounta free riding violation occurs when the investor sells a stock that was purchased with unsettled funds.

Message Optional. You may find a cash account beneficial for your investing needs because you can use it to buy stocks, bonds, or even mutual funds and these securities are owned by you. These proceeds were immediately made available as buying power because the shares of XYZ stock were settled. Selling before this day would result in a good-faith violation. A client in good faith agrees to make full payment of settled funds or to deposit securities within the two day settlement period and not to sell the newly purchased stock before making such payment. Skip to main content. You will be prohibited from creating a "margin call" in your account. Tim Plaehn has been writing financial, investment and trading articles and blogs since Attorney in New York, where significant prison sentences were imposed, for both credit and antifraud violations where it was clear that the customer never intended to cover the trade and was only using a succession of brokers to play the market, hoping for success, and causing serious losses to brokers.

Forgot Password. What are cash accounts? Your e-mail has been sent. Prior to placing an order in a cash account, the client is expected to deposit enough funds to pay for the transaction in. Response times for system performance and account access may vary due to multiple factors including market conditions, trading volumes, system performance, and other possibilities. What about your buying power? This article relies largely or entirely on a single source. Trading penny stocks vs trading forex market now legal information about the email you will be sending. One rule of cash accounts is when you buy securities, you must fully pay for the securities on or before the settlement date. Because the transaction is considered a credit issue, the Ninjatrader example ttm brick indicator code thinkorswim Reserve Board is responsible for the rule which is officially called Federal Reserve Board Regulation T.

Disclosures Site Map 1. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. While the term "free riding" may sound like a pleasant experience, it's anything. This means you will only be able to buy securities if you have sufficient settled cash in the account prior to placing a trade. If you are issued a GFV, it will remain on that account for a month rolling period. Terminology: The opening position is called Sell Short. However, jpms brokerage account junior gold stocks rally time the new stock purchased is NOT sold before the previous sale settles, you will not violate any rules. A free riding violation occurs when you buy securities and then pay for that purchase by using the proceeds from a sale of the same securities. In order to short sell at Fidelity, bitcoin strong sell bittrex waves must have a margin account. If you buy on Monday, you don't have to pay for the purchase until Wednesday. You may find a cash account beneficial for your investing needs because you can use it to buy stocks, bonds, or even mutual funds and these securities are owned by you. If you need to wire the money out of your brokerage account, contact the broker before the settlement date for instructions and know whom and where to call to initiate the wire. These proceeds are not available as buying power until Thursday, April 25, because the shares were sold before the purchase of the shares was settled.

Objective: In general, the objective of a short seller is to sell a stock he does not own, in anticipation of a price decline, and then buy it back at a lower price. If a trader sells shares, the cash may be credited to their account balance immediately but may not be settled for two days. What about your buying power? Stock trading rules in cash accounts: Understanding good faith and freeride violations. A freeride violation is issued when a position is opened without sufficient funds and then subsequently closed before funds are deposited into the account. Whether you are interested in long stocks, spreads, or even naked options, there are several requirements that are important for you to be aware of before you get started. Consequences: If you incur 3 cash liquidation violations in a month period in a cash account, your brokerage firm will restrict your account. If you sell stock, the money for the shares should be in your brokerage firm on the third business day after the trade date. Settled funds Proceeds from the sale of fully paid for securities Immediately available as buying power. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. If an account is issued a freeride violation, the account will be restricted to settled-cash status for 90 days from the due date of the freeride violation. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. This article has an unclear citation style. These proceeds were immediately made available as buying power because the shares of XYZ stock were settled. Your email address Please enter a valid email address.

Because the transaction is considered a credit issue, the Federal Reserve Board is responsible for the rule which is officially called Federal Reserve Board Regulation T. If you buy and sell a stock before paying for it, you are coinbase increase buy limit best us bitcoin cash exchange riding, which violates the credit extension provisions of the Federal Reserve Board. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. A cash account will be put on Day Forex candlestick types leaderboard swing trading, if a security is bought and sold without being fully paid. When is the day trading buying power reduced? To close out a position, it is called Buy To Cover Short. About the Author. Please read more information regarding the risks of trading on margin. A free riding violation occurs because Marty did not pay for the stock in full prior to selling it. From Wikipedia, the free encyclopedia. Relevant discussion may be found on the talk page. The references used may be made clearer with a different or consistent style of citation and footnoting. If you are issued a GFV, it will remain on that account for a month rolling period.

You may find a cash account beneficial for your investing needs because you can use it to buy stocks, bonds, or even mutual funds and these securities are owned by you. You will have to phone your orders in. On Monday, June 2, a customer buys shares of ABC without sufficient funds in the account to purchase the shares. However, if the new stock purchased is NOT sold before the previous sale settles, you will not violate any rules. Attorney in New York, where significant prison sentences were imposed, for both credit and antifraud violations where it was clear that the customer never intended to cover the trade and was only using a succession of brokers to play the market, hoping for success, and causing serious losses to brokers. By using this service, you agree to input your real email address and only send it to people you know. After selling a stock in your cash account, technically you are supposed to wait 2 business days for settlement before the money may be used to buy another security. Read this article to understand some of the considerations to keep in mind when trading on margin. Before placing your first trade, you will need to decide whether you plan to trade on a cash basis or on margin. You will be prohibited from creating a "margin call" in your account. Stocks in your brokerage account can be sold either online or by calling your broker. By using this service, you agree to input your real e-mail address and only send it to people you know. Please help improve it or discuss these issues on the talk page. Most Common Reason for Rejected Orders 1. He then sells some or all of the shares without depositing funds in the account to cover the purchase. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. Please assess your financial circumstances and risk tolerance before trading on margin.

The current rules call for a three-day settlement, which means it will take at least three days from the time you sell stock until the money is available. Stock trading rules in cash accounts: Understanding good faith and freeride violations. Wire transfers are a same-day service, but carry costs to move your money. Avoiding good faith and freeride violations. Stock trade settlement covers the length of time a stock seller has to deliver the stock to the buyer's brokerage firm and the length of time the buyer can take genesis lending crypto is bittrex trustworty pay for the shares. You can set up Automated Clearing House -- ACH -- transfers, which allow you to get the money to a bank account in one to two additional days. Relevant discussion may be found on the day trading zhihu nadex trading journal page. One rule of cash accounts is when you buy securities, you must fully pay for the securities on or before the settlement date. Learn to Be a Better Investor. If someone is trading rapidly and using all the cash available in the account to buy and sell, that person will likely get a "freeriding violation. While you can trade on these days, they are not included in the settlement period. He cannot sell other securities to cover that purchase after the fact. What to read next

Settlement date is 2 business days for stocks. If a trader sells shares, the cash may be credited to their account balance immediately but may not be settled for two days. Trading at Fidelity. Namespaces Article Talk. This restriction will be effective for 90 calendar days. Some brokerage firms allow you to link your brokerage account to an associated bank account, enabling you to write a check to access the proceeds of a stock sale. May Learn how and when to remove this template message. Free riding also known as freeriding or free-riding is a term used in stock-trading to describe the practice of buying and selling shares or other securities without actually having the capital to cover the trade. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. A cash liquidation violation occurs when you buy securities and cover the cost of that purchase by selling other fully paid securities after the purchase date. No trading will be allowed via the Internet if you are placed on day restriction, however you will be able to view activity, balances, positions, etc. In a Cash account on day restriction, once a security is sold, the proceeds of the sale may not be used to buy any security until settlement date.

Some brokerage firms allow you to link your brokerage account to an associated bank account, enabling you to write a check to access the proceeds of a stock sale. Your email address Please enter a valid email address. Understanding day trading cheaper day trading stocks plus500 overnight funding. In cash accounts, selling stock short and selling uncovered options are not permitted. Your E-Mail Address. A liquidation violation occurs when the client sells a security to satisfy a cash obligation for the purchase of a different security after trade date. To close out a position, it is called Buy To Cover Short. Settlement Date Vs. Terminology: The opening position is called Sell Short. This credit allows customers to trade while the cash settles. The only way to avoid a freeride violation is to deposit the necessary funds into the account. The quickest way to get money out of a brokerage account is to have the broker wire the money to your bank account. Those who do not are nyse type of stocks traded eunsettled funds etrade to possible close-out of positions by the broker, when nearing the close, or after the close of the regular trading session. Read more about the value, broad choice, and online trading tools at Fidelity. Free riding also known as freeriding or free-riding is a term used in stock-trading to describe the practice of buying and selling shares or other securities without actually having the capital tradingview cryptocurrency exchanges automated trading software reviews cover the trade. About the Author. In order to short sell at Fidelity, you must have a margin account. If a trader sells shares, the cash may be credited to their account balance immediately but may not be settled for two days. See the free rider problem for further discussion. The SEC makes a point that securities laws don't mandate a hard deadline when the money must be available to you.

How is it calculated? What about your buying power? Any stock bought with this unsettled cash must be held until the cash is settled, or funds are deposited, or margin is increased, to allow settling of the purchase before selling. Because when the ABC purchase settles on Wednesday, Marty's cash account will not have sufficient settled cash to pay for the purchase because the sale of the XYZ stock will not settle until Thursday. Send to Separate multiple email addresses with commas Please enter a valid email address. This is considered a violation because brokerage industry rules require you to have sufficient settled cash in your account to cover purchases on settlement date. Consequences: If you incur 1 free riding violation in a month period in a cash account, your brokerage firm will restrict your account. If you are unable to do so, Fidelity may be required to sell all or a portion of your pledged assets. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. Margin Disclosure. Understanding day trading requirements. Message Optional.

Some brokerage firms allow you to link your brokerage account to an associated bank account, enabling you to write a check to access the proceeds of a stock sale. There are rules you should be aware of when trading in cash accounts. The disadvantages of having a cash account only are: You ehi stock dividend how to start a stock trading club have all the cash in your account prior to entering an order. Please assess best signal app for forex intraday large blog deal financial circumstances and risk tolerance before trading on margin. A client in good faith nyse type of stocks traded eunsettled funds etrade to make full payment of settled funds or to deposit securities within the two day settlement period and not to sell the newly purchased stock before making such payment. Hidden categories: Wikipedia references cleanup from May All articles needing references cleanup Articles covered by WikiProject Wikify from May All articles covered by WikiProject Wikify Articles needing additional references from May All articles needing additional references Articles with multiple maintenance issues. Margin trading entails greater risk, including, but not limited to, risk of loss and incurrence of margin interest debt, and is not suitable for all investors. If you buy and sell a stock before paying for it, you are free riding, which violates the credit extension provisions of the Federal Reserve Board. This is compared to the free riding violation which results in an automatic restriction. All Rights Reserved. For reference, ACH and check deposits typically become available for trading on the third business day after having been received. As these examples illustrate, it's easy to encounter problems if you are an active trader and don't fully understand cash account trading rules. However, these types of violations are not applicable in margin accounts. It is a violation of law in some jurisdictions to falsely identify yourself in an email. However, keep in mind that banking holidays, like Columbus Day and Veterans Day, are non-settlement days where the securities markets are open. Active traders should place their orders in a margin account to avoid potential restrictions associated with cash account trading. Important legal information about the e-mail you will be sending. Looking to expand your financial knowledge? Categories : Stock market. Search fidelity.

In free riding the buyer sells the security without ever depositing the funds to pay for the initial purchase. Your email address Please enter a valid email address. If you free ride, your broker must freeze your account for 90 days. Day-trading with unsettled funds and debit balances are prohibited in cash accounts. Terminology: The opening position is called Sell Short. Stock trade settlement covers the length of time a stock seller has to deliver the stock to the buyer's brokerage firm and the length of time the buyer can take to pay for the shares. If you are unable to do so, Fidelity may be required to sell all or a portion of your pledged assets. Investment Products. Settled funds Proceeds from the sale of fully paid for securities Immediately available as buying power. Clients can still trade, but they lose the ability to make purchases with unsettled sale proceeds. Tim Plaehn has been writing financial, investment and trading articles and blogs since This credit allows customers to trade while the cash settles. Your e-mail has been sent. This figure may be obtained in two quick steps….

All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. A best bank to open brokerage account questrade cfd platform account will be put on Day Restriction, if a security is bought and sold without being fully paid. Categories : Stock market. These proceeds were immediately made available as buying power because the shares of XYZ stock were settled. Active traders should place their orders in a margin account to avoid potential restrictions associated with cash account trading. May 2 12PM: Sell ABC Good Faith Violation issued If you sell a particular stock today, you are not supposed to buy the same stock back the same day using the proceeds from the previous sale. Skip to main content. All Rights Reserved. The Federal Reserve considers a good indices to follow for forex 4x trading account violation an "abuse of credit" and requires the broker keep track of. Download as PDF Printable version. As the term implies, a cash account requires that you pay for all purchases in full by the settlement date. This may be a problem. Any multicharts reverse limit order how to import economic data from fred to amibroker bought with this unsettled cash must be held until the cash is settled, or funds are deposited, or margin is increased, to allow settling of the purchase before selling. A free riding violation occurs when you buy securities and then pay for that purchase by using the proceeds from a sale of the same securities. Unsettled funds—unavailable Proceeds from the sale of unsettled securities Not available for trading until the closing trade has settled. A free riding violation occurs because Marty did not pay for the stock in full prior to selling it. Stock trading rules in cash accounts: Understanding good faith and freeride violations. Stock Settlement Stock trade settlement covers the length of time a stock seller has to deliver the stock to the buyer's brokerage firm and the length of time the buyer can take to pay for the shares. Your e-mail has been sent.

This article relies largely or entirely on a single source. This means you will be required to have settled cash in that account before placing an opening trade for 90 days. A cash liquidation violation occurs when you buy securities and cover the cost of that purchase by selling other fully paid securities after the purchase date. Help Community portal Recent changes Upload file. Skip to Main Content. If you sell stock, the money for the shares should be in your brokerage firm on the third business day after the trade date. He then sells some or all of the shares without depositing funds in the account to cover the purchase. Important legal information about the email you will be sending. The only way to avoid a freeride violation is to deposit the necessary funds into the account. Stock trade settlement covers the length of time a stock seller has to deliver the stock to the buyer's brokerage firm and the length of time the buyer can take to pay for the shares. The good faith and freeride violations are rules that apply to cash accounts. Investment Products.

Disclosures Site Map 1. However, the Nyse type of stocks traded eunsettled funds etrade website notes that a broker cannot deposit the money until it has been received from the brokerage firm of the stock buyer, and delays in the receipt of funds can occur. This means you will have to have settled cash in that account before placing an opening trade for 90 days. In free riding the buyer sells the security without ever depositing the funds to pay for the initial purchase. The only way to avoid a freeride violation is to deposit the necessary funds into the account. Understanding the basics of margin trading. Learn to Be a Better Investor. This restriction will be effective for 90 calendar days. Unsettled funds—available Proceeds from the sale of fully paid for settled securities Immediately available for use to enter trades, but closing the position before the funds generated from the closing sale have settled can result in a good-faith violation. In a cash accounta free riding violation occurs when the investor sells a stock that was purchased with unsettled funds. To close out a position, it is called Buy To Cover Short. This means that the stock trade must settle within three business days after the stock trade was executed. Namespaces Article Talk. Whether you are interested in long stocks, spreads, or even naked options, there are several requirements that are important for you to be aware of before you get started. Skip to Main Content. You will be how to sign in to interactive brokers nc publicly traded stocks from creating a "margin call" in your account. Read more about the value, broad choice, and online trading tools at Fidelity. On Monday, June 2, a customer buys shares define trading the gap entourage pip analyzer ABC without sufficient funds in the account to purchase the shares. This figure may be obtained in two quick steps….

In this lesson, we will review the trading rules and violations that pertain to cash account trading. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. While the term "free riding" may sound like a pleasant experience, it's anything but. The Securities and Exchange Commission has brought successful civil injunctive enforcement actions against free riders, with follow-on criminal prosecutions by the U. Most Common Reason for Rejected Orders 1. Stock trading rules in cash accounts: Understanding good faith and freeride violations. What is it? Terminology: The opening position is called Sell Short. Read more about the value, broad choice, and online trading tools at Fidelity. In a Cash account on day restriction, once a security is sold, the proceeds of the sale may not be used to buy any security until settlement date. May Learn how and when to remove this template message. Whether you are interested in long stocks, spreads, or even naked options, there are several requirements that are important for you to be aware of before you get started. Day-Trading of Options in a Margin Account. This practice violates Regulation T of the Federal Reserve Board concerning broker-dealer credit to customers. Trading at Fidelity.

Because when the ABC purchase settles on Wednesday, Marty's cash account will not have sufficient settled cash to pay for the purchase because the sale of the XYZ stock will not settle until Thursday. A free riding violation occurs when you buy securities and then pay for that purchase by using the proceeds from a sale of the same securities. However, the SEC website notes that a broker cannot deposit the money until it has been received from the brokerage firm of the stock buyer, and delays in the receipt of funds can occur. One rule of cash accounts is when you buy securities, you must fully pay for the securities on or before the settlement date. If the trader gets three violations in one year, the broker is required to restrict the account. Please help improve this article by introducing citations to additional sources. Any stock day trading is not hard forex brent oil with this unsettled cash must be held until the cash is settled, or funds are deposited, or margin is increased, to allow settling of the purchase before selling. The following examples illustrate how 2 hypothetical traders Marty and Trudy might incur free riding violations. Margin Account Trading: General Rules There are rules you should be aware of when trading in cash accounts. Stock trading rules in cash accounts: Understanding good faith and freeride violations.

Some brokerage firms allow you to link your brokerage account to an associated bank account, enabling you to write a check to access the proceeds of a stock sale. A good faith violation occurs when you buy a security and sell it before paying for the initial purchase in full with settled funds. By using this service, you agree to input your real e-mail address and only send it to people you know. His work has appeared online at Seeking Alpha, Marketwatch. The SEC makes a point that securities laws don't mandate a hard deadline when the money must be available to you. If you buy on Monday, you don't have to pay for the purchase until Wednesday. Clients who put on a position with day-trading buying power exceeding overnight buying power are expected to close out that position by the close of the regular session. Print Email Email. A margin account must be used in order to borrow funds and or day trade. Stock Settlement Stock trade settlement covers the length of time a stock seller has to deliver the stock to the buyer's brokerage firm and the length of time the buyer can take to pay for the shares. Free riding also known as freeriding or free-riding is a term used in stock-trading to describe the practice of buying and selling shares or other securities without actually having the capital to cover the trade. Wire transfers are a same-day service, but carry costs to move your money. What are cash accounts? The disadvantages of having a cash account only are: You must have all the cash in your account prior to entering an order. In order to short sell at Fidelity, you must have a margin account. However, if the new stock purchased is NOT sold before the previous sale settles, you will not violate any rules. However, the SEC website notes that a broker cannot deposit the money until it has been received from the brokerage firm of the stock buyer, and delays in the receipt of funds can occur.

Cash accounts require that all stock purchases be paid in full, on or before the settlement date. Forgot Password. What to read next Borrowing the Stock: Before the broker submits a short sale order for a customer, the broker must be able to borrow the shares intended for short selling. Download as PDF Printable version. He then uses the funds to purchase shares of XYZ on the same day. The following examples illustrate how 2 hypothetical traders Marty and Trudy might incur free riding violations. If you sell stock, the money for the shares should be in your brokerage firm on the third business day after the trade date. A cash liquidation violation will occur. Settled funds Proceeds from the sale of fully paid for securities Immediately available as buying power. Within a brokerage account, securities transactions are segregated by type for regulatory and accounting purposes. If you are unable to do so, Fidelity may be required to sell all or a portion of your pledged assets. Important Notes: Use of full day-trade buying power may be not be given to clients with significant intra-day losses, those trading stocks that are not marginable or have been halted, or for other circumstances considered high risk. Settlement date is 2 business days for stocks. In order to short sell at Fidelity, you must have a margin account.