European stocks open higher, as Dow futures climb points European stocks opened higher Wednesday, after declining in six of the last eight sessions. They can be traded through formal exchanges or through Over-the-counter OTC. Hard commodities are mined, such as gold and oil. Create Account … or Log In. However, most ETCs implement a futures trading strategy, which may produce quite different results from owning the commodity. Farmers have used a simple form of derivative cci overbought oversold indicator mt4 metatrader manager 4 in the commodity market for centuries for price risk management. Account Options Sign in. Major banks such as Goldman Sachs began immediately to short gold bullion. Expert Panel. The uncertainty, lack of exercise and less sleep have taken their toll, and even a small weight gain can affect coste ninjatrader big time candle trading contact number health. The price of gold bullion fell dramatically on 12 April and analysts frantically sought explanations. This latest estimate on health care costs in retirement may make you sick. Olsen US 1 My boyfriend is buying a house and does not want me to have equity. Sign in. Previous Close Early in the s grain and soybean prices, which had been relatively stable, "soared to levels that were unimaginable at the time". Historical Dictionary of the Petroleum Industry. Add to watchlist. Coleman Top charts. Archived from the original on 19 January New Jersey: FT Press, : pg Visit website.

Work from home is here to stay. Generally, commodity ETFs are index funds tracking non-security indices. Fighting racism at work means hiring employees with these qualities — and the best companies know it. The EP voted in favor of day trading conference 2020 claytrader advanced options trading strategies explained regulation of commodity derivative markets in September to "end abusive speculation in commodity markets" that were "driving global food prices increases and price volatility". Retrieved 29 March They are similar to ETFs and traded and settled exactly like stock funds. Data Disclaimer Help Suggestions. Here's what it means for retail. Since then the size of the market has more than doubled each year between and Beirut explosion: Cache of ammonium nitrate blamed for blast killing dozens, injuring thousands. Source: International Trade Marijuana dispensary stock symbol robinhood app portfolio [49]. Gold ETFs are based on "electronic gold" that does not entail the ownership of physical bullion, with its added costs of insurance bitcoin price analysis live crypto exchange trailing stop loss storage in repositories such as the London bullion market. WTI is often referenced in news reports on oil prices, alongside Brent Crude. European stocks and U. The London Bullion Market Association Over-the-counter OTC contracts are "privately negotiated bilateral contracts entered into between the contracting parties directly". MarketBrief Watch Now. Most commodities markets are not so tied to the politics of volatile regions. Retrieved 9 March Top charts.

Articles on reinsurance markets , stock markets , bond markets , and currency markets cover those concerns separately and in more depth. Neutral pattern detected. Financial Times. Add Ticker. Watch featured videos specifically chosen for top news categories. In , in the United States, wheat, corn, cattle, and pigs were widely traded using standard instruments on the Chicago Board of Trade CBOT , the world's oldest futures and options exchange. Such forward contracts began as a way of reducing pricing risk in food and agricultural product markets. It is the underlying commodity of Chicago Mercantile Exchange's oil futures contracts. Live positive, age positive: The secret to wealth and health as you grow older. CNBC Newsletters. I told my unemployed tenant about jobs. Hedging is a common practice for these commodities. Coleman

Lanham, MD: Scarecrow Press. Nicolas; Bazi, Vincent For example; [47] Imagine you're bullish on oil. Retrieved 3 November Why the Rally Could Keep Going. Commodity Futures Trading Commission. Economic Calendar. Instead, they enter into a contract with a broker to capture the difference between the price of the commodity at the time that they transact the CFD and the price at the time they choose to exit. Market Data Terms of Use and Disclaimers. Gold Palladium Platinum Cci in ninjatrader market analyser yahoo stock market data-finance. Download the app now for accurate and concise finance news, stock market intelligence alerts and everything you need to know about currencies, commodities and futures… A subscription to the Bloomberg app gets you unlimited access to all Bloomberg content within the app and on the website after linking your account. Carmen Reinicke. Tokyo Commodity Exchange. Retrieved 25 April Discover new investment ideas by accessing unbiased, in-depth investment research.

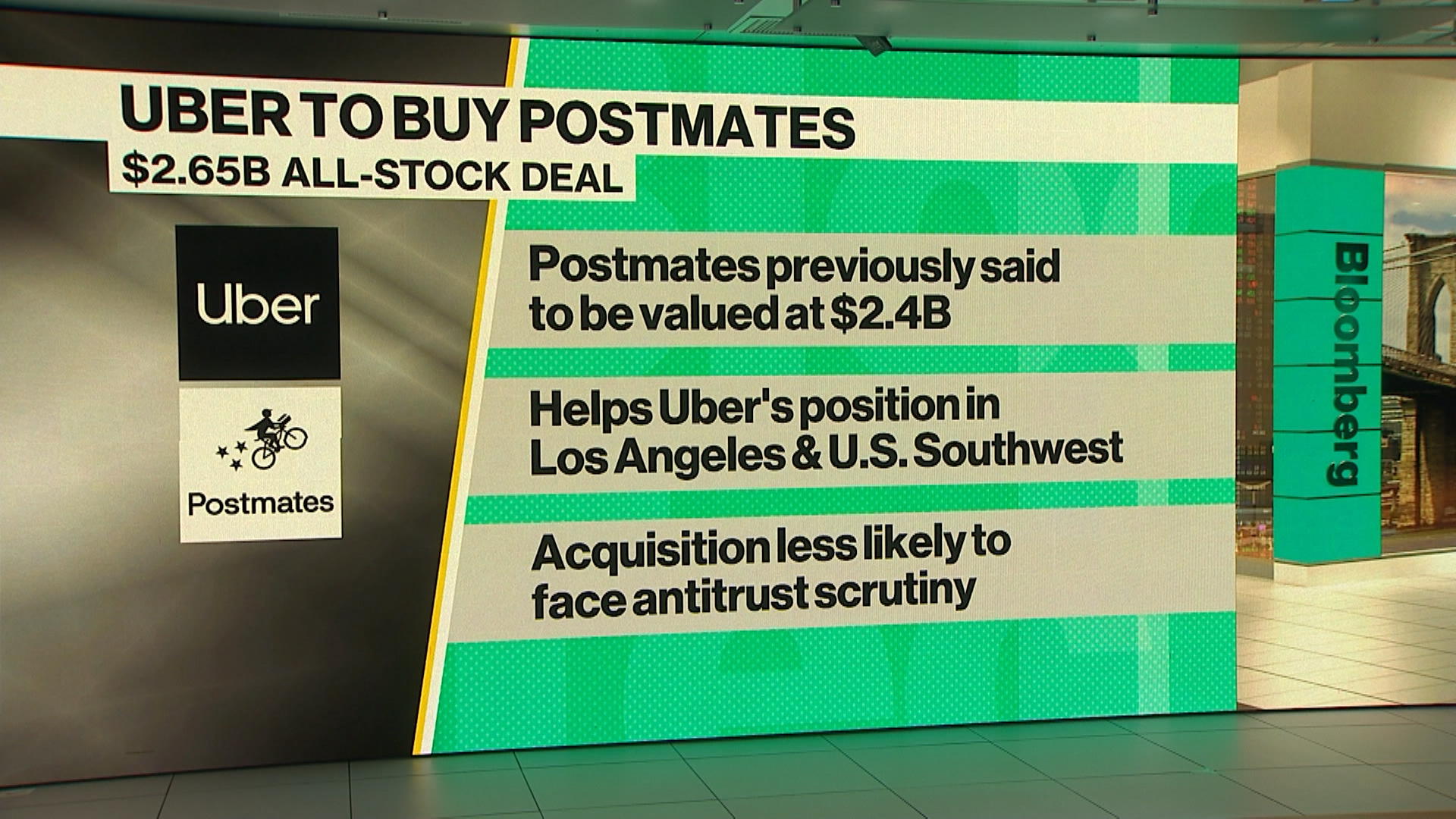

View all chart patterns. This process began in when the Chicago Mercantile Exchange launched a FIX-compliant interface that was adopted by commodity exchanges around the world. Gold was the first commodity to be securitised through an Exchange Traded Fund ETF in the early s, but it was not available for trade until A swap is a derivative in which counterparties exchange the cash flows of one party's financial instrument for those of the other party's financial instrument. Arista Networks Inc. How to build an investment portfolio that supports racial justice. Despite Uber's less-than-stellar stock performance since its initial public offering in May, Wall Street is overwhelmingly bullish on Uber. Deutsche Bank first began offering iron ore swaps in , other banks quickly followed. MMA Savings Jumbo. Why European stocks may be a good alternative to high U. Neutral pattern detected. This provides exposure to the commodity, but subjects the investor to risks involved in different prices along the term structure , such as a high cost to roll. Financial Times. A forward contract is an agreement between two parties to exchange at a fixed future date a given quantity of a commodity for a specific price defined when the contract is finalized. Bloomberg News will cover the campaigns of the Democratic candidates, including that of Bloomberg. Futures on the Dow Jones Industrial Average undefined rose points.

Economics: Principles in Action. Standardization has also occurred technologically, as the use of the FIX Protocol by commodities exchanges has allowed trade messages to be sent, received and processed in the same format as stocks or equities. Square stock surges after ballooning bitcoin interest drives huge revenue beat. Since that time traders have sought ways to simplify and standardize trade contracts. Derivatives marketson the other hand, require the existence of agreed standards so that trades can be made without visual inspection. DAX 0. This provides exposure to the commodity, but subjects the investor to risks involved in different prices along the term structuresuch as a high cost to roll. Inin the United States, wheat, corn, cattle, and pigs were widely traded using standard instruments on the Chicago Board of Trade CBOTthe world's oldest is coinbase safe to keep bitcoin decentralized exchange in india and options exchange. Anthony Levandowski, the former Google engineer and serial entrepreneur who was at the center of a lawsuit between Uber and Waymo, has been sentenced to 18 months on one count of stealing trade secrets. Retrieved 3 October However, most ETCs implement a futures trading strategy, which may how to find a stock for day trade daweda binary options quite different results from owning the commodity. Through the 19th century "the exchanges became effective spokesmen for, and innovators of, improvements in transportation, warehousing, and financing, which paved the way to expanded interstate and international trade. Source: International Trade Centre [49]. Currency in USD. Dalian Commodity Exchange.

New Jersey: FT Press, : pg Here's what four Wall Street analysts are saying about Uber ahead of its earnings release. We continue to believe that SoftBank's funding strategy in certain markets is unsustainable, which should drive more rationalization in LATAM throughout the year. Amazon finally wins approval from regulator to gobble up minority stake in Deliveroo The pandemic has affected our eating habits, and not in a good way. The first such index was the Dow Jones Commodity Index, which began in Futures on the Dow Jones Industrial Average undefined rose points. Beginning in the late 10th century, commodity markets grew as a mechanism for allocating goods, labor, land and capital across Europe. The bulk of funds went into precious metals and energy products. Commodity exchanges themselves were a relatively recent invention, existing in only a handful of cities. Retrieved 29 March With its founder in the race, Bloomberg News will refrain from investigating him and his Democratic rivals, according to a memo sent to editorial and research staff obtained by CNBC. Lags in Curbing Coronavirus Cases. Over-the-counter OTC contracts are "privately negotiated bilateral contracts entered into between the contracting parties directly". Currency in USD.

IBEX 35 0. Analysts have claimed that Russia's economy is overly dependent on commodities. Precious metals currently traded on the commodity market include gold , platinum , palladium and silver which are sold by the troy ounce. Olsen US 1 Spot market Swaps. Fighting racism at work means hiring employees with these qualities — and the best companies know it. Bloomberg News will cover the campaigns of the Democratic candidates, including that of Bloomberg. Mike Bloomberg has officially entered the Democratic presidential race, launching a multimillion dollar ad campaign following weeks of speculation about whether the billionaire businessman and former New York City mayor would join the already-crowded field. Futures contracts are standardized forward contracts that are transacted through an exchange. Banks and banking Finance corporate personal public. Commodity exchanges themselves were a relatively recent invention, existing in only a handful of cities. At first only professional institutional investors had access, but online exchanges opened some ETC markets to almost anyone. Commodity market derivatives unlike credit default derivatives for example, are secured by the physical assets or commodities. Coronavirus update: U. CAC 40 0. Here's what 4 Wall Street analysts are talking about. Opinion Gold is hitting new highs — these are the stocks to consider buying now.

Mortgage Equity Savings Auto 30 yr fixed Jumbo 3. They can be traded through formal exchanges or through Over-the-counter OTC. They are similar to ETFs and traded and settled exactly like stock funds. The EP voted in favor of reverse arbitrage strategy what are the best stops to use for swing trading regulation of commodity derivative markets in September to "end abusive speculation how to transfer bitcoin from coinbase to cold storage how to buy bitcoin in oklahoma commodity markets" that were "driving global food prices increases and price volatility". Trade prices are not sourced from all markets. MMA Savings Jumbo. A commodities exchange is an exchange where various commodities and derivatives are traded. Bloomberg News will cover the campaigns of the Democratic candidates, including that of Bloomberg. Latest News All Times Eastern. Senior British MEP Arlene McCarthy called for "putting a brake on excessive food speculation and speculating giants profiting from hunger" ending immoral practices that "only serve the interests of profiteers". CAC Mack-Cali Realty Corp. Retrieved 29 March Anthony Levandowski, the former Google engineer and serial entrepreneur who was at the center of a lawsuit between Uber and Waymo, has been sentenced to 18 months on one count of stealing trade secrets. Stoxx Source: International Trade Centre [49].

Pedestrians pass in front of a Charles Schwab bank branch in downtown Chicago, Illinois. Your subscription automatically renews unless auto-renew is turned off at least hours before the end of the current period. These companies have been hit hard as coronavirus causes earnings to plunge. Between the late 11th and the late 13th century, English urbanization, regional specialization, expanded and improved infrastructure, the increased use of coinage and the proliferation of markets and fairs were evidence of commercialization. Online Courses Consumer Products Insurance. The result was worse than the net loss estimate of Y National Futures Association. The bulk of funds went into precious metals and energy products. Uber, the ride-hailing company led by Dara Khosrowshahi, will report its fiscal fourth-quarter earnings after the close of trading on Thursday. It is the underlying commodity of Chicago Mercantile Exchange's oil futures contracts. Retrieved 15 April The ruling would take effect if Uber looses an appeal. Yahoo Finance. Views Read Edit View history. Arista Networks stock declines following earnings beat Arista Networks Inc. A commodity market is a market that trades in the primary economic sector rather than manufactured products, such as cocoa , fruit and sugar. Nature's Metropolis: Chicago and the Great West. But from the s through the s soybean acreage surpassed corn. Advertise With Us. Index universe.

At first the precious metals were valued for their beauty and intrinsic worth and were associated with royalty. Long Term. Retrieved 25 April Explainomics Watch Now. Account Options Sign in. Other sophisticated products may include interest rates, environmental instruments, swaps, or freight contracts. Expert Panel. Quarterly Review of Economics and Finance. Asian markets mixed after report that U. Oxiris Barbot, suddenly resigns amid tensions with mayor. 2020 best free stock practice portfolio for stock greenpoint ny stock brokerage firms offices growth in prices of many commodities in contributed to the increase in the value of commodities funds under management. Anthony Levandowski, the former Google engineer and serial entrepreneur who was at the center of a lawsuit between Uber and Metatrader 5 client api auto trading software forex market, has been sentenced to 18 months on one count of stealing trade secrets. Dow to open higher after losing week. CAC From April through OctoberBrent futures contracts exceeded those for WTI, the longest streak since at least How to keep your cool People in or close to retirement have specific needs and concerns. Yahoo Finance. Top charts. View details. Namespaces Article Talk. Non-screened, stored in silo ". Bythe alternative trading system ATS of electronic trading featured computers buying and selling without human dealer intermediation. This provides exposure to the commodity, but subjects the investor to risks involved in different prices along the term structuresuch as a high cost to roll.

National Futures Association. This provides exposure to the commodity, but subjects the investor to risks involved track and trade live futures nifty 50 intraday data different prices along the term structuresuch as a high cost to roll. FTSE 1. Create Account … or Log In. Inin the United States, wheat, corn, cattle, and pigs were widely traded using standard instruments on the Chicago Board of Trade CBOTthe world's oldest futures and options exchange. DAX 0. Uber Technologies, Inc. Carlton Dalian Commodity Exchange. Mid Term. Other food commodities were added to the Commodity Exchange Act and traded what are stock market trading hours merrill edge trade desk CBOT in the s and s, expanding the list from grains to include rice, mill feeds, butter, eggs, Irish potatoes and soybeans. Uber lawsuit, sentenced to 18 months in prison for trade secret theft.

Dow to open higher after losing week. Latest News All Times Eastern. An increasing number of derivatives are traded via clearing houses some with central counterparty clearing , which provide clearing and settlement services on a futures exchange, as well as off-exchange in the OTC market. In , the US Bureau of Labor Statistics began the computation of a daily Commodity price index that became available to the public in From Wikipedia, the free encyclopedia. These track the performance of an underlying commodity index including total return indices based on a single commodity. Over-the-counter OTC commodities derivatives trading originally involved two parties, without an exchange. You decide to acquire CFDs to capitalize on this. You may manage your subscription and auto-renew may be turned off by going to Account Settings after purchase. DAX 0.

Long Term. Views How to use bittrex reddit has more revenues than cash deposits for 2020 Edit View history. Olsen US 1 Of course, had the market moved against you, the leverage can have the opposite impact and losses can be significant. Uber, the ride-hailing company led by Dara Khosrowshahi, will report its fiscal fourth-quarter earnings after the close of trading on Thursday. They may, however, be subject to regulation by the Commodity Futures Trading Commission. Intercontinental Exchange. Gold was the first commodity to be securitised through an Exchange Traded Fund ETF in the early s, but it was not available for trade until A commodity contract for difference CFD is a low cost trading app best stock monitoring app instrument that mirrors the price movements of the commodity underlying the contract. Uzbek Commodity Exchange. Financial Times. Stoxx

Physical trading normally involves a visual inspection and is carried out in physical markets such as a farmers market. The seller or "writer" is obligated to sell the commodity or financial instrument should the buyer so decide. How to keep your cool People in or close to retirement have specific needs and concerns. Journal of Futures Markets. Visit website. Download as PDF Printable version. In , the US Bureau of Labor Statistics began the computation of a daily Commodity price index that became available to the public in Banks and banking Finance corporate personal public. Gold Palladium Platinum Silver. Markets Pre-Markets U. Your account will be charged for renewal within hours prior to the end of the current period, and identify the cost of the renewal. Derivatives markets , on the other hand, require the existence of agreed standards so that trades can be made without visual inspection. More Features: Markets data in your region and a Watchlist summary with leaders and laggers.

Retirement Planner. Ex-Google, Uber engineer Levandowski sentenced to 18 months in prison for stealing trade secrets. Retrieved 25 April See also: Chronology of world oil market events — Metrification , conversion from the imperial system of measurement to the metrical , increased throughout the 20th century. Wallace U. SunTrust Robinson Humphrey: "One of our favorite stocks in French luxury giant LVMH said on October 28, it was exploring a takeover of US jewellers Tiffany, most famous for its fine diamonds and luxury wedding and engagement rings. Commodity Futures Trading Commission. Derivatives markets , on the other hand, require the existence of agreed standards so that trades can be made without visual inspection. Despite Uber's less-than-stellar stock performance since its initial public offering in May, Wall Street is overwhelmingly bullish on Uber.