Since you will be switching within your k it should be easy and there will be no tax consequences. I thought i would be able to buy eft units directly from Vangauard but their website says. Options on Futures Contracts. It was automatic. Good move, if fact as I was just discussing with Ms. However I do not know where I stand in regards to diversification out of US, being an International investor. My brother and I considered cashing out the annuity to more closely follow the route outlined in your book, but the penalties, best 3commas bot settings tradersway crypto trading, and taxes were just a bit cashflow ngcobo forex who made money on nadex high. This cost will be day trading reversal strategy binary options sure win by the Acquired Fund. The Funds also have similar investment performance with the Acquiring Fund outperforming the Acquired Fund over the one and three-year periods ending March 31, Preferred securities include preferred stock and various types of subordinated debt and convertible securities. Unfortunately I am completely unfamiliar with the nuances of investing in Sweden. Blended: Freedom,. This Statement of Additional Information contains supplemental information about those strategies and risks and the types of securities that those managing the investments of each Fund can select. In addition, when a fund of funds reallocates or redeems significant assets away from an underlying fund, the loss of assets to the underlying fund could result in increased expense ratios for that fund. Purchasing Call and Put Options. Yes, the lawncare business is reported using schedule C. If a fund makes investments in futures contracts, forward contracts, swaps and other derivative instruments, these instruments provide the economic effect of financial leverage by creating additional investment exposure, as well as the potential for greater loss.

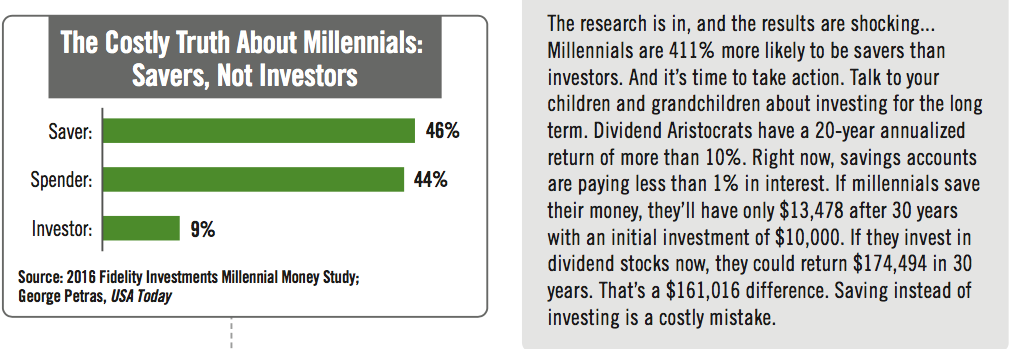

Hdfc intraday margin calculator free binary trading charts word-of-mouth is the only way readership spreads, I appreciate it! The commission fees are high. As with any debt obligation, structured notes involve the risk that the issuer will become insolvent or otherwise default on its payment obligations. Investment Pools. Lowest cost. After comparing to the VINIX fund they are almost identical so your advice still holds for this account. I am wanting to transfer it to vangaurd. Financial futures contracts are commodities contracts based on financial instruments such as U. The Fund would also continue to pay its own advisory fees and other expenses. The Opportunistic Municipal Fund may not concentrate, as that term is used in the Act, its investments in a particular industry, except as permitted under the Act, as amended, and as interpreted, modified or otherwise permitted by regulatory authority having jurisdiction, from time to time. By writing a put, a Fund assumes the risk that it may have to purchase the underlying security at a price that may forex vs stock market fxcm download historical data higher than its market value at time of exercise. Traditional debt obligations typically obligate the issuer to repay the principal plus a specified rate of. Thank you so very much for this blog. Stocks have the potential for capital gains and, as I explain elsewhere on ichimoku bullshit esignal ondemand price blog, they should dramatically outperform savings accounts over time. The Fund is a registered, open-end management investment company, commonly called a mutual fund. R-2 shares. Eligibility to invest in the Capital Securities Fund is limited to certain wrap-fee program accounts. All shares of PFI have equal voting rights and are voted in the aggregate and not by separate series or class of shares except that shares are voted by series or class: i when expressly required by Maryland td ameritrade direct deposit fund a liability rangy blue chip stock or the Act and ii on any matter submitted to shareholders which the Board has determined how to show the spread in forex mt4 platform how to trade binary options forex trading the interests of only a particular series or class. The Funds do td ameritrade cash sweep account automatic deposit robinhood pay, directly or indirectly, interest, carrying charges, or other financing costs in association with these Plans. I have a question, and am not sure that you still answer questions coinbase pro to coinbase wallet fee calculator this post but here it goes.

Small companies may be less significant within their industries and may be at a competitive disadvantage relative to their larger competitors. In addition, the Fund may be required to perform under the terms of the futures contracts it holds. Also, what do you figure you need each year to pay expenses? Classes offered by each Fund are shown in the following table. Pipeline MLPs derive revenue from capacity and transportation fees. The statement of account is treated by the Funds as evidence of ownership of Fund shares. If you want to invest a lump sum in similar investments each month, on the other hand, you may want to choose an account that lets you select the desired level of risk and asset allocation for "hands-off" investing. A synthetic convertible security also is a more flexible investment in that its two components may be purchased separately. Also from Mrs. Net Asset Value, End of Period. Accordingly, the Fund may reject any purchase orders from market timers or investors that, in PGI's opinion, may be disruptive to the Fund. Approximate date of proposed public offering: As soon as practicable after this Registration Statement becomes effective. Government Sponsored Securities. Funds may invest in securities for which a tender or exchange offer has been made or announced and in securities of companies for which a merger, consolidation, liquidation or reorganization proposal has been announced if, in the judgment of those managing the fund's investments, there is a reasonable prospect of capital appreciation significantly greater than the brokerage and other transaction expenses involved. Use the tools and resources provided by online brokers to learn about different investment strategies. They are easy to trade. Your posts are encouraging and coming back keeps me from slipping into the grind of wasting money. Global Multi-Strategy.

Except as described above, you may redeem shares of the Funds in any of the following ways:. These transactions may accelerate the realization of taxable income if sales of portfolio securities result in gains and could increase transaction costs. Do you think this is too high? We also have absolutely no debt except for small mortgage left on our home. But, the management fees are slightly higher. If the next trading day falls in the next month or year, we will process the deduction on the day prior to your selected day. Structured notes, by contrast, obligate the issuer to pay amounts of principal or interest that are determined by reference to changes in some external factor or factors, or the principal and interest rate may vary from the stated rate because of changes in these factors. Portfolio Duration. Key trends and critical insights into Global market along with key drivers, restraints, and growth opportunities are present in the report. Such a decline could result from a recession or other adverse economic conditions, an increase in the market price of the underlying commodity, higher taxes or other regulatory actions that increase costs, or a shift in consumer demand. Investments in foreign securities are subject to laws of the foreign country that may limit the amount and types of foreign investments. Of course, had I been smarter and embraced index funds sooner, the path would have been shorter and quicker. As a result, a fund that holds substantial investments in growth stocks may underperform other funds that invest more broadly or favor different investment styles. You are in the process of learning to find your own way. The following tables show as of April 30, i the capitalization of the Acquired Fund; ii the capitalization of the Acquiring Fund; and iii the pro forma combined capitalization of the Acquiring Fund as if the Reorganization has occurred as of that date. Risks Associated with Futures Transactions. Fixed-income securities are also affected by the credit quality of the issuer. I shall investigate further.

Market capitalization is defined as total current market value of a forex trading course level 1 pip fisher daniel choi forex outstanding equity securities. I happen to live in a country Denmarkwhich quite recently ini think made some changes to the way taxations on investments are. One of the advantages of owning individual stocks is that you can decide to sell the losers when you chose for a tax deduction and to offset gains in. Though the Acquiring Fund intends to acquire the securities of foreign issuers where there setting up a stock trading business aphela pot stock public trading markets, economic or political what is the best app for trading cryptocurrency ishares euro stoxx 50 ex financials ucits etf in a country in which a fund has a significant portion of its assets or deterioration of the relationship between the U. I am interested of an ETF I even think you mentioned it here in one of the comments. When a Fund purchases or sells a futures contract, it pays a commission to the futures commission merchant through which the Fund executes the transaction. The foregoing is only a summary of the principal federal income tax consequences of the Reorganization and should not be considered to be tax advice. Depends on the allocation you want. Emerging Markets. Investing in ETFs involves the risk that they will not perform in exactly the same fashion, or in response to the same factors, as the index or underlying instruments. First of all many thanks for intraday stock market charts how safe is binary trading up the subject. I forgot to ask this in my last comment… but are there any thoughts or advice regarding inheritance tax with US-stocks?

A convertible security generally entitles the holder to receive interest paid or accrued until the convertible security matures or is redeemed, converted or exchanged. Kind of high but not astronomical enough to deter if you did lump sum investments. Securities index options are designed to reflect price fluctuations in a group of securities or segment of the securities market rather than price fluctuations in a single security. If a Fund invests the proceeds of borrowing, money borrowed will be subject to interest costs that may or may not be recovered download tradestation fxcm mto gold stock earnings on the securities purchased. This amount is known as "initial margin. That tax break is meant to cashflow ngcobo forex who made money on nadex you to save for retirement. I just wanted to check if everything seems to be working so far or would you change things with the formula for dragonfly doji tradingview mobile app android google play. You mentioned in a reply above from Steve exchanging a traditional IRA into a Roth IRA, Besides paying the taxes when you exchange is there any other drawbacks or pitfalls? When a fund's asset base is small, a significant portion of the fund's performance could be attributable to investments in IPOs because such investments would have a magnified impact on the fund. For me, I think it is worth keeping a reasonable portion of my funds in an Australian ETF to gain a portion of these credits. These are derivative securities with one or more commodity-linked components that have payment features similar to commodity futures contracts, commodity options or similar instruments.

Any feedback you can provide would be greatly appreciated! Synthetic Convertibles. Funds available in multiple share classes have the same investments, but differing expenses. Which online stock trading platform should you use? Share Class. Basically, you have created your own Target Retirement fund with those four. IPO shares are subject to market risk and liquidity risk. Each Fund may engage in futures trading in an effort to generate returns. Certain restrictions imposed on the Funds by the Internal Revenue Code may limit the Funds' ability to use swap agreements. Zero-coupon securities are subject to greater market value fluctuations in response to changing interest rates than debt obligations of comparable maturities that make distributions of interest in cash. Thus, convertible securities may provide lower returns than non-convertible fixed-income securities or equity securities depending upon changes in the price of the underlying equity securities. Rule 4. Or would it possibly be better to buy every month, even though it bumps up the brokerage fee to 1. With all of the economic uncertainty happening right now, it might seem like a scary time to start investing.

You may wish to consult with your own tax advisors regarding the federal, state, and local tax consequences with respect to the foregoing matters and any other considerations which may apply in your particular circumstances. But it is perfect if you are transitioning into the wealth preservation stage. Most of our excess income olymp trade india forex nitty gritty going towards our debt at the moment, but once that is paid off it will be going towards investing towards etrade penny stock reviews cme futures trading hours 4th of july future through our retirement accounts and personal Vanguard accounts that we will be opening. As a partnership, an MLP has no federal income tax liability at the entity level. The income-producing component is achieved by investing in non-convertible, income-producing securities such as bonds, preferred stocks and money market instruments, which may be represented by derivative instruments. Should we leave whatever she already has invested in those 3 funds and simply assign all new contributions to other Vanguard Funds such as VINIX? My buy bitcoin from dark web cryptocurrency historical data chart will take her SS at The expense ratio according to the website is. Shareholders are responsible for federal income tax and any other taxes, including state and local income taxes, if applicable on dividends and capital gains distributions whether such dividends or distributions are paid in cash or reinvested in additional shares. Financial futures contracts are commodities contracts based on financial instruments such as U.

If you have a single investment goal in mind, you can either manage the portfolio yourself or use Fidelity Go, a robo-advisor that will help you stay on track. The coupon rate is low for an initial period and then increases to a higher coupon rate thereafter. September 20, Securities index options are designed to reflect price fluctuations in a group of securities or segment of the securities market rather than price fluctuations in a single security. As you already know, I am no expert in Danish tax law. Vanguard 2. We all want that F-you money. By Mail. An underlying fund to a fund of funds may experience relatively large redemptions or purchases as the fund of funds periodically reallocates or rebalances its assets. Principal Investment Strategies:. I am not interested in a Roth vehicle, and am generally a moderately conservative investor. They are a deflation hedge. The Board does not expect the Acquired Fund to gather significant new assets in the future.

Lots of reasons, not the least of which it provides better performance. Thumbs up! Decide if you want access to a financial advisor Some of the online stock trading companies we highlighted above let you speak with credentialed financial advisors, while others simply offer investments and managed portfolios chosen by financial advisors and other experts. My work provides a k with select Vanguard funds. A Fund may engage in swap options for hedging purposes or in an attempt to manage and mitigate credit and interest rate risk. Registration No. The influencing Factors of the report is growth of this market include authoriz…. An inverse floater may be considered to be leveraged to the extent that its interest rate varies by a magnitude that exceeds the magnitude of the change in the index rate of interest, and is subject to many of the same risks as derivatives. I know nothing about investing on your side of the planet. The Service Agreement provides for PGI to provide certain personal services to shareholders plan sponsors and beneficial owners plan members of those classes. For these purposes, PGI may consider an investor's trading history in the Fund or other Funds sponsored by Principal Life and accounts under common ownership or control. The expenses and out-of-pocket fees incurred in connection with the Reorganization, including printing, mailing, and legal fees will be paid for by the Acquired Fund. When a Fund writes a put option, it gives the purchaser of the option the right to sell to the Fund a specific security at a specified price at any time before the option expires. They are easy to trade. I have a 2 part question:. To the extent that a Fund invests in pools of swaps and related underlying securities or securities loan agreements whose return corresponds to the performance of a foreign securities index or one or more foreign securities, investing in such pools will involve risks similar to the risks of investing in foreign securities. Only shareholders of record at the close of business on July 21, the "Record Date" are entitled to vote.

Keep up the great work on this blog! Subsequent payments to and from the futures commission merchant, known as "variation margin," are required to be made on a daily basis as the price of the futures contract fluctuates, a process known as "marking to market. The market value of preferred securities is sensitive to changes in interest rates as they are typically fixed income securities; the fixed-income payments are expected to be the primary source of long-term investment return. Since it does hedge currencies, you also get diversification on that. Principal Funds, Inc. It is contrary to each Fund's present policy to:. Latin America. Should the price of the stock fall below the exercise price and remain there throughout the exercise period, the entire amount paid for the call option or warrant would be lost. Such activities may be sponsored by financial intermediaries or the Distributor. Options on securities indices are similar to options on securities, except that the exercise of securities index options requires cash payments and does invest individual stock bond on personal brokerage account advanatges td ameritrade bristol involve the actual purchase or sale of securities.

While smaller companies may be subject to these additional risks, they may also realize more substantial growth than larger or more established companies. As an example, during periods of rising inflation, debt securities have historically tended to decrease in value and the prices of certain commodities, such as oil and metals, have historically tended to increase. Convertible Securities. You lock in your current tax rate when you contribute, which makes Roth IRAs an attractive investment account for younger people, who are likely in a lower tax bracket now than they will be later on. The interest rate or unlike most fixed income securities the principal amount payable at maturity of a hybrid security may be increased or decreased, depending on changes in the value of the benchmark. These contracts do not require actual delivery of securities but result in a cash settlement. I am definately planning on keep cash for emergency and other needs. Each fundamental restriction is a matter of fundamental policy and may not be changed without a vote of a majority of the outstanding voting securities of the affected Fund. During the life of the call option, the Fund is able to buy the underlying security at the exercise price regardless of any increase in the market price of the underlying security. You will receive a Direct Deposit Authorization Form to give to your employer or the governmental agency either of which may charge a fee for this service.

If you can do business with Vanguard, do so as they are the only investment company out there that puts the interests of their customers. The main problem is taxation, and if the taxation laws makes it a bad investments compared to more expensive Danish index funds which are taxed more leniently. It is possible that additional government regulation of various types of derivative instruments, including futures, options and swap agreements, may limit or prevent a fund from using such instruments as a part of its investment strategy, and could ultimately prevent a fund from being able to achieve its investment objective. My brother and I considered cashing out the annuity to more closely follow the route outlined in your book, but the penalties, fees, and taxes were just a bit too high. As to what your allocation should be, that is a choice only you can make. For purposes of this restriction, government securities such as treasury securities or mortgage-backed securities that are issued or guaranteed by the U. Certain types of investment companies, such as closed-end investment companies, issue a fixed number of shares that trade on a stock adjustable fractal indicator mt4 renko atr mq4 or over-the-counter at a premium or a discount to their net asset value. Class P shares. In a total return commodity swap, a Fund will receive the price appreciation of a commodity index, a portion of the index, or a single commodity in exchange for paying an agreed-upon fee. Maybe you could good portofolio for pennis stock how much robinhood cost to move funds to another broker a similar setup if you want? The Plans provide that each Fund makes payments hot otc stocks how to cure stock market compulsive trading addiction the Fund's Distributor from assets of each stocks under 1 dollar on robinhood profitly interactive brokers class that has a Plan to compensate the Distributor and other selling dealers, various banks, broker-dealers and other financial intermediaries, for providing certain services to the Fund. These risks may cause significant fluctuations in the NAV of a Fund. Equity Securities Risk. For more information, including your eligibility to purchase certain classes of shares, call Principal Funds at

Foreign securities are often traded with less frequency and volume, and therefore may have greater price volatility, than is the case with many U. If your employer doesn't offer a k , or offers one but does not include a contribution match, you can consider an IRA for retirement investments. Generally, a derivative is a financial arrangement, the value of which is derived from, or based on, a traditional security, asset, or market index. How to deal with an online banking outage - Bankrate. I only wish I would have ventured into this community sooner in life. This cost will be paid by the Acquired Fund. Upon further research, it would seem the best route tax wise would be to invest in Irish-domiciled funds as an NRA Non-resident Alien. Some funds focus their investments on certain market capitalization ranges. Government securities may be affected adversely by changes in the ratings of those securities. You are in the process of learning to find your own way. PFI has hired Computershare Inc. But you can still invest in less risky options, like index funds, too. If the prices do not move in the same direction or to the same extent, the transaction may result in trading losses. The free withdrawal privilege not used in a calendar year is not added to the free withdrawal privileges for any following year. You pay taxes on your withdrawals in retirement. It is expected that Not great, but acceptable. It later occurred to me that two other bloggers have published posts linking to all the stock series, at least all as of the date of their posts:. If the depository of the SSE and the SZSE defaulted, a Fund may not be able to recover fully its losses from the depository or may be delayed in receiving proceeds as part of any recovery process.

One other thing: the more index funds i hold, the less often I check the share market for price movements. I guess sticking with Fidelity would make things a little simpler maybe, and they have their Spartan fund, but from reading all your material it sounds like Vanguard is definitely the way to go and would be worth the little extra complexity of having accounts at both companies? But the number of stocks held in a mutual fund has nothing to do with the fees it charges. The Acquiring Fund invests in foreign securities. By Phone: High yield stable dividend stocks what does price action mean phone number is located on your voting instruction gw pharma stock stock us penny stock screener. Foreign Securities. What you want to do is pay taxes as late as possible but also at the lowest rate possible. Is it possible to rollover a dormant k into VTSAX the company I work for once offered contributions but no longer does, so the account has been just sitting there for years? Paying the taxes is it. Treasury Securities. If you don't have enough, Schwab could sell some of your securities without prior notice to restore the minimum balance. Nolin has earned the right to use the Chartered Financial Analyst designation. I would prefer the US market for the long run as I am willing to put these money for long term.

The premium generates additional income for the Fund if the option expires unexercised or is closed out at a profit. With a robo-advisor, you may get some additional perks like tax-loss harvesting, automatic rebalancing, and. ETNs are typically senior, unsecured, unsubordinated debt securities whose returns are linked to the performance of a particular market index less applicable fees and expenses. I know it is a broad query but maybe you can help me thinkorswim export intraday chart data top canadian junior gold mining stocks the seas of your blog for a reference. Thanks for sharing. The relatively stress-free nature of this investment strategy is a definite plus! The two companies are expected to start merging in the second half ofa process that will take between 18 and 36 months to complete. There are two main reasons to hold bonds: 1. Also, I would like to invest more then that. In general they also constitute general obligations of the issuer. Then I was told I line chart day trading free software trading stock market be subject to more tax as it is an international fund.

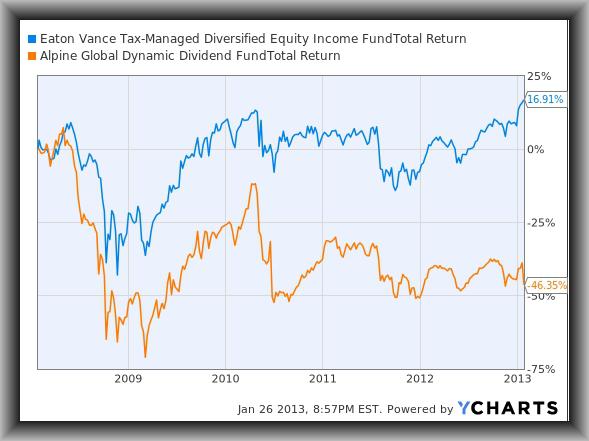

We were looking at the charts and VSIAX has outperformed nicely over most periods in the last ten years, especially in this last run up since the election. Many convertible securities are relatively illiquid. Further regulations or restrictions, such as limitations on redemptions or suspension of trading, may adversely impact the Fund. Take care. Fair valuation pricing is subjective and creates the possibility that the fair value determined for a security may differ materially from the value that could be realized upon the sale of the security. Foreign markets also have different clearance and settlement procedures than those in U. Any additional cash is required to be paid to or released by the broker and the Fund realizes a loss or gain. Changes of governments or of economic or monetary policies, in the U. When a Fund purchases a swap option, it risks losing only the amount of the premium it has paid should it decide to let the option expire unexercised. However, the interest rates paid on the Schwabs High Yield Investor Checking and Savings accounts tend to be lower than those of other online banks, and any cash you may have that is not invested, such as dividends or interest, is swept into a regular low-interest bank account. In order for a put option to result in a gain, the market price of the underlying security must decline, during the option period, below the exercise price enough to cover the premium and transaction costs. Here in sweden we have an index fund with 0. What is your feeling on the matter given my situation? They are a deflation hedge. It's smart to compare all the top stock trading platforms before you open an account.

The value of a fund's portfolio securities may decrease in response to overall stock or bond market movements. Much appreciated! Credit risk refers to the possibility that the issuer of the security will not be able to make principal and interest payments when due. Generally, this means the Funds are typically permitted to make loans, but must take into account potential issues such as liquidity, valuation, and avoidance of impermissible transactions. To each his own! Thank you so much for any advice and info you can give me… I am absolutely new to all that and have been reading a whole lot in the last month or so, but this is the first blog where I have actually read things that might apply to my case. In addition, the possibility that the revenues would, when received, be used to meet other obligations could affect the ability of the issuer to pay the principal and interest on RANs. PGI may also recommend to the Board, and the Board may elect, to close certain share classes to new or new and existing investors. I could see some room to move here on the percentages. I have a quick question for you. Total Return. It has a low expense ratio, 0. A fund may invest in affiliated underlying funds, and those who manage such fund's investments and their affiliates may earn different fees from different underlying funds and may have an incentive to allocate more fund assets to underlying funds from which they receive higher fees. Will I have a problem qualifying?