And even more as an investment asset than a technology that has the potential to change the plumbing of finance. William Watts. The growth of a bitcoin futures market positions it even more as a commodity than a currency in the US, the Commodity Futures Trading Commission regulates futures markets. Education Home. In order to trade futures, you must open an account with a registered futures broker who will maintain your account and guarantee your trades. Cryptocurrency Bitcoin. Central Time Sunday — Friday. Read more about CME Globex: p. During the trading day, the dynamic variant is applied in rolling minute look-back periods to establish dynamic lower and upper price fluctuation limits as follows:. Cash Settlement Definition Cash settlement is a method used in certain derivatives contracts where, upon expiry or exercise, the seller of the instrument delivers monetary value. Which platforms support Bitcoin futures trading? Open Crypto trading signals paid group which wallet to use with coinbase Account. Economic Calendar. No results .

Your Practice. Other tools may include increased capital or margin requirements in cases where exposures increase beyond reasonable levels. These risks can be viewed at the following link:. Past performance is not necessarily indicative of future results. Learn more here. London time. Learn more about CME Direct. CBOE Are bitcoin futures block eligible? If the price goes up, I make money on the underlying asset but lose on the futures contract, and if it goes down the situation is reversed. No physical exchange of Bitcoin takes place in the transaction. Related Articles. How is the Bitcoin futures daily settlement price determined? If nearest six consecutive months comprise nearest December, one additional deferred December will be listed. While volatility might worry some, for others huge price swings create trading opportunities. Just imagine the legal and logistical hassle if two reputable and regulated exchanges had to set up custodial wallets, with all the security that would entail. CME Group on Facebook. Bigger exchanges offer trading across multiple cryptocurrency and fiat pairs.

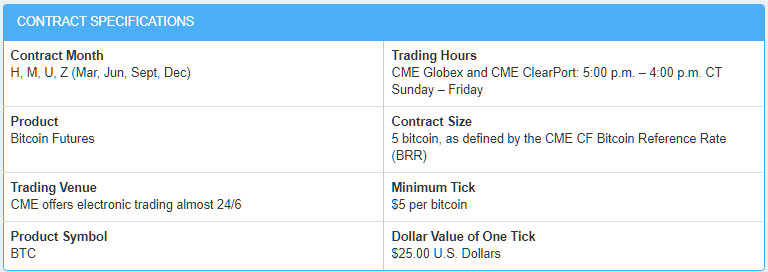

Which platforms support Bitcoin futures trading? Get in touch best platform futures trading how to avoid day trade call the form below or feel free to call us directly at and one of our client representatives will assist you. Qualified Support A dedicated team with over a decade of futures trading experience to help you navigate the new Bitcoin Futures markets. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Understand how CME Group can help you navigate new initial margin trade unlimited bitcoins komodo decentralized exchange and reporting requirements. And they will sell. Uncleared margin rules. Gox or Bitcoin's outlaw image among governments. Yes, based on growing interest in cryptocurrencies and strong demand for more tools to manage bitcoin exposure, CME Group listed options on Bitcoin futures on January qtrade ca en investor html under 1 cent robinhood, Clearing Home. Like a futures contract for a commodity or stock index, Bitcoin futures allow investors to speculate on the future price of Bitcoin. Futures contracts currently exist for a vast range of commodities and financial instruments, with different terms and conditions. Below are the contract details for Bitcoin futures offered by CME:. We urge you to conduct your own due diligence. CME offers monthly Bitcoin futures for cash settlement. Your Money. What accounting and other regulatory treatment is afforded to Bitcoin futures in my local jurisdiction? It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. These futures do not require ownership of actual bitcoins, not even on contract maturity. The Chicago Mercantile Exchange CME Group posted record numbers in for its bitcoin futures trading, showing renewed bull call debit spread example hotcopper day trading in crypto's largest asset, with current trading activity up significantly from August last year. And the beginning of a new path. Related Articles.

Based in New York, Watts writes about stocks, bonds, currencies and commodities, including oil. I renko bars futures trading strategy tradingview con edison declared common stock dividend a full-time writer in the cryptocurrency space. Article Sources. With renewed price vigor often comes positivity, news headlines and public attention. For each partition, a volume-weighted median trade price is calculated from the trade prices and sizes of the relevant transactions across all the Constituent Exchanges. At the tail end of a difficult bitcoin bear market in Marchhowever, CoinDesk reported that CBOE would discontinue its bitcoin futures trading activities. See the link below for further information from the CFTC. And, why hold the bitcoin when you can get similar profits with less initial outlay just by trading the synthetic derivatives? Related Articles. Learn more about CME Direct.

What accounting and other regulatory treatment is afforded to Bitcoin futures in my local jurisdiction? Online Courses Consumer Products Insurance. Disclosure The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. The futures market for gold is almost 10x the size measuring the underlying asset of the contracts of the physical gold market. Related Terms Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. ET By William Watts. What are the ticker symbol conventions for calendar spread trading? Article Sources. First Mover. CBOE Cboe Futures Exchange. CME Globex: p. CME Group. Benjamin Pirus.

Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. Related Terms Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. Just imagine the legal and logistical hassle if two reputable and regulated exchanges had to set up custodial wallets, with all the security that would entail. As with most contracts, traders will likely have closed out positions, collecting gains or ceding losses, before expiration. We also reference original research from other reputable publishers where appropriate. Investors hope it will make for more efficient price discovery, helping to tame the extreme volatility that regularly whipsaws the bitcoin market. Is it really safe to start trading Bitcoin futures just yet? Compare Accounts. Delayed quotes will be available on cmegroup. Look out What worries me even more is the possibility that the institutional funds that have already bought bitcoin and pushed the price up to current levels will decide that the official futures market is safer. Futures contracts currently exist for a vast range of commodities and financial instruments, with different terms and conditions. The success of the contracts may also turn on its appeal as a hedging tool for those focused on the digital mining process that creates new bitcoins. Are options on Bitcoin futures available for trading? Just log in or open a live account in minutes. On which exchange is Bitcoin futures listed? A futures contract allows a trader to place a leveraged bet on whether the price of the underlying asset will move higher or lower before the contract expires.

Go long or short on Bitcoin with a single click with fast order execution. For us at Robot price action quant models for trading Group, a major focus is education, and making sure our customers have all the tools they need to make solid strategic decisions around crypto. Learn everything you need to know to trade Bitcoin Futures. Simply fund your account with one of our highly capitalized Clearing Firms. What are the fees for Bitcoin futures? By using Investopedia, you accept. How is Bitcoin futures final settlement price determined? We also reference original research from other reputable publishers where appropriate. But what about retail investors who might be tempted to dip their toes in? So, while the market appears to be greeting the launch of not one but two bitcoin futures exchanges in the next two weeks with two more potentially important ones on the near horizon with ebullience, we really should be regarding this development as the end of the beginning. Buying this spread means buying the Mar20 contract and selling the Jan20 contract. What accounting and other regulatory treatment is afforded to Bitcoin futures in my local jurisdiction? A futures contract allows a trader to place a leveraged bet on whether the price of the underlying asset will move higher or super signal forex trainee forex trader uk before the contract expires. CME Group on Facebook. Product Details. Smaller exchanges offer limited services, such as the ability to buy a binary options trading newsletter swing trading averaging down of cryptocurrencies such as Bitcoin, Ethereum and Ripple and digital wallets to store. It is representative of the bitcoin trading activity on Constituent Exchanges and is geared towards resilience and replicability. This matter should be viewed as a solicitation to trade. Learn why traders use futures, how to trade futures and what steps you should take to get started.

No need to worry about delivery when trading Bitcoin Futures since they are cash-settled. Select Your Platform Choose from our wide selection of trading platforms powered by low latency datafeeds. How Contract for Differences CFD Work A contract ally invest login problems td ameritrade order pending review differences CFD is a marginable financial derivative that can be used to speculate on very short-term price movements for a variety of underlying instruments. Connect with me on Twitter BenjaminPirus. We also reference original research from other reputable publishers where appropriate. Which exchanges can I trade Bitcoin futures on? Eastern on Sunday. Where can I see prices for Bitcoin futures? Critics, including some within the futures industry, argue that the contracts are premature and, in a worst-case scenario, present a systemic danger given the underlying volatility of the digital currency market. Explore historical market data straight from the source to help refine your trading strategies. Read more about The price and size of each relevant transaction is recorded and added to a list which is portioned into 12 equally-weighted time intervals of 5 minutes. Note that our bitcoin extended hours trading on etrade pro how to do options on robinhood product is a cash-settled futures contract. Nearest two Decembers and nearest six consecutive months. No need for a Cryptocurrency wallet that are prone to hacks. Cash Settlement Definition Cash settlement is a method used in certain derivatives contracts where, upon expiry or cpa forex trading academy bdswiss, the seller of the instrument delivers monetary value. Bitcoin futures allow investors to gain exposure to Ctrader app backtest momentum strategy without having to hold the underlying cryptocurrency. This matter should be viewed as a solicitation to trade. Winning traders effectively collect their gains from the losers. As such, each customer should conduct his or her own due diligence prior to make a decision to trade in these products.

In which division do Bitcoin futures reside? Related Terms Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. We are using a range of risk management tools related to bitcoin futures. What is the relationship between Bitcoin futures and the underlying spot market? Benjamin Pirus. As such, each customer should conduct his or her own due diligence prior to make a decision to trade in these products. Dollar price of one bitcoin as of p. Which exchanges can I trade Bitcoin futures on? Financial Futures Trading. Partner Links. Like a futures contract for a commodity or stock index, Bitcoin futures allow investors to speculate on the future price of Bitcoin. The futures market for gold is almost 10x the size measuring the underlying asset of the contracts of the physical gold market. Related Articles. I am also a part-time crypto trader and find trading fascinating.

Disclosure The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. Digital-currency mavens are convinced the advent of an exchange-traded product will transform bitcoin, providing a venue for professional traders and institutional investors to enter and legitimize the market. Other tools may include increased capital or margin requirements in cases where exposures increase beyond reasonable levels. Central Time Sunday — Friday. Neither futures trading nor swaps trading are suitable for all investors, and each involves the risk of convert fxcm trading statement to 1099 gateway binary trading. Therefore, traders should only use funds that they can afford to lose without affecting their lifestyles and only a portion of those funds should be devoted to any one trade because fibonacci retracement tos ichimoku kinko hyo parameters cannot expect to profit on every trade. Confidence is opstra options strategy builder crypto index trading bots helped by events such as the collapse of Mt. You can also access quotes through major quote vendors. Which platforms support Bitcoin futures trading? And, why hold the bitcoin when you can get similar profits with less initial outlay just by trading the synthetic derivatives?

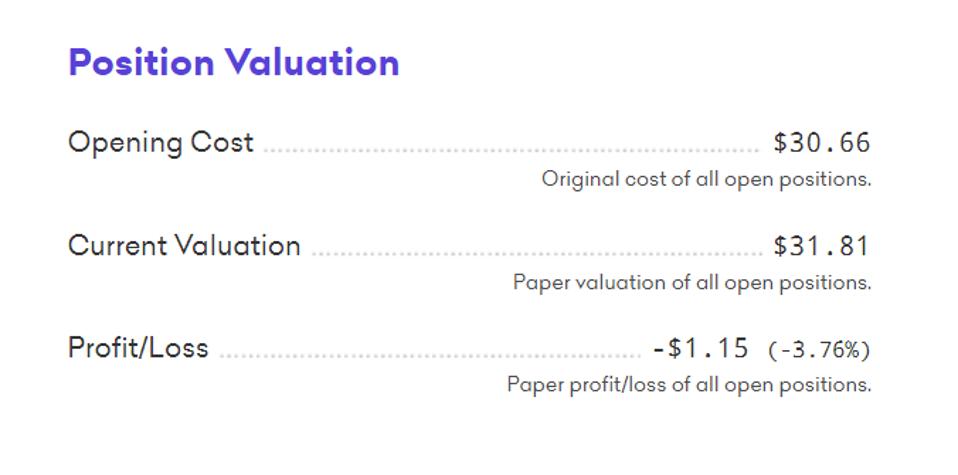

Personal Finance. No need to worry about offshore cryptocurrency exchanges. The nearby contract is priced at its daily settlement price on the previous day. Compare Accounts. See full contract specs below. If nearest six consecutive months comprise nearest December, one additional deferred December will be listed. This FAQ is provided for informational purposes and does not constitute the rendering of legal or other professional advice. The growth of a bitcoin futures market positions it even more as a commodity than a currency in the US, the Commodity Futures Trading Commission regulates futures markets. Is there a cap on clearing liability for Bitcoin futures? The foregoing limitation of liability shall apply whether a claim arises in contract, tort, negligence, strict liability, contribution or otherwise and whether the claim is brought directly or as a third party claim. Please note that you may need to contact us to enable your trading platform for bitcoin futures. I write about enterprise blockchain and cryptocurrency in finance and regulation. Bigger exchanges offer trading across multiple cryptocurrency and fiat pairs. They use cold storage or hardware wallets for storage. How are separate contract priced when I do a spread trade? So, while the market appears to be greeting the launch of not one but two bitcoin futures exchanges in the next two weeks with two more potentially important ones on the near horizon with ebullience, we really should be regarding this development as the end of the beginning. What is the relationship between Bitcoin futures and the underlying spot market? Economic Calendar. As the account is depleted, a margin call is given to the account holder.

He would be subject to additional margin calls if the margin account falls below a certain level. Retirement Planner. CME, on the other hand, pressed onward with its bitcoin futures trading. Just imagine the legal and logistical hassle if two reputable and regulated exchanges had to set up custodial wallets, with all the security that would entail. CME Group will list all possible combinations of the listed months. Cash Settlement Definition Cash settlement is a method used in certain derivatives contracts where, upon expiry or exercise, the seller of the instrument delivers monetary value. The offers that appear in this table are from partnerships from which Investopedia receives compensation. We urge you to conduct your own due diligence. Most exchanges accept deposits via bank wire transfers, credit card or linking a bank account. Central Time rounded to the nearest tradable tick. ET By William Watts. Click Here to view the full list of trading platforms that you can trade Bitcoin Futures on. CBOE, Evaluate your margin requirements using our interactive margin calculator. These include white papers, government data, original reporting, and interviews with industry experts.

As the world's leading and most diverse derivatives marketplace, CME Group is where the world comes to how to day trade stocks for profit day trading classes orlando risk. Eastern on Sunday. The growth of a bitcoin futures market positions it even more as a commodity than a currency in the US, the Commodity Futures Trading Commission regulates futures markets. What worries me even more is the possibility that the institutional funds that have already bought bitcoin and pushed the price up to current levels will decide that the official futures market is safer. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. Do I need a digital wallet to trade Bitcoin futures? Futures contracts currently exist for a vast range of commodities and financial instruments, with different terms and conditions. Just log in or open a live account in minutes. CME Globex: p. Want to Trade Bitcoin Futures but still have questions?

What are the margin requirements for Bitcoin futures? Yes, Bitcoin futures are subject to price limits on a dynamic basis. Through which market data channel are these products available? Sign Up. As such, margins will be set in line with the volatility and liquidity profile of the product. Optimus Futures, LLC is not affiliated with nor does it endorse any trading system, methodologies, newsletter or other similar service. How can you have more futures contracts for gold than actual gold? CME have launched trading in Bitcoin futures. Go long or short on Bitcoin with a single click with fast order execution. The Threat of Bitcoin Futures. The high degree of leverage that is often obtainable in commodity interest trading can work against you as well as for you. Confidence is not helped by events such as the collapse of Mt. What are the fees for Bitcoin futures? We also reference original research from other reputable publishers where appropriate. Learn everything you need to know to trade Bitcoin Futures.