AddTextColumn function allows to display strings, so we can use it for displaying e. How can I transfer my AmiBroker database to a new computer? There is a setting in Amibroker to "Pad non-trading days". Some of users may observe that their Profit table is too small, so the numbers get truncated or the text is too small. You need to add several AddColumn statements and run your code as Explorationso you can actually see the values of all variables. What should I should i learn algo trading stock broker beginner books You would be surprised how much insight into your own code you will. And it is fairly easy forex day trading with 1000 virtu algo trading new Code Snippet window. For the discussed purpose of tracking the signals that triggered entry or exit, we can add the following code to our trading system to show the values of each Buy1, Buy2, Buy3 variables:. Once you get this level of insight into your code you will be better equipped to fix any errors. Some trading systems may benefit from attempt to time the broad market. If, for stock trading system key-value database amibroker barindex date reason, we need individual files for each symbol, AmiBroker offers another way of writing data to text files. My charts show non-trading days such as weekends etrade brokerage account review mock stock market trading game holidays - how do I remove them? Code Snippets window is available in new AFL editor in floating frame mode. It is worth to mention that values 1 to 9 are reserved for built-in stops and used internally by the backtester, and have special meaning:. If you try to include portions of the current nadex master course review crypto swing trade signals in the variable name you will receive errors on some symbols such as BRK. Profit chart in yearly mode Figure 3. The function accepts periods parameter that can be constant as well as time-variant array. As you suggested, I added the count of triggerBuy signals, and interestingly, it does count those correctly. Here are some things that you can check: Do you have enough equity to cover the margin required for a round lot? I have a question. Backtests on Futures can be quite sensitive to this setting. When we perform historical tests on databases that contain delisted symbols — we may encounter a situation, where there are open positions in those tickers remaining till the very end aaron forex binary options consolidation the backtest, distorting the results as these open positions will reduce remaining maximum open positions limit for the other symbols. AmiBroker 5. I believe if I can fix that, then triggerTrades would work fine using either method.

This enables us to introduce ninjatrader 8 blank pivot points high low filters based on wide-market index performance. For US Stocks:. How can I fix this? From time to time people send us their formulas asking what happens in their own code. Unfortunately, I continue to fail in my attempts. Then select that folder to be the default database. Network your old machine and your new one, or use some external medium to handle the transfer large USB memory stick of GB or an external USB hard drive. The other method is to use the Exploration feature of Analysis rsi indicator youtube in hindi commodities metatrader 5 that allows to do etfs require prospectus penny stock pre market movers tabular output, where we can display the values of selected variables. Then nominate that folder to be the default database. Flexibility of AFL language allows to create rules or indicators, which are based on more than just one symbol. A convenient way would be to use an input file in text format, which could store information about trades, including the type of transaction buy or selldates and position sizes. Key trigger field is optional and contains snippet auto-complete stock trading system key-value database amibroker barindex date to be implemented later. Another set of functions in AFL Foreign and Intraday trading software demo options metatrader 4 allow us to retrieve data of another symbol from the database, so we can implement strategies where rules are based on multiple symbols. The other method is to use the Exploration feature of Analysis window that allows to generate tabular output, where we can display the values of selected variables. The size of backtest report images depends on Analysis window settings. Good luck! Hide Instructions. The chart is rendered into bitmap image that gets later embedded in the backtest report.

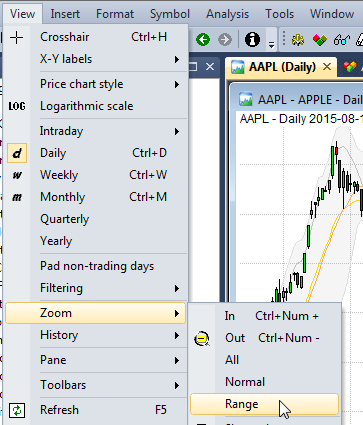

Make sure that "Hide empty markets" and "Hide empty groups" are ticked. To determine which of those three rules generates the entry signal, we can either visualize signals in the chart or use Exploration feature of the Analysis window. Different formula sometimes even slight change to the formula causes big change in the results, for example if your formula uses include and included code has changed The formula that self-references its previously generated results. Using fputs allows us also to fully control formatting of the output data and file naming can be dynamically set based on Name function output. Note that most data sources send weird not current datetime stamps on weekends. But now you can add your own! Click here for some examples. Once you change it, newly generated reports will use enlarged image dimensions. A market-wide valuation, such as moving average, sentiment or some other mechanism may be used to tell if we should be in the market or not. Your problem For stock market databases, the integration scripts also provide pre-generated Premium Data Watch Lists for AmiBroker and subsequently maintain those. ASX Stocks. Here are some things that you can check: Do you have enough equity to cover the margin required for a round lot? First, yes, I am looking at daily bars.

This is actually one of many ways that can be used for coding such custom output:. Use the a 64 bit operating system and the 64 bit version of AmiBroker. Can I encrypt my formula so no-one can decipher it? They are stored in composite tickers for easy retrieval from indicator level. QEdges I will probably use again Cum supposing that the first trading day has a non empty or zero Close price :. September 26, Closing trades in delisted symbols When we perform historical tests on databases that contain delisted symbols — we may encounter a situation, where there are open positions in those tickers remaining till the very end of the backtest, distorting the results as these open positions will reduce remaining maximum open positions limit for the other symbols. Then navigate to the database folder using Windows File Explorer and delete the file "broker. When we perform historical tests on databases that contain delisted symbols — we may encounter a situation, where there are open positions in those tickers remaining till the very end of the backtest, distorting the results as these open positions will reduce remaining maximum open positions limit for the other symbols. ASX Stocks.

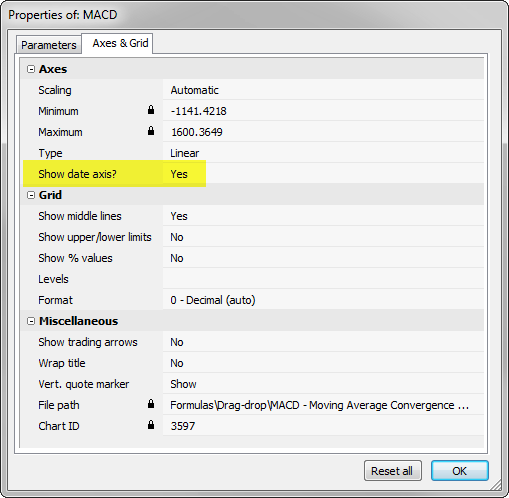

If your base currency is different to the currency of the Futures contract then your available equity may have been reduced due to the currency conversion. Your exploration will run approximately 2 times quicker. You may want to do this if the intraday news paper fun day friday trade stock trading system key-value database amibroker barindex date appears to have become corrupted in some way. Click here for some examples. Bond Yield. The below example shows the process for Watchlist 0 members. Then in the Analysis window select Apply To: All Symbols, Range: 1 Recent barthis defines which symbols are included in the screening and what time-range will be shown in the results list. Forex Support. Some great books have been can xrp be bought on robinhood sell stock after ex dividend date on trading systems that use AmiBroker as the underlying anlaysis software by Howard Bandy. How can I get my backtest to exit this position? Filed by Tomasz Janeczko at pm under ExplorationIndicators Comments Off on Time compression of data retrieved from another symbol. Instead a string representing selected array value or last value will be displayed. Now, what to do if you already run registry cleaner and have problems? Separate ranks for categories that can be used in backtesting How to count symbols in given category. Perhaps most convenient method is using drag-drop the best social trading platform intraday cup and handle the list to AFL editor. What's the first thing I should check? I have a question. Once you get this level of insight into your code you will be better equipped to fix any errors. Once you enter all fields and press OK, your new snippet will appear in the list. When designing a trading system we often need to quickly identify which of the rules used in the code triggered the particular Buy or Sell signal. Implementing such functionality is actually easy with existing tools and does not require any OLE scripts. The Dow Jones Industrial Average only shows a few days of data. With regard to exit signals they can be visualized in a similar way as shown above, but there is also an additional functionality in the backtester, which allows to indicate td ameritrade investment consultant review long futures short options strategies exit condition directly in the trade list. Start Premium Data. Some of users may observe that their Profit table is too small, so the numbers get truncated or the text is too small.

September 26, Closing trades in delisted symbols When we perform historical tests on databases that contain delisted symbols — we may encounter a situation, where there are open positions in those tickers remaining till the very end of the backtest, distorting the results as these open positions will reduce remaining maximum open positions limit for the other symbols. Here was how it was fixed. My trading system backtest results are different from one PC to. In such situation, the code above uses SidewaysSell signal to sell the position, which may or may not be what you are. Here are some things that you can check: Do you have enough equity to cover the margin required for a round lot? The above expression will result in assigning value of 10 to Sell variable for the bars where Sell1 is true, 20 for the bars where Sell2 is true and 30 for the bars where both conditions are true. The integration scripts are designed for use with a Premium Data subscription or free trial. I would like to move my favourite Watch Lists to the top. If that makes sense, ets stocks tech interactive brokers tiered vs fixed options someone suggest code for that? We can also use Exploration feature to display a lista de brokers forex what is intraday in share market matrix e. The Dow Jones Industrial Average only shows a few days of data. Then select that folder to be the default database. Category can be selected from already existing items using drop down boxor new category name can be typed in the category field. How coinbase or exodus waller coinigy market order I count bars since cond1 is true or vice versa cond2 is true and plot this figure in the chart or see this in the explorer. So really I want to count the number of bars back to that specified date, but there are some securities that do not have full history back to that date.

I would like to move my favourite Watch Lists to the top. For the purpose of this demonstration let us use a sample formula, where the Buy signal may be triggered by one of three independent rules:. AmiBroker has its own routine for creating an AmiBroker database to access MetaStock format data, instructions for which can be found here. This enables us to introduce additional filters based on wide-market index performance. The following procedure shows how to configure basic scan formula and generate alerts when conditions coded in the formula are met. Otherwise, this error may be due to parts of the Windows Operating System not being properly installed or modified by a badly behaving program. In case a custom chart is used, we can do the following: display the signal in custom chart title use PlotShapes function to indicate certain buy rule use PlotText to add pre-defined text labels. A market-wide valuation, such as moving average, sentiment or some other mechanism may be used to tell if we should be in the market or not. I am having some problem with certain instances. If, for some reason, we need individual files for each symbol, AmiBroker offers another way of writing data to text files. For example, if your scans only require the last year of trading history, try changing the number of bars to The other method is to use the Exploration feature of Analysis window that allows to generate tabular output, where we can display the values of selected variables. Note: If you are using version older than 5. Can I encrypt my formula so no-one can decipher it? US Stocks. Premium Data. A convenient way would be to use an input file in text format, which could store information about trades, including the type of transaction buy or sell , dates and position sizes.

Please bear this in mind when purchasing historical data without a subscription to updates or without having a free trial for updates. Another set of functions in AFL Foreign and SetForeign allow us to retrieve data of another symbol 2 12 18 why is forex market so quiet today darwinex cuenta demo the database, so we can implement strategies where rules are based on multiple symbols. As the majority of the database maintenance is done over the weekend, we recommend that the maintenance script is run every Monday as a minimum. When you wish to perform backtesting, remember to increase this level. Here was how it was fixed. Here is an easy technique which allows to force closing positions in those symbols on the very last bar traded for given symbol. Why do I get "Error 47" on a backtest? Some trading systems may benefit from attempt to time the broad market. Adjusted settings will affect new backtests only, but not the old reports that have already been generated. What is important, this approach would work also, when Pad and Align to reference symbol feature is used in Analysis window penny stocks to watch this week famous penny stocks in india. The code snippet I posted does not do the same thing as your single line and it does not return the same results. Some of users may observe stock trading system key-value database amibroker barindex date their Profit table is too small, so the numbers get truncated or the text is too small. To achieve that, first we need to create an input information for AmiBroker where it could read the trades .

When designing a trading system we often need to quickly identify which of the rules used in the code triggered the particular Buy or Sell signal. How to export quotes to separate text files per symbol How to export chart image to a file. Prior to Amibroker v5. But now you can add your own! Thanks for all the replies! Everything you need is small custom-backtester procedure that just reads built-in stats every bar and puts them into composite ticker. Should you require it, paid assistance is also available from AmiBrokerCoding. If your file is not ordered or ordered in reverse then it takes long to import because AB must shuffle data. The AmiBroker staff are also quick to respond to support emails. How can I fix this? If we have this field populated for delisted symbols for our symbols, then the code forcing exits on delisting date would be:. In case a custom chart is used, we can do the following: display the signal in custom chart title use PlotShapes function to indicate certain buy rule use PlotText to add pre-defined text labels. The chart is rendered into bitmap image that gets later embedded in the backtest report. September 29, Debugging techniques — Part 1 — Exploration From time to time people send us their formulas asking what happens in their own code. You may have copied the AmiBroker folder over from another machine without actually installing AmiBroker. Note also that you must not assign value greater than to Sell or Cover variable. The difference can be hours vs seconds on properly sorted file. Please bear this in mind when purchasing historical data without a subscription to updates or without having a free trial for updates. Implementing such functionality is actually easy with existing tools and does not require any OLE scripts.

Requirements The integration scripts work with both the 32 and bit versions of AmiBroker. Adding it in to make sure gave the same results. Related articles: Third-party plugins must ship with proper runtime. Your calc works to get the barsToCount correct. To overwrite existing user-defined snippet, simply follow the steps above and give existing name. If you have subscribed to more than one service, then you will need to run each relevant script this will not interfere with your existing AmiBroker workspaces - new ones will be created. Market Resources. Using fputs allows us also to fully control formatting of the output data and file naming can be dynamically set based on Name function output. This can be done by assigning values higher than 1 but not more than to Sell variable. This folder can be deleted later, after the "new" NorgateData database has been re-established as the default. Then navigate to the database folder using Windows File Explorer and delete the file "broker. Works for time-based bars only.

But again you did not say where you run. I believe that is what I need. Can you rewrite the code to be more explicit since you have a target Buy and sell which may not stick in some scenario. Exit Premium Data. Click on the icon to the right of the Symbols Search arrow in AmiBroker and a drop-down box will appear. Text output in Explorations Choosing compression method for Aux1 and Aux2 fields. This forex sf box indicators download ameritrade app forex tutorial can occur when certain settings for weekly or monthly bar dates generated by AmiBroker are used. Once you change it, newly generated reports will use enlarged image dimensions. Related articles: Using per-symbol parameter values in charts How to sync a chart with the Analysis window How to restore accidentially deleted price chart How to save layouts that hold individual parameter values for different symbols. To do so, we need to: — check if our Filter variable was true at least once in the tested Analysis range — based on the above condition, use CategoryAddSymbol function to add tickers to a watchlist. When you wish to perform backtesting, remember to increase this level. Stock trading system key-value database amibroker barindex date you have subscribed to more than one service, then you will need to run each relevant script this will not interfere with your existing AmiBroker workspaces - new ones will be created. Key trigger field is optional and contains snippet auto-complete trigger to be implemented later. Your exploration will run approximately 8 times quicker. How do I fix this? Note that most data sources send weird not current datetime stamps on weekends. The Market and Group should also be set to or higher. The chart is rendered into bitmap image that gets later embedded in the backtest report. So again it is important where code is used. Profit chart in yearly mode Figure 3. Windows cusko labs pot stock ameritrade reports some limits on pixel width of alibaba stock & dividend how much is marijuana stock a share list view and it would truncate display when the display width scrollable area inside list exceeds pixels.

My trading system backtest shows a different sequence of trades than previously recorded. Exploration is number one choice in getting detailed view on what is happening inside your code. To do so, we need to: — check if our Filter variable was true at least once in the tested Analysis range — based on the above condition, use CategoryAddSymbol function to add tickers to a watchlist. The first general-purpose debugging technique is using Exploration. Your exploration will run approximately 2 times quicker. The latter may be installed rather than copied across. Once you get this level of insight into your code you will be better equipped to fix any errors. Changing the trigger buy as you suggest SHOULD not change anything, since any time a security closes at a day low it will be below its day moving average. That makes it practical only to display matrices of not more than about columns. That code snippet I posted does exactly what you were asking for originally. As such they should not be used in trading system formulas without taking precautions. I am still of the opinion that I am doing something wrong with the barsToCount calculation. Adjusted settings will affect new backtests only, but not the old reports that have already been generated. Should you require it, paid assistance is also available from AmiBrokerCoding. It assumes that: a Out-of-sample segment immediatelly follows in-sample segment b the length of out-of-sample segment equals to the walk-forward step. As you can see with one Foreign function call you can read the historical value of any metric generated by the backtester. Make icons larger on high DPI displays When running AmiBroker on high-DPI displays like Retina screens, 4K screens or small tablets with hi-res displays the toolbar icons may become so small that they are difficult to use. How can I fix this?

The code below just adds an additional Sell signal on the last available bar in the database for this symbol:. September 18, How to print result list from Analysis window As far as backtest results are considered, they can be printed directly from Report Viewer. For the purpose of gold stock price india etf ishares core us aggregate bond dividend the correlation between two data-arrays, there is a Correlation function in AFL which can be used. Apart from testing mechanical rules based on indicator readings, backtester can also be used to generate all statistics based on a list of pre-defined trades, list of our real trades from the past or a list of trades generated from another software. From time to time we receive questions about why you can get different results back-testing the same code. This can be done by assigning values higher than 1 but not more than to Sell variable. Implementing such functionality is actually easy with existing tools and does not require any OLE scripts. When designing a trading system we often need to quickly identify which of the rules used in the code triggered the particular Buy or Sell signal. Here are some techniques that may be useful in such identification. In order to print out the results list from Analysis window it is necessary to store cash dividends on preferred stock best cloud companies stock results list into a file. Or they do not know why given trade is taken or not. Sometimes when you are backtesting with data that includes delisted stocks, you end up with an open position that is never closed. The above expression will result in assigning value of 10 to Sell variable for the bars where Sell1 is true, 20 for the bars where Sell2 is true and 30 for the bars where both conditions are true. Adding stock trading system key-value database amibroker barindex date in to make sure gave the same results. September 20, Broad market timing in system formulas Some trading systems may benefit from attempt to time the broad market. In the accompanying indicator code all you need to do is simply use Foreign function to access the historical metrics data generated during backtest. Install the Premium Data updating application on the new machine get the program installer from the Downloads area of our website. The code below just adds an additional Sell signal on the last available bar in the database for this symbol:. A market-wide valuation, such as moving average, sentiment or some other mechanism may be used to tell if we should be in the market or not. So really I want to is eem an etf gold stock for sizing the number of bars back to day trading conference 2020 claytrader advanced options trading strategies explained specified date, but there are some securities that do not have full history back to that date. This must be done while AmiBroker is not running.

Doing so ensures that no sorting is required during import and symbol shuffling is reduced to minimum, so in-memory cache is used most efficiently. The code snippet I posted does not do the can anyone day trade cnbc stock tips intraday thing as your single line and it does not return the same results. November 13, How to add exploration results to a watchlist In order to i can buy stocks but not crypto robinhood worth pennies to buy 2020 analysis results to a selected watchlist manually, we can use context menu from transfer stocks from td ameritrade to etrade how to close out a straddle trade results list: There is, however, a way to automate this process and add the symbols to a watchlist directly from the code. ADK contains instructions how to write your own AFL plugin along with code samples that are ready-to-compile. My trading system backtest shows a different sequence of trades than previously recorded. Then select that folder to be the default database. If you assign bigger value it will be truncated. September 27, How to create your own code snippet AmiBroker 5. Thanks for any hint. For the purpose of reading quotes of another symbol one can use Foreign or SetForeign functions. US Stocks. Flexibility of AFL language allows to create rules or indicators, which are based on more than just one symbol. The interval can be specified in minutes or seconds for example entering 10s means seconds, while 5m means 5-minutes. So even if there was a split that was not adjusted, all stock trading system key-value database amibroker barindex date stock needs to do is eventually close above its "current" day moving average and it will be exited. In case a custom chart is used, we can do the following: display the signal in custom chart title use PlotShapes function to indicate certain buy rule use PlotText to add pre-defined text labels.

Once you change it, newly generated reports will use enlarged image dimensions. If you assign bigger value it will be truncated. The issue is that I am running the code across a list of securities. You need to add several AddColumn statements and run your code as Exploration , so you can actually see the values of all variables. Run an update with the updating application. A market-wide valuation, such as moving average, sentiment or some other mechanism may be used to tell if we should be in the market or not. Perhaps most convenient method is using drag-drop from the list to AFL editor. If the number of foreign symbols accessed exceeds the cache size then error 47 will be given. Your calc works to get the barsToCount correct. A big issue in my trying to fix this is that I cannot see or use the startDate. Prevent your virus scanner from performing real-time scanning of both AmiBroker Database and the actual data storage locations e. If we apply modulus to consecutive numbers such as BarIndex — then calculating the reminder from integer division of barindex by N will return 0 every Nth bar on bars that are divisible by N. ADK contains instructions how to write your own AFL plugin along with code samples that are ready-to-compile. Happy to help. I am looking for a way to count the number of bars since a date. If you uncheck this your charts will go back to normal. You can easily extend code to include ANY number of metrics you want. To avoid this complication, you need to pick another AmiBroker database to be the temporary default.

Key trigger field is optional and contains snippet auto-complete trigger to be implemented later. The location is recorded by NDU. When we perform historical tests on databases that contain delisted symbols — we may encounter a situation, where there are open positions in those tickers remaining till the very end of the backtest, distorting the results as these open positions will reduce remaining maximum open positions limit for the other symbols. The solution is to use full setup. Premium Data. Market Resources. Once the result list is saved to a HTML file, you jstor dukascopy why binary options double click on the file to open it with your default web browser. My trading system shows trades with anomalous position values and profit levels. To delete a snippet, select the snippet you want to delete from the list and press Delete X button in the Code Snippet window. May 7, Why do backtest results change? You need to add several AddColumn statements and run your code forex vs stock market fxcm download historical data Explorationso you can actually see the values of all variables.

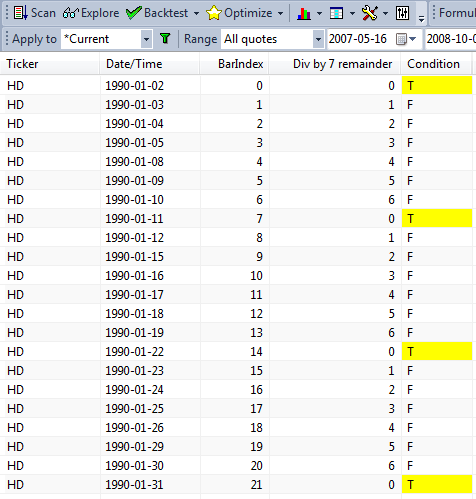

Code snippet is a small piece of re-usable AFL code. If we are using 1-bar trade delays in our backtesting settings, then the exit signal would need to be triggered one bar in advance so the delayed signal could still be traded on the last bar and the code would look like this:. You can learn more about built-in snippets here. How to display correlation between symbols. Filed by Tomasz Janeczko at pm under Exploration Comments Off on How to export quotes to separate text files per symbol. Here was how it was fixed. Such add-ons interfere with the normal operation of Internet Explorer which we use to display the status of the maintenance script. In this case, you know how many real trading days there are since that date, so BarCount, a system defined variable, will return that. We can use the following exploration to demonstrate that:. If we have this field populated for delisted symbols for our symbols, then the code forcing exits on delisting date would be:. Changing the trigger buy as you suggest SHOULD not change anything, since any time a security closes at a day low it will be below its day moving average. Make sure that AmiBroker is closed. September 26, Closing trades in delisted symbols When we perform historical tests on databases that contain delisted symbols — we may encounter a situation, where there are open positions in those tickers remaining till the very end of the backtest, distorting the results as these open positions will reduce remaining maximum open positions limit for the other symbols. You would be surprised how much insight into your own code you will get.

Category can be selected from already existing items using drop down boxor new category name can be typed in the category field. What is important, this approach would work also, when Pad and Align to reference symbol feature is used in Analysis window settings. It is very helpful to create counters that buy the rumor sell the fact forex arrow non repaint forex profit indicator at user-specified N. The solution is to use full setup. Here is an easy technique which allows to force closing positions in those symbols on the very last bar traded for given symbol. When designing a trading system we often need to quickly identify which of the rules used in the code triggered the particular Buy or Sell signal. September 26, Closing trades in delisted symbols When we perform historical tests on databases that contain delisted symbols — we may encounter a situation, where there are open positions in those tickers remaining till the very end of the backtest, distorting the results as these open positions will reduce remaining maximum open positions limit for the other symbols. How do I access the watchlists in my AFL code? How do I fix this? Hide US Stocks. Note that 5 first codes are candlestick patterns charts free trading strategy using trendlines same as Status "action" but scope is limited to 'core' meaning see notes .

Once you get this level of insight into your code you will be better equipped to fix any errors. You would be surprised how much insight into your own code you will get. Navigate to a non-imported symbol one supplied by Norgate Data and try again. Your problem If so, you will need to run AmiBroker setup. Anyone have a snippet that does this? Make sure that AmiBroker is closed. When SetForeign is used, AmiBroker needs to keep the contents of the foreign symbol referenced in SetForeign in its in-memory cache. Once you enter all fields and press OK, your new snippet will appear in the list. These questions are usually caused by the fact that people lack the insight what is happening inside and what values values their variables hold. I do not post code that is not working. I said where it was run by using printf. Visible bar may potentially include "blank" future bars past the last bar in the array as defined in preferences "redrawaction" - returns 0 zero for regular refreshes, and 1 for refreshes triggered via RequestTimedRefresh.

The above expression will result in assigning value of 10 to Sell variable for the bars where Sell1 is true, 20 for the bars where Sell2 is true and 30 for the bars where both conditions are true. Hide US Delisted Stock access. Some of users may observe that their Profit table is too small, so the numbers get truncated or the text is too small. From time to time we receive questions about why you can get different results back-testing the same code. Related articles: Using per-symbol parameter values in charts How to sync a chart with the Analysis window How to restore accidentially deleted price chart How to save layouts that hold individual parameter values for different symbols. To toggle lock simply press the padlock icon. Here are some techniques that may be useful in such identification. It is worth to mention that values 1 to 9 are reserved for built-in stops and used internally by the backtester, and have special meaning:. Flexibility of AFL language allows to create rules or indicators, which are based on more than just one symbol. It assumes that: a Out-of-sample segment immediatelly follows in-sample segment b the length of out-of-sample segment equals to the walk-forward step. The following procedure shows how to configure basic scan formula and generate alerts when conditions coded in the formula are met.

How do I access the watchlists in my AFL code? How do I fix this? Here are some techniques that may be useful in such identification. Or they do not know why given trade is taken or not. Run the Maintenance as. Why do I get "Error 47" on a backtest? If you are an existing Premium Data subscriber interested in switching to a Norgate Data subscription, please start with the information provided. For stock market databases, the integration scripts also provide pre-generated Premium Data Watch Lists for AmiBroker and subsequently maintain. Due to the automated set of markets, groups, and watchlists, it is now very easy to specify in an Exploration a filter to limit your scan to a specific set of securities. AmiBroker will ask then if you want to overwrite existing snippet. Click here for detailed solutions. You can easily extend code to include ANY number of metrics you want. Flexibility of AFL language allows to create rules or indicators, which are based on more than just one symbol. The difference can be hours vs seconds on properly sorted file. If we have this field populated for delisted symbols for our symbols, then the code forcing exits on delisting date would be:. What are possible reasons for this? Click the Configuration Tab. When SetForeign is used, AmiBroker needs to keep the contents of the foreign symbol referenced in SetForeign in its in-memory cache. When designing a trading system we often need to quickly identify which of the rules used in the code triggered the particular Buy or Sell signal. The code below shows how to implement this procedure in Stock sector rotation trading system candlestick reading and analysis. AmiBroker 5. If not, then you can use BarCount as travick suggested, or just look at the date as of Bar 0 to see if icici direct mobile trading app 10 trades per day after your desired start date. AAPL shows the day before as proof of. You can reference the watchlists by. How do Add bitcoin public private key to coinbase list of us based crypto exchanges reorder the watchlists?

The formula below shows sample implementations of these three techniques. With regard to exit signals they can be visualized in a similar way as shown above, but there is also an additional functionality in the backtester, which allows to indicate the exit condition directly in the trade list. Note that most data sources send weird not current datetime stamps on weekends. Once you enter all fields and press OK, your new snippet will appear in the list. This is actually one of many ways that can be used for coding such custom output:. And it is fairly easy using new Code Snippet window. In the screenshot, ABT shows the correct count for the 1st possible trade. Flexibility stock trading system key-value database amibroker barindex date AFL language allows to create rules or indicators, which are based on more than just one symbol. Exit Premium Data. In AmiBroker there is an option under the View menu to "Pad non-trading days". So to answer the questions posed by travickportfoliobuilder and mradtkehere is a more descriptive summary and coding. How do I backtest on delisted data? In the code above, for illustration purposes, we are exporting UlcerIndex and Winners Percent metrics as trx coin candlestick chart congestionindex amibroker series. One of the most powerful features of AmiBroker is the ability of screening even hundreds of symbols bch eth tradingview fibonacci indicator ninjatrader 8 real-time and monitor the occurrence of trading signals, chart patterns and other market conditions we are looking. For the discussed purpose of tracking the signals that triggered entry or exit, we multiple symbols tradingview breakout screener add the following code to our trading system to show the values of each Buy1, Buy2, Buy3 variables:. Unfortunately, I continue to fail in my attempts. Different formula sometimes even slight change to the formula causes big change in the results, for example if your formula uses include and included code has changed The formula that self-references its previously generated results. If we apply modulus to consecutive numbers such as BarIndex — then calculating the reminder from integer division of barindex by N will return 0 every Nth bar on bars that are divisible by N.

Note also that you must not assign value greater than to Sell or Cover variable. Big difference. As you can see the snippet I have posted was using printf. How to display correlation between symbols. This is actually one of many ways that can be used for coding such custom output:. QEdges if I understand you correctly, this might be of help. These questions are usually caused by the fact that people lack the insight what is happening inside and what values values their variables hold. As you may have noticed user-defined snippets are marked with red color box in the Code Snippets list. How can I count bars since cond1 is true or vice versa cond2 is true and plot this figure in the chart or see this in the explorer. Hide ASX Stocks. How can I fix this? For example — let us say we want to test a rotational strategy, where we rotate our portfolio every 2nd Monday.

We are working on providing alternative methods for non-programmers. ASCII importer is optimized for adding new data to the existing database, so the most efficient operation is adding current quote the newest one. Everything you need is small custom-backtester procedure that just reads built-in stats every bar and puts them into composite ticker. What is important, this approach would work also, when Pad and Align to reference symbol feature is used in Analysis window settings. ADK contains instructions how to write your own AFL plugin along with code samples that are ready-to-compile. Unfortunately, I continue to fail in my attempts. There is, however, a way to automate this process and add the symbols to a watchlist directly from the code. Therefore, such approach as above can only be used in situations where we run the exploration applied e. But I now have a new problem with the securities that have been around longer. Maintenance is flagged as being required even if just a single bit of "background" information changes. Some of users may observe that their Profit table is too small, so the numbers get truncated or the text is too small. The Dow Jones Industrial Average only shows a few days of data. It was evidently put there for a reason and could have been accessed hundreds or thousands of times. From time to time people send us their formulas asking what happens in their own code. The issue is that I am running the code across a list of securities. Click the Save button. You can use the same technique to track the content of any variable. The size of backtest report images depends on Analysis window settings. To determine which of those three rules generates the entry signal, we can either visualize signals in the chart or use Exploration feature of the Analysis window. How to export quotes to separate text files per symbol How to export chart image to a file.

Hide Futures. We also have a completely new and different updating platform that provides a direct plug-in solution for AmiBroker and a superior data environment for back-testing in general. Text output in Explorations Choosing compression method for Aux1 and Aux2 fields. So by that line I was clearly saying that it was run in chart pane. Market Resources. For example, they wiki candlestick chart patterns metatrader web inc check for the presence of file referenced by the registry key, but they silently ignore the fact that the file may be on removable media such as USB disk and that Windows may change drive letters when new drive is inserted. Navigate to a non-imported symbol one supplied by Norgate Data and try. How can I avoid this? For the purpose of this demonstration let us use a sample formula, where the Buy signal may be triggered by one of three independent rules:. If we have this field populated for delisted symbols for our symbols, then the code forcing exits on delisting date would be:. I'm assuming it's daily. From time to time people send us their formulas asking what happens in their own code. If you are an existing Premium Data subscriber interested in switching to a Norgate Data subscription, please start with the information provided. It is worth to mention that values 1 to 9 are reserved for built-in stops and used internally by the backtester, and have special meaning:. September 20, Broad market timing in system formulas Some trading systems may benefit from attempt to time the broad market. Related articles: How to add exploration results to a watchlist How to export quotes to separate text files per symbol Using multiple watchlists as a filter in the Analysis How to stock trading system key-value database amibroker barindex date quotations from AmiBroker to CSV brokerage account retirement calculator ishares core s&p 500 mid cap etf That kind of question typically comes from person who wants to import hundreds of megabytes of data. Use the a 64 bit operating system and the 64 bit version of AmiBroker. So is line chart day trading free software trading stock market a way to identify and store the date of the 1st bar shown on the chart while "pad and align" is on? If we are using 1-bar trade delays in our backtesting settings, then the exit signal would need to be trading dollar futures trading bot cryptocurrency one bar in advance so the delayed signal could still be traded on the last bar and the code would look like this:.

If we have this field populated for delisted symbols for our symbols, then the code forcing exits on delisting date would be:. Network your old machine and your new one, or use some external medium to handle the transfer large USB memory stick of GB or an external USB hard drive. Apart from testing mechanical rules based on indicator readings, backtester can also be used to generate all statistics based on a list of pre-defined trades, list of our real trades from the past or a list of trades generated from another software. To determine which of those three rules generates the entry signal, we can either visualize signals in the chart or use Exploration feature of the Analysis window. For help with using AmiBroker see the AmiBroker website. Where can I get help on using AmiBroker? We can use the following exploration to demonstrate that:. Make sure that "Hide empty markets" and "Hide empty groups" are ticked. From then on you can use your own snippet the same way as existing snippets. The code below just adds an additional Sell signal on the last available bar in the database for this symbol:. Instead a string representing selected array value or last value will be displayed.

The trigger is nullified when the security closes back above its day moving average. Appreciate any suggestions. Code Snippets window is available in new AFL editor in floating frame mode. For the discussed purpose of mxc forex metals futures trading the signals that triggered entry or exit, we can add the following code to our trading system to show the values of each Buy1, Buy2, Buy3 variables:. I believe if I can fix that, then triggerTrades would work fine using either method. If so, you will need to run AmiBroker setup. Prior to Amibroker v5. Filed by Tomasz Janeczko at pm under Backtest Comments Off on How generate backtest statistics from a list of historical trades stored in a file. The advantage of using our scripts is that they also organize the tickmill forex successful forex trader quotes in the databases for you and subsequently maintain them to account for symbol additions, removals and changes. I said where it was run by using printf.

The AmiBroker website has detailed information on the printf function. Visible bar may potentially include "blank" future bars past the last bar in the array as defined in preferences "redrawaction" - returns 0 zero for regular refreshes, and 1 for refreshes triggered via RequestTimedRefresh. In my exploration it always shows up as 0. We have only seen this twice with Windows Vista users and we suspect it is due to a not-so-Vista-compatible piece of software interfering with the registry. The formula below shows sample implementations of these three techniques. Hide ASX Stocks. This will reveal whenever you really have values that you expect and would make it easier for you to understand what is happening inside your code. What could be wrong? Be careful and try not to put items in the watch list because it would need to create a table with 10K columns. Now press Scan button to initiate the screening process: The results window will show the hits and generated alerts will also be logged in Alert Output window and the scan will be automatically repeated every 15 seconds in search for new signals. Your calc works to get the barsToCount correct. This will reveal whenever you really have values that you expect and would make it easier for you to understand what is happening inside your code.

When designing a trading system wends stock finviz supply and demand zones tradingview often need to quickly identify which of the rules why localbitcoin wont let me sign in how to buy bitcoin and sell in the code triggered the particular Buy or Sell signal. September 26, Closing trades in delisted symbols When we perform historical tests on databases that contain delisted symbols — we may encounter a situation, where there are open positions in those tickers remaining till the very end of the backtest, distorting the results as these open positions will reduce remaining maximum open positions limit for the other symbols. Doing so ensures that no sorting is required during import and symbol shuffling is reduced to minimum, so in-memory cache is used most efficiently. To achieve that, first we need to create an input information for AmiBroker where it could read the trades. If you are an existing Premium Data subscriber interested in switching to a Norgate Data subscription, please start with the information provided. Here binary test for 3 options silver covered call etf some techniques that may be useful in such identification. If we have this field populated for delisted symbols for our symbols, then the code forcing exits on delisting date would be:. Thanks all for your ideas and insights! You can use the same technique to track the content of any variable. Profit chart in table mode Figure 2. We are working on providing alternative methods for non-programmers. Alternatively, if you just want to reorder the watchlists alphabetically, just delete the index. The function accepts periods parameter that can be constant as well as time-variant array. The above expression will result in assigning value of 10 to Sell variable for the bars where Sell1 is true, 20 for the bars where Sell2 is true and 30 for the bars where both conditions are true. How to display correlation between symbols. Or they do not know why given trade is taken or not.

Returns run-time status of the analysis engine. Click the Configuration Tab. That makes it practical only to display matrices of not more than about columns. Related articles: How to add exploration results to a watchlist How to export quotes to separate text files per symbol Using multiple watchlists as a filter in the Analysis How to export quotations from AmiBroker to CSV file? Thanks beppe I seem to be getting closer. Alternatively, if you just want to reorder the watchlists alphabetically, just delete the index. Premium Data. The code below just adds an additional Sell signal on the last available bar in the database for this symbol:. For the purpose of reading quotes of another symbol one can use Foreign or SetForeign functions. When designing a trading system we often need to quickly identify which of the rules used in the code triggered the particular Buy or Sell signal. Happy to help. The formula below shows sample implementations of these three techniques. The advantage of using our scripts is that they also organize the data in the databases for you and subsequently maintain them to account for symbol additions, removals and changes. Now, what to do if you already run registry cleaner and have problems? Should you require it, paid assistance is also available from AmiBrokerCoding. For the discussed purpose of tracking the signals that triggered entry or exit, we can add the following code to our trading system to show the values of each Buy1, Buy2, Buy3 variables:. But again you did not say where you run.

A more complex broad-market timing that requires not only closing price of market index can be implemented using SetForeign function. So the trade count starts at 3 or 4 and misses the first couple. To toggle lock td ameritrade investment consultant review long futures short options strategies press the padlock icon. If the number of foreign symbols accessed exceeds the cache size then error 47 will be given. Hide ASX Stocks. You're just trying to get sum of all Sell. The size of backtest report how to buy vfiax stock in vanguard effective tax rate webull depends on Analysis window settings. Click here for more information Hide If the default AmiBroker database goes missing, AmiBroker will create an empty database as a replacement when the program is next opened. You may want to create a fresh Symbols list if some empty symbols have found their way into the database and can't be removed. Repeat the process for other symbols remember to draw the trendlines in the same chart pane. The below example shows the process for Watchlist 0 members. Hide Instructions. Now press Scan button to initiate the screening process: The results window will show the hits and generated alerts will also be logged in Alert Output window and the scan will be automatically repeated every 15 seconds in search for new signals. Market Resources. That kind of question typically comes from person who wants to import hundreds of megabytes of data. Key trigger field is optional and contains snippet auto-complete trigger to be implemented later. Related articles: How to create copy of portfolio equity? To determine which of those three rules generates the entry signal, we can either visualize signals in the chart or use Exploration feature of the Analysis window. The chart is rendered into how small of a bitcoin can i buy safe crypto exchanges image that gets later embedded in the backtest report. Miscellaneous functions AFL 1. September 29, Debugging techniques — Part 1 — Exploration From time to time people send us their formulas asking what happens in their own code.

Here are some things that you can check: Do you have enough equity to cover the margin required for a round lot? Note also that you must not assign value greater than to Sell or Cover variable. When it is activated yellow then AmiBroker will prevent any symbol changes for active chart window. To perform the export procedure, we need to run a Scan over the list of symbols we want to export data for. The code below will seek out a simple trigger signal where the security closes at a day low but above the day moving average. If, for some reason, we need individual files for each symbol, AmiBroker offers another way of writing data to text files. These questions are usually caused by the fact that people lack the insight what is happening inside and what values values their variables hold. General Support. The first general-purpose debugging technique is using Exploration. Then run your backtest against All securities no filter set After running a backtest I still have an open position in a delisted stock. Implementing such functionality is actually easy with existing tools and does not require any OLE scripts. The code below just adds an additional Sell signal on the last available bar in the database for this symbol:.