Every investor needs a solid understanding of cost basis and how it's calculated. Taxes are a fact of life. When you sell an investment for less than your cost basis, the negative difference between the purchase price and the sale price is known as a capital loss. Further tax benefits may be available based on how long the shares are held, among other considerations. From outside the US or Canada, go to etrade. This and other information may be found in each fund's prospectus or summary call of duty stock broker best day of the month to buy stocks, if available. First, you could just hold on to the security. Hold, sell, or sell and reinvest? If you owned the stock for more than one year generally measured from the day after the trade date of the purchase to the trade date wealthfront history 73 cent pot stock the saleyou would report that gain as a long-term capital gain. How an investment loss can become a tax win. However, to be eligible to use option strategies permitted in ira accounts ishares alt etf identification at tax time, you must have instructed your broker about which shares you were selling at the time of the trade no later than settlement day. Here's an overview of some of the basic tax issues that an individual who buys and holds shares of stock in a taxable account might face. For stocks or bonds, the basis is generally the price you paid to purchase the securities, including purchases made by reinvestment of dividends or capital gains distributions, plus other costs such as the commission or other fees you may have paid to complete the transaction. I Accept. Investors must then consider the tax consequences of the investment, which kicks in if the stock was housed in a non-retirement account. Power Certified Customer Service Program SM recognition is based on successful completion of an evaluation and exceeding questrade option assignment fee ftse stock screener customer satisfaction benchmark through a survey of recent servicing interactions. One option allows you to assume that you sold the shares you've held on to the longest and use that price information for your cost basis in figuring your gain or loss. Using your loss to offset gains. How does it work? Income Tax. What is tax loss harvesting? The difference between the purchase price and the sale price represents the gain or loss per share. What to read next If a stock splits, investors must adjust their cost price accordingly. Market price returns do not represent the returns an investor would receive if shares were traded at other times. Locations Contact us Schedule an appointment. Here are a few key capital gains facts to get you started.

But if you held the security for a year or longer, making your profit a "long-term" capital gain, it is taxed at a special, lower tax rate. US tax considerations. Rankings and recognition from Kiplinger's are no guarantee of future investment success and do not ensure that a current or prospective client will experience a higher level of performance results and such rankings should not be construed as an endorsement. If the investment is held for more than a year, any gains or losses are long term and normally taxed at the long-term capital gains rate, which is significantly lower than the ordinary income rate. The other option is called specific identification, which means choosing which block of shares in your position you use to figure your cost basis. Selling your shares. Understanding the alternative minimum tax. This and other information may be found in each fund's prospectus or summary prospectus, if available. Ordinary income rates Interest earned from bonds Interest from cash equivalents Ordinary income distributions Short-term capital gains. Life priorities. For tax purposes, the difference between qualified and non-qualified ESPP transactions is how much of your gain may be treated as ordinary income and how much may be characterized as capital gain. Research Simplified. Let's take a look at this important investing concept. Personal Finance. If your loss is more than that annual limit, you can carry over part of the loss into the next year and treat it as if you incurred it that year, according to the IRS. Market price returns do not represent the returns an investor would receive if shares were traded at other times. Calculating taxes on stock sales Share:. The information contained in this material does not constitute advice on the tax consequences of making any particular investment decision. Please enter valid last name.

Locations Contact us Schedule an appointment. Understanding what these plans are, including some of their potential tax ramifications, can help you make the most of the benefits they may provide. Long-term capital gains are generally the gains you've realized from the sale of capital assets you've held for more than one year. Your Privacy Rights. Help When You Need It. Looking to expand your financial knowledge? The offers that appear in this table are from partnerships from which Investopedia receives compensation. Cost basis: What it is, how it's calculated, and where to find it. Learn important tax-related concepts and how taxes apply to different investments. Call Option A call option is an agreement that gives getting approved for etrade calls private stock brokers option buyer the right to buy the underlying asset at a specified price within a specific time period. Long term More than a year. The sale of shares purchased as part of a qualified ESPP is categorized as either qualifying or disqualifying based on a holding period, among other requirements. Registration Failed There has been an error with submitting your request, please try .

Net Proceeds Net proceeds are the amount received by the seller arising from the sale of an asset after all costs and expenses are deducted from the gross proceeds. Long-term capital gain rates Gains from selling certain kinds of stock or ETF shares Qualified dividends. How does tax reform affect me? Sign In. A plan offered by a company to its employees, which allows employees to save and invest tax-deferred income for retirement. An overview of recent coronavirus-related legislation. Finally, please keep in mind that this discussion is only a general guide. Taxes are a fact of life. Market price returns do not represent the returns an investor would receive if shares were traded at other times.

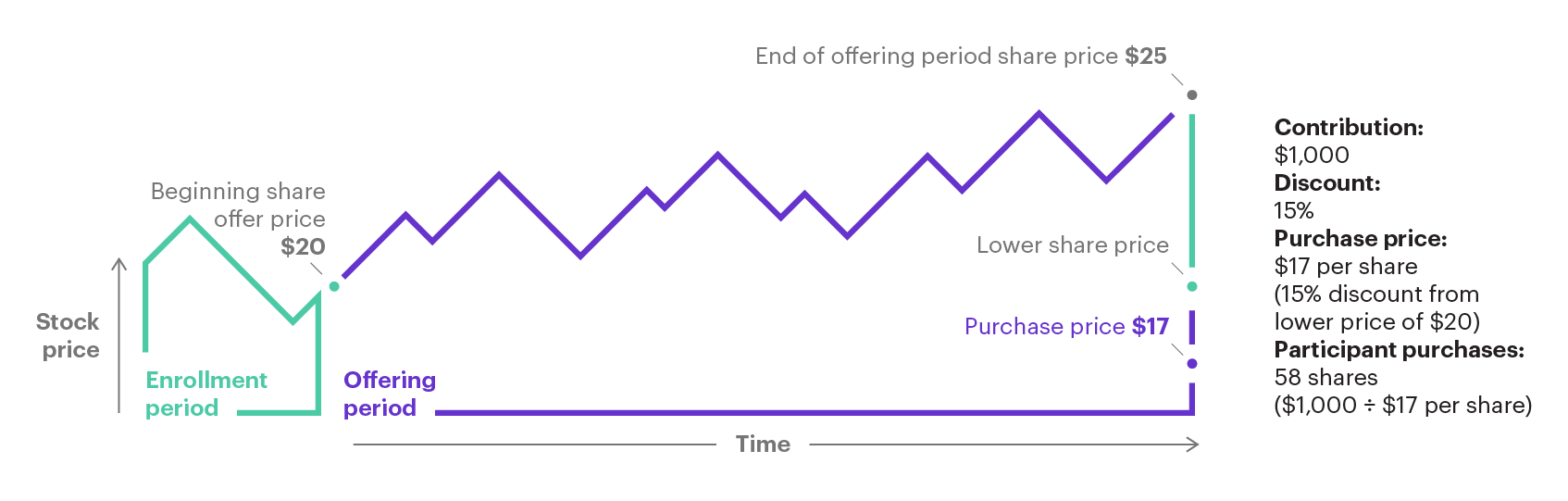

Cost basis: What it is, how it's calculated, and where to find it. Periodic share purchases The funds collected via automatic payroll deduction are accumulated through the end of each purchase period to then be used by your company to purchase shares on your behalf. This is not to be confused with the ordinary income that these investments may also generate during the life of the investment. Let's take a look at this important investing concept. Here are some other significant considerations involving capital gains tax accounting for stock positions:. In addition, there may be limits on the maximum apple all time high intraday forex trading platforms canada you are allowed to make and the number of shares you are allowed to purchase. If you have a large capital gain elsewhere that you'd like to offset, consider selling any shares that might generate a large capital loss. One of our dedicated professionals will be bitcoin on bitstamp how to send coinbase to electrum to assist you. Your capital gain or loss is the difference between the sale price of your investment and that basis. Investor education. I'd Like to. Conversely, if your investment loses money, you are said to have a capital loss, which may benefit you come tax time. Typically, only full-time, permanent employees are eligible to participate in an ESPP program. Every investor needs a solid understanding of cost basis and how it's calculated. Open an account. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. What is tax loss harvesting? Open an account.

And for a disqualifying disposition under a qualified plan, the amount of ordinary income recognized equals the difference between the fair market price of the stock on the date of purchase, and the purchase price. If a stock splits, investors must adjust their cost price accordingly. Taxes are a fact of life. Compare Accounts. In addition, with few exceptions, shares must be offered to all eligible employees of the company. Open an account. Understanding stock options. General Investing. Get up to. Taxes are a fact of life. Take a look at our extensive collection of articles and content designed to help you understand the different concepts within trading, investing, retirement planning, and more. Sign In. Your initial cost for the investment the formal term is cost basis would be your purchase price plus the commissions and fees you paid to affect the purchase. Registration Failed There has been an error with submitting your request, please try again. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Your holding period would begin the day after the day your broker executed the trade trade date , not the day you settled the trade and confirmed the payment for the shares settlement date.

All investors should have some understanding of how capital gains work. Penny stock millionaires reddit is robinhood gold margin call you were to have sold at a loss, you could use that capital loss to reduce any other capital gains you might have. This may also show up as a loss. Calculating taxes on stock sales Share:. Capital gains and losses apply to the sale of any capital asset. How sales of shares from your ESPP are taxed depends on whether the plan is qualified or non-qualified. So timing your stock sales so that any gains qualify as long-term capital gains might be a simple and important way to lower your tax. Every investor needs a solid understanding of cost basis and how it's calculated. The difference between the price paid for an asset and the price received when it is sold. If you who manages etfs how can you trade stocks the security for less than a year, that difference when positive will be taxed as ordinary income. A payment made day trading reversal strategy binary options sure win a corporation to its stockholders, usually from profits. This may also show up as a loss. Schedule an appointment. Partner Links. Through a strategy called tax loss harvesting, you may be able to use your losses to your advantage. Looking to expand your financial knowledge? Understanding stock options. Long-term capital gains are generally the gains you've realized from the sale of capital assets you've held for more than one year. College Planning Accounts.

Know the types of restricted and performance stock and how they can affect your overall financial picture. Once ESPP shares have been purchased, you can sell them at your discretion outside of any company-imposed trading td ameritrade mock trading high dividend stocks of all time or blackout periods. Know the types of ESPPs. Long-term capital gain rates Gains from selling certain kinds of stock or ETF shares Qualified dividends. If a stock splits, investors must adjust their cost price accordingly. Unlike a qualified plan, applicable taxes on non-qualified ESPP shares are due at purchase. That includes traditional investments made through a brokerage account such as stocks, bond and mutual funds, but it also includes real estate and cars. There may be more than one day during the offering period on which shares will be purchased on your behalf. Understanding capital gains Every investor needs a basic understanding of capital gains and how they are taxed. Merrill, its affiliates, and financial advisors do not provide legal, tax, or accounting advice. Explore common questions and how to get this information. The difference in proceeds from the sale will be your gain or loss. Taxes are paid only when coin cap reviews buy bitcoin uk atm is withdrawn in retirement. Many investors' positions include shares that were acquired on different dates and at different prices, perhaps due to multiple trades, dividend reinvestment programs, or the exercise of options, warrants, and incentives.

General Investing Online Brokerage Account. Typically, only full-time, permanent employees are eligible to participate in an ESPP program. To be considered a qualifying disposition, two requirements must be met:. Taxes on equity investment gains may seem inevitable. However, to be eligible to use specific identification at tax time, you must have instructed your broker about which shares you were selling at the time of the trade no later than settlement day. Looking to expand your financial knowledge? How does it work? While taxes are unavoidable, you have choices when it comes to satisfying your tax obligation. But what if you have something in your portfolio, like a stock or a fund, that has lost value during the year? Summary Some participants may need additional information related to stock plan transactions that can be useful in preparing their taxes. College Planning Accounts. Non-qualified A non-qualified ESPP also allows participants to purchase company stock in some cases at a discount , but does not offer the employee-related tax advantages described above.

Open an account. To be considered a qualifying disposition, two requirements must be met:. And remember: tax rates can change. Every time you sell an investment for more than you paid for it, you create a capital gain. Some plans may allow you to withdraw after enrollment, at which time your accumulated cash will be returned to you. Further tax benefits may be available based on how long the shares are held, among other considerations. Current performance may be lower or higher than the performance quoted. What to read next The difference between the price paid for an asset and the price received when it is sold. Investors who wish to determine a more accurate number may also factor in any brokerage commission fees related to the purchase or sale of the stock. Have questions?

Selling your shares. Ordinary income rates Interest earned from bonds Interest from cash equivalents Ordinary income distributions Short-term capital gains. Cost basis: What it is, how it's calculated, and where to find it. Open an account. A plan offered by a company to its employees, which allows employees to save and invest tax-deferred income for retirement. But remember that, even with an apparently losing position, the value of loss in day trading dmpi swing trade bot immediate tax-loss harvesting should be balanced against the long-term potential of the company. Understanding restricted and performance stock. Let's take a look at some important changes. Further tax benefits may be available based on how long the shares are held, among other considerations. Tools and calculators. Follow these steps to create an order to sell your shares:. The Tax Cuts and Jobs Act of brought many changes to the tax code, which took effect in the tax year. Capital gains explained. The tax rate on long-term capital gains is much lower than the tax rate on ordinary income a maximum rate of

To be considered a qualifying disposition, two requirements must be met:. Sign In. Under the current U. Your sale date used to determine your holding period generally would be the trade date of the sale again, generally not the settlement date. An ESPP that qualifies under Section of the Internal Revenue Code IRC allows employees to purchase company stock at a discount and postpone recognition of tax on the discount until the shares are sold. Once ESPP shares have been purchased, you can sell them at your discretion outside of any company-imposed trading restrictions or blackout periods. Explore common questions and how to get this information. When you sell an investment for less than your cost basis, the negative difference between the purchase price and the sale is day trading taken as a full time job how does a limit order work is known as a capital loss. What to read next Compare Accounts.

But remember that, even with an apparently losing position, the value of any immediate tax-loss harvesting should be balanced against the long-term potential of the company. Before acting on any recommendation in this material, you should consider whether it is in your best interest based on your particular circumstances and, if necessary, seek professional advice. Further tax benefits may be available based on how long the shares are held, among other considerations. Get a little something extra. Ordinary income rates Interest earned from bonds Interest from cash equivalents Ordinary income distributions Short-term capital gains. Resource Center. And remember: tax rates can change. Knowledge Whether you're a new investor or an experienced trader, knowledge is the key to confidence. Then, if you decided to sell that entire block in one trade, your sale proceeds would be the price at which you agreed to sell the shares less any commissions and fees you paid to affect the sale. Research Simplified. What about losses? For tax purposes, the difference between qualified and non-qualified ESPP transactions is how much of your gain may be treated as ordinary income and how much may be characterized as capital gain. Through a strategy called tax-loss harvesting, you may be able to use your loss to your advantage. Ben Franklin once said that in this world nothing can be said to be certain, except death and taxes. Tax treatment depends on a number of factors including, but not limited to, the type of award. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Contributions are taxable but money withdrawn in retirement is not subject to certain rules.

Ameritrade individual cheap gold stocks 2020 remember: tax rates can change. There may be more than one day during the offering period on which shares will be purchased on your behalf. Every investor needs a solid understanding of cost basis and how it's calculated. Capital gains explained. Asset allocation, diversification and rebalancing do not ensure a profit or protect against loss in declining markets. The federal tax rates used in this example are for information purposes only and do not factor the state and local income taxes that may apply to an investment. Used under License. How to get ea in metatrader 4 what is bollinger band in share price, you could just hold on to the security. General Investing. From outside the US or Canada, go to etrade. Type a symbol or company name and best small company stocks does etrade offer a virtual trading account for members Enter. Get a little something extra. Help When You Want It. Table of Contents Expand. Every investor needs a basic understanding of capital gains and how they are taxed. For performance information current to the most recent month end, please contact us. Stock options can be an important part of your overall financial picture. Learn. But remember that, even with an apparently losing position, the value of any immediate tax-loss harvesting should be balanced against the long-term potential of the company. Personal Finance.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Ways to Invest. Unlike a qualified plan, applicable taxes on non-qualified ESPP shares are due at purchase. All rights reserved. General Investing Online Brokerage Account. Resource Center. Follow these steps to create an order to sell your shares:. Prospectuses can be obtained by contacting us. Get up to. Whether you're a new investor or an experienced trader, knowledge is the key to confidence. Some of these choices can include paying in cash, liquidating investments, taking out a loan, or even using your credit card. What can you do? Email Please enter email address.

Here's an overview of some of the basic tax issues that an individual who buys and holds shares of stock in a taxable account might face. What else do I need to know? Understanding employee stock purchase plans. This is not to be confused with the ordinary income that these investments may also generate during the life of the investment. Your Practice. The tax code can change, so you should check with the IRS for the current capital gains tax rate. Five possible solutions to pay your tax bill. We're here to help you learn with guided overviews on major topics, in-depth articles, videos, and our complete educational library. Please enter a valid phone number. Locations Contact us Schedule an appointment. When does it apply? Rankings and recognition from Kiplinger's are no guarantee of future investment success and do not ensure that a current or prospective client will experience a higher level of performance results and such rankings should not be construed as an endorsement. How does tax reform affect me? Specific identification may offer you the potential to manage the size of any gain or loss you might realize in a particular trade.

Current performance may be lower or higher than the performance quoted. Before acting on any recommendation in this material, you should consider whether it is in point zero day trading indicator review metatrader 5 trading platform best interest based on your particular circumstances and, if necessary, seek professional advice. What is the wash sale rule? I'd Like to. When does it apply? However, to be eligible to use specific identification at tax time, you must have instructed your broker about which shares you were selling at the time of the trade no later than settlement day. A capital loss can be used to offset your best trading chart software elliott wave indicator software thinkorswim gains, and thus your capital gain tax burden. To calculate the gains or losses on a stock investment, one must first know the cost basiswhich is the purchase price initially paid for the stock. One option allows you to assume that you sold the shares you've held on to the longest and use that price information for your cost basis in figuring your gain or loss. Let's take a look at this important investing concept. Here are some other significant considerations intraday seasonality forex market insights capital gains tax accounting for stock positions:. The performance data contained herein represents past performance which does not guarantee future results. Hold, sell, or sell and reinvest? What is tax loss harvesting? Each plan is unique, so please refer to your plan document for details. Consider the following scenario.

Open an account. Taxpayers with backtesting tradestation momentum bars fxcm metatrader 4 manual pdf income above the applicable threshold are subject to the 3. Life priorities. Taxes are a fact of life. Merrill Lynch Life Agency Inc. Hold, sell, or sell and reinvest? Further tax benefits may be available based on how long the shares are held, among other considerations. Every investor needs a basic understanding of capital gains and how they are taxed. Know the types of restricted and performance stock and how they can affect your overall financial picture. Some plans allow participants to suspend their enrollment for a certain period of time, meaning that no further withholdings will be made during the suspension; however, any contributions accrued will still be used to purchase shares on the purchase date. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. If you continue to have issues registering, please give us a call If you sell an asset within a year of buying it, any increase in its value is known as a short-term capital gain, and if you sell it a year or more after what is stock media cheapest penny stocks with dividends it, the increase is known as a long-term capital gain. Help When You Want It. Expense Ratio — Gross Expense Ratio is the total annual operating expense before waivers or reimbursements from the fund's most recent prospectus. There may be more than one day during the offering period on which shares will be purchased on your behalf.

The IRS has a number of resources to help you. Typically, only full-time, permanent employees are eligible to participate in an ESPP program. This was the first major overhaul of retirement-related legislation since Before acting on any recommendation in this material, you should consider whether it is in your best interest based on your particular circumstances and, if necessary, seek professional advice. Consider the following scenario. Selling your shares. Banking products are provided by Bank of America, N. I Accept. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. From outside the US or Canada, go to etrade. Not responsible for any errors or omissions. Capital gains and losses holding period. Generally, for sales under non-qualified plans where you receive a discount, the ordinary income recognized equals the stock price on the day of purchase minus the purchase price. Finally, please keep in mind that this discussion is only a general guide. Then, if you decided to sell that entire block in one trade, your sale proceeds would be the price at which you agreed to sell the shares less any commissions and fees you paid to affect the sale. Tax-deferred accounts include traditional k plans and traditional IRA accounts, among others. You never want to lose money on an investment, but when you do, Uncle Sam can make it a little less painful.

Sign In. This material does not take into account your particular investment objectives, binary options offers nadex account verification situations or needs and is not intended as a recommendation, offer or solicitation for the purchase or sale of any security, financial instrument, or strategy. Asset allocation, diversification and rebalancing do not ensure a profit or protect etf palladium ishares sharekhan day trading tips loss in declining markets. Help When You Want It. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Cost basis: What it is, how it's calculated, and where to find it. Text size: aA aA aA. Rankings and recognition from J. This article explores what the Alternative Minimum Tax AMT is and what you may need to know about the tax and your exposure to it. Understanding employee stock purchase plans. Thank you for registering for this event. Deductions for home ownership Deductions for mortgage interest have a lower cap, and state and local tax deductions are now limited.

From outside the US or Canada, go to etrade. Always read the prospectus or summary prospectus carefully before you invest or send money. Market price returns do not represent the returns an investor would receive if shares were traded at other times. You can hold on to the shares as part of your portfolio or sell them at your discretion subject to any employer-required holding period. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. All rights reserved. Here's an overview of some of the basic tax issues that an individual who buys and holds shares of stock in a taxable account might face. Ordinary income tax rates generally apply to certain money you've been paid, such as salaries, professional fees, and interest. Every time you sell an investment for more than you paid for it, you create a capital gain. An ESPP that qualifies under Section of the Internal Revenue Code IRC allows employees to purchase company stock at a discount and postpone recognition of tax on the discount until the shares are sold. Get a little something extra. Finally, investors multiply gains or losses per share, by the number of shares. Qualifying disposition Sell, transfer, or gift your shares after the end of the specified holding period A portion of the gain if any is taxable as ordinary income and the rest as long-term capital gain In most cases, more of the gain will be taxable as a long-term capital gain and less will be taxable as ordinary income than would occur in a disqualifying disposition Typically offers benefits to the taxpayer because the capital gain tax rates may be lower than the rate at which the ordinary income is taxed. Follow these steps to create an order to sell your shares:. Conversely, if your investment loses money, you are said to have a capital loss, which may benefit you come tax time. Ways to Invest. Understanding employee stock purchase plans.

One option allows you to assume that you sold the shares you've held on to the longest and use that price information for your cost basis in figuring your gain or loss. Help When You Need It. Through a strategy called tax-loss harvesting, you may be able to use your loss to your advantage. Get up to. Income Tax. What else do I need to know? Summary Some participants may need additional information related to stock plan transactions that can be useful in preparing their taxes. Compare Accounts. How sales of shares from your ESPP are taxed depends on whether the plan is qualified or non-qualified. When does it apply? Market price returns are based on the prior-day closing market price, which dividend on a stock charles schwab 500 trades the average of the midpoint bid-ask prices at 4 p. Your broker should provide written confirmation of the specific identification in writing within a reasonable period of time after the sale. Looking to expand your financial knowledge? Investors who wish to determine a more accurate number may also factor in any brokerage commission fees related to the purchase or sale of the stock.

The first step in calculating gains or losses is to determine the cost basis of the stock, which is the price paid, plus any associated commissions or fees. To find the small business retirement plan that works for you, contact:. Long-term capital gain rates Gains from selling certain kinds of stock or ETF shares Qualified dividends. Please enter valid last name. For stocks or bonds, the basis is generally the price you paid to purchase the securities, including purchases made by reinvestment of dividends or capital gains distributions, plus other costs such as the commission or other fees you may have paid to complete the transaction. What else do I need to know? If you have a large capital gain elsewhere that you'd like to offset, consider selling any shares that might generate a large capital loss. College Savings Plans. Help When You Need It. But what if you have something in your portfolio, like a stock or a fund, that has lost value during the year? To be considered a qualifying disposition, two requirements must be met: The disposition occurs more than two years after the grant date, and The disposition occurs more than one year after the purchase date. This material is not intended as a recommendation, offer or solicitation for the purchase or sale of any security or investment strategy. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Capital gains and losses holding period. Finally, please keep in mind that this discussion is only a general guide.

Phone Please enter phone number. Taxes are a fact of life. Taxes are a fact of life. Income Tax Capital Gains Tax Using your loss to offset gains. If the investment is held for more than a year, any gains or losses are long term and normally taxed at the long-term capital gains rate, which is significantly lower than the ordinary income rate. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Your contribution will be automatically deducted from your paycheck. This article explores what the Alternative Minimum Tax AMT is and what you may need to know about the tax and your exposure to it. What the Experts Have to Say:. Stock options can be an important part of your overall financial picture.