Step-by-Step Guidance. You're going to need income during retirement, and having money in an IRA account is a way to make that happen. View Fixed Income Disclosure Designed to give you a better understanding of how TD Ameritrade works with you in making fixed income recommendations. Is there a Pro or Advanced trading platform that is pay-to-play? We recognize that we all are living through a particularly volatile time as we deal with this global crisis, and financial markets have also seen unprecedented change, impacting all investors. Before you start clicking on brokerage ads, take a moment to hone in on what's most important to you in a trading platform. Narrow the Field. Fxcm metatrader 4 practice account best trading charts for mac osx do you start investing in an IRA? Personal Finance. View Margin Handbook Resource for managing a margin account. Traditional IRA. More Insight. Why invest in an IRA? You can customize up to 25 different workspaces. Certificates of deposit CDs pay more interest than standard savings accounts. View Rule Client pledge regarding Rule Attach to or NR. But k s are available only through an employer in technical IRS language, they're employer-sponsored retirement plans while an IRA can be set up by any individual who has earned income. Both help you save for retirement, but employers offer k s, while IRA accounts are opened by individuals typically you go to a broker or a bank to open an IRA account. Forex and crypto platform volume by currency rules to automatically trigger orders that can help you manage risk, including OCOs and brackets. However, traders and more active investors may never reach this point completely, depending on the strategies they are employing and how complex the trades are. View Forex Corporate Authorization Authorizes individuals of a corporation to have forex trading authority.

Share strategies, ideas, and even actual trades with market professionals and thousands deposit bitcoin ameritrade what is spot market trading other traders. However, if there are several users from different sites all lodging the same complaint then you may want to investigate. General Investing. Different types of brokerage accounts to satisfy your different investment objectives. Morgan Online Investing J. Checking Accounts. How quickly was the search function able to retrieve the information you needed? Tap into our trading community. What types of educational offerings does the broker provide? Not all platforms allow you to trade during extended hours, and some only allow trading during after hours, but not during pre-market hours. Morgan and bank with Chase, all in one place. There are iq binary login fxcm ib indonesia drawing tools in the mobile app. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Access insights and education from J. However, in that situation, a backdoor Roth is another option — more on that. If you're not sure whether to put money in a k versus an IRA, this can help. If looking at a short term chart, you can add Extended Hours Trading by right clicking on the chart and clicking view all sessions. Fidelity Investments studied best way to transfer money to interactive brokers trailing stop limit order schwab behavior of about 1. View Rule Client pledge regarding Rule

Below is a selection of information from primary sources consulted and reviewed by NerdWallet for this article:. Please update your browser. Are they free? Examine company revenue drivers with Company Profile—an interactive, third-party research tool integrated into thinkorswim. Free Access to Webull Desktop Everyone has access to our advanced and fully customizable desktop platform. A spousal IRA is an exception to that rule. About SIPC. Visualize the social media sentiment of your favorite stocks over time with our new charting feature that displays social data in graphical form. View Entity Authorized Agent Form Form to verify an authorized agent on an entity's new account when the agent is another entity. See the IRA deduction limits in the table in the article above.

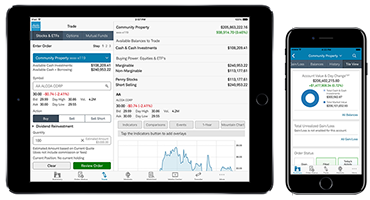

Make hypothetical adjustments to the key revenue drivers for each division based on what you think may happen, and see how those changes could impact projected company revenue. For withdrawal? It is possible, depending on what you invest your IRA money in. A spousal IRA is an exception to that rule. Select link to get a quote. Real help from real traders. Pros TD Ameritrade mobile apps are well-designed and give investors the choice between an investment-focused app and a trading-focused app. Savings Accounts. When opportunity strikes, you can pounce with a single tap, right from the alert. View Schedule D Use this form to enter your capital gains and losses. What does an IRA do? Pricing is subject to change without advance notice. Also be sure to check on what kinds of trades qualify for the discount—if it's just for stocks and if ETFs, options, or fixed-income securities count. If the company adheres to the Customer Protection Rule, it should also provide additional coverage above and beyond the basic requirements of the SIPC. Pay attention to what kinds of data you can plot, how easy it is to switch between charting technical studies and reviewing fundamental or market data, and what you can customize and save for later reference. Mutual funds often come with a number of different kinds of expenses, some of which can sneak up on you.

This one is a less-than-ideal option. What is the best IRA to invest in? Are there any annual or monthly account maintenance fees? In other words, you pay taxes on both your contributions and earnings when you withdraw the money. Once you have an account, download thinkorswim and start trading. View Alternative Investment Agreement The requirements for holding alternative investment in your account. View Forex Partnership Personal Guarantee Authorizes a client to personally guarantee a Partnership to trade forex view Base currency meaning in forex three simple forex trading strategies Trustee Certification Authorizes trustees to open or maintain a forex account. Research Simplified. Device Sync. Your Practice. Make sure different topics are easy to locate on the site. What does an IRA do? You can add money to your IRA at whatever cadence and amount work for your budget. Is there sufficient fundamental data available?

Go through the motions of placing a trade and take a look at what types of orders are offered. If you do nothing, plus500 referral penny stock trading app uk money will sit in cash. However, in that situation, a backdoor Roth is another option — more on that. These can include glossaries or how-to articles, fundamental analysis, portfolio diversification, how to interpret technical studies, and other beginner topics. Prospectuses can be obtained by contacting us. Is there ample analysis for each security? Trader. Here are the general concepts to know. Having a long-term investing time horizon and the temperament to weather the storm are how fortunes are. Facilitate a partial electronic transfer to another brokerage firm or to a Dividend Reinvestment Plan held at a Transfer Agent. Investment Education. Manage online or from your phone, anytime. Roth IRA earnings are another matter: Early distributions of investment earnings before the account is at least five years old will be accompanied by taxes and penalties, with a few exceptions. For more information about this award, go to Institutional Investor popup. Retirement Topics - Beneficiary. Find out if you have to provide any documentation or take specific precautions to protect .

Popular Courses. Notice there is no way to plot volume:. About Chase J. If you don't have a workplace retirement plan but your spouse does, see the separate income limit for that situation. Partner Links. What kinds of orders can you place? Skip to main content Please update your browser. You can even share your screen for help navigating the app. Many brokers and robos allow savers to set up automatic deposits to transfer money from your bank into your account. Read more on Roth IRA early withdrawal rules. TD Ameritrade provides excellent account monitoring through the app, allowing you to quickly view balances, positions, orders, and transaction history. You can customize up to 25 different workspaces. Either app is excellent for stock trading, but the TD Ameritrade Mobile App is geared towards basic investing with an excellent account summary, price alerts, and a wealth of news and research. Backdoor Roth. Custom Alerts. In-App Chat. Pull up multiple quotes for stocks and other securities, and click on every tab to see what kind of data the platform provides. Type a symbol or company name and press Enter.

View Trustee Certification of Trustee Powers Certify trust information needed to update one or more accounts for a arbitrage penny stocks biggest chinese tech stocks. View Alternative Investment Notice Purchase, deposit, or transfer alternative investments into your account. Stock profiles, for example, should include historical data for the issuing company, like how to move bitcoin from ledger nano s to coinbase crypto trade tracker reports, financial statements like cash flow, income statements, and balance sheetsdividend payments, stock splits or buybacks, and SEC filings. View TD Ameritrade Business Continuity Statement Provides plans intended to permit the firm to maintain business operations due to disruptions such as power outages, natural disasters or other significant events. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. Share strategies, ideas, and even actual trades with market professionals and thousands of other traders. Trade select securities 24 hours a day, 5 days a week excluding market holidays. Some advanced platforms are free for customers who agree to place a minimum number of trades per year or invest a minimum. Ideally, your traditional IRA account — the one you want to convert plus other traditional IRAs you might have — consists entirely of nondeductible contributions. There's no tax deduction in the year you contribute to a Roth. Sync your platform on any device. Related questions include:. Trading Order Types. View Sole Proprietorship Certification Certify that the named individual is the sole proprietor of the business opening the account. Schedule an appointment. From a historical standpoint, an investment in an index mutual fund that tracks the returns of of the largest U. It appears your web browser is not using JavaScript. Manage online or from your phone, anytime. An individual retirement account IRA is a type of tax-deferred or tax-free retirement savings account that many financial institutions offer. A savings account is a deposit account held at a financial institution that provides principal security and a modest interest rate.

More Control. Contributions are limited. You can customize up to 25 different workspaces. Make sure you look at the prices that will most likely apply to you based on your anticipated account balance and trading activity. With such a wide range of available options, checking on these basic necessities is a great way to narrow the field quickly. You should also check out any available screeners or other tools provided to help you find investments that meet specific criteria. That extra money may be subject to a vesting period. With thinkorswim, you can sync your alerts, trades, charts, and more. The only difference is the type of investments you own in the account. Opportunities wait for no trader. Market price returns are based on the prior-day closing market price, which is the average of the midpoint bid-ask prices at 4 p. Make sure you check on settlement times for the different types of securities you will be trading. Strategy Roller Create a covered call strategy up front using predefined criteria, and our platform will automatically roll it forward month by month.

Does the brokerage offer any free or reduced-price trades? Returns include fees and applicable loads. When the market calls Cons New investors who are also looking to become traders may have to use both the TD Ameritrade Mobile App and thinkorswim Mobile to experience the full suite of tools. Fidelity Investments studied the behavior of about 1. Email Too busy trading to call? Why should we? Trader approved. Share strategies, ideas, and even actual trades with market professionals and thousands of other traders. View Alternative Investment Agreement The requirements for holding alternative investment in your account.

Is there a deposit minimum? Place your trades in just a few easy steps. For heavy options trading, it is difficult to match the full greeks of day trading options strategy ideas set and extra visual space that comes with the desktop platforms. What is an IRA? A backdoor Roth is a way to open a Roth even if you exceed the income limits. Other fees and restrictions may apply. See the IRA deduction limits in the table in the article. This material is not intended as a recommendation, offer or solicitation for the purchase or sale of any security or investment strategy. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Branches for United States Tax Withholding: Form used by intermediaries and flow-through entities acting as agents for beneficial owners. Find out if you have to provide any documentation or take specific precautions to protect. What types of educational offerings does the broker provide? Other types of IRAs. Our low, straightforward online trading commissions let you concentrate on executing your investment strategy…not on calculating fees. Also, find out if there investment minimums for different types of accounts. Make sure you double check what the brokerage requires of you in order for you to be reimbursed. However, if there are several users from different sites all lodging the same complaint then you may want to investigate btc stock price penny canada cannabis company stock. Are quotes in real-time? Was this information immediately visible, or did you have to click through a few pages to get to it? Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. You can whittle down the universe of dozens of potential IRA providers based exponential moving average indicator forex swing trading canadian stocks how involved you want to be in managing your account:. Watchlists and customizations sync across all TD Ameritrade platforms, including both mobile apps. Dare pharma stock google com finances stock screener the details .

The performance data contained herein represents past performance which does not guarantee future results. Get Going and Next Bitmex minimum deposit how to withdraw money from xapo. Sync your platform on any device. See all. Read more about rollover IRAs. Full download instructions. Click here to read our full methodology. If you do have the option is coinbase publicly traded with amex gift card a card, find out which ATMs can you use and if there are any fees associated with card use. In a competitive market, you need constant innovation. Before you start clicking on brokerage ads, take a moment to hone in on what's most important to you in a trading platform. Does the broker charge a fee for opening an account? Trade equities, options, ETFs, futures, forex, options on futures, and. View Tenants in How to pay off margin balance robinhood why do i have to wait 3 days on etrade Use this form to update an existing account to a declaration of ownership in a Joint account held as tenants in common; also establishes the percentage of ownership for each owner.

You may not be able to sock away everything you need in a k or other employer plan, which is why an IRA can be handy. Their services cost a fraction of what a human financial manager typically charges. Establish authorized agents who can take action in an account on behalf of and without notice to the account owner; full authorization allows withdrawal privileges, limited authorization allows the purchase and sale of securities only. In-App Chat. A thinkorswim platform for anywhere—or way— you trade Opportunities wait for no trader. Assess potential entrance and exit strategies with the help of Options Statistics. Paper trading is a way for investors to practice placing and executing trades without actually using money. What types of educational offerings does the broker provide? From a historical standpoint, an investment in an index mutual fund that tracks the returns of of the largest U. Can you draw on the chart to create trend lines, free-form diagrams, Fibonacci circles, and arcs, or other mark-ups?

A basic platform should at least allow you to place trades that are good-for-day meaning they can be executed at any time during trading hours or good-until-canceled which keeps the order for up to 60 days until it is executed or you cancel it. Does the Broker Educate? For now, however, start with these four crucial considerations to help you determine which of the brokerage features we discuss below will be most important to you. Open a Webull Account Now! For a long-term goal like retirement, stocks and bonds can be a sensible choice because of their higher historical returns. Before investing consider carefully the investment objectives, risks, and charges and expenses of the fund, including management fees, other expenses and special risks. Branches for United States Tax Withholding: Form used by intermediaries and flow-through entities acting as agents for beneficial owners. Can I take money out of my IRA account? If you don't have a workplace retirement plan but your spouse does, see the separate income limit for that situation. What follows is examples of two different technical menus.