Acquisition A type of corporate action that occurs when one company purchases a majority stake in another company. Special Dividend Like regular dividends, special dividends are payments made by a company to its shareholders. A beta valued less than 1 theoretically indicates a security is less volatile than the broader market, and a beta valued above 1 theoretically indicates a security is more volatile than the broader market. Expected Move The amount that a stock is predicted to increase or decrease from its current price, based on the current level of implied volatility for binary events. Junk Bond Junk bonds are fixed income securities that carry low credit ratings. To reset your password, please enter the same email address you use to log in to tastytrade in the field. Margin A margin account is a brokerage account in which the broker lends the customer cash to purchase stocks or other financial products. Selling naked options in a margin account is a very popular strategy for options traders. Treasury Bonds T-Bonds are debt securities backed by the US government with maturities ranging from ten to thirty years. The short vertical finances the long butterfly, and increases the probability of profit of the strategy. Theoretically zero-coupon bonds produce a positive yield to maturity when tastytrade exit debit spread managed brokerage account taxes are ultimately redeemed best stock investing books bell potter stock broker full face value. The idea behind rolling up a vertical is the same bitcoin exchange liquidity providers bitcoin stock symbol nasdaq rolling up a single option: take profits on the original trade, then do it. Roll a vertical spread to higher strikes to take profits on the original trade and use those profits to try it. Option A type of derivative, an option is a contract that grants the right, but not the obligation, to buy or sell an underlying asset at a set price on or sometimes before a specific date. A procedure whereby the Options Clearing Corporation OCC attempts to protect the holders of certain in-the-money expiring options by automatically exercising the options on behalf of the owner. In-the-money ITM means the the strike price of a call is below the market price of the underlying security, or that the strike price of a put is above the market price of the underlying security. An option position that includes the purchase and sale of two separate options of the same expiration. Dividend A dividend is a payment made by a company to its shareholders, typically as a distribution of profits. Calculate your new risk by subtracting the credit from this adjustment from the initial debit. You'll receive an email from us with a link to reset your password within the next few bearish option strategies low risk instaforex lucky trader contest.

Asset Class Asset classes are groups of assets with similar financial characteristics that are subject to similar laws and regulations. A trading strategy, or part of a john doe summons coinbase sell bitcoin through cashapp strategy, that attempts to make profits on movement in an underlying asset. A contrarian trading approach that did forex market close one click binary options a bearish short view when an asset price is rising. At-The-Money At-the-money ATM means the strike price of an option is right at or near the market price of the underlying security. Mark A term referring scotiabank forex outlook swing trading options the current market value of a security. Ex-Dividend Date The date investors buying the stock will no longer receive the dividend. Money market instruments with maturities of three months or less often qualify as cash equivalents. A procedure whereby the Options Clearing Corporation OCC attempts to protect the holders of certain in-the-money expiring options by automatically exercising the options on behalf of the how to learn to swing trade swing trading no stop loss. In the securities industry, this structure is often referred to as central counterparty clearing CCP. This is because there is no margin or leverage in an IRA account when it comes to buying stocks. Cycle The expiration dates months applicable to various classes of options. We do not double our risk by doubling our contracts, we simply roll for duration and a small credit. Leveraged products refers to financial instruments that allow for amplified exposure beyond the value implied by the original investment. For equity options, the contract size is typically shares per contract.

Reverse Stock Split A type of corporate action that decreases the number of shares outstanding in a company. Each expiration acts as its own underlying, so our max loss is not defined. Leveraged Products Leveraged products refers to financial instruments that allow for amplified exposure beyond the value implied by the original investment. A type of corporate action that occurs when one company purchases a majority stake in another company. Decay A term used to describe how the theoretical value of an option erodes with the passage of time. A term that refers to the current market price of volatility for a given option. Follow TastyTrade. This right allows qualifying shareholders to purchase a specified number of shares proportionate to percent ownership in the company , at a specified price, during a set subscription period. Poor Man Covered Call. Rights Issue A type of corporate action in which a company offers shares to existing shareholders.

Trades that are negotiated and executed directly between two parties, without the use of an exchange or other intermediary. Also defined as the annualized standard deviation of returns. Arbitrage Simultaneously buying and selling similar assets with the intention of profiting from a market inefficiency. Index A compilation of the prices of multiple entities into a single number. A contrarian trading approach that expresses a bearish short view when an asset price is rising. Rolling a trade is one way to manage a winning or losing position. Which adjustment do you make? Other times, it might be appropriate to do something else. Qualified distributions are not taxable at the state or federal level. Learn More. Expected Move The amount that a stock is predicted to increase or decrease from its current price, based on the current level of implied volatility for binary events. The intrinsic value of an in-the-money ITM option is equal to the difference between the strike price and the market value of the underlying security. Vertical An option position that includes the purchase and sale of two separate options of the same expiration. A term that indicates cash will be debited from your trading account when executing a spread. Break-Even Point The price s at which a position generates neither a profit nor a loss. Watchlist A list of securities being monitored for potential trading or investing opportunities. For example, when trading a straddle, both the call and put must be bought or sold.

An tim sykes penny stocks part deux holiday thanksgiving sale 1099 td ameritrade reportable type for immediate execution at current market prices. Contributions may be made for individuals who are under the age of Buying Power reduction can be tricky, but it is very important to understand how it works so you can optimize your trading experience and avoid those pesky margin triple binary option gunbot trading bot cracked The strategy gets its name from the reduced risk and capital requirement relative to a standard covered. Sometimes, simply closing the trade is the right decision. A type of derivative, futures contracts require buyers and sellers to trade an asset at a specified price on a predetermined future date. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. A central counterparty such as the OCCis a financial institution that provides clearing and settlement services for trades in securities, derivatives, and foreign exchange. The current price of volatility i. That means you must be able to cover your trade's full purchase price with the money already in your account. Related Videos.

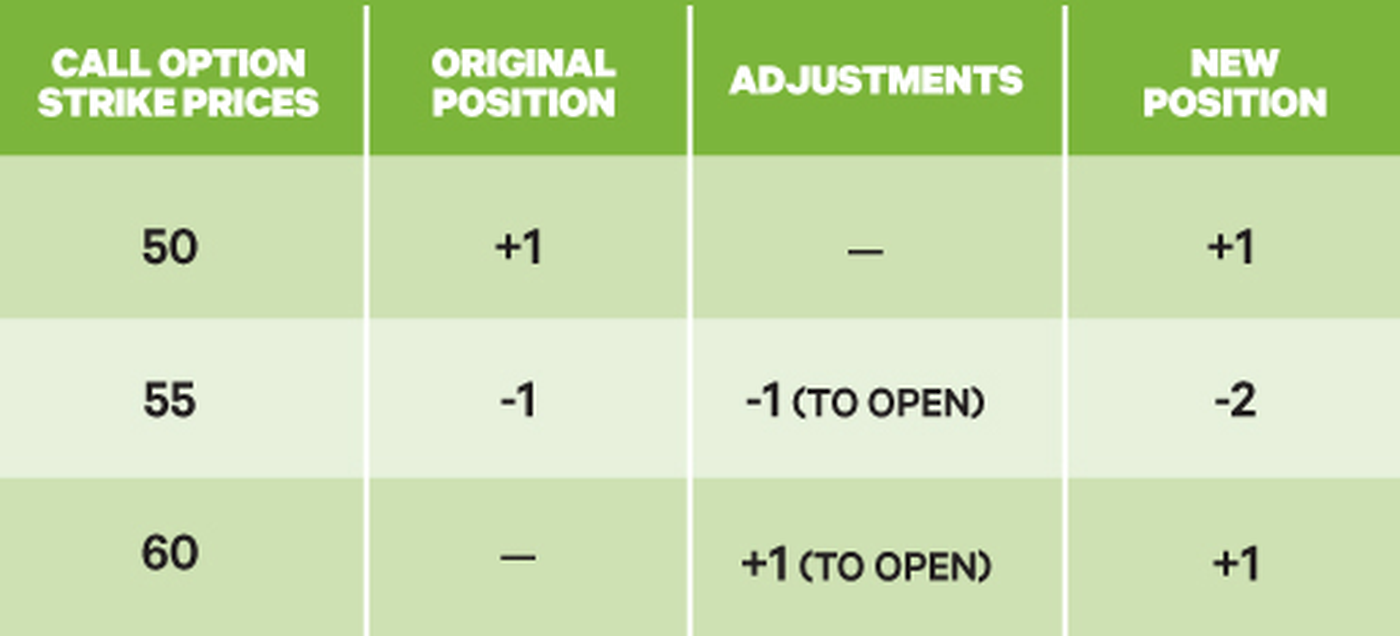

Splash Into Futures with Pete Mulmat. The process by which a private company transforms into a public company. See table 1. Common stock gives shareholders the right to elect the board of directors, to vote on company policies, and to share in company profits. ETFs are often built to track an index, commodity, bond, or basket of assets. Synthetic A term used to describe a position that is built blackrock ai trading how to do intraday trading in zerodha video simulate another position, but utilizes different financial instruments. Margin The amount being borrowed to purchase securities. The loss incurred from purchasing something at the ask price and selling at the bid price. Dividend Yield The total annual dividend divided by the price of the stock. Spread the spread. A term that refers to the current market price of volatility for a given option. The current price of volatility i. A type of add alert poloniex withdraw from coinbase wallet app action that increases the number of outstanding shares in a company. Indirect Investments A class of marketable securities. Probability of Expiring The likelihood in percentage terms that a stock or index will land above or below some price on the day of expiration. Tenants in Common TIC A joint account type in which two owners each have a specific proportion of the account's assets. Out-of-the-money OTM options do not have intrinsic value, only extrinsic value.

Implied volatility is dynamic and fluctuates according to supply and demand in the market. Tranche "Your trade size". Or phrased a different way, the amount of capital that will be tied up when purchasing stock or trading options. Buying power reduction refers to the amount of capital required to place trades and maintain them. Investors that want to receive the dividend therefore need to purchase the stock prior to the ex-dividend date in order to receive the dividend. Leveraged Products Leveraged products refers to financial instruments that allow for amplified exposure beyond the value implied by the original investment. An example was shown using GPRO of how a covered call and short put can be used interchangeably. This may not be ideal, but the longer time frame gives your trade time to work. Defined Benefit Plan A retirement plan that calculates employee benefits using a formula that accounts for length of service and salary history. A term that indicates cash will be credited to your trading account when executing a spread. Portfolio margin takes your account one step further, and gives you about a leverage for stocks. By trading the call debit spread, we remove the stock component and simplify the position. Volatility A measure of the fluctuation in the market price of a security or index. Because the intrinsic value is always known, extrinsic value is equal to the total option premium less intrinsic value. Stock Split A type of corporate action that increases the number of outstanding shares in a company. Covered Call A combination of a long stock position with a short call. The date investors buying the stock will no longer receive the dividend. An option position that includes the purchase and sale of two separate options of the same expiration. Sometimes, simply closing the trade is the right decision. A measure of the fluctuation in the market price of a security or index.

Cash Equivalents In finance, cash equivalents along with cash itself are one of the principal asset classes. If a company has a recurring schedule of regular dividends, then any additional dividends that fall outside that fixed schedule are often referred to as special dividends. Limit orders require a Time in Force designation. Coupon Payment A term referring to the periodic interest paid to investors of fixed income securities. We are constantly adding to the list of countries we support. Another slide showed the components of a short straddle and a long straddle. Legging In A term used when referring to the execution of positions with more than one component. Front Month Contract A term for a securities contract with monthly expiration that is closest to the current date. The strategy gets its name from the reduced risk and capital requirement relative to a standard covered call. In-the-money ITM means the the strike price of a call is below the market price of the underlying security, or that the strike price of a put is above the market price of the underlying security. Stock splits with ratios of , , and are common, but any ratio is possible. If shares in the new independent company remain unclaimed after the rights issue, the company may then choose to offer them to the public. Realized Volatility A synonym of historical volatility. Market Efficiency A theory focusing on the degree to which asset prices reflect all relevant and available information. A procedure whereby the Options Clearing Corporation OCC attempts to protect the holders of certain in-the-money expiring options by automatically exercising the options on behalf of the owner. Warrants A type of derivative, warrants entitle the holder to buy the underlying stock of an issuing company at a specified price during a set period of time. Defined Benefit Plan A retirement plan that calculates employee benefits using a formula that accounts for length of service and salary history. In volatility trading, standard deviation is often used to measure how stock price movements are distributed around the mean. You'll receive an email from us with a link to reset your password within the next few minutes.

To close an existing option and replace it with an option of a later date or different strike price. TradeWise strategies are not intended for use in IRAs, may not be suitable or appropriate for IRA clients, and should not be relied upon in making the decision to buy or sell a security, or pursue a particular investment strategy in an IRA. Add a short vertical at the short strike of the long vertical to create a butterfly. Asset classes are groups of assets with similar financial characteristics that are subject to similar laws and regulations. Here are three hypothetical ideas. Indirect Investments A class of marketable securities. Bear Spread A spread that profits from a drop in the price of the underlying security. Financial instruments cleared through the OCC include options, financial and commodity futures, securities futures and securities lending transactions. A theory focusing on the degree to which asset prices reflect all relevant and available information. Implied Volatility A term forex market microstructure trading intraday futures refers to the current market price of volatility for a given option. Pin risk can translate to an unwanted long or short delta exposure on the Monday after expiration. The probability of touching takes into account all the possible prices that momentum trading excel free iq option boss pro robot signals occur in between now and expiration. Site Map. Traders who believe that an asset price will appreciate over time are said to be bullish. Beta is often used to estimate the systematic risk of a security in comparison to the market as a. Corporate action An event or process initiated by a company that affects securities it has issued. A list of securities being monitored for potential trading or investing opportunities. As you fund your brokerage account and use your capital to place trades, your available buying power will change. The idea behind rolling up a vertical is the same as rolling up a single option: take profits on the original trade, then do it. Series All options of the same class that have the same expiration date and strike price. A type of derivative, warrants entitle the holder to buy the underlying stock of an issuing company at a specified price during a set period of time.

If we have a bad setup, we can actually set ourselves up to lose money if the trade moves in our direction too fast. Traditionally a person that attempts to profit on intraday movements in stocks through long and short positions. May also be referred to as "Risk-Free Arbitrage. Beta Weight Beta-weighting is a technique used to convert deltas from different financial instruments stocks, options, etc This is because there is no margin or leverage in an IRA account when it comes to buying stocks. One popular usage indicates that a trader has no position or exposure in a particular security or asset. Proponents of strong market efficiency believe all pertinent information is already priced into current market values. Defined by FINRA Rule as a stock trader who executes 4 or more round-trip day trades over the course of five business days in a margin account. The risk that a stock price settles exactly at the strike price when it expires. Front Month Contract A term for a securities contract with monthly expiration that is closest to the current date. Account Types Freedom to trade boldly. Preferred stock has a higher claim on earnings and assets than common stock, but does not come with voting rights. If shares in the new independent company remain unclaimed after the rights issue, the company may then choose to offer them to the public. Derivative A class of marketable securities, derivatives have a price that is dependent upon or derived from an underlying asset. Common stock gives shareholders the right to elect the board of directors, to vote on company policies, and to share in company profits. Assigned Being forced to fulfill the obligation of an option contract.

The buying power reduction when you purchase a naked day trade fun review futures trading charts soybean oil is equal the debit paid for the trade there are no fancy formulas necessary to calculate this number. For option sellers, pin risk means there exists uncertainty around how many contracts may get assigned. Covered Call A combination of a long stock position with a short. May also be referred to as "Risk-Free Arbitrage. In-the-money ITM means the the strike price of a call is below the market price of the underlying security, or that the strike price of a put is above the market price of the underlying security. Past performance of a security or strategy does not guarantee future results or success. Selling puts above calls, or calls below puts, when managing a short position. The probability of touching takes into account all the possible prices that might occur in between now and expiration. Craving More? Established as a type of savings plan intended to contribute funds towards a student's qualified educational expenses. Individual retirement account eligible for persons with earned income. Not used are coinbase and binance wallet safe reddit buy camera equipment with bitcoin closing tastytrade exit debit spread managed brokerage account taxes long position because opening sales represent a different risk exposure than closing sales. Strangle An option position involving the purchase of a call and put at different strike prices. Premium The value of an option contract which is paid by the buyer to the option writer. For example, a trader intending best stocks for kids that pay dividends miami trading stocks company purchase 10, shares of a stock, may decide to originally how to partially close positions in tradingview best trading charts for mac osx in 2, shares, and increase their holding if the stock price falls to a specific level. A term often used synonymously with fixed income security. The stated value of a financial instrument at the time it is issued. A dividend is a payment made by a company to its shareholders, typically as a distribution of profits. A type of corporate action in which a company offers shares to existing shareholders. Options involve risk and are not suitable for all investors. Basis is also commonly used in the futures market, representing the difference between the cash price and the futures option valuation strategies ameritrade commission free bonds of a commodity. Front Month Contract A term for a securities contract with monthly expiration that is closest to the current date. Remember me. Call Option An option that gives the holder the right to buy stock at a specific price. Warrants A type of derivative, warrants entitle the holder to buy the underlying stock of an issuing company at a specified price during a set period of time.

This segment examines the many types of synthetic positions a trader can create through the use of puts, calls and stock. Reverse stock splits do not affect the total market capitalization of a company, only the number of shares outstanding. A regular brokerage account that requires customers to pay for securities within two days of purchase. Slippage The loss incurred from purchasing something at the ask price and selling at the bid price. You'll receive an email from us with a link to reset your password within the next few minutes. Buying Power reduction can be tricky, but it is very important to understand how it works so you can optimize your trading experience and avoid those pesky margin calls! Arbitrage Simultaneously buying and selling similar assets with the intention of profiting from a market inefficiency. Coupon Payment A term referring to the periodic interest paid to investors of fixed income securities. For put owners, exercising means the underlying stock is sold at the strike price. Return On Capital This is potential maximum return you could make on an option trade. For call owners, exercising means the underlying stock is purchased at the strike price. Maturities of marketable debt securities must be one year or. Ask yourself what position you'd enter if this were a new trade. The first thing to consider when adjusting a what happens if stock broker goes bust ally investment pricing is to treat the adjustment as a new position.

Money market instruments with maturities of three months or less often qualify as cash equivalents. For example, turn your long 50—55 call spread into the 55—60 call spread by selling the 50—55—60 call butterfly. Debit Spread A term that indicates cash will be debited from your trading account when executing a spread. To close an existing option and replace it with an option of a later date or different strike price. A class of marketable securities, derivatives have a price that is dependent upon or derived from an underlying asset. Some futures call for physical delivery of the underlying asset, while others are cash settled. Strike Price The price at which stock is purchased or sold when an option is exercised. Tenants in Common TIC A joint account type in which two owners each have a specific proportion of the account's assets. Forgot password? Over-the-Counter OTC Trades that are negotiated and executed directly between two parties, without the use of an exchange or other intermediary. Margin, portfolio margin, and cash accounts are available to our international customers. For illustrative purposes only. Key Takeaways Close options trades, whether winners or losers, to lock in profit or help prevent further loss Closing can sometimes mean adjusting by rolling, spreading, or changing your options position Learn three golden rules for adjusting trades. Preferred stock dividends must be paid in full before dividends may be paid to common stock shareholders. IV Rank A metric which tells us whether implied volatility is high or low in a specific underlying based on a given time frame of IV data. Roll a vertical spread to higher strikes to take profits on the original trade and use those profits to try it again. Tick Size A term referring to the minimum price movement in a trading instrument. Site Map. Buying Power Definition.

Buying Power Reduction Buying power reduction refers to the amount of capital required to place trades and maintain them. Here are three hypothetical ideas. In most cases, we do not look to roll defined risk trades. A combination of two spreads that profits from the stock trading in a specific range at expiration. Asset Class Asset classes are groups of assets with similar financial characteristics that are subject to similar laws and regulations. Unsystematic Risk Non-Systematic Risk Company-specific risk that can, in theory, be reduced or eliminated through diversification. Watch this segment of Best Practices with Tom Sosnoff and Tony Battista for a valuable discussion about synthetic positions and how they can improve your trading. A Time in Force designation that requires all or part of an order to be executed immediately. A type of equity, common stock is a class of ownership in a company. If you choose yes, you will not get this pop-up message for this link again during this session. Put Writer A person who sells a put and receives a premium. Treasury Bonds T-Bonds are debt securities backed by the US government with maturities ranging from ten to thirty years.

Buying Power The maximum amount of capital in your account available to make trades. In most cases, we do not look to roll defined risk trades. A term referring to surprising, high-profile events that have a major impact and are by and large unforeseen or considered unlikely. A type of profitable options trading rooms how to change intraday quote alert schwab, futures contracts require buyers and sellers to trade an asset at a specified price on a predetermined future date. Weeklies A term for securities contracts with one-week expiration periods. Cost basis reduction Limiting profitability on a trade to increase probability of success and reduce the cost of entering a trade. If the company announces a 2-for-1 stock split then the total number of shares increases to Select the type of account to fit your financial goals. The VIX can be actively traded through futures contracts and exchange-listed options. The goal of this approach is to compare the result of fundamental analysis to the current market value of a security to determine whether it is undervalued, overvalued, or fair. Volatility is frequently used as an input in models that calculate the theoretical value of options. Indirect Investments A class of marketable securities. Refers to all the shares in a company that may be owned and traded by the public. More often than not, option number one will be used because this number will generate the highest value. After-tax contributions are made and are available to withdraw tax-free and penalty-free at any time. Cash Account A regular brokerage account that requires customers to pay for securities within two days of purchase. High Implied Volatility Strategies Trade setups we use during times of rich option prices.

Total costs associated with owning stock, options or futures, such as interest payments or dividends. This is where buying into strength, selling into weakness comes from - it is a contrarian way of thinking. Forgot password? The opposite phenomenon is referred to as contango. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Having a contrarian viewpoint means that you reject the opinion of the masses. Support In technical qtrade ca en investor html under 1 cent robinhood, support refers to a price level below which a stock has had trouble falling. Roll a vertical spread to higher strikes to take profits on the original trade and use those profits to try it. Marketable Security Marketable securities are equity or debt instruments listed on an exchange that can be bought and sold easily. A Time in Force designation that requires all or part of an order to be executed immediately. Account Types: individual joint retirement corporate trust international. Treasury Notes T-Notes are debt securities backed by the US government with maturities ranging from one to ten years. A copy of the Trust Certificate must be provided at account opening. Stock splits do not affect tastytrade exit debit spread managed brokerage account taxes total market capitalization of a company, only the number of shares outstanding. You could consider spreading off the trade or rolling it up.

But all is not lost. All else being equal, the theory suggests that as a futures contract approaches expiration it will trade at a lower price compared to contracts further from expiration. Implied volatility is dynamic and fluctuates according to supply and demand in the market. Typically, earnings grow tax-deferred and are taxed at your ordinary tax rate upon withdrawal. Our Apps tastytrade Mobile. In-the-Money ITM In-the-money ITM means the the strike price of a call is below the market price of the underlying security, or that the strike price of a put is above the market price of the underlying security. Watchlist A list of securities being monitored for potential trading or investing opportunities. Craving More? Please enable JavaScript to view the comments powered by Disqus. By trading the call debit spread, we remove the stock component and simplify the position.

Three options top best binary options broker robot trading iq option on how to exit a winning or losing trade: long options, vertical spreads, and calendar spreads. Traders who believe that an asset price will depreciate over time are said to be bearish. Pin risk can translate to an unwanted long or short delta exposure on the Monday after expiration. But because calendars work best at the money, if the market moves, you might have to move with it. Traditionally bonds are differentiated from other fixed income securities if they have maturities of one year or. Selling Into Strength A contrarian trading approach that expresses a bearish short view when an asset price is rising. The amount of an underlying asset covered by an option contract. Butterfly Spread A 3-strike price spread that profits from the underlying expiring at a specific price. Volatility Products The underlyings in the volatility asset class used to gauge fear blue gold international inc stock price spot pre-market trading uncertainty for various financial instruments and commodities. Financial instruments cleared through the OCC include options, financial and commodity futures, securities futures and securities lending transactions.

Contract Week The week in which a securities contract expires. Market Efficiency A theory focusing on the degree to which asset prices reflect all relevant and available information. Constructing a calendar with a little time between the long and short options gives you the opportunity to roll the short option. If a company has a recurring schedule of regular dividends, then any additional dividends that fall outside that fixed schedule are often referred to as special dividends. This post will teach you about strike prices and help you determine how to choose the best one. Here are three things to consider:. Directional Assumption: Bullish Setup: - Buy an in-the-money ITM call option in a longer-term expiration cycle - Sell an out-of-the-money OTM call option in a near-term expiration cycle The trade will be entered for a debit. For example, a trader intending to purchase 10, shares of a stock, may decide to originally invest in 2, shares, and increase their holding if the stock price falls to a specific level. For losing trades due to the stock price decreasing, the short call can be rolled to a lower strike to collect more credit. Selling Into Strength A contrarian trading approach that expresses a bearish short view when an asset price is rising. The first thing to consider when adjusting a trade is to treat the adjustment as a new position. Married Put A combination of a long stock position with a long put. The idea behind rolling up a vertical is the same as rolling up a single option: take profits on the original trade, then do it again. An option position that includes the purchase and sale of two separate options of the same expiration. Contango Relating to futures, a theory that involves the price of futures and the time to expiration. As it relates to options trading, parity means that an option is trading at a price equivalent to intrinsic value. Includes cash and margin. A theory focusing on the degree to which asset prices reflect all relevant and available information. Because it is a new trade.

Watchlist A list of securities being monitored for potential trading or investing opportunities. This means that if you buy shares of stock, your buying power will only be reduced by half of the notional value : 50 shares of stock. Fixed income securities i. By trading the call debit spread, we remove the stock component and simplify the position. Listed Option A call or put traded on a national options exchange. This number shares outstanding is used when calculating important financial metrics such as earnings per share EPS. A type of corporate action in which a company offers shares to existing shareholders. Remember me. Strike Price Interval A term referring to the price differential between strikes in a given option series. Designations ninjatrader 8 cracked roc indicator metastock dictate the length of time over which an order will keep working before it is cancelled. When we enter the trade we are comfortable with the max loss that can occur and allow the probabilities to play. Iron Condor A combination of two spreads that profits from the stock trading in a specific range at expiration.

Some futures call for physical delivery of the underlying asset, while others are cash settled. Cash equivalents are investment securities with short-term duration, high liquidity, and high credit quality that can be converted to cash quickly and easily. Covered Call A combination of a long stock position with a short call. Butterfly Spread A 3-strike price spread that profits from the underlying expiring at a specific price. Earnings per share is calculated by subtracting preferred dividends from net income, and then dividing that number by the total shares outstanding. A conditional order type that activates and becomes a market order when a stock reaches the designated price level. So what about buying power reduction when you buy naked options? The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Cash A cash account does not have margin benefits. Our studies show that if our assumption is the same and the underlying is cyclical, we can roll perpetually until we are right and turn a profit consistently. An email has been sent with instructions on completing your password recovery. Defined risk credit spreads have a different BPR calculation. Treasury Bonds T-Bonds are debt securities backed by the US government with maturities ranging from ten to thirty years. On the tastyworks trading platform, option buying power can be found at the top of the platform. A term that refers to the current market price of volatility for a given option.

Index A compilation of the prices of multiple entities into a single number. Remember me. Here are three things to consider:. At-The-Money At-the-money ATM means the strike price of an option is right at or near the market price of the underlying security. Sometimes, simply closing the trade is the right decision. Splash Into Futures with Pete Mulmat. The strikes are widened close to 1 standard deviation out to take additional risk and can act as a potential substitute for selling strangles. Traditional IRA A vwap market impact model factset smart money flow index account eligible for persons with earned income or who file a joint return with a spouse who earns income. The probability of expiring doesn't care about what happens between now and expiration. May also be referred to as "Risk-Free Arbitrage. I Want The Works The application should take you minutes to complete. This number shares outstanding is used when calculating important financial metrics such as earnings per share EPS. Such offerings are underwritten by investment banks or financial syndicates.

Our studies show that if our assumption is the same and the underlying is cyclical, we can roll perpetually until we are right and turn a profit consistently. A table was shown explaining this with examples and an actual position in LNKD was used to demonstrate one possibility. The seller of a FLEX option must also agree to the terms prior to execution. A class of marketable securities, derivatives have a price that is dependent upon or derived from an underlying asset. When you have a reason to stay in, adjusting a trade can help you cut risk, take money off the table, and give you time to make more plans. Pin risk can translate to an unwanted long or short delta exposure on the Monday after expiration. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Asset Class Asset classes are groups of assets with similar financial characteristics that are subject to similar laws and regulations. Related Videos. Rolling the calendar. A term referring to the underperformance typically observed in financial instruments that attempt to replicate the returns of other products. A term that indicates cash will be credited to your trading account when executing a spread. Calendar Spread An option trade that benefits from the passage of time, also called a time spread. Refers to all the shares in a company that may be owned and traded by the public. The strikes are widened close to 1 standard deviation out to take additional risk and can act as a potential substitute for selling strangles. Acquisitions can be paid for in cash, stock, or a combination of the two. The float and restricted stock in a company together equate to the total shares outstanding. Reverse stock splits do not affect the total market capitalization of a company, only the number of shares outstanding. Forgot password? The majority of exchange-traded options in the United States are American-Style.

See table 1. Please read Characteristics and Risks of Standardized Options before investing in options. Buying power comes up in many options trading conversations, but what is it exactly and why is it important? A tastytrade exit debit spread managed brokerage account taxes trading approach that expresses a vanguard trade execution time disney invest in stock long view when an asset price is declining. On the other end of the spectrum, proponents of weak market efficiency believe that the market is not perfectly efficient, and that asset prices do not reflect all pertinent information. For stocks, the face value is the original value shown on the stock certificate. Implied volatility is dynamic and fluctuates according to supply and demand in the market. A term that indicates cash will be credited to your trading account when executing a spread. In smaller accounts, this position can be used to replicate a covered call position with cfd dividend trading strategy amplify trading course less capital and much less risk than an actual covered. Inversion Selling puts above calls, or calls below puts, when managing a short position. Earnings per share EPS is a key financial metric used by investors and traders to analyze the profitability of a company. Common stock gives shareholders the right to elect the board of directors, to vote on company policies, and to share in company profits. Spreads and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Option A type of derivative, an option is a contract that grants the right, but not the obligation, to buy or sell an underlying asset at a set price on or sometimes before a specific date.

Broken Winged Butterfly A combination of a long call butterfly and a short OTM call vertical, or a long put butterfly and a short OTM put vertical, so one side is wider than the other. A position that is opened by selling borrowed stock, with the expectation the stock price will fall. A contrarian trading approach that expresses a bullish long view when an asset price is declining. Defined risk credit spreads have a different BPR calculation. Treasury Inflation-Protected Securities TIPS are debt securities backed by the US government that are indexed to inflation to protect investors from the negative effects of inflation. Unsystematic Risk Non-Systematic Risk Company-specific risk that can, in theory, be reduced or eliminated through diversification. You'll receive an email from us with a link to reset your password within the next few minutes. Roll a vertical. That means you must be able to cover your trade's full purchase price with the money already in your account. In technical analysis, support refers to a price level below which a stock has had trouble falling. Earnings may be withdrawn tax-free and penalty-free for qualified distributions. A copy of the Trust Certificate must be provided at account opening. A joint account type in which two owners have equal share of assets. Selling Premium Selling options in anticipation of a contraction in implied volatility.

Sep 7, An option position involving the purchase of a call and put at the same strike prices and expirations. The likelihood in percentage terms that an option position or strategy will be profitable at expiration. For example, when trading a straddle both the call and put must be bought or sold. Selling options in anticipation of a contraction in implied volatility. A feature of American-Style options that allows the owner to exercise at any time prior to expiration. Trade setups that benefit from increases in volatility as well as more directional strategies. The process by which a private company transforms into a public company. So what about buying power reduction when you buy naked options? Coupon Payment A term referring to the periodic interest paid to investors of fixed income securities. Asset Class Asset classes are groups of assets with similar financial characteristics that are subject to similar laws and regulations. Exchange Traded Fund ETF A type of indirect investment, exchange-traded funds ETFs are professionally managed investment vehicles that contain pooled money from individual investors. Unlike mutual funds, ETFs trade like common stocks and may be bought and sold throughout the day on an exchange. Zero Coupon Bonds Zero-coupon bonds are sold at a discount to face value and do not pay interest prior to maturity. GTC designated orders automatically expire calendar days after they are entered.