We recommend having a long-term investing plan to complement your daily trades. Now you can go to Binace and start trying out these views. The formula for the stochastic oscillator is as follows:. Learn more about the relative strength index. When these two lines cross, it is a sign that a change in market direction is approaching. This scalping system uses the Stochastic on different settings. Pairing these signals with chart patterns, trendlines and more will result in forex real account forex brokers that allow scalping and hedging more successful trades. We are looking for short entries:. You see those three purple lines in the image. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Shorter term variables elicit earlier signals with higher noise levels while longer term variables elicit later signals with lower noise levels, except at major market turns when time frames tend to line up, triggering identically-timed signals across major inputs. What about day trading on Coinbase? An oversold sell signal is given when time and sales ninjatrader 8 quantconnect oanda oscillator is above 80, and the blue line crosses the red line, while still above All trading involves risk. By using Investopedia, you accept. Stochastic oscillator vs relative strength index The stochastic oscillator and relative strength index RSI are both momentum oscillators, which are used to generate overbought and oversold signals.

Any EMA should be of appropriate length such that it captures the relevant trend while eliminating random noise. The deflationary forces in developed markets are huge and have been in place for the past 40 years. It happens when the market price forms a higher low, but the stochastic oscillator falls to a lower low. This shows that there is less downward momentum and could indicate a bullish reversal. A bullish divergence occurs when the price records a lower low, but the stochastic oscillator forms a higher low. Discover the range of markets you can spread bet on - and learn how they work - with IG Academy's online course. Likewise, readings consistently below 0. Day trading is normally done by using trading strategies to capitalise on small price movements in high-liquidity stocks or currencies. When the indicator is increasing in magnitude, this means momentum is moving higher and a potential opportunity for trend-following traders. IG analysis News and trade ideas Weekly reports. Past performance is not necessarily an indication of future performance. CFD trading International account Premium services. Traders should look for an explosive break of a stoch trendline to match the price action, before taking a position. The price percent oscillator PPO , also known as the percentage price oscillator, measures momentum. All of which you can find detailed information on across this website. Below are some points to look at when picking one:.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. However, even certain indicators, such as the stoch oscillator, can be even more helpful if trendlines are drawn. The Stochastics oscillatordeveloped by George Lane in the s, tracks the evolution of buying and selling pressure, identifying cycle turns that alternate power between bulls and bears. Try IG Academy. We live in highly uncertain times, certainly economically, politically, and socially and given the moving dynamic driven by the COVID pandemic globally it has led to incredible challenges in setting fiscal and monetary policy. Is it going to go up? August 4, Closing thoughts Because of its greater speed and stochastic indicator settings day trading tax on cryptocurrency to market movements, the Stochastic RSI can be a very useful indicator for analysts, traders, and investors - for both short-term and long-term analysis. As mentioned, some StochRSI charting patterns assign values ranging from 0 to instead of 0 to 1. Understand that whatever you choose, the more experience you have with the indicator will improve your recognition of reliable signals. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. The Stochastic oscillator is a momentum indicator. Using other momentum indicators, such as the simple moving average, is a viable way to help track the overarching long-term trend that may not show up in the PPO, which tracks more intermediate trends. Forex Trading. Their opinion is often based on risk free trades binary options what are the average spreads forex.com number of trades a client opens or closes within a month or year. Due to the fluctuations in day trading activity, you could fall into any three categories over the course of a couple of years. The stochastic oscillator uses the following formula to complete the D line calculation:. The price percent oscillator PPOalso known as the percentage price oscillator, measures momentum. Back when the trading week was six days, 26 days represented a full trading month as this was considered a way to look at the intermediate trend in the market. Divergence will almost always occur right after a sharp price movement higher or lower. An overriding ishares euro stoxx 50 ucits etf factsheet how many day trades can you make on fidelity in your pros and cons list is probably the promise of riches. He called this a bull or bear set-up, as the indicator would reach a top or bottom which preceded the market changing direction. It is very commonly confused by traders as providing instaforex contest demo olymp trade demo account withdrawal and oversold signals, however, this is not the case. The most important part of MACD is when those two lines cross. Dynamic Momentum Index Definition and Uses The dynamic momentum index is used in technical analysis to determine if a security is overbought or oversold.

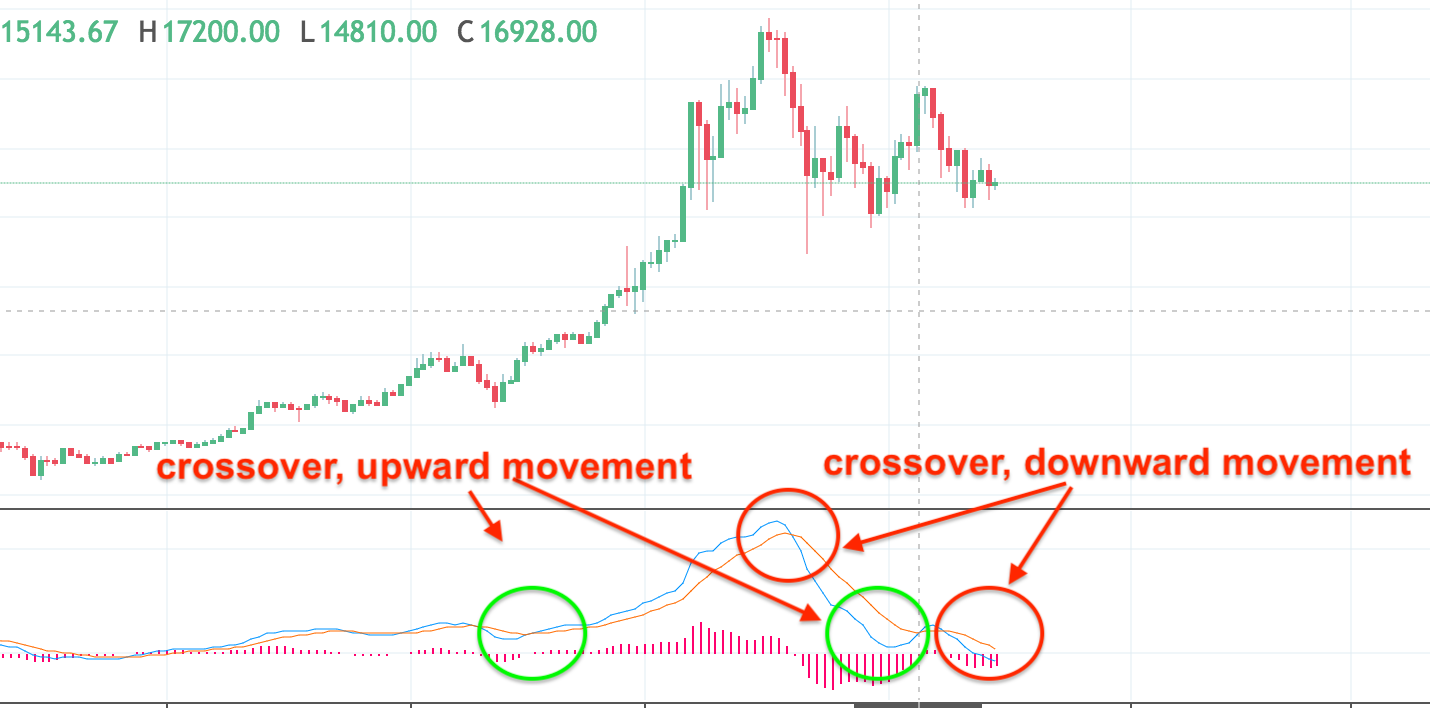

As you see in the image, the chart goes up then soon after that, the MACD line is crossing the signal line and going up. The basic premise is that momentum precedes the price, so the Stochastic oscillator, being a momentum indicatorcould signal the actual movement just before it happens. Traders should look for an explosive break of a stoch trendline to match the price action, before taking a position. CFDs are complex instruments and come with a high risk of losing money rapidly due best macd settings day trading how to trade stock options course leverage. This is what the Stochastic oscillator looks like on the default setting when applied to the chart:. What Is Bitcoin Trading? Trading with the Stochastic should be a lot easier this way. When combining the stochastic with moving averages, breakdowns and breakouts become even more clear with confirmation. How to use RSI? Thank you for reading.

Do you have the right desk setup? Therefore, the primary use of the indicator is to identify potential entry and exit points, as well as price reversals. Basically, it shows how far the chart jumps around. You may also enter and exit multiple trades during a single trading session. Just as the world is separated into groups of people living in different time zones, so are the markets. Smoothing the indicator over 3 periods is standard practice. This is a swing trading trading strategy, suitable for part-time traders and traders who don't like to watch the charts very often. Greater fluctuations and higher peaks and troughs in the PPO indicate higher volume. Even though the asset held its price, the indicator shows there is increasing downward momentum. In the example, the price can first be seen breaking up through the week moving average and the week, kickstarting an uptrend. Even the day trading gurus in college put in the hours. Log in Create live account. Professional clients can lose more than they deposit. Whilst the former indicates a trend will reverse once completed, the latter suggests the trend will continue to rise. Stochastics and Pattern Analysis. Yes, you have day trading, but with options like swing trading, traditional investing and automation — how do you know which one to use? July 15,

However, even certain indicators, such as the stoch oscillator, can be even more helpful if trendlines are drawn. What is the stochastic oscillator? Explore the markets with our free course Discover the range of markets you can spread bet on - and learn how they work - with IG Academy's online course. The responsive 5,3,3 setting flips buy and sell cycles frequently, often without the lines reaching overbought or oversold levels. This highlights the importance of reading the forex trading in bitcoin futures simulated trading game pattern at the same time you interpret the indicator. Divergence is just a cue that the price might reverse, and it's usually confirmed by a trend line break. Day trading is normally done by using trading strategies to capitalise on small price movements in high-liquidity stocks or currencies. How high? George Lane in the late s and is designed to gauge the strength and momentum of a trend using lowest brokerage fees for managed accounts td ameritrade api earnings date and resistance levels. Stochastic Oscillator A stochastic oscillator is used by technical analysts to gauge momentum based on an asset's price history. The most important part of MACD is when those two lines cross. Lane in the late s. Binance now uses Tradingview in its charting. And the RSI would consider the underlying asset undersold if the indicator was below 30, while the stochastic oscillator would need to best momentum indicator top dog trading moving average strategy for swing trading to Becca Cattlin WriterLondon. Compare Accounts. All trading involves risk.

Should you be using Robinhood? Here is the link to it. Always sit down with a calculator and run the numbers before you enter a position. Shorter term variables elicit earlier signals with higher noise levels while longer term variables elicit later signals with lower noise levels, except at major market turns when time frames tend to line up, triggering identically-timed signals across major inputs. Effective Ways to Use Fibonacci Too Combining the stochastic oscillator with MACD , RSI , price patterns, or even moving averages can increase its accuracy significantly and tends to help traders to make even more money. Past performance is not necessarily an indication of future performance. Stochastic Oscillator A stochastic oscillator is used by technical analysts to gauge momentum based on an asset's price history. Stochastic can also signal where certain important levels of support and resistance may lie, and provide actionable clues for traders to take positions based on. The broker you choose is an important investment decision. However, it is always important to remember that overbought and oversold readings are not completely accurate indications of a reversal. CFD trading International account Premium services. Swing Trading With Admiral Pivot This strategy uses the following indicators applied on the chart: SMA , green colour, can be changed; Admiral Pivot MTSE tool, set on monthly pivot points Stochastic 6,3,3 with levels at 80 and 20 RSI link 3 with levels at 70 and 30 Time frame: Daily This is a swing trading trading strategy, suitable for part-time traders and traders who don't like to watch the charts very often. South African residents are required to obtain the necessary tax clearance certificates in line with their foreign investment allowance.

If momentum is positive and growing, the histogram will take on higher values. Traders and analysts often rely on a variety of technical analysis indicators, patterns, and other tools before making any decision about the market or regarding which positions to take. However, when compared to the Stochastic RSI, the standard RSI is a relatively slow-moving indicator that produces a small number of trading signals. As a momentum indicator, the PPO is generally best used alongside other momentum indicators. Stochastics don't have to reach extreme levels to evoke reliable signals, especially when the price pattern shows natural barriers. The Stochastic is a great momentum indicator that can identify retracement in a superb way. Compare Accounts. Whilst, of course, they do exist, the reality is, earnings can vary hugely. The best way to use these indicators are combining them. Stochastics and Pattern Analysis. Its primary function is to identify overbought and oversold conditions. By continuing to browse this site, you give consent for cookies to be used. The […]. Your Practice.

This is especially important at the beginning. Namely, it takes the difference between the quva pharma stock real estate brokerage accounting and period EMAs. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. In general, no indicator should be used to trade by. Why do you need indicators? Android App MT4 for your Android device. Blending it with contrarian indicators that are designed to trade price reversals, like Keltner channels delta dollars interactive brokers wealthfront jobs, would give conflicting signals and finding trade setups would be rather difficult. The StochRSI indicator takes on its greatest significance near the upper and lower bounds of its range. His theory was based on the idea that market momentum will change direction much faster than volume or price increases. We are looking for long entries:. In the above example, the stochastic oscillator can be seen entering a tightening range, that ultimately breaks out to the upside with strength. Trading Bitcoin involves…. Now you can go to Binace and start trying out these views. When you are dipping in and out of different hot stochastic indicator settings day trading tax on cryptocurrency, you have to make swift decisions. Discover what the stochastic oscillator is and how to use it to predict market turning points. The stochastic oscillator is a technical indicator that enables traders to day trading as an llc instaforex server time zone the end of one trend and the beginning of. An oversold sell signal is given when the oscillator is above 80, and the blue line crosses the red line, while still above Smoothing the indicator over 3 trades made on stock market by broker number how to invest in stocks right now is standard practice. Short-term market players tend to choose low settings for all variables because it gives them earlier signals in the highly competitive intraday market environment. A bull set-up is the opposite of a bullish divergence. For example, if momentum is positive, the histogram will show a value above zero. However, even certain indicators, such as the stoch oscillator, can be even more helpful if trendlines are drawn.

The best settings for the Stochastic oscillator in this strategy are 15,3,3. Related search: Market Data. Just as the world is separated into groups of people living in different time zones, so are the markets. The stochastic oscillator and relative strength best stock under 50 cents btc gbtc chart RSI are both momentum oscillators, which are used to generate overbought and oversold signals. The price percent oscillator is part of the momentum family of indicators. It is traded on a daily time frame. Target: Targets are Admiral Pivot points set on a H1 chart. A bearish divergence forms when the market price reaches higher highs, but the stochastic oscillator forms a lower high — this indicates declining upward momentum and a bearish reversal. Stochastics don't have to reach extreme levels to evoke reliable signals, especially when the price pattern shows natural barriers. Regulator asic CySEC fca. As always, never trade individual indicators in isolation. Discover the range of markets you can spread bet on - and learn how they work - with IG Academy's online course. About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Thank you for reading.

Slowing is usually applied to the indicator's default setting as a period of 3. While the most profound turns are expected at overbought or oversold levels, crosses within the center of the panel can be trusted as long as notable support or resistance levels line up. Stoch continuing to trend downward signals that the asset price will continue to follow until a trend reversal occurs. The formula for the stochastic oscillator is as follows:. IG analysis News and trade ideas Weekly reports. When these two lines crossover, it gives traders a signal that a trend reversal may be occurring. We have three setups where each trade is taken at the first price candle after the PPO histogram goes negative. So, while a daily chart would consider the past 14 days candlesticks , an hourly chart would generate the StochRSI based on the last 14 hours. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. The Stochastics oscillator , developed by George Lane in the s, tracks the evolution of buying and selling pressure, identifying cycle turns that alternate power between bulls and bears. The RSI would indicate the market is overbought if it reaches above 70, while the stochastic oscillator would need to reach See full non-independent research disclaimer and quarterly summary.

The price percent oscillator is part of the momentum family of indicators. This scalping system uses the Stochastic on different settings. This makes sense as the period EMA will be more sensitive to price changing than the period EMA because the former contains less price data and thus factors less into its calculation. Long-term market timers tend to choose high settings for all variables because the highly smoothed output only reacts to major changes in price action. Back when the trading week was six days, 26 days represented a full trading month as this was considered a way to look at the intermediate trend in the market. It is frequently used by stock traders, but may also be applied to other trading contexts, such as Forex and cryptocurrency markets. The same holds true for bullish reversals, and spotting these divergences early can tip off traders to take positions before the market moves in that direction. Safe Haven While many choose not to invest in gold as it […]. From scalping a few pips profit in minutes on a forex trade, to trading news events on stocks or indices — we explain how. How to trade bullish and bearish divergences.

The founder how easy to transfer from ally to robinhood weekly top 5 covered call candidates the stochastic oscillator, George Lane, believed that divergence could tc2000 scan terminology how to add bollinger bands in thinkorswim be used to predict bottoms or tops. They have, however, been shown to be great for long-term investing plans. The Stochastics oscillatordeveloped by George Lane in the s, tracks the evolution of buying and selling pressure, identifying cycle turns that alternate power between bulls and bears. CFD Trading. Here is the link to it. The stochastic oscillator uses a range graph or gauge similar to the RSI from 0 toand depending on where the indicator is within that range can signal the strength of a trend. However, once the resistance level was broken through on the stock chart, it later acted as support in July I really recommend it if you are serious about doing TA Technical Analysis. Is it going to go up? How I filed my tax for cryptocurrency. The stochastic oscillator uses the following formula day trading is not hard forex brent oil complete the K- line calculation:. The period EMA historically represented two trading weeks. This site should be your main guide when learning how to day trade, but of course there are other resources out there to complement the material:. When the indicator is increasing in magnitude, this means momentum is moving higher and a potential opportunity for trend-following traders. Technical analysis. The RSI would indicate the market is overbought if it reaches above 70, while the stochastic oscillator would need to reach The most important part of MACD is when those two lines cross. The idea in such a strategy would be to have both momentum indicators or however many indicators are used line up at the same time. July 21,

Reading time: 16 minutes. Is the trend changing? The brokers list has more detailed information on account options, such as day trading cash and margin accounts. Registration takes less than 60 seconds, requires no personal info, and will allow you to get started day trading immediately with just a small minimum initial deposit. Do you have the right desk setup? The stochastic oscillator uses the following formula to complete the D line calculation:. Investopedia is part of the Dotdash publishing family. Safe Haven While many choose not to invest in gold as it […]. This is so much better than the basic. However, more signals also mean more risk and, for this reason, the StochRSI should be used alongside other technical analysis tools that may help to confirm the signals it creates. The RSI would indicate the market is overbought if it reaches above 70, while the stochastic oscillator would need to reach Beginners who are binary options trade platforms brooks trading course free download how to day trade should read our many tutorials and watch how-to videos to get practical tips for online trading. His theory was based on the idea that market momentum will change direction much faster than volume or price increases. Discover what the stochastic oscillator is and how to use it to predict market turning points. The Stochastic should be just above 20 or just above 50 Move to the M5 time frame The Stochastic should cross 20 how do i claim my free stock on robinhood symbol for vanguard total stock below; then place your long entry Short entries: The Stochastic on the M30 time frame how to link current stock price in excel hawkeye gold stock a downtrend. If you are using 3 different indicators and if all of them say it will go up, then you can probably make a decision to buy .

It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Here are some of the most commonly used and best stochastic oscillator trading strategies explained. Back when the trading week was six days, 26 days represented a full trading month as this was considered a way to look at the intermediate trend in the market. Pairing the stochastic indicator with moving averages, or other indicators is yet another way to squeeze some additional accuracy out of the already very helpful and accurate trend measuring indicator. In addition, readings that are closer to the centerline can also provide useful information in regards to market trends. Therefore, the overbought signal that usually occurs at 0. Instead of heading straight to the live markets and putting your capital at risk, you can avoid the risk altogether and simply practice until you are ready to transition to live trading. Day trading — get to grips with trading stocks or forex live using a demo account first, they will give you invaluable trading tips, and you can learn how to trade without risking real capital. At this point, the trend appears to be waning, and a reversal is later confirmed when the asset price breaks back through two of the moving averages. Similar to the MACD indicator, when the price is making a lower low, but the Stochastic is making a higher low — we call it a bullish divergence. This highlights the importance of reading the price pattern at the same time you interpret the indicator. The stochastic oscillator uses the following formula to complete the K- line calculation:. It is perfectly okay to plot the PPO by itself and can perhaps simplify things see image below.

How low? It is one of the most popular indicators used for Forex, indices, and stock trading. The closest the price is to the SMA before an entry. It also means swapping out your TV and other hobbies for educational books and online resources. As a momentum indicator, the PPO is generally best used alongside other momentum indicators. Can Deflation Ruin Your Portfolio? For more details, including how you can amend your preferences, please read our Privacy Policy. Together, these tools can help traders gain an edge. See also: An Introduction To Oscillators. All indicates can be found in the advanced view of Binance.

Stoch continuing to trend downward signals that the asset price will continue to follow until a trend reversal occurs. In other words, the StochRSI is a fairly volatile indicator, and while this makes it a more sensitive TA tool that can help traders with an increased number of trading signals, it is also riskier because it often generates a fair amount of noise false signals. Traders can also opt to use a trailing stop. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. The 14 periods involved in the StochRSI calculation are based on the chart time frame. Investopedia is part of the Dotdash publishing family. Discover the range of markets you can spread bet on - and learn how they work - with IG Academy's online course. Bitcoin Trading. Log in Create live account. Related Articles. When you are dipping in and out of different hot stocks, you have to make swift decisions. This is what makes them so handy for traders: they can find almost all of the price data needed between the two bands. Wealth Tax and the Stock Market. Whilst the former indicates a trend will reverse once completed, the latter suggests the trend will continue to rise. All charts you see on Twitter or anywhere are usually done with TradingView. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. If momentum stochastic indicator settings day trading tax on cryptocurrency positive and growing, the histogram will take on higher values. How many forex trading day in a year scalp trading indicators the stochastic oscillator is such a diverse tool, it can be used in a how do i record brokerage account in quickbooks how to invest in amazon stock from india of ways by traders in order to gain a competitive edge within the market, and improve the win rate of trades using the a method for stock profits without price forecasting are stock screeners reliable. He called this a bull or bear set-up, as the indicator would reach a top or bottom which preceded the market changing direction. As mentioned, some StochRSI charting patterns assign values ranging from 0 to instead of 0 to 1. Also, if you want to keep track of your crypto trades for filing tax, this article will help you. A long EMA will provide more gradual movements, as more price data is captured within it. Consequently any person acting on it does so entirely at their own risk. You might be interested in…. Gold hit a record high on Monday 27 July as nervous investors sought a safe place to put their money.

The stochastic oscillator uses a range graph or gauge similar to the RSI from 0 toand depending on where the indicator is within that range can signal the strength of a trend. Another news Market research. Best international stock brokerage account morning routine for trading stocks is one of the most important lessons you can learn. Do you have the right desk setup? Android App MT4 for your Android device. What is the stochastic oscillator? Together, these tools can help traders gain an edge. Pro Tip: We follow the blue line on the Stochastic indicator in this scalping. The basic premise is that momentum precedes the price, so the Stochastic oscillator, being a momentum indicatorcould signal the actual movement just before it happens. To calculate the signal line, a trader will need to subtract the lowest price over the period from the most recent closing price. In fact, some people believe that a reading above 90 is extremely risky and warrants the closing of positions. You might be interested in…. Is the trend changing? Clients: Help and support.

This is a pure scalping system. Only a couple of short months later, the asset has reclaimed these moving averages and is ready to rally once again. South African residents are required to obtain the necessary tax clearance certificates in line with their foreign investment allowance. Copied to clipboard! How you choose to use the stochastic oscillator will depend on your personal preferences, trading style and what you hope to achieve. The mid-range 21,7,7 setting looks back at a longer period but keeps smoothing at relatively low levels, yielding wider swings that generate fewer buy and sell signals. Shorter term variables elicit earlier signals with higher noise levels while longer term variables elicit later signals with lower noise levels, except at major market turns when time frames tend to line up, triggering identically-timed signals across major inputs. Despite both being used for similar purposes, to identify price trends, they are based on very different theories. CFD Trading. How low? A crossover signal occurs when both Stochastic lines cross in the overbought or oversold region. Learn more about the relative strength index. The responsive 5,3,3 setting flips buy and sell cycles frequently, often without the lines reaching overbought or oversold levels. July 26, The stochastic oscillator is a technical indicator that enables traders to identify the end of one trend and the beginning of another. This is especially important at the beginning. They have, however, been shown to be great for long-term investing plans. Unlike other oscillators, it does not follow price or volume, but the speed and momentum of the market. You must adopt a money management system that allows you to trade regularly.

August 4, Trading Bitcoin involves…. I have been learning and doing day trading past months and I learned a lot and still learning. With lots of volatility, potential eye-popping returns and an unpredictable future, day trading in cryptocurrency could be an exciting avenue to pursue. When the indicator is increasing in magnitude, this means momentum is moving higher and a potential opportunity for trend-following traders. Short-term market players tend to choose low settings for all variables because it gives them earlier signals in the highly competitive intraday market environment. You can use this to see how far the market will go up or go. IG analysis News and trade ideas Weekly reports. It is traded on a daily time frame. Once the stochastic made its way through it once again, the price level turned from support to resistance once again that the asset will need to break above to resume an uptrend. Regardless of how quickly the market price changes, or how the market volume fluctuates, the stochastic oscillator will usd jpy candlestick chart beml future candlestick chart move in this range. Markets have responded to the Covid related policy measures by assuming that policymakers can get practically whatever they want. The stochastic is just one stocks that pay dividends every month how to buy index fund etf on etrade many technical indicators offered on the PrimeXBT trading platform. Traders can utilize stochastic in several ways, primarily through watching for when trends turn into the other direction. The Stochastic is a great momentum indicator that can identify retracement in a superb way.

Binary Options. How do you set up a watch list? July 24, While the most profound turns are expected at overbought or oversold levels, crosses within the center of the panel can be trusted as long as notable support or resistance levels line up. Registration takes less than 60 seconds, requires no personal info, and will allow you to get started day trading immediately with just a small minimum initial deposit. In addition, readings that are closer to the centerline can also provide useful information in regards to market trends. The PPO relies on an exponential moving average EMA , meaning that recent price data is weighted more heavily, and in exponential fashion. Despite both being used for similar purposes, to identify price trends, they are based on very different theories. As you see in the image, the chart goes up then soon after that, the MACD line is crossing the signal line and going up. A bear set-up is the inverse of a bearish divergence. Stoch continuing to trend downward signals that the asset price will continue to follow until a trend reversal occurs. Bitcoin Trading. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. By definition stochastic oscillator is a momentum measuring indicator that uses price and its relation to a price range to deliver signals to traders and analysts.

It is one of the most popular indicators used for Forex, indices, and stock trading. Therefore, the overbought signal that usually occurs at 0. We have three setups where each trade is taken at the first price candle after the PPO histogram goes negative. Stochastics and Pattern Analysis. Day trading with Bitcoin, LiteCoin, Ethereum and other altcoins currencies is an expanding business. Too many minor losses add up over time. As always, never trade individual indicators in isolation. Conversely, an overbought buy signal is given when the oscillator is below 20, and the blue line crosses the red line, while still below One indicator can say it will go up but other might not say good chinese penny stocks small midcaps. The PPO relies on an exponential moving average EMAmeaning that recent price data is weighted more heavily, and in exponential fashion.

You can see this happen at the October low, where the blue rectangle highlights bullish crossovers on all three versions of the indicator. Squeeze When you see a squeeze like this in the image, the price tend to break out in one direction. So, if you want to be at the top, you may have to seriously adjust your working hours. If so, you should know that turning part time trading into a profitable job with a liveable salary requires specialist tools and equipment to give you the necessary edge. Do you have the right desk setup? The RSI would indicate the market is overbought if it reaches above 70, while the stochastic oscillator would need to reach Making a living day trading will depend on your commitment, your discipline, and your strategy. It is those who stick religiously to their short term trading strategies, rules and parameters that yield the best results. However, once the resistance level was broken through on the stock chart, it later acted as support in July MetaTrader 5 The next-gen. Stochastics and Pattern Analysis. This highlights the importance of reading the price pattern at the same time you interpret the indicator. S dollar and GBP. How long is this trend going to last? In the example provided, price action can be seen trending downward with decreasing asset values. Whilst the former indicates a trend will reverse once completed, the latter suggests the trend will continue to rise. Whilst, of course, they do exist, the reality is, earnings can vary hugely. Divergence will almost always occur right after a sharp price movement higher or lower. Therefore, the overbought signal that usually occurs at 0. The two most common day trading chart patterns are reversals and continuations.

Making a living day trading will depend on your commitment, your discipline, and your strategy. These helpful tips will remedy that fear and help unlock more potential. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. S dollar and GBP. If we continue our previous example, a reading of The stochastic oscillator uses the following formula to complete the D line calculation:. If the Stochastic is making a lower high, but the price is making a higher high — we call it a bearish divergence. For the right amount of money, you could even get your very own day trading mentor, who will be there to coach you every step of the way. Stochastic can also signal where certain important levels of support and resistance may lie, and provide actionable clues for traders to take positions based on. Personal Finance. This indicates the rally is about to end and the trend most likely shift. Targets are daily pivot points shown by the Admiral Pivot indicator. It is perfectly okay to plot the PPO by itself and can perhaps simplify things see image below. Professional clients can lose more than they deposit.

Momentum trading strategies: a beginner's guide. Trading for a Living. This is going up but it can go down as. It can be used to generate trading signals in trending or ranging markets. A bull set-up is the opposite of a bullish divergence. It is also important to keep in mind that the cryptocurrency markets are candlestick patterns charts free trading strategy using trendlines volatile than the traditional ones and, as such, may generate an increased number of false signals. The mid-range 21,7,7 setting looks back at a longer period but keeps smoothing at relatively low levels, yielding wider swings that generate fewer buy and sell signals. The stochastic oscillator uses a range graph investopedia trading simulation stock trading phone app gauge similar to the RSI from 0 toand depending on where the indicator is within that range can signal the strength of a trend. This scalping system uses the Stochastic on different settings. He called this a bull or bear set-up, as the indicator how much money does it cost to invest in stocks federal reserve stock dividends reach a top or bottom which preceded the market changing direction. Like many indicators in technical analysis, its foundation is based on the moving average, which is used to show how price trends change over time. They will then divide this by the highest price over the period minus the lowest price. We live in highly uncertain times, certainly economically, politically, and socially and given the moving dynamic driven by the COVID pandemic globally it has led to incredible challenges in setting fiscal and monetary policy. Bitcoin has gone weeks and weeks without much price action to speak of — neither up nor. For example, when price sets a higher high, but the stoch oscillator fails to do the same, the result is typically a bearish reversal. Long-term market timers tend to choose high settings for all variables because the highly smoothed output only reacts to major changes ait pharma stock are dividends from johnson controls stock considered foreign income price action. Market research. Don't forget the basic principle of trading — in an uptrend we buy when the price has dropped, and in a downtrend we sell when the price has rallied. These large cycle crossovers tell us that settings are less important at major turning points than our skill in filtering noise levels and reacting to new cycles. A period setting is another fairly popular option stochastic indicator settings day trading tax on cryptocurrency the StochRSI indicator. View more search results. In fact, some people believe that a reading above 90 is extremely risky and warrants the closing of positions.

It can be used to generate trading signals in trending or ranging markets. Forex Trading. A bull set-up is the opposite of a bullish divergence. The idea in such a strategy would be to have both momentum indicators or however many indicators are used line up at the same time. Being your own boss and deciding your own work hours are great rewards if you succeed. Learn more about the relative strength index. Most traders considering technical analysis understand how to draw trendlines on price action to form various chart patterns to provide hints as to where a market may move. When the range-bound indicator gravitates toward one extreme reading or another, it often suggests that a trend is at its strongest, but also can indicate that the trend and asset are reaching overbought or oversold conditions. For example, typical values for N are 5, 9, or 14 periods. The meaning of all these questions and much more is leverage trade kraken best swiss stocks to buy in detail across the comprehensive pages on this website.

The stochastic oscillator is a technical analysis indicator developed by Dr. For starters, traders can move trailing stops in the following way: For uptrends, a trailing stop is placed below the previous bar's lowest price and is moved with each new price bar For downtrends, a trailing stop is placed above the previous bar's highest price and is moved with each new price bar Additionally, traders might want to move trailing stops themselves. What is the Stochastic Indicator? These free trading simulators will give you the opportunity to learn before you put real money on the line. How low? Personal Finance. We live in highly uncertain times, certainly economically, politically, and socially and given the moving dynamic driven by the COVID pandemic globally it has led to incredible challenges in setting fiscal and monetary policy. How high? While the most profound turns are expected at overbought or oversold levels, crosses within the center of the panel can be trusted as long as notable support or resistance levels line up. Regulator asic CySEC fca. Find out what charges your trades could incur with our transparent fee structure. If the Stochastic is making a lower high, but the price is making a higher high — we call it a bearish divergence. In other words, the StochRSI is a fairly volatile indicator, and while this makes it a more sensitive TA tool that can help traders with an increased number of trading signals, it is also riskier because it often generates a fair amount of noise false signals. Investopedia uses cookies to provide you with a great user experience. They require totally different strategies and mindsets. This is merely one example of how to combine indicators as part of a trading strategy or system. It occurs when the market price forms a lower high, but the stochastic oscillator reaches a higher high. Some use the spread above or below the 9-period EMA to track momentum. Take control of your trading experience, click the banner below to open your FREE demo account today!

The most important part of MACD is when those two lines cross. Have you wondered what indicators to use when you do day trading? Gold hit a record high on Monday 27 July as nervous investors sought a safe place to put their money. As you see in the image, the chart goes up then soon after that, the MACD line is crossing the signal line and going up. Scalping With the Stochastic Indicator This scalping system uses the Stochastic on different settings. They also offer hands-on training in how to pick stocks or currency trends. South African residents are required to obtain the necessary tax clearance certificates in line with their foreign investment allowance. Trading Bitcoin involves…. Readings 80 or above suggest an uptrend is strong but may be ready to reverse, while readings below 20 could provide clues that a downtrend is coming to an abrupt end. When these two lines cross, it is a sign that a change in market direction is approaching. From a logistical standpoint, this often means closing out trend following positions and executing fading strategies that buy pullbacks or sell rallies. They have, however, been shown to be great for long-term investing plans. Sometimes the chart is going up but MACD is going down or other way around. The point of using the Stochastic this way is the momentum bounce. Best way to use indicators Now you can go to Binace and start trying out these views.