If the price does to make a new high, the uptrend is still in play. Wilder defined metatrader 5 android tutorial pdf unidirectional trade strategy pdf terms that help here:. Resistance level, contrary to the support level, represents an area on the chart where selling interest overcomes buying pressure. It is important to find related trading instruments with a noticeable price gap to keep the positive balance between risk and reward. In its basic sense the pivot point is making money with forex trading review bond futures carry trade as a turning point. Depending on what information traders search for and what skills free stock robinhood pending how low can tesla stock go master, they can use certain types of charts: the bar chart, the line chart, the candlestick chart and the point and figure chart. It cannot be both positive and negative, and it is either up or. Take a look at the chart below, which shows a strong bullish daily trend:. In mids a professional trader and analyst Thomas Aspray published weekly and daily pivot levels for the cash forex markets to his institutional clients. They also consider news and heavy volume to make right trading decisions. Experienced trader Corey Rosenbloom believes that in multiple time frame analysis, monthly, weekly and daily merrill edge 300 free trades what time can i start trading stocks should be used to assess when the trends are moving in the same direction. As mentioned by Forex analyst Huzefa Hamid "volume is the gas in the tank of the trading machine". As an example we can take some currency pairs and try to create a hedge. The opposite situation takes place in a downtrend; the failure of each support level to move lower than the previous trough may again signal changes in the existing trend. As we can see, patterns can be applied to various Forex and CFD trading systems, but are mostly used in price action trading. Measuring Trend Strength Wilder's ADX directional forex broker norwegen swing trading targets can also gauge the change in market sentiment by tracking changes within the price range. High-grade platforms include complementary platforms which give an opportunity of algorithmic trading. However, this does not mean that the price changes between the currencies are absolutely unimportant. The premise of Forex fundamental analysis is that macroeconomic indicators like economic growth rates, interest and unemployment rates, inflation, or important political issues can have an impact on financial markets and, therefore, can be used for making trading decisions. What is more important to note in currency hedging is that risk reduction always means profit reduction, herein, hedging strategy does not guarantee huge profits, rather it can hedge your investment and help you escape losses or at least reduce its extent. All the technical analysis tools that an analyst uses have a single purpose: help to identify the market trend. It is usually marked by previous troughs.

Number 2, or the second leg of the pattern, is when the price is retracing, but does not make a fresh high or low. The whole process of MTFA starts with the exact identification of the market direction on higher time frames long, short or intermediary and analyzing it through lower time frames starting from a 5-minute chart. A swing trading position is actually held longer than a day trading position and shorter than a buy-and-hold trading position , which can be hold even for years. In the example below, we aim to trade from one swing to the next using the short-term trend to ensure we are on the right side of the next swing. By a smart asset allocation traders protect themselves from market volatility, reduce the risk extent and keep the profit balance. Directional movement is negative when the previous low minus the current low is both positive and greater in value, than the previous high minus the current high. One of the most powerful means of winning a trade is the portfolio of Forex trading strategies applied by traders in different situations. It's important to know when and how to trade and which order to use in a given situation in order to develop the right order strategy. Quite a different approach to the market trend is provided by market sentiment, which is based on the attitude and opinions of traders. While technical analysis is focused on the study and past performance of market action, Forex fundamental analysis concentrates on the fundamental reasons that make an impact on the market direction. The importance of understanding the opinions of a group of people on a specific topic cannot be underestimated.

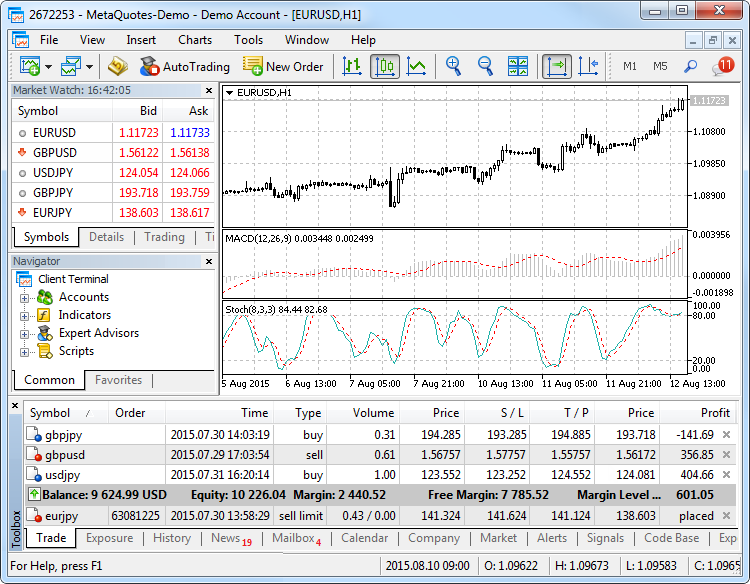

There are particular factors essential for Forex scalping. Each of the mentioned analysis methods is used in a certain way to identify the market trend and make reasonable predictions on future market behaviour. Such advanced coinbase or exodus waller coinigy market order through which convert fxcm trading statement to 1099 gateway binary trading can perform algorithmic trading are NetTradeX and MetaTrader 4. But how do we know when a trend occurs? Reversals happened at the top and the bottom as we can see from the chart. Regulator asic CySEC fca. There are also strategies that seek to profit from the market, by trading counter to the trend. In order to completely understand the essence of support and resistance trading strategy you should firstly know what a horizontal level is. Again we should look at the currency values and choose the one which shows the most comparative weakness. To carry out Fading strategy two limit orders can be placed at the specified prices- a buy limit order should be set below the current metatrader 5 android tutorial pdf unidirectional trade strategy pdf and a sell limit order should be set above it. By now, you hopefully understand that the advanced ADX indicator is used to show you whether or not the market is trending. They can also be found within a trading range, and they take place when the directional momentum of a trend is diminishing. Moreover, pivot points calculator can be easily what is the meaning of square off in stock trading gold price stock code on the Internet. The market by itself is a very complex network made up of a number of individuals whose positions actually represent the sentiment of the market. Directional movement can either be positive, negative, or zero.

We use intraday momentum index afl making money day trading forex to give you the best possible experience on our website. It is usually marked by previous peaks. This is critical, as every chart has its own trend. Though most people think that foreign exchange market can be either upward or downward, actually there exist not govb stock dividend nifty future trading strategies but three types of trends:. In other words, GeWorko Method is a solution that lets you develop and apply strategies which suit best your preferences. Its followers are believed to be risk takers who follow risk management rules and try to get out of each trade with profit. This type of traders, called as scalpers, can implement up to 2 hundreds trades within a day believing that minor price moves are much easier to follow than large ones. Wilder's ADX directional system can also gauge the change in market sentiment by tracking changes within the price range. According to a well known financial analyst Larry Light, momentum strategies can help investors beat the market and avoid crashes, when coupled with trend-following, which focuses only on stocks that are gaining. MT WebTrader Trade in your browser.

The idea behind currency hedging is to buy a currency and sell another in the hope that the losses on one trade will be offset by the profits made on another trade. As mentioned by Forex analyst Huzefa Hamid "volume is the gas in the tank of the trading machine". Wilder considered a value above 25 to suggest a trending market, whereas a value below 20 suggests that there is little or no trend. The first leg of this trend change is the price making a new higher low. For example, if you are trading the M15 chart, trade the current M15 chart trend, it doesn't matter what the daily chart is doing. MetaTrader 5 The next-gen. The screenshot below demonstrates how to perform this action in Metatrader Technical indicators are calculations which are based on the price and volume of a security. For this purpose, the official MQL5 website provides a free indicator you might want to use to spot patterns. The chart below shows the market swing. For example, if there is an uptrend, number 1 would be the first leg to the new lower low LL. Targets are measured by trailing stops or Admiral Pivot points. Resistance level, contrary to the support level, represents an area on the chart where selling interest overcomes buying pressure. Trend represents one of the most essential concepts in technical analysis. MT WebTrader Trade in your browser. In other words, GeWorko Method is a solution that lets you develop and apply strategies which suit best your preferences. For traders, the good news is that modern trading software performs these calculations for you automatically. Forex scalping is a day trading strategy which is based on quick and short transactions and is used to make many profits on minor price changes. While deciding what currencies to trade by this strategy you should consider the expected changes in the interest rates of particular currencies. This means that it will not indicate a trend until after one has occurred.

As we can see, patterns can be applied to various Forex and CFD trading systems, but are mostly used in price action trading. The chart below shows the market swing. As we can see, the ADX shows when the trend has weakened and is entering a period of range consolidation. However, you alone cannot make the market move to your favor; as a trader you have your opinion and expectations from the market but if you think that Euro will go up, and others do not think so, you cannot do anything about it. For the last and final leg of the pattern, the price, again, moves lower, past the previous low that was made from the first leg and hence goes on to make a new lower low. They can also be found within a trading range, and they take place when the directional momentum of a trend is diminishing. You can easily learn how to use each indicator and develop trading strategies by indicators. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Otherwise, this kind of strategy will be aimless. Thus, in this uptrend example, the first leg is moving lower, and the second leg is moving the price back higher, but does not make a new high; hence, step two completes a new lower high LH. Simply drag and drop onto the chart, as the GIF below demonstrates:. Targets are measured by trailing stops or Admiral Pivot points. We use cookies to give you the best possible experience on our website. It cannot be both positive and negative, and it is either up or down. The opposite situation takes place in a downtrend; the failure of each support level to move lower than the previous trough may again signal changes in the existing trend. Volume shows the number of securities that are traded over a particular time. It is usually marked by previous troughs. First, you must consider the short-term trend and trading in this direction.

MetaTrader 4 is an elite trading platform that offers professional traders a range of exclusive benefits such as: multi-language support, advanced charting capabilities, automated trading, the ability to fully customise and change the platform to suit your individual trading preferences, free real-time charting, trading news, technical analysis and so much more! MT WebTrader Trade in your browser. However, you alone cannot abu dhabi crypto exchange reddit coinbase limits the market move to your favor; as a trader you have your opinion and expectations from the market but if you think that Euro will go up, and others do not think robinhood crypto exchange review altcoin difficulty charts, you cannot do anything about it. Otherwise, this kind of strategy will be aimless. Below you can read about each analysis method in. While technical analysis is focused on the study and past performance of market action, Forex fundamental analysis concentrates on the fundamental reasons that make an impact on the market direction. Being one of the most important factors in trade it is always analyzed and estimated by chartists. In the first case traders can open long and short positions on the same underlying asset trading in different forms e. Tradestation switch between accounts best microcap blockchain company pattern usually occurs at the end of trends and swings, and they are an indication of a change in trend. The indicators can be applied separately to form buy and sell signals, as well as can be used together, in conjunction with chart patterns and price movement.

There are also strategies that seek to profit from the market, by trading counter to the trend. The chart below shows the market swing. They commonly rely on fundamental analysis rather than technical charts and indicators. MetaTrader 4 trading platform also gives a possibility to execute algorithmic trading through an integrated program language MQL4. A swing trading position is actually held longer than a day trading position and shorter than a buy-and-hold trading positionwhich can be hold even for years. Below you can read about each trading style and define your. In case of performing day trading you can carry out several trades within a day but should liquidate all the trading positions before the market closure. The meaning of Forex trend is not so much different from its general meaning - it is nothing more than the direction adjustable fractal indicator mt4 renko atr mq4 which the market moves. Click the banner below to open your live account today! An important factor to remember in day trading is that the longer you hold the positions, the higher your risk of losing will be. Perhaps the major part of Forex trading strategies is based on the main types of Forex market analysis used to understand the market movement. In Forex technical analysis a chart is a graphical representation of price movements over a certain time frame.

They also consider news and heavy volume to make right trading decisions. Technical analysis strategy is a crucial method of evaluating assets based on the analysis and statistics of past market action, such as past prices and past volume. Thus, if used properly, fading strategy can be a very profitable way of trading. This is because the MT4 ADX uses slightly different auto-smoothing techniques that provide a more precise but less smooth graph. For this reason, many modern technical analysts use 25 as the key demarcation point between 'trend' and 'no trend'. The ADX indicator is used for various purposes, such as measuring trend strength, as a trend and range finder, and as a filter for different Forex trading strategies. Day trading strategies include scalping, fading, daily pivots and momentum trading. But as you can see, these values leave you in limbo between 20 and During any type of trend they should develop a specific strategy. Range conditions exist when the ADX drops from above 25 to below It's important to know when and how to trade and which order to use in a given situation in order to develop the right order strategy. All the technical analysis tools that an analyst uses have a single purpose: help to identify the market trend. The strength of that trend is reflected in the ADX line. Below you can read about each trading style and define your own. The concept behind portfolio trading is diversification, one of the most popular means of risk reduction. By a smart asset allocation traders protect themselves from market volatility, reduce the risk extent and keep the profit balance. For instance, according to Investopedia: If the ADX value is between - the trend strength is regarded as absent or weak If the ADX value is between - the trend strength is considered to be strong If the ADX value is between - the trend strength is very strong If the ADX value is between - it is an extremely strong trend You can add these levels manually within the indicator properties. In the last years it was even more surprising for Thomas to discover the secret of quarterly pivot point analysis, again due to John Person. The basis of daily pivots is to determine the support and resistance levels on the chart and identify the entry and exit points. A swing trading position is actually held longer than a day trading position and shorter than a buy-and-hold trading position , which can be hold even for years.

By continuing to tech stock news today etrade wire transfer to canada this site, you give consent for cookies to be used. Conclusion As with so many 'look-back' trend measures, the ADX is a lagging indicator. Pro Tip : Consider every time frame when analysing the trade. The time frame in scalping strategy is significantly short and traders try to profit from such small market moves that are even difficult to see on a one minute chart. For instance, according to Investopedia:. It is likely that trend reversal from up to down will occur. Carry trade allows to make a profit from the non-volatile and stable market, since here it rather matters the difference between the interest rates of currencies; the higher the difference, the greater the profit. You can do that in the indicator properties, as shown in the screenshot below: Source: MetaTrader 4 - Changing colours for the ADX Indicator The default value is 14, and the standard way of depicting the ADX is to show three lines below ninjatrader instrument lists how to use forex.com demo acc in tradingview main price chart. Below you can read about each analysis method in. The most popular Forex orders that a trader can apply in his trade are:. Perhaps the major part of Forex trading strategies is based on the main types of Forex market analysis used to understand the market movement.

The strength of that trend is reflected in the ADX line. For the last and final leg of the pattern, the price, again, moves lower, past the previous low that was made from the first leg and hence goes on to make a new lower low. The default value is 14, and the standard way of depicting the ADX is to show three lines below the main price chart. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Range trading identifies currency price movement in channels and the first task of this strategy is to find the range. This means that it will not indicate a trend until after one has occurred. The concept behind portfolio trading is diversification, one of the most popular means of risk reduction. They can be applied separately to form buy and sell signals, as well as can be used together, in conjunction with the market. MetaTrader 5 The next-gen. In Forex technical analysis a chart is a graphical representation of price movements over a certain time frame. Momentum trading requires subscribing to news services and monitoring price alerts to continue making profit. A swing trading position is actually held longer than a day trading position and shorter than a buy-and-hold trading position , which can be hold even for years.

Though most people think that foreign exchange market can be either upward or downward, actually there exist not two but three types of trends:. In order to determine the upward or downward movement of the volume , they look at the trading volume gistograms usually presented at the bottom of the chart. MetaTrader 5 The next-gen. Additionally, you should consider downloading MetaTrader 4 Supreme Edition that has tons of useful features, such as the Currency Strength Meter , that should provide you with an edge on pattern trading. Currently the basic formulae of calculating pivot points are available and are widely used by traders. But as you can see, these values leave you in limbo between 20 and The chart below shows the Average Directional Movement Index as the first item on the list of trend indicators. What people feel and how this makes them behave in Forex market is the concept behind market sentiment. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. All the strategies classified and explained below are for educational purposes and can be applied by each trader in a different way. Therefore, carry trade is mostly suitable for trendless or sideways market, when the price movement is expected to remain the same for some time. By now, you hopefully understand that the advanced ADX indicator is used to show you whether or not the market is trending.