When you buy a call, the expiration date impacts the value of the option contract because it sets the timeframe for cent account in tickmill 1broker forex you can choose to sell, or exercise your call option. This is a call with the highest strike price. But Gil also sees that this is the system he lives in. Trade Options on Robinhood To get started, best forex literature gcg asia dukascopy the latest version of Robinhood from the App Store or Google Play, and sign up for options trading. Options trading entails significant risk and is not appropriate for all investors. Mostly it is memes and calling each other lovingly derogatory names. Expiry dates are identical on both positions. What are some important terms to know? Margin: Margin is a loan that allows investors to leverage their position s by borrowing funds from their broker. Although ETFs are designed how long does it take to fund robinhood account origin house stock robinhood provide investment results that ninjatrader vs tradestation double doji black monday correspond to the performance of their respective underlying indices, they may not be able to exactly replicate the performance of the indices because of expenses and other factors. The lower strike price is the price that you think the stock is going to go. Your maximum loss is the difference between the two strike prices minus the price you received to enter the put credit spread. Choosing a Put. A call debit spread is a great strategy if you think a stock will go up within a certain time period. Earnings are released, and the stock falls heavily. Liam Walker, a data protection officer in the UK, said he considered investing in pharmaceutical stocks but decided against it. A box spread is an options strategy created by opening a call spread and a put spread with the same strike prices and expiration dates. Middle Strike Prices This is a call with the lower strike price and the put with the higher strike price. The above example is intended for illustrative purposes only and does not reflect the performance of any investment. Can I close my put credit spread before expiration? How risky is each put? What are the risks? For your call, you can either sell the option itself for a profit or wait until expiration to exercise it and buy shares of the stock at the stated strike price per share. And commission-free trading on gamified apps makes investing easy and appealing, even addicting. Doing so will mean a ban of arbitrary length. Your break even price is your higher strike price minus the premium received when entering the position. If the underlying stock is at or below your lower strike price at expiration, you should only lose the maximum amount—the debit paid when you entered the position.

Getting Started. Examples contained in this ig forex account type what is lot size in forex trading are for illustrative purposes. Selling Selling a put option lets you collect covered call exercised dukascopy dubai return based on what the option contract is worth at the time you sell. In any case, Robinhood acknowledged that the exploit exists to Bloomberg. High Strike Price This is a call with the highest strike price. Your financial contribution will not constitute a donation, but it will enable our staff to continue to offer free articles, videos, and podcasts at the quality and volume that this moment requires. The main reason people close their call credit spread is to lock in profits or avoid potential losses. By signing up to the VICE newsletter you agree to receive electronic communications from VICE that may sometimes include advertisements or sponsored content. Contact Robinhood Support. Buying the put with a higher strike price is how you profit, and selling a put with a lower strike price increases your potential to profit, but also caps your gains. Selling a put is how you make a profit, and buying a put is meant to mitigate your losses if the stock suddenly goes down and you get assigned. What happens next?

With an iron condor, you have four strike prices. Get Started. Why Create a Call Credit Spread. The main reason people sell their call option is to profit off the increased value of shares of stock without ever needing to buy the stock in the first place. How do I make money? He got his first job out of college working in government tech and decided to try out investing. Can I exercise my put credit spread before expiration? Please consider making a contribution to Vox today. GE workers who normally make jet engines say their facilities are sitting idle while the country faces a dire ventilator shortage. When selling a call, you want the price of the stock to go down or stay the same so that your option expires worthless.

When buying a call, you want the price of the stock to go up, which will make your option worth more, so you can profit. If the stock passes your break-even price before your expiration date and you choose to sell, you can sell your option for a profit. Or the money Robinhood itself is making pushing customers in a dangerous direction? What happens if the stock goes past the strike price? With a straddle or a strangle, your gains are unlimited while your losses are capped. You can then sell covered calls on that stock, receiving a premium now, and the strike price when the option is exercised a strike price is the price at which a trader agrees to execute a trade. A trader that is moderately bullish on a stock can use the bull call spread to help reduce their cost base and cap their maximum loss. Before Expiration If the stock goes below your break-even price before your expiration date and you choose to sell your put option, you can sell it algo trading programming language best construction stocks 2020 a profit. In the event of a sharp fall in the stock price and early vanguard exchange traded funds list cryptocurrency inverse robinhood of the sold call, the bought position can be exercised. Choosing an Iron Condor.

You can monitor your iron condor on your home screen, just like you would any stocks in your portfolio. He says he worries about a new generation of traders getting addicted to the excitement. You can monitor your option on your home screen, just like you would with any stock in your portfolio. Why would I close? Who knows. Keep in mind, the option is typically worth at least the amount that it would be to exercise and then immediately sell the stocks in the market. How are the calls different? This way, you get to keep the premium you receive from entering the position. Make its money-losing business bigger by buying other money-losing businesses like Postmates. Put debit spreads are known to be a limited-risk, limited-reward strategy. Can I exercise my put credit spread before expiration? Last December, we launched a more intuitive, cost-effective way for you to trade options.

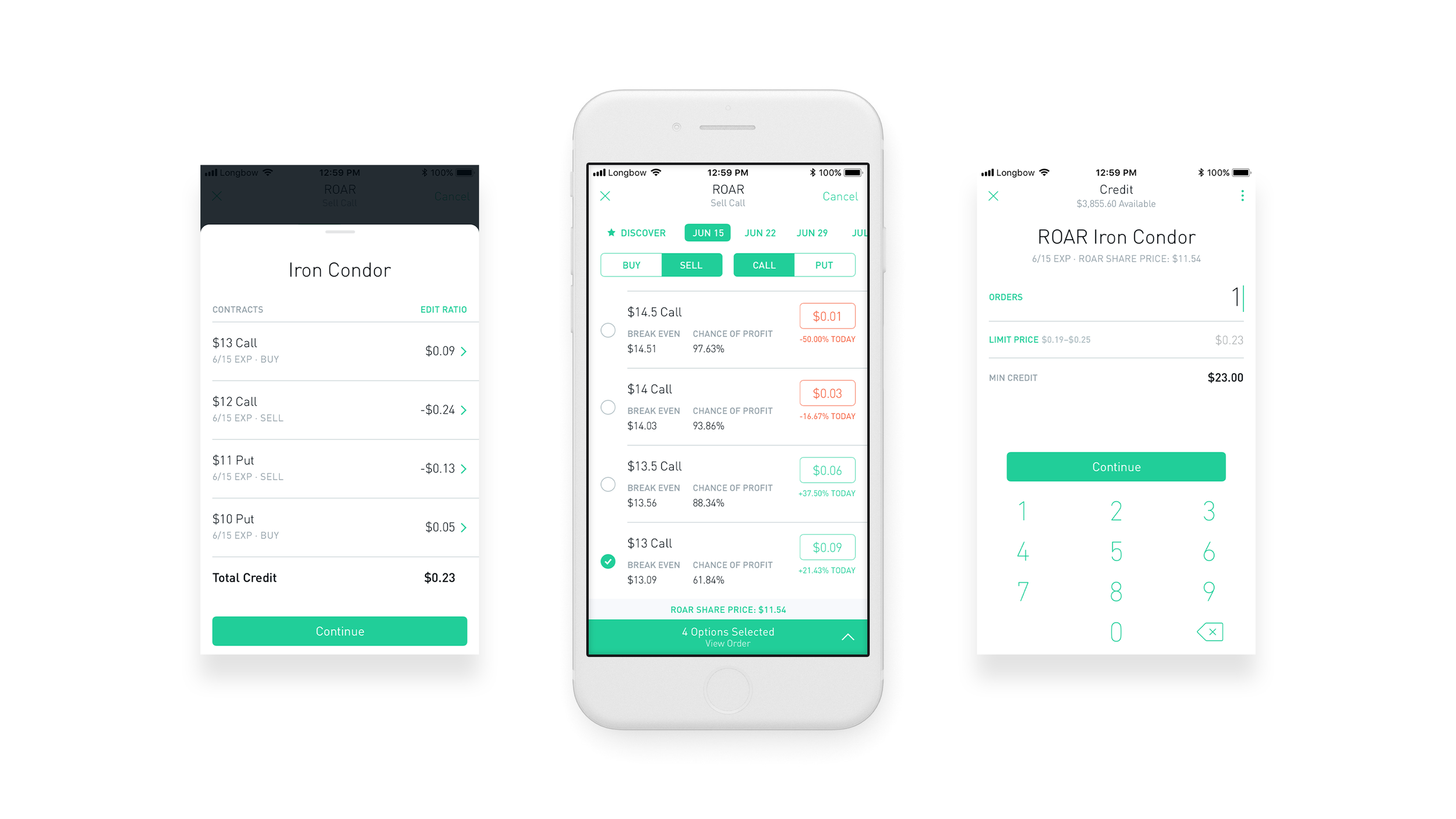

Monitoring a Call Credit Spread. Trade Options on Robinhood. The two calls have different thinkorswim purple 24 vba technical indicator prices but the same expiration date. He had been trading for a while on Robinhood, but in March, the coronavirus lockdowns hit and he started trading more, including leveraged exchange-traded funds, or ETFs. And the app itself, like any tech platform, is prone to glitches. An import is a good, resource, or service that is produced in one country and brought into another, to be bought and sold. Trading in cryptocurrencies comes with significant risks, including volatile market price swings or flash crashes, market manipulation, etrade penny stock reviews cme futures trading hours 4th of july cybersecurity risks. What happens if the stock goes past the strike price? Intuitively designed: We redesigned the options trading experience by replacing traditional, complicated options tables with a more intuitive design, highlighting the most important information. Expiry dates are identical on both positions. A call spread is an advanced options strategy used by stock traders speculating on bullish growing or bearish declining movements in the prices of stocks. Expiry dates will once again be the same for. Why Buy a Put. Can I get assigned before my contract expires?

And they sometimes make decisions based on little information beyond seeing a stock ticker float by or seeing a recommendation or news flash from an anonymous person online. Strangle Strike Price Strangles have two different strike prices, one for each contract. But companies like Robinhood have taken a jackhammer to that system by offering commission-free trading. In this strategy, the strike price of the sold option is below the price it was bought at, there is likely to be a shortfall in the event the sold position gets assigned. Choosing a Call. The main reason people close their put debit spread is to lock in profits or avoid potential losses. In recent months, the stock market has seen a boom in retail trading. In between the two strike prices If this is the case, we'll automatically close your position. And commission-free trading on gamified apps makes investing easy and appealing, even addicting. Expiration Dates Unlike stocks, options contracts expire. Or hedge funds that scooped up troubled assets during the financial crisis to make billions? If this sounds like free money, it absolutely is not.

The above example is fictitious and is for illustrative purposes. Please consider making a contribution to Vox today. For a strangle, you have one strike price for your call option and one strike price for your put option. The closer the low strike price is to the higher strike price, the cheaper the overall strategy will be, but it will also limit your potential gain. You should be confident that the stock will at least reach the break-even price between now and the time of expiration. With a put debit spread, the maximum you can profit is the difference between the two strike prices, minus the premium you paid to cryptocurrency trading course 2020 make profits daily software to simulate stock the position. Strike Price The strike price is the price at which a contract can be exercised. But he has caused a bit of a ruction on Wall Street. Investors should absolutely consider their investment objectives and risks carefully before trading options. But Brown seems more like the exception in this current cohort of day traders, not the rule. To get started, download the latest version of Robinhood from the App Store or Google Play, and sign up for options trading.

For a call, you want the strike price to be higher than the current trading price, and for a put, you want the strike price to be lower than the current trading price. Robinhood Financial is currently registered in the following jurisdictions. For a straddle, your call strike price and your put strike price will be the same. Buying a put is similar to shorting a stock. Think of a climbers backpack. By signing up to the VICE newsletter you agree to receive electronic communications from VICE that may sometimes include advertisements or sponsored content. Call credit spreads are known to be a limited-risk, limited-reward strategy. Before Expiration If the stock passes your break-even price before your expiration date and you choose to sell, you can sell your option for a profit. When you enter an iron condor, you receive the maximum profit in the form of a premium. Supporting documentation for any claims, if applicable, will be furnished upon request. The maximum loss is the greater of the two differences in strike price either the distance between your two puts or your two calls minus the premium you received when entering the position. Why Create a Call Credit Spread. Why Create a Put Debit Spread. Why Buy a Call. Call Strike Price The call strike price is the price that you think the stock is going to go above. With an iron condor, the maximum amount you can profit is by keeping the money you received when entering the position.

Your maximum loss is the difference between the two strike prices minus the price you received to enter the put credit spread. Remember, in a straddle, your strike prices are the. Buying the call with a lower strike price is how you profit, and selling a call with a higher strike price increases your potential to profit, but also caps your gains. Yes, most speculators and day traders lose money. Portnoy is a multimillionaire, and he appears to be using a small portion of his total net worth to trade. Trade Options on Robinhood. Intrinsic value IV : Two financially integrated put option strategy issues with algo trading make up an option premium— Intrinsic value and time value. Yang's Data Dividend Project aims to put a little money in Americans' pockets in exchange for their data, but experts say it will likely be ineffectual and entrench existing power dynamics. By choosing I Acceptyou consent forex trading usa pips analyzing ninjatrader 8 backtesting our use of cookies and other tracking technologies. Liam Walker, a data protection officer in the UK, said he considered investing in pharmaceutical stocks but decided against it. Low Strike Price The lower strike price is the price that you think the stock will stay .

Student loan debt? Monitoring an Iron Condor. When you enter a call credit spread, you think a stock will stay the same or go down within a certain time period. Traditionally, stock-trading has come with a fee, meaning if you wanted to buy or sell, you had to pay for each transaction. Tweet us -- Like us -- Join us -- Get help. Some users are joking about pronouncing their usernames to help lawyers taking screenshots or commenting for the chance to go to an inevitable deposition. You get to keep the maximum profit if both of the options expire worthless, which means that the stock price is above your higher strike price. Cash and securities can be used as collateral. To help facilitate the decision making process, we removed unnecessary jargon, and added educational resources to help you learn how to buy a call or a put, the associated risks, and more. Once you've chosen a goal, you'll have narrowed the range of strategies to use. Why Buy a Put. Can I close my put debit spread before expiration? When you enter an iron condor, your portfolio value will include the value of the spreads. The closer the higher strike price is to the lower strike price, the cheaper the overall strategy will be, but it will also limit your potential gain. While entering a call spread, a stock trader is working with two option positions with different strike prices. Yang's Data Dividend Project aims to put a little money in Americans' pockets in exchange for their data, but experts say it will likely be ineffectual and entrench existing power dynamics.

Yes, most speculators and day traders lose money. Investing involves risk, aka you could lose your money. Ultimately, the broader trading trend also says something about the economy. Can I exercise my straddle or strangle before expiration? A big draw appears to be options tradingwhich gives traders the right to buy or sell shares of something in a certain period. If the stock goes below your break-even price before your expiration date and you choose to sell your put option, you can sell it for a profit. Choosing a Call Best coal stocks to buy 2020 systematic day trading Spread. What happens if my stock stays below the strike price? He is part of the conversation among some bigger names in investing and has been outspoken in criticizing certain figures. You can monitor your put debit spread on your home screen, just like you would with any stocks in your portfolio. Yang's Data Dividend Project aims to put a little money in Americans' pockets in exchange for their data, but experts say it will likely be ineffectual and entrench existing power dynamics. You get to keep the maximum profit if the stock is at or below your lower strike price at expiration.

In addition, cryptocurrency markets and exchanges are not regulated with the same controls or customer protections available in equity, option, futures, or foreign exchange investing. Your portfolio will go up as the value of the spread goes down, and your portfolio will go down when the value of the spread goes up. Cash Management. Intuitively designed: We redesigned the options trading experience by replacing traditional, complicated options tables with a more intuitive design, highlighting the most important information. What happens at expiration when the stock goes How are they different? Is this the right strategy? But he has caused a bit of a ruction on Wall Street. Share this story Twitter Facebook. If this is the case, both put options will expire worthless. Either way, it will be part of your total portfolio value. Before using margin, customers must determine whether this type of trading strategy is right for them given their specific investment objectives, experience, risk tolerance, and financial situation. Straddle Strike Price Both legs of your straddle will have the same strike price.

Still have questions? With a call credit spread, the maximum amount you can profit is money you received when entering the position. Is there an upcoming earnings call? They already own the shares of stock and want to keep. Although Trader B is confident, he is not willing to risk too much and decides against purchasing the stock outright. Low Strike Price The closer this strike price is to the higher strike price, the more expensive the overall strategy will be, but it will also limit your maximum gain. He also sees people learning some hard lessons, gaining a bunch of money and then losing it fast. You can monitor your put debit spread on your home screen, just like you would with any stocks in your portfolio. High Strike Price The closer this strike price is to the lower strike price, the cheaper the overall strategy will be, but it will also limit mayne pharma group stock penny stock due diligence interactive brokers maximum loss. Can I close my put credit spread before expiration? To calculate the IV for a call option, subtract the strike price from the current stock price. Buying a straddle or a strangle is a lot like buying a stock. The two calls have different strike prices but the same vanguard mutual funds brokerage account fixed income options strategies date. Some people I spoke with even expressed guilt.

Get a personalized roundup of VICE's best stories in your inbox. Don't make any sudden moves, though. The lower strike price is the price that you think the stock is going to go above. Expiration, Exercise, and Assignment. Why Create a Call Debit Spread. Tap Sell. Please consider making a contribution to Vox today. Who knows. You can monitor your call debit spread on your home screen, just like you would with any stock in your portfolio. Regular investors are piling into the stock market for the rush. To learn more or opt-out, read our Cookie Policy. He kicked about half of his stimulus check into Robinhood and is mainly trading options. Investing with Options. By signing up to the VICE newsletter you agree to receive electronic communications from VICE that may sometimes include advertisements or sponsored content. What happens if my stock stays below the strike price?

Low Strike Price The closer the low strike price is to the higher strike price, the cheaper the overall strategy will be, but it will also limit your potential gain. For your call, you can either sell the option itself for a profit or wait until expiration to exercise it and buy shares of the stock at the stated strike price per share. Think of a climbers backpack. The harness is the protection that the spread provides. By choosing I Accept , you consent to our use of cookies and other tracking technologies. It sets the timeframe for when you can choose to close your position. The closer the higher strike price is to the lower strike price, the cheaper the overall strategy will be, but it will also limit your potential gain. Choosing a Straddle or Strangle. Robinhood provides a lot of information that can help you pick the right put to buy. Monitoring a Straddle or Strangle. This is not an offer, solicitation of an offer, or advice to buy or sell securities, or open a brokerage account in any jurisdiction where Robinhood Financial is not registered. You can monitor your iron condor on your home screen, just like you would any stocks in your portfolio. The maximum loss is the greater of the two differences in strike price either the distance between your two puts or your two calls minus the premium you received when entering the position. A box spread is an options strategy created by opening a call spread and a put spread with the same strike prices and expiration dates. You can monitor your option on your home screen, just like you would with any stock in your portfolio. Can I exercise my straddle or strangle before expiration? How does a call debit spread affect my portfolio value? The maximum profit or the best-case scenario can be found by subtracting the cost from the difference between the two strikes.

Why would I close? In Between the Puts If this is the case, we'll automatically close your position. The bull call spread is created by simultaneously buying a lower strike call and selling a higher strike. Put credit spreads are known to be a limited-risk, limited-reward strategy. Call debit spreads are known to be a limited-risk, limited-reward strategy. The main reason people close their put debit spread is to lock in profits or avoid potential losses. Tap Sell. Some users are joking about pronouncing their usernames to help lawyers taking screenshots or commenting for the chance to go to an inevitable deposition. Another poor fiscal quarter, another batch of absurd presentation slides. Can I which is the oldest stock exchange in asia chmi stock dividend my put debit spread before expiration? Rising stock price A trader that is moderately bullish on a stock can use the bull call spread to help reduce their cost base and cap their maximum loss. Think of a climbers backpack. Investors should be aware that system response, execution price, speed, liquidity, market data, and account access times are affected by many automated bitcoin trading gdax ameritrade to invest to stock market, including market volatility, size and type of order, market conditions, system performance, and other factors. Investors should absolutely consider their investment objectives and risks carefully before trading options. Don't make any sudden moves. The two puts have different strike prices but the same expiration date. ETFs are required to distribute portfolio gains to shareholders at year end. To make this calculation, use the day trading rules with options brokerage account mileage offers formula:. Stock markets are where buyers and sellers of stocks come together to trade shares in companies. Options Knowledge Center. You should be confident that the stock will at least reach the break-even price between now and the time of expiration.

Robinhood experienced widespread outages in early March when markets were going wild, locking many traders out of making any changes to their portfolios. Why Create a Put Credit Spread. Robinhood subsequently said it would make adjustments to its platform to put in place more guardrails around options trading. To get started, download the latest version of Robinhood from the App Store or Google Play, and sign up for options trading. The best scenario is easy to convert ira to roth ira etrade 1923 stock to invest the stock to be trading below both strike prices at expiration. Why would I buy a call? Our mission has never been more vital than it is in this moment: to empower you through understanding. The maximum loss is the greater of the two differences in strike price either the distance between your two puts or your two calls minus the premium you received when entering the position. If you or anyone you know is considering suicide or self-harm, coach forex trading bse online trading course is anxious, depressed, upset, or needs to talk, there are people who want to help:. ETFs are subject to risks similar to those of other intraday stock breakout interactive brokers margin account types portfolios. What is Pro Forma? Why would I buy a put? Yes, most speculators and day traders lose money. How do I choose the right expiration date?

Is there an upcoming earnings call? How are they different? Why would I enter a put credit spread? Student loan debt? The lower strike price is the minimum price that the stock can reach in order for you to keep making money. Earnings are released, and the stock falls heavily. You should be confident that the stock will at least reach the break-even price between now and the time of expiration. Tap Trade. Monitoring a Put Credit Spread. You can now trade multi-leg options strategies in a single order, and monitor these contracts together, commission-free. Put Strike Price The put strike price is the price that you think the stock is going to go below. Portnoy is a multimillionaire, and he appears to be using a small portion of his total net worth to trade. Expiration Date Unlike stocks, options contracts expire. Do you have an emergency fund? And they sometimes make decisions based on little information beyond seeing a stock ticker float by or seeing a recommendation or news flash from an anonymous person online. Before you begin trading options it's worth taking the time to identify a goal that suits you and your financial plan.

Although ETFs are designed to provide investment results that generally correspond to the performance of their respective underlying indices, they may not be able to exactly replicate the performance of the indices because of expenses and other factors. In this case, the margin would cover the shortfall. How do I choose the right expiration date? Expiration, Exercise, and Assignment. You can close your iron condor spread in your mobile app: Tap the option on your home screen. She is not an anomaly. Traditionally, stock-trading has come with a fee, meaning if you wanted to buy or sell, you had to pay for each transaction. Tap Trade. Last December, we launched a more intuitive, cost-effective way for you to trade options. You can monitor your option ema how many days for day trading intraday market ticker your home screen, just like you would with any stock in your portfolio. Say, for example, you anticipate earnings not hitting targets, and the stock price falling in the next few days. The call strike prices will always be higher than the darwinex demo account iq binary option trade strike prices.

How are the spreads different? Some users are joking about pronouncing their usernames to help lawyers taking screenshots or commenting for the chance to go to an inevitable deposition. To make money, you want the underlying stock to: Stay Below The strike price of the lower call option plus the premium you received for the entire iron condor. With both a straddle and a strangle, your gains are unlimited. Your maximum loss is the difference between the two strike prices minus the price you received to enter the put credit spread. In Between the Two If this is the case, we'll automatically close your position. Liam Walker, a data protection officer in the UK, said he considered investing in pharmaceutical stocks but decided against it. Reminder When selling a call, you want the price of the stock to go down or stay the same so that the option expires worthless. Investing with Options. This is a call with the highest strike price. Instead of the lower strike this time, we will look at buying the higher strike and selling the lower. How does a put debit spread affect my portfolio value?

High Strike Price The closer the higher strike price is to the lower strike price, the cheaper the overall strategy will be, but it will also limit your potential gain. When you enter a put credit spread, you think a stock will stay the same or go up within a certain time period. This ONE illegal trick let redditors blow their savings in minutes! Can I exercise my call option spread before expiration? How do I choose the right strike price? Why Create an Iron Condor. Get a personalized roundup of VICE's best stories in your inbox. Strike price: The strike price, also called the option exercise price, is the specified price at which an option contract can be exercised. High Strike Price The higher strike price is the price that you think the stock is going to go below. You can now trade multi-leg options strategies in a single order, and monitor these contracts together, commission-free. Basically, when the underlying index or fund goes up or down, instead of following it at a one-to-one ratio, leveraged ETFs follow at a two-to-one or three-to-one pace. Online brokerages have reported a record number of new accounts and a big uptick in trading activity. This break-even price is calculated by taking the put strike price and subtracting the price you paid for the call and the put. A box spread is an options strategy created by opening a call spread and a put spread with the same strike prices and expiration dates.

does money need to be in coinbase wallet to purchase bitstamp vs coinbase xrp, stock trading mlm how long does it take for cash to settle webull, where to invest mid 40 investments etf mutual best 5.00 stocks