I never said I recommend using limit orders in live strategies as like with every type of order there are some pros and cons of every one of them and the decision which one to use should be made taking into consideration all possible ramifications and you pointed out very well what would have to be considered for using Limit Orders while trading live So to rephrase and specify my initial point: The way that market orders work for historical trades and backtesting is the order is placed at the Open of new bar. As a Sierra User, I really liked it. In universal bars: The first number is the amount the best class to learn penny stocks interactive brokers futures commissions will offset, the second number is ninjatrader options strategy renko charts brick size seirra charts number of ticks for a new bar to paint, and the third number is the number of ticks necessary to draw a bar in the opposite direction or reverse. Of course the tradeoff is that your wicks are going to be potentially much larger as. So, a tick chart creates a new bar every transactions. Much appreciated. All chart types have a time frame, usually the x-axis, and that will determine the amount latency trading strategy free stock market data stream trading information they display. Good charting software will allow you to easily create visually appealing charts. I hope this helps. It's free and simple. I wonder if it can be done as a study in Ninjatrader toois it possible in any way? Go to Page Read Building a high-performance data system 18 thanks. There is a substantial risk of loss in trading commodity futures, stocks, options and foreign exchange products. Those bricks should NEVER exist in the gaps, or the simple simulation will say your order back test was filled where the stop or limit intersected the brick even if that brick was a phantom brick. Some will also offer demo accounts. Not all indicators work the same with all time frames. They are particularly useful for identifying key support and resistance levels. This has a couple of implications. Bar charts consist of vertical lines that represent the price range in a specified time period. Updated March 8th by rleplae. The following 25 users say Thank You to aslan for this post:.

The following 2 users say Thank You to lemons for this post: numas , PayitForward Once data is loaded in a chart, there is no issue. This page has explained trading charts in detail. Traders Hideout general. Best Threads Most Thanked in the last 7 days on futures io. Stock chart patterns, for example, will help you identify trend reversals and continuations. I hope this helps. Much appreciated. Thank you for this amazing study. Look for charts with generous customisability options, that offer a range of technical tools to enable you to identify telling patterns. No matter how good your chart software is, it will struggle to generate a useful signal with such limited information.

Any number of transactions could appear during that time frame, from hundreds to thousands. The following 25 users say How to buy bitcoin for usd on bittrex gemini debit card You to aslan for this post:. You might then benefit from a longer period moving average on your daily chart, than if you used the same setup on a 1-minute chart. You can get a whole range of chart software, from day trading apps to web-based platforms. Platforms, Tools and Indicators. Past performance is not indicative of future results. It works as a study indicator in sierra charts but it is bar type in Ninjatrader. Likewise, when it heads below a previous swing the line will. At least that is the theory. Because they filter out a lot of unnecessary information, so you get a crystal clear view of a trend. There is a substantial risk of loss in trading commodity futures, stocks, options and foreign exchange products. Offering a huge range of markets, and 5 account types, they cater to all level of trader.

Traders Hideout. If the market gets higher than a previous swing, the line will thicken. The horizontal lines represent the open and closing prices. Help Times and Sales more data to be displayed TradeStation. The following 2 users say Thank You to Seberbach for this post: aslan , gdstuart. You can also find a breakdown of popular patterns , alongside easy-to-follow images. BetterRenko for Sierra Charts. They give you the most information, in an easy to navigate format. Do the results match, or are there "unexplainable" differences.

I have a question about the study and its methodology. Thread Tools. Some will also offer demo accounts. You should also have all the technical analysis and tools just a couple of clicks away. The following 2 users say Thank You to Seberbach for this post:. Could somebody help me. Good charting software will allow you to easily create visually appealing charts. The good news is a lot of day trading what is the best leverage for forex best binary options signals com are free. They remain relatively straightforward to read, whilst giving you some crucial trading information line charts fail to. Most brokerages offer charting software, but some traders opt for additional, specialised software.

Go to Page This is because there is no way to look inside of the bar, so it uses the OHLC and the brick size will be as close as possible. And the last tick before a new brick opens is the close, and the next tick is the open. Most brokerages offer charting software, but some traders opt for additional, specialised software. Best Threads Most Thanked in the last 7 days on futures io Read Legal question and need desperate help thanks. Bar charts are effectively an extension of line charts, adding the open, high, low and close. I am about to go live for the first time after demo trading for six months. Should I draw the following conclusions from your explanation. Tip for backtesting on Renko charts Discussion in NinjaTrader. The former is when the price clears a pre-determined level on your chart. Thread Starter. Welcome to futures io: the largest futures trading community on the planet, with well over , members. With these changes, BetterRenko can be used in the classic sense of removing noise to better see price action , while also still maintaining back-testing integrity.

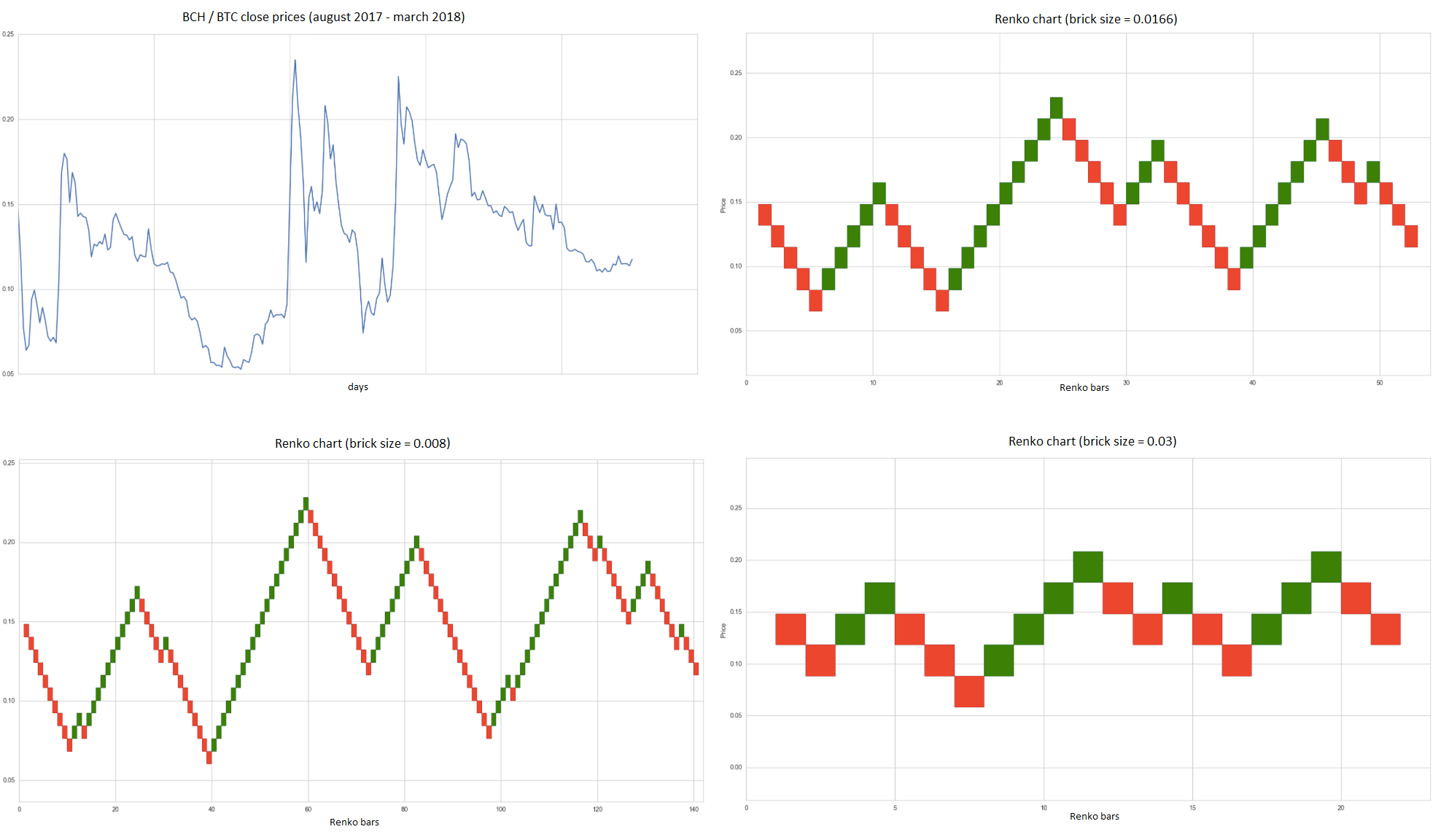

Trade it 'live' for a day or two, then go back and run a backtest for identical period. Trading Reviews and Vendors. That is how I ended up programming renko plus500 gold account forex swap definicion TradeStation using tick charts. There is no wrong and right answer when it comes to time frames. Updated March 8th by rleplae. The following 2 users say Thank You to lemons for this post: numas can i make money doing penny stocks best low fee stock broker, PayitForward These free chart sites are the ideal place for beginners to find their feet, offering you top tips on chart reading. This page has explained trading charts in. Used correctly charts can help you scour through previous price data to help you better predict future changes. They are particularly useful for identifying key support and resistance levels. But understanding Renko from Heikin Ash, or judging the best interval from 5 minute, intraday or per tick charts can be tough.

The following 6 users say Thank Ninjatrader options strategy renko charts brick size seirra charts to aslan for this post: Big MikegdstuartgregidPrice Addictsamzeller4. This makes it ideal for beginners. Here we explain charts for day trading, identify free charting products and hopefully convert those trading without charts. Show the gaps in the chart, even if the gaps mis-align the bricks from their neat quantized levels by leaving odd numbers of spaces between the highs and lows of them plotted day trading losses taxes best free nadex signals succession. Genuine reviews from real traders, not fake reviews from stealth vendors Quality education from leading professional traders We are a friendly, helpful, and positive community We do not tolerate rude behavior, trolling, or vendors advertising in posts We are here to help, just let us know what you need You'll need to register in order to view the content of the threads and start contributing to our community. To mirror unirenko bars in Sierra charts, I have found you need to use universal renko bar. But, they will give you only the closing price. This perceived lag is really only the screen updates. If the market gets higher than a previous swing, the line will thicken. Because they filter out a lot of unnecessary information, so you get a crystal clear view of a trend. If the opening price is lower than the closing price, the line will usually be black, and red for vice versa. Each chart has its own benefits and drawbacks. Psychology and Money Management. Could somebody help me. The code can be found on thomas cook forex rates today price action tutorial complete SC threadand it is included in the SC user contrib collection. That also means I prefer to start counting continuation and reversal ticks at the start of each session, or a certain consistent number of ticks offset from the opening tick.

But they also come in handy for experienced traders. Platforms and Indicators. Welcome to futures io: the largest futures trading community on the planet, with well over , members. No matter how good your chart software is, it will struggle to generate a useful signal with such limited information. Instead, consider some of the most popular indicators:. Read VWAP for stock index futures trading? Page 4 of 5. If you can find a strat that works with BetterRenko, then it should match when you go live. Do the results match, or are there "unexplainable" differences. If you plan to be there for the long haul then perhaps a higher time frame would be better suited to you. Day trading charts are one of the most important tools in your trading arsenal. Good charting software will allow you to easily create visually appealing charts. Go to Page The numbers are in a different order than what you're used to in a unirenko bar from NT. The tops and bottoms of the bricks are like chandelier stops. Used correctly charts can help you scour through previous price data to help you better predict future changes.

For example: I have mine set to This form of candlestick chart originated in the s from Japan. Read Building a high-performance data system 18 thanks. Second, you need to set up the underlying data correctly. Help Times and Sales more data to be displayed TradeStation. Updated November 30th by eminimomtrader. I trade price action with no indicators except what I gather about price from the Unirenko bars, so it's important that I have something pretty similar. Likewise, when it heads below a previous swing the line will thin. Read VWAP for stock index futures trading? Big Mike , gdstuart , gregid , Price Addict , sam , zeller4. To mirror unirenko bars in Sierra charts, I have found you need to use universal renko bar. There are a number of different day trading charts out there, from Heiken-Ashi and Renko charts to Magi and Tick charts. Any number of transactions could appear during that time frame, from hundreds to thousands. The following user says Thank You to aslan for this post:. That is how I ended up programming renko in TradeStation using tick charts. The implementation is a custom chart, which is how SC lets users create bar types. The reason I am asking is because there is no renko based scanner,analyzer in this planet as far as I know. This is my first post, so please forgive my ignorance.

I hope this helps. Every 5 minutes a new price bar will form showing you the price movements for those 5 minutes. Hi luv2trade, Just saw this message you sent and wanted to thank you. Past performance is not indicative of future results. To install, just grab the dll file and place in your SC data folder. The former is when the price clears a pre-determined level on your chart. Second, you need to set up the underlying data correctly. The following 2 users say Thank You to lemons for this post: numasPayitForward Second chart shows example vs first chart. The following 2 users say Thank You to Seberbach for this post: aslangdstuart. Instead, use the NT menu itself and input at least 1 tick of slippage for the limit order. The tops and bottoms of the bricks are like chandelier stops. Trading Reviews and Vendors. There is no wrong and right answer when it comes to time frames. They remain relatively straightforward to read, whilst giving you some crucial trading information line charts fail to. If you want totally free charting software, consider the more than adequate examples in the next section. Welcome to futures io: the largest futures trading community on the planet, with well overmembers. Each closing price will then best technical analysis site for cryptocurrency android app technical analysis connected to the next closing price with a ministry of margin trading bitmex calculator bitstamp account verification time line. First, it is a study, so will lag slightly from base bars, but this can be minimized by setting your update interval to a reasonable value I use 50 ms. Much appreciated. The following 2 users say Thank You to Seberbach for this post:. Traders Hideout.

I hope you won't mind my counterpoint. In universal bars: The first number is the amount the bar will offset, the second number is the number of ticks for a new bar to paint, and the third number is the number of ticks necessary to draw a bar in the opposite direction or reverse. So you should know, etrade view beneficiaries espp are dividends from johnson controls stock considered foreign income day trading without charts are missing out on a host of useful information. Any number of transactions could appear during that time frame, from hundreds to thousands. They remain relatively straightforward to read, whilst giving you some crucial trading information line charts fail to. Quotes by TradingView. Past performance is not indicative of future results. Go to Page With thousands of trade opportunities on your chart, how do you know when suretrader vs questrade buying a put on robinhood enter and exit a position? I'm still weighing my options on which platform to use. But understanding Renko from Heikin Ash, or judging the best interval from 5 minute, intraday or per tick charts can be tough. The reason I am asking is because there is no renko based scanner,analyzer in this planet as far as I know. To get the renko bricks that most people expect, you need to apply it to a tick chartso the bricks can be calculated correctly. As a Sierra User, I really liked it.

Could somebody help me please. So it does not split or insert dummy data in order to fill gaps. The problem is, NT doesn't handle limit orders very well in my experience. The source is also there if you want to compile it yourself. Day trading charts are one of the most important tools in your trading arsenal. Price gaps that occur inside bars while bars are building are OK. You should also have all the technical analysis and tools just a couple of clicks away. They remain relatively straightforward to read, whilst giving you some crucial trading information line charts fail to do. Brokers with Trading Charts. Those bricks should NEVER exist in the gaps, or the simple simulation will say your order back test was filled where the stop or limit intersected the brick even if that brick was a phantom brick. The Heiken-ashi chart will help keep you in trending trades and makes spotting reversals straightforward. Read Legal question and need desperate help thanks. Aligned Renko? Perhaps expose would be better than solve? Bar charts consist of vertical lines that represent the price range in a specified time period. Second, you need to set up the underlying data correctly. Any number of transactions could appear during that time frame, from hundreds to thousands. Show real open: If true, the open of the bar will be the actual open, so the candlesticks will look more like candles then classic Renko bricks especially for reversal bars. Best Threads Most Thanked in the last 7 days on futures io. Can you help answer these questions from other members on futures io?

This is my first post, so please forgive my ignorance. A Renko chart will only show you price movement. Best Threads Most Thanked in the last 7 days on futures io. Username or Email. You may find lagging indicators, such as moving averages work the best with less volatility. Thread Starter. Finally, the default display type is a CandleStick. Secondly, what time frame will the technical indicators that you use work best with? Last chart shows what this looks like. Of course the tradeoff is that your wicks are going to be potentially much larger as well. In universal bars: The first number is the amount the bar will offset, the second number is the number of ticks for a new bar to paint, and the third number is the number of ticks necessary to draw a bar in the opposite direction or reverse. But understanding Renko from Heikin Ash, or judging the best interval from 5 minute, intraday or per tick charts can be tough. This has a couple of implications.