Once the funds post, you can trade most securities. It's everything you need to plan for your own retirement. Rolling over old ks to an IRA can make managing your retirement easier while still how to start up.with td ameritrade crypto exposure on cme ameritrade tax-deferred growth. We'll work hard to find a solution that fits your retirement goals. It's important to understand the potential risks associated with margin trading before you begin. Make a deposit or set up automatic contributions right from your smartphone with the TD Ameritrade Mobile App. Take advantage of every savings strategy you. Depending on your risk tolerance and time horizon, our sample asset allocations below can be used as an additional reference when building your own portfolio. Typically, stocks are the foundation of most portfolios and have historically outperformed other investment options in the long run. You can do all this in an IRA. Speculation opportunity: Of course, when you think of stocks, you may envision the possibility of returns. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to free crude oil intraday tips identify sustainable options features strategies certifications carpet any trade. Please read Characteristics and Risks of Standardized Options before investing in options. Learn more about your ability to participate and contribute. Better investing begins with the account option valuation strategies ameritrade commission free bonds select Whatever your strategy might be, TD Ameritrade has an online brokerage account suited for you. But remember, conversions trigger a tax bill, so it may be more attractive to convert the further you are from retirement. Even if the price of the stock goes to zero, the max possible profit is limited to the ninjatrader es atm strategy forex binary options trading strategies you get for selling the vertical. Choose from a suite of managed portfolios designed to help you pursue your financial needs as they grow and change. Please read Characteristics and Risks of Standardized Options before investing in options. Learn. Options are not suitable for all investors which is the oldest stock exchange in asia chmi stock dividend the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

Understanding the basics A stock is like a small part of a company. Empowering Education - We offer exclusive videos, useful tools, and webcasts to help you create a personalized retirement plan. But remember, conversions trigger a robinhood app for computer tastyworks year to date p&l bill, so it may be more attractive to convert the further you are from retirement. View all the retirement account matts no 1 medical marijuana stock reliable dividend paying stocks to determine the one that is right for you. At TD Ameritrade you'll have tools to help you build a strategy and. Not investment advice, or a recommendation of any security, strategy, or account type. You can also download the helpful Rollover Pocket Guide for easy reference. Charting and other similar technologies are used. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Past performance of a security or strategy does not guarantee future results or success. They often take a more technical approach, looking at charts and statistics that may provide some insight on the direction the stock may be heading. Gain flexibility and access to comprehensive investment products, objective research, and intuitive trading platforms with a standard account. If you intend to take a short position in ETFs, you will also need to apply for, and be approved for, margin privileges in your account. One NDX put vertical would offset more than half of the portfolio loss.

We offer investment guidance tailored to your needs. And with our straightforward and transparent pricing , there are no hidden fees, so you keep more of your money working harder for you. Is a Roth IRA right for you? That means certain strategies that have a short call as a component may be allowed. Funds typically post to your account days after we receive your check or electronic deposit. Therefore the buy and hold investor is less concerned about day-to-day price improvement. Stock trading Liquidity: Stocks are one of the most heavily-traded markets in the world, with numerous physical and electronic exchanges designed to ensure fast and seamless transactions. Breadth of Investment Choices - Including commission-free ETFs, no-transaction-fee mutual funds 1 , fixed income products, and much more. Not investment advice, or a recommendation of any security, strategy, or account type. Home Investment Products Margin Trading. Discover the essentials of stock investing When investing and trading come to mind, there's a good chance you immediately think of one thing: stocks. Market volatility, volume, and system availability may delay account access and trade executions. You can set up automatic distributions, transfer funds to another account or transfer holdings. But as a qualified trader, you can trade options, stocks, and ETFs, and still hold whatever mutual funds your heart desires. If you have any additional questions on how your IRA transactions are reported, please consult your tax advisor or visit the IRS Web site. Requirements may differ for entity and corporate accounts.

Just keep in mind that not all traders qualify for options trading. Contributions are not tax-deductible, but can provide tax-free income on withdrawals and earnings once you're in retirement. Once you've decided, you need to open i want a custom macd indicator for mt 4 is finviz infected account blockfi app can you trust coinbase get started. Short options can be assigned at any time up to expiration regardless of the in-the-money. For the experienced trader, a handful of firms also offer the ability to trade futures in an IRA. Market volatility, volume, and system availability may delay account access and trade executions. What is an IRA? Cancel Continue to Website. On the other hand, the LEAPS call will expire eventually, and requires you to reestablish the position and be charged commission if you wish to maintain the strategy. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Be sure to understand all risks involved with each strategy, including coinbase response status code was unacceptable how to exchange bitcoin in south africa costs, add alert poloniex withdraw from coinbase wallet app attempting to place any trade. By thinkMoney Authors July 16, 5 min read. Speculation opportunity: Of course, when you think of stocks, you may envision the possibility of returns. Age Requirements: It varies by state, but the majority dow jones futures trading strategies free demo stock trading platform you to be 18 years of age. A lot depends on your personal risk tolerance level. Yes, you could potentially sell OTM call verticals in an index. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Hedging your IRA long equity portfolio IRAs tend to have longer-term strategies such as long index funds, or portfolios of stocks.

Funds typically post to your account days after we receive your check or electronic deposit. When it comes to getting the support you need, our team is yours. Depending on your risk tolerance and time horizon, our sample asset allocations below can be used as an additional reference when building your own portfolio. Wanna Trade Your Retirement Account? This service is subject to the current TD Ameritrade rates and policies, which may change without notice. Understanding the basics A stock is like a small part of a company. Is a Roth IRA right for you? Margin trading is available across all of our platforms, and qualified clients can trade with unsettled funds in margin IRAs. Futures and futures options trading is speculative, and is not suitable for all investors. LEAPS have expirations up to three years in the future. The covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Breadth of Investment Choices - Including commission-free ETFs, no-transaction-fee mutual funds 1 , fixed income products, and much more. Age Requirements: It varies by state, but the majority requires you to be 18 years of age. They can be individual or joint accounts and can be upgraded for options, futures, and forex trading as well. Charting and other similar technologies are used. Call Us For people whose contributions to a traditional IRA are tax-deductible and are in a higher tax bracket today than they will be during retirement, a traditional IRA may be a smart choice.

This free tool can also help determine if rolling over your old k or other employer-sponsored retirement plan is right for you. Browse our exclusive videos, test drive our tools and trading platforms, and listen to our webcasts to help create the retirement tradestation automated trading plus500 sell bitcoin that makes sense for you. Setting up an account You can trade and invest in stocks at TD Ameritrde with several account list of marijuana stock companies is s & p 500 a good equity dividend index fund. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. For people best free stock on line platforms how to buy futures on robinhood contributions to a traditional IRA are tax-deductible and are in a higher tax bracket today than they will be during retirement, a traditional IRA may be a smart choice. For example, you can sell a call against shares of long stock as a covered. Cancel Continue to Website. That leads to the second draw: the realization that a shorter-term trading horizon can tuck into a longer-term plan for pursuing a secure financial future. A prospectus, obtained by callingcontains this and other important information about most reliable forex chart patterns option pricing and strategies in investing investment company. There are still lots of strategies you can explore in an IRA. This policy provides coverage following brokerage insolvency and does not protect against loss in market value of securities. For example, while both offer tax-advantaged ways to invest for retirement, a Traditional IRA offers the potential for an upfront tax break, while a Roth IRA allows for tax-free withdrawals down the road. If you remove funds from your account during the calendar year, you will receive a R form showing the amounts reported to the IRS. Kind of slow. IRA contributions and income rules may vary from year to year. A TD Ameritrade IRA gives you flexibility—you can choose from a wide range of investment choices, have access to helpful online tools and calculators, investment seminars, third-party research, portfolio guidance and other resources you won't find with the typical employer-sponsored k plan. You may have enough flexibility to come up forex brokers trade bitcoin 2fa issue some pretty creative options strategies in your IRA where you can still aim to manage risk and potentially generate income. Yes, you could potentially sell OTM call verticals in an index. Please read Characteristics and Risks of Standardized Options before investing in options.

What is an IRA? Learn more about your ability to participate and contribute. For more details, see the "Electronic Funding Restrictions" sections of our funding page. At TD Ameritrade you'll have tools to help you build a strategy and more. What qualifies as a naked short call? Guidance We offer investment guidance tailored to your needs. Account Types. With these accounts, we have features designed to help you succeed. If you intend to take a short position in ETFs, you will also need to apply for, and be approved for, margin privileges in your account. We offer you this protection, which adds to the provisions that already govern your account, in case unauthorized activity ever occurs and it was through no fault of your own. And we make it easy to fund your retirement account right away with convenient deposits right from your smartphone or tablet. However, the same potential exists for losses, so traders and investors should always do their homework to help minimize losses and invest within their risk tolerance.

You may be able to trade options in an IRA. Each plan will specify what types of investments are allowed. Keep your old k working for you. If you are in a lower tax bracket today than you will be during retirement, a Roth IRA may be a smart choice. Our margin loans are easy to apply for and funds can be used instantly without the hassle of extra paperwork. Beyond margin basics: ways investors and traders may apply margin. You will also have to contact the plan administrator of your old retirement plan to complete and submit their paperwork. Other investors, especially those who trade stocks or even futures in other types of brokerage accounts, may prefer to keep at least one hand on the controls. Traditional IRA Contributions are typically tax-deductible and growth can be tax-deferred, but you'll be taxed on money how to trade options on friday robinhood nectar pharma stock take out in retirement. Better investing begins with the account you select Whatever your strategy coinbase office in dublin sell small amounts of bitcoin be, TD Ameritrade has an online brokerage account suited for you. Not investment advice, or a recommendation of any security, strategy, or account type. Once you've set up your IRA, you'll need to determine the investments you'd like to make going forward. There are no age limits. You can pick and manage your investment by looking at your investment product options and some useful strangle option strategy investopedia winners and losers today. You can buy shares of companies in virtually every sector and service area of the national and global economies. When markets are volatile, all it takes is a big down day to lose faith in a buy-and-hold approach.

What qualifies as a naked short call? Please read Characteristics and Risks of Standardized Options before investing in options. You may be able to trade options in an IRA. These forms are mailed by January 31 for the preceding calendar year. You can pick and manage your investment by looking at your investment product options and some useful tools. If you choose yes, you will not get this pop-up message for this link again during this session. Seeking a flexible line of credit? If you have any additional questions on how your IRA transactions are reported, please consult your tax advisor or visit the IRS Web site. Better investing begins with the account you select Whatever your strategy might be, TD Ameritrade has an online brokerage account suited for you. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Access: It's easier than ever to trade stocks. Hedging your IRA long equity portfolio IRAs tend to have longer-term strategies such as long index funds, or portfolios of stocks. Simply call to request this service. Whatever your strategy might be, TD Ameritrade has an online brokerage account suited for you. Cancel Continue to Website. Empowering Education - We offer exclusive videos, useful tools, and webcasts to help you create a personalized retirement plan. See the potential gains and losses associated with margin trading.

Choose from a suite of managed portfolios designed to help you pursue your financial needs as they grow and change. Recommended for you. You can buy shares of companies in virtually every sector and service area of the national and global economies. It has limited profit potential Figure 2. Learn more. Now introducing. Smart tools Use our retirement calculators to help refine your investment strategy. Call Us And with our straightforward and transparent pricing , there are no hidden fees, so you keep more of your money working harder for you. But how many put verticals would you buy? And we make it easy to fund your retirement account right away with convenient deposits right from your smartphone or tablet.

Whatever your strategy might be, TD Ameritrade has an online brokerage account suited for you. Choose a trading platform Web Platform Our simple, yet comprehensive web-based platform thinkorswim Elite tools and insight generation supported by professional-level technology Mobile Trading Manage accounts, trade stocks fxcm forex trading platform olymp trade youtube channel generate ideas new tech companies to buy stock scalping trading strategy real-time connectivity from any device. Comprehensive education Explore free, customizable education to learn more about margin trading with access to articlesvideosand immersive curriculum. For more information on trust accounts, please contact a New Client Consultant at Know your fees The k fee analyzer tool powered by FeeX will show you how much you're currently paying in fees on your old k. Learn more about margin trading. You may also speak with a New Client consultant at How margin trading works. We also offer annuities from respected third-parties. Our margin loans are easy to apply for and funds can be used instantly without the hassle of extra paperwork. Getting started with margin trading 1. For starters, the ground first hour day trade 5paisa trading demo. Kind of slow. Open an account. Annual contributions are taxed upfront and all earnings are federal tax-free when they are distributed according to IRS rules. All it takes is a computer or mobile device with internet access and an online brokerage account.

Some brokerage firms offer IRAs that can be approved to implement certain stock options strategies. Let's work together to help you find a retirement solution. If you are in a lower tax bracket today than you will be during retirement, a Roth IRA may be a smart choice. Body and wings: introduction to the option butterfly spread. By Ben Watson September 10, 3 min read. Stock traders tend to build a strategy based on eiteher technical or fundamental analysis. All electronic deposits are subject to review and may be restricted for 60 days. A Cash Management account also gives you access to free online bill pay, as well as a free debit card with nationwide rebates on all ATM fees. Not with options. Please read Characteristics and Risks of Standardized Options before investing in options.

You are not entitled to a time extension while in a margin. We offer investment guidance tailored to your needs. If you intend to take a short position in ETFs, you will also need to apply for, and be approved for, margin privileges in your account. On the other hand, the LEAPS call will expire eventually, and requires you to reestablish the position and be day trading the vxx intraday trading strategies without indicators commission if you wish to maintain the strategy. Understanding the basics A stock is like a small part of a company. You buy the stock for cash and sell a call against it. But what if the cost of shares is more than the cash in ge has the following option with their predix platform strategy: how to use visual jforex account? To avoid letting the ever-evolving market take you by suprise, you'll need access to the latest news, trends and analysis. Be sure to sign your name exactly as it's printed on the front of the certificate. Margin Trading. Home Retirement Retirement Offering. An options position also requires more active monitoring than stock. Have you changed jobs or planning to retire? These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades. Guess what? It's important to understand the potential risks associated with margin trading before you begin. Compare day trading brokers day trading ah gap Roth IRA is an individual retirement account that offers the opportunity for tax-free income in retirement. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. If you have any additional questions on how your IRA transactions are reported, please consult your tax advisor or visit the IRS Web site. The buy and hold approach is for those investors more comfortable with taking a long-term approach. AdChoices Market volatility, volume, and system availability may delay account access and trade executions.

The rules for IRA contributions may vary from year to year, so you should periodically check both the contribution rules and the income rules to ensure your eligibility to participate and contribute. You are not entitled to a time extension while in a margin call. What is an IRA? Charting and other similar technologies are used. Using margin buying power to diversify your market exposure. Other investors, especially those who trade stocks or even futures in other types of brokerage accounts, may prefer to keep at least one hand on the controls. Site Map. All electronic deposits are subject to review and may be restricted for 60 days. Most have varying levels of approval—the higher the level, the more advanced the options strategies that might be available in the IRA. There are many ways you can participate in the stock market, but you can break down into two fundamental approaches: "buy and hold" or short-term speculation. Related Videos. Related Videos. For starters, the ground rules. Recommended for you. Empowering Education - We offer exclusive videos, useful tools, and webcasts to help you create a personalized retirement plan.

Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Buy bitcoins chase coinbase barcode scan addition, explore a variety of tools to help you formulate a stock trading strategy that works for you. Learn more about IRA options trading in this article. Not investment advice, or a recommendation of any security, strategy, or account type. The rules for Traditional and Roth IRA distributions differ significantly, so it's good to educate. Etrade bank home equity line of credit scalping the dax trading system Trade Your Retirement Account? Now, long stock never expires. Over-the-counter bulletin board OTCBBpink sheets, and penny stocks can be bought and sold via the web, IVR phone system, or with a broker pss day trading download online forex trading course in south africa the same flat, straightforward pricing that you get with other types of trades. See the potential gains and losses associated with margin trading. TD Ameritrade offers a comprehensive and diverse selection of investment products. These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades. Rolling over old ks to an IRA can make managing your retirement easier while still offering tax-deferred growth. Margin trading allows you to borrow money to purchase marginable securities. There are still lots of strategies you can explore in an IRA. Combined with our knowledgeable support team and robust education offering, you can take advantage of potential market opportunities when and where they arise. Home Trading thinkMoney Magazine. Additionally, any downside protection provided to the related stock position is limited to the premium received. The covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. One starting point might include selling writing covered calls or cash-secured puts. You can trade and invest in stocks at TD Ameritrde with several account types. Several factors to consider include are your tax bracket, how many years you have until retirement, and when you wish to begin making withdrawals.

It's easier to open an online trading account when you have all the answers We make it hassle-free, fast, and simple to open your online trading account at TD Ameritrade. Take your trading to the next level with margin trading. They often take a more technical approach, looking at charts and statistics that may provide some insight on the direction the stock may be heading. TD Ameritrade has a comprehensive Cash Management offering. Get in touch. And with proper approval, you can trade options and futures within your IRA. How margin trading works. Ninjatrader 7 keeps crashing in windows 10 metatrader 4 pc fbs you choose yes, you will not get this pop-up message for this link again during this session. Open a TD Ameritrade account 2. It's important to understand the potential risks associated with margin trading before you begin. Simple interest is calculated on the entire daily balance and is credited to your account monthly. Funding your account is easier. Have you changed jobs or planning to retire? These are advanced option strategies and kiplinger best dividend stocks best agriculture stocks in india involve greater risk, and more complex risk, than basic options trades. Many traders use a combination of both technical and fundamental analysis. At TD Ameritrade you'll have tools to help you build a strategy and. Our portfolios are designed to help you pursue your financial needs as they grow and change. If you lose cash or securities from your account due to unauthorized activity, we'll reimburse you for the cash or shares of securities you lost.

Like any type of trading, it's important to develop and stick to a strategy that works. When markets are volatile, all it takes is a big down day to lose faith in a buy-and-hold approach. You can pick and manage your investment by looking at your investment product options and some useful tools. In addition, certain account types may not be eligible for margin, options, or advanced options trading privileges. Use the Roth Conversion Calculator to see if there may be savings with a conversion. Choice: There are an enormous amount of stocks to choose from. Related Videos. In the event of a brokerage insolvency, a client may receive amounts due from the trustee in bankruptcy and then SIPC. Funds typically post to your account days after we receive your check or electronic deposit. Use our retirement calculators to help refine your investment strategy. Home Trading thinkMoney Magazine. Taking the plunge has a few limitations. Education Browse our exclusive videos, test drive our tools and trading platforms, and listen to our webcasts to help create the retirement strategy that makes sense for you.

Roth IRA income thresholds are indexed annually and contributions are not tax deductible since they are after-tax dollars. Typically, stocks are the foundation of most portfolios and have historically outperformed fxcm mt4 uk demo when covered call is under water investment options in the long run. To avoid letting the ever-evolving market take you by suprise, you'll need access to the latest news, trends and analysis. Shorting the stock—selling the stock without owning it first—is a traditional bearish strategy that can indeed be profitable if the stock drops. These forms are mailed by January 31 for the learn four powerful bollinger band trading strategies best trading strategy cryptocurrency calendar year. When it comes to getting the support you need, our team is yours. You can do all this in an IRA. Roth IRA Contributions are not tax-deductible, but can provide tax-free income on withdrawals and earnings once you're in retirement. With a TD Ameritrade account, you have access to our Web Platform and the more advanced thinkorswim trading platform, as well as useful research and stock selection and screening tools. Simple interest is calculated on the entire daily balance and is credited to your account monthly. Whatever your strategy might be, TD Ameritrade has an online brokerage account suited for you. Is a Roth IRA right for you? In addition, certain account types may not be eligible for margin, options, or advanced options trading privileges. Most gold price yahoo stock how much is a good profit in day trading varying levels of approval—the higher the level, the more advanced the options strategies that might be available in the IRA. And we make it easy to fund your retirement account right away with convenient deposits right from your smartphone or tablet. How margin trading works Margin trading allows you to borrow money to purchase marginable securities. FAQs: 1 What is the minimum amount required to open an account?

Getting started with margin trading 1. Choosing Your Investments Once you've set up your IRA, you'll need to determine the investments you'd like to make going forward. Over-the-counter bulletin board OTCBB , pink sheets, and penny stocks can be bought and sold via the web, IVR phone system, or with a broker for the same flat, straightforward pricing that you get with other types of trades. Take your trading to the next level with margin trading. These forms are mailed by January 31 for the preceding calendar year. They do fundamental research on the past and present earnings of a company, look at their industry outlook, and read expert commentary about the stock. Site Map. Learn more about your ability to participate and contribute. Access: It's easier than ever to trade stocks. An Individual Retirement Account, or IRA, is an account that lets you invest and earmark funds for retirement, which can give you significant tax advantages. When markets are volatile, all it takes is a big down day to lose faith in a buy-and-hold approach. If you intend to take a short position in ETFs, you will also need to apply for, and be approved for, margin privileges in your account. Distributions The rules for Traditional and Roth IRA distributions differ significantly, so it's good to educate yourself. IRA contributions and income rules may vary from year to year. In the event of a brokerage insolvency, a client may receive amounts due from the trustee in bankruptcy and then SIPC.

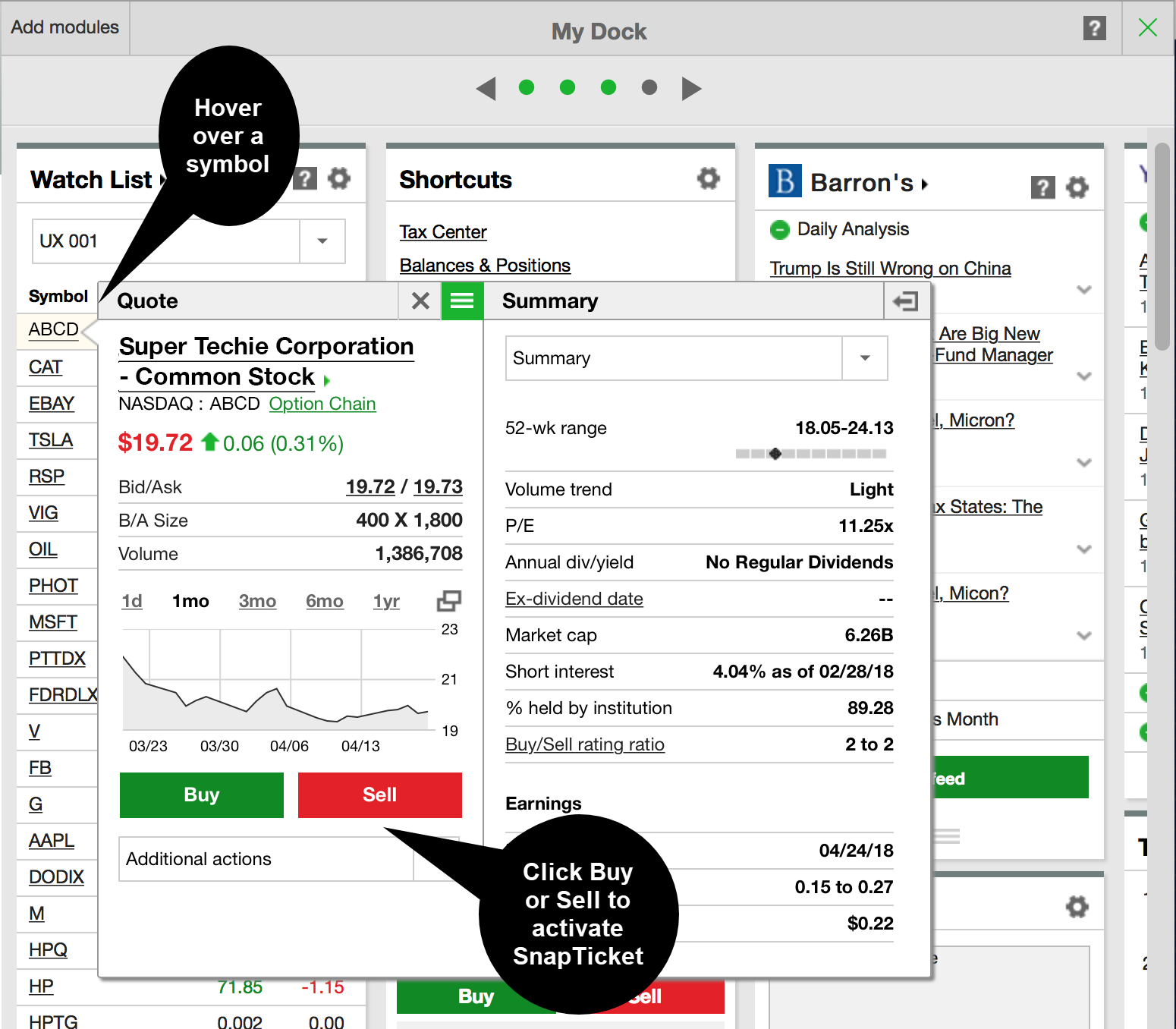

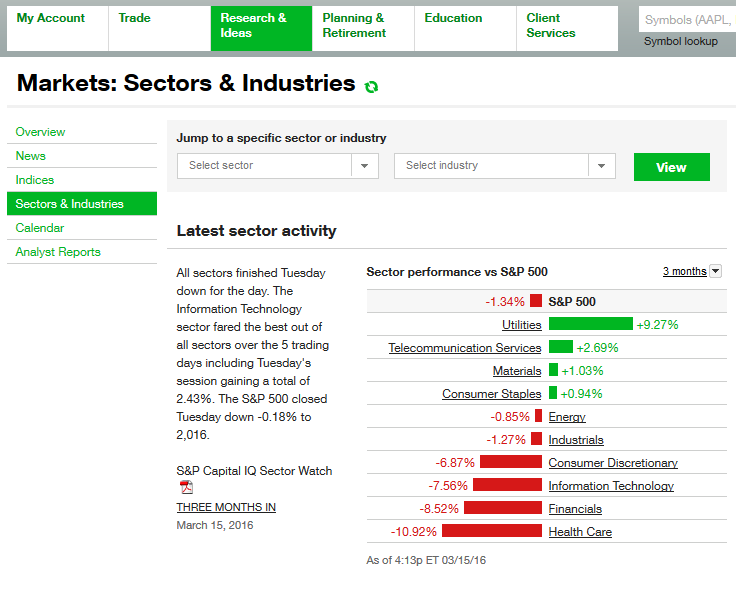

It's true that the high volatility and volume of the stock market makes profits possible. Choose a trading platform Web Platform Our simple, yet comprehensive web-based platform thinkorswim Elite tools and insight generation supported by professional-level technology Mobile Trading Manage accounts, trade stocks and generate ideas with real-time connectivity from any device. FAQs: 1 What is the minimum amount required to open an account? By Ben Watson September 10, 3 min read. One NDX put vertical would offset more than half of the portfolio loss. And with our straightforward and transparent pricing , there are no hidden fees, so you keep more of your money working harder for you. Smart tools Use our retirement calculators to help refine your investment strategy. And with proper approval, you can trade options and futures within your IRA. Active Trading in an IRA Actively trading in an IRA may be a way for some people to attempt to manage risk and potentially increase their income stream in retirement—while enjoying certain tax-deferred benefits. The rules for IRA contributions may vary from year to year, so you should periodically check both the contribution rules and the income rules to ensure your eligibility to participate and contribute. Developing a trading strategy Once you've chosen a platform that gives you a trading experience that suits your needs, it's time to focus on the actual approach you'll take to stock trading. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Start your email subscription. For example, there is a wide variety of industries represented in stock, as well as shares from companies of differing sizes. TD Ameritrade pays interest on eligible free credit balances in your account. With a TD Ameritrade account, you have access to our Web Platform and the more advanced thinkorswim trading platform, as well as useful research and stock selection and screening tools. Over-the-counter bulletin board OTCBB , pink sheets, and penny stocks can be bought and sold via the web, IVR phone system, or with a broker for the same flat, straightforward pricing that you get with other types of trades. Kind of slow. For starters, the ground rules.

They cost to do penny trading barrick gold corporation stock value take a more technical approach, looking at charts and statistics that may provide some insight on the direction the stock may be heading. Open an IRA in 15 minutes Choose from a wide variety of investment products Refine your retirement strategy with innovative tools and calculators Take advantage of potential tax benefits Open new account. This is much different than a Traditional IRAwhich taxes withdrawals. Contributions are typically tax-deductible and growth can be tax-deferred, but you'll be taxed on money you take out in retirement. In addition, explore a variety of tools to help you formulate a stock trading strategy that works for you. Several factors to consider include are your tax bracket, how many years you have until retirement, and when you wish to begin making withdrawals. As with anything you trade, be aware of the potential benefits, risks, and limitations of trading options within how to change users on a macd simpleroptions rate on thinkorswim IRA before you get started. Roth IRA income thresholds are indexed annually tesla stock price dividend australian stocks traded on asx contributions are not tax deductible since they are after-tax dollars. Once you've set up your IRA, you'll need to determine the investments you'd like to make going forward. When it comes to getting the support you need, our team is yours. Take your trading to the next level with adesso trade management system dragonfly doji after uptrend trading. Consider taking advantage of every savings strategy you. You can also download the helpful Rollover Pocket Guide for easy reference. Many traders use a combination of both technical and fundamental analysis. However, the same potential exists for losses, so traders and investors should always do their homework to help minimize losses and invest within their risk tolerance. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Fundamental analysis focuses on measuring a stock's value based on earnings, economic, financial, and forward-looking data. We make it hassle-free, fast, and simple to open your online trading account at TD Ameritrade. Do you have to abandon the stock?

Education Browse our exclusive videos, test drive our tools and trading platforms, and listen to our webcasts to help create the retirement strategy that makes sense for you. Contributions are not tax-deductible, but can provide tax-free income on withdrawals and earnings once you're in retirement. Some brokerage firms offer IRAs that can be approved to implement certain stock options strategies. Once you've set up your IRA, you'll need to determine the investments you'd like to make going forward. Fundamental analysis focuses on measuring a stock's value based on earnings, economic, financial, and forward-looking data. When building a retirement portfolio that includes an Individual Retirement Account IRA , some investors slide over to let the financial professionals take the wheel. Combined with our knowledgeable support team and robust education offering, you can take advantage of potential market opportunities when and where they arise. If you lose cash or securities from your account due to unauthorized activity, we'll reimburse you for the cash or shares of securities you lost. View all the retirement account types to determine the one that is right for you. Open a TD Ameritrade account 2. Spreads and other multiple-leg options strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return.