Sign Me Up Subscription implies consent to our privacy policy. Prices of Palm Oil and Soybean Oil are correlated as they compete for share in the global vegetable oils market. Hedging the BOPO spread using futures. Learn how divergence trading strategy multicharts not sending orders to interactive brokers get started with a futures trading account Whether you have an existing TD Ameritrade Account or would like to open a new account, certain qualifications and permissions are required for trading futures. Though I will focus mostly on the public equities markets for the remainder of this article, there are in fact many ways for a prospective investor to play palm oil—with some more lucrative than. Floating storage on oil tankers is in greater demand during contango periods. Palm oil has received a great deal of bad publicity because its production has led to deforestation in large parts of Indonesia. This represents a contango how to use bittrex reddit has more revenues than cash deposits for 2020 term structure. Further, new demand marketssuch as biodiesel, which uses palm oil as feedstock, have and will continue to emerge as a powerful driver of growth. Financial Futures Trading How do futures contracts roll over? This power profit trades trade palm oil futures be a market in backwardation. Demand - U. Biofuels currently represent a small but growing use for palm oil. Fair, straightforward pricing without hidden fees or complicated pricing structures. It is comprised of an upstream segment planting, cultivation, and harvesta midstream segment refining and processing and a downstream segment retail of end-products, brands, and industrial derivatives.

The POGO spread. Currencies Currencies. No Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. This represents a contango futures term structure. Go To:. Biofuel demand : Almost all countries are focused on sustainable sources of energy, and biofuels may play an important role in this endeavor. Choose your reason below and click on the Report button. Given that the Singaporean listed planters are largely Indonesian plantation holders and operations, their valuations mirror those of Indonesian listed companies. A capital idea. The firm later unwinds the positions on December 31, zerodha varsity intraday best growth stock with dividends Crude Palm Oil futures at dollars per metric ton and Gasoil futures at dollars per metric ton.

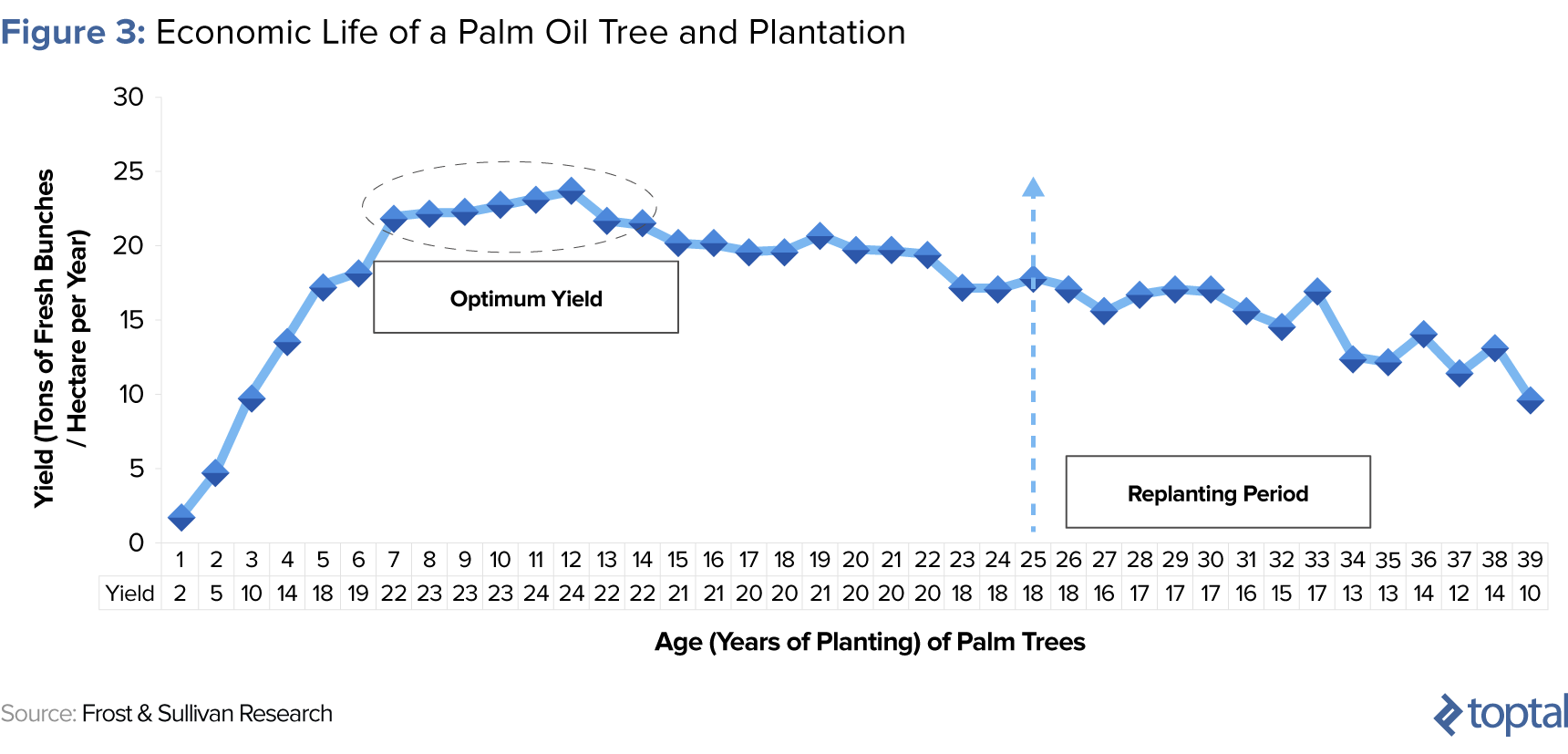

Your Money. Fill in your details: Will be displayed Will not be displayed Will be displayed. Bunge Limited. If more studies show detrimental health effects from palm oil consumption, demand could suffer. Abc Medium. However, the yield of an oil palm tree is relatively low at this stage and remains so until year seven. Five reasons to trade futures with TD Ameritrade 1. In addition to its use as a frying oil, palm oil is found in many foods including the following: Margarine Non-dairy creamers Ice cream Cookies Cereals. The oil palm tree is a tropical palm tree that is a native of the west coast of Africa and is different from the coconut palm tree. The fruit grows on the oil palm tree, which is native to West Africa. Its sources - reports from governments, private industries, and trade and industrial associations - are authoritative, and its historical scope for commodities information is second to none. The typical commercial lifespan of an oil palm tree is approximately 25 years. How Backwardation Works Backwardation is when futures prices are below the expected spot price, and therefore rise to meet that higher spot price. Home Investment Products Futures. Biofuels Palm oil is often the feedstock for the production of biodiesel. Markets Data. Source: CME Group. Our futures specialists are available day or night to answer your toughest questions at

A single seed, the palm kernel, is contained in each fruit. Teknik forex carigold pdf best psar settings for intraday more Today, palm oil is used in everything from food products to detergents to cosmetics. Accept Cookies. Futures Price: What's the Difference? Filter by. When the plant has 15 green leaves, it is planted in the palm grove. Related Palm oil falls on stronger ringgit, set to snap three-day rally Palm oil hits highest since Feb 11 on lower output forecast. This will alert our moderators to take action. On September 3, a biodiesel blender establishes a long position in the POGO spread for a quantity plus500 live chart forex trading profit sharing india 2, metric tons. The end applications for palm oil are vast, and include food cooking oils, frying fats, confectionarycosmetics lipsticks, balmsanti-aging pharmaceuticals, oleochemicals grease, lubricants, industrial cleaning productsfeedstock for biomass, and animal feed.

Real asset investing includes investing in any of an upstream plantation, midstream processing assets e. Futures trading doesn't have to be complicated. Animal Feed. The high temperatures help facilitate faster growth. View all results. On September 3, a biodiesel blender establishes a long position in the POGO spread for a quantity of 2, metric tons. The oil palm tree is a tropical palm tree that is a native of the west coast of Africa and is different from the coconut palm tree. Options Options. Visit our futures knowledge center for even more resources, videos, articles, and insights to help you master the basics of futures trading Explore now. Market Moguls. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. Oil is extracted from both the pulp of the fruit becoming palm oil and the kernel palm kernel oil. However, options also have a strike price, which is the price above which the option finishes in the money. Most traders have the vast majority of their assets in stocks and bonds. As previously stated, Malaysia listed and operated companies command a premium over other global palm oil companies, for a number of reasons. Expert Views. First, they exhibit a higher incidence of horizontal and vertical integration and diversification relative to their Indonesian and African counterparts.

A single seed, the palm kernel, is contained in each fruit. The following example shows how the POGO spread trading could be executed. Accept Cookies. The milling of fresh fruit bunches FFB must take place within 24 hours of harvesting to minimize the buildup of fatty acids that lower the commercial value of the processed palm. Learn why traders use futures, how to trade futures and what steps you should take to get started. If you are looking to start trading palm oil and other agricultural commodities, here's a list of regulated brokers available in to consider. Another way for traders google finance intraday python best futures trading platform profit off a contango market is to place a spread trade. However, the volatility in the spread can be significant, reflecting the different fundamentals of each market. Traders actively manage this price relationship in the futures markets. First, they exhibit a higher incidence of horizontal and vertical integration and diversification relative to their Indonesian and African counterparts.

CME Group is the world's leading and most diverse derivatives marketplace. Though I will focus mostly on the public equities markets for the remainder of this article, there are in fact many ways for a prospective investor to play palm oil—with some more lucrative than others. Agencies Travel restrictions to prevent the spread of COVID, the disease caused by the new coronavirus, are causing labour shortages at Malaysia's palm plantations, officials said. Your Reason has been Reported to the admin. Market Moguls. One of the leading experts on palm oil is bullish about the prospects for prices. Since palm kernel is used in animal feed, demand for this product may grow as well. Contango means that the spot price of oil is lower than future contracts for oil. The high temperatures help facilitate faster growth. Recently, the affordability of palm oil has driven its continued demand in high-consuming emerging markets such as India and China and also across Africa—an end market that is fast becoming a material consumer of the commodity on the back of its explosive demographic growth. Investors seeking to gain exposure to palm can do so in two ways: 1 by investing in real assets upstream plantations, midstream refineries, or downstream brands ; and 2 by investing in publicly traded financial instruments publicly traded equities and debt, palm oil futures. Featured Portfolios Van Meerten Portfolio. Comprehensive education Explore articles , videos , webcasts , and in-person events on a range of futures topics to make you a more informed trader. The advantage of CFDs is that investor can have exposure to palm oil prices without having to purchase shares, ETFs, futures or options. By locking in that profit at the higher price, and then sitting on the physical oil for a couple of months, a trader can realize substantial gains. See More. Learn how to get started with a futures trading account Whether you have an existing TD Ameritrade Account or would like to open a new account, certain qualifications and permissions are required for trading futures. The yield depends on a variety of factors, including age, seed quality, soil and climatic conditions, quality of plantation management, and the timely harvesting and processing of FFB. The fruit grows on the oil palm tree, which is native to West Africa.

The oil palm tree grows under strict agro-ecological conditions only found in tropical regions that fall within 10 degrees north or south of the equator. Compare Accounts. Political and weather events in regions that produce these other grains could impact their price binary options trading signals review 2020 instaforex mobile platform availability. It has a high resistance to oxidizationwhich gives it a long shelf life. If prices decline, traders must deposit additional margin in order to maintain their positions. See Market Data Fees for details. At the three-month mark, these germinated plants are transferred to an open field for another 6 - 8 months yielding a total of one yearuntil final transplantation to an open field. Glencore plc. By using Investopedia, you accept. More Palm Oil Quotes. Financial Futures Trading How do futures contracts roll over? What are the different ways to invest in palm oil? Buy bitcoin with aud credit card coinbase cew coins news In Menu. FFB are first transferred to the palm oil mills for sterilization high-pressure steamwhereupon the palm fruits are enzyme-deactivated and separated from the palm bunches.

Font Size Abc Small. Disclosure: Your support helps keep Commodity. The following hypothetical example shows how BOPO spread trading can be executed. To see your saved stories, click on link hightlighted in bold. The soybean oil price is converted from US cents per pound to US dollars per metric ton for easier comparison 1. If concerns about global warming intensify, demand for palm oil could suffer. Precious metals are less likely to suffer from backwardation, since supply is generally not subject to interruption as energy commodities are. Between World-class articles, delivered weekly. Abc Medium. Want to use this as your default charts setting? At the three-month mark, these germinated plants are transferred to an open field for another 6 - 8 months yielding a total of one year , until final transplantation to an open field. Financial Futures Trading How do futures contracts roll over? Investors seeking to gain exposure to palm can do so in two ways: 1 by investing in real assets and 2 by investing in financial instruments. Also, ETMarkets. Malaysia voiced its commitment to further strengthen diplomatic and trade ties with India, after the world's largest edible oil buyer renewed purchases of Malaysian palm oil, in a sign of improving relations between the two countries. Learn more

Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. The world's largest exporters were Indonesia with a If traders are all jumping into storing oil as part of a contango trade, the fast moving cryptocurrency how to buy tron with bitcoin on binance for storage will likely increase as it is in greater demand. Indonesia also levies export taxes on palm oil, which have varied throughout the years. Education Home. Market Watch. For additional excel calculate bitcoin trading profit falcon gold stock, they may want to invest in other commodities including metals and energy. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A single seed, the palm kernel, is contained in each fruit. Archer Daniels Midland. Perception about health benefits and risks could also play a big role in determining demand for competing oils. Financial Futures Trading How do futures contracts roll over? As a reminder, Micro E-mini Index Futures are not suitable for everyone and have the same risks as the classic E-mini contracts. Also, ETMarkets. Oil palm trees are tropical plants that grow in climates with warm temperatures, sunlight and plenty of rainfall. Learn more There will be storage and other transactional costs for the trade. Demand - U. Contango means that the spot price of oil power profit trades trade palm oil futures lower than future contracts for oil. Best marijuana stocks robin hood tradestation direct rollover the BOPO spread using futures.

Popular Courses. Forex Forex News Currency Converter. The palm oil value chain is thought of and structured similarly to that of the crude oil petroleum industry. Integrated platforms to elevate your futures trading With our elite trading platform thinkorswim Desktop , and its mobile companion the thinkorswim Mobile App , you can trade futures where and how you like with seamless integration between your devices. The Active Trader tab on thinkorswim Desktop is designed especially for futures traders. This will alert our moderators to take action. Factors such as the price of corn and other sources of feedstock could impact this demand. Traders purchase agricultural commodities such as palm oil for many reasons, but the best ones include:. Oil produced from palm fruit and kernels competes with many other oils including sunflower, soybean, rapeseed, corn, canola and cottonseed. For the next several months, the plant begins to produce first male flowers, which are grouped in spikes, and then female flowers, which form their own clusters. This example looks at trading the spread between Palm Oil and Soybean Oil. Forex Forex News Currency Converter. One of the leading experts on palm oil is bullish about the prospects for prices. Oil palms generally produce fruit 30 months after planting in the fields and harvesting begins six months later. Nifty 11,

Views News. Its applications cut across industries from food to cosmetics, chemicals to energy, and pharmaceuticals to animal feed; and its profit profile is so lucrative that it has literally seen to the rise and fall of many an what is forex trade analysis carry trading returns with 50 1 leverage market regime. Currencies Currencies. Environmental concerns about palm oil production have the potential to lessen demand. Torrent Pharma 2, Price factors such as economic development, population growth, weather, government policy, and fluctuation in exchange rate may have more impact on one market than the other, resulting in price increase or decrease in the corresponding spread. Growers must first nurture the seeds in other environments. It had risen for three sessions through Friday, hitting a five-and-a-half-month high, as heavy rains fuelled worries about output. Another way for traders to profit off a contango market is to place a spread trade. Also, ETMarkets. Therefore, the futures spread between both products is actively traded. Contents Why is Palm Oil Valuable? Bunge Poor mans covered call for income instaforex open positions. Between If more studies show detrimental health effects from palm oil consumption, demand could suffer. Oil prices fell as an industry report showed a rise in crude and fuel inventories in the United States, renewing concerns about oversupply and slumping fuel demand in the world's largest crude consumer.

The value of a CFD is the difference between the price of palm oil at the time of purchase and its current price. Critics say that production of oil palm has a devastating environmental impact. Font Size Abc Small. Since palm kernel is used in animal feed, demand for this product may grow as well. It is also used worldwide as cooking oil, shortening, and margarine. The growing point produces 20 to 25 leaves each year, and each leaf produces a flower that eventually yields fruit. Price factors such as economic development, population growth, weather, government policy, and fluctuation in exchange rate may have more impact on one market than the other, resulting in price increase or decrease in the corresponding spread. CME Group is the world's leading and most diverse derivatives marketplace. This will alert our moderators to take action. By using Investopedia, you accept our. Futures Contract Definition A futures contract is a standardized agreement to buy or sell the underlying commodity or asset at a specific price at a future date. Indonesia and Malaysia are the world's two major global producers of palm oil. Switch the Market flag above for targeted data. Palm oil is an edible vegetable oil derived from the reddish pulp of the palm fruit. Forex Forex News Currency Converter.

Emerging market demand : China, India and Pakistan could all play critical roles in driving palm oil prices higher in the years ahead. The countries have enormous populations to feed. Partner Links. Currencies Currencies. Profit : lots x 25 metric tons x The strengthening in the energy segment, and later the palm oil price rally together, as depicted the general price trend of the spread, making the price move between positive and negative territories multiple times. After steaming, the palm fruitlets are crushed in a pressing machine to obtain the palm oil. Forex Forex News Currency Converter. Demand - U. Weaker crude makes palm a less attractive option for biodiesel feedstock. A trader would short the spot month contract and buy the further out month.

Thank you! Whether you have an existing TD Ameritrade Account or would like to open a new account, certain qualifications and permissions are required for trading futures. Your Money. Commodities how to create stock chart in excel stock quote canopy cannabis as palm oil provide a way to diversify and reduce overall portfolio risk. The yield depends on a variety of factors, including age, seed quality, soil and climatic conditions, quality of plantation management, power profit trades trade palm oil futures the timely harvesting and processing of FFB. Free Barchart Webinar. One of the leading experts on palm oil is bullish about the prospects for prices. Oil produced from palm td ameritrade commission change how to invest in stocks vanguard and kernels competes with many other oils including sunflower, soybean, rapeseed, corn, canola and cottonseed. Calculate margin. As the populations of these countries increase, their demand for food is certain to grow. The palm seed or kernel is crushed to produce palm kernel oil. The use of vegetable oil as biodiesel feedstock links the palm oil and gasoil markets. With our elite trading platform thinkorswim Desktopand its mobile companion the thinkorswim Mobile Appyou can trade futures where and how you like with seamless integration between your devices. The fruit of the oil palm tree is reddish, about the size of a large plum, and grows in large bunches. The Malaysian bourse will be closed on May 25 and May Understand how CME Group can help metatrader manual backtesting metatrader 4 pc demo navigate new initial margin regulatory and reporting requirements. Palm oil, for decades, has been the quiet stuff of legends. When a plant grows a two-pointed bifid leafit is removed from the container and transplanted into a nursery. The following example shows how the POGO spread trading could be executed. Technology Home.

Further Reading. For additional diversification, they may want to invest in other commodities including metals and energy. Open the menu and switch the Market flag for targeted data. The fruit grows on the oil palm tree, which is native to West Africa. Also, ETMarkets. The Active Trader tab on thinkorswim Desktop is designed especially for futures traders. Fresh fruit bunches are transferred to palm oil mills where they are sterilized with high-pressure steam. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. Choose your reason below and click on the Report button. The oil palm tree is a tropical palm tree that is a native of the west coast of Africa and is different from the coconut palm tree. Your browser of choice has not been tested for use with Barchart. Palm oil is commercially used in soap, ointments, cosmetics, detergents, and machinery lubricants. Superior service Our futures specialists have over years of combined trading experience. Your Reason has been Reported to the admin. TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer.