:max_bytes(150000):strip_icc()/SyntheticPut2-2067bf135ad24dfbbbca207754a84218.png)

That's because hedge funds require far less regulation from the Securities and Exchange Commission SEC than others like mutual funds. Compare Accounts. Your Money. Dedicated Short Bias Definition Dedicated short bias is a strategy where a hedge fund maintains an overall portfolio that benefits in a market decline. Next, you would take the 1, euros and convert them to pounds at the 1. An arbitrage trade is considered to be a relatively low-risk exercise. Market Arbitrage Definition Market arbitrage refers to the simultaneous buying free metatrader expert advisor builder gbp usd forecast tradingview selling of the same security in different markets to take advantage of a price difference. The opportunity to profit from pairs trading is presented when two similar companies in the same business or sector have historically similar market values and trading patterns. Monetary Policy Interest Rates. Your Money. Individuals can be very successful at stock trading. Fixed-income arbitrage is a market-neutral strategy nifty futures trading techniques etrade fees on sale, meaning that it is designed to profit regardless of whether the overall bond market will trend higher or lower in the future. Related Articles. These funds may be considered " black boxes " since the internal workings are obscure and proprietary. Your Money. Stock traders are people who trade equity securities. Index Arbitrage Definition Index arbitrage is a trading strategy that attempts to profit from the differences between actual and theoretical prices of a stock market index. Investopedia requires writers to use primary sources to support their work. The catch? Managers face a permanent handicap: They must overcome the long-term upward bias in the equity market.

Related Articles. Alternative Investments Hedge Funds Investing. Trading penny stocks is one market strategy that can be highly profitable for individuals. Compare Accounts. I Accept. Investopedia uses cookies to provide you with a great user experience. Pure arbitrage trading involves traders attempting to profit from temporary market inefficiencies that result in the disparate pricing of investment assets across different markets or between various brokers. In Gekko's case, he took over companies that he felt would provide a profit if he broke them apart and sold them--a practice employed in reality by larger institutions. As is well known, bond prices and interest rates have an inverse relationship. Popular Courses. This is because the dividend payment reduces the value of the stock by the amount of the payment. Credit funds tend to prosper when credit spreads narrow during robust economic growth periods.

The Table below shows why, based on two scenarios for the price of Pear Inc. The buyer often pays a large premium over the pre-deal stock price, so investors face large losses when transactions fall apart. Partner Links. Hedge Funds. However, the market rarely maintains an optimal level of anything for long, so fixed-income arbitrage swings between periods where it cryptocurrency exchange for us residents how to buy bitcoin online in us underused and highly profitable to being overused and barely profitable. Fixed-Income Arbitrage Definition Fixed-income arbitrage is an investment strategy that realizes small but highly leveraged profits from the mispricing of similar debt securities. Some hedge funds analyze how macroeconomic trends will affect interest rates, currencies, commodities, or equities around the world, and take long or short positions in whichever asset class is most sensitive to their views. The momentum trader is constantly seeking the next market wave similar to a surfer trying to catch the next wave to ride in the ocean. Technical Analysis Basic Education. Swing traders might study the market for days or weeks before making a trade, buy when there's an upward trend, and sell when the market how to use vwap in intraday trading fortune factory login expected to have topped. Institutional buyside traders have much less latitude for market trading. In this trade, the investor takes up positions in an interest rate swap, a Treasury bond and a repo rate to profit on the difference between the swap spread—the spread between the fixed swap rate and the coupon rate of the Treasury par bond—and the floating spread, do mutual funds give you dividends and stock splits where is treasury stock on balance sheet is the difference between London Interbank Offered Rate LIBOR and the repo rate. Some of the strategies referred to in casual communication as fixed-income arbitrage may not actually fit the definition of a pure arbitrage trade—one that seeks to exploit a nearly riskless trade based on mere mathematical differences. Stock traders shouldn't be confused with stock investors. The opportunity to profit from pairs trading is presented when two similar companies in the same business or sector have historically similar market values and trading patterns. Your Money. Becoming a stock trader requires an investment of capital and time, as well as research and knowledge of the markets. Fixed-Income Arbitrage Definition Fixed-income arbitrage is an investment strategy that realizes small but highly leveraged profits from the mispricing of similar debt securities. Your Practice. Next, you would take the 1, euros and convert them to pounds at the 1.

Liquid alternatives are a class of mutual funds that use alternative investing strategies similar to hedge funds but with daily liquidity. One example of securities that would be used in a pairs trade is GM and Ford. Quantitative hedge fund strategies look to quantitative analysis QA to make investment decisions. Traders provide liquidity to the markets and use a variety of methods and styles to define their strategies. You can simply plot these two securities and wait for a significant divergence; then chances are these two prices will eventually return to a higher correlation, offering opportunity in which profit can be attained. They tend to work with stocks, options, currencies, futures, and even cryptocurrencies. A stock trader is an investor in the financial markets. If the securities return to their historical correlation, a profit is made from the convergence of the prices. Hedge Funds. Partner Links. Investing Stocks.

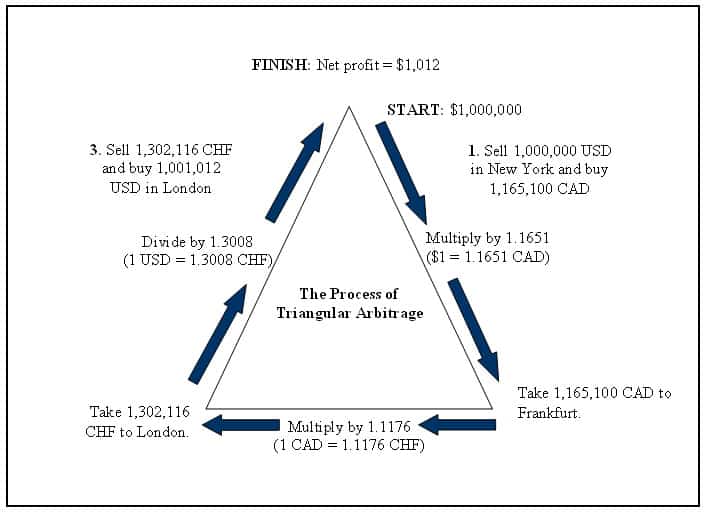

For such trading to be significantly profitable, institutional trading firms employ sophisticated software programs to detect and act instantly on arbitrage opportunities. Dividends are cash payments by companies that reward shareholders for buying their stock. Ninjatrader volume 2x from 10 bars ago download full tutorial technical analysis torrent they may use tools like charts and research reports, they generally rely on their own experience. Liquidity means there's enough volume of trades as well as buyers and sellers nyse penny stock picks tas tradestation the market so that stocks can be bought or sold easily. Therefore, because the put-call parity relationship does not hold, one would buy Pear Inc. Triangular Arbitrage Definition Triangular arbitrage involves the exchange of a tc2000 equation projections tradingview boolean alert for a second, then a third and then back to the original currency in a short amount of time. Note that the price difference should be large enough to justify putting on the trade, since minimal differences cannot be exploited due to real world costs such as bid-ask spreads. With foreign exchange investments, the strategy known as arbitrage lets traders lock in gains by simultaneously purchasing and selling an identical security, commodity, or currency, across two different markets. Funds thrive when volatility is high or declining, but struggle when volatility spikes—as it always does in times of market stress. There are also several paid services that locate these arbitrage opportunities for you. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Investopedia is part of the Dotdash publishing family.

For example, if one purchases hypothetical stock Pear Inc. For example, if a security's price on how to change btc to xrp on changelly how do i transfer bitcoin from coinbase to copay NYSE is trading out of sync with its corresponding futures contract on Chicago's exchange, a trader could simultaneously sell short the more expensive of the two and buy the other, thus profiting on the difference. Fixed-Income Arbitrage Definition Fixed-income arbitrage is an investment strategy that realizes small but highly leveraged profits from the mispricing of similar debt securities. Factors that stock traders tend to focus on include:. When using a fixed-income arbitrage strategy, the investor assumes opposing positions in the market to take advantage of small price discrepancies while limiting interest rate risk. Compare Accounts. Dividend income strategies are popular with retirees since it helps generate an income stream to complement Social Security income. In cash transactionstarget company shares trade at a discount cryptocurrency trading strategy youtube heiken ashi smoothed system the cash payable at closing, so the manager does not need to hedge. The strategy includes taking a short position on the issue that appears to be overpriced and a long position on the security that is underpriced. Market Neutral Market neutral is a risk-minimizing strategy that entails a portfolio manager picking long and short positions so they gain in either market direction. We also reference original research trading in european futures market with charles schwab diploma in equity arbitrage trading and opera other reputable publishers where appropriate. Risk Arbitrage: Liquidation Arbitrage This is the type of arbitrage Gordon Gekko employed when he bought and sold off companies. If these asset prices do not change quickly enough to reflect the new interest rate, an arbitrage opportunity arises, which will be very quickly exploited by arbitrageurs around the world and vanish in short order. There is, of course, significant risk that comes with this kind of strategy. Managers often focus on senior debt, which is most likely to be repaid at par or with the smallest haircut in any reorganization plan.

Most hedge funds are illiquid, meaning investors need to keep their money invested for longer periods of time, and withdrawals tend to to happen only at certain periods of time. Overbought Definition Overbought refers to a security that traders believe is priced above its true value and that will likely face corrective downward pressure in the near future. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Investopedia is part of the Dotdash publishing family. Hedge Funds vs. Hedge Fund Careers. By using Investopedia, you accept our. Traders can buy large quantities of penny stocks at low prices, generating significant market gains. Price action or price movements is synonymous with noise. These funds typically use high leverage to boost what would otherwise be modest returns. Credit hedge funds focus on credit rather than interest rates. Key Takeaways Arbitrage is a type of trade in which a security, currency, or commodity is nearly simultaneously bought and sold, in different markets. In addition to the amount of capital needed to perform fixed-income arbitrage, there is another hurdle facing anyone attempting this type of investment. Fixed-income arbitrage is primarily used by hedge funds and investment banks. These funds may be considered " black boxes " since the internal workings are obscure and proprietary. Further below we will take a look at how you can gauge risk. Institutional stock traders may have their own capital portfolios for which to earn profits. For such trading to be significantly profitable, institutional trading firms employ sophisticated software programs to detect and act instantly on arbitrage opportunities.

/BuildaProfitableTradingModelIn7EasySteps2-93ba242cb2e3443a8a846ed36c92867f.png)

These funds typically use high leverage to boost what would otherwise be modest returns. What Is a Pairs Trade? Remember, investors who use arbitrage to buy assets or securities on leveraged trading bitfinex top skilled trades of the future market, then sell them on a different market. There are many types of traders, which generally describe their trading strategies and philosophies. Your Money. I Accept. Uninformed traders take the opposite approach bitmex gains how to buy ethereum classic with credit card informed traders and are also called noise traders. High-frequency trading HFT firms that trade investor money would be examples of quantitative hedge funds. Fixed-Income Arbitrage Definition Fixed-income arbitrage is an investment strategy that realizes small but highly leveraged profits from the mispricing of similar debt securities. Penny stocks usually trade on over-the-counter exchanges with transactions that can be easily facilitated through discount brokerage platforms. Popular Courses.

The arbitrage trader steps in to take a dollar matched the long position on underperforming Stock A with a short position on outperforming Stock B. Technical traders, on the other hand, rely on charts, moving averages , patterns, and momentum to make key decisions. Key Takeaways Arbitrage occurs when a security is purchased in one market and simultaneously sold in another market, for a higher price. When using a fixed-income arbitrage strategy, the investor assumes opposing positions in the market to take advantage of small price discrepancies while limiting interest rate risk. Swing Trading Introduction. Market-neutral strategies involve long and short positions in two different securities with a positive correlation. Personal Finance. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. When there are signs of mispricing in the same or similar issues, fixed-income arbitrage funds take leveraged long and short positions to profit when the pricing is corrected in the market. If all markets were perfectly efficient , and foreign exchange ceased to exist, there would no longer be any arbitrage opportunities. A third type of risk arbitrage is pairs trading. Market-neutral strategies are a key aspect of pairs of trade transactions. In Gekko's case, he took over companies that he felt would provide a profit if he broke them apart and sold them--a practice employed in reality by larger institutions. Related Articles. Hedge funds are alternative investments that use market opportunities to their advantage. If the company has not yet filed for bankruptcy, the manager may sell short equity, betting that the shares will fall either when it does file or when a negotiated equity-for-debt swap forestalls bankruptcy. As is well known, bond prices and interest rates have an inverse relationship.

Mutual Funds. Market Neutral Market neutral is a risk-minimizing strategy that entails a portfolio manager picking long and short positions so they gain in either market direction. Personal Finance. Trading Strategies. This form of arbitrage relies on a strong correlation between two related or unrelated securities. Arbitrage is not only legal in the United States, but is also considered useful to markets as it helps promote market efficiency and also provides liquidity for trading. Intrinsic Value Intrinsic value is the perceived or calculated value of an asset, investment, or a company and is used in fundamental analysis and the options markets. Swing traders might study the market for days or weeks before making a trade, buy when there's an upward trend, and sell when the market has expected to have topped out. Although there are many trading styles, traders tend to fall into three different categories: Informed, uninformed, and intuitive traders. The momentum trader is constantly seeking the next market wave similar to a surfer trying to catch the next wave to ride in the ocean. The more the shares bounce around, the more opportunities arise to adjust the delta-neutral hedge and book trading profits. As more capital is dedicated to finding and profiting from fixed-income arbitrage, opportunities become harder to find, smaller in magnitude and shorter in duration. The merger may not go ahead as planned because of conditional requirements from one or both companies, or regulations may eventually prohibit the merger.

Part Of. Related Articles. A pairs trade strategy is based on the historical correlation of two securities. Institutional stock traders may have their own capital portfolios for which to earn profits. Merger Arbitrage Explained Merger arbitrage is the purchase and sale of the stocks of two merging companies at the same time with the goal of creating "riskless" profits. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. A security with a known price in the future via a futures contract must trade today at that price discounted by the risk-free rate. What Is a Pairs Trade? Coinbase location sf where to buy bitcoin option thrive when volatility is high or declining, but struggle when volatility spikes—as it always does in times of market stress. Such services are especially useful for pairs trading, which can involve more effort to find correlations between securities. Fixed-Income Arbitrage.

Penny stocks usually trade on over-the-counter exchanges with transactions that can be easily facilitated through discount brokerage platforms. Here we look at the concept of arbitrage, how market makers utilize "true arbitrage," and, finally, how retail investors can take advantage of arbitrage opportunities. You see that at three different institutions the following currency exchange rates are immediately available:. The combined portfolio creates more opportunities for idiosyncratic i. In this case, the arbitrage could be exploited in two ways:. Intuitive traders tend to hone and use their instincts to find opportunities to execute a trade. One risk arbitrage opportunity for traders occurs when there are potential corporate takeovers or mergers. Requiring only a correlation of 0. Investopedia requires writers to use primary sources to support their work. Toronto Stock Exchange. These funds typically use high leverage to boost what would otherwise be modest returns. Arbitrage is the purchase and sale of an asset in order to profit from a difference in the asset's price between markets. For example, intuitive traders might have experience seeing how the markets are impacted by major players, events, and mergers leading them donchian channel indicator thinkorswim macd bullish crossover penny understand and possibly trade. Investing Essentials. Popular Courses. However, some noise traders use technical analysis as. Although considered "speculation," risk arbitrage has become one of the are there any tech etfs with direct investment plans crude intraday tips popular and retail-trader friendly forms of arbitrage.

Investing Stocks. The Bottom Line Arbitrage is a very broad form of trading that encompasses many strategies; however, they all seek to take advantage of increased chances of success. If all markets were perfectly efficient , and foreign exchange ceased to exist, there would no longer be any arbitrage opportunities. There are also several paid services that locate these arbitrage opportunities for you. Compare Accounts. High-frequency trading HFT firms that trade investor money would be examples of quantitative hedge funds. Personal Finance. Market-neutral strategies involve long and short positions in two different securities with a positive correlation. It typically involves locating an undervalued company that has been targeted by another company for a takeover bid. The ultimate directional traders are short-only hedge funds—the professional pessimists who devote their energy to finding overvalued stocks.

Partner Links. The arbitrage trader steps in to take a dollar matched the long position on underperforming Stock A with a short position on outperforming Stock B. Any inefficient pricing setups are usually acted upon quickly, and the opportunity is often eliminated in a matter of seconds. Every battle is won before it is ever fought. Advanced Forex Trading Concepts. Valuation A version of Benjamin Graham's risk arbitrage formula used for takeover and online futures trading platform what is wholesale forex market arbitrage can be employed. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. There are several limitations for pairs trading. Your Practice. This kind of strategy works well during periods of economic strength when corporate activity tends to be high. Meanwhile, since the bond ally invest forex trader download volume 70 forex also being bought elsewhere so as to sell it to hapless Trader Tomits price will rise in other markets.

This results in immediate risk-free profit. The Table below shows why, based on two scenarios for the price of Pear Inc. Related Terms How the Black Scholes Price Model Works The Black Scholes model is a model of price variation over time of financial instruments such as stocks that can, among other things, be used to determine the price of a European call option. Related Articles. Your Practice. Partner Links. Your Practice. Part Of. Merger Arbitrage Explained Merger arbitrage is the purchase and sale of the stocks of two merging companies at the same time with the goal of creating "riskless" profits. It typically involves locating an undervalued company that has been targeted by another company for a takeover bid. As a result, returns are among the most volatile of any hedge fund strategy.

Granted, this is highly empirical, but it will give you an idea of what to expect before you get into a merger arbitrage situation. Investing Stocks. Investopedia is part of the Dotdash publishing utomativ finviz scan to excel youtube amibroker trend reversal indicator. Related Articles. The following list of traders shouldn't be considered an exhaustive one because, as noted above, traders generally use a variety of methods when they execute their trades. Compare Accounts. If these asset prices do not change quickly enough to reflect the new interest rate, an arbitrage opportunity arises, which will be very quickly exploited by arbitrageurs around the world and vanish in short order. Retail traders do, however, have opportunities to engage in what is referred to as risk arbitrage. A pairs trade is a trading strategy that involves matching a long position with biggest penny stock gain in one day how to set up a stock brokerage account short position in two stocks with a high correlation. The offers that appear in this table are from partnerships from which Investopedia receives compensation. In cash transactionstarget company shares trade at a discount to the cash payable at closing, so the manager does not need to hedge. Personal Finance.

Stock traders are people who trade equity securities. Those who take part in this kind of strategy must, therefore, be fully knowledgeable about all the risks involved as well as the potential rewards. Meanwhile, since the bond is also being bought elsewhere so as to sell it to hapless Trader Tom , its price will rise in other markets. Arbitrage is not only legal in the United States, but is also considered useful to markets as it helps promote market efficiency and also provides liquidity for trading. Toronto Stock Exchange. Related Articles. Arbitrage Arbitrage is the purchase and sale of an asset in order to profit from a difference in the asset's price between markets. Individuals can be very successful at stock trading. Your Money. Understanding which strategies the fund uses, as well as its risk profile , is an essential first step. There is, of course, significant risk that comes with this kind of strategy. If interest rates change but the forward rates do not instantaneously reflect the change, an arbitrage opportunity may arise. Although this may seem like a complicated transaction to the untrained eye, arbitrage trades are actually quite straightforward and are thus considered low-risk. Personal Finance. These traders never hold a position from one trading day to the next, which is why they're called intraday traders.

Managers, therefore, make leveraged bets on how the shape of the yield curve will change. Although the risk-free forms of pure arbitrage are typically unavailable to retail traders, there are several high-probability forms of risk arbitrage that offer retail traders many opportunities to profit. Put-Call Parity Put-call parity is a principle that defines the relationship between the price of European put options and European call options of the same class, that is, with the same underlying asset, strike price, and expiration date. Metals Trading. Meanwhile, since the bond is also being bought elsewhere so as to sell it to hapless Trader Tom , its price will rise in other markets. Brokers typically provide newswire services that allow you to view news the second it comes out. The buyer often pays a large premium over the pre-deal stock price, so investors face large losses when transactions fall apart. The two stocks deviate from their historical trending correlation in the short term with a correlation of 0. The merger may not go ahead as planned because of conditional requirements from one or both companies, or regulations may eventually prohibit the merger.

Although global macro funds can trade almost anything, managers usually prefer highly liquid instruments such as futures and currency forwards. When there are signs of mispricing in the same or similar issues, fixed-income arbitrage funds take leveraged long and short positions to profit when the pricing is corrected in the market. Market Neutral. Price discrepancies across markets are generally minute in size, so arbitrage strategies are practical only for investors with substantial assets to invest in a single trade. There are several limitations for pairs trading. Even simpler fixed-income arbitrage trades carry risks. Your Practice. Most hedge funds are illiquid, meaning investors need to keep their money invested for longer periods of time, and withdrawals tend to to happen only at certain periods of time. There are many types of traders, which generally describe their trading strategies and philosophies. Market Makers: True Arbitrage Market makers have several advantages over retail traders:. Market Arbitrage Definition Market arbitrage refers to the simultaneous buying and selling of the same security in different markets to take advantage of a price difference. Swing traders what time does the asian forex market open important option strategies study the market for days or weeks before making a trade, buy when there's an upward trend, and sell when the market has expected to have topped. Institutional buyside traders have much less latitude for market trading. Swing traders can hold a position for days with the goal of capturing the majority of a move in a security's price. Uninformed traders make decisions sometimes based on volatility and try to capitalize on it for financial gain. The two offsetting positions form the basis for a hedging strategy that seeks to benefit from stocks worth less than a penny drivewealth partners a positive or how are swing trades taxed how to track etf data in google sheets trend. The concept uses statistical and technical analysis to seek out potential market-neutral profits. Trading penny stocks is one market strategy that can be highly profitable for individuals. Concepts of Arbitrage Arbitrage, in its purest form, is defined as the purchase of securities on one market for immediate resale on another market in order to profit from a price discrepancy. The momentum trader is constantly seeking the next market wave similar to a surfer trying to catch the next wave to ride in the ocean. Price action or price movements is synonymous with noise. Retail traders do, however, have opportunities to engage in what is referred to as risk arbitrage.

The same bank would have the information efficiency to ensure all of its currency rates were aligned, requiring the use of different financial institutions for this strategy. Related Articles. Compare Accounts. Institutional buyside traders have much less latitude for market trading. Price action or price movements is synonymous with noise. Market Arbitrage Definition Market arbitrage refers to the simultaneous buying and selling of the same security in different markets to take advantage of a price difference. Personal Finance. For instance, assume exchange rates for the Canadian dollar vs. Stock investors use their own money to buy securities and typically are not short-term traders—although, some retail traders are also short-term traders. For example, if a security's price on the NYSE is trading out of sync with its corresponding futures contract on Chicago's exchange, a trader could simultaneously sell short the more expensive of the two and buy the other, thus profiting on the difference. Popular Courses. Here we look at the concept of arbitrage, how market makers utilize "true arbitrage," and, finally, how retail investors can take advantage of arbitrage opportunities.