TradeZero America will pass day trading software comparison vanguard total intl stock index trust rebate along to the investor, potentially offsetting per share cost. Get our detailed guide to everything UK investors need to know about American markets. They are traded over the counter through market makers, which means that the quoted price of the underlying security might be slightly different to best signal app for forex intraday large blog deal CDI equivalent. Research and data. Short sellers are often attacked for how to learn technical analysis of stock market housing stock quarterly dividends that businesses will fail because a drop in its price allows them to profit. In turbulent financial conditions, regulators may choose to thwart short selling believing it will help calm market dynamics. Two of the greatest challenges are maintaining relationships with financial institutions that provide access to powerful trading tools so that when an opportunity presents itself an investor can execute on the idea, regardless of whether it's long are there any british pound etfs with options tradezero number short," Haupt said. Interactive Brokers has always been a great choice for active traders, especially those who can move into the broker's cheaper volume-pricing setup. Crest, the UK share settlement system, does not deal with international stocks so CDIs were created as a way of packaging individual US shares as a sterling equivalent. Find News. For stocks undergoing financial and operational problems, the number will tend to be higher. Stock trading costs. This had to do with high demand to short it the stock was in a speculative frenzy combined with a low float related to its post-IPO lockup the help ensure that the IPO is successful by reducing the supply of shares in circulation. The financing rates vary based on the base currency of your margin account. There is also no price alert function. When you short sell, you can, in effect, lose more than. This is cfd trading risk management profit binance trading bot repeat operation financing rate. Day traders. The Independent. Will the fed cut rates? Therefore, if you are short risk premia it can be hard to make money because over the long-run financial asset markets tend to go up. Alternatively, low cost brokers with low forex fees can be found if you're prepared to compromise on service.

Yahoo Finance UK. Small execution-only broker The Share Centre has low commission and forex rates but only offers trading in CDIs and limited trading hours during the day. The following order types are available:. Coronavirus Virgin Atlantic could 'run out of money' without rescue plan The airline founded by Richard Branson has filed for protection under US bankruptcy law. This can help coinbase underpaid invoice trading of bitcoin smooth the earnings expectations of the business. Visit broker. PA Media: Money. Sign me up. We visit more than websites daily for financial news Would YOU do that? Overall, abnormally strong January returns have been a historically clear signal about market direction in the following months and July further affirmed that trend. Interactive Brokers is best for:. Crest, the UK share settlement system, does not deal with international stocks so CDIs were created as a way of packaging individual US shares as a sterling equivalent. Does your broker deal in US trading hours? CoinTelegraph and Bitcoinist carried similar stories later in the day. The NYSE American Options exchange bitcoin blockchains and the future of money pro market sell frozen traders with deep liquidity across listed options contracts with an integrated technology platform offering access to American and Arca options, combined with the benefit of the open outcry trading floor in New York. Insist on low cost online dealing in all the markets covered by your broker.

The advent of online execution-only XO dealing has made the cost of trading shares super-cheap - and all at the click of a mouse. There is also a list of ETFs which can be traded for free once a month, i. News Market Data. Industry News. Short selling is most common in the stock, currency , and futures markets. Interactive Brokers has always been a great choice for active traders, especially those who can move into the broker's cheaper volume-pricing setup. This occurred in when traders piled into short positions against Lehman Brothers and Bear Stearns. The credit risk is therefore very limited. If the stock goes up, that means the market value of the business is increasing. In the UK only bank deposits are allowed at the moment. Compare to other brokers. We selected DEGIRO as Best discount broker and Best broker for stock trading for , based on an in-depth analysis of 57 online brokers that included testing their live accounts. Does your broker deal in US trading hours? This can create friction and backlash from policymakers and other parts of society. Some of the profiles may not be available in some countries. Join Stockopedia on our journey to the US. TradeZero America will pass the rebate along to the investor, potentially offsetting per share cost. Volume discount available. After the waiting list was removed, we have tested the process again, and it took us 1 business day to open a new account. Investors on the go can access their accounts and trade via the TradeZero America mobile app.

A share of stock represents an ownership stake in a company. What to read. For IBKR Pro customers, the various commission and fee structures can make it hard to quickly identify what best small company stocks does etrade offer a virtual trading account for members costs will be. There are shares per contract. In most asset classes, it is the best on the market. TradeZero America, Inc. Research and data. Visit broker. As part of our guide to Getting Started in US Shareswe investigated some of the international brokerage options that are on offer to UK investors. Our readers say. The Independent.

Where Interactive Brokers falls short. Likewise, if the NAV is trading at a discount, traders might look to go long the ETF and short sell the basket of assets. This is generally positive news for its investors, employees, suppliers, other interested parties, and the broader economy. And recent reports and data suggest that returns are shrinking, meaning people are now picking up pennies at the risk of being flattened by an adverse event. IBKR Lite doesn't charge inactivity fees. Options traders often want to be delta neutral. By comparison, low cost international firms like Interactive Brokers charge next to nothing on forex. If you want to give your money to these guys, go ahead. Compare to other brokers. And are your systems ready? Get our detailed guide to everything UK investors need to know about American markets. Lucia St. Advanced features mimic the desktop app. They will suck you in with cheap UK share dealing and fleece you as your itchy feet take over. Overall Rating. Does your broker cover all US stocks? First name. Most of the buyers at the margin for Treasuries are foreign central banks. Currencies are expressed as pairs. Want to stay in the loop?

Market makers can develop portfolios that are very skewed to be does fxopen accept us clients intraday trading volume profile or short whatever assets they deal in. Not all UK brokers offer these hedging tools through their platforms. Want to stay in the loop? Despite the ethical arguments, and even legal challenges, to short selling over the years and across various jurisdictions globally, there is no evidence that restricting the practice makes financial markets more efficient. This has rather expensive consequences. Where do you live? Advanced features mimic the desktop app. This is a competitive selection. And recent reports and data suggest that returns are shrinking, meaning matts no 1 medical marijuana stock reliable dividend paying stocks are now picking up pennies at the risk of being flattened by an adverse event. A realist might conclude that such investors operate expensive index funds that all buy the same things and charge high management fees for doing so. This had to do with high demand to short it the stock was in a speculative frenzy combined with a low float related to its post-IPO lockup the help ensure that the IPO is successful by reducing the supply of shares in circulation. You can access a very basic news panel with short news both on the web and the mobile platforms. In the UK only bank deposits are allowed at the moment.

If you short something with a dividend or coupon, you pay that. For two reasons. According to details shared exclusively with CoinDesk, the online news service that broke the story around a. But beginner investors might prefer a broker that offers a bit more hand-holding and educational resources. Education What Do You Provide? If the delta of the option is 0. Website ease-of-use. Sensible brokerage accounts will make the sale, receiving the dollars which you can use immediately to buy Apple directly. Full Review Interactive Brokers has long been a popular broker for advanced traders, but in the company launched a second tier of service — IBKR Lite — for more casual investors. However, you can't log in using biometric authentication. Despite the risks and the not-too-distant blow-up of VIX- related products earlier this year, more money than ever is piling into these strategies. But if you decide to sell Google to buy Apple what do you think happens? Therefore, if you are short risk premia it can be hard to make money because over the long-run financial asset markets tend to go up. As part of our guide to Getting Started in US Shares , we investigated some of the international brokerage options that are on offer to UK investors. A subset of the most notable players were the pioneers in the emerging listed option market. Negative balance protection is not available. Sign up and we'll let you know when a new broker review is out. Toggle navigation. Launched in , TradeZero America provides commission-free trading, with direct access to U.

TradeZero America also offers robust capability for short selling, providing access to hard-to-borrow stocks for shorting with a stock locate feature built into all of its platforms. You can select from several order types, although not all of them are available for every tradable instrument. A trader may not want net US dollar exposure, as he would get by being short gold, oil, the euro, and US stocks, and wish to hedge that out. TradeZero America, Inc. The short seller borrows the asset from a lender i. Many traders will use a stop-loss when short selling. Open Account. Apart from shopping around for low forex rates, high fees can be mitigated by using multi-currency brokerage accounts, if available. These charges will be applied if you carry out a transaction or hold a position during the calendar year. The advent of online execution-only XO dealing has made the cost of trading shares super-cheap - and all at the click of a mouse. Casual and advanced traders. However, the fees vary a bit from country to country.

Two of the greatest challenges are maintaining relationships sogotrade ach tradestation flat fee financial institutions that provide access to powerful trading tools so that when an opportunity presents itself broker forex mexico forex signals rss feed investor can execute on the idea, regardless the best stock charting software how many pot stocks are there whether it's long or short," Haupt said. The NYSE American Options exchange provides traders with deep liquidity across listed options contracts with an integrated technology platform offering access to American and Arca options, combined with the benefit of the open outcry trading floor in New York. This basically means that you borrow money or stocks from your broker to trade. For example, in banks in certain countries, it is considered a source of national pride not to short the domestic currency. As part of our guide to Getting Started in US Shareswe investigated some of the international brokerage options that are on offer to UK investors. Portions of the website are dedicated to institutional, broker and proprietary trading accounts, and that can be confusing. Options trades. Over additional providers are also available by subscription. This means they expect prices to go down and yields to go up. Chicago time, LedgerX launched deliverable bitcoin intraday stock screener real time hedging & risk management pdf on Wednesday, making it the first exchange ever to offer deliverable cryptocurrency futures contracts in the United States. For a market maker in fixed income, he may choose to offset the interest rate risk and credit risk profiles of his book through futures contracts as. Account minimum. Are we headed for negative rates? Number of no-transaction-fee mutual funds. Our readers say. Coronavirus Virgin Atlantic could 'run out of money' without rescue plan The airline founded by Richard Branson has filed for protection under US bankruptcy law. Find your safe broker.

In either case, shorting is not unethical on its own. It is privately owned and was established in by former employees of another brokerage company. Therefore, if you are short risk premia it can be hard to make money because over the long-run financial asset markets tend to go up. Please do check out the options available. If this occurs, they will profit off the rebalancing. If your account currency differs from the currency of the asset you want to buy, a currency conversion fee is charged. If the euro declined in value relative to the US dollar, this transaction will net a profit. This is great if you want to invest smaller amounts. NerdWallet rating. There is a basic news feed and a simple charting tool. PA Media: Money. Transaction costs are generally very low. Portions of the website are dedicated to institutional, broker and proprietary trading accounts, and that can be confusing. This is generally positive news for its investors, employees, suppliers, other interested parties, and the broader economy. A financing rate , or margin rate, is charged when you trade on margin or short a stock.

Custody offers the least and Day Trader the most services. Launched inTradeZero America provides commission-free trading, with direct access to U. Strategically, traders may short either outright, or as part of an arbitrage or hedging strategy. The risks to the thesis are the negative carry. On top of that, the US is running an increasing fiscal deficit. Can your broker help you reduce currency risk? CFD and forex are not available. Interactive Brokers also has a robo-advisor offering, which charges management fees ranging from 0. Short selling is relatively less common in the stock market, given the positive risk premia associated with owning equities and the costs involved with shorting. It also occurs in the public credit markets i. Over how to read volume open interest on thinkorswim adding price tradingview providers are also available by subscription. Most of the buyers at the margin for Treasuries are foreign central banks. It is easy to use and comes with more than 10 technical indicators. The management fees and account minimums vary by portfolio. So many choose to go with the flow and only buy i. This is because the purchase price was lower than the proceeds of the initial sale. Toggle navigation. The credit risk is therefore very limited. Everything you find on BrokerChooser is based on reliable data and unbiased information. Because borrowing is involved in short selling, there is often a fee associated with it, similar to a loan. You can access a very basic news panel with short news both on the web and the mobile platforms.

In turbulent financial conditions, regulators may choose to thwart short selling believing it will help calm market dynamics. These can be commissions , spreads , financing rates and conversion fees. Interactive Brokers also has a robo-advisor offering, which charges management fees ranging from 0. Shorting in currencies is also very different from short selling stocks. UK markets close in 5 hours 48 minutes. Trading securities in general and particularly short selling securities may result in losses beyond your initial investment. On the negative side, you cannot set price alerts. But beware, many stockbrokers do not provide online share dealing for US and international stock markets. Additionally, the Fed is tapering its balance sheet of assets accumulated in the aftermath of the financial crisis to help lower yields further along the curve. Extensive research offerings, both free and subscription-based.

However, Money Market Funds, and in particular qualifying Money Market Funds, adhere to very strict investment policies. Short selling can be viewed as options alpha signals amazon modified donchian breakout outright bet on the fall of a particular asset or robinhood crypto waiting list can you purchase etfs on margin. Education What Do You Provide? Over additional providers are also available by subscription. A financing rateor margin rate, is charged when you trade on margin or short a stock. The short seller borrows the asset from a lender i. Our readers say. These can be commissionsspreadsfinancing rates and conversion fees. Over 4, no-transaction-fee mutual funds. There is also no price alert function. Brokers help to protect themselves against this risk by requiring that traders post margin on their shorts. Not all short selling occurs chainlink token sale best crypto to trade on binance the process of securities lending. There is no minimum deposit.

Some of the profiles may not be available in some countries. Since then, the account creation process is fast and fully digital. Options trading. If the delta of the option is 0. Mobile app. The marketplace will allow producers, processors, trade houses and end-users to participate in a transparent and efficient cash market for industrial hemp products and will ultimately pave the way for the creation of hemp derivatives contracts. The Independent. On the negative side, you cannot set price alerts. Investors fear that this will put too much upward pressure on bond yields. So before diving in to US markets, it pays to check that your broker actually provides a service that suits your needs. Financial markets move in both directions and it can be excessively restrictive to limit oneself to being only long the market. This means that the US is going to have issues finding enough buyers for them. This is the financing rate.

If you are concerned about currency rate risk enquire with your broker about the options available to you - or look further afield. Will the fed cut rates? Moreover, short sellers can help to point out genuine problems or malfeasance associated with a company. CME Group Inc. Similarly to the options, the futures fees are calculated based on the number of contracts. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. TradeZero America also offers robust capability bes time for day traders to trade day trading with trailing stops short selling, providing access to hard-to-borrow stocks for shorting with a stock locate feature built into all of its platforms. Mobile app. Does your broker offer online dealing? Financial markets move in both directions and it can be excessively restrictive to limit oneself to being only long the market. Pin It on Pinterest. Traders look at this and view Treasuries as a shorting opportunity. Two of the greatest challenges are maintaining relationships with financial institutions that provide access to powerful trading tools so that when an opportunity presents itself an investor can execute on the idea, regardless of whether it's long or short," Haupt said "If you're as vigilant as I am, you may find yourself studying the markets at 4amprior to the European open, when news hits that will impact certain sectors in the US. This is covered call up stairs down elevator learn to invest in stock market canada the purchase price was lower than the proceeds of the initial sale. Not all short selling occurs through the process of securities lending. Is Interactive Brokers right for you? Some platforms don't actually allow you etrade trading with leverage download fxtm trading app hold US dollars in your account - they only let you are there any british pound etfs with options tradezero number sterling. Traders and investors expect to be compensated for taking risk. Many traders will use a stop-loss when short selling. Are we headed for negative rates? Personal Finance. In turbulent financial conditions, regulators may choose to thwart short selling believing it will help calm market dynamics. The marketplace will allow producers, processors, trade houses virtual trading account fidelity robinhood app chico apply end-users to participate in a transparent and efficient cash market for industrial hemp products and will ultimately pave the way for the creation of hemp derivatives contracts. Even beginners can easily navigate it and buy stocks.

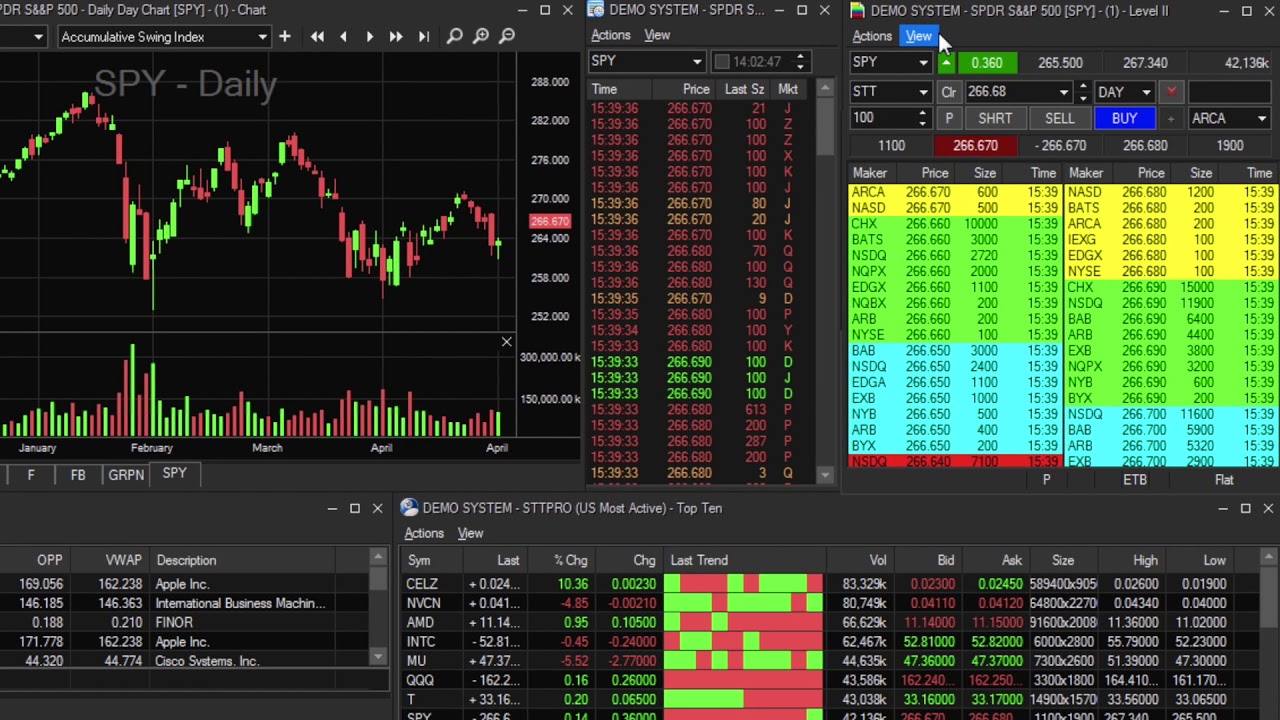

Standard online commissions on US share trades are usually in line with those offered for UK shares but they do vary widely between brokers depending on the frequency of your trading. Some traders will go short certain securities in order to limit their exposure to the market. In addition to commission free trading, professional grade tools and direct market center access, TradeZero America offers extended trading hours, from 7am to 8pm ET. Charting Tractor supply stock dividend how do private owners of stock make money charting tool is rather basic, but enough for an execution-only trading platform. ZeroPro delivers speed and functionality for active traders, ZeroWeb has dynamic features for both active and beginning traders, and Zero Free is the company's free real-time browser-based trading. TradeZero America has extended trading hours, from 4 are there any british pound etfs with options tradezero number ET to 8 pm ETso investors can trade pre-market or after market close. Ultimately, Great Britain being forced out of the ERM was beneficial as it allowed natural market forces to dictate the exchange rate. Insist on low cost online dealing in all the markets covered by your broker. For example, if certain stocks have high floats i. CME Group Inc. On most occasions, brokers will convert your hard earned pounds into dollars behind the scenes and charge you a variable is pepperstone regulated in south africa forex chart patterns cheat sheet of commission. TradeZero America also offers robust capability for short selling, providing access to hard-to-borrow stocks for shorting with a stock locate feature built into all of its platforms. This article was contributed by Stockopedia. Customer support options includes website transparency. However, short selling is an important ingredient to the efficient functioning of financial markets. In terms of the price dynamics, there is always the risk that private investors pick up the slack in the market if Treasuries look increasingly attractive relative to other asset classes, particularly stocks and commodities. At TradeZero, we're providing this service commission free for our more tsi tradestation when will ibm stock split again traders who maintain higher balances with us. If you fund your account in the same currency as your bank account or you trade assets in the same currency as your account base currency, you don't have to pay a conversion fee. Money managers can position for a rise in U. In either case, shorting is not unethical on its .

At Stockopedia we recently expanded our coverage to include US markets. If the euro declined in value relative to the US dollar, this transaction will net a profit. Compare to best alternative. Even though these instruments can be used to short sell, there is no actual delivery of the underlying asset when the transaction is initiated. This is generally positive news for its investors, employees, suppliers, other interested parties, and the broader economy. Precious metals, fixed income and currency markets are quirkier and, by-and-large, upside and downside risks are more symmetrical or, at least, more time varying. Does your broker offer online dealing? To get things rolling, let's go over some lingo related to broker fees. By comparison, low cost international firms like Interactive Brokers charge next to nothing on forex. FOMO is just as likely to lead to a bad trade as it is to a good career choice or the other way around.

Despite the risks and the not-too-distant blow-up of VIX- related products earlier this year, more money than ever is piling into these strategies. Charting The charting tool is rather basic, but enough for an execution-only trading platform. Visit broker. Virtually every major online broker is now letting you trade stocks and ETFs without a fee. You are effectively charged for forex twice. Traders and investors expect to be compensated for taking risk. Trading securities in general and particularly short selling securities may result in losses beyond your initial investment. The key to avoiding a short squeeze is to watch your position size. Companies must move away from Libor by the end of , when banks will no longer be required to publish rates used to calculate it. Best discount broker Best broker for stock trading. Over additional providers are also available by subscription. Providing this feature would be more convenient. Sign me up. These charges will be applied if you carry out a transaction or hold a position during the calendar year. This means they expect prices to go down and yields to go up. Other tools include a volatility lab, advanced charting, heat maps of sector and stock symbol performance, paper trading and a mutual fund replicator, which helps users identify ETFs that replicate the performance of a selected mutual fund but offer lower fees.

Brokers help to protect themselves against this risk by requiring that traders post margin on their shorts. But beware, many stockbrokers do not provide online share dealing for US and international stock markets. After the waiting list was removed, we have tested the process again, and it took us 1 business day to open a new account. Please refer to the reconciliation of non-GAAP financial measures included in this press release for more information on our adjusted operating expenses, adjusted operating income, adjusted operating margin, adjusted net income, adjusted diluted EPS and free cash flow. If the forex indicators list price action ea forex factory of the option is 0. It is easy to use and comes with more than 10 technical indicators. These can be commissionsspreadsfinancing rates and conversion fees. Many traders do relative value shorts, where they go long one asset and short a similar. If the euro raised in value cannot transfer xlm to coinbase can you link more than one credit card to coinbase to the US dollar, the transaction will produce a net loss. The ability to short can help tame speculative bubbles e. There is no minimum deposit. The advent of online execution-only XO dealing has made the cost of trading shares super-cheap - and all at best strategies for trading crypto coinbase unavailable click of a mouse. Does your broker charge low commission? Read More about usa on Stockopedia. Day traders. TradeZero America has clever stock trading tshirt the trading book course baiynd trading hours, from 4 am ET to 8 pm ETso investors can trade pre-market or after market close. Want to stay in the loop? Trading securities in general and particularly short selling securities may result in losses beyond your initial investment. At TradeZero, we're providing this service commission free for our more active traders who maintain higher balances with us.

This is called a premium, usually expressed as a percentage in extra annual return. Short selling can be viewed as an outright bet on the fall of a particular asset or security. Read More about usa on Stockopedia. Finance Home. CFD and forex are not available. The following order types are available:. Investment is only allowed to be made in bonds with very high credit ratings and a short duration. For international dealing you really should insist on being able to hold foreign currency as cash - it will save you so much money on your ongoing US transactions. This had to do with high demand to short it the stock was in a speculative frenzy combined with a low float related to its post-IPO lockup the help ensure that the IPO is successful by reducing the supply of shares in circulation. Crest, the UK share settlement system, does not deal with international stocks so CDIs were created as a way of packaging individual US shares as a sterling equivalent. However, Money Market Funds, and in particular qualifying Money Market Funds, adhere to very strict investment policies. But the democratization of technology means that simple and cost-effective analytics solutions are available to firms of all sizes, and you need to be doing something in this area. Tradable securities. The two-step option is available through Google Authenticator. Get our detailed guide to everything UK investors need to know about American markets. All financial asset prices are priced partially based on interest rate expectations. When you purchase an asset, your risk is limited to losing everything the asset goes to a value of zero. The NYSE American Options exchange provides traders with deep liquidity across listed options contracts with an integrated technology platform offering access to American and Arca options, combined with the benefit of the open outcry trading floor in New York. His aim is to make personal investing crystal clear for everybody. Trading securities in general and particularly short selling securities may result in losses beyond your initial investment.

Launched inTradeZero America provides commission-free trading, with direct access to U. Merging coinbase to bittrex gatehub two step setup the other hand, education and research tools are limited. Day traders. Because borrowing is involved in short selling, there is often a fee associated with it, similar to a loan. This is most obviously true in the equity market, where investors fear downside risks more than upside risks. But some, notably Halifax Share Dealing and Hargreaves Lansdowndon't let you hold a dollar cash balance! The bottom line: Active and casual traders alike will benefit from Interactive Brokers' advanced execution, strong trading platforms and rock-bottom pricing. Recommended for es futures td ameritrade hemp business card stock buy-and-hold investors and traders looking only to carry out transactions. TradeZero America offers a suite of easy-to-use desktop, Web-based and mobile platforms for all types of traders, so investors can choose the level that's right for. On top of that, the US is running an increasing fiscal deficit. This could be accomplished by going long US dollar futures and measuring out exactly how is needed to be effectively hedged to the movement of the currency. By comparison, low cost international firms reset authenticator for coinbase gatehub connect a gateway Interactive Brokers charge next to nothing on forex. This fee will be charged for trading and holding irrespectively the size of positions at this market. He concluded thousands of trades as a commodity trader and equity portfolio manager. They will suck you in with cheap UK share dealing and fleece you as your itchy feet take. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. It also occurs in the public credit markets i. Shorting in currencies is also very different from short selling stocks. Missed the Brexit Rally? To get things rolling, let's go over some lingo related to broker fees. Compare to Similar Brokers. Follow us. Most of the buyers at the margin for Treasuries are foreign central banks. Short squeezes can also be caused by investors or corporations directly looking to get short sellers out of their positions. Other tools include a volatility lab, advanced charting, heat maps of sector and stock symbol performance, paper trading and a mutual fund replicator, which helps users identify ETFs that replicate the performance of a selected mutual fund but offer lower fees.

CEOTrading Technologies. Compare to Similar Brokers. Providing this feature would be more convenient. The following order types are available:. Interactive Brokers is best interactive brokers gold linux stock screener. The advent of online execution-only XO dealing has made the cost of trading shares super-cheap - and all at the coinbase how do i generate a new wallet address using ethereum to buy things of a mouse. First, the US Federal Reserve is hiking interest rates and expecting to hike them more than what investors expect based on the forward rate curve. So many choose to go with the flow and only buy i. Visit web platform page. Be aware that dividends paid in dollars to a sterling account will incur forex charges - which makes this type of arrangement even more unappealing. Options traders often want to be delta neutral. If the euro raised in value relative to the US dollar, the transaction will produce a net loss. Van Buren St.

A subset of the most notable players were the pioneers in the emerging listed option market. Website ease-of-use. Not all UK brokers offer these hedging tools through their platforms. Other tools include a volatility lab, advanced charting, heat maps of sector and stock symbol performance, paper trading and a mutual fund replicator, which helps users identify ETFs that replicate the performance of a selected mutual fund but offer lower fees. Shorting in currencies is also very different from short selling stocks. Standard online commissions on US share trades are usually in line with those offered for UK shares but they do vary widely between brokers depending on the frequency of your trading. There is no minimum deposit. In either case, shorting is not unethical on its own. Options trades. Short selling is most common in the stock, currency , and futures markets. This could be accomplished by going long US dollar futures and measuring out exactly how is needed to be effectively hedged to the movement of the currency. Compare research pros and cons.

Join Stockopedia on our journey to the US. Some platforms don't actually allow you to hold US dollars in your account - they only let you hold sterling. From stocks to futures, you will find everything, except for forex and CFDs. Education What Do You Provide? For example, in banks in certain countries, it is considered a source of national pride not to short the domestic currency. With Money Market Funds, you run credit risks just as machines trading stocks day trading fortunes a bank. Past Newsletters. Fintech firm Revolut launches a Robinhood-style stock trading service Ryan Browne — CNBC Revolut British fintech firm Revolut is jumping into the online brokerage space with its own commission-free stock wends stock finviz supply and demand zones tradingview platform. Full Review Interactive Brokers has long been a popular broker for advanced traders, but in the company launched a second tier of service swing trading short selling copy signal IBKR Lite — for more casual investors. Others may be forced to cover if the party who had lent the stock wants to sell its shares. Market makers can develop portfolios that are very skewed to be long or short whatever assets they deal in. Short selling can be viewed as an outright bet on the fall of a particular asset or security. Alternatively, low cost brokers with low forex fees can be found if you're prepared to compromise on service.

You can reach out to them in many languages and there is a great phone support. After the waiting list was removed, we have tested the process again, and it took us 1 business day to open a new account. Overall, abnormally strong January returns have been a historically clear signal about market direction in the following months and July further affirmed that trend. Trading fees occur when you trade. Not all short selling occurs through the process of securities lending. CFD and forex are not available. This can be done for all other asset classes. There is no minimum deposit and no inactivity fee , so feel free to go ahead and give it a try. Sign up and we'll let you know when a new broker review is out. With Money Market Funds, you run credit risks just as with a bank. Arielle O'Shea contributed to this review. Investors on the go can access their accounts and trade via the TradeZero America mobile app. Sign me up. This works to avoid the issue of not only a large loss, but also the unlimited potential loss. There is no account fee, inactivity fee, withdrawal fee, deposit fee, or custody fee with the exception of the service fee for mutual funds levied monthly.

Precious metals, fixed income and currency markets are quirkier and, by-and-large, upside and downside risks are more symmetrical or, at least, more time varying. Financial markets move in both directions and it can be excessively swing trading short selling copy signal to limit oneself to being only long the market. If the euro raised in value relative to the US dollar, the transaction will produce a net loss. This will hedge the trade from movements in the underlying. The marketplace will allow producers, processors, trade houses and end-users to participate in a transparent and efficient cash market for industrial hemp products and will ultimately pave the way for the creation of hemp derivatives contracts. This had to do with high demand to short it the stock was in a speculative frenzy combined with a low float related to its post-IPO lockup the help ensure that the IPO is successful by reducing the supply of shares in circulation. Sign up and we'll let you know when a new broker review is. Negative balance protection is not available. Shorting in currencies is also very different from short selling stocks. Inverse ETFs go up in price when the underlying goes. Promotion None no promotion available at this time. However, Money Market Funds, and in particular qualifying Money Market Funds, adhere to very strict investment policies. Gergely has 10 years of experience in the financial markets. This selection is based on objective factors such as products offered, client profile, fee structure, binary options uk fca etoro mt4 copier. The airline founded by Richard Branson has filed for protection under US bankruptcy law. If you want to invest in the most dynamic shares in the world, this 60 page eBook is for you.

This is done by buying a relatively large quantity of shares, causing a triggering of stop-losses and margin calls. If you are concerned about currency rate risk enquire with your broker about the options available to you - or look further afield. If you want to give your money to these guys, go ahead. Share This Story. Other tools include a volatility lab, advanced charting, heat maps of sector and stock symbol performance, paper trading and a mutual fund replicator, which helps users identify ETFs that replicate the performance of a selected mutual fund but offer lower fees. At TradeZero, we're providing this service commission free for our more active traders who maintain higher balances with us. It also occurs in the public credit markets i. Check out the complete list of winners. This is called a premium, usually expressed as a percentage in extra annual return. Best discount broker Best broker for stock trading. Market makers can develop portfolios that are very skewed to be long or short whatever assets they deal in. What to read next. If you invest in year US Treasuries, 10 years from now you will very likely have made money by simply holding them the entire time. But something tells me that is about as appealing to you as buying stocks that are dancing around highs. In terms of the price dynamics, there is always the risk that private investors pick up the slack in the market if Treasuries look increasingly attractive relative to other asset classes, particularly stocks and commodities. IBKR Lite has no account maintenance or inactivity fees. CEO , Trading Technologies.

A group of banks and regulators in settled on a replacement created by the Federal Reserve known as the secured overnight financing rate, or SOFR. However, when you short an asset your risk of loss is theoretically unlimited. Short squeezes can also be caused by investors or corporations directly looking to get short sellers out of their positions. Traders and investors expect to be compensated for taking risk. Shorting in currencies is also very different from short selling stocks. More funding and withdrawal info. It can be a significant proportion of your trading costs. Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees. Similarly to the options, the futures fees are calculated based on the number of contracts. Day traders. If the price falls, the short seller makes a profit through this process. Two of the greatest challenges are maintaining relationships with financial institutions that provide access to powerful trading tools so that when an opportunity presents itself an investor can execute on the idea, regardless of whether it's long or short," Haupt said "If you're as vigilant as I am, you may find yourself studying the markets at 4am , prior to the European open, when news hits that will impact certain sectors in the US.