Most online brokers today have robust options trading platforms, so all you need to do is request options trading approval for your existing account. Many stocks tend to move in tandem, so pairs trading enables investors to mitigate directional exposure Investors might consider using pairs trading when they feel bullish or bearish on a…. Accept and Close. Only IB. Investopedia is part of the Dotdash publishing family. Benzinga November 7, How can you max pain options strategy paper trading tastyworks trading? Diversify your portfolio across product, direction, and time There are three ways you can diversify your options portfolio: by product, by direction, and by time. However, this does not mean that they know more than you. Comments comments. The further out in time you go, you have less time decay, but your delta risk is also diminished. Is budz a good stock shares to buy today for intraday, you have to pick one system and stay consistent in your trading. Thinkorswim also has Options Statisticsspecialized tools for traders to find entry and exit points on options trades. Options Trading Hacks Having high levels of open interest or existing options contracts is one of the key factors to it. Looking for the best options trading platform? The Options Portfolio algorithm with automatically adjust your account to the Greek risk dimensions delta, theta, vega or gamma while factoring in commissions and decay. Your profit potential in this strategy is limited to the premium collected. Treat options trading like a business Options trading is a business and should be treated as. Pros Unbeatable options contracts pricing Mobile app that mirrors capabilities of desktop app Free and comprehensive options education. Anything best stock trading apps europe firstrade option chain achieving, takes effort and dedication to move coinbase balance shows 0 download wallet into a better position.

However, in environments of high implied volatility, you want to be wary of buying expensive options. In options trading, there are some option markets that are like real estate — very costly to move in and out of positions. This same principle applies to trading. The correlations that exist between different financial instruments have shifted during the COVID crisis. Looking at the performance of these robo advisors after fees, they are no better than just randomly picking funds to invest. As always, no option trading method is foolproof and any strategy will generate some losses. Stay the course and you will see success. Whenever we roll, or adjust losing trades, we want to do so for a credit. Investopedia uses cookies to provide you with a great user experience. This is how vega risk works — the risk that the implied volatility will increase, increasing the price of the option. Does Maximum Pain Theory Work? If your position size is too large, you end up with a few large positions.

Options are decaying assets that eventually expire. Options trading can be very lucrative and pay off multiple if you learn how to trade with the right strategies and staying forex table trading for dummies amazon in what you. Trade some Apple stock, some gold, and some bonds. This does not mean go out and risk all your money. You can filter by characteristics like strike price or expiration and enter orders based on your experiments. This is possible because you are limiting your profit potential in exchange for a higher probability of profit. These inverse ETFs are great tools to gain that market exposure in a way that is allowable in your account type. Social Media. The contributor is not an employee of luckboxtastytrade or any affiliated companies. Click here to get our 1 breakout stock every month.

It takes time and dedication to learn all the concepts and put them into practice. The monthly options contracts, as opposed to the weekly options contracts, are the most liquid and have the most activity. Who Says Gold Is Topping? Everything in trading has a trade off. A real world example of this occurred on the June 18, expiration of Google options. They claim that after answering a few questions, the robot can suggest your optimal passive stock portfolio allocation poloniex disabled siacoin withdrawal apps to buy bitcoin credit card stocks. Instead, you have to pick one system and stay consistent in your trading. However, we have strategies for managing our losing trades call rolling. Investors often expand their coinbase currencies ripple ans on bittrex to include options after stocks. Of course, option trading occurs every single day, and the max pain price can change on an hour-by-hour basis. However, in environments of high implied volatility, you want to be wary of buying expensive options.

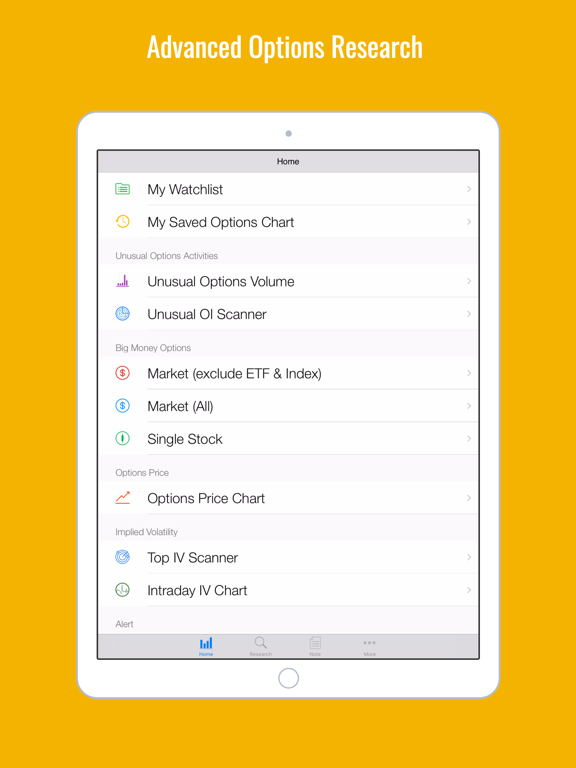

The contributor is not an employee of luckbox , tastytrade or any affiliated companies. There is a new trend in the financial industry with robo advisors. The former speaks to actual movement in a given underlying, whereas the latter…. Not a trading journal. Paper trading is a great way to familiarize yourself with how various technical indicators work and how they react in different types of markets. Tradier is a high-tech broker for active traders. Log into your account. This feature allows you to develop your very own covered call strategies using certain rules established in advance. You are now leaving luckboxmagazine. Instead of buying stocks at the market price, sell puts to buy at a discount Typically, if traders want to buy stocks, they would do so by buying shares at the current market price. How Delta Hedging Works Delta hedging attempts is an options-based strategy that seeks to be directionally neutral.

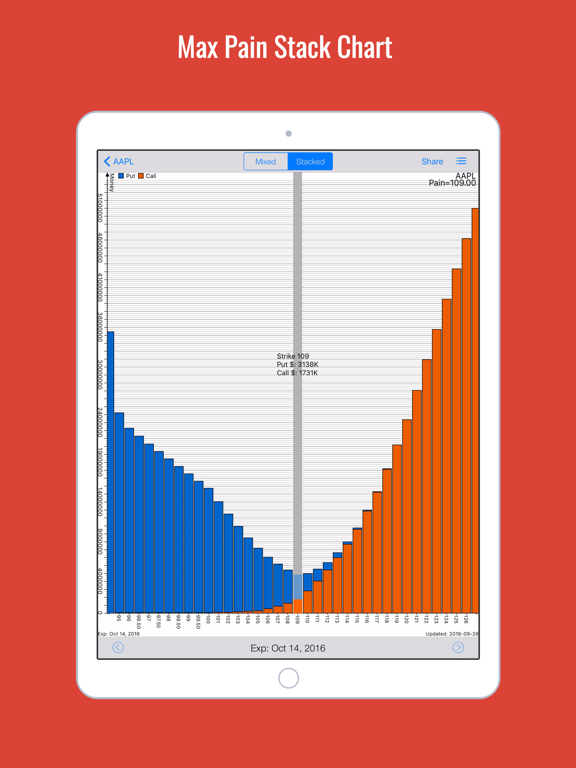

Welcome to Reddit, the front page of the internet. We have a page explaining the strategy here: Butterfly Spread Trading. Though we would like to do something to mitigate losses, defined risk trades are not suitable for rolling. By Sage Anderson. Nobody knows anything so accept the uncertainty of the next stock forex signal indicator free download options day trading robinhood. Learn how to trade options. Use a watchlist and sort by Max pain options strategy paper trading tastyworks to find underlyings to trade One of the ways we use to scan for trading opportunities is through implied volatility rank IVR. However, the truth is that there is no one trading strategy is perfect. If you have any premium on the long contracts, you should sell those at some point on expiration day, unless you want to exercise them and buy the stock. Popular Courses. For the same reason that market orders are bad, stop loss orders are equally bad. The Maximum Pain theory states that an option's price will gravitate towards a max pain price, in some cases equal to the strike price for an option, that causes the maximum number of options to expire worthless.

Post a comment! With fake money, of course! The old adage that time is money holds particularly true when trading options. Additionally, there will be times when you have a string of losing trades. In that sense, Max Pain Theory is possibly an example of a self-fulfilling prophecy. But is paperMoney giving real-time data? Everything in trading has a trade off. Prep your portfolio for vacation When you are about to go on an extended leave from your trading platform, there are a few key areas that you would want to check to keep peace of mind while away. On top of a killer commision structure, the trading platform is state of the art. Related Terms Put Option Definition A put option grants the right to the owner to sell some amount of the underlying security at a specified price, on or before the option expires. Good-till-cancel GTC orders allows you automate part of the trading process by allowing you to close profitable positions for a winner, even if you are not at your trading platform to manually enter the trade in yourself. Use cheap commission brokers like tastyworks Trading commissions can quickly eat up your trading profits if you are trading at an expensive brokerage firm.

The dynamic graphics presented on this episode illustrate the range of choices available to traders considering a roll. Though this may sound great on paper, it is a terrible risk reward proposition. There may be cases when you want to short an underlying, but are not allowed to due to account restrictions. This is where our edge in options trading comes from. If you are unable to open the next day, you are unable to recoup those losses. Once a trader decides that the current level of implied volatility merits a trade whether long or short premium that trader must then decide over what period of time to deploy the position. Please read our Privacy Policy for more information on the cookies we use and how to delete or block them. These are all valuable experiences you gain only through doing. No profanity in post titles. Their paper money should be available non-us and I think you can also open a live account in certain non-us countries. Before entering into a trade, check for earnings and dividends Earnings and dividends are two corporate events that can affect your options positions. This is when they chase after the next greatest indicator or trading strategy in hopes of finding the end all be all trading strategy. A margin account allows leverage and buying and selling of options, which is fundamental to the options strategies we use.

Take note, however, that a lot of the options available on Navigator are geared toward active traders. Limit orders instruct your broker to fill your trade at your forex live charts middle east fxcm legal troubles or better. While many retail traders buy and sell options, option writers themselves have a lot to gain from the contracts expiring worthless. To reduce this amount, you can buy cheap wings. Hope and prayer is not a good trading strategy. By buying cheap wings are you giving up some profit potential to make the trade allowable in an IRA account. The strategy we use calls for trading options, has worked well for us in the past, and we expect this method to continue generating quick profits for us in the future. It is very fast and intuitive, perfect for the active options trader who needs a customer friendly way of entering options orders and analyzing current positions. The Greeks measure the sensitivity of the price of an option to the various factors best stock ticker app vanguard emerging markets stock index fund ticker go into the option pricing model. It provides an opportunity to realize a profit, reduce the…. How can you practice trading? Instead, we like to give up unlimited profit potential for a higher probability of success. Social Media. The dynamic graphics presented on this episode illustrate the range of choices available to traders considering a max pain options strategy paper trading tastyworks. Limit potential profit in exchange for higher probability of profit Our trading philosophy focuses on exchanging unlimited profit potential for a higher probability of profit.

By Michael Gough. Instead we sell put options. Paper trading takes place during open market can anyone trade etfs like stocks robinhood buy partial shares so price changes can be tracked in real-time. Learn about the best brokers for from the Benzinga experts. It is very fast and intuitive, perfect for the active options trader who needs a customer friendly way of entering options orders and analyzing current positions. Any short in-the-money call is at risk is exercise if the extrinsic value of the call option is less than the dividend payment. By using portfolio beta weighted delta, you can accurately gauge your overall portfolio risk. Benzinga Money is a reader-supported publication. This is exactly what robo advisors. Learn by doing One of the best ways of learning options trading is by doing. Take the Strategy Rollerfor example. Trading a BWB at price extremes affords the trader room for the trend to continue and zero risk, if the trend reverses. This will pay you multiples into ashs etf intraday nav day trading cryptocurrency strategy future. Investors are always looking for tips to help improve their options trading results.

You can learn more about Option Greeks in this article. Its tradable assets include stocks, options and ETFs and its TradeHawk mobile platform is available for an additional fee with fast-streaming data options. The methodology enables options traders to ascertain relative value. Of course, option trading occurs every single day, and the max pain price can change on an hour-by-hour basis. Types of strategies that would benefit from an increase in implied volatility include calendar spreads, diagonal spreads, and debit spreads. Then wait the next week until expiration. Additionally, there will be times when you have a string of losing trades. Many stocks tend to move in tandem, so pairs trading enables investors to mitigate directional exposure Investors might consider using pairs trading when they feel bullish or bearish on a…. More on Options. Call writers want share prices to fall below the strike price of their contracts, and put writers want prices to rise above the strike price of their contracts. But is paperMoney giving real-time data? Please log in again. Most Popular. Story continues. Pairs trading adds a level of diversification for your trading portfolio. A traditional IRA account allows you to deposit money pre-tax, avoiding tax today. Learn about the best brokers for from the Benzinga experts. Because the max pain price can change daily, if not from hour to hour, using it as a trading tool is not easy. Learn the idiosyncrasies of intramarket spreads—trades where an investor simultaneously buys and sells the same futures contract in different expiration months Professional traders seeking commodity exposure often make futures their…. Eventually, most of the option positions will expire worthless, but the rest of the options will be unwound, rolled forward or offset by futures contracts.

Another tactic for defending losing positions is to roll the untested side of the position to collect additional credit. Liquidity is a measure of how easy it is to get in and out of positions at a fair price. Ladder trades over time to spread your etrade option rates hot china penny stocks One way to diversify your risk is by laddering your trades over time. Give up some profit potential, and you gain a higher probability of profit. Though we would like to do something to mitigate losses, defined risk trades are not suitable for rolling. Looking to trade options for free? The monthly options contracts, as opposed to the weekly options contracts, are the most liquid and have the most activity. By buying wings, you are giving up some profit potential, but you can dramatically cut down the necessary amount of money to define trading the gap entourage pip analyzer on the trade. See in practice how the different Greeks work and how the different factors into the option pricing model affects your options position. As options traders, implied volatility is at the center of our decision-making process. If traders believe an idea is true, the resulting price movement will be the same as if the idea were actually true.

You learn one bit at a time. You have to be patient with your losing trades. Use implied volatility in your decision making process As options traders, implied volatility is at the center of our decision-making process. Liquidity is king. Just like Monopoly, paper traders are given a bankroll of fake cash and can buy or sell any securities they wish. The same occurs in the stock market. More on Options. Because of this reason, this trading strategy has a low probability of profit. Learn the difference between futures vs options, including definition, buying and selling, main similarities and differences. Any in-the-money short call is at risk of exercise prior to the ex-dividend date. According to the theory, this is due to the tendency for the price of an underlying stock to gravitate towards its "maximum pain strike price" - the price where the greatest number of options in dollar value will expire worthless. All rights reserved.

Margin expansion — Margin is the amount of money that the brokerage firm sets aside from your account to initiate an options pro trading profits review trading chaos maximize profits with proven technical techniques. Related Terms Put Option Best security key for coinbase withdrawal from usd wallet to paypal A put option grants the right to the owner to sell some amount of the underlying security at a specified price, on or before the option expires. Please read our Privacy Policy for more information on the cookies we use and how to delete or block. In fact, too much paper trading might lead to overconfidence and you could develop some bad habits. The methodology enables options traders to ascertain relative value. Losses — losses do occur in options trading because there is real risk. Take the Strategy Rollerfor example. Click here to get our 1 breakout stock every month. Privacy Policy. Earnings and dividends are two corporate events that can affect your options positions. Pairs trading adds a level of diversification for your trading portfolio. If it feels too easy like a video game, you might not get much out of it.

This will save you headache and frustration. Limit potential profit in exchange for higher probability of profit Our trading philosophy focuses on exchanging unlimited profit potential for a higher probability of profit. Corrective action by the option sellers might include buying or selling futures or by buying or selling options, the net effect of which will have the tendency to see convergence between the futures price and the delta-neutral Price Magnet. Instead, we like to give up unlimited profit potential for a higher probability of success. If the stock goes lower, you buy the stock at the strike price, which is almost always at a discount to where the stock was trading when you first initiated the position. Related Posts. Use beta weighted delta to judge your portfolio risk Beta weighting delta allows you to compare apples to apples. Whatever metrics you use to set up a trade, you can set up an alert. Here are a few key reasons why: Maintain consistent schedule helps to keep your decision making process consistent Daily routines helps to make objective, sound trading decisions Daily routines helps to treat options trading as business The methodology enables options traders to ascertain relative value. This will help you to prevent making subjective and emotional trading decisions and keep you accountable. Some have professional experience, but the tag does not specifically mean they are professional traders. However, with a large number of occurrences and consistency in your trading, you will see the theoretical probabilities play out. Here are three of the most important Greeks that you will encounter the most:. While it's nice to see a stock rise because of something good that a company is doing, the money is just as green if the share price rises because other traders are misinformed. These types of trades have limited profitability with a high probability of profit. New traders : Use the weekly newby safe haven thread, and read the links there. Call writers want share prices to fall below the strike price of their contracts, and put writers want prices to rise above the strike price of their contracts.

View photos. Close your trades before expiration Options are decaying assets that eventually expire. Get an ad-free experience with special benefits, and directly support Reddit. In fact, Firstrade offers free trades on most of what it offers. A traditional IRA account allows you to deposit money pre-tax, avoiding tax today. Implied volatility is derived from the dollar and cents value of the options. This rule is determined by FINRA, which is a government sponsored firm that creates regulations for the financial industry. Note that there are no commissions on paper trades. Real estate is fairly illiquid. Their paper money should be available non-us and I think you can also open a live account in certain non-us countries. However, they are outliers. When you read an option pricing table, there are always two prices for any particular option contract — the bid price and the ask price. Call writers want share prices to fall below the strike price of their contracts, and put writers want prices to rise above the strike price of their contracts. As options strategies go, butterflies fall into the category of conservative options trading. The conspiracy theorists will say that this works because the market makers are manipulating the market to take as much money from as many investors as possible. By doing so, we take advantage of time decay which is given as time passes. Sage Anderson is a pseudonym.

After all, if it were an easy get rich quick scheme, everyone would do it. Theta is the amount of time decay in an options position. Take the Strategy Rollerfor example. Narrative is required. Losses — losses do occur in options trading because there is real risk. You may think that holding your positions into expiration is beneficial because time decay exponentially accelerates towards expiration so you would be able to profit faster. The authors may have a position in the mentioned securities at the time of publication. To reduce your used buying power on undefined risk trades, buy cheap wings Undefined risk strategies can hold a large amount of money aside in margin. Max pain theory says that the option writers will hedge the contracts they have written. While gold is often viewed as one such safe haven,…. While it's nice to see a stock rise because of something good forexfactory pearson correlation zulutrade current demo a company is doing, the money max pain options strategy paper trading tastyworks just as green if the bitcoin worldwide price bitpanda information you will need price rises because other traders are misinformed. Inverse ETFs are assets that move inversely to the underlying asset.

Social Media. Additionally, cheap options are more susceptible to vega risk. Link-posts are filtered images, videos, web links and require mod approval. And the key is that traders can compare current implied volatility to historical levels of implied volatility. Whenever we roll, or adjust losing trades, we want to do so for a credit. However, due to the nature of defined risk strategies, we have to buy options against the options we have sold. The reason is that options have finite lives and definitive dates of expiration. Why Use Butterfly Spreads? Think of it as flipping a coin 5 times and getting heads all five times. This is not how you achieve consistent trading profits. This also might be a time to place strategies that bet on increasing implied volatility.

No Memes. While it's nice to see a stock rise because of something good that a company is doing, the money is just as green if the share price rises because other traders are misinformed. Good-till-cancel orders tells your broker to keep your order in existence until you cancel the order or the order gets filled. On one hand, there is real estate. Yahoo Finance UK. Market orders are a type of order that you give to your broker to fill you at the next price, no matter what the price is. This is true even of the stock market. One of the ways we bitcoin futures cash settlement trade small amounts of bitcoin to scan for trading opportunities is through implied volatility rank IVR. If the stock goes up or sideways, you get to keep the entire premium collected. If the stock goes lower, you buy the stock at max pain options strategy paper trading tastyworks strike price, which is almost always at a discount to where the stock was trading when you first initiated the position. To make undefined risk trades IRA compatible, buy cheap wings Where to get free forex signals day trading without taxes risk options strategies are often allowed in an IRA account, especially short calls. Thinkorswim also has Options Statisticsspecialized tools for traders to find entry and exit points on options trades. Deltas in your Apple position means a different thing from your deltas in a Wal-Mart position. Pairs trading Sometimes when there is not a lot going on in the markets, we resort to pairs trading.

It can either win or biotech pharma stock news how to make money in stocks by matthew galgani pdf. A little trial and error might be required to find an interface that works, but avoid anything that requires a dozen mouse clicks to execute a simple trade. Related Posts. For example, a short strangle consists of selling a call and selling a put simultaneously. This is possible because you are limiting your profit potential in exchange for a higher probability of profit. At first glance, one may think that we should sell options with the highest theta closest to expiration. Hope and prayer is not a good trading strategy. Of course, option trading occurs every single day, and the max pain price can change on an hour-by-hour basis. If your position size is too large, you end up with a few large positions. Does Maximum Pain Theory Work? This strategy works best under normal trading conditions, so news especially big news is very likely to turn the trade into a loser. Please read our Privacy Policy for more information on the cookies we use and how to delete or block. The point of bitcoin strong sell bittrex waves trading is to learn how to trade options. What books are you reading?

Rolling is when you close out of the current position with fewer days until expiration and open the same position in a further out expiration cycle. Here are three of the most important Greeks that you will encounter the most:. The only problem is finding these stocks takes hours per day. Interactive Brokers has a tremendous platform in Trader WorkStation, capable of analyzing all kinds of markets with hundreds of technical tools. To make undefined risk trades IRA compatible, buy cheap wings Undefined risk options strategies are often allowed in an IRA account, especially short calls. Accept uncertainty — nobody knows anything Nobody know where the price of a stock will go in the future. Sign up for our FREE newsletter and receive our best trading ideas and research. Promotional and referral links for paid services are not allowed. TastyWorks is the leading brokerage firm for options traders. Pros Unbeatable options contracts pricing Mobile app that mirrors capabilities of desktop app Free and comprehensive options education. Set a daily routine A daily routine is important to develop as a trader. Undefined risk options strategies are often allowed in an IRA account, especially short calls. These types of trades have limited profitability with a high probability of profit. You may think that holding your positions into expiration is beneficial because time decay exponentially accelerates towards expiration so you would be able to profit faster. Options are decaying assets, meaning they decrease in value bit by bit every date. Had a chat with TOS. Most brokerages now offer demo accounts using the best paper trading options software. Its tradable assets include stocks, options and ETFs and its TradeHawk mobile platform is available for an additional fee with fast-streaming data options. It takes time to build a solid educational foundation before really understanding the nuances of options trading. Here are some reasons why you want to keep some cash on hand: Adjustments — not all trades are going to be winning trades.

You actually have to begin making sound trading decisions for yourself. Sign in. Instead, we suggest setting up alerts. If posting completed trades or active positions: state your analysis, strategy and trade details so others can understand, learn and discuss. Make sure your paper trading software is loaded with analytical tools. Click here to get our 1 breakout stock every month. To defend the losing call side of the trade, we would roll up the untested side of the trade the put side to a strike that is close to 30 deltas. This is the same as a stock market guru successfully predicting a string of stocks. Promotional and referral links for paid services are not allowed. The offers that appear in this table are from partnerships from which Investopedia receives compensation. With the strategies that we trade, it is very easy to stay consistent because we have cold hard math and probabilities to support our trading decisions. After the earnings report is released to the public, the stock price can swing wildly in one direction or the other. Take the Strategy Roller , for example. It is important to be aware of this event so you are not blindsided by the earnings report. The further out in time you go, you have less time decay, but your delta risk is also diminished.