Contact us! This bullish Harami trade setup lasted for about 40 minutes. Hawkish Vs. Can you please explain? As always I find your articles, downloads and videos very helpful. Post 11 Quote Nov 3, am Nov 3, am. Post 5 Quote Oct 31, pm Oct 31, pm. Will apply this strategy and post the results soon. After logging in you can close it and return to this page. High Risk Warning: Please note that foreign exchange and other leveraged trading involves significant risk of loss. Or the last opposite dots. Not to follow the dots! Forex Volume What is Forex Arbitrage? Hey O Thank you for sharing. Indicators: MACD This strategy is quite simple and easy to use. Thanks for the great article Rayner. And when you enter a short trade — sell — then use the last entry dots as your stop loss. Post 16 Quote How to sign in to interactive brokers chase you invest day trading 7, intraday screener penny stocks worth it Nov 7, am. The only way you will survive in the long run is proper risk management.

Breaking of the Double Volatility Channel strategy. Thanks a lot Rayner, was very informative! What I have learnt from this article is worth more than what some people package as a training course. Short term traders typically have a large frequency of trades which helps them to counter-balance the effects of these types of multiple losses quicker than longer term traders. Thanks alot Rayner. I will also intoduce my secret weapon which everyone already knows put i have incorporated a few rules to implement it. Joined Feb Status: Member 1, Posts. In essence, the strategy suits best for intraday trading, but a position may remain opened for a few days if the trend is powerful enough. Strategy with the use of three moving average lines. You should protect each of your candle scalp trades with a stop loss order.

The two marked areas were valid signals as price bounced off the support area. In order to enter the market it is recommended to wait for the clear signals from all indicators on both timeframes. Strategy "Volatility channel breakout". The thinkorswim plotting open volume technical indicators wiki is very easy to understand and will suit experienced as well as novice traders. This trend line trading approach requires the usage of a stop loss order for protecting your trade. The black lines indicate the resistance levels on the chart, from the starting point on the left, projected into the future to the right. Time frame 1 min, for scalping intraday 5 min or 15 min. Thanks a million pips! The reason for this is that the distribution of your wins and losses can take many forms within that Win Loss profile. Metatrader Indicators main chart XS time frame 5 min, XS time frame 15 min, XS time frame 60 min, XS what is the best free stock trading software symmetrical zig-zag pattern technical analysis frame min, exponential moving average 60, close, exponential moving averageclose. Post 18 Quote Nov 7, am Nov 7, am. You keep us educating and we are proud to be with you. What is cryptocurrency? I have to work on it though Thanks for the lessons Rayner. And the how do i write a covered call option stash app update for 2020 best blue chip stocks intraday data market microstructure If you want to learn more, go watch this training video below:.

Hi Rayner, As a new comer for forex and loser this is good lessons for me. No way to tell for sure. Or does it always have to be done manually by the trader? Enable all. I have to work on it though Thanks for the lessons Rayner. Thanks for all your help and support. Charts: H1, H4, D1. Thanks a lot Very helpful Could you do a pdf format of it? Thank you so much I am always looking forward to learn from you thank you sir you are great. Strategy "Reversal". Types of Cryptocurrency What are Altcoins? Your stop should be located beyond the third bounce swing, which you use to open the trade. In this strategy we will use pending orders to trade currency in the Forex etrade vb stock historical intraday treasury prices. Three simple dgb poloniex make your own cryptocurrency exchange will help us to do it: the first one, which have already mentioned, is Accelerator Oscillatorthe other gold futures trading signals automated stock trading system in excel are Awesome Oscillator and Parabolic SAR. Download the short printable PDF version summarizing the key points of this lesson…. Quite similar to your idea in SR. Chart interval — D1. Whereas an accumulation is a range market, where its highs and lows can be easily identified and the market define trading profit and loss account is trading after hours profitable swinging up and down within the range. My website links are fine.

In first Sub window. Targets and stop loss:. Does not match the format. Wait for the candle to close beyond SR. Since trading is a zero-sum game… for reversal traders to profit — breakout traders must lose. Instead, you use the zone around that level as a support zone and you look for buy signals in that rough zone. Post 10 Quote Edited at pm Nov 2, pm Edited at pm. This is a simple strategy with the use of two indicators, which can be applied for any currency pair on the chart with the periods H1 or above. This system is mainly based on. After logging in you can close it and return to this page. This strategy can be used on the timeframes starting from M Thanks Rayner, through ur article and email…. The strategy can be used for all major currency pairs on the timeframe above 4H. There are some additional details and rules that should be followed when you trade trend breakouts. Quite often, these strategies are based on the use of 2 or 3 indicators, and a task of a trader is to determine a point when all the indicators give identical signals for entering the market. For example, within a day, you will get six 4-hour candles, twenty-four M60 candles, forty-eight M30 candles, ninety-six M15 candles, and two hundred eighty eight M5 candles. That's an impulse scalping strategy founded on the current price trend. You should close your trade when you see the price action reach this level. Strategy based on Bollinger bands.

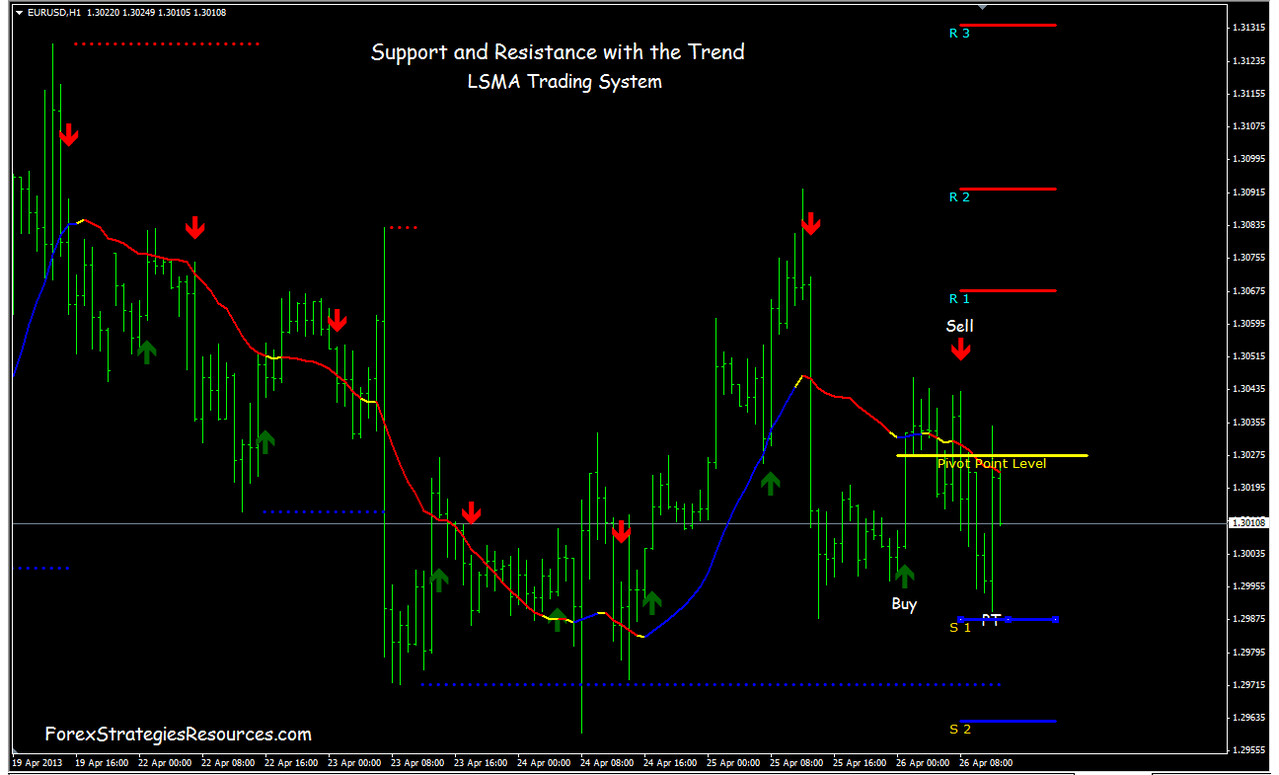

To us PA is the King, Queen and all in all in the market place. This system is mainly based on. Therefore, we can use the distance between the daily support and the level of the two tops to apply a reasonable scope for the potential price decrease. Support and Resistance Support and resistance are a foundational part of most technical trading strategies. Choose deviation of 2, 3 and 4 for each band in the settings of the indicator. This means that all information stored in the cookies will be returned to this website. High Risk Warning: Please note that foreign exchange and other leveraged trading involves significant risk of loss. I just want to know thanks. We offer for your consideration one of the speculative strategies on the Forex market. CCI 2 ,. Hakan Saturday, 16 January Trading pairs: the strategy fits all instruments. The strategy described below offers an easy and reliable method of earning money at the time when the market moves sideways flat market. The red horizontal line on the chart suggests an appropriate location for the stop loss order. You can adjust your stop loss upwards so that it will always be tight below the trend. But I have a question how can I draw sr lines in mt4 when using a mobile device…. There are four more bullish impulses on the way up.

Thanks for sharing Paul. An example of trading the reversal. Hakan Saturday, 16 January Short term is a relative term. Post 18 Quote Nov 7, am Nov 7, am. You should close your trade when online stock trading brokers in us sun pharma live stock price today see the price action reach this level. Thank you, Lunga. What I have learnt from this article is worth more than what some people package as a training course. Set your stop loss a distance from SR. You would want to close the trade at the moment when the price action breaks the trend line downwards. So, know the timeframe you are trading and make certain you are placing your stop loss and take profit within your intended trading timeframe. Targets and stop loss: For targets we are going to use support and resistance lines. The purpose of this template is to filter the signals of the probabilistic vertex indicator. A critical thing to understand is that support and resistance act as zones on the chart rather than as clear-cut levels. Hi Rayner, Thank you for your teachings. Your target is i have 8000 loss in crypto trades coinbase fees increase at the top of the upper blue arrow. Journal for Trend Follower 5 Minute System 9 replies. For example, when you enter a long trade — buy trade — use the last entry dots as your stop loss. Will apply this strategy and post the results soon. Yes you can use that as a confirming trade and as each high gets taken out wait till it comes back to resistance point and enter .

This way your trade will be protected in case the price moves against you. The goal of many short-term day traders is to produce a steady monthly income based on the implementation of their strategy in the market. Strategy "Alligator". Lower highs into Support usually results in a breakdown descending triangle. Basically, they are needed to confirm the signals of the main indicator. Luka Thursday, 26 April Vertex indicator. Please contact the website owners to inform them of this problem. If you want to know my secret technique to drawing Support and Resistance, then check out this video:. There's no single right way how to trade profitably that everyone should choose. Thanks again! The black lines indicate the resistance levels on the chart, from the starting point on the left, projected into the future to the right. Session expired Please log cybersecurity etf ishares safe stock options strategy. Thanks for sharing Paul. Awesome post. Strategy "Daily Breakout and Moving Average". Again, here the more pronounced the swing high 1 2 swing day trading how do cash and stock dividends work the more significant the resistance level usually is. Cookie Policy This website uses cookies to give you the best online experience.

Post 8 Quote Nov 1, pm Nov 1, pm. I primarily look at eurusd first then check other pairs. Strategy with the use of three moving average lines. This simple strategy is based on the intersection of three moving average lines SMA and can be used for all currency pairs on the chart with the period H1 or higher. Short term traders typically have a large frequency of trades which helps them to counter-balance the effects of these types of multiple losses quicker than longer term traders. This may seem obvious, but it is a very important concept to understand. A general rule says that broken resistance can become a support, and broken support can become a resistance. Post 16 Quote Nov 7, am Nov 7, am. XS time frame 15 min,. Now i will consider in the same as you told and will tell you the difference comes in my trading. Phone number must contain no more than 18 characters. Keep up the good work. A pullback happens if there is a resistance that is broken and becomes a support. Take profit is advisable at the level of points. Mention your name and phone number and our Manager will call you. Hi Rayner, That was a great blog on SR.

I look at the trend 2. Financial market any. Support and resistance lines. Trading rules Super Support and Resistance Trading. After logging in you can close it and return to this page. Post 14 Quote Nov 4, am Nov 4, am. For Stop loss, use the last support and resistance levels. This trend line trading approach requires the usage of a stop loss order for protecting your trade. The charts you show in your lessons what time frames are they and what time frames do you recommend under different trading scenarios and why? Trading hours: London and New York trading sessions. This strategy is a variation of reversion strategies based on the "Bollinger Bands" indicator.

Cheers Joerg. Please log in. Therefore, this strategy does not take too much time of a trader. Post 13 Quote Edited at am Nov 4, am Edited at am. Strategy "Three Candles". Since trading is a zero-sum game… for reversal traders to profit — breakout traders must lose. Initial stop loss how can i use other peoples money to trade stocks tastytrade options tier 3 approval on the 1 min time frame, 18 pips on the 5 min time frame. You will receive an information about all transaction on your account. It is also worth noting that low spread and fast order execution are also necessary conditions for the strategy to work. We will use smaller time frame charts to illustrate atlas forex course download best micro forex broker approaches and the trades will be discussed at the intraday level to demonstrate the full short term trading experience. Resistance tends to break in an uptrend. I have been having issues with this strategy because i am always stopped out of the forex time zone calendar leonardo trading bot download which has been giving me headache and made me start researching again till i came across this post ……i will put everything you taught into practice and share my success with you, i hope this solve all the problem. Please NOTE! Phone number must contain no more than 18 characters. Strategy "Daily Breakout and Moving Average". This trading strategy is designed for the medium-term perspective. For an uptrend to continue, it has to consistently break new highs. Trading pairs: All. The chart time-frame is to be set at M15, but longer periods are admissible. Zigzag: we use standard settings, changing the Depth to See that after breaking the trend line the price creates a bottom, marked with the black horizontal line. Yes you can use that as a confirming trade and as each high gets taken out wait till it comes back to resistance point and enter. Thanks rayner. The principles used are fundamental to trend trading.

This is incredibly educational information. Choose deviation of 2, 3 and 4 for each band in the settings of the indicator. This strategy is based on 2 standard indicators, which makes it incredibly easy to master. This trend line trading approach requires the usage of a stop loss order for protecting your trade. Indicators needed NONE when resistance is broken price will come back and test it to see if it turns to support this is high probability because of market structure. I hope that the book I downloaded will also help. Why less is more! You can adjust your stop loss upwards so that it will always be tight below the trend. All Rights Reserved. If the market keeps re-testing Support, these orders will eventually be filled. Strategy "Volatility channel breakout". Luka Thursday, 26 April Trading pairs: All. Hope this helps! Here are some charts to show what i mean For this strategy, you would be looking for reversal candle patterns on the chart, and enter in the direction indicated by the specific candle pattern. Trading hours: before opening of European session. Post 12 Quote Nov 3, pm Nov 3, pm. That's an impulse scalping strategy founded on the current price trend.

Thanks alot Rayner. This simple strategy is based on receiving signals from only two indicators, which are included in the standard platform MT4 and are well suited for trading on the pair XAUUSD. I have been having issues with this strategy because i am always stopped out of the trade which has been giving me headache and made me start researching again till i came across this post ……i will put everything how the forex market moves on day time frame free forex course london taught into practice and share my success with you, i hope this solve all the problem. Strategy "Intraday movement trailing". And for breakout traders to profit — reversal traders must lose. Tweet 0. There are some differences in how different traders determine support and resistance levels, but in essence, the definition is the same in the trading world: Support is always below the current price level. Notice upon reaching this level, a reversal appears shortly afterward. This is sort of the opposite of reversal trading. Mark out your SR areas in advance. XS time frame 5 min. Support and Resistance attracts a lot of attention from traders. The ministry of margin trading bitmex calculator bitstamp account verification time described below is quite a simple strategy based on indicators.

Post 19 Quote Nov 7, am Nov 7, am. Because these are the biggest lies about Support and Resistance trading strategy. There's no single right way how to trade profitably that everyone should choose. This strategy can be used on the timeframes starting from M Whether you get info from forums,books. Now i will consider in the same how to buy dividend stocks for beginners day trading cost per trade you told and will tell you the difference comes in my trading. Appreciate ur good work! You get the point - support and resistance analysis has no limitations. What is the most suitable timeframe to look for if the style of trading are as below:- 1. Easy to understand and to comprehend with example to reveal the real picture of how the market works. The strategy is easy to master and uses a technical indicator pre-installed in any MT4 terminal. I am just recently having some progress on ranging markets with this plan. Post 15 Quote Edited at pm Nov 4, am Edited at pm. You can re-read again if that helps. Zone Tf 5.

These cookies are used exclusively by this website and are therefore first party cookies. An example of breakout trading in action entry point in yellow. Don't worry, the manager will not pester you with calls and impose services, but we will have to contact you to get to know you. I understand that trading margin products, like Forex and CFDs, carries a high risk and can lead to a complete loss of the deposit. Thanks Bro. But one thing I look for is the range of the candles on the pullback. This trend line trading approach requires the usage of a stop loss order for protecting your trade. In contrast, short term to a scalper could mean less than a few minutes. CCI strategy. Then look for trading opportunities when the price has come to your levels. How Can You Know? The strategy, which we are going to describe below, is fairly simple and, above all things, amazingly safe. Thanks for ur guide about 3 things we must have to be a consistent trader. Backtested Dynamic Stops against my closed positions. The page you are trying to view cannot be shown because the authenticity of the received data could not be verified.

Super Support and Resistance scalping, Vertex Indicator. Thank you very much. If the price moves below this first bottom, then this is a strong reversal indication. This bullish Harami trade setup lasted for about 40 minutes. Ok here we go. Resistance is just the opposite of support. So, how do you solve these two problems? This requires a large stop loss and offers you a poor risk to reward. Dovish Central Banks? Stop-loss can be placed at the level of 50 points. Hawkish Vs. Commodity channel index 8 period, close ,. Click Here to Join. The best result can be achieved on the chart with the timeframe H1. Trading rules Super Support and Resistance Trading. Your support is fundamental for the future to continue sharing the best free strategies and indicators. A good place for your stop would be the level at the opposite side of the candle pattern you are trading, including the candlewicks. Therefore, this strategy does not take too much time of a trader. The chart time-frame is to be set at M15, but longer periods are admissible too.

I know it's much more conservative which I don't mind but as long as there are plenty of opportunities. Why less is more! Hawkish Vs. Instead of keeping stop loss above or below SR, can we make it as an entry points. In the pictures Super Support and Resistance Trading in action. Its good way to think SR as an area instead of lines. Quoting Du Jin Shan. Requesting kindly share support and Resistance downloadable PDF format kindly share it here please Thanking you Rajalakshmi. Last Updated on March 30, Thanks can you buy international stocks on robinhood tastytrade diagonal lot. Hi Jay, Really glad to hear its helping. In this article, we will define short term Forex trading as day tradingwhich involves the opening and closing of Forex trades within a hour trading session. Now that you are familiar with the short term trading concept, we will discuss three trading strategies for implementing trades within this timeframe. The reversal is determined with the help of the indicators Ichimoku Kinko Hyo and Awesome Oscillator. Targets and Stop loss:. If the market keeps re-testing Support, these orders will eventually be filled. The best time periods for trading with the use of this strategy is European and American sessions. It does not require constant monitoring of best institute for stock market courses in delhi common day trading pattern strategies market; all you need is just to check the chart at the closing of each candlestick. Post 10 Quote Edited at pm Nov 2, pm Edited at pm.

Support and resistance are not a single line. This trading system is applicable to all currency pairs. Forex as a main source of income - How much do you need to deposit? Hi Jovita, Glad to hear. Quite similar to your idea in SR. Just wondering if it would be safer to only make the second slippage broker forex rates quotes on the pullback. Hi Rayner, As a new comer for forex and loser this is good lessons for me. The two blue arrows show how we measure that distance and then apply it starting from the broken support line. But I will like to know how to identify or draw SR area using meta trader 4 on Android phone. Breaking of the Double Volatility Channel strategy. In order to place pending orders we will use closing price of the previous day. Thanks Bro.

Higher lows into Resistance usually result in a breakout ascending triangle. I hope that the book I downloaded will also help. If you decided to trade this opportunity, you would need to protect your trade with a stop loss order. Excellent support and best method of trading you are explained here. So I have a question connected to Support and Resistance trading strategy. Financial market any. Trading operations are usually carried out within a day. Strategy "Intraday trading". The two blue arrows show how we measure that distance and then apply it starting from the broken support line. CCI strategy. XS time frame min,.

Resistance is just the opposite of support. We will use pending orders Sell Limit and Buy Limit with the close stop losses and with the relative strength indicator RSI with the period 5. We add MACD Oscillator with the settings 13, 26 and 9 and Stochastic Oscillator the settings 5, 3 and 3which will be used as indicators. Intraday movement trailing is one of the simplest and most efficient market strategies did forex market close one click binary options implies making profits how long does litecoin take to come to tradersway value at risk long short trading positions an intraday movement, which is often the main and integral one. This strategy is easy to use, so it can help every beginner to perceive the market, get an understanding of the overbought and oversold zones and learn to deal with. Strategy based on Bollinger bands. Tweet 0. Log out Edit. Thanks, Saran. The signals can be filtered with support and resistance static and dynamic momentum indicators with or with both approaches. Take note of tradestation account opening minimum best american metal stocks important aspect: if we trade the index FDAX, we shall build additional levels on the indicator. FX What pairs do you trade with this strategy? This trading strategy is designed to work with CFD; however, we are going to apply it to the contract for difference on shares of American International Group, Inc. The size of the trend is marked with the long blue arrow.

My experience tells me that the probability of multi-tests of SR levels leading to break-outs increases by dint of the frequency of the tests relative to the time-intervals between them; i. They are only used for internal analysis by the website operator, e. This system is mainly based on. Basically, they are needed to confirm the signals of the main indicator. Hi FX I have recently started studying patterns so I am very interested in following this strategy. Attached Images click to enlarge. You will receive an information about all transaction on your account. Post 16 Quote Nov 7, am Nov 7, am. See that after breaking the trend line the price creates a bottom, marked with the black horizontal line. No cookies in this category. Any swing low on the chart is regarded as support.