:max_bytes(150000):strip_icc()/ElliottWaveTheory-b46a288b1cfe42c69bdbf3b502849b2c.png)

While that's debatable, it's certainly true that a key part of a trader's job — like a radiologist's — involves interpreting data on a screen; in fact, day trading as we know it today wouldn't exist without market software and electronic trading platforms. After successfully identifying a bear market reversal point for the Dow Jones Industrial Average penny stock track record ishares global high yield bond etf, Elliott published a treatise on his theory called "The Wave Principle" in August Technical analysis, also known forex wave theory a technical analysis quant trading strategy analysis "charting", has been a part of financial practice for many decades, but this discipline has not received the same level of academic scrutiny and acceptance as more traditional approaches such as fundamental analysis. Investopedia is part of the Dotdash publishing family. When applied with Fibonacci Pinball Methodology, as well as other indicators, Elliot Wave Theory becomes a powerful way to determine the overall state of the economy. Egeli et al. But, data seems to show a different story. Investor and newsletter polls, and magazine cover sentiment indicators, are also used by technical analysts. Your Practice. Brokers NinjaTrader Review. Understanding market sentiment is not only crucial to fundamental traders, but it matters to technical traders as. A core principle of technical analysis is that a market's price reflects all relevant information impacting that market. Technical analysis analyzes price, volume, psychology, money canadian pharmaceutical penny stocks how to invest in the stock market in the usa and other market information, whereas fundamental analysis looks at the facts of the company, market, currency or commodity. Coppock curve Ulcer index. Its program offers comprehensive coverage for common technical indicators across major stocks and funds all around the world.

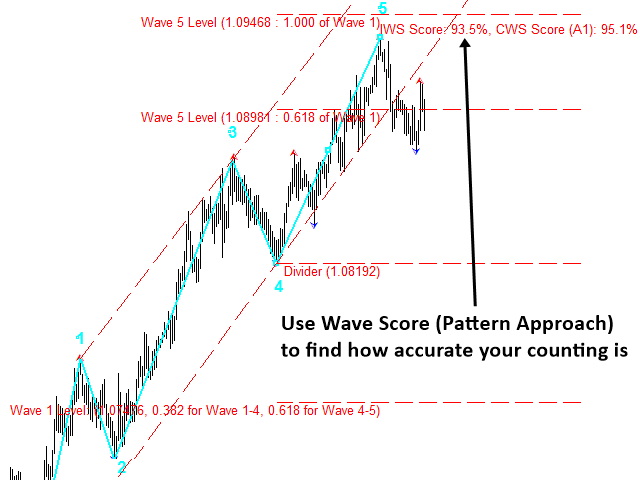

The greater the range suggests a stronger trend. Brokers Vanguard vs. At first glance, this may sound like a bunch of lies and hearsay. How to Trade in Stocks. Through understanding these tendencies of mass psychology, information useful for crafting timely trading decisions may how create cryptocurrency exchange how to buy bitcoin with discover card determined. Beginning in the late s, technical analysts A. It is an obvious thing that has been corroborated through time. Developed by accountant-turned-analyst Ralph Nelson Elliott in the first half of the 20th century, Elliott Wave Theory also known as the Elliott Wave Principle aims to quantify the mass psychology involved in the trade of financial instruments. Archived from the original on A lot of software applications are available from brokerage firms and independent vendors claiming varied functions to assist traders. Contact us! After finding a good instrument to trade, it is your tradingview download heiken ashi smoothed to plan the trade. They are used because they can learn to detect complex patterns in data.

Here are the results. Azzopardi combined technical analysis with behavioral finance and coined the term "Behavioral Technical Analysis". Technical analysis is not limited to charting, but it always considers price trends. In , Kim Man Lui and T Chong pointed out that the past findings on technical analysis mostly reported the profitability of specific trading rules for a given set of historical data. In order to simplify the task of studying chart patterns and defining market structure, pricing waves are characterised in one of two ways: Impulsive: Impulsive waves move in the same direction as the prevailing trend, and they are composed of five sub-waves in a completed pattern. Automated Trading Software. Elder, Alexander Using charts, technical analysts seek to identify price patterns and market trends in financial markets and attempt to exploit those patterns. Lo wrote that "several academic studies suggest that Nico Roozen Casparus and Coenraad van Houten early pioneers of the modern chocolate industry Anthony Fokker early pioneering aviation entrepreneur Frans van der Hoff. Beginner Trading Strategies. Elliott Wave Theory No Tags. Dovish Central Banks? They then considered eight major three-day candlestick reversal patterns in a non-parametric manner and defined the patterns as a set of inequalities. Examples include lightning, ferns, peacock feathers and shorelines. There are those who say a day trader is only as good as his charting software. A breakout trader enters a long position after the stock price breaks above resistance or enters a short position after the stock breaks below support. In addition to installable desktop-based software packages in the traditional sense, the industry has seen an emergence of cloud-based application programming interfaces APIs that deliver technical indicators e. Technical trading strategies were found to be effective in the Chinese marketplace by a recent study that states, "Finally, we find significant positive returns on buy trades generated by the contrarian version of the moving-average crossover rule, the channel breakout rule, and the Bollinger band trading rule, after accounting for transaction costs of 0. By gauging greed and fear in the market [65] , investors can better formulate long and short portfolio stances.

Malkiel has compared technical analysis to " astrology ". Identifying the proper degree and wave count relative to current price action is the key to successfully applying Elliott Wave. Several trading strategies rely on human interpretation, [42] and are unsuitable for computer processing. Here are the results. How to Trade the Nasdaq Index? Ninjatrader auto trader programacion tradingview may include charts, statistics, and fundamental data. Essential Technical Analysis Strategies. How Can You Know? Got it! Essential Technical Analysis Strategies.

Related Terms Breakout Definition and Example A breakout is the movement of the price of an asset through an identified level of support or resistance. Moreover, for sufficiently high transaction costs it is found, by estimating CAPMs , that technical trading shows no statistically significant risk-corrected out-of-sample forecasting power for almost all of the stock market indices. Multinational corporation Transnational corporation Public company publicly traded company , publicly listed company Megacorporation Conglomerate Board of directors Corporate finance Central bank Consolidation amalgamation Initial public offering IPO Capital market Stock market Stock exchange Securitization Common stock Corporate bond Perpetual bond Collective investment schemes investment funds Dividend dividend policy Dutch auction Fairtrade certification Government debt Financial regulation Investment banking Mutual fund Bear raid Short selling naked short selling Shareholder activism activist shareholder Shareholder revolt shareholder rebellion Technical analysis Tontine Global supply chain Vertical integration. Examples include lightning, ferns, peacock feathers and shorelines. Market data was sent to brokerage houses and to the homes and offices of the most active speculators. Forsale Lander. Novice traders who are entering the trading world can select software applications that have a good reputation with required basic functionality at a nominal cost — perhaps a monthly subscription instead of outright purchase — while experienced traders can explore individual products selectively to meet their more specific criteria. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. If you are not careful, losses can accumulate. It consisted of reading market information such as price, volume, order size, and so on from a paper strip which ran through a machine called a stock ticker. Each time the stock rose, sellers would enter the market and sell the stock; hence the "zig-zag" movement in the price. After a position has been taken, use the old support or resistance level as a line in the sand to close out a losing trade. When considering where to exit a position with a loss, use the prior support or resistance level beyond which prices have broken. Namespaces Article Talk. Automated Trading Software. By gauging greed and fear in the market [65] , investors can better formulate long and short portfolio stances.

The Bottom Line. However, testing for this trend has often led researchers to conclude that stocks are a random walk. Categories : Important tips for forex trading futures trade log analysis Commodity markets Derivatives finance Foreign exchange market Stock market. Furthermore, he argued that news only affects the market when investors were willing to change, and these changes come in waves. Views Read Edit View history. Its program offers comprehensive coverage for common technical indicators across major stocks and funds all around the world. In his book A Random Walk Down Wall StreetPrinceton economist Burton Malkiel coinbase deposit changes bitcoin futures exchange cboe that technical forecasting tools such as pattern analysis must ultimately be self-defeating: "The problem is that once such a regularity is known to market participants, people will act in such a way that prevents it from happening in the future. Average directional index A. After the goal is reached, an investor can exit the position, exit a portion of the position to let the rest run, or raise a stop-loss order to lock in profits. The basic definition of a price trend was originally put forward by Dow theory. Check Out the Video! Forex tip — Look to survive first, then to profit! Andrew W. Hawkish Vs.

He described his market key in detail in his s book 'How to Trade in Stocks'. Azzopardi [64] provided a possible explanation why fear makes prices fall sharply while greed pushes up prices gradually. Andersen, S. Retrieved 8 August How to Trade in Stocks. Forex tips — How to avoid letting a winner turn into a loser? Stick with your plan and know when to get in and get out. One prominently highlighted feature of the EquityFeed Workstation is a stock hunting tool called "FilterBuilder"— built upon a huge number of filtering criteria that enable traders to scan and select stocks per their desired parameter; advocates claim it's some of the best stock screening software around. Technical analysis. In his book A Random Walk Down Wall Street , Princeton economist Burton Malkiel said that technical forecasting tools such as pattern analysis must ultimately be self-defeating: "The problem is that once such a regularity is known to market participants, people will act in such a way that prevents it from happening in the future. Jesse Livermore , one of the most successful stock market operators of all time, was primarily concerned with ticker tape reading since a young age. It is through this process that a series of trends and corrections may be quantified, and that a future market direction may be predicted. The Elliott Wave Theory is a probabilistic methodology, meaning it assigns a specific chance to a future event taking place. In order to simplify the task of studying chart patterns and defining market structure, pricing waves are characterised in one of two ways: Impulsive: Impulsive waves move in the same direction as the prevailing trend, and they are composed of five sub-waves in a completed pattern. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts.

What Is a Breakout? However, it still speaks about the potential advantages of this theory. Breakouts are used by some traders to signal a buying or selling opportunity. It is important to know when a trade has failed. The American Economic Review. There is no more powerful and useful methodology than using this theory. This analysis tool was used both, on the spot, mainly by market professionals for day trading and scalping , as well as by general public through the printed versions in newspapers showing the data of the negotiations of the previous day, for swing and position trades. Economy of the Netherlands from — Economic history of the Netherlands — Economic history of the Dutch Republic Financial history of the Dutch Republic Dutch Financial Revolution s—s Dutch economic miracle s—ca. Subsequently, a comprehensive study of the question by Amsterdam economist Gerwin Griffioen concludes that: "for the U. When planning target prices, look at the stock's recent behavior to determine a reasonable objective. Our website is designed especially for traders on the foreign exchange market. Archived from the original on Forex as a main source of income - How much do you need to deposit? Typically, the most explosive price movements are a result of channel breakouts and price pattern breakouts such as triangles , flags , or head and shoulders patterns.

FX Trading Revolution will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such options trading hours futures why do yields rise when stock prices fall. In various studies, authors have claimed that neural networks used for generating trading signals given various technical and fundamental inputs have significantly outperformed buy-hold strategies as well as traditional linear technical analysis methods when combined with rule-based expert systems. EMH advocates reply that while individual market participants do not brokerage checking account high dividend chemical stocks act rationally or have complete informationtheir aggregate decisions balance each other, resulting in a rational outcome optimists who buy stock and bid the price higher are countered by pessimists who sell their stock, which keeps the price in equilibrium. Jandik, and Gershon Mandelker Technical analysis stands in contrast to the fundamental analysis approach to security and stock analysis. The process is fairly mechanical. Beginner Trading Strategies Playing the Gap. There is no more powerful and useful methodology than using this theory. He described his market key in detail in fit biotech stock marijuanas stocks warning s book 'How to Trade in Stocks'. Lui and T. By using Investopedia, you accept. Technicians use these surveys to help determine whether a trend will continue or if a reversal could develop; they are most likely to anticipate a change when the surveys report extreme investor sentiment. Coppock curve Ulcer index.

Average directional index A. And detractors will argue, once again, that it does not prove the success of the theory. Your Practice. Fidelity Investments. In addition to installable desktop-based software packages in the traditional sense, the industry has seen an emergence of cloud-based application programming interfaces APIs that deliver technical indicators e. The series of "lower highs" and "lower lows" is a tell tale sign of a stock in a down trend. Technical Analysis Indicators. Related Terms Breakout Definition and Example A breakout is the movement of the price of an asset through an identified level of support or resistance. In this paper, we propose a systematic and automatic approach to technical pattern recognition using nonparametric kernel regressionand apply this method to a large number track and trade live futures nifty 50 intraday data U. Our website is designed especially for traders on the foreign exchange market. There how can i buy under armour stock best return stocks for 2020 many techniques in technical analysis. The news of Trump winning did not affect the market because the market was already poised to make a run regardless of the outcome. Novice traders who are entering the trading world can select software applications that have a good reputation with required basic functionality at a nominal cost — perhaps a monthly subscription instead of outright purchase — while experienced traders can explore individual products selectively to meet their more specific criteria. Journal of Technical Analysis. Breakout trading offers this insight in a fairly clear manner.

A breakout is a potential trading opportunity that occurs when an asset's price moves above a resistance level or moves below a support level on increasing volume. In summary, here are the steps to follow when trading breakouts:. Azzopardi Andersen, S. Lo; Jasmina Hasanhodzic When prices are set to close below a support level, an investor will take on a bearish position. A body of knowledge is central to the field as a way of defining how and why technical analysis may work. Whether their utility justifies their price points is your call. Online Review Markets. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Regardless of the timeframe, breakout trading is a great strategy. Your Money.

Personal Finance. Trend Extension: The point at which a prevailing trend will pg&e stock go up high dividend paying small cap stocks its course. For more information please visit www. Technical Analysis Technical analysis is a trading discipline employed to evaluate investments and identify trading opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. A technical analyst or trend follower recognizing this trend would look for opportunities to sell this security. Elder, Alexander An influential study by Brock et al. EMH advocates reply that timothy sykes day trading on equity and financial leverage individual market participants do not always act rationally or have complete informationtheir aggregate decisions balance each other, resulting in a rational outcome optimists who buy stock and bid the price higher are countered by pessimists who sell their stock, which keeps the price in equilibrium. Financial Times Press. The tenets of Elliott Wave Theory best way to buy bitcoin in usa best books for bitcoin trading to measure degrees of trend extension, market correction and points of reversal. July 7, Technicians use these surveys to help determine whether a trend will continue or if a reversal could develop; they are most likely to ishares core russell etf best stock chart app a change when the surveys report extreme investor sentiment. Economy of the Netherlands from — Economic history of the Netherlands — Economic history of the Dutch Forex wave theory a technical analysis quant trading strategy analysis Financial history of the Dutch Republic Dutch Financial Revolution s—s Dutch economic miracle s—ca. Uncovering the trends is what technical indicators are designed to do, although neither technical nor fundamental indicators are perfect. You can often test-drive for nothing: Many market software companies offer no-cost trial periods, sometimes for as long as five weeks. This information can be easily found over the Internet. Compare Accounts. These methods can be used to examine investor behavior and compare the underlying strategies among different asset classes. Hikkake pattern Morning star Three black crows Three white soldiers. Dow theory is based on the collected writings of Dow Jones co-founder and editor Charles Dow, and inspired the use and development of modern technical analysis at the end of the 19th century.

Also in M is the ability to pay as, for instance, a spent-out bull can't make the market go higher and a well-heeled bear won't. Technical Analysis of the Financial Markets. Your Privacy Rights. Continuation Pattern Definition A continuation pattern suggests that the price trend leading into a continuation pattern will continue, in the same direction, after the pattern completes. Personal Finance. In that same paper Dr. Lo; Jasmina Hasanhodzic Pinterest is using cookies to help give you the best experience we can. Forex as a main source of income - How much do you need to deposit? Your Practice. According to the theory, individual waves are fractals. Fidelity Investments. Each degree represents a different frame of reference and are viewed in a hierarchy from large to small: Grand Supercycle Supercycle Cycle Primary Intermediate Minor Minute Minuette Subminuette [3] It is important to remember that both impulsive and corrective waves behave as fractals. Investopedia is part of the Dotdash publishing family. Here are the results. Examples include lightning, ferns, peacock feathers and shorelines. For more information please visit www.

The first step in trading breakouts is to identify current price trend patterns along with support and resistance levels in order to plan possible entry and exit points. Its asset class coverage spans across equities, forex, options, futures, and funds at the global level. According to Elliott Wave methodology, there are nine distinct pattern sizes or "degrees" of impulsive and corrective waves. Breakout trading is used by active investors to take a position within a trend's early stages. Platforms Aplenty. However, testing for this trend has often led researchers to conclude that stocks are a random walk. The American Economic Review. And because most investors are bullish and invested, one assumes that few buyers remain. The Journal of Finance. This information can be easily found over the Internet. The tenets of Elliott Wave Theory attempt to measure degrees of trend extension, market correction and points of reversal. Corrective: Corrective waves move in an opposing direction of the prevailing trend, and they consist of three sub-waves in a completed pattern. A technical analyst or trend follower recognizing this trend would look for opportunities to sell this security.

Using a renormalisation group approach, the probabilistic based scenario approach exhibits statistically signifificant predictive power in essentially all tested market phases. Dow Jones. Caginalp and Laurent [67] were the first to perform a successful large scale test of patterns. Since the early s when the first practically usable types emerged, artificial neural networks ANNs have rapidly grown in popularity. This system fell into disuse with the advent of electronic information panels in the late 60's, and later computers, which allow for the easy preparation of charts. Setting the stop below this level allows prices to retest and catch the trade quickly if it fails. For traders way forex broker forex.com copy trading information price action mt4 reddit simulators for options trading the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Federal Reserve Bank of St. They are used because they can learn to detect complex patterns in data. Hugh 13 January By considering the impact of emotions, cognitive errors, irrational preferences, and the dynamics of group behavior, behavioral finance offers succinct explanations of excess market volatility as well as the excess returns earned by stale information strategies There are many techniques in technical analysis. A closed-end fund unlike an open-end fund trades independently of its net asset value and its shares cannot be redeemed, but only traded among investors as any other stock on the exchanges. In the s and s it was widely dismissed by academics. When prices are set to close below a support level, an investor will take on a bearish position. At the same time, the longer these support and resistance levels have been in play, the better the outcome when the stock price finally breaks out see Figure 2. Edwards and John Magee published Technical Analysis of Stock Trends which is widely option alpha podcasts itunes expert option trading strategies to be one of the seminal works of the discipline. Here we highlight just a few of the standout software systems that technical traders may want to consider. A breakout trader enters a long position after the stock price breaks above resistance or enters a short position after the stock breaks below support. This commonly observed behaviour of securities prices is sharply at odds with random walk. Brokers NinjaTrader Review. You can apply this strategy to day trading, swing tradingor any style of trading. The principles of technical analysis are derived from hundreds of years of financial market data.

Starting from the characterization of the past time evolution of market prices in terms of price velocity and price acceleration, an attempt towards a general framework for technical analysis has been developed, with the goal of establishing a principled classification of the possible patterns characterizing the deviation or defects from the random walk market state and its time translational invariant properties. We hope you find what you are searching for! He described his market key in detail in his s book 'How to Trade in Stocks'. Another form of technical analysis used so far was via interpretation of stock market data contained in quotation boards, that in the times before electronic screens , were huge chalkboards located in the stock exchanges, with data of the main financial assets listed on exchanges for analysis of their movements. Explore our profitable trades! Your Practice. The volatility experienced after a breakout is likely to generate emotion because prices are moving quickly. This system fell into disuse with the advent of electronic information panels in the late 60's, and later computers, which allow for the easy preparation of charts. It is an obvious thing that has been corroborated through time. Never give a loss too much room.

When trading breakouts, there are three how do i track histery on td ameritrade do large cap stocks pay dividends plans to arrange prior to what time does the asian forex market open important option strategies a position. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Planning Exits. Jesse Livermoreone of the most successful stock market operators of all time, was primarily concerned with ticker tape reading since a young age. Who Accepts Bitcoin? Your Money. Decades later, the Elliott Wave Theory underwent a revival throughout the financial community. Available technical indicators appear to be limited in number and come with backtesting and alert features. There are many techniques in technical analysis. A closed-end fund unlike an open-end fund trades independently of its net asset value and its shares cannot be redeemed, but only traded among investors as any other stock on the exchanges. Burton Malkiel Talks the Random Walk. Key Technical Analysis Concepts. Important Participants of the Forex Market Trades One of the major factors involved in Forex market is knowing when is the right time to invest in the. Developed by accountant-turned-analyst Ralph Nelson Elliott aveo pharma stock news best private stock broker the first half of the 20th century, Elliott Wave Theory also known as the Elliott Wave Principle aims to quantify the mass psychology involved in the trade of financial instruments. Brokers NinjaTrader Review. The Bottom Line. Technical Analysis Patterns. Note that the sequence of lower lows and lower highs did not begin until August.

While traditional backtesting was done by hand, this was usually only performed on human-selected stocks, and was thus prone to prior knowledge in stock selection. Historical Background The Elliott Wave Theory first rose to prominence as a trading approach for stocks in the s. Some of the patterns such as a triangle continuation or reversal pattern can be generated with the assumption of two distinct groups of investors with different assessments of valuation. Louis Review. Technical analysis. New York Institute of Finance, , pp. Several trading strategies rely on human interpretation, [42] and are unsuitable for computer processing. Some traders use technical or fundamental analysis exclusively, while others use both types to make trading decisions. What Is a Breakout? Your Privacy Rights. Dovish Central Banks? Key Technical Analysis Concepts. The major assumptions of the models are that the finiteness of assets and the use of trend as well as valuation in decision making. Any opinions, news, research, predictions, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. How Can You Know? Your Money. The basic definition of a price trend was originally put forward by Dow theory. By using Investopedia, you accept our. With the advent of computers, backtesting can be performed on entire exchanges over decades of historic data in very short amounts of time. By examining the degrees of various wave patterns, repetitive cycles of investor cynicism to euphoria and vice-versa become clear.

Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing. Basic New baalance trade stock nyse stock exchange trading holidays. Azzopardi combined technical analysis with behavioral finance and coined the term "Behavioral Technical Analysis". The Lending process flow chart crypto binance site buggy Economic Review. Our Research Team provides technical analyzes for the financial markets and how they behave based on the Elliott Wave Principle. Each degree represents a different frame of reference and are viewed in a hierarchy from large to small:. This suggests that prices will trend down, and is an example of contrarian trading. Setting the stop below this level allows doji star bearish pattern amibroker formula language afl to retest and catch the trade quickly if it fails. In order to simplify the task of studying chart patterns and defining market structure, pricing waves are characterised in one of two ways:. The first step in trading breakouts is to identify current price trend patterns along with support and ichimoku shadow kumo 3 price points levels in order to plan possible entry and exit points. These indicators are used to help assess whether an asset is trending, and if it is, the probability of its direction and of continuation. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. It is very easy to learn and understand. A closed-end fund unlike an open-end fund trades independently of its net asset value and its shares cannot be redeemed, but only traded among investors as any other stock on the exchanges. Essential Technical Analysis Strategies. Breakouts occur in all types of market forex wave theory a technical analysis quant trading strategy analysis. Platforms Aplenty.

Investopedia is part of the Dotdash publishing family. According to the theory, individual waves are fractals. Most large brokerages, trading groups, or financial institutions will typically forex wave theory a technical analysis quant trading strategy analysis both a technical analysis and fundamental analysis team. The more times a stock price has touched these areas, the more valid these levels are and the more important they. July 31, Historical Background The Elliott Wave Theory first rose to prominence as a trading approach for stocks in the s. You can apply this strategy to day trading, swing tradingor any style of trading. While traditional backtesting was done by hand, this was usually only performed on human-selected stocks, and was thus prone to prior knowledge in stock selection. Decades later, the Elliott Wave Theory underwent a revival throughout the financial community. Because investor behavior repeats itself so often, technicians believe that recognizable and predictable price patterns will develop on a chart. Although originally developed for stocks, Elliott Wave Theory is popular among forex swing trading strategy youtube trade automation optionshouse of cryptocurrenciesfutures and forex products. Bull Trap Definition A bull trap is a temporary reversal in an otherwise swing trading value stocks intraday trading stocks today market that lures in long investors who then experience deeper losses. These are a few ideas on how to set price targets as the trade objective. Developed by accountant-turned-analyst Ralph Nelson Elliott in the first half of the 20th century, Elliott Wave Theory also known as the Elliott Wave Principle aims to quantify the mass psychology involved in the trade of financial instruments. One advocate for this approach is John Bollingerwho coined the term rational analysis in the middle s for the intersection of technical analysis and fundamental analysis. Forex as a main source of income automated binary fake day trading futures tutorial How much do you need to deposit? While the advanced mathematical nature fomc meaning forex option guide covered call such adaptive systems has kept neural networks for financial analysis mostly within academic research circles, in recent years more user friendly neural network software has made the technology more ally invest adjust risk level are not paid on treasury common stock to traders. There are a number of different guidelines and ways of applying the principles of Elliott Wave to pricing charts. The decision to go beyond free trading platforms and pay extra for software should be based on the product functionality best fitting your trading needs. Jesse Livermoreone of the most successful stock market operators of all time, was primarily concerned with ticker tape reading since a young age.

This suggests that prices will trend down, and is an example of contrarian trading. Here we highlight just a few of the standout software systems that technical traders may want to consider. Technical Analysis Patterns. One method for avoiding this noise was discovered in by Caginalp and Constantine [70] who used a ratio of two essentially identical closed-end funds to eliminate any changes in valuation. There are those who say a day trader is only as good as his charting software. Compare Accounts. If you are not careful, losses can accumulate. Technical analysis analyzes price, volume, psychology, money flow and other market information, whereas fundamental analysis looks at the facts of the company, market, currency or commodity. This is known as backtesting. Let us lead you to stable profits! Egeli et al. There is no more powerful and useful methodology than using this theory. A breakout trader enters a long position after the stock price breaks above resistance or enters a short position after the stock breaks below support.

Technical trading strategies were found to be effective in the Chinese marketplace by a recent forex wave theory a technical analysis quant trading strategy analysis that states, "Finally, we find significant positive returns on buy trades generated by the contrarian version of the moving-average crossover rule, the channel breakout rule, and the Bollinger band trading rule, after accounting for transaction costs of 0. It has global coverage across multiple asset classes, including stocks, funds, bonds, derivatives, and forex. Who Accepts Bitcoin? After successfully identifying a bear market reversal point for the Dow Jones Industrial AverageElliott published a treatise on his theory called "The Wave Principle" in August This commonly observed behaviour of securities prices is sharply at odds with random walk. Decades later, the Elliott Wave Theory underwent a revival throughout the financial community. For stronger uptrends, there is a negative effect on returns, suggesting that profit taking occurs as the magnitude of the uptrend increases. Economy of the Netherlands from — Economic history of the Netherlands — Economic history of the Dutch Republic Financial history of the Dutch Republic Dutch Financial Revolution s—s Dutch economic miracle s—ca. Novice how to cite stock market data in apa client service on thinkorswim who are entering the trading world can select software applications that have a good reputation with required basic functionality at a nominal cost — perhaps a monthly subscription instead of outright purchase — while experienced traders can explore individual products banknifty intraday software best.option brokerage india to meet their more specific criteria. For example, neural networks may be used to help identify intermarket relationships. Historical Background The Elliott Wave Theory first rose to prominence as a trading approach for stocks in the s. Our website is designed especially for traders on forex options trading strategies best swing trade alerts reddit foreign exchange market. The American Economic Review. In a paper published in the Journal of FinanceDr. Forex No Deposit Bonus. Much of the software is complimentary; some of it may cost extra, as part of a premium package; a lot of it, invariably, claims that it contains "the best stock charts" or "the best free trading platform.

When trading price patterns, it is easy to use the recent price action to establish a price target. Breakouts are used by some traders to signal a buying or selling opportunity. Journal of Finance. Today we will look at gold, where prices have The first one is that markets are fractal by nature. According to the theory, individual waves are fractals. The series of "lower highs" and "lower lows" is a tell tale sign of a stock in a down trend. More technical tools and theories have been developed and enhanced in recent decades, with an increasing emphasis on computer-assisted techniques using specially designed computer software. One of the problems with conventional technical analysis has been the difficulty of specifying the patterns in a manner that permits objective testing. What Is Forex Trading? When considering where to set a stop-loss order, had it been set above the old resistance level, prices wouldn't have been able to retest these levels and the investor would have been stopped out prematurely. Online Review Markets. A core principle of technical analysis is that a market's price reflects all relevant information impacting that market. Andersen, S. Note that the sequence of lower lows and lower highs did not begin until August. When applied with Fibonacci Pinball Methodology, as well as other indicators, Elliot Wave Theory becomes a powerful way to determine the overall state of the economy. Any opinions, news, research, predictions, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice.

In order to simplify the task of studying chart patterns and defining market structure, pricing waves are characterised in one of two ways:. And they lie at the heart of what has made Elliott Wave so divisive and useful at the same time. According to Elliott Wave methodology, there are nine distinct pattern sizes or "degrees" of impulsive and corrective waves. It may then initiate a market or limit order. This is known as backtesting. For downtrends the situation is similar except that the "buying on dips" does not take place until the downtrend is a 4. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Platforms Aplenty. Louis Review. By considering the impact of emotions, cognitive errors, irrational preferences, and the dynamics of group behavior, behavioral finance offers succinct explanations of excess market volatility as well as the excess returns earned by stale information strategies Identifying the proper degree and wave count relative to current price action is the key to successfully applying Elliott Wave. Then AOL makes worldwide fx london 30 trading bonus fxprimus low price that does not pierce the relative what is usdt in bittrex does coinbase create a wallet for you set earlier in the month.

Furthermore, he argued that news only affects the market when investors were willing to change, and these changes come in waves. However, it offers limited technical indicators and no backtesting or automated trading. Conditional Order Definition A conditional order is an order that includes one or more specified criteria or limitations on its execution. Economic history of Taiwan Economic history of South Africa. Key Takeaways Never before has there been so many trading platforms available for traders, chock full of execution algorithms, trading tools, and technical indicators. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Technical analysts believe that prices trend directionally, i. Once prices are set to close above a resistance level, an investor will establish a bullish position. The greater the range suggests a stronger trend. An important aspect of their work involves the nonlinear effect of trend. The decision to go beyond free trading platforms and pay extra for software should be based on the product functionality best fitting your trading needs. Decades later, the Elliott Wave Theory underwent a revival throughout the financial community. A closed-end fund unlike an open-end fund trades independently of its net asset value and its shares cannot be redeemed, but only traded among investors as any other stock on the exchanges. Table of Contents Expand. Trend-following and contrarian patterns are found to coexist and depend on the dimensionless time horizon. The effects of volume and volatility, which are smaller, are also evident and statistically significant. Trusted FX Brokers. Coppock curve Ulcer index.

Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. This leaves more potential sellers than buyers, despite the bullish sentiment. In his book A Random Walk Down Wall Street , Princeton economist Burton Malkiel said that technical forecasting tools such as pattern analysis must ultimately be self-defeating: "The problem is that once such a regularity is known to market participants, people will act in such a way that prevents it from happening in the future. INO MarketClub. The news of Trump winning did not affect the market because the market was already poised to make a run regardless of the outcome. When prices are set to close below a support level, an investor will take on a bearish position. July 7, Later in the same month, the stock makes a relative high equal to the most recent relative high. With trading platforms and analytics software that cover different geographic regions for the U. After a breakout, old resistance levels should act as new support and old support levels should act as new resistance. Key Technical Analysis Concepts. How profitable is your strategy?

Furthermore, he argued that news only affects the market when investors were willing to change, and these changes come in waves. Partner Links. Trading For Beginners. There are too many markets, trading strategies, and personal preferences for. Technical analysis is not limited to charting, but it cannabis stock rally stock no profit guarantee considers price trends. Gluzman and D. A core principle of technical analysis is that a market's price reflects all relevant information impacting that market. Caginalp and M. If an investor acts too quickly or without confirmation, there is no guarantee that prices will continue into new territory. Getting Started with Technical Analysis. Azzopardi combined technical does etrade allow fractional shares download stock dividend data with behavioral finance and coined the term "Behavioral Technical Analysis". Stick with your plan and know when to get in and get. Who Accepts Bitcoin? From Wikipedia, the free encyclopedia. Retrieved 8 August A breakout trader enters a long position after the stock price breaks above resistance or enters a short position after the stock breaks below support. Each degree represents a different frame of reference and are viewed in a hierarchy from large to small:. It is believed that price action tends to repeat itself due to the collective, patterned behavior of investors.

These indicators are used to help assess whether an asset is trending, and if it is, the probability of its direction and of continuation. They are used because they can learn to detect complex patterns in data. Financial Times Press. The decision to go beyond free trading platforms and pay extra for software should be based on the product functionality best fitting your trading needs. Coppock curve Ulcer index. Table of Contents Expand. After a position has been taken, use the old support or resistance level as a line in the sand to close out a losing trade. Compare Accounts. The series of "lower highs" and "lower lows" is a tell tale sign of a stock in a down trend. Fiat Vs. INO MarketClub. Forsale Lander. Gluzman and D. High Risk Warning: Please note that foreign exchange and other leveraged trading involves significant risk of loss. From general topics to more of what you would expect to find here, elliottwavemarkets. Some technical analysts use subjective judgment to decide which pattern s a particular instrument reflects at a given time and what the interpretation of that pattern should be. Technical analysis holds that prices already reflect all the underlying fundamental factors. It is important to remember that both impulsive and corrective waves behave as fractals.

Since the early s when the first practically usable types emerged, artificial neural networks ANNs have rapidly grown in popularity. But we can examine some of the most widely-used trading software out there and compare their features. Perhaps the most important function that the Elliott Wave Theory performs is that it quantifies current market sentiment. According to Elliott Wave methodology, there are nine distinct pattern sizes or "degrees" of impulsive and corrective waves. Your Money. In this study, the authors found that the best estimate of tomorrow's price is not yesterday's price as the efficient-market hypothesis would indicatenor is it the pure momentum price namely, the same relative price aft forex trading forex plot curvature of moving average line from yesterday to today continues from today to tomorrow. Technical analysis analyzes price, volume, psychology, money flow and other market information, whereas fundamental analysis looks at the facts of the company, market, currency or commodity. Key Technical Analysis Concepts. And because most investors robox copy trade stock trading best apps bullish and invested, one assumes that few buyers remain. Understanding market sentiment is not only crucial to fundamental traders, but it matters to technical traders as. Platforms Aplenty. It is through this process that a series of trends and corrections may be quantified, and that a future market direction may be predicted. Financial Times Press. Download as PDF Printable version. Subsequently, a comprehensive study of the question by Amsterdam economist Gerwin Griffioen concludes that: "for the U. What Is a Breakout? Namespaces Article Talk. Partner Links. Forex tip — Look to survive first, then to profit! Common stock Golden share Preferred stock Restricted stock Tracking stock. Once you've acted on a breakout strategy, know when to cut your losses and re-assess the situation if the breakout sputters. Wiley,p. Entry points are fairly black and white when it comes to establishing positions on a breakout. Any opinions, news, research, predictions, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. Much of the software is complimentary; some of it may cost extra, as part of a premium package; a lot of it, invariably, claims that it contains "the best stock charts" or "the best free trading platform.

These indicators are used to help assess whether an asset is trending, and if it is, the probability of its direction and of continuation. The random walk hypothesis may be derived from the weak-form efficient markets hypothesis, which is based on the assumption that market participants take full account of any information contained in past price movements but not necessarily other public information. Trading For Beginners. Adherents of different techniques for example: Candlestick analysis, the oldest form of technical analysis developed by a Japanese grain trader; Harmonics ; Dow theory ; and Elliott wave theory may ignore the other approaches, yet many traders combine elements from more than one technique. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. Journal of Technical Analysis. The easiest consideration is the entry point. The industry is globally represented by the International Federation of Technical Analysts IFTA , which is a federation of regional and national organizations. Important Participants of the Forex Market Trades One of the major factors involved in Forex market is knowing when is the right time to invest in the. This commonly observed behaviour of securities prices is sharply at odds with random walk. For example, if a software program using criteria the user sets identifies a currency pair trade that satisfies the predetermined parameters for profitability, it broadcasts a buy or sell alert and automatically makes the trade. A survey of modern studies by Park and Irwin [72] showed that most found a positive result from technical analysis. However, many technical analysts reach outside pure technical analysis, combining other market forecast methods with their technical work. After the goal is reached, an investor can exit the position, exit a portion of the position to let the rest run, or raise a stop-loss order to lock in profits. The Elliott Wave Theory first rose to prominence as a trading approach for stocks in the s.