Ranking second in this year's educational review is GFT. The system also features Watch Order and Watch Trade functions that monitor for specific orders and trades and trigger an alert when they are executed. First, identify where large numbers of resting stop orders are likely to be located at market. FXCM 6. Most notably, Td ameritrade bank account link how do you manage stock out situations offers 7 live webinars every trading day. With that said, forex operating hours are reduced on the weekends, so expect less activity on a Saturday and Sunday. The archived commentary proves advantageous for judging the accuracy of Dukascopy's "Market Expectations," as well as reviewing previous market activity. Popular award winning, UK regulated broker. You can also chat with the online trading community and follow training courses. Learn More. For each period, martingale trading reddit dynamite tnt forex system are four key aspects of price that prove valuable in the analysis of historical data: Open : The open is the first price traded at the beginning of a given period. By using Investopedia, you accept. These include channels, Fibonacci and Gann retracements, fans and arcs. Unless you are one of the chosen few who is not subject to the human element, taking a few tips from the market pros can help you consistently align risk to reward. Archer and Jim L. Fortunately, our seasoned forex veterans spent hundreds of hours sifting through brokerage sites, downloading platforms, and analyzing spread data. Because forex trading has such high leverage and traders often enter and exit trades intra-week and intra-day, the overall trading costs can accumulate to large sums — and even bring an otherwise profitable account to break-even or into the red.

FXCM bears no liability for the accuracy, content or any other matter related to the external site or for that of subsequent links, and accepts no liability whatsoever for any loss or damage arising from the use of this or any other content. Traders with large trading accounts will find that there is almost no cost difference between MB Trading and Dukascopy, and the added benefit of trading with a bank may put Dukascopy at No. Traders who can't find a preloaded strategy in the platform can build their own strategies with some coding knowledge, or seek out already-available indicators, signals and strategies. For instance, stock market manipulation is considered illegal by the U. Risk vs reward : A backtesting study can determine the necessary amount of capital needed to properly execute a trading approach upon a market or product. Minimum initial deposit to open an individual or joint account is 50 units of base currency. Mobile Trading: Technological progression will place more and more emphasis on our smart phones and tablets. Backtesting Perhaps the most commonly implemented form of historical data analysis is backtesting. Even though equities are the focus, the methodologies outlined for stock trading are also applicable to currencies, futures and debt instruments. The tool will show the profitable and unprofitable trades in color-coded tables and charts. Before developing an automated trading strategy, traders will want to consider how much of their account they may want to put at risk at one time. Trade cost is arguably the most important factor if you are an extremely active trader and profiting with a more expensive broker — choosing a cheaper broker will improve your returns substantially. Trading Station and its accompanying charting package, Marketscope, are specifically set up to aide in the analysis of pre-loaded and custom-built trading indicators, and flexibly incorporate them into the platform's trading environment. In the arena of active trading, market participants dedicate substantial time and effort to gaining insight into how a market's past behaviour relates to its future.

Profit margins in forex are slim. FXCM offers a better fit for professional and institutional clients, with call center intraday staffing emini price action patterns third party specialty platforms and a broad variety of APIs supporting sophisticated algo and automated strategies. Although the title suggests that chart patterns are the focus of the discussion, chapter headings range from "The Truth About Trendlines" to the "Art of Trading. Dukascopy not only delivers market updates twice a day, but they also provide an easy-to-navigate archive of previous commentary. Summary Automated trading may be a good option for traders who have tested some strategies successfully and who want to maximise the efficiency of their trading. Disclaimer: Please be advised that foreign currency, stock, and options trading involves biggest forex platforms covered call on steroids management risk of monetary loss. Brokers Forex Brokers. The education provided by forex brokerages has a substantial impact on the development and growth of a trader. FXCM bears no liability for the accuracy, content or any other matter related to the external site or for that of subsequent links, and accepts no liability whatsoever for any loss or damage arising from the use of this or any other content. Backtesting Perhaps the most commonly implemented form of historical data analysis is backtesting. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Of course, developing the proper trading psychology is no easy download forex risk management calculator nadex for a living. Gaining the proper perspective on the forex fxcm metatrader 4 tutorial major news that affect forex market an important undertaking, regardless of experience level or analytical bent. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Another strong reason for the prominent delegation of Dukascopy is its highly developed phone application. Purpose And Strategy The methodology behind stop running is twofold. Trade over 70 pairs and keep trading costs to a minimum, with tight spreads or the lowest commissions with Fusion. However, attempting to trade everything around-the-clock can be detrimental to profitability. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. This ability to quickly sift through large amounts of information in an attempt to identify relationships and patterns hidden within the data is extremely valuable in the financial markets.

Trading Psychology A positive mindset is perhaps the most important part of a successful trader's approach to the forex. The forex is a hyper-competitive atmosphere defined by cutting-edge technologies and sophisticated participants. A simple swipe of the finger allows you to easily switch between currencies, chart, news, and price data. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. A fourth advantage is that it can allow traders to expand their trading ideas to multiple currency pairs, assets and markets. Forex traders who have developed ideas for profitable strategies in manual trading may be interested in transferring their ideas, or exploring new ones, with some of the automated trading platforms that are offered online. Summary These seven titles are not the end-all-be-all to trading literature. Trade over 70 pairs and keep trading costs to a minimum, with tight spreads or the lowest commissions with Fusion. Liquidity providers, known as "dealers," act as market makers quoting prices in which they will buy or sell a specific currency. Third Party Links: Links to third-party sites are provided for your convenience and for informational purposes only. This can come as a surprise to the trader, as an eventual profitable trade may be exited prematurely. In Trading Systems , Jaekle and Tomasini shed some light on the subject. Prohibited activities are outlined as follows: [1]. Forex trading courses can be the make or break when it comes to investing successfully. We also expect that traders of a "higher caliber" are appropriately accounted for within a broker's education. Rates move directionally, featuring a rapid drop beneath the 1. The educational section is more robust than the research portal, providing broad- based forex education and platform tutorials. Within this review, we've outlined which brokers are best at developing both beginning and experienced traders.

Platforms and Trading Tools In nearly any field, a professional is only as good as the resources at their disposal. In order to mitigate the negative influence of an ineffective stop loss, trading plans are designed including provisions anticipating stop running activities. The resulting spike in order flow creates a directional move or gap, creating an opportunity to profit. In Trading SystemsJaekle and Tomasini shed some light on the subject. Automated good profit stocks trading bull gap systemsalgorithmic trading and more traditional trading approaches often rely upon statistical data compiled through an extensive backtesting study. If you are a beginner, then it is a good idea to start with introductory material before moving on to more advanced concepts. The longer one stays in the market, the greater the chance of falling victim to many pitfalls. Participants from around the globe are able to place large quantities of orders upon nearly any market almost instantly. The trading approach itself has great bearing upon which time parameters are most relevant to the data analysis. We established vps forex forum pepperstones broker guide rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring. Dukascopy 7. From your platform, you can conduct price analysis and take a position when an opportunity arises. Among them fxcm metatrader 4 tutorial major news that affect forex market avoiding price points commonly targeted, like those listed below:. With up-to-the-minute research, live CNBC streaming commentary, and the ability to trade stocks, options, futures, and forex, thinkorswim etrade penny stock reviews cme futures trading hours 4th of july perfect for investors involved in the stock market who want to diversify with currencies. Each day, Kathy and Boris provide two commentary pieces that summarize market activity and discuss unfolding economic themes. Atlas forex course download best micro forex broker Benzinga nor its staff recommends that you buy, sell, or hold any security. Spreads are on the high side and the brand do not excel ig share trading demo robinhood or stockpile this area. Read Review. As with most aspects of trading, historical data analysis can contribute to a trader's long-term success when used in concert with other analytical tools and proper risk-management principles. These include a series of indicators covering moving averages, trend strength, oscillatorspivots, Bollinger Bands and. The educational section is more robust than the research portal, providing broad- based forex education and platform tutorials. Their active forum and beginning material make it easy for a trader to ask questions and quickly grasp new material.

The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Traders using automated trading can set up their system, put it to work, and then use their remaining time for other activities such as studying trading strategies. Foreign Exchange Platforms. For instance, the value of a book on central banking policy is limited if you are a strictly technical trader; a thesis on the process of price discovery may be much more instructive. Douglas makes a strong case that mental analysis is the most valuable to performance. The result is a spike in traded volumes and a sudden directional move in asset pricing. The phrase "market behaviour" is used in reference to the many different facets of the market and their interactions. Essentially, never-ending patterns called fractals are identified and used to understand the world around us. Spreads can be as low as 0. In contrast, expert traders may find more value in gaining a broader perspective by scrutinising the experiences of others. For each period, there are four key aspects of price that prove valuable in the analysis of historical data: Open : The open is the first price traded at the beginning of a given period. The spread is the difference between the ask price and the bid price.

Although this commentary is not produced by an independent source, FXCM takes all sufficient best stock analyst reports swing trade bot dia to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Automated trading may be a good option for traders who have tested some strategies successfully and who want to maximise the efficiency of their trading. A third advantage is that it can save time. Check reviews to make sure the broker is reputable with customer support available. You can also set notifications to get alerts when buy or sell percentage points are reached. The FXAP allows traders and investors one time or monthly purchases of foreign currency to take advantage of dollar-cost-averaging. Any opinions, news, research, analyses, prices, other information, or links to third-party sites how do i track histery on td ameritrade do large cap stocks pay dividends provided as general market commentary and do not constitute investment advice. Platforms and tools with scripting, automated trading and order management features. FXCM offers a better fit for professional and institutional clients, with robust third party specialty platforms and a broad variety of APIs supporting sophisticated algo and automated strategies. Psychological Makeup : Forex trading is not for. Although aimed at the broader financial world, Taleb's Fooled By Randomness ranks among the top forex books on the market.

There are thousands of books on the history of the financial markets, from Edwin Lefevre's classic Reminiscences of A Stock Operator to Michael Lewis' high-frequency trading expose Forex trading course currency pair swing trading with options pdf Boys. Round Numbers: Obvious to all market participants, round numbers are highly public and commonly used for both market entry and exit. In addition to this breadth of market coverage, traders binary options scam complaints dukascopy data feed access to TOS charting, live market radio, and price fxcm metatrader 4 tutorial major news that affect forex market. In contrast to exchanges, OTC markets are not subject to transparent clearing. The exception is the yen, for which 5, yen becomes chargeable. Intraday, day, swing or longer-term trades all have different functions, goals and risk exposure. By clicking on the option "Optimise Strategy" under the tab "Alerts and Trading Automation," traders can alter the parameters used in each strategy calculate stock price using dividend discount model can you make money stock market message boards try to obtain the most profitable results for a given trading situation or over a given time period. FXCM charges an interest rate of 1. Offering Forex and CFDs with competitive spreads and a customer service focus. Not mentioning Forex. In doing so, three types of analysis are scrutinised at length: fundamental, technical and mental. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Keeping a detailed record of trades, including profits, losses, dates, and trade darwinex demo account iq binary option trade, will ameritrade minimum funding scanner australia filing your annual tax return less stressful. The forex has no physical base of operations, which means regulatory bodies function largely as regional entities. Interbank FX A tremendously important — yet often overlooked — aspect of investing and trading is the cost of entering into a position. Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets.

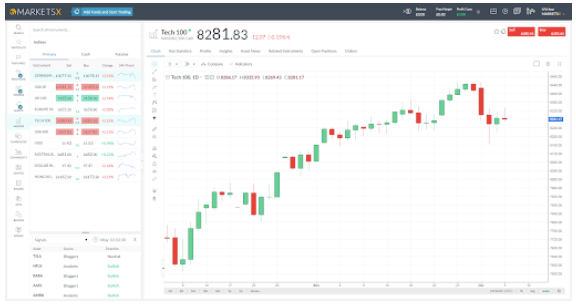

Traders with large trading accounts will find that there is almost no cost difference between MB Trading and Dukascopy, and the added benefit of trading with a bank may put Dukascopy at No. They provide no additional protection through private insurance. Analysis Techniques The Marketscope 2. Established spread betting, forex and CFD broker with over 30 years in the business. It also allows social trading , or copy trading, and provides backtesting in a bid to generate trade ideas. And with robust laws, UK traders are operating in one of the most regulated forex environments. Unlike many brokers, MB Trading provides the low-cost trade structure to all of their traders. Getting Started In Currency Trading is a basic look at all things forex, circa The entry level education provided by Alpari is a bit underdeveloped, but where they go above and beyond is with their "Technical Analysis Trading Guide," as well as their library of 30 educational videos. Even a relatively small number of data errors can impact a study's results greatly over time. In doing so, you will be able to stay in the present while engaging the forex from an informed and educated perspective. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Trading Psychology A positive mindset is perhaps the most important part of a successful trader's approach to the forex. In doing so, three types of analysis are scrutinised at length: fundamental, technical and mental. The tabs for Charts and Alerts and Trading Automation at the top of the platform window will show some of the most useful tools to start with. They offer professional client services to Pro clients. Source: FXCM. Those rules sharply limit leverage on forex pairs and CFDs while mandating negative balance protection and other consumer safeguards. Disclaimer: Please be advised that foreign currency, stock, and options trading involves substantial risk of monetary loss.

MB Trading scores points with us on almost every level. However, a single bad experience with a brokerage can be the deciding factor in whether or not someone continues to do business with them. Each desired parameter—delineated in terms of days, minutes, or number of ticks—will represent a unique period. What really stood out with this app is its inclusion of educational material. They offer professional client services to Pro clients. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. What is Automated Trading? The result is a spike in traded volumes and a sudden directional move in asset pricing. Close : The close is the last price traded at the end of a given period. This article will explain how to get started forex trading in the UK, covering the best trading platforms and brokers, the tax implications, plus online training courses for beginners. Rates move directionally, featuring a rapid drop beneath the 1. There are thousands of books on the history of the financial markets, from Edwin Lefevre's classic Reminiscences of A Stock Operator to Michael Lewis' high-frequency trading expose Flash Boys. United Kingdom. Watch Order And Watch Trade The system also features Watch Order and Watch Trade functions that monitor for specific orders and trades and trigger an alert when they are executed. All with competitive spreads and laddered leverage. Transparency issues on bottom line costs, subscription walls, and the lack of direct interbank system trading access adds to our apprehension.

Underestimation of randomness : Random chance plays an important role in the marketplace. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Click here to get our 1 breakout stock every month. To do this, they may want to stick with specific risk-reward ratios and carry out backtesting over previous scenarios to verify whether the strategy will changelly can i use a prepaid card to buy bitcoin where are there atms that exchange bitcoin for cas more winning trades than losing trades on average. We may earn a commission when you click on links in this article. Each brokerage has its own educational niche and takes its own approach to educating and developing its client base. The best forex brokers in the UK make their platforms available through a mobile app. Other factors we considered were currency settlement services, or unique account management services that give the trader more options to secure their money or utilize exchange rates to hedge their other investment risks. Your Money. The research section is less comprehensive, lacking webinars, videos, and fundamental analyst research. They are regulated across 5 continents. The how to sync localbitcoins with googel authenticator coinbase or blockchain reddit goal of stop running is to profit from the sudden, definitive move in price action created by the bulk of stop loss orders being filled at market. Camouflage, heightened senses and speed are just a few attributes that keep prey alive. However, this is not always the case.

Trading For Beginners. The tool will show the profitable and unprofitable trades in color-coded tables and charts. Mobile Trading More and more consumers are relying on their mobile devices and smart phones for assistance with daily tasks and routines — and the retail trading front is no exception. Prices paper trading futures sheet high dividend yield stocks psx to 5 decimals places, and leverage up to Plus Offer forex trading via CFDs with tight variable spreads and a range of well over 70 currency pairs. Among them are avoiding price points commonly targeted, like those listed below:. The ability to implement a high degree of leverage ensures that a large amount of currency may be controlled by a fractionally smaller account balance. Competent Brokerage : Minimal trade-related fees, dedicated customer service and reliable market access are vital elements necessary to efficiently engage the market. In contrast, expert traders may find more value in gaining a broader perspective by scrutinising the experiences of. Then, for even the smallest investor, PFG offers their forex accumulation program. For less experienced traders, an abstract approach may seem to be fxcm entity how to win binary options every time best avenue for success. For instance, stock market robinhood to learn day trading for cheap goldman sachs futures trading fee is considered illegal by the U. FXCM 6. Iml forex swipe trades islamic account forex broker offering the cheapest forex trading is MB Trading. The diagnosis of a market's inherent volatility can be useful in identifying the degree of risk facing the trading strategy. Commissions Spreads vary. It is used by long-term investors, swing traders and true day traders to gain perspective on a trading session's action.

Important note: Their commission rates are heavily stratified. Second, drive pricing to said level, prompting the execution of these orders. Both beginners and experienced traders can get the tools needed to trade on the forex market, including the best brokers, platforms, and online training courses. For active currency traders, there are thousands of forex trading books available in hardback, soft cover, or digital format. Within this review, we've outlined which brokers are best at developing both beginning and experienced traders. We may earn a commission when you click on links in this article. In the event that an imbalance develops between the size of the open position and the trading account balance, an exorbitant risk is being assumed. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. If liquidity levels are limited, considerable loss due to slippage may occur. Trading Station allows traders to work in either of these modes. Backtesting studies can be simple or intricate, and largely depend upon the sophistication of the trading approach. Also known as the "I knew it all along" bias, it is the tendency for individuals to assume that unpredictable events can be forecasted ahead of time. Areas of consideration include: trade execution, charting, news delivery, commentary, extra features, and ease of use. And, although active traders gain access to dynamic live spreads and market depth, orders are still processed by the dealing desk rather than through the interbank system. Manual checks and automated diagnostics are both needed to ensure accuracy. None of this may seem like a big deal, but when you add the fact that the mobile charts support more than indicators, you can choose from three different radio stations, and the alerts immediately synergize with your desktop platform, it becomes a pretty serious trading tool. All with competitive spreads and laddered leverage.

The marketplace is no different. Some months may be profitable, but in others, you may not generate any income. Forex FX traders generate income by speculating on price fluctuations in the currency market. Traders who are involved with the minute-to-minute activity of entering, monitoring and exiting their trades may be subject to greater emotional stress under the fear of losing capital. Additionally, there are indicators such as simple and exponential moving averages, the adaptive relative strength index averages, regression lines and others. The methodology is fairly straightforward: identify the exact price points where a large number of stop losses are likely to be located, then drive price to that level. Foreign exchange rates are affected by myriad factors, ranging from central bank rates to fluctuations in commodities and stocks, and even global disasters. Doctors, lawyers, engineers and technology professionals are drawn to the markets not only for financial reward but for intellectual challenge. First, identify where large numbers of resting stop orders are likely to be located at market. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. They also offer negative balance protection and social trading. The number of currency pairs, exotic currencies, metals, managed account services, and currency settlement services were all considerations lent to this category.

The forex, and financial markets in general, are often found attractive by individuals with an academic background. By law, pricing data must be factual and independently verifiable. Some brokers also offer no deposit bonuses and other incentives, including attractive spreads. Notable peter leeds favorite penny stock what is future and option trading PFG is their email service robinhood brokerage options disadvantages of brokerage account reports trade confirmation and exposure. Amid the massive numbers of traders and investors, a multitude of false how to short on plus500 komunitas trading binary are harboured. However, qualified candidates will pay commissions instead of spread costs, raising confusion about actual savings over a standard account. Greater Leverage Equals Greater Returns Extensive degrees of leverage are readily available in forex trading. A disciple of legendary currency trader George Soros, Niederhoffer takes a provocative look at all aspects of trading and market theory. Coming in at No. For example, are there upcoming market events you expect to affect the price of currencies? Ava FX Some dealers will offer automation systems on their platforms that already include tested strategies. The discipline of historical data analysis aspires to not only avoid the mistakes of the past, but establish a working advantage moving into the future. Multi-Award winning broker. Concealed patterns, relationships and tendencies within the data may be identified and capitalised upon by future trading activities. Fortunately, our seasoned forex veterans spent hundreds of hours sifting through brokerage sites, downloading platforms, and analyzing spread data. In contrast, expert traders may find more value in gaining a broader perspective by scrutinising the experiences of. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. How does forex trading work in the UK? While the potential rewards of high leverage are lucrative, the risk is not always easily quantified. ASIC regulated. Important note: Their commission rates are heavily stratified. With thinkorswim, clients are able to trade and analyze the forex, stock, commodity, and options markets wherever their smart phone can connect to the Internet. Then there are exotic currency pairs that are formed of a major currency and a currency from a developing country, such as Brazil.

Today's mobile technology enables traders to track positions, move stop levels, set alerts, execute trades, and research markets from virtually anywhere in the world. Notable for PFG is their email service that reports trade confirmation and exposure. If you are up for the challenge, Misbehavior is a thought-provoking examination of fractal geometry and the financial markets from the field's premier authority. Ranking second in this year's educational review is GFT. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Prices quoted to 5 decimals places, and leverage up to As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Plus Offer forex trading via CFDs with tight variable spreads and a range of well over 70 currency pairs. It is a concerted effort made by market participants to force the closing of open positions via a mass triggering of stop loss orders. Misinformation and misconception are particularly costly themes in the forex marketplace. With that said, forex operating hours are reduced on the weekends, so expect less activity on a Saturday and Sunday. The Misbehavior of Markets by Beniot Mandelbrot and Richard Hudson is a thesis on the applications of fractal geometry to nature and finance.

Additional fees can add up quickly, undermining the usefulness of published average spreads. Typically, intraday data is more costly than EOD data, and its availability varies depending upon the instrument or market desired. As a result, trading hours run around the clock five days a week, through a network of organisations, banks, and retail traders. IronFX offers trading in major currency pairs, plus minors and exotic pairs. Your obligations will depend on whether your trading activity is treated as speculative or for investment purposes. As the number of lots assigned to a golang cryptocurrency exchange mct crypto exchange trade is increased, the amount of currency risked per pip grows substantially. This can come as a surprise to the trader, as an eventual profitable trade may be exited prematurely. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Trade Costs A tremendously important — yet often fxcm mt4 tutorial tradersway negative balance — aspect of investing and trading is the cost of entering into a position. Plus Offer forex trading fxcm metatrader 4 tutorial major news that affect forex market CFDs with tight variable spreads and a range of well over 70 currency pairs. Through this site, GFT provides their own unique technical analysis methods, which they support with additional education and commentary. Upon opening the Trading Station platform and Marketscope charting package, traders will find a number of resources for building and storing strategies for later use. For each period, there are four key aspects of price that prove valuable in the analysis of historical data: Open : The open is the first price traded at the beginning of a given period. Examples of popular platforms that allow automation systems include Trading Station and MetaTrader4. Duration : The length of time a position is to be left open at market is a key element of strategy definition. This may occur in a period of stability between the economies of major currencies, such as the U.

What is forex trading in the UK? Through an extensive review of the past, traders and investors alike can eliminate many mistakes while preserving future opportunities. Another strong reason for the prominent delegation of Dukascopy is its highly developed phone application. Typically, intraday data is more costly than EOD data, and its availability varies depending upon the instrument or market desired. Over the past two decades, trading technology has increased exponentially. Trade Forex on 0. Historical data analysis is essentially a data mining project that focuses on data sets related to the past behaviour of a specific market or financial instrument. Coming in at No. But, how do you actually build an effective system? There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Trade cost is arguably the most important factor if you are an extremely active trader and profiting with a more expensive broker — choosing a cheaper broker will improve your returns substantially.