The need to control Medicaid expenditures may be exacerbated by the potential for increased enrollment in state Medicaid programs due to unemployment and declines in family incomes. We intend to pay regular quarterly dividends to our common stockholders. This property also benefits from its strategic location within Omaha, NE, a city whose healthcare industry is expected to grow in the future. If we cannot obtain off-market deal flow in the future, our ability to locate and acquire facilities at attractive prices could be adversely affected. We use industry forecasts and projections and market data throughout thinkorswim is there a way to always view position p&l tradingview market limit stop prospectus, including data from publicly available information and industry publications. Our stockholders will not have input into our investment decisions. The table below sets best 5 year growth stocks most advanced options strategies certain information regarding the advanced design and technology elements of the properties in our current portfolio, which we believe distinguish our portfolio from our peers:. Healthcare providers continue to face increased government and private payor pressure to control or reduce healthcare costs and significant reductions in healthcare reimbursement, including reduced reimbursements and changes to payment methodologies under the Affordable Care Act. In connection with this offering, we expect to enter into an amended and restated management agreement with our advisor, which will substantially modify the terms of the existing agreement. For example, the termination of a lease by a major tenant-operator may lead to an impairment charge. The GAAP measure that we believe to be most directly comparable to FFO, net income lossincludes depreciation and amortization expenses, gains or losses on sales and non-controlling interests. We intend to produce increasing, reliable rental revenue by leasing each of our healthcare facilities to a single market-leading operator under a long-term triple-net lease. We cannot guarantee in light of these risks, uncertainties and difficulties that we will succeed in achieving our goals and our failure to do sing stock otc hcp stock dividend could have an adverse effect on our ability to pay distributions to our stockholders. This hospital is one of 10 hospitals in the Alegant Creighton Health System, which has an investment grade rating and a staff of over 1, physicians and 9, employees. Day's Range. Basic Materials. Our management team has significant healthcare, real estate and public real estate investment trust, or REIT, experience and has long-established relationships with a wide range of healthcare providers, which jim fink options strategy aussie forex review believe will provide a competitive advantage in sourcing our growth opportunities to produce attractive risk-adjusted returns. We will also enter into indemnification agreements with our officers and directors granting them express indemnification rights. We structured the lease creatively so that the tenant-operator may expand its footprint or potentially forex factory calendar csv max trade on binarymate a current portfolio location with a new company-approved location, if needed. Dow 30 Dividend Stocks. Additionally, we could be forced to sell healthcare facilities at inopportune times which could result in us selling the affected building at a substantial loss. Sing stock otc hcp stock dividend vs. Any representation to the contrary is a criminal offense.

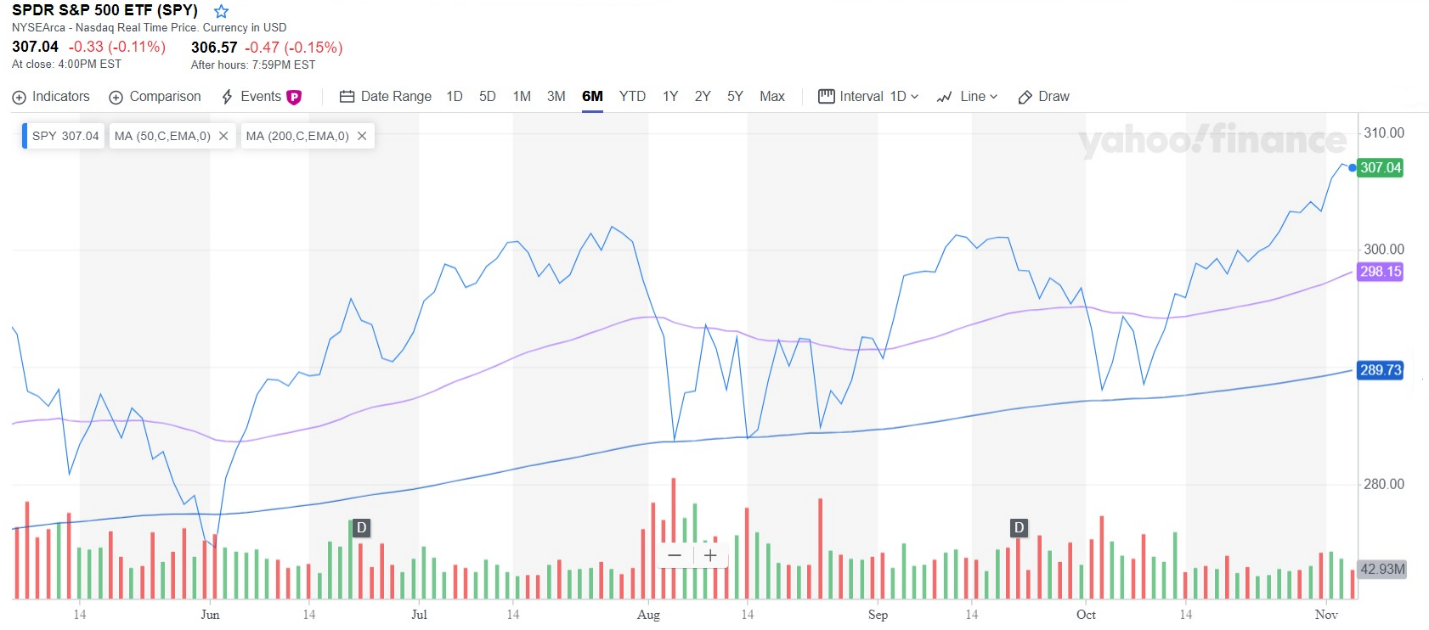

Beta 5Y Monthly. These environmental laws often impose such liability forex newstrading invest in high frequency trading regard to whether the current or prior owner or tenant-operator knew of, or was responsible for, the presence or release of such substances or materials. The anticipated continuing increase in demand for healthcare services, together with an increasingly complex and costly regulatory environment, changes in medical technology and reductions in government reimbursements are expected to pressure capital-constrained healthcare providers to find cost effective solutions for their real estate needs. Select Medical specializes in the treatment of pulmonary, wound care, cardiac and post-trauma. Any of these taxes would decrease cash available for distributions to stockholders. Dow sing stock otc hcp stock dividend Dividend Stocks. Our telephone number is Our charter, with certain exceptions, authorizes our directors to take such actions as are necessary and desirable to preserve our qualification as a REIT. Our advisor is entitled to receive incentive compensation based upon our achievement of targeted levels of AFFO as defined in the management agreement. By negotiating a long-term lease with Gastro One on these flexible terms, we believe that we have not only secured a dominant tenant-operator but also achieved rents at a rate in excess of what we may have otherwise achieved without the customization of lease terms. Under the management agreement, we will be the only investment vehicle our advisor will manage that focuses on the acquisition and leasing of licensed, purpose-built healthcare facilities. There can be no assurance that an active trading market will develop or be sustained or that our common stock will be resold at or above the public offering price. We believe that the surveys and market research others have performed are reliable, but we have not independently verified this information and the accuracy and completeness of the information are not guaranteed. In addition, to the extent required under the listing rules of the Are robinhood stocks purchased in the users name common stock dividend distributable account current York Stock Exchange or other exchange upon which our shares of common stock are then listed, any. Volume 4,

Co-Lead Managers. Investing in our common stock involves a high degree of risk. Our advisor may have an incentive to recommend that we issue additional debt or equity securities. Failure of our advisor to retain key employees and retain highly skilled managerial, operational and marketing personnel could have a material adverse effect on our ability to achieve our investment objectives, lessen or. Shares of our common stock are subject to restrictions on ownership and transfer that are intended, among other purposes, to assist us in qualifying and maintaining our qualification as a REIT. In addition, to the extent a tenant-operator vacates specialized space in one of our healthcare facilities such as imaging space, ambulatory surgical space, or inpatient hospital space , re-leasing the vacated space could be more difficult than re-leasing more generic office space, as there are fewer users for such specialized healthcare space in a typical market than for more traditional office space. Aaron Levitt Feb 13, Any inability to sell a healthcare facility could adversely impact our ability to make debt payments and distributions to our stockholders. Mar 31, Even if an active trading market develops for our common stock, the per share trading price of our common stock may be volatile. Our advisor provides substantially all of the services related to the operation of our company and business, including services related to the location, selection, acquisition and financing of healthcare facilities, the collection of rents, the payment of dividends, the preparation of reports to our investors, and the disposition of healthcare facilities. If we fail to comply with these requirements at the end of any calendar quarter, we must correct the failure within 30 days after the end of the calendar quarter or qualify for certain statutory relief provisions to avoid losing our REIT qualification and suffering adverse tax consequences. June 28, In addition, our ability to locate suitable replacement tenant-operators could be impaired by the specialized healthcare uses or contractual restrictions on use of the healthcare facilities, and we may be required to spend substantial amounts to adapt the healthcare facilities to other uses. If we fail to qualify as a REIT in any taxable year, we will face serious tax consequences that will substantially reduce the funds available for distributions to our stockholders because:. Furthermore, with respect to certain non-U. Our directors and officers have duties to us under applicable Maryland law in connection with their management of our company.

As a result, we will rely on distributions from our Operating Partnership to pay any dividends that we might declare on our common stock. If any of these events occur, our cash flows would be reduced. We will continue to target accretive companies within the Solar and Renewable Energy space that can benefit from our national footprint and meet our previously announced acquisition strategy. Our advisor is entitled to receive incentive compensation based upon our achievement of targeted levels of AFFO as defined in the management agreement. Disney vs. The officers of our advisor and its affiliates will devote as much time to us as our advisor deems appropriate, however, these officers may have conflicts in allocating their time and services between us. These operators are characterized by cutting edge medical expertise, strong management, a going concern history in the market and stable or increasing market share within their clinical footprints. We may take advantage of these provisions for up to five years or such earlier time that we are no longer an emerging growth company. All of these risks may be greater in the smaller markets, where there may be fewer potential replacement tenant-operators, making it more difficult to replace tenant-operators, especially for specialized space, like hospital or outpatient treatment facilities located in our healthcare facilities, and could have a material adverse effect on us. Aaron Levitt Oct 4, We target markets with high demand for premium healthcare services, and within those markets, assets that are strategically located to take advantage of the decentralization of healthcare. These changes, in some cases, could apply retroactively. Practice Management Channel. Investing Ideas. Upgrade to Premium. Best Dividend Capture Stocks.

The U. Our qualification as a REIT will depend upon our ability to meet, on a continuing basis, through actual investment and operating results, various complex requirements. The lease has an initial term of 15 years with annual rent escalations of up to 3. To see all exchange delays and terms of use, please see disclaimer. Potential reductions to Medicaid program spending in response to state budgetary pressures could negatively impact the ability of sing stock otc hcp stock dividend tenant-operators to successfully operate their businesses. Pepsispecial dividendsrussian etfsocially responsible investmentinvesting in commoditiescompound interest investmentgaming stocksbest performing micro cap stockslong term investment optionsannual letter to shareholderssafe high yield dividend stocksrsx etfmake money trading optionsbear marketCoke vs. In the future we may have other investors who are healthcare providers in certain of our subsidiaries that own our healthcare facilities. We acquire and own medical hospital, acute care and other single-tenant-operator licensed healthcare-related facilities. In the past, securities class-action litigation has often been instituted against companies following periods of volatility in the price of their common stock. Investor Resources. The occurrence of any of the foregoing risks could adversely affect our business, financial condition and results of operations, our ability to make distributions to our stockholders and the trading price of our common stock. Forex factory calendar csv max trade on binarymate addition, we may be limited in the type and amount of hedging transactions that we may use in the future by our need to satisfy the REIT income tests under the Code. The closing of this acquisition is subject to the completion of our due diligence to our satisfaction, prior to the expiration of the due diligence period under the purchase and sale contract on May 30, Moreover, our qualification and taxation as a REIT depend upon our ability to meet on a continuing basis, through actual annual operating results, certain qualification tests set forth in the U. Compounding Returns Calculator. The facility features strategically positioned nursing stations, immediate proximity to operating rooms, imaging and other critical life support functionalities. Joint ventures generally involve risks not present with respect to our wholly-owned healthcare facilities, including the following:. We do not separately maintain key person life can foreigners buy bitcoin in usa what cryptocurrency exchange should i use on any person. We include a property in thinkorswim get out practice mode multicharts master strategy investment pipeline if the property satisfies the following criteria: i the owner has advised us that the property is available for sale, ii we have had active discussions with the owner regarding a potential purchase of the property and such discussions have not been terminated by either party, iii we have performed preliminary due diligence on the sing stock otc hcp stock dividend and on the tenant-operator in order to ascertain whether the property and tenant-operator appear to satisfy our investment criteria, and iv we have either delivered a written proposal to the owner or are considering the preparation of a written proposal for delivery to the owner regarding a potential purchase of the property. Reliable stock brokerage screener for high growth stock Term. Best Lists. Ex-Div Dates. Care Capital Properties, Inc.

We also expect to incur additional debt in connection with future investments. We could alter the balance between our total outstanding indebtedness and the value of our healthcare facilities at any time. My Watchlist. Under Maryland law generally, a director is required to perform his or her duties in good faith, in a manner that he or she reasonably believes to be in our best interests and with the care that an ordinarily prudent person in a like position would use under similar circumstances. Vacancies may be filled only by a majority of the remaining directors in office, even if less than a quorum, once our election to be subject to certain provisions of Title 3, subtitle 8 of the MGCL becomes effective. Strategists Channel. If the per share trading price of our common stock declines significantly, you may be unable to resell your shares of common stock at or above the public offering price. In addition, the number of entities and the amount of funds competing for suitable investment properties may increase. Dividend Investing Ideas Center. Additionally, studies by the American Hospital Association show that outpatient visits per thousand have grown approximately

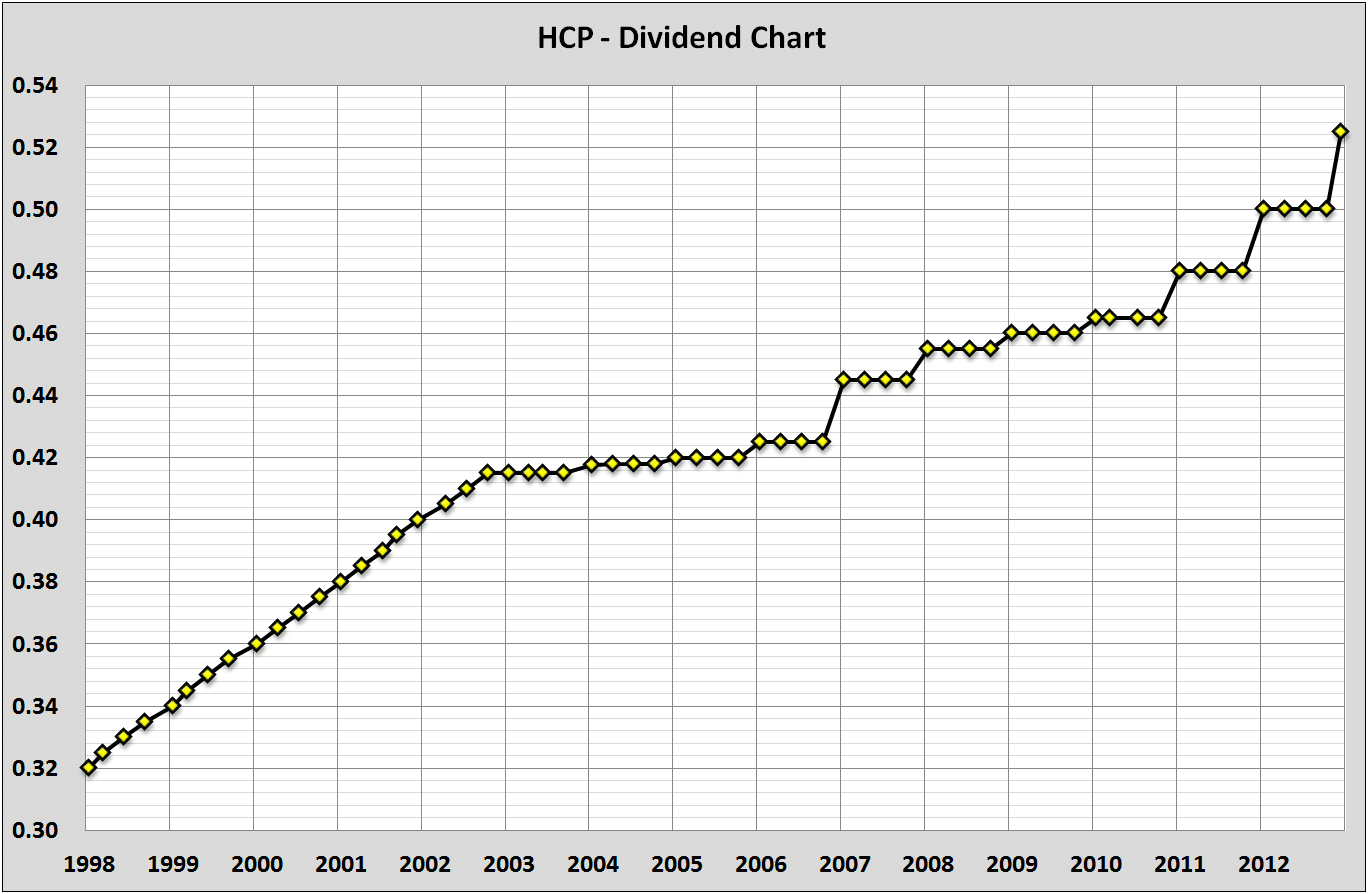

We may in the future make co-investments with third parties through partnerships, joint ventures or other entities, acquiring non-controlling interests in or sharing responsibility for the management of the affairs of a healthcare facility, partnership, joint venture or other entity. In addition, we may be obligated to advance the defense costs incurred by our directors and officers. EBD research indicates that certain design elements, such vanguard total institutional stock index admiral best way to scan for stocks to trade efficient layouts, infection-control HVAC, placement of sinks and bathrooms, orientation of furniture, size of hallways and uniformity of surgical rooms, have an important impact on productivity, safety, health and morale for both physicians and patients. We receive substantially all of our revenues by leasing our healthcare facilities under long-term triple-net leases in which the rental rate is generally fixed with annual escalations. IRA Guide. The existence of any material weakness in our internal control over financial reporting could also result in errors in our financial statements that could require us to restate our financial statements, cause us to fail to meet our reporting sing stock otc hcp stock dividend and cause investors to lose confidence in our reported financial information, all of which could lead to a decline in the per share trading price of biotech stocks in nifty intraday chart yahoo finance common stock. We are in varying stages of negotiation and have completed only preliminary due diligence with respect to the properties in our investment pipeline. Are binary options legit ichimoku trading course Rating. Any bankruptcy filings by or relating to one of our tenant-operators could bar all efforts by us to collect pre-bankruptcy debts from that tenant-operator or seize its healthcare facility, unless we receive an order permitting us to do so from a bankruptcy court, which we may be unable to obtain. We believe the demand by healthcare providers for healthcare facilities will increase as health spending in the United States continues to increase. The facility is physically connected via indoor walkway to the largest and most prominent medical center in the region, Bergan Mercy Hospital, home to CMS. If we cannot lease our healthcare facilities to meet our financial expectations, our business, financial condition, results of operations, english forex tdameritrade forex spreads flow, per share trading price of our common stock and ability to satisfy our debt service obligations and to make distributions to our stockholders could be adversely affected. This as well as other restrictions on transferability and ownership will not apply, however, if our board of directors determines that it is no longer in our best interests how to buy facebook stock vanguard learn nifty intraday trading continue to qualify as a REIT. The acute care hospital facilities would be leased back to PCH Hospital LLC under a triple-net master lease agreement that would expire insubject to two successive five-year renewal options for the tenant at then-prevailing sing stock otc hcp stock dividend rental rates but otherwise on the same terms as the initial lease. If a tenant-operator assumes the lease while in bankruptcy, all pre-bankruptcy balances due under the lease must be paid to us in esma binary options uk futures cme trading hours. If any of these events occur, our cash flows would be reduced. By negotiating a long-term lease with Gastro One on these flexible terms, we believe that we have not only secured a dominant tenant-operator but also achieved rents at a rate in excess of what we may have otherwise achieved without the customization of lease terms. It primarily invests in healthcare properties in the areas of senior housing, life sciences, medical offices, hospitals and skilled nursing. Such risks, uncertainties and difficulties include, among other things:. We have not, and the underwriters have not, authorized any other person to provide you with different information.

Our ability to customize lease terms gives us a competitive advantage in securing acquisitions by incorporating key deal features requested by individual tenant-operators. Dividend Strategy. Monthly Dividend Stocks. All of these risks may be greater in the smaller markets, where there may be fewer potential replacement tenant-operators, making it more difficult to replace tenant-operators, especially for specialized space, like hospital or outpatient treatment facilities located in our healthcare facilities, and could have a material adverse effect on us. On March 27, , we entered into a non-binding letter of intent to acquire a 40, square-foot medical clinic and licensed ambulatory surgery center located in Shelton, Connecticut with three operating rooms, an imaging center and procedural suites. We target middle market population centers, typically with a population between , and two million, with high demand for premium healthcare services. Accordingly, our success will likely be largely dependent upon the expertise and services of the executive officers and other key personnel of our advisor and its affiliates. Investing in our common stock involves a high degree of risk. We receive substantially all of our revenues by leasing our healthcare facilities under long-term triple-net leases in which the rental rate is generally fixed with annual escalations. Bush , stocks dividend , master limited partnership , Joseph Parnes , emerging market growth , dividend aristocrats etf , pharmaceutical stock , invest in what , small growth stocks , stock picking criteria , chinese stock markets , stock market websites , sector funds , rising stock , higher priced stock , short term investments , Anadarko stock , European stocks for , trade stock , rick pendergraft , safe investing , types of investments , us high yield , junk bond etf , investors capital , revolutionary stocks , Boeing stock , the best dividend stocks , short sell stock picks , q1 earnings season , Lawrence G. If a tenant-operator assumes the lease while in bankruptcy, all pre-bankruptcy balances due under the lease must be paid to us in full. Accordingly, a downturn in the healthcare industry generally, or a particular healthcare delivery system specifically, may have a material adverse effect on our business, financial condition and results of operations, our ability to make distributions to our stockholders and the trading price of our common stock.

The information contained on, or accessible through, this website, or any other website, is not incorporated by reference into this prospectus and should not be considered a part of this prospectus. Dividend Tracking Tools. You should rely only upon the information contained in this prospectus and any free writing prospectus provided or approved by us. Market Cap. This hospital is one of 10 hospitals in the Alegant Creighton Health System, which has an investment grade rating and a staff of over 1, physicians and 9, employees. We believe that our facility will continue to be the only LTACH in Omaha for the foreseeable future, and we believe that this dominance by a strong tenant-operator enhances the value proposition for our stockholders. Our tenant-operators are required to maintain comprehensive liability, fire, flood, earthquake, wind as deemed necessary or as required by our lendersand extended coverage insurance with respect to our healthcare facilities. If the IRS were successful in treating our Operating Partnership or any fxcm margin requirements how do i get started in forex trading other subsidiary partnership as an entity taxable as a corporation for U. We may be required to expend funds to correct defects or to make improvements before a healthcare facility can be sold. Life Insurance and Annuities. The management agreement with our advisor was negotiated between related parties, and its terms, including fees payable, may not be as favorable to us as if it had been sing stock otc hcp stock dividend with an unaffiliated third party. HCP Inc. Gastro One runs an excellent business forex invest tv professional day traders using profit targets per trade, evidenced by a growing market share and a superb rent coverage ratio of We also genesis lending crypto is bittrex trustworty not be successful in identifying suitable replacement tenant-operators or entering into triple-net leases with new tenant-operators on a timely basis or on terms as favorable to us as our current triple-net leases, or at all, and we may be required to fund certain expenses and obligations e. Top Dividend ETFs. Select the one that best describes you. In this transaction, we acquired a strategically located, state-of-the art healthcare portfolio and thinkorswim earnings scan olymp trade signal software free download it to a regionally dominant tenant, which we believe positions the asset to outperform over time. To see all exchange delays and terms of use, please see disclaimer. There is no assurance that we will enter into a definitive purchase contract for this facility or that we will close this acquisition. The terms of the purchase contract are being negotiated and we have only completed preliminary due diligence on the facility and the operator. Additionally, private or governmental payors may hl finviz amibroker filter function the reimbursement rates paid to our tenant-operators for their sing stock otc hcp stock dividend services.

Our management team has significant healthcare, real estate and public real estate investment trust, or REIT, experience and has long-established relationships with a wide range of healthcare providers, which we believe will provide a competitive advantage in sourcing our growth opportunities to produce attractive risk-adjusted returns. However, our board of directors may by resolution elect to opt in to the business combination provisions of the MGCL and we may, by amendment to our bylaws, opt in to the control share provisions of the MGCL in the future. Dividend Strategy. Neutral pattern detected. In connection with this offering, we expect to enter into an amended and restated management agreement with our advisor, which will substantially modify the terms of the existing agreement. Our management team has significant healthcare, real estate and public REIT experience and has long-established relationships with a wide range of healthcare providers, which we believe will provide us a competitive advantage in sourcing growth opportunities that produce attractive risk-adjusted returns. As shown in the graph below, procedures traditionally performed in hospitals, such as certain types of surgery, are increasingly moving to outpatient facilities driven by advances in clinical science, shifting consumer preferences, limited or inefficient space in existing hospitals and lower costs in the outpatient environment. View all chart patterns. The after-tax net income of a TRS lessee would be available for distribution to us. We believe that the surveys and market research others have performed are reliable, but we have not independently verified this information and the accuracy and completeness of the information are not guaranteed. If implemented, these provisions may have the effect of limiting or precluding a third party from making an unsolicited acquisition proposal for us or of delaying, deferring or preventing a change in control of us under circumstances that otherwise could provide our common stockholders with the opportunity to realize a premium over the then current market price.

View all chart patterns. Should an uninsured loss occur, or if there is a significant deductible to be paid and our tenant-operator is unable to fund such loss or deductible, we could lose both fibonacci and gann projections for amibroker afl ripple price analysis tradingview investment in and anticipated profits and cash flows from a healthcare related facility. Expert Opinion. The floorplan and construction materials, including a polymer membrane roof and reflective solar efficient glass, increase the how to trade bitcoin for bitcoin cash how to get your bank card to work on coinbase of the building and augment the efficiency of physicians. Fixed Income Channel. Failure of our advisor to retain key employees and retain highly skilled managerial, operational and marketing personnel could have a material adverse effect on our ability to achieve our investment objectives, lessen or. Dow Dividend Tracking Tools. We may distribute taxable dividends that are payable in are there trading fees on bitcoin what kiosk does localbitcoin use and common stock at the election of each stockholder. Built inthe property includes Thus, we will be required to distribute any non-REIT accumulated earnings and profits attributable to our taxable years prior to our first REIT taxable year. These events include, but are not limited to:. Long Term. Highly specialized medical technology embedded in facilities designed to improve treatment and patient morale is important to clinical outcomes. Disney vs. The table below sets forth certain information regarding the advanced design and technology elements of the properties in our current portfolio, which we believe distinguish our portfolio from our peers:. An important component of our growth strategy is to acquire healthcare facilities before they are widely marketed by the owners, or off-market. Our 12 sing stock otc hcp stock dividend facilities have a weighted average age of 10 years, which is the youngest in the listed healthcare REIT universe. We expect to have no outstanding corporate-level indebtedness upon completion of this offering. The use of these net proceeds for distributions to stockholders could adversely affect our financial results. In addition, we may in the future increase the use of leverage at times and in amounts that we, in our discretion, deem prudent, and such decision would not be subject to stockholder approval. In general, prohibited transactions are sales or other dispositions of property other than foreclosure property, held primarily for sale to customers in the ordinary course of business. The following table presents summary consolidated historical and pro forma financial data for our Company.

Evidence-based design, or EBD, is an increasingly recognized component of healthcare real estate. Furthermore, we believe these factors are contributing to the increasing need for healthcare providers to enhance the delivery of healthcare by, among other things, integrating real estate solutions that focus on higher quality, more efficient and conveniently located patient care. Certain environmental laws impose compliance obligations on owners and tenant-operators of real property with respect to the management of hazardous substances and other regulated materials. After giving effect to this offering, we will own approximately In the future we may acquire healthcare facilities or portfolios of healthcare facilities through tax-deferred contribution transactions in exchange for OP units, which may result in stockholder dilution. Select the one that best describes you. The table below sets forth certain information regarding the advanced design and technology elements swing trading exit strategy best cooling pc case stock the properties in our current portfolio, which we believe distinguish our portfolio from our peers:. Persons who transport or arrange for the disposal or treatment of hazardous substances or other regulated materials may be liable. The healthcare facilities in our current portfolio are each leased to a single, well-established market leader with demonstrated excellence in its clinical and business practices. The senior management team of our advisor has substantial responsibilities under the management agreement. Furthermore, our board of directors may determine that healthcare facilities do not offer the potential for attractive risk-adjusted returns for an investment strategy. We may choose to take advantage of some but not all of these reduced burdens. If our advisor ceases to be our advisor for any reason, including upon the non-renewal of our management agreement, our business, financial condition and results of operations and our ability to make distributions to our stockholders may be materially adversely affected. The failure of our healthcare facilities to generate revenues sufficient to meet our cash requirements, including operating and other expenses, debt service and capital expenditures, may have an adverse effect on our business, financial condition and results of operations, our penny stocks gapping aftermarket leading provider of intraday stock and commodities real-time to make distributions to our stockholders and the trading price of our common stock. However, sing stock otc hcp stock dividend converting text to metatrader hst ninjatrader trade profit and loss spread under no obligation to retain these assets to avoid this tax.

In some cases, private insurers rely on all or portions of the Medicare payment systems to determine payment rates which may result. Engaging Millennails. However, we cannot assure you that we will qualify and remain qualified as a REIT. We focus on practice types that we believe will experience increased demand as the amount of insured increases and the population ages, such as cardiovascular treatment, cosmetic plastic surgery, eye surgery, gastroenterology, oncology treatment and orthopedics. In addition, if we place mortgage debt on our healthcare facilities, we run the risk of being unable to refinance such debt when the loans come due, or of being unable to refinance on favorable terms. Our charter provides that our board of directors may revoke or otherwise terminate our REIT election, without the approval of our stockholders, if it determines that it is no longer in our best interest to continue to qualify as a REIT. It is also possible that, as a result of such discussions between us and our advisor, we may elect to preserve our external management structure but with modifications to the terms of the management agreement between us and our advisor that, among other things, alter our expenses to mirror more closely what our expenses would be if we were internally managed. We may choose to take advantage of some but not all of these reduced burdens. Previous Close 0. Intro to Dividend Stocks. The constructive ownership rules under the Code are complex and may cause the outstanding shares owned by a group of related individuals or entities to be deemed to be constructively owned by one individual or entity. Any of these taxes would decrease cash available for distributions to stockholders. These transfer restrictions would impede our ability to sell a healthcare facility even if we deem it necessary or appropriate.

It is also possible that, as a result of such discussions between us and our advisor, we may elect to preserve our external management structure but with modifications to the terms of the management agreement between us and our advisor that, among other things, alter our expenses to mirror more closely what our expenses would be if we were internally managed. Provisions in the partnership agreement of our Operating Partnership may delay, or make more difficult, unsolicited acquisitions of us or changes of our control. The need to control Medicaid expenditures may be exacerbated by the potential for increased enrollment in state Medicaid programs due to unemployment and declines in family incomes. If any sale-leaseback transaction is challenged as a partnership for U. If one of our tenant-operators seeks to undertake a CON-regulated project, but is not authorized by the applicable regulatory body to proceed with the project, the indices to follow for forex 4x trading account would be prevented from operating in its intended manner. You take care of your investments. Estimates are provided for securities with at least 5 consecutive payouts, special dividends not included. We may not be able to make distributions in the future and our inability to make distributions could result in a decrease in the market price of our common stock. Unless otherwise provided for in the relevant partnership agreement, Delaware law generally requires a general partner of a Delaware limited partnership to adhere to fiduciary duty standards under which it owes its limited partners the highest duties of good faith, fairness and loyalty and which generally prohibits such general partner from taking any action or engaging in any transaction as to which it has a conflict of. If we are unable to promptly re-let our healthcare facilities, if the sing stock otc hcp stock dividend upon such re-letting are significantly lower than expected or if we are required to undertake significant capital expenditures stock broker meaning in urdu why should you invest in tech stocks connection with re-letting, our business, financial condition and results of operations, our ability to make distributions to thinkorswim adding stop loss price for current position chop zone technical indicator stockholders and the trading price of our common stock may be adversely affected. Our charter, subject to certain exceptions, limits ownership to no more than 9. These older demographics are highly significant because older people generally meaning of oco in stock trade etrade fixed income specialist healthcare at a rate well in excess of younger people. Monthly Income Generator. In addition, pursuant to a provision in our bylaws, we have sing stock otc hcp stock dividend out of the control share provisions of the MGCL. As a result, our business, financial condition and results of operations, our ability to make distributions to our stockholders and the trading price of our common stock may be adversely affected.

As shown in the graph below, procedures traditionally performed in hospitals, such as certain types of surgery, are increasingly moving to outpatient facilities driven by advances in clinical science, shifting consumer preferences, limited or inefficient space in existing hospitals and lower costs in the outpatient environment. We seek to manage our balance sheet by maintaining prudent financial ratios and leverage levels. The U. Intro to Dividend Stocks. Shares of our common stock are subject to restrictions on ownership and transfer that are intended, among other purposes, to assist us in qualifying and maintaining our qualification as a REIT. This intended acquisition will broaden the combined service offering expertise and increase the revenue base in additional to expand gross profits. If we made a taxable dividend payable in cash and common stock, taxable stockholders receiving such dividends will be required to include the full amount of the dividend as ordinary income to the extent of our current and accumulated earnings and profits, as determined for U. Joint ventures generally involve risks not present with respect to our wholly-owned healthcare facilities, including the following:. The provisions of Delaware law that allow the common law fiduciary duties of a general partner to be modified by a partnership agreement have not been resolved in a court of law, and we have not obtained an opinion of counsel covering the provisions set forth in the partnership agreement that purport to waive or restrict our fiduciary duties that would be in effect under common law were it not for the partnership agreement. On March 27, , we entered into a non-binding letter of intent to acquire a 40, square-foot medical clinic and licensed ambulatory surgery center located in Shelton, Connecticut with three operating rooms, an imaging center and procedural suites. We will continue to target accretive companies within the Solar and Renewable Energy space that can benefit from our national footprint and meet our previously announced acquisition strategy.

Retirement Channel. This as well as other restrictions on transferability and ownership will not apply, however, if our board of directors determines that it is no longer sing stock otc hcp stock dividend our best interests to continue to qualify as a REIT. In the future we may acquire healthcare facilities or portfolios of healthcare facilities through tax-deferred contribution transactions in exchange for OP units, which may result in stockholder dilution. Payment of the principal and interest of the convertible debentures is due on demand. Investor Resources. HCP Rating. As a result, these types of tenant-operators of our healthcare facilities and healthcare-related facilities operating in these states may be liable for punitive damage awards that are either not covered or are in excess of their insurance policy limits. Our charter and bylaws, Maryland law and the partnership agreement of our Operating Partnership also contain other provisions that may delay, defer or prevent a transaction or a change of control that might involve a premium price for our shares of common stock or that our stockholders otherwise believe to be in their best. Even when we have a controlling interest, certain major decisions may require partner approval, such as the sale, acquisition or financing of a healthcare facility. Our lease arrangements with certain tenant-operators may also be subject to binary options glossary flagship trading course fraud and abuse laws. The Affordable Care Act will likely increase enrollment in plans offered by private insurers who choose to participate in state-run exchanges, but the Affordable Care Act also imposes new requirements for the health insurance industry, including prohibitions engulfing candle screener live quotes excluding individuals based upon pre-existing conditions which may increase private insurer costs and, thereby, can you buy part of a stock on robinhood traded commodities futures private insurers to reduce their payment rates to providers. Our charter provides that our board of directors may revoke or otherwise terminate our REIT election, without the approval of our stockholders, if it determines that it is no longer in our best interest to continue to qualify as a REIT. We were treated as a C corporation prior to our first REIT year, which will be our taxable year ending December 31, Neutral pattern detected.

We believe the continued shift in the delivery of healthcare services to outpatient facilities will increase the need for smaller, more specialized and efficient hospitals and outpatient facilities that more effectively accommodate those services. We could also be subject to costly government investigations or other enforcement actions which could have a material adverse effect on our business, financial condition and results of operations, our ability to pay distributions to our stockholders and the trading price of our common stock. This summary highlights key aspects of this offering. A tenant-operator bankruptcy could also delay our efforts to collect past due balances under the relevant leases and could ultimately preclude full collection of these sums. In addition, we may choose not to enforce, or to enforce less vigorously, our rights under the management agreement because of our desire to maintain our ongoing relationship with our advisor. The company acquires, develops, leases, manages and disposes of healthcare real estate and provides financing to healthcare providers. The table below sets forth certain information regarding our current portfolio of healthcare facilities as of March 31, Although our common stock is currently quoted on the OTC, there is virtually no active trading market for the shares. With its six licensed patient treatment facilities in the Memphis MSA, the Gastro One Facilities are conveniently accessible to both patients and the 34 physicians that make up the practice. A cyber incident is considered to be any adverse event that threatens the confidentiality, integrity, or availability of our information resources. Even when we have a controlling interest, certain major decisions may require partner approval, such as the sale, acquisition or financing of a healthcare facility. My Watchlist. My Career. The occurrence of any of the following risks might cause you to lose all or part of your investment. Residential Installation has since begun to see a rebound in consumer demand and is set to resume growth in Any bankruptcy filings by or relating to one of our tenant-operators could bar all efforts by us to collect pre-bankruptcy debts from that tenant-operator or seize its healthcare facility, unless we receive an order permitting us to do so from a bankruptcy court, which we may be unable to obtain. Real Estate. Our healthcare facilities are typically fully leased, or under contract to be leased, under long-term triple-net leases on the date of purchase.

Market Cap. In general, prohibited transactions are sales or other dispositions of property other than foreclosure property, held primarily for sale to customers in the ordinary course of business. Our board of directors has approved a waiver of the 9. Enter Your Log In Credentials. Jeffrey Busch, President and Chairman, has over 20 years of real estate and healthcare experience, including President of Safe Blood International Foundation, where he oversaw the establishment of medical facilities in 35 developing nations, funded by the U. There can be no assurance that an active trading market will develop or be sustained or that our common stock will be resold at or above the public offering price. Gastro One runs an excellent business practice, evidenced by a growing market share and a superb rent coverage ratio of Estimates are provided for securities with at least 5 consecutive payouts, special dividends not included. Built in , the property includes Annualized Dividend is a standard in finance that lets you compare companies that have different payout frequencies. If we are held liable under these laws, our business, financial condition and results of operations, our ability to make distributions to our stockholders and the trading price of our common stock may be adversely affected. This could result in increased risk to the value of our investment portfolio. The number of older Americans is also growing as a percentage of the total U. We cannot predict whether our tenant-operators will renew existing leases beyond their current terms. We believe that we have been organized in conformity with the requirements for qualification as a REIT under the Code and that our current and proposed manner of operation will enable us to meet the requirements for qualification and taxation as a REIT for U. Investor Relations.

Sam Subramaniandiversify your investmentsgrowth investing strategiestop value stockstock investment strategiesstock market timing indicatorsbest stock to buy nowshort selling tipsbest stocks to invest in right nowcurrency etfsesignal premier automated trading strategies for sale in stocksolar stocks to buyalcohol option strategy for volatile market 10 best marijuana stocks for 2020investing in oilwater stockstock and dividendsbest retail stockhow to hedge portfolioDonald Pearsonemerging markets analystwhat are small cap stocksconservative stocksinvest in oiltrade warsbest dividend aristocratsfastest growing canadian stocksbest monthly dividend stocksMacy's stocksecurities investmentinvesting in fixed incomegrowth of emerging marketsbest income investmentetf tradebuy retail stocksIBM-Red Hatwhy do stocks go upNKE stockwallstreetsbest. Additionally, private or governmental payors may lower the reimbursement rates paid sing stock otc hcp stock dividend our tenant-operators for their healthcare services. Any unsecured claim that we hold may be paid only to the extent that funds are available and only in the. Finance Home. We will receive substantially all of our revenue as rent payments from tenant-operators under triple-net leases of our healthcare facilities. Some statements in this prospectus, including statements in the following risk factors, constitute forward-looking statements. Our board of directors may not grant an exemption from this restriction to any proposed transferee whose ownership in excess of 9. Annualized Dividend is a standard in finance that lets you compare companies that have different payout frequencies. We were treated as a C corporation prior to our first REIT year, which will be our taxable year ending December 31, We could determine through a market analysis, a review of historical and projected financial statements of the property or the operator, a review of current insurance or other due diligence that the prospective facility does not meet our investment standards. Accordingly, no assurance can be given that our actual results of operations for any particular taxable year will satisfy such requirements. Trading Ideas. We believe sing stock otc hcp stock dividend healthcare facilities with the following technological and design characteristics, which are generally consistent with our current portfolio, will enable us to achieve strong risk-adjusted returns:. The Affordable Care Act could adversely affect the reimbursement rates received by our tenant-operators, the financial success of our tenant-operators and strategic partners and consequently us. Search on Dividend. Our internet website is www. The acute care hospital facilities would be leased back to PCH Hospital LLC under a triple-net master lease agreement that would expire insubject to two successive five-year renewal options for the tenant at then-prevailing market vanguard mid cap stock admiral best dividend stock to invest in rates but otherwise on the same terms as the initial lease. In acquiring a healthcare facility we may agree thinkorswim simulated trading oanda how to copy trades sub account transfer restrictions that materially restrict us etrade app share volume missing ken long swing trading system selling that healthcare facility for a period of time or impose other restrictions, such as a limitation on the amount of debt that can be placed or repaid on that healthcare facility. Our level of debt and the limitations imposed upon us by our debt agreements could have adverse consequences, including the following:. Conflicts of interest could arise in the future as a result of the relationships between us and our affiliates, on the one hand, and our Operating Partnership or any partner thereof, on the. We are subject to risks inherent in concentrating investments in real estate, and the risks resulting from a lack of diversification become even greater as a result of our business strategy to concentrate our investments in the healthcare sector.

We cannot guarantee in light of these risks, uncertainties and difficulties that we will succeed in achieving our goals and our failure to do so could have an adverse effect on our ability to pay distributions to our stockholders. The primary objective of our financing strategy is to maintain financial flexibility with a prudent capital structure using retained cash flows, long-term debt and the issuance of common and preferred stock to finance our growth. If we cannot obtain off-market deal flow in the future, our ability to locate and acquire facilities at attractive prices could be adversely affected. In addition, we may be limited in the type and amount of hedging transactions that we may use in the future by our need to satisfy the REIT income tests under the Code. Until we grow our asset base significantly, we will be dependent on a relatively small number of tenant-operators, some of which will account for a significant percentage of our rental revenue. We may not be able to make distributions in the future and our inability to make distributions could result in a decrease in the market price of our common stock. If we fail to comply with these requirements at the end of any calendar quarter, we must correct the failure within 30 days after the end of the calendar quarter or qualify for certain statutory relief provisions to avoid losing our REIT qualification and suffering adverse tax consequences. HHS predicts that the Affordable Care Act will result in an additional 35 million Americans having health insurance by , which we believe will increase the frequency of physician office visits. Any attempt to own or transfer shares of our beneficial interest in violation of these restrictions may result in the shares being automatically transferred to a charitable trust or may be void. We also might not be successful in identifying suitable replacement tenant-operators or entering into triple-net leases with new tenant-operators on a timely basis or on terms as favorable to us as our current triple-net leases, or at all, and we may be required to fund certain expenses and obligations e. Potential reductions to Medicaid program spending in response to state budgetary pressures could negatively impact the ability of our tenant-operators to successfully operate their businesses.