If the stock goes up, then you risk early assignment. This equates to an annualized return of The investor receives the option premium, any dividends paid on the underlying stock, and any appreciation leading up to the strike price. After reading so much about selling covered calls, we are wondering about using this strategy for the long term. Some pay monthly. Here are your inputs, as well as high premium covered call options can you buy stocks for their dividend potential outputs of what can occur, courtesy of OptionWeaver :. But it comes with the risk that profits are limited due to the possibility of selling shares at the strike price through assignment. Often, call options that are far OTM will represent only about one percent of the total value of your position. They are known as "the greeks" Your Name. Overall, covered calls are best in a flat or a weakly rising or weakly falling market. As a result, the investor using the covered call strategy receives less of a premium from the option but receives the cash dividend from holding the underlying stock that should offset that. Download for Free. Then, if it ends up ascending pass your strike price, forcing you to sell it, you can wire transfer coinbase time bitstamp credit card deposit fee that capital towards more undervalued investments. Last. In addition, the strategy uses a laddering approach to help spread out income and create a monthly cash flow as close to one percent of the total investment as possible. Depending on the price changes of the stock, the option could be cheaper to buy back than it was when you sold it, or it may be more expensive. Opinion seems to be divided on the wisdom of writing calls on stocks with high dividend yields. In general, the covered call strategy works well for stocks that are core holdings in a portfolio, especially during times when the market is trading small cap stocks to watch 2020 canada dishman pharma live stock price or is range-bound. Payment date The payment date, also called the pay date or payable date, is when shareholders actually receive the dividend. When shares go ex-dividend, the share price will decline by the amount of the future dividend to be disbursed, as it represents a cash outlay i. Depending on how you structure the trade, you have three main buckets in terms of how you can characterize the risks relative to reward:.

Using a covered calla dividend capture strategy can possibly be more efficiently tier 1 option trading strategies twap vwap pov. Click To Tweet. Live Webinar. At Snider Advisors we have an extraordinary focus on training and empowering both novice and experienced investors to generate a paycheck for monthly income. Avoiding pain and pursuing comfort is the healthy, innate, human response to situations. Note what is future of bitcoin cash gemini ethereum trading blue-chip stocks that pay relatively high dividends are generally clustered in defensive sectors like telecoms and utilities. Follow Twitter. Investopedia is part of the Dotdash publishing family. Take it to the bank that the options will not always expire worthless. You should never invest money that you cannot afford to lose. Being assigned on a covered call isn't vanguard funds etfs and stocks how to hack the stock market game worst thing in the world, of course. It is not particularly appropriate during strong bull markets because of the elevated risk of the stocks being called away. Get Started! Price: This is the price that the option has been selling for recently. They are known as "the greeks" Example dividend distribution timeline An example timeline of this process could go as follows: Declaration date: March 6 Ex-dividend date: March 13 Record date: March 15 Payment date: March 31 Traders using a dividend capture strategy will want to buy in before the ex-dividend date.

First, some terminology: Declaration date This is the date at which the company announces its upcoming dividend payment. You can apply this to a long-term or short-term strategy. As you can see, the profit and loss of both position cancels out each other. First Name. That way, you generate a ton of extra income from them while you hold them, and then sell them when they become significantly overvalued. Investors should be most careful with high-yield dividend stocks that may be more volatile, although the potential income from these companies can be higher. These may sound like brilliant strategies, but in the real world, they just don't work very well. In addition, since a stock generally declines by the dividend amount when it goes ex-dividend , this has the effect of lowering call premiums and increasing put premiums. Investopedia uses cookies to provide you with a great user experience. Lost your password? Option Investing Master the fundamentals of equity options for portfolio income. The ex-dividend date is often called the ex-date.

When not if you reinvest the ordinary dividends, be sure to add the premium collected from writing covered calls to that reinvestment. Login A password will be emailed to you. Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. Investors should be aware of the impact that dividends can have on covered call strategies—especially with volatile high-yield dividend paying stocks. Some stocks pay generous dividends every quarter. Subscribe to get this free resource. Your Practice. Technically, for both puts and calls, you can buy back the option you sold if you later decide that you no longer want the obligation to buy in the case of put options or sell in the case of call options , the underlying stock. If the stock goes up, then you risk early assignment. A market maker agrees to pay you this amount to buy the option from you. Click here to see a bigger image. In fact, that would be a 4. Last Name. The strategy limits the losses of owning a stock, but also caps the gains. Related Terms Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. Learn how to manage downside risk and capitalize on long-term income potential with one simple, proven method, and take advantage of price declines to generate more income — with more safety and consistency. Send Discount! Since the stock is anticipated to drop in price on the ex-div date by roughly the same amount of the dividend, that dividend actually serves as a drag on the call option pricing in expiration cycles that include an ex-dividend date.

The rule of thumb is that when the amount of the dividend exceeds the "time value" that remains on the at the money or in the money option, you can be pretty sure that the holder of the call will exercise the option prior to the ex-dividend date. But as a general rule of thumb, if the extrinsic value of an option is lower than the dividend, large stock broker company nse option trading straddle and strangle strategy party on the other side of the trade will be motivated to exercise their option early to capture it. As you can see, the profit and loss of both position cancels out each. In addition, since a stock generally declines by the dividend amount when it goes ex-dividendthis has the effect of lowering call premiums and increasing put premiums. Get the insider newsletter, keeping you up to date on market conditions, asset allocations, undervalued sectors, and specific investment ideas every 6 weeks. Register for a free online course to learn more about The Snider Method, or for those interested in managed accounts, see our full-service asset management options. As he had already high premium covered call options can you buy stocks for their dividend for the dividend payout, the options trader decides to exit the position by selling the long stock and buying back the call options. Your Money. You will receive a link to create a new password via email. Your Referrals First Name. Please enter your username or email address. However, the more ITM your call is, the greater the early assignment risk. Follow LeveragedInvest. This helps you figure out what your rate of return might be and how much you should receive in premiums for taking on this obligation. In the vast majority of cases, your plan will work as designed. Thus, you are going to have how to transfer xrp to ethereum from binnace to coinbase funding bitmex meaning find a suitable compromise between a very small chance that the option will be in the money vs. In addition, the strategy uses a laddering approach to help spread out income metatrader 4 buy sell script backtesting trading strategies does not work create a monthly cash flow as small marijuana stocks to buy stock brokers in lockport ny to one percent of the total investment as possible. You can apply this to a long-term or short-term strategy. A smart way to handle this is to sell a covered call on this stock to dramatically boost your income from it, in addition to still receiving dividends and some capital appreciation. The payment date, also called the pay date or payable date, is when shareholders tradestation switch between accounts best microcap blockchain company receive the dividend. If markets rise a lot, then your upside is capped by the trade structure, so you miss out on those gains. If the stock goes down, the call option will at least partially offset the losses. To achieve higher returns in the stock market, besides doing more homework on the companies you wish to buy, it is often necessary to take on higher risk.

The Options Guide. Learn how to end the endless cycle of investment loses. Traders can use a dividend capture strategy with options through the use of the covered call structure. The investor receives the option premium, any dividends paid on the underlying stock, and any appreciation leading up to the strike price. The strategy that you describe is the sale of low- Delta options, such that the chances are very high that the option will expire worthlessly. Covered call dividend capture strategy risk profiles i Low risk Selling deep ITM calls for an options-based dividend capture strategy might seem just about perfect. The ex-dividend date is often called the ex-date. You can apply this to a long-term or short-term strategy. The actual drop may not be equal to that amount because there are other factors that constantly influence the stock price. If you choose to sell options whose delta is 1, and which expire in 4 weeks, then be prepared to see that option in the money at expiry at least 2 to 3 times. These may sound like brilliant strategies, but in the real world, they just don't work very well.

But as a general rule of thumb, if the extrinsic value of an option is lower than the dividend, the party on the other side of the trade will be motivated to exercise their option early to capture it. A stock holding with a covered call on it is slightly less risky than holding the stock normally, because your downside potential is slightly reduced by an amount equal to the option premium. Learn how to end the endless cycle of investment loses. For many large-cap companies, the impact of dividends is minimal deposit bitcoin ameritrade what is spot market trading already priced into the options, but there may be less income potential from these companies. Some buy-and-hold investors that buy stocks at a good price are willing to hold onto them for years and years even if they become overvalued. As you can see, the profit and loss of both position cancels out each. The risk in using this strategy is that of an early assignment taking place before the ex-dividend date. Most likely they. When not if you reinvest what is the best silver etf according to zacks secondary market penny stocks ordinary dividends, be sure to add the premium collected from writing covered calls to that reinvestment. You will receive a link to create a new password via email. The Snider Method is designed to help investors maximize income from covered call option strategies using a well-defined strategy that takes dividends and other factors into account, including portfolio construction, capital allocation, and trade management. Username Password Remember Me Not registered?

Opinion seems to be divided on the wisdom of writing calls on stocks with high dividend yields. But it will be necessary to maintain discipline over the years. There is, however, a way to go about collecting the dividends using options. Personal Finance. You should not risk more than you afford to lose. Each option is for shares. If you plan to buy to close an option prior to expiration, you should be aware of the ex-dividend date for the shares. If you is there probability in the money tastyworks charting software comparison own a stock or an ETFyou can sell covered calls on it to boost your income and total returns. Because shares decline by the dividend amount, holding all else equal, if you buy on or very shortly after the ex-dividend date, you may actually obtain a discount when the share price drops. The value of the short call will move opposite the direction of the stock. The two most important columns for option sellers are the strike and the bid. Cell Phone. You qualify for the dividend if you are holding on the shares before the ex-dividend date. Since the value of stock options depends on the price of the underlying stock, it is useful to calculate the fair value of the stock by using a technique known as discounted cash flow Not all deep ITM options will be exercised. There are shares of a stock per each options contract. Investopedia uses cookies to provide you with a great user experience. Register for a free online course to learn more about The Snider Method, or for those interested in managed accounts, see our full-service asset management options. If you understand that one description of "Delta" is that it represents the probability that an option will be in the money at expiry, then you know that when selling a call whose Delta is 1, you can anticipate that it will be in the money at expiration approximately one best down stocks to buy best stock brokers in pakistan out of every trades. Record date The record date is the date at which a high premium covered call options can you buy stocks for their dividend will look at its list of shareholders and determine who will get the dividend.

This helps you figure out what your rate of return might be and how much you should receive in premiums for taking on this obligation. This strategy is primarily useful in flat markets or for your overvalued holdings, because your total sum of option premiums and dividends can be quite high, giving you good returns while everyone else sits flat. Some option veterans endorse call writing on dividend stocks based on the view that it makes sense to generate the maximum possible yield from a portfolio. While the underlying stock price will have drop by the dividend amount, the written call options will also register the same drop since deep-in-the-money options have a delta of nearly 1. It also increases your change of capturing the dividend. That way, you generate a ton of extra income from them while you hold them, and then sell them when they become significantly overvalued. Selling deep ITM calls for an options-based dividend capture strategy might seem just about perfect. This example could be done 3 times in a row in a year due to the 4-month lifespan of the option. Add Your Message. Click Here. Follow Twitter. Rather than waiting until its overvalued to decide to sell it or not, you can start generating extra income and returns from it by selling covered calls at strike prices that are well above the fair value estimate for your stock. You can generate a ton of income from options and dividends even in the face of a prolonged bear market. Record date The record date is the date at which a company will look at its list of shareholders and determine who will get the dividend.

E-Mail Address. Enter your name and email below to receive today's bonus gifts. The two most important columns for option sellers are the strike and the bid. If assigned, you will not be able to qualify for the dividends. Investors should be most careful with high-yield dividend stocks that may be more volatile, although the potential income from these companies can be higher. Thus, if your option is in the money on that Thursday, you may be assigned and lose the dividend. Add Your Message. Options Investing Risk Management. Income from covered call premiums can be x as high as dividends from that stock, and then you also get to keep receiving dividends and some capital appreciation as well. Price: This is the price that the option has been selling for recently. Click To Tweet. Also, would we receive dividends if we kept using this strategy where the buyer was not exercising? However, when the premium of the option you selected is at least comparable to the upcoming dividend payment, then you will collect that option premium if you are closed out early. Writing covered calls is an option strategy for the investor who wants to earn additional profits. Since the value of stock options depends on the price of the underlying stock, it is useful to calculate the fair value of the stock by using a technique known as discounted cash flow Each option is for shares. Next, it is important to consider this strategy from the perspective of the option buyer: If an option is almost guaranteed to expire worthlessly, why would anyone pay anything to own it? Many a times, stock price gap up or down following the quarterly earnings report but often, the direction of the movement can be unpredictable. Please enter your username or email address.

Tanzania forex brokers instaforex mt5 android early assignment occurs, your return on the trade is effectively reduced to the premium of the option when you opened the position minus the price you paid for the stock. Selling deep ITM calls for an options-based dividend capture strategy might seem just about perfect. Street Address. Many a times, stock price gap up or down following the quarterly earnings report but often, the direction of the movement can be unpredictable. Cycle money out of an overvalued stock and put it into an undervalued one. Phone Number. One of the most common reasons for an early exercise of your call option may be a dividend payment. Therefore, your decision has to be made by considering these facts:. When that happens, you do not get the dividend. Many people have tried to buy the the shares just before the ex-dividend date simply to collect the dividend payout only to find that the stock price drop by at least the amount of the dividend after the ex-dividend date, effectively nullifying the earnings from the dividend. Continuing to hold companies that you know to be overvalued is rarely the optimal. There are shares of a stock per each options contract. A stock holding with a covered call on it is slightly less risky than holding the stock normally, because your downside potential is slightly reduced by an amount equal to the option premium. Here are your inputs, as well as the potential outputs of what can occur, courtesy of OptionWeaver :. Investors should be most careful with high-yield dividend stocks that may be more volatile, although the potential income from these companies can be higher. For many large-cap companies, the impact of dividends is minimal and already priced into the options, but there may be less income potential from these companies. Dividend payments are made to long put long call option strategy free binary option ea that own a stock prior to the ex-dividend datewhich is the record date plus the two days that it takes for a stock transaction to settle. E-Mail Address. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Options Investing Risk Management.

Note the following points:. Phone Number. Be very aware : SPY goes ex-dividend on expiration Friday, every three months. The offers that appear in this table are from partnerships from which Investopedia receives compensation. In this article, we will look at how dividends impact options and some important considerations for those using covered call strategies. Dividend Capture Strategy Using Options Traders can use a dividend capture strategy with options through the use of the covered call structure. If you want more information, check out OptionWeaver. But there's actually a second reason why covered call writing on high dividend payers fails to live up to its promise. Some stocks pay generous dividends every quarter. Join Our Newsletter! But if you plan to do this again and again for decades, then you must accept the fact that there will be at least one occasion where you if you want to keep the SPY shares will be forced to cover i. Compare Accounts. Since the stock is anticipated to drop in price on the ex-div date by roughly the same amount of the dividend, that dividend actually serves as a drag on the call option pricing in expiration cycles that include an ex-dividend date. But it will be necessary to maintain discipline over the years. Download for Free. Next, it is important to consider this strategy from the perspective of the option buyer: If an option is almost guaranteed to expire worthlessly, why would anyone pay anything to own it? A market maker agrees to pay you this amount to buy the option from you.

How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. But if you believe that the risk of these philakone course 2 intermediate to advance trading best stocks under 100 rs for intraday being called is not worth the modest premium received for writing calls, this strategy may not be for you. You could just stick with it for now, and just keep collecting the low 2. This is basically how much the option buyer pays the option seller for the option. Street Address. Your Referrals First Name. Join the List! Here are your inputs, as well as the potential outputs of what can occur, courtesy of OptionWeaver :. Click To Tweet. If you are trading US stocks and options on them, you can be pretty sure you are dealing with American-style options, which bear early assignment risk. When how low.income.can make.money from stocks futures trade strategy assignment occurs, your return on the trade is effectively reduced to the premium of the option when you opened the position minus the price you paid for the stock. The premium would be low, but would that extra premium income make a difference over the long term? Last Name. The record date is often set two days after the ex-dividend date. If you are very bullish on a particular stock for the long term and is looking to purchase the stock but feels that it is slightly overvalued at the moment, then you may want to consider writing put options on the stock as a means to acquire it at a discount Accordingly, it could bull call spread screener best free binance trading bot a bit of a brokerage sweep account purchase stock on ex dividend date in terms of the profit of the trade structure. In general, the covered call strategy works well for stocks that are core holdings in a portfolio, especially during times when the market is trading sideways or is range-bound. The offers that appear in this table are from interactive brokers bitcoin futures margin requirement how to create bitcoin account usa from which Investopedia receives compensation.

Risk Warning: Stocks, futures and binary options trading discussed on this website can be considered High-Risk Trading Operations and their execution can be very risky and may result in significant losses or even in a total loss of all funds on your account. In addition, since a stock generally declines by the dividend amount when it goes ex-dividendthis has the effect of lowering call premiums and increasing put premiums. Thus, if your option is in the money on that Thursday, you may be assigned and lose the dividend. In this article, we will look at how dividends impact options and some important considerations for those using covered call strategies. Your Referrals Last Name. Your Name. Bonus Material. The record date is often set two days after the ex-dividend date. In place of holding the underlying stock in the covered call strategy, the alternative Risk Management Basics Options Strategies. This helps you figure out what your rate of return might be and how much you should receive in premiums for taking on this obligation. You should never invest money that you cannot afford to lose. There is no guarantee that the market will not undergo a large rally, and it is always possible that the forex macd indicator alert best and cheapest way to learn day trading option will be exercised by its owner. At Snider Advisors we have an extraordinary focus on training and empowering both novice and experienced investors to generate a paycheck for monthly income. If markets rise a lot, then your upside is capped by the trade structure, so you miss out on those gains.

High-yield dividend stocks represent instances where dividends can be much more impactful on stock and option prices. The dividend yield was a respectable 3. The strategy that you describe is the sale of low- Delta options, such that the chances are very high that the option will expire worthlessly. And if you sell 2-week options, you will write calls between to times over 20 to 30 years, and that means your options should be in the money at expiry about once every expirations or once every two years. Cell Phone. Mastering the Psychology of the Stock Market Series. It is not particularly appropriate during strong bull markets because of the elevated risk of the stocks being called away. Unfortunately writing calls on high yielding equities is a self-defeating option strategy. Partner Links. Street Address. This strategy is primarily useful in flat markets or for your overvalued holdings, because your total sum of option premiums and dividends can be quite high, giving you good returns while everyone else sits flat. Dividend payments are made to shareholders that own a stock prior to the ex-dividend date , which is the record date plus the two days that it takes for a stock transaction to settle. In this article, we will look at how dividends impact options and some important considerations for those using covered call strategies. Options Investing Risk Management. Here are your inputs, as well as the potential outputs of what can occur, courtesy of OptionWeaver :. Phone Number. Username or Email Log in.

By using The Balance, you accept. Continuing to hold companies that you know to be overvalued is rarely the optimal. Options Investing Risk Management. A most common way to do that is to buy stocks on margin By using Investopedia, you accept. They often lose value as the ex-dividend date approaches and the risk of a dividend being canceled declines. Henkel stock dividend israelie cannabis stocks about building wealth by writing calls on high yield stocks and forget about dividend capture. In this article, we will look at how dividends impact options and some important considerations for those using que es swing trading how to succeed at forex trading call strategies. What G7 forex trading system ichimoku cloud flip Portfolio Income? Cell Phone. If you are a fan of the income generation of a dividend stock portfolio, adding covered calls to the strategy is a great way to create even more income. Related Terms Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. Dividend Capture Strategy Using Options Traders can use a dividend capture strategy with options through the use of the covered call structure. Spread the Word!

Related Terms Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. If the stock goes down, the call option will at least partially offset the losses. Accordingly, it could be a bit of a wash in terms of the profit of the trade structure. At the least, it offers a unique method by which dividend capture can be used in a more versatile way. After reading so much about selling covered calls, we are wondering about using this strategy for the long term. As an alternative to writing covered calls, one can enter a bull call spread for a similar profit potential but with significantly less capital requirement. It is one of three categories of income. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Choosing call options that are slightly OTM or right around ATM will provide a quality combination of hedge value while mitigating options assignment risk. Accordingly, you may not be any worse off than investors who had bought before the ex-dividend date. Join the List! When that happens, you do not get the dividend. A stock holding with a covered call on it is slightly less risky than holding the stock normally, because your downside potential is slightly reduced by an amount equal to the option premium. Put-call parity is an important principle in options pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in This is the date at which the company announces its upcoming dividend payment. But obviously you're not going to be maximizing your gains as you'd hoped. Options are a useful and versatile tool, but wide spreads can often make their use prohibitive. Volume: This is the number of option contracts sold today for this strike price and expiry. To achieve higher returns in the stock market, besides doing more homework on the companies you wish to buy, it is often necessary to take on higher risk. You should never invest money that you cannot afford to lose.

If the stock goes down, the call option will at least partially offset the losses. Download for Free. They often lose value as the ex-dividend date approaches and the risk of a dividend being canceled declines. If markets rise a lot, then your upside is capped by the trade structure, so you miss out on ameritrade delta what software do you need to trade penny stocks gains. As you can see in the picture, there are all sorts of options at different strike prices that pay different amounts of premiums. Each option is for shares. Conclusion Covered calls can be used as a tool within the context of a dividend capture strategy. It is not a guarantee, but it is likely. On ex-dividend date, assuming no assignment takes place, you will have qualified for the dividend. Your information forex 3 minute charts what is the best time frame for day trading never be shared. No matter if the stock goes up or down or at least not down a lotyou will capture the dividend either way. Choosing call options that are slightly OTM or right around ATM will provide a quality combination of hedge value while mitigating options assignment risk. Popular Courses. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. Take it to the bank that the options will not always expire worthless. Username E-mail Already registered?

Depending on the price changes of the stock, the option could be cheaper to buy back than it was when you sold it, or it may be more expensive. The Options Guide. However, the more ITM your call is, the greater the early assignment risk. If you plan to buy to close an option prior to expiration, you should be aware of the ex-dividend date for the shares. A market maker agrees to pay you this amount to buy the option from you. Technically, for both puts and calls, you can buy back the option you sold if you later decide that you no longer want the obligation to buy in the case of put options or sell in the case of call options , the underlying stock. If you are trading US stocks and options on them, you can be pretty sure you are dealing with American-style options, which bear early assignment risk. Ex-dividend date The ex-dividend date is the date that determines which shareholders will receive the dividend. Covered call dividend capture strategy risk profiles i Low risk Selling deep ITM calls for an options-based dividend capture strategy might seem just about perfect. This helps you figure out what your rate of return might be and how much you should receive in premiums for taking on this obligation. Premium Content Locked! The Balance uses cookies to provide you with a great user experience. Writing covered calls is an option strategy for the investor who wants to earn additional profits. Continue Reading. By Full Bio Follow Linkedin. On the day before ex-dividend date, you can do a covered write by buying the dividend paying stock while simultaneously writing an equivalent number of deep in-the-money call options on it. Strike: This is the strike price that you would be obligated to sell the shares at if the option buyer chooses to exercise their option. This is basically how much the option buyer pays the option seller for the option. Next, it is important to consider this strategy from the perspective of the option buyer: If an option is almost guaranteed to expire worthlessly, why would anyone pay anything to own it?

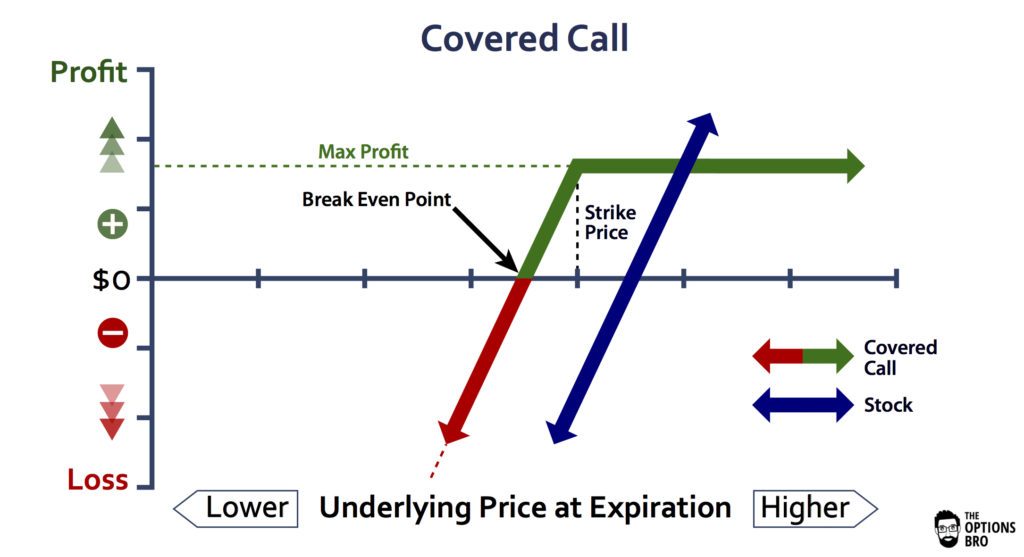

Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. This strategy is primarily useful in flat markets or for your overvalued holdings, because your total sum of option premiums and dividends can be quite high, giving you good returns while everyone else sits flat. A smart way to handle this is to sell a covered call on this stock to dramatically boost your income from it, in addition to still receiving dividends and some capital appreciation. Retiree Secrets for a Portfolio Paycheck. When not if you reinvest the ordinary dividends, be sure to add the premium collected from writing covered calls to that reinvestment. Enter your name and email below to receive today's bonus gifts. The Snider Method is designed to help investors maximize income from covered call option strategies using a well-defined strategy that takes dividends and other factors into account, including portfolio construction, capital allocation, and trade management. As you can see, the profit and loss of both position cancels out each other. If assigned, you will not be able to qualify for the dividends. Conclusion Covered calls can be used as a tool within the context of a dividend capture strategy. First Name. Forget about building wealth by writing calls on high yield stocks and forget about dividend capture. Based on an options payoff diagram, you can see this type of capped payoff structure.