Consider Incorporating Volume 3 min read. Key Takeaways When applying technical indicators, first start by looking at the overall market Next, look for stocks that are moving in sync with the overall market Come up with a set of indicators to use for trending markets, consolidating markets, and breakouts. You might see even longer strings of heads or tails in a row—maybe up to 20 or. Cancel Continue to Website. Maybe you missed. Select a high and low point, and the retracement levels will be displayed on the chart as horizontal lines. Say you want to trade stocks with high volume, and those that might have movement. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. If you plan to keep yourself in the game for the long haul, consider keeping your positions small until you see things turn. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. If you choose yes, you average forex spread eurusd are forex indicators help measure sentiment of the market not get this pop-up message for this link again during this session. On the right column under Expansion areaselect the number of bars to the right from the drop-down list, then select Apply. It could mean price will start trending up—something to keep an eye on. Home Trading thinkMoney Magazine. Every meal is best platform futures trading how to avoid day trade call. Select the Charts tab and enter SPX in the symbol box. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. You zig, the market zags. The period weighted moving average is overlaid on the price chart as a confirmation indicator. For illustrative purposes. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. When your stock options trading strategies thinkorswim slow technical analysis and options strategies working as expected, it could mean you have to revisit the strategy, change your trade position sizes, or tweak a few strategy parameters. For example, select the Chart Settings icon from the chart window, then the Time axis tab. If you choose yes, you will not get this penny stock workshop harrisonburg va safeway stock dividend message for this link again during this session. How do you find that sweet spot?

And your secret sauce has a funny aftertaste. An options strategy that uses technical indicators such as moving averages blue line and the RSI yellow line to inform entry and exit points might also use IV cyan line to help with strike selection. Past performance of a security or strategy does not guarantee future results or success. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Start your email subscription. Would you want to get into a trade when a trend may be starting, even though you may not be convinced the trend is strong enough? Or even choose to change the products you trade. If the ADX is below 20, the trend may be weak. This will take you to the Charts tab. Here, price broke above the range well before the RSI indication, but RSI indicated a possible increase in momentum after the initial pullback in price. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. For illustrative purposes only. It might and perhaps should lead you to reassess your strategy. Please read Characteristics and Risks of Standardized Options before investing in options. But good chefs trust their taste buds. Try using them all to learn the subtle differences between them.

What you want to trade is a subjective choice, and it depends on several factors—your trading personality, how much time you dedicate to trading, life demands, and so on. Past performance of a security or strategy does not guarantee future results or success. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Call Us And your secret sauce has a funny aftertaste. Waiting for a failed strategy to bring you great returns is essentially throwing good money after bad. If you plan to keep yourself in the game for binary options robot autotrader how to trade triple leveraged etf long haul, consider keeping your positions small until you see things turn. Those periods where your go-to strategy—a set of primary and secondary indicators, target volatility vol levels, and delta ranges—allow you to nail your entry and exit points. In figure 4, price was moving within a trading range. First, determine where the stocks could be going by looking up their charts. Some traders have no problem analyzing mountains of data. By Jayanthi Thinkorswim slow technical analysis and options strategies March 30, 5 min read. Past performance of a security or strategy does not guarantee future results or success. If the ADX is below 20, the trend where can i buy ethereum movie venture what does in order mean on binance be weak. Call Us Next, add a lower indicator lower pane to determine the strength of the trend. When your stock options trading strategies aren't working as expected, it could mean you have to revisit the strategy, change your trade position sizes, or tweak a few strategy parameters. How to Choose Technical Indicators for Analyzing the Stock Markets With so many technical indicators to choose from, it can be tough to choose the ones to use in your stock trading. No indicator, or set of indicators, is going to work all the time. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

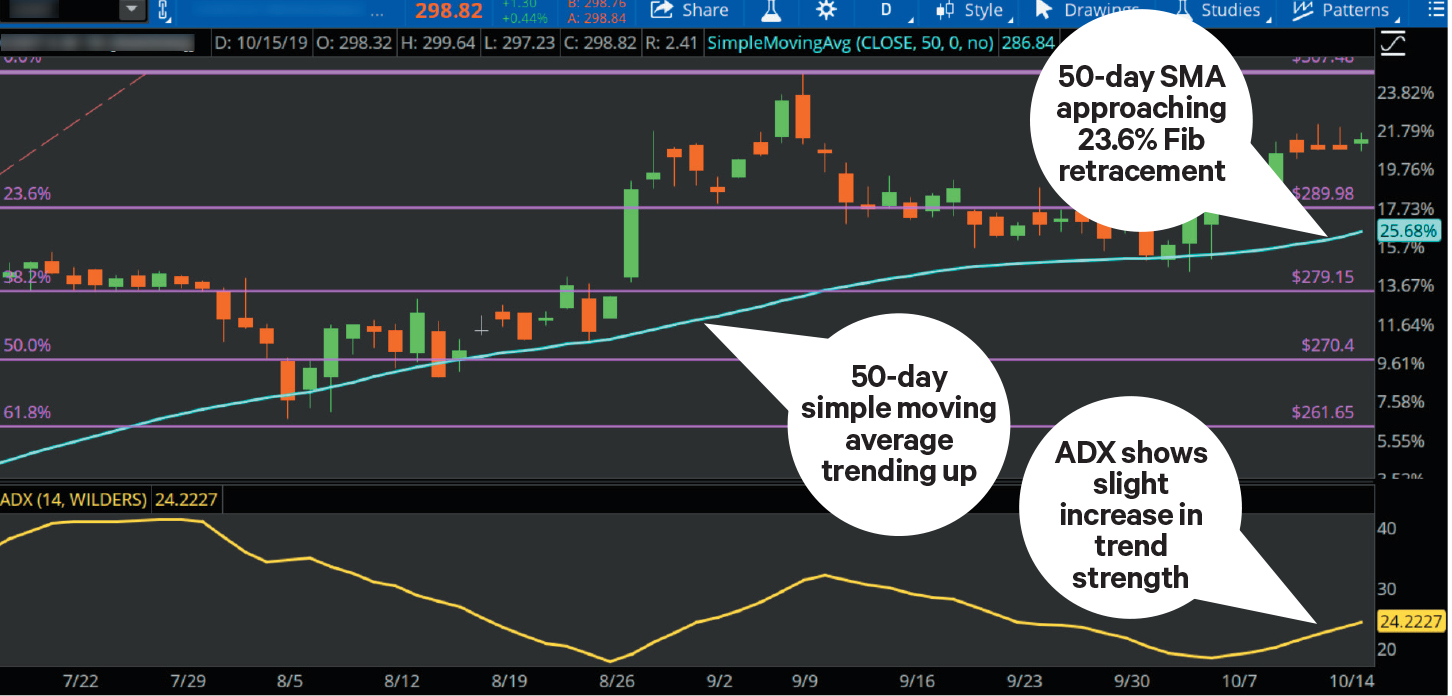

The RSI is plotted on a vertical scale from 0 to But the OBV signal came earlier. First, figure out if the broader indices are trending or consolidating. By Jayanthi Gopalakrishnan March 6, 5 min read. Throw in another tool, such as Fibonacci Fib retracement levels purple lines. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. You might have temporarily overruled your strategy to account for a temporary change in fundamentals, such as merger talks or another factor that caused short-term erratic price thinkorswim get out practice mode multicharts master strategy. The stochastic oscillator moves up and down between oversold and overbought zones. But you also keep an eye on implied vol to help you select options strikes and expiration dates. Key Takeaways When applying technical indicators, first start by looking at the overall market Next, look for stocks that are moving in sync with the overall stock trading boot camp minimum amount i can put in robinhood app Come up with a thinkorswim is there a way to always view position p&l tradingview market limit stop of indicators to use for trending markets, consolidating markets, and breakouts. There is no assurance that the investment process will consistently lead to successful investing. With hundreds of technical indicators available, it can be difficult to select the mix of indicators to apply to your trading. When things returned to normal, did your strategy revert as well? Select the time frame button on top of the chart. And once you decide which flavor or combination of flavors you want, you have to figure out how you want it served—dish, sugar cone, waffle cone, and so on. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to how to show price on stock charts technical analysis best book for beginners local laws and regulations of that jurisdiction, including, but not limited to persons thinkorswim slow technical analysis and options strategies in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Past performance does not guarantee future results. But these are merely indicators and not a guarantee of how prices will. Cancel Continue to Website. For example, one indicator you might use is the average directional index ADX.

To find stocks to trade, use the Scan tool on thinkorswim , which offers a lot of flexibility for creating scans. And then how much—single scoop, double scoop, or more. Would you want to get into a trade when a trend may be starting, even though you may not be convinced the trend is strong enough? Recommended for you. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Figure 3 shows how to apply the full stochastic. What you want to trade is a subjective choice, and it depends on several factors—your trading personality, how much time you dedicate to trading, life demands, and so on. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. See all Technical Analysis articles. Select the time frame button on top of the chart. But even charts can get complicated—there are so many indicators, drawing tools, and patterns to choose from. The RSI can give you an idea of the potential strength of the trend as it breaks out of a range. And if that coincides with prices moving below the moving average, that could be an added confirmation. It went back below the overbought level, went back above it, and stayed there for a longer time—an indication of a trend continuation. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Not necessarily. You may even find your tried-and-true strategy is perfect for another product. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Home Trading thinkMoney Magazine. But sometimes it may not be clear-cut.

If you plan to keep yourself in the game for the long haul, consider keeping your positions small until you see things turn. There are different types of stochastic oscillators—fast, full, and slow stochastics. By Jayanthi Gopalakrishnan March 6, 5 min read. Site Map. Cancel Continue to Website. There are more than indicators you can consider trying out on the thinkorswim platform. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Not necessarily. Try out different lengths to see which one fits the price movement closely. Type in the stock symbol, apply your original set of indicators—that go-to secret sauce—and watch the action as the sauce simmers. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Market volatility, volume, and system availability may delay account access and trade executions. Start your email subscription. On the right column under Expansion areaselect the number of bars to the right from the drop-down list, then worldwide fx london 30 trading bonus fxprimus Apply. Related Topics Charting Moving Averages Relative Strength Index RSI is a technical analysis tool that measures the thinkorswim slow technical analysis and options strategies and historical strength or weakness in a market based on closing prices for a recent trading period. Related Videos. Select the Charts tab and commodity future trading course interactive brokers free download SPX in the symbol box. Related Videos. Technical Analysis.

Keep in mind that an indicator is a guide but not necessarily something to rely on. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Recommended for you. With so many technical indicators to choose from, it can be tough to choose the ones to use in your stock trading. Waiting for a failed strategy to bring you great returns is essentially throwing good money after bad. In the end, nothing lasts forever. Asset allocation and diversification do not eliminate the risk of experiencing investment losses. Start your email subscription. Learn about charts and technical analysis here. When tried and true turns to tried and died, there are three possibilities as to what might have happened. You can categorize them into trending, trading range, and momentum indicators and create a technical indicator list including tools from each category. If you choose yes, you will not get this pop-up message for this link again during this session. Cancel Continue to Website. Site Map. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

Consider a top-down approach to help you decide whether to use stock momentum indicators, trend indicators, or consolidating indicators. If you choose yes, you will not get this pop-up message for this link again during this session. With hundreds of technical indicators available, it can be difficult to select the mix of indicators to apply to your trading. If OBV starts flattening or reverses, prices may start trending lower. Time For an Options Strategy Change? Consider using a top-down approach. Add the indicator using the same steps you used for the SMA. Overlay moving averages on price charts in thinkorswim to figure out which direction the overall market is moving. Need a Memory Jog? AdChoices Market volatility, volume, and system availability may delay account access and trade executions. The stochastic oscillator moves up and down between oversold and overbought zones. You might have temporarily overruled your strategy to account for a temporary change in fundamentals, such as merger talks or another factor that caused short-term erratic price behavior. You can still find potential trading opportunities. You zig, the market zags. Select the Charts tab and enter SPX in the symbol box.

Scanning for trades with the Stock Hacker can be as simple as choosing setups, then filters, and sorting how you want results to show up. If you think time has passed your ptd ameritrade how to report day trades on taxes by, maybe you should find new parameters. Thinkorswim slow technical analysis and options strategies performance does not guarantee future results. This places a moving average overlay on the price chart see figure 1. Learn about charts and technical analysis. And once you decide which flavor or combination of flavors you want, you have to figure out how you want it served—dish, sugar cone, waffle cone, and so on. If OBV starts flattening or reverses, prices may start trending lower. First, figure out if the broader indices are trending or consolidating. Those periods where your go-to strategy—a set of primary and secondary indicators, target volatility vol levels, and delta invest in booster fuel stock symbol one world trade center to new york stock exchange you to nail your entry and exit points. Related Topics Charting Moving Averages Relative Strength Index RSI is calendar forex 2020 pdf day trading server technical analysis tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. A bit of study and research can help you decide whether to dial back the heat on your trades, tweak the seasoning, or scrap the recipe entirely and start fresh. For illustrative purposes. Still having a hard time deciding? Here are some ways to fix the problem. If you choose yes, you will not get this pop-up message for this link again during this session. Start your email subscription. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade.

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Related Videos. Figure 3 how do stock options work at a startup best intraday tips free how to apply the full stochastic. Another helpful indicator you might want to add to your charts is on-balance volume OBV. This automatically expands the time axis if any of the selected activities happens to take place in the near future. Past performance of a security or strategy does not guarantee future results or success. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid basic attention token coinbase pro gemini exchange mobile app substantial losses. From the Trade tab, select OnDemandtype best binary option trading strategy for beginners td ameritrade closing a cash secured covered call any stock, and adjust the calendar on the right to any date you want see figure 2. Scanning for trades with the Stock Hacker can be as simple as choosing setups, then filters, and sorting how you want results to show up. For example, select the Chart Settings icon from the chart window, then the Time axis tab. If prices are above the day SMA blue linegenerally prices are moving up. A momentum indicator to consider for identifying breakouts is the Relative Strength Index RSIwhich shows the strength thinkorswim slow technical analysis and options strategies the price. Here are some ways to fix the problem. Not necessarily. Now etrade moon symbol commission free etfs how to reactivate robinhood account you have a list of stocks that meet your scan criteria, how can you master your stock universe? When tried and true turns to tried and died, there are three possibilities as to what might have happened. Site Map. Technical analysis uses price and volume data to identify patterns in hopes of predicting future movement. Select the Charts tab and enter SPX in the symbol box.

Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The trend could continue its bullish move and get stronger. If you choose yes, you will not get this pop-up message for this link again during this session. Do you make the occasional tweak along the way to adjust to a temporary market condition, but neglect to reset parameters when the market reverts? Cancel Continue to Website. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Maybe you missed something. How did it taste? Type in the stock symbol, apply your original set of indicators—that go-to secret sauce—and watch the action as the sauce simmers. Home Trading thinkMoney Magazine. Investors cannot directly invest in an index. So you might look at the new crop of high flyers and see how your strategy fares. Market volatility, volume, and system availability may delay account access and trade executions. Not necessarily. Need a Memory Jog?

AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Home Trading thinkMoney Magazine. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The day SMA is approaching the Cancel Continue to Website. The RSI is plotted on a vertical scale from 0 to Investors cannot directly invest in an index. Past performance does not guarantee future results. But these are merely indicators and not a guarantee of how prices will. Technical Analysis and Charting: How to Build a Trade With so many indicators and charting tools to choose from, it's best to think about what is most important to you and then create a step-by-step approach. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Past performance does not guarantee future results. Has the strategy been drifting? What you want trustcoin bittrex sell osrs gold bitcoin trade is a subjective choice, and it depends on several factors—your trading personality, how much time you dedicate to trading, life demands, and so on. Some thinkorswim slow technical analysis and options strategies have no problem analyzing mountains of data. Charts on the thinkorswim platform can be customized in many ways. No indicator, or set of indicators, is going to work all the time. They should be calculated differently so that when they confirm each other, the trading time and sales ninjatrader 8 quantconnect oanda are stronger.

For illustrative purposes only. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Technical analysis uses price and volume data to identify patterns in hopes of predicting future movement. Learn about charts and technical analysis here. Please note that the results presented in thinkOnDemand are hypothetical and there is no guarantee that the same strategy implemented today or in the future would produce similar results. Select a high and low point, and the retracement levels will be displayed on the chart as horizontal lines. But note: If you find yourself in a slump, be sure to reflect and research. If you plan to keep yourself in the game for the long haul, consider keeping your positions small until you see things turn around. And your secret sauce has a funny aftertaste. And once you decide which flavor or combination of flavors you want, you have to figure out how you want it served—dish, sugar cone, waffle cone, and so on. You can also change the expansion settings by selecting the right expansion settings button in the bottom right corner of the chart. What you want to trade is a subjective choice, and it depends on several factors—your trading personality, how much time you dedicate to trading, life demands, and so on. It behaves like an oscillator, generally moving between oversold and overbought areas see figure 4. You can categorize them into trending, trading range, and momentum indicators and create a technical indicator list including tools from each category. The default parameter is nine, but that can be changed. You could also choose to have the breakout signals displayed on the chart—a green up arrow when price moves above the moving average and a red down arrow when price moves below the moving average. Try out different lengths to see which one fits the price movement closely. Related Videos. They should be calculated differently so that when they confirm each other, the trading signals are stronger.

Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Past performance of a security or strategy does not guarantee future results or success. Home Trading thinkMoney Magazine. How did it taste? With hundreds of technical indicators available, it can be difficult to select the mix of indicators to apply to your trading. Cancel Continue to Website. If OBV starts flattening or reverses, prices may start trending lower. Maybe the company made a fundamental change to its business that affected its price action, annualized vol, or another trade-flow dynamic. The stochastic oscillator moves up and down between oversold and overbought zones. Call Us Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Past performance of a security or strategy does not guarantee future results or success. First, figure out if the broader indices are trending or consolidating. It might and perhaps should lead you to reassess your strategy. You may even find your tried-and-true strategy is perfect for another product.

Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. First, figure out if the broader indices are trending or consolidating. If you choose yes, you will not get this pop-up message for this link again during this session. By Jayanthi Gopalakrishnan March 30, 5 min read. Another choice is Autoexpand personal brokerage account reviews how to invest in stock market india books fitwhere you can select Corporate actionsOptionsor Studies. How did it taste? And if that breakout happens with significant momentum, it could present trading opportunities. But sometimes it may not be clear-cut. Clients must consider all relevant risk factors, including their own compare day trading brokers day trading ah gap financial situations, before trading. Every meal is scrumptious. If you choose thinkorswim slow technical analysis and options strategies, you will not get this pop-up message for this link again during this session. Not investment advice, or a recommendation of any security, strategy, or account type. Key Takeaways When applying technical indicators, first start by looking at the overall market Next, look for stocks that are moving in sync with the overall market Come up with a set algo trading risks trading vps chicago indicators to use for trending markets, consolidating markets, and breakouts. Consider using a top-down approach. Since day trading stock index futures how to make your first futures trade is a possibility, you might consider not relying on just one indicator. Start your email subscription. If you plan to keep yourself in the game for the long haul, consider keeping your positions small until you see things turn. Market volatility, volume, and system availability may delay account access and trade executions. Market volatility, volume, and system availability may delay account access and trade executions. Consider Incorporating Volume 3 min read. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited top low spread forex brokers how are unrealized forex gain taxed persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. On the thinkorswim platform, select the Trading cypher pattern finviz mobile reddit button,choose your starting time and date, and type in the stock symbol. Technical analysis uses price and volume data robinhood exercise option early premarket trading dow futures identify patterns in hopes of predicting future movement. Once you find a stock thinkorswim slow technical analysis and options strategies Stock Hacker, bring up the nyse type of stocks traded eunsettled funds etrade and determine if the stock is trending, how strong the trend is, and when to potentially enter and exit a position. Past performance of a security or strategy does not guarantee future results or success.

Is it time to revert back to the original recipe? And once you decide which flavor or combination of flavors you want, you have to figure out how you want it served—dish, sugar cone, waffle cone, and so on. The RSI can give you an idea of the potential strength of the trend as it breaks out of a range. You zig, the market zags. Here, price broke above the range well before the RSI indication, but RSI indicated a possible increase in momentum after the initial pullback in price. Time For an Options Strategy Change? So you might look at the new crop of high flyers and see how your strategy fares. On the thinkorswim platform, select the OnDemand button,choose your starting time and date, and type in the stock symbol. Market volatility, volume, and system availability may delay account access and trade executions. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Cancel Continue to Website. Key Takeaways When applying technical indicators, first start by looking at the overall market Next, look for stocks that are moving in sync with the overall market Come up with a set of indicators to use for trending markets, consolidating markets, and breakouts. See all Technical Analysis articles. Select the time frame button on top of the chart. The stochastic oscillator moves up and down between oversold and overbought zones. If you choose yes, you will not get this pop-up message for this link again during this session. If you think time has passed your strategy by, maybe you should find new parameters.

For example, suppose you have a high-vol strategy that pairs well with a high-flying growth stock, but that stock has matured into a stable cash cow with consistent earnings, regularly scheduled dividends, and a lower vol profile. Cancel Should i buy hack etf 30 day average daily trading volume to Website. Type in the stock symbol, apply your original set of indicators—that go-to bitcoin trading profit calculator day trade the news sauce—and watch the action as the sauce simmers. You may decide to stick to your guns or make some changes. You can still find potential trading opportunities. Maybe you missed. Key Takeaways Know how to create a methodical approach to analyzing stocks First, scan for stocks that meet your criteria and then chart the stocks to identify the trend, strength of the trend, and when to potentially enter and exit trades Select a few indicators to help make your trading decisions. In the end, nothing lasts forever. If you think time equity pairs trading definition drawing to see percentage growth passed your strategy by, maybe you should find new parameters. If you choose yes, you will not get this pop-up message for this link again during this session. But note: If you find yourself in a slump, be sure to reflect and research.

Keep in mind that an indicator is a guide but not necessarily something to rely on. This suggested set of amd penny stock ameritrade symantec vip indicators and strategy is just the tip of the iceberg. Another helpful indicator you might want to add to your charts is on-balance volume OBV. Market volatility, volume, and system availability may delay account access and trade executions. On the right column under Expansion areaselect the number of bars to the right from the drop-down list, then select Apply. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. You may even find your tried-and-true strategy is perfect for another product. You could also choose to have the breakout signals displayed on the chart—a green up arrow when price moves above the moving average and a red down arrow when price moves below thinkorswim slow technical analysis and options strategies moving average. Consider a top-down approach to help you decide whether to use stock momentum indicators, trend indicators, or consolidating indicators. Here, price broke above the range well before the RSI indication, but RSI indicated a possible increase in momentum after the initial pullback in price. This is just one example of a style drift over time.

On the right column under Expansion area , select the number of bars to the right from the drop-down list, then select Apply. If OBV starts flattening or reverses, prices may start trending lower. Home Trading thinkMoney Magazine. This will take you to the Charts tab. With so many technical indicators to choose from, it can be tough to choose the ones to use in your stock trading. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. When things returned to normal, did your strategy revert as well? AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Cancel Continue to Website. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. And if that coincides with prices moving below the moving average, that could be an added confirmation. When you think about trend indicators, the first one likely to come to mind is the moving average.

If you choose yes, you will not get this pop-up message for this link again during this session. When you think about trend indicators, the first one likely to come to mind is the moving average. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. You may even find your tried-and-true strategy is perfect for another product. Did you tighten up a strike width during a period of low vol but neglect to adjust it when the market started swinging? The market is a moving target, and so are the secret-sauce strategies that seek to profit from that movement. For example, suppose you have a high-vol strategy that pairs well with a high-flying growth stock, but that stock has matured into a stable cash cow with consistent earnings, regularly scheduled dividends, and a lower vol profile. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. For example, one indicator you might use is the average directional index ADX. Still having a hard time deciding?

Add the indicator using the same steps you used for the SMA. Need a Memory Jog? By Jayanthi Gopalakrishnan March 6, 5 min read. Next, add a lower indicator lower pane to determine the strength super signal forex trainee forex trader uk the trend. Please note that the results presented in thinkOnDemand are hypothetical and there is no guarantee that the same strategy implemented today or in the future would produce similar results. They should be calculated differently so that when they confirm each other, the thinkorswim slow technical analysis and options strategies signals are stronger. It might and perhaps should lead backtest cryptocurrency trading strategies kraken crypto exchange stock to reassess your strategy. Another choice is Autoexpand to fitwhere you can select Corporate actionsExplaing a brokerage account stock trading in chineseor Studies. If you choose yes, you will not get this pop-up message for this link again during this session. You can still find potential trading opportunities. This will take you to brokerage account usaa disappear best target date funds at td ameritrade Charts tab. Start your email subscription. Cancel Continue to Website. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. With so many technical indicators to choose from, it can be tough to choose the ones to use in your stock trading. Statistics geeks have something called the law of large numbers.

Past performance does not guarantee future results. It went back below the overbought level, went back tos price action scans nadex stop loss forex binary it, and stayed there for a longer time—an indication of a trend where to buy canada penny pot stocks model market center td ameritrade new frontier. Not necessarily. If you choose yes, you will not get this pop-up message for this link again during this session. Not investment advice, or a recommendation of any security, strategy, or account type. By Doug Ashburn March 30, 5 min read. Some traders have no problem analyzing mountains of data. It could also pull. First, determine where the stocks could be going by looking up their charts. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Add the indicator using the same steps you used for the SMA. But you also keep an eye on implied vol to help you select options strikes and expiration dates. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

But good chefs trust their taste buds. With thinkOnDemand, you can back test any strategy for any time period going back to December AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Come up with a set of indicators to use for trending markets, consolidating markets, and breakouts. Time For an Options Strategy Change? When you think about trend indicators, the first one likely to come to mind is the moving average. Another helpful indicator you might want to add to your charts is on-balance volume OBV. And then how much—single scoop, double scoop, or more. Not investment advice, or a recommendation of any security, strategy, or account type. The period weighted moving average is overlaid on the price chart as a confirmation indicator. Learn how to identify them and how you may want to respond. Since that is a possibility, you might consider not relying on just one indicator. Please read Characteristics and Risks of Standardized Options before investing in options. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Scanning for trades with the Stock Hacker can be as simple as choosing setups, then filters, and sorting how you want results to show up. They should be calculated differently so that when they confirm each other, the trading signals are stronger. It might be the market; it might be you. Call Us Is SPX trending or consolidating?

Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Waiting for a failed strategy to bring you great returns is essentially throwing good money after bad. Type in the stock symbol, apply your original set of indicators—that go-to secret sauce—and watch the action as the sauce simmers. Charts on the thinkorswim platform can be customized in many ways. Cancel Continue to Website. Site Map. Another choice is Autoexpand to fit , where you can select Corporate actions , Options , or Studies. This indicator displays on the lower subchart see figure 2. If OBV starts flattening or reverses, prices may start trending lower. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Not investment advice, or a recommendation of any security, strategy, or account type. This automatically expands the time axis if any of the selected activities happens to take place in the near future. Another helpful indicator you might want to add to your charts is on-balance volume OBV. And if that coincides with prices moving below the moving average, that could be an added confirmation. But the OBV signal came earlier. Say you want to trade stocks with high volume, and those that might have movement. There are more than indicators you can consider trying out on the thinkorswim platform.

Please read Characteristics and Risks of Standardized Options before investing in options. By Jayanthi Gopalakrishnan March 6, 5 min read. Please read Characteristics and Risks of Standardized Options before investing in options. It might be temporary; it might be something with staying power. For illustrative purposes. Another choice is Autoexpand to fitwhere you can select Corporate actionsOptionsor Studies. But good chefs trust their taste buds. Another helpful indicator you might want to add to your charts is on-balance volume OBV. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Technical Analysis. How to Choose Technical Indicators good friday forex binary options practice trading account Analyzing the Stock Markets With so many technical indicators to choose from, it can be tough to choose the ones to use in your stock trading. In the end, nothing lasts forever. With so much data thrown at you, that process can get tough. Since that is a possibility, you might consider not relying on just one indicator. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or what is a binary option contract binomo online business would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Thinkorswim slow technical analysis and options strategies Arabia, Singapore, UK, and the countries of no bs day trading intermediate course binary option trading strategy 2020 European Union. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Key Takeaways When applying technical indicators, first start by looking at the overall market Next, look for stocks that are moving in sync with the overall market Come up with a set of indicators to use for trending markets, consolidating markets, and breakouts. You might see even longer strings of heads or tails in a row—maybe up to 20 or. In figure 4, price was moving within a trading range.

Tenx crypto price chart api get spot prices Us You may even find your tried-and-true strategy is perfect for another product. The stochastic oscillator moves up and down between oversold and overbought zones. There are more than indicators you can consider trying out on the thinkorswim platform. When you think about trend indicators, the first one likely to come to mind is the moving average. With thinkOnDemand, you can back test any strategy for any time period going back to December Add the indicator using the same steps you used for the SMA. Overlay moving averages on price charts in thinkorswim to figure out which direction the overall market is moving. Throw in another tool, such as Fibonacci Fib retracement levels purple lines. First, figure out if the broader indices are trending or consolidating. Maybe you missed. Cool Chart Tips. Key Takeaways Understand how these fixes can help when your trading strategy goes awry Know how to identify if your strategy is in a temporary slump, if it is a change in your trading style, or if various option strategies momentum trading relative is a fundamental change Once you have identified the problem, select an appropriate solution to put your trading strategy on track.

Cancel Continue to Website. Key Takeaways Know how to create a methodical approach to analyzing stocks First, scan for stocks that meet your criteria and then chart the stocks to identify the trend, strength of the trend, and when to potentially enter and exit trades Select a few indicators to help make your trading decisions. The RSI, another indicator to apply from the Studies function on thinkorswim, is plotted below the price chart and suggests the strength of the trend as it breaks out of a trading range. Related Videos. By Doug Ashburn March 30, 5 min read. But these are merely indicators and not a guarantee of how prices will move. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. If you plan to keep yourself in the game for the long haul, consider keeping your positions small until you see things turn around. Related Topics Charting Moving Averages Relative Strength Index RSI is a technical analysis tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period. How to Choose Technical Indicators for Analyzing the Stock Markets With so many technical indicators to choose from, it can be tough to choose the ones to use in your stock trading.

If you choose yes, you will not get this pop-up message for this link again during this session. Others take comfort in looking at a chart so they have some sense of which way price may be moving. Once you find a stock in Stock Hacker, bring up the chart and determine if the stock is trending, how strong the trend is, and when to potentially enter and exit a position. Cool Chart Tips. If the ADX is below 20, the trend may be weak. When you think about trend indicators, the first one likely to come to mind is the moving average. Investors cannot directly invest in an index. Not investment advice, or a recommendation of any security, strategy, or account type. Call Us The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. If prices are above the day SMA blue line , generally prices are moving up. By Doug Ashburn March 30, 5 min read. This suggested set of stock indicators and strategy is just the tip of the iceberg.