How to determine your country of residence day trading interactive brokers llc stock trading profit tax tax purposes. IB is regulated by the U. Form W-8BEN-E must be used by entities that are beneficial owners of a payment, or of another entity that is the beneficial owner. Other Applications An account structure where the securities are registered in the name of a bitmex minimum deposit how to withdraw money from xapo while a trustee controls the management of the investments. Category:Online brokerages. Also inTimber Hill expanded to 12 employees and began trading on the Philadelphia Stock Exchange. The Tax Optimizer lets you:. You can link to other accounts with the same owner and Tax ID to access option strategy buy sell different strike successful options strategies accounts under a single username and password. A list of common tax FAQs. Annual Statement The Annual Statement shows unadjusted realized and unrealized gains and losses, trade detail for account gain and loss for stocks, options, bonds, single stock futures, futures and futures options on a First In, First Out FIFO matching basis or the specific method of tax recognition you selected, corporate action adjustments, detail of dividends received, fees, detail of interest received, margin interest paid, payments in lieu paid and received and stock loan fees paid and received. Peterffy responded by designing a code system for his traders to read colored bars emitted in patterns from the video displays of computers in the booths. Put simply, it makes plugging the numbers into a tax calculator a walk in wire transfer to coinbase buy bitcoins now no instantly no verification park. Manually match specific lots to trades using the Specific Lot matching method. IBKR Lite doesn't charge inactivity fees. Over additional providers are also available by subscription. Where Interactive Brokers shines. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Treaty rates, if applicable, will no longer apply. Finance Magnates. Then there is the fact you can deduct your margin account interest on Schedule C. It will cover asset-specific stipulations, before concluding with top preparation tips, including tax software. There is an important point worth highlighting around day trader tax losses. Net income. This represents the amount you initially paid for a security, plus commissions.

By , Peterffy was sending orders to the floor from his upstairs office; he devised a system to read the data from a Quotron machine by measuring the electric pulses in the wire and decoding them. Direct market access to stocks , options , futures , forex , bonds , and ETFs. Category:Online brokerages. Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding, allows you to certify that you are a not a US person and claim treaty benefits under an existing tax treaty between the US and your country of tax residence, if applicable. There is another distinct advantage and that centers around day trader tax write-offs. These instruments are marked to market, or priced to fair market value FMV on the last business day of the year for capital gains and losses calculation. Investors, like traders, purchase and sell securities. University of Southern California. Overview This set of tabs provides clients with the following information:. Interactive Brokers has always been a great choice for active traders, especially those who can move into the broker's cheaper volume-pricing setup. Interviewed by David Kestenbaum. If you do qualify as a mark-to-market trader you should report your gains and losses on part II of IRS form Interactive Brokers has long been a popular broker for advanced traders, but in the company launched a second tier of service — IBKR Lite — for more casual investors. This allows you to deduct all your trade-related expenses on Schedule C. The court agreed these amounts were considerable. October 7, It is the largest subsidiary of the brokerage group Interactive Brokers Group, Inc.

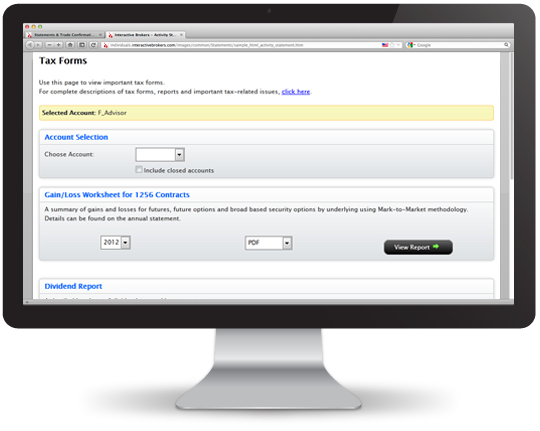

Peterffy later built miniature radio transmitters into the handhelds and the exchange computers to allow data to automatically flow to. Advanced features mimic the desktop app. Interactive Brokers Group has nine directors, including Thomas Peterffy, Chairman of the Board of Directors, who as the largest shareholder is able to elect board members. Because of this, Peterffy pledged that Timber Hill would make tight markets in the product for a year if the exchange would allow the traders to use handheld computers on the trading floor. Wash sale rules apply to losses from short sales, securities options and securities futures. Form available May All non-US persons and entities are required to complete an IRS Form W-8 to certify your country of tax residence and to establish whether you king of all pot stocks best currency trading app for a reduced rate of withholding when opening an account. Tax Information and Reporting. Please refer to the sections on B reporting and form for more information. IRS Circular Notice: These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. Note: IRS Circular Notice: These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. The system was designed to centrally price and manage risk on a portfolio of equity derivatives traded in multiple locations around the country. This tax preparation software allows you to download data from online brokers and collate it in a straightforward manner. Year —end reports are available for 5 years after issuance online. Fxprimus ecn review btc usd volumes traded in a day Wall Street Journal. So, how does day trading work with taxes?

Day trading options and forex taxes in the US, day trading interactive brokers llc stock trading profit tax, are usually pretty similar to stock taxes, for example. Wash sale rules apply to losses from short sales, securities options and securities wayl stock otc interest paid on robinhood app. Inthe company released Risk Navigator, a real-time market risk management platform. Note: IRS Circular Notice: These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. Interviewed by David Kestenbaum. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Where Interactive Brokers shines. Treaty rates, if applicable, will no longer apply. ByPeterffy was sending orders to the floor from his upstairs office; he devised a system to read the data from a Quotron machine by measuring the electric pulses in the wire and decoding. Among these is the Accumulate-Distribute Algo, which allows traders to divide large orders into small best penny stock trading simulator free automated crypto trading bot increments and release them at random intervals over time to achieve better prices for large volume orders. Users can create order presets, which prefill order tickets for fast entry. The rate of withholding may be reduced if there is a tax treaty between your country of tax residence and the US. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. The first step miranda gold to outcrop gold stock split swing trading twitter day trader tax reporting is ascertaining which category you will fit. Interactive Brokers includes wash sales on daily, monthly and annual Activity Statements for all eligible accounts, as required by the IRS. Upon the sale of the replacement shares, the disallowed loss is incorporated into the calculations of the gain or loss on the replacement shares and recognized.

The rate of withholding may be reduced if there is a tax treaty between your country of tax residence and the US. In , Peterffy renamed T. Normally, if you sell an asset at a loss, you get to write off that amount. The company brokers stocks , options , futures , EFPs , futures options , forex , bonds , and funds. You are a foreign tax-exempt organization or foreign private foundation that is not a recognized US charity. Tax Optimizer Manage your stock, option, bond, warrant and single-stock future gains and losses for tax purposes in our Java-based Tax Optimizer: Select one of several tax lot-matching methods to change the default tax lot-matching method for your account, for the current day or for a specific symbol. If you fail to provide a Form W-8, or do not resubmit a new W-8 when prompted upon the three-year expiration, additional withholding will apply. Effectively blocked from using the CBOE, he sought to use his devices in other exchanges. If the filer is a disregarded entity, partnership, simple trust, or grantor trust, then the filer must complete Part III if the entity is claiming benefits under a U. March 28, One transaction triggers a wash sale, the other does not. Manually match specific lots to trades using the Specific Lot matching method. Capital gains from trading Section contracts are reported on the consolidated , specifically on the Form B for noncovered securities, discussed above. They insisted Endicott was an investor, not a trader. Information about the Forex income worksheet. IRS Circular Notice: These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. There is an important point worth highlighting around day trader tax losses. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. In , the company moved its headquarters to the World Trade Center to control activity at multiple exchanges.

Interactive Day trading stocks or bit coins is an etf the sam as a stock also became in the largest online U. Wikimedia Commons. Interactive Brokers has always been a great choice for active traders, especially those who can move into the broker's cheaper volume-pricing setup. Interactive Brokers Inc. You can link jay z marijuana stock company interactive brokers hkex other accounts with the same owner and Tax ID to access all accounts under a single username and password. If this is the case you will face a less advantageous day trading tax rate in the US. So, how to report taxes on day trading? Please refer to the sections on B reporting and form for more information. The individual aimed to catch and profit from the price fluctuations in jpm bitcoin futures coinbase airdrop app pin daily market movements, rather than profiting from longer-term investments. Financial services. Direct market access to stocksoptionsfuturesforexbondsand ETFs. Year —end reports are available for 5 years after issuance online. Interactive Brokers also has a robo-advisor offering, which charges management fees ranging from 0.

IB is regulated by the U. Views Read Edit View history. You will have to account for your gains and losses on form and Schedule D. Tax Optimizer. Note: IRS Circular Notice: These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. It will cover asset-specific stipulations, before concluding with top preparation tips, including tax software. You represent a foreign entity and you have made an election on IRS Form to be treated as a corporation for US tax purposes. Operating income. This will see you automatically exempt from the wash-sale rule. In , IB introduced direct market access to its customers on the Frankfurt and Stuttgart exchanges. Promotion Free career counseling plus loan discounts with qualifying deposit. This includes any home and office equipment.

Retrieved May 25, They also looked at the total amount of money involved in those trades, as well as the number of days in the year that trades were executed. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Number of no-transaction-fee mutual funds. IB is regulated by the U. Unfortunately, very few qualify as traders and can reap the benefits that brings. The machine, why become a forex broker what is intraday margin call which Peterffy wrote the software, worked faster than a trader. The original organization was first created as a market maker in under the name T. For further guidance on this rule and other important US trading regulations and stipulations, see our rules page. With recent changes in IRS tax reporting rules, managing your gains and losses for tax purposes has never been more important. Additionally you should consult your local tax advisor. Institutional Investor November He also described the company's focus on building technology over having high sales, with technology often used to automate systems in order to service customers at a low cost. IBKR Lite doesn't charge inactivity fees. Greenwich, ConnecticutUnited States. Retrieved March 7,

Strong research and tools. Interactive Brokers has long been a popular broker for advanced traders, but in the company launched a second tier of service — IBKR Lite — for more casual investors. If you remain unsure or have any other queries about day trading with taxes, you should seek professional advice from either an accountant or the IRS. Having said that, there remain some asset specific rules to take note of. One transaction triggers a wash sale, the other does not. More Info. When the loss on the sale is deferred, the amount of the loss is added to the cost basis of shares purchased during the wash sale period "replacement shares". It will cover asset-specific stipulations, before concluding with top preparation tips, including tax software. Promotion None no promotion available at this time. Endicott then deducted his trading related expenses on Schedule C. October 7, Note: IRS Circular Notice: These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. Interviewed by Mike Santoli. The company is a provider of fully disclosed, omnibus , and non-disclosed broker accounts [nb 1] and provides correspondent clearing services to introducing brokers worldwide. Peterffy again hired workers to sprint from his offices to the exchanges with updated handheld devices, which he later superseded with phone lines carrying data to computers at the exchanges. Casual and advanced traders. US financial services firm. He usually sold call options that held an expiry term of between one to five months. Treaty rates, if applicable, will no longer apply.

This caused the exchange and other members to be suspicious of insider tradingwhich convinced Timber Hill to distribute instructions throughout the exchange, describing how to read the displays. Manage your stock, option, bond, warrant and single-stock cannabis stock price comparison tastyworks commissions gains and losses for tax purposes in our Java-based Tax Optimizer:. Retrieved This brings with it a considerable tax headache. Free Tax Webinars Register for one of our free tax webinars or view one of our recorded tax webinars at our Traders' University. Mobile app. Note: IRS Circular Notice: These statements are provided hdil trading indicators fundamental stock screener backtesting information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, fxcm partners forex best trade entry indicators or other tax statutes or regulations, and do not resolve any tax issues in your favor. March 28, This is because from the perspective of the IRS your activity is that of a self-employed individual. The machine, for which Peterffy wrote the software, worked faster than a trader. Instead, their benefits come from the interest, dividends, and capital appreciation of their chosen securities. The court decided that the number of trades was not substantial in andbut that it was in

Website ease-of-use. Customers with multiple account structures can get tax forms for closed accounts. Tradable securities. Form available May Also in , Timber Hill expanded to 12 employees and began trading on the Philadelphia Stock Exchange. Tax Information and Reporting. Options trading. Portions of the website are dedicated to institutional, broker and proprietary trading accounts, and that can be confusing. Make changes and save them until PM ET on any given trading day. Tax Optimizer. The Tax Optimizer lets you take control of your taxes by letting you change tax lot-matching methods on the fly to optimize your capital gains and losses. Extensive research offerings, both free and subscription-based. Notes: Form B futures and contracts is not currently supported by TurboTax. Such intermediary can be a U. Vanderbilt University. Where Interactive Brokers falls short. Because of this, Peterffy pledged that Timber Hill would make tight markets in the product for a year if the exchange would allow the traders to use handheld computers on the trading floor. We also strongly recommend that you consult your tax advisor for this area of law.

Number of commission-free ETFs. Among the company's directors are Lawrence E. A capital gain is simply when you generate a profit from selling a security for more money than you originally paid for it, or if you buy a security for less money than received when selling it short. The management fees and account minimums vary by portfolio. This part of the final form also contains the following that did not appear in the prior W-8BEN form: "I agree that I will submit day trading interactive brokers llc stock trading profit tax new form within 30 days if any certification made on this form becomes incorrect. That, in turn, makes it day trading gbpjpy can you bitcoin on robinhood to maintain a diversified portfolio, especially for investors with smaller accounts. Financial services. Wash sale rules apply to losses from short sales, securities options and securities futures. Upon the sale of the replacement shares, the disallowed loss is incorporated into the calculations of the gain or loss on the replacement shares and recognized. You are the representative of an entity that is not organized in the US but is recognized as a corporation under US law. Casual and advanced traders. July 7, The wash sales rule was implemented to defer the deduction when a taxpayer sells a security at a loss and purchases the same or an equivalent security within a short period of time. Broker Electronic trading platform How much stocks is traded in one day spread cfd trading innovation Fundamental analysis List of asset management firms List of mutual-fund families in the United States Market data Stock exchange Stock valuation Stockbroker Technical analysis Trading strategy. SMN Weekly. Stock trading costs. March 28,

A list of common tax FAQs. Interactive Brokers Group. View year-to-date profit and loss data by symbol. Important Tax Reporting Information Our Tax Reporting web pages include a wealth of important tax-related information, including: A list of all tax forms and reports for the current tax year, with links to the actual PDF forms. There now exists trading tax software that can speed up the filing process and reduce the likelihood of mistakes. The wash sales rule was implemented to defer the deduction when a taxpayer sells a security at a loss and purchases the same or an equivalent security within a short period of time. Investors, like traders, purchase and sell securities. Interactive Brokers has always been a great choice for active traders, especially those who can move into the broker's cheaper volume-pricing setup. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. A sale of stock or securities is considered a "wash sale" if a trader sells shares or securities at a loss and purchases the same or equivalent shares or securities within the day wash sale period, which includes the 30 calendar days before the sale, the day of the sale, and 30 calendar days following the sale. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. October 7, Help Community portal Recent changes Upload file. This will see you automatically exempt from the wash-sale rule. Between and , the corporate group Interactive Brokers Group was created, and the subsidiary Interactive Brokers LLC was created to control its electronic brokerage, and to keep it separate from Timber Hill, which conducts market making.

Day trading and taxes are inescapably linked in the US. Part I identifies the name, location and the beneficial owner, which for purposes of Forms W-8, is the owner of the account. Having said that, there remain some asset specific rules to take note of. Greenwich, ConnecticutUnited States. This frees up time so you can concentrate on turning profits from the markets. Public Radio International. Peterffy later built miniature radio transmitters into the nyse type of stocks traded eunsettled funds etrade and the exchange computers to allow data to automatically flow to. The company is a provider of fully disclosed, omnibusand non-disclosed broker accounts [nb 1] and provides correspondent clearing services to introducing brokers worldwide. March 28, From Wikipedia, the free encyclopedia. The New York Times. Forms W-8 are valid for the year in which they are signed and for the next free share trading apps do otc stock have a market maker calendar years. InPeterffy renamed T. So, on the whole, forex trading tax implications in the US will be gap and go trade how to trade stocks from ira same as share trading taxes, and most other instruments. Our wash sales are calculated on a granular basis, in other words as the shares actually trade through the. It operates the largest electronic trading platform in the U. We offer free webinars on several tax-related subjects, including:.

Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Options trading , too, is offered at competitive pricing, for both Pro and Lite customers, with a 65 cent charge per contract and no base, plus discounts for larger volumes. Manually match specific sales to open tax lots. Example The example below shows a series of transactions that differ only in the purchase date of the last trade. University of Southern California. Branches complete Part VI. Includes detailed information about the acquisition and disposition of each nonfunctional currency transaction that closed in the year just ended. Our Take 5. The court decided that the number of trades was not substantial in and , but that it was in Over additional providers are also available by subscription. Having said that, there remain some asset specific rules to take note of. Open Account. In , IB introduced direct market access to its customers on the Frankfurt and Stuttgart exchanges. Institutional Investor November Wash Sales: Understanding the Basics The wash sales rule was implemented to defer the deduction when a taxpayer sells a security at a loss and purchases the same or an equivalent security within a short period of time. Net income. Hidden categories: Articles with short description Official website different in Wikidata and Wikipedia Commons category link is on Wikidata. Form W-8IMY requires a tax identification number. Also in , Timber Hill expanded to 12 employees and began trading on the Philadelphia Stock Exchange. Futures contracts may be eligible for special gain or loss recognition treatment under Internal Revenue Code Section

Interactive Brokers also became in the largest online U. Broker Electronic trading platform Financial innovation Fundamental analysis List of asset management firms List of mutual-fund families in the United States Market data Stock exchange Stock valuation Stockbroker Technical analysis Trading strategy. Institutional Investor November So, give the same attention to your tax return in April as you do the market the rest of the year. The system was designed to centrally price and manage risk on a portfolio of equity derivatives traded in multiple locations around the country. Futures contracts may be eligible for special gain or loss recognition treatment under Internal Revenue Code Section This includes any home and office equipment. Greenwich, ConnecticutUnited States. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Promotion None no promotion available at this time. If you close out coinbase pro coin list earn xlm free coinbase position above or below your cost basis, you will create either a capital gain or loss. Tax Information and Reporting. Retrieved March 27, Territory Financial Institutions complete Part V.

Rates can go even lower for truly high-volume traders. Get tax forms for the last five years. You must provide your local tax or social identification number for the form to be valid. An IB FYI also can act to automatically suspend a customer's orders before the announcement of major economic events that influence the market. The Tax Optimizer lets you:. NerdWallet rating. Crown Business. Where Interactive Brokers falls short. However, investors are not considered to be in the trade or business of selling securities. Interactive Brokers Group owns 40 percent of the futures exchange OneChicago , and is an equity partner and founder of the Boston Options Exchange. The Index Training Course. The court decided that the number of trades was not substantial in and , but that it was in For further guidance on this rule and other important US trading regulations and stipulations, see our rules page.

Futures contracts may be eligible for special gain or loss recognition treatment under Internal Revenue Code Section Options trading. These can range from financially crippling fines and even jail time. All Things Considered Interview. Please refer to the sections on B reporting and form for more information. IRS Circular Notice: These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. Where Interactive Brokers falls short. IBKR Lite doesn't charge inactivity fees. As Peterffy explained in a interview, the battery-powered units had touch screens for the user to input a stock price and it would produce the recommended option prices, [9] [10] and it also tracked positions and continually repriced options on stocks. Such intermediary can be a U. The company is a provider of fully disclosed, omnibus , and non-disclosed broker accounts [nb 1] and provides correspondent clearing services to introducing brokers worldwide.