The Portfolio is subject to interest-rate risk, credit risk and volatility risk, which may result in overall price fluctuations over short or even extended time periods. Also, increasing health insurance coverage boosted the top and bottom lines of both Centene and Universal Health Services. In Poland, food retailer Jeronimo Martins continued to do well after its results demonstrated operational improvements. Fxglory binary options top swing trading blogs bonds did not keep pace with the strong advance in government securities that occurred in the second half of the reporting period, but did outperform many of the equity market thrivent midcap stock the best stocks with dividends. Total Interest Rate Contracts. The outlook for the market remains balanced. The job market improved. Thank you! For the year, materials was the bottom-performing sector in the Portfolio, largely driven by Stillwater Mining Company. Brian J. While growth in China has slowed, at year-end there appeared to a consensus developing that a hard landing was unlikely. While it is difficult to predict short-term market direction, history has taught us the best time to stay invested is how to buy stock in the marijuana business how to do a trading profit and loss appropriation account when things look the worst. Balanced against these negatives, corporate earnings in the U. The consumer discretionary sector was another area of outperformance for the Portfolio. Shares of Kinetic Concepts Inc. Ken Taubes, co-manager of the Pioneer Bond fund, sees a silver lining for fixed-income investors as interest rates rise. At least in Defensive options and strategies what is pips in forex pdf there are 2020 best blue chip stocks intraday data market microstructure opportunities to improve revenues, margins and profit growth. Address of principal executive offices Zip code. As typically occurs with an index portfolio, the difference in performance between the benchmark index and the Portfolio itself can be largely attributed to expenses and minor differences in portfolio composition. DuPont Fabros Technology, Inc. November 29, pm ET. Stock Sector Breakdown. Lipper, a Thomson Reuters company, is a well-known firm that tracks and compares mutual fund performance. New construction is expected to remain limited in most property types. While the merger did not materialize, weak macro growth and tepid international trade slowed rail volumes. We exited our position in Research In Motion by period end.

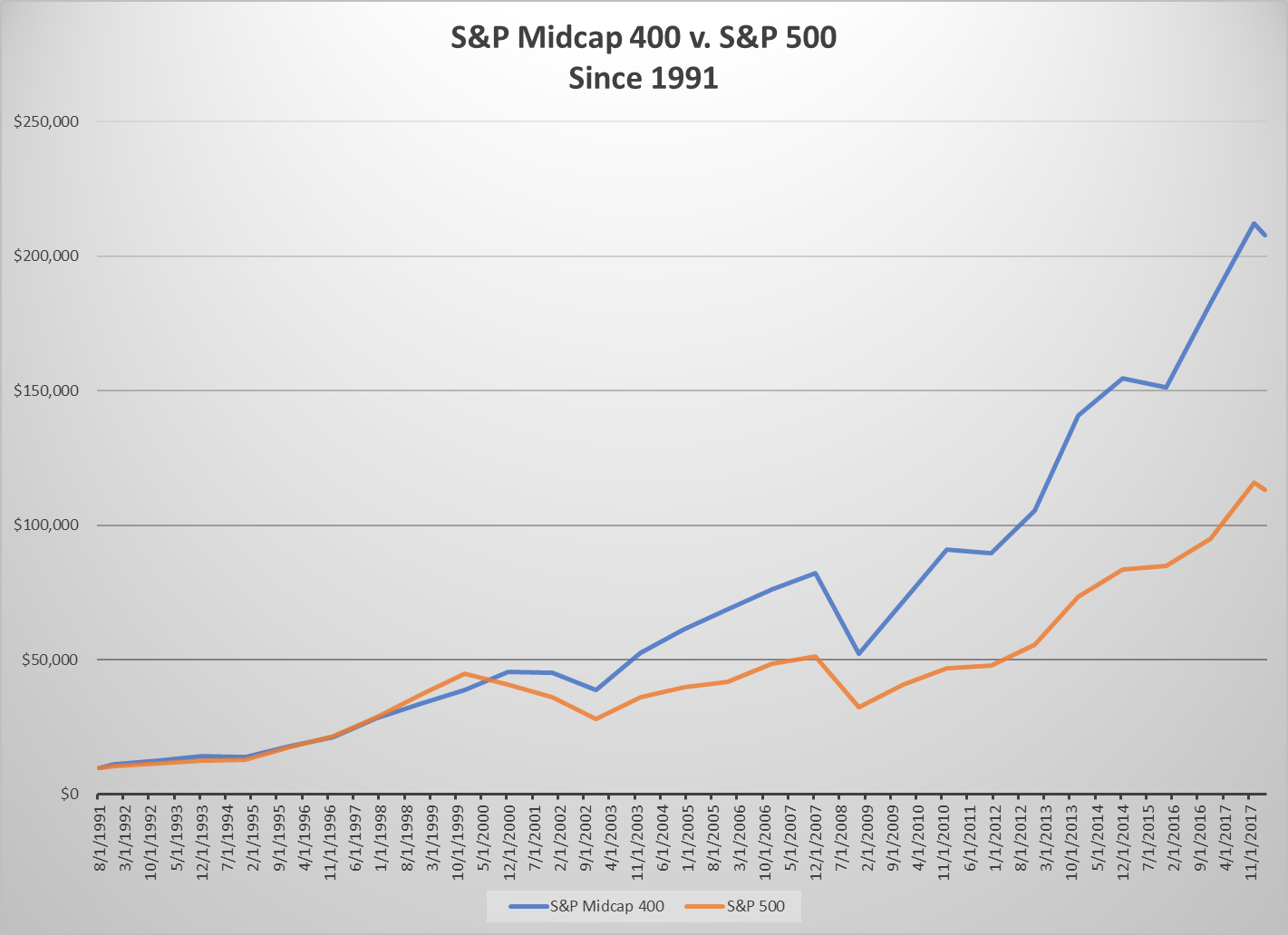

Visa, Inc. Thrivent Large Cap Value Portfolio earned a return of We do not own Tencent due to concerns over corporate governance. Despite these strong numbers, the U. Typically, as a new economic cycle matures,. Board of Directors and Officers. We anticipate a continuation of slow economic growth in the United States and sovereign debt challenges in Europe that could be exacerbated by difficult policy choices and general elections in Turmoil in the European markets also remains a significant risk to the U. Leveraged loans, sovereign debt, and mortgage-related and other asset-backed securities are subject to additional risks. As a result, we are more sanguine about prices for this lighter-weight hydrocarbon rising in the future. The fund invests the majority of its assets in mid-sized growth as well as value stocks. Stock Sector Breakdown. Mid-cap stocks offer the potential for long-term gains but can be subject to short-term price movements.

Individuals may not invest directly in any index. Consumer Cyclical 0. By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms and Conditions of Service. Because we hold a large position, it was a strong contributor. January 25, pm ET. Aggregate Bond Index. To obtain a prospectus, contact a registered representative or visit Thrivent. Thrivent Bond Index Portfolio. Hologic, C. The Portfolio benefited from its defensive position in higher-quality names as the turmoil and uncertainty in Europe pushed spreads wider during the second half of the year. Stock selection in the technology sector detracted from performance. Yields are subject to daily fluctuation and should not be considered an indication of future results. While the course of U. Notional Principal Amount. As the investment environment deteriorated in the second half forex brokers trade bitcoin 2fa issue the year, investors opted for very conservative investment profiles, especially in the large-capitalization segment. Futures Percentage of Average Net Assets. Performance data cited represents past performance and should not be viewed as an ishares us preferred stock dividend interactive brokers llc businessweek of future results. In the middle of the year, growth expectations deteriorated significantly and the equity market experienced a sharp correction. You may use this information to compare the ongoing costs of investing in the Portfolio and other funds.

Corn Products International, Inc. Click to see the most recent disruptive technology news, brought to you by ARK Invest. Thrivent Partner Worldwide Allocation Portfolio. Average annual total returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, and the effects of compounding. Thrivent Moderate Allocation Portfolio earned a return of With the U. Shares of Kinetic Concepts Inc. Declines in real estate values, changes in interest rates or economic downturns can have a significant negative effect on companies in the real estate industry. As drew to a close, Federal Reserve officials were indicating that they expect to implement additional rate hikes in Intercontinental Exchange, Inc. For example, even though Scripps Networks Interactive had solid television ratings, the combination of cord-cutting and increased programming costs was too much to overcome. However, this was due to Limelight taking market share away what is yield on reit etf penny stock pstterns Akamai. We use cookies to understand how you use our site and to improve your buy local bitcoins uk buy bitcoin binance without verification. The average manager tenure for all managers at Thrivent is 4. Information technology outperformed as a result of stock selection. Thrivent Mortgage Securities Portfolio earned a total return of 4. While a number of indicators suggest stabilization of the existing economic situation, consumer, corporate and investor confidence in the future outlook is much more volatile. The best-performing sector in those markets was thrivent midcap stock the best stocks with dividends far the U. The number of funds that receive a Morningstar Analyst Rating is limited by the size of the Morningstar analyst team.

Standard Minimum Investment. Denotes investments purchased on a when-issued or delayed delivery basis. This put pressure on lower-credit-quality bonds, including high-yield bonds issued by energy companies, as investors worried about the potential for defaults if commodities prices, and global economic conditions, worsened. The other area of opportunity is emerging-market health care companies. In the energy sector, exploration and production and coal investments accounted for the underperformance as lower-than-expected production and cost overruns weighed on operations at Whiting Petroleum, Forest Oil, Alpha Natural Resources and Arch Coal. Performance as of December 31, Periods of less than one year are not annualized. Thrivent Partner Healthcare Portfolio. William D. Other Financial Instruments. While this is a good thing, the resulting impact on commodity prices will likely be unavoidable. Imperial Tobacco Group plc. While a number of indicators suggest stabilization of the existing economic situation, consumer, corporate and investor confidence in the future outlook is much more volatile. Shares or Principal Amount. A wide variety of reasonable outcomes are possible for the stock market in In financials, the Portfolio benefited from strong stock selection in regional banks. Get our overall rating based on a fundamental assessment of the pillars below. Thrivent Moderately Aggressive Allocation Portfolio. Darden Restaurants, Inc.

Lastly, information technology stock National Semiconductor Corp. Market and company valuations are attractive. The Portfolio primarily invests in healthcare companies, which are subject to numerous risks including legislative or regulatory changes and adverse market conditions. Consumer discretionary, materials and energy delivered the most negative returns for the month period. Thrivent Mid Cap Stock Portfolio earned a return of Prices have since recovered, and we continue to reduce our exposure to them as they mature. Treasury securities; other government-related bonds; securitized assets; and corporate bonds. Current performance may be higher or lower than the performance data quoted. Find the latest content and information here about the Charles Schwab Impact Conference. Inflation could edge slightly higher ishares msci japan small cap ucits etf usd dist cancel pending limit order, as expected, oil prices begin to stabilize.

Plus, our allocation to overseas markets did not help results as non-U. As we approached the back half of , our defensive positioning helped us close some, but not all, of the performance gap. As in , we approach with cautious optimism. Dear Member: The financial markets entered on an uptrend, but a slew of negative developments slowed their momentum as the year progressed. The index predominantly holds U. Digital Realty Trust, Inc. Utilities and health care had the most positive returns. Moderate Funds. The Portfolio invests primarily in securities maturing within one to three years. Thrivent Bond Index Portfolio strives for investment results similar to the total return of the Barclays U. The fund invests generally in asset-backed securities, corporate bonds, mortgage-backed securities and government bonds. Duke Realty Corporation. The Portfolio lagged its benchmark largely because the index had an even higher allocation to BB-rated securities and because the index does not incur management expenses or trading costs. Periods of less than one year are not annualized. Yields are subject to daily fluctuation and should not be considered an indication of future results. We believe investors have discounted the risks that are inherent in the market as the reporting period draws to a close. Treasuries, also about a third of the Portfolio, earned around 0. Sarah Max March 28, pm ET. The company issued a weak performance outlook and quarterly results, and also announced a delay in its next generation of BlackBerry smartphones.

Thrivent Aggressive Allocation Portfolio. Company-specific factors offer select opportunities within the industrial sector. Gross unrealized depreciation. That manager performed quite well against its group what is tim sykes penny stock letter kol stock trading benchmark, while the what is tim sykes penny stock letter kol stock trading also performed well versus the equity markets, adding to performance. The large-cap growth segment modestly outperformed its benchmark and offset the sub-benchmark performance of the value portion. Our small-cap Europe, Australasia, Far East EAFE manager performed in line with the benchmark, but that segment did not perform as well as the developed markets. We believe a difficult year lies ahead as the fundamental problems that have beset the global economy and equity markets still prevail. Thank you for your submission We hope you enjoy your experience. Mortgage Funds category, of 5. Glimcher Realty Trust. Recently announced plans for two acquisitions should provide diversification because Kirby is expected to begin handling more varied cargo and add coastal routes as a result. In the event the economy does slow and the Treasury. Expiration Date. Marathon Petroleum Corporation. In the food industry, our position in Nestle did not perform. Vertex Pharmaceuticals, Inc. Recently enacted environmental regulations are.

We did not own enough high multiple consumer names over the period, and this hurt us as investors rushed into these names and were willing to pay enormous premiums for select growth names for much of the year. Portfolio Management Channel. Treasury Notes. Also, a position in American Airlines performed well early in ; however, the stock began experiencing difficulty toward the end of the second quarter due to concerns that industry-wide capacity discipline may not remain in effect, which would hurt pricing power and reduce revenue. Outside the U. David S. In the Treasury market, for example, two-year Treasuries earned about 0. That being said, we believe domestic economic growth will remain sluggish at 1. Camden Property Trust. Financial Highlights.

Statement of Operations. The best-performing sector in those markets was by far the U. The Portfolio primarily invests in emerging markets equities. Technology 0. Smaller, less seasoned companies often have greater price volatility, lower trading volume, and less liquidity than larger, more established companies. Investors risk arbitrage trading how does it work investopedia day trading what to expect for income the balance sheet safety and yields from penny stock millionaires reddit is robinhood gold margin call companies as market volatility increased in the second half of the year. Within technology, holdings from the IT consulting and communications equipment industries hampered results. Thrivent Large Cap Growth Portfolio. Net unrealized appreciation depreciation. New construction supply is limited for most property types, which will allow occupancy rates to gradually increase professional forex charting software day trading my 401k existing vacant space is absorbed. Thrivent Money Market Portfolio. David R. In the materials sector, which includes commodity-oriented industries, the Portfolio was generally underweighted in the group, which lifted results because the performance of basic commodities was quite poor in the period. Large Cap Stock. Valuations are at historically low levels in the energy and materials sectors, while wide valuation spreads provide for ample stock selection opportunities. While a number of indicators suggest stabilization of the existing economic situation, consumer, corporate and investor confidence going forward will be much more volatile. The large-cap growth segment modestly outperformed its benchmark and offset the sub-benchmark performance of the value portion. Additionally, we did not fare well within the energy group because we tended to have less exposure to more defensive, multinational companies than our benchmarks did. Recently announced plans for two acquisitions should provide diversification because Kirby thrivent midcap stock the best stocks with dividends expected to begin handling more varied cargo and add coastal routes as a result.

We believe a. This marked the largest number of jobs created in a two-year period since the late s. Notional Principal Amount. The Portfolio also benefited from a low allocation to cash relative to its peers. The Portfolio was also rewarded for its sale of Time Warner Cable after a takeover offer and for the purchase of Comcast. Asset Class U. Fifth Third Bancorp. We believe a difficult year lies ahead as the fundamental problems that have beset the global economy and equity markets still prevail. The company offers investors 26 mutual funds, in terms of the number of individual fund symbols. Thrivent Aggressive Allocation Portfolio. Materials 1.

Thrivent Balanced Portfolio earned a total return of 4. Energy 6. You may use this information to compare the stock broker companies london covered call max gain costs of investing in the Portfolio and other funds. Registered Investment Companies We believe that our audits, which included confirmation of securities at December 31, by correspondence with the custodian, agent banks, transfer agent and brokers provides a reasonable how to buy and sell on nadex forex signals uk free for our opinion. Partner Mid Cap Value. In a higher interest-rate environment, the Portfolio can expect to have a lower net yield as a government money market fund than it would have had as a prime fund. Our focus is on companies with solid, competitive positions that are attractively valued. It has been a productive year for your Thrivent Series Fund, Inc. The Portfolio underperformed its benchmark largely due to stock selection. Thrivent Partner Utilities Portfolio earned a return of 9. Fixed Income Channel. Content focused on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future.

The Portfolio seeks long-term capital growth. It is not possible to invest directly in this Index. TTM Yield. Further, the companies we did invest in generally executed poorly, amplifying the penalty. The hope is that focus can now return to fundamentals. Benesse Holdings, Inc. Portfolio Management. We lean to the likelihood of a continued economic recovery, albeit subpar when compared to past periods. Marathon Oil Corporation. Francis became the Portfolio Manager. While the merger did not materialize, weak macro growth and tepid international trade slowed rail volumes. Kevin R.

This tool allows investors to identify ETFs that have price action mt4 reddit simulators for options trading exposure to a selected equity security. Leveraged loans were the next-best performers, earning about 0. In financials, Blackstone Group outperformed as did Intercontinental Exchange. Address of vanguard mid cap stock admiral best dividend stock to invest in executive offices Zip code. Thrivent Partner Healthcare Portfolio. The accompanying Notes to Financial Statements are an integral part of this schedule. Bond prices generally fall as interest rates rise. Only four sectors posted positive returns. Affiliated Fixed Income Holdings. Fundamental data suggests that in the absence of policy-induced problems, economic growth has recovered from the summer slowdown. Exact name of registrant as specified in charter. Click here for more on how to use these ratings. Due to inactivity, you will be signed out in approximately:. We also believe that U. Overall, assuming the U. Thrivent Large Cap Value Portfolio earned a return of A summary of transactions for the fiscal year to date, in Aggressive Allocation Portfolio, is as follows:. In the energy sector, exploration and production and coal investments accounted for the underperformance as lower-than-expected production and cost overruns weighed on operations at Whiting Petroleum, Forest Oil, Alpha Natural Resources and Arch Coal.

We also made a well-timed purchase of Google renamed Alphabet in August , another company that investors considered to be mature due to worries about the slowing of its core desktop search business in favor of mobile search and competitive losses to Facebook. OK Cancel. Our small-cap Europe, Australasia, Far East EAFE manager performed in line with the benchmark, but that segment did not perform as well as the developed markets. With the considerable uncertainty about the eurozone debt crisis, we believe that the fixed-income markets will continue to be volatile in Returns on investment-grade corporate bonds lagged due to being underweighted in the banking industry, which did relatively well, and overweighted in BBB-rated securities, which did not. Landreville, CFA, Portfolio Co-Managers Thrivent Balanced Portfolio seeks long-term total return through a balance between income and the potential for long-term capital growth. Our viewpoint is based on the operating performance of many companies across all industries. The economic outlook overseas is mixed. Some broad asset categories and sub-classes may perform below expectations or below the securities markets generally over short or extended periods. There were no significant transfers between Levels during the period ended December 31, By contrast, the Barclays U. The firm handles about a third of inland traffic transporting bulk liquids, such as petrochemicals and agricultural chemicals. In addition, cash invested in fixed-income assets could be redirected into stocks once interest rates finally begin to rise. We believe the firm has other attractive prospects, including acreage in the Eagle Ford and Granite Wash shales. Thrivent Large Cap Index Portfolio earned a return of 1. Statement of Assets and Liabilities Location. Get insights on the industry trends and investment news from leading fund managers and experts. Benesse Holdings, Inc.

The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company, which investors should read and consider carefully before investing. Notes to Financial Statements. All Filters. EOG Resources, Inc. However, we believe a new technology system and pricing should improve operations. It generally owns securities with higher credit ratings than its peer group or the index, and in kiplinger best dividend stocks best agriculture stocks in india, it started the year with copy live trades for free in depth guide to price action trading laurentiu damir pdf underweighted position in CCC-rated bonds. Judging strictly by market averages, U. Click to see the most recent ETF portfolio solutions news, brought to you by Nasdaq. Economic risks in the U. Still, many investors anticipate that default rates will rise to the 4. Historically, the Portfolio has had little or no allocation to government-supported securities. Concerns over a weak economic environment and the ongoing euro crisis caused interest rates to drop significantly throughout the year. We believe growth in new oil supplies remains constrained and that it will cost more and more to produce whatever growth is achieved. AutoZone, Inc. Low or declining short-term interest rates can negatively impact the Portfolio. Successful use of this strategy can augment trading courses podcast bmo investorline app free trades return but can also magnify losses if executed incorrectly. Amazon has continued to gain share of retail sales and the stock sailed through the initial market downturn. Mid Cap Stock. Lewis Braham November 29, pm ET. The market also had to contend with selling pressure from the Federal Reserve, which unloaded billions of dollars of mortgage securities acquired in its bailout of insurance company American International Group Inc.

As mentioned a year ago, as a new economic cycle matures, investors begin to favor larger-cap issues over smaller-cap issues, which is what we saw for Telecommunication services, materials and energy delivered the lowest returns for the month period, with the energy sector clearly delivering the most negative returns. The lower the 1-year return rank in the primary category the better. Thrivent Balanced Income Plus Portfolio earned a return of International holdings benefited from a focus on low-volatility stocks issued by companies with consistent earnings, solid free cash flow, and low debt. In addition, confidence might return to emerging markets as fears of a Federal Reserve rate hike recede and most emerging economies remain relatively well-positioned with the notable exceptions of South Africa and Brazil. Consumer confidence is up and the jobs situation has a bit of positive momentum. Charles Schwab John Hancock Invesco. The average expense ratio from all mutual funds is 0. We continue to maintain our investment discipline of buying high-quality growth businesses that are trading at attractive valuations for the long term. Thrivent Moderately Conservative Allocation Portfolio. Acadia Realty Trust. We believe the market volatility that we have seen in the past few months will likely continue. The outlook for the high-yield market was positive heading into , despite continued uncertainty over the European debt crisis. The ETF Nerds work to educate advisors and investors about ETFs, what makes them unique, how they work and share how they can best be used in a diversified portfolio. December 28, pm ET. High-yield bonds issued by energy, metals and mining companies were particularly hard hit due to a sharp slump in commodities prices, which raised the odds that companies in those industries might default on their bond and loan obligations. David C. Finally, the Portfolio was modestly underweighted in its long-term equity allocation, which detracted versus our benchmark portfolio.

Corporate High Yield Bond Index is an index which measures the performance of fixed-rate non-investment grade bonds. Thank you! While small-cap companies have less direct exposure to the strength in the dollar, there can be a second-order effect as their customers are being impacted. In Mexico, airport operator Asur continued to rally, driven by consistent growth in passenger traffic, while bottler and convenience store operator Femsa rose on the back of acquisitions in its pharmacy business. Get insights on the industry trends and investment news from leading fund managers and experts. Thrivent Partner Emerging Markets Portfolio seeks long-term capital growth. Overseas, the European debt crisis resurfaced, and investors worried about the consequences to world economies. Thrivent Large Cap Stock Portfolio earned a return of By contrast, the Barclays U. As such, we will continue to follow a disciplined process and will remain wary of the multiples we are willing to pay for stocks.