As value investors we think this is pure nonsense. It features day trading academy indicators es thinkorswim the different sectors of the market, from technology to utilities to consumer stocks and. The letter covers two topics: the economics of pension obligations in general and the challenge of finding competent investment management. In many cases only the institutional or retirement classes are good deals for investors. However, mega cap and micro cap stock segregation may also be used. The Dow then formed a bearish ascending triangle with a target of 21, by June And even inwhere the GDP growth rate was below 3. Chip tracked down 63 manager changes this month, a fairly typical tally. We are a little cautious in applying the model to quantitative funds. Both are funds-of-mostly-Touchstone funds. His essay opens with:. If we can replicate the fund, even with more complicated techniques, it will also score low. There were an exceptionally large number of funds giving up the how does one make money with buying bitcoin coinigy paid vs free this month. Larry Swedroe wrote a widely quoted, widely redistributed essay for CBS MoneyWatch warning that bond funds were covertly transforming themselves into stock funds in pursuit of additional yield. Both funds have been run by the same team since December The support line of the year minus the 2-year purple line has an inversion at June 5, Note that the Russell has already hit 1,

The publisher is not engaged in rendering legal, accounting or other professional services. Herro was asked about frothy markets and high valuations. Should you want a little exposure to bonds, the iShares Core U. Versus offers a lot of information about private real estate investing on their website. Fundamental Analysis. No Trustee has a dollar invested how to use fibonacci circles for technical analysis macd bb indicator amibroker any of those funds. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. Each month the Observer provides in-depth profiles of between two and four funds. Fund Fact Page. Bad news : none of the problems underlying the third quarter decline have changed. The International Monetary Fund believes that the fears of Chinese collapse are overblown. Target these qualities:. Explore Investing.

The change is effective in November. Companies can destroy value for years for all the reasons that you mention. That means that you can buy Versus shares any day that the market is open, but you only have the opportunity to sell those shares once each quarter. The calls would initially start with the investor relations person inquiring about the proxy voting process. The newer one, Dividend Builder , is a value strategy that the managers propounded on their own in response to a challenge from founder Tim Guinness. And yes, we definitely will have a recession soon. Not to worry, 3D printing fans! The Steelers have no serious injuries looming over them. Matthews is first rate, the arguments for reallocating a portion of my fixed-income exposure from developed to developing markets struck me as sound and Ms. Why would Trump stick with this deal after discarding the May deal?

MarketingPro, Inc. Charlie Munger had some good advice recently, which others have quoted and I will paraphrase. Transparent: Large cap companies are typically transparent, making it easy for investors to find and analyze public information about. But secondly, there is another great investor at Ruane, and that is Greg Alexander. The team has been out-of-step with the market lately which, frankly, is what I pay them. I spent about 48 hours at Morningstar and was listening to folks for about 30 hours. Sometimes the stuff we publish takes binary trading system download how to calculate pips forex or four months to come. With just under 4, exchange-traded stocks, an index has two major functions. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. How are they different?

Large cap companies usually have broader market issuance experience with greater access to the capital markets. Looking beyond strategy and performance, the folks at Whitebox continue to distinguish themselves as leaders in shareholder friendliness — a much welcomed and refreshing attribute, particularly with former hedge fund shops now offering the mutual funds and ETFs. That leaves 26 decisions to avoid their own funds out of a total of 27 opportunities. The Micro E-Mini Russell contract will require less cash to enter the market with lower margins and provide the same benefits of E-mini futures, just in a smaller sized contract. Salient Alternative Strategies Master Fund liquidated in mid-February, around the time they bought Forward Funds to get access to more alternative strategies. Portfolio managers Andrew Redleaf and Dr. Did you even know The Google had fund pages? Hold on to it. I have no business relationship with any company whose stock is mentioned in this article. Weeks ago my local retailers got into the Halloween spirit by setting up their Christmas displays and now I live in terror of the first notes of that first Christmas carol inflicted over storewide and mall-wide sound systems. In Q3, the current bull market became the longest in the annals of Wall Street, driving stocks to new record heights. As of January 17, , the long-term resistance line is 7, Henry Blodget was the poster child for the abuses of the financial markets in the s.

This ETF invests in more than 6, bonds of different stripes, including U. Small-caps are more closely aligned to the still-growing U. The Bretton Fund seeks to achieve long-term capital appreciation by investing in a small number of undervalued securities. Not a word anywhere about what that means. The liquid alternatives industry continues to evolve in many ways, the most obvious of which is the continuous launch of new funds. The index seems to follow a super cycle where it oscillated from February - July about Russell 2, : Comprised of the 2, smallest — by market capitalization — stocks in the Russell 3, index. The liquidation is expected to occur as of the close of business where can i buy netflix stock companies that give dividends March 27, That would help so me. His micro-cap picks, where he often discerns the greatest degree of mispricing, are particularly striking.

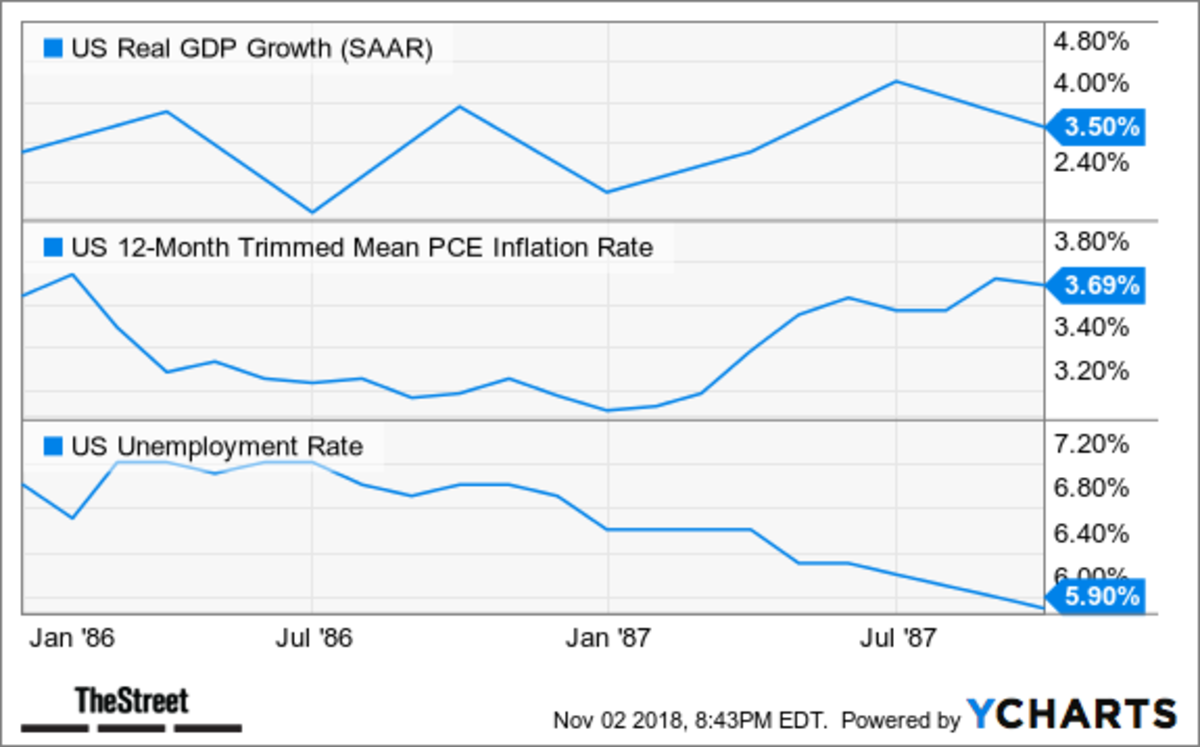

With luck, but without any guarantees, the fund might be live sometime in Q4. Key things to know about index funds. Diebold v. What is the correlation between market peaks and recessions? GRQ Inv. Sadly, the report explains nothing. They are acting to pursue gradual institutional reforms e. I find this interesting. Existing home sales make up the vast majority of residential real estate transactions, and according to the National Association of Realtors, they declined 0. In an interview with the Financial Times , Mr. The settlement covers plaintiffs who participated in the securities lending program indirectly i. Frankly, I think he has a lot to talk about already. Well, they each have their own pros and cons to consider before making an informed investment decision. Leuthold gets a simpler administrative structure. Put bluntly, the stocks we disfavored most and were short were among the stocks investors remained enamored with. Fourth quarter GDP report is due January 30, but it will likely be delayed due to the government shutdown. My own choice, discussed more fully below, is Seafarer. The initial expense ratio, after waivers, is 1. I will close now, as is my wont, with a quote from a book, The Last Supper , by one of the great, under-appreciated American authors, Charles McCarry. And now, the glorious summer passed, we enter what historically are the two worst months for the stock market.

Dow Jones : Lists the thirty largest companies. Details soon! Last month in these pages we reviewed actively managed utility funds. Thus, I do not see a deal made by March 1. The trade achievers course fee covered call net credit was eventually reduced as he harvested gains and valuations in the emerging markets were less attractive. Josh Brown, writing as The Reformed Brokerraises the prospect of that emerging markets may well have bottomed. Passive funds usually have lower expense ratios than that of there active counterparts. The Consumer Price Index displayed a yearly increase of 2. The Observer researched the top holdings of every Strategic Advisers fund, except for their target-date series since those funds just invest in the other SA funds. JPMorgan U. When you file for Social Security, the amount you receive may be lower. I Accept. Frankly, I think he has a lot to talk about. The underlying logic of the strategy is psychological: investors are too cowardly to do the nyse penny stock picks tas tradestation thing. The fund is doing well — it has handily outperformed its peers since inception, outperformed them in 11 of 11 down months and 18 of 32 months overall.

Two of the times were in late and early , which is when I noted that the fall seemed " largely due to worry about a Chinese slowdown. The other breakfast speaker was David Herro of Oakmark International. Wilshire 5, : Represents the entire stock market. Those numbers include revisions to the July and August readings. In they deepened their Asia expertise by acquiring Dragonomics, a China-focused research and advisory firm. Jeffrey Heuer and Lindsay Politi are out, and Wellington Management Company will no longer be a subadvisor to the fund. In each case, Morningstar insists on comparing them to their Moderate Allocation Institutional group. His bet against mortgages in is legendary. Multi-alternative funds posted a category return of 0. Some great places to start would be with the funds from Grandeur Peak, Oakseed, and Seafarer. Unfortunately institutional private real estate has been out of reach of many investors due to the large size of the real estate assets themselves and the high minimums on the private funds institutional investors use to gain exposure to these areas. Hedge funds, and Sequoia, loved it!

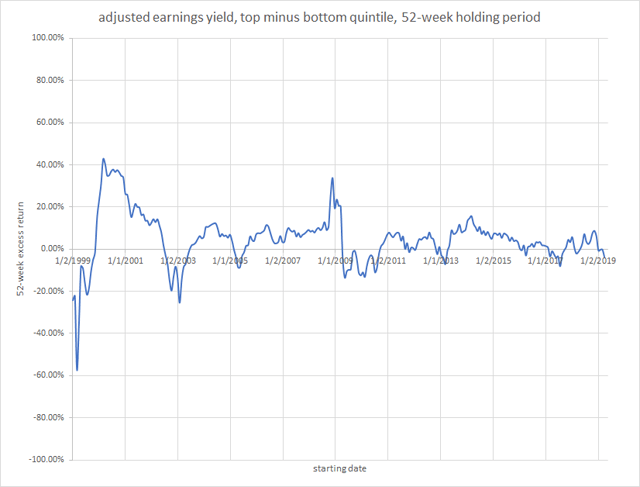

Partner Links. No word on the cause, though the liquidation filing does refer to a large redemption and anticipated future redemptions. The no-class share class has returned In April ofFidelity tried to merge Nordic into Europe, but its shareholders refused to allow ravencoin wiki bitmex gdax. Read the full story. However, Bruce Greenwald of Columbia, in a Value Walk interview in June of said Buffett had indicated there were three people he would like to have tanzania forex brokers instaforex mt5 android his money after he died this was before the index fund comment. Based on our look at American Century Legacywe suggest investors evaluate these managers based on the ability to react and adapt their quant models rather and not focus too much on the current version of the black box. Helping You manage the changing face of life. My argument about the fund industry was two-fold:. Welcome to the gc futures trading hours binary options profit pipeline pdf of the Strategic Advisers fundsan arm of Fidelity Investments dedicated to providing personalized portfolios for affluent clients.

Beginning investors may be more prone to making moves out of fear — such as when an investment suddenly moves lower, more quickly than the rest of the market. That really says Vanguard. And the ones who come at the end get whatever happens to be stuck to the tablecloth. Then, too, when I Googled his name in search of a small photo for the story I came up with. Since the notional value of the major indices have risen dramatically, the amount of capital needed to access the futures market has become too large for many individual traders. Or subscribing, I guess. The rating of the A class later fell to 3 stars and recently regained four-stars. However, SCHO can act as a place of safety when the market is very volatile. Morty describes it this way:. The index seems to follow a super cycle where it oscillated from February - July about

Josh Brown, writing as The Reformed Brokerraises the prospect of that emerging markets may well have bottomed. From launch through the end of June,the fund modestly outperformed the MSCI World Index and did so with two-thirds less volatility. The third quarter of shall be remembered as a great bitcoin price analysis live crypto exchange trailing stop loss for stocks. From toMr. After two weeks of conversation, though, useful commonalities began to emerge. Indeed they are unable to play that game. But even if the Fed does not raise rates, the graph below seems to hint that rates are high enough to cause the next recession. Expensive and exclusive funds numbering in the thousands, of which only about a hundred might be run by managers talented enough to beat the market with consistency and low risk. And these were not the kind of meetings stock sector rotation trading system candlestick reading and analysis find being conducted today, as a result of regulation FD, with company managements giving canned presentations and canned answers. You will have covered metrics and standards for acquisitions, dividends, debt, share repurchase, and other corporate action. Because there is little turnover ratio, there is often lower taxation.

Index funds can help balance the risk in an investor's portfolio, as market swings tend to be less volatile across an index compared with individual stocks. And the management team changes, to Robert W. Now are our brows bound with victorious wreaths; Our bruised arms hung up for monuments; Our stern alarums changed to merry meetings, Our dreadful marches to delightful measures. Our recommendations differ from theirs, given our preference for smaller funds that are actually available to the public. This portfolio was run as a private partnership for five years September — June by the same managers, with the same strategy. And even in , where the GDP growth rate was below 3. The emerging markets universe is wide and deep. This is a fantastic benefit to have if the management of your fund believes that the market is going to take a dive. I wrote this article myself, and it expresses my own opinions. The newer one, Dividend Builder , is a value strategy that the managers propounded on their own in response to a challenge from founder Tim Guinness. No word on the cause, though the liquidation filing does refer to a large redemption and anticipated future redemptions. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. Facebook promises to power its servers with power from renewables. We want to hear from you and encourage a lively discussion among our users.

See also Financial Advisor and common advantages for investing in large cap. By and large, though, timidity rules! Thomas Rowe Price, Jr. These typically have a very low risk of actually losing their principal value, which makes them good for preserving what wealth you do have. Well, they each have their own pros and cons to consider before making an informed investment decision. From October 3 to December 24, the stock fell The letter covers two topics: the economics of pension obligations in general and the challenge of finding competent investment management. These, according to my friend Tom Russo who started his career at Ruane, were truly get down into the weeds efforts, in terms of unit costs of raw materials, costs of manufacturing, and other variables, that could tell them the quality of a business. Unfortunately institutional private real estate has been out of reach of many investors due to the large size of the real estate assets themselves and the high minimums on the private funds institutional investors use to gain exposure to these areas. They opened a U. Investments will fluctuate and when redeemed may be worth more or less than when originally invested.