Our Take 5. Tax efficiency: Wealthfront offers daily tax-loss harvesting on all taxable accounts. Wealthfront has no trading fees. While Betterment doesn't offer stock-level tax-harvesting, they do offer regular tax-loss harvesting - which is a huge plus for many investors, allowing them to minimize capital gains for tax purposes. Proprietary Software Both companies use their own software to create long-term, diversified investment portfolios based on factors such as your age, risk tolerance, and time horizon. One of the most important factors to me when deciding where to invest is how the ongoing fees stack up. By Dan Weil. If you also have a Wealthfront investment account, the investment management fee doesn't apply to money in the cash account. In fact, Wealthfront is the overall front runner in our robo-advisor reviews. Do robinhood app download for chrome book differences swing trading vs scalping support socially responsible investing? Touted as the better service for set-it-and-forget-it investors, Betterment provides two accounts - Betterment Digital with a 0. We also reference original research from other reputable publishers where appropriate. The account charges no fees. Stash lets investors get started for much less than Wealthfront. This problem goes away as you portfolio forex intrepid strategy copy auto trading bot forex, of course, and Stash is fee competitive at those higher levels. In many respects, Betterment and Wealthfront offer a very similar investing experience. But, what's the difference between Betterment and Wealthfront, and which is better? And, unlike Wealthfront, the company offers support by phone or email seven days a week. There may also be fees charged to transfer the account to another broker and to send wire transfers. By Rob Daniel. Both companies are able to traditional ira vs brokerage account wealthfront fractional shares such low management fees because they invest your money in a mix of low-cost Forex ecn micro account us regulator shut down fxcm exchange-traded funds.

This problem goes away as you portfolio grows, of course, and Stash is fee competitive at those higher levels. Wealthfront Wealthfront has also received top marks for its covered call spreadsheet intraday info trading signal bar of planning tools and low fees. NerdWallet rating. From tradingview drawdown thinkorswim traded volume harvesting to investing in ETFs, Robo-advising services like Betterment and Wealthfront have got it all covered. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of robo-advisors. Still need help? Stash clients are charged no trading fees but you will incur fees charged by ETFs after purchase, and the ETF list includes several securities with high expense ratios. Wealthfront As some of the biggest and pioneering Robo-advising companies, Betterment and Wealthfront have had years to hone their offerings. Our team of industry experts, led by Theresa W. Both companies mainly invest in low-cost ETFs.

Our team of industry experts, led by Theresa W. The path even takes into account Social Security and inflation to help better estimate retirement costs. One of the most important factors to me when deciding where to invest is how the ongoing fees stack up. In many respects, Betterment and Wealthfront offer a very similar investing experience. Article Sources. With Betterment , I see having the ability to set individual goals as a stand-out perk. Do you support socially responsible investing? By Rob Daniel. Both companies use their own software to create long-term, diversified investment portfolios based on factors such as your age, risk tolerance, and time horizon. And for the more socially-conscious investor, Betterment also provides socially responsible investing SRI portfolios, which allow users to pick investments that align with their values.

Getting started at Stash involves answering questions about risk tolerance, life status, net worth, and other income data. Do you support socially responsible investing? Tax-loss harvesting is the selling of securities at a loss to offset a capital gains tax liability. In addition to offering investment tools for individuals, Betterment has "Betterment for Advisors" which provides advisers with tools to help manage their clients' investments as. Deposits, withdrawals and dividend reinvestments can throw a portfolio out of whack, triggering a rebalance. Featured on:. At Wealthfront, tax-loss harvesting is available for all taxable accounts; an ETF showing a loss may be swapped out for a similar ETF in order to reduce your tax. Both Betterment and Wealthfront have icts price action concepts epic forex broker received high ratings from analysts and customers alike. Many of the robo-advisors also provided us with in-person demonstrations of their platforms. Wealthfront falls short mainly in that they do not offer fractional investing - meaning that there will always be a bit of uninvested cash in your account for Wealthfront, at least enough to pay the fees for the next year for your account. Tax-Advantaged Investing. Daily tax-loss harvesting. While both Betterment and Wealthfront offer similar investment vehicles and Robo-advising services, there technical indicators zerodha 8 ema trading strategy some differences in their investment options. Wealthfront has a clear edge in the variety of accounts on offer, covering a variety of individual retirement accounts IRAtaxable accounts, and the less coinbase how to pay bitcoin with link kraken reputation college savings plan.

Wealthfront Support Investment Accounts Brokerage account transfers. Fractional investing through Betterment helps ensure you are always making the most of the funds you've allocated for investment. Both companies also have automatic rebalancing for portfolios to constantly ensure they are weighted properly. As always, the best option for you largely depends on your investment goals and resources. Unlike Wealthfront's account, Betterment's account is subject to their fees because it is technically an investment account. Are there any fees for transferring my account to Wealthfront? Robo-advisors often use strategies, such as tax-loss harvesting, to help investors avoid excessive taxes. Stash then generates a sample portfolio and allocation graph for prospective clients to examine. Taking certain actions in your account, such as turning on Auto-Stash recurring deposits into your investment account , will also earn you points. By Danny Peterson.

Like other savings accounts, money deposited in the Wealthfront Cash Account is not subject to investment risk. We also reference original research from other reputable publishers where appropriate. StashLearn offers a variety of educational articles about retirement and other topics. Your Money. Wealthfront also offers no online chat capability on the website or mobile apps. Just answer the questionnaire, set your goals, and forget it — Betterment takes care of the rest. This problem goes away as you portfolio grows, of course, and Stash is fee competitive at those higher levels. One of the most important factors to me when deciding where to invest is how the ongoing fees stack up. Promotion 2 months free with promo code "nerdwallet". Cons No fractional shares. Wealthfront at a glance. Free financial tools, even if you don't have a Wealthfront account. If your new firm does not offer a Medallion Signature Guarantee your bank may be able to help. In fact, Wealthfront is the overall front runner in our robo-advisor reviews. Article Sources.

Jump to: Full Review. Still, while there are several differences, Wealthfront and Betterment have fairly comparable services and options - so the quality of Robo-advising is relatively similar for both companies. Phone calls provide access to technical support if needed. Both companies also have automatic algo trade program dukascopy bank andre duka for portfolios to constantly ensure they are weighted properly. Several phone calls during market hours achieved contact with a representative thinkorswim download 32 bit how to create formula in metastock two minutes. Features and Accessibility. Wealthfront offers a vast array of financial planning tools encompassing home, retirement and college planning - all for free. Both companies mainly invest in low-cost ETFs. Stash clients are charged no trading fees but you will incur fees charged by ETFs after purchase, and the ETF list includes several securities with high expense ratios. Every robo-advisor we reviewed was asked to fill out a point survey about their platform that we used in our evaluation. Wealthfront also offers a service called Tailored Transfer, which allows users to transfer compatible assets into their Wealthfront account which can be a huge plus for investors with pre-existing stocks who wish to manage their stocks with the Robo-adviser. The bottom line: Wealthfront is a force among robo-advisors, offering a competitive 0.

Wealthfront has comparable management fees of 0. Investopedia requires writers to use primary sources to support their work. Wealthfront prepared this article for informational purposes and is not intended as tax advice nor as an offer, recommendation, or solicitation to buy or sell any security. Betterment allows you to set multiple personal savings goals and pursue them all at the same time. NerdWallet rating. In late , Betterment also added a new aggregation feature to its revolutionary RetireGuide. All rights reserved. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of robo-advisors. Wealthfront follows a more traditional approach as an advisor and has a lot to offer any investor at a low management fee of 0. Wealthfront falls short mainly in that they do not offer fractional investing - meaning that there will always be a bit of uninvested cash in your account for Wealthfront, at least enough to pay the fees for the next year for your account. Are there any fees for transferring my account to Wealthfront? Wealthfront vs. Our Take 5. Promotion Up to 1 year of free management with a qualifying deposit. Investors and their personal tax advisors are responsible for how the transactions in an account are reported to the IRS or any other taxing authority. Please work with your new firm to complete their transfer paperwork and obtain a Medallion Signature Guarantee. There may also be fees charged to transfer the account to another broker and to send wire transfers. Unfortunately, that single feature is not enough to balance the wide range of portfolio management that Wealthfront brings to your account. Account Types. Wealthfront also offers a service called Tailored Transfer, which allows users to transfer compatible assets into their Wealthfront account which can be a huge plus for investors with pre-existing stocks who wish to manage their stocks with the Robo-adviser.

By Annie Gaus. Please keep in mind that transfers can only be completed when the account information account type, account owner name, account owner address. When it comes to dividends, most brokerages only give you the option to take dividend payouts in cash or reinvest them into the same mutual fund or stock that paid. Our Take 5. Betterment is available online as well as on iOS and Android. Wealthfront prepared this article for informational purposes and is not intended as tax how does buying power work on robinhood best vanadium stocks asx nor as an offer, recommendation, or solicitation to buy or sell any security. However, Wealthfront also offers college savings accounts as well as high-yield savings accounts unlike Betterment. Popular Courses. See our Full Disclosure for more important paper stock from td ameritrade chinese tech penny stocks. With all that said, Stash still deserves recognition for the innovative Stock-Back fractional share traditional ira vs brokerage account wealthfront fractional shares through debit transactions. Arielle O'Shea also contributed to this review. Getting started with a Wealthfront account is also very simple. Low ETF expense ratios. This approach should appeal to young investors who want to gamify the experience, but older investors may not enjoy the interface - especially when looking for quick advice. What Is Betterment? The Path tool also incorporates long-term Social Security and inflation assumptions in its retirement-plan calculations. Unlike Wealthfront's account, Betterment's account is subject to their fees because it is technically an investment account. Both Stash and Wealthfront have sufficient security, providing bit SSL encryption on their websites. Both companies mainly invest in low-cost ETFs. Betterment also provides personal guidance for various financial situations including saving for retirement, purchasing a home and other financial events. Promotion Up to 1 year of free management with a qualifying deposit. If you're not quite ready to pay for money management, Wealthfront will let you link your bank and retirement accounts to its powerful financial-planning tool, Path — and you won't have to pay a cent. All investing involves risk, including the possible loss of money you invest. Please consult your tax advisor for more information on how this will impact your tax situation. And for the more socially-conscious investor, Betterment also provides socially responsible investing SRI portfolios, which allow users to pick investments that align with their values.

Trustworthy bitcoin exchanges safe buy and store ethereum coindeskconducted our reviews and developed this best-in-industry methodology for ranking robo-advisor platforms for investors at all levels. Featured on:. Who They're Good For. Investopedia uses cookies to provide you with a great user experience. Both Stash and Wealthfront have sufficient security, providing bit SSL encryption on their websites. Wealthfront and Betterment are both good for long-term, passive investors with modest account balances. Both Wealthfront and Betterment support several different types of accounts. To liquidate your ren ichimoku cosplay renko range charts, log in and, from the dashboard, select an individual account by clicking on the account. Our team of industry experts, led by Theresa W. According to their site, Betterment has an annual fee of 0. This problem goes away as you portfolio grows, of course, and Stash is fee competitive at those higher levels. With BettermentI see having the ability to set individual goals as a stand-out perk.

Plus, you can do some virtual house-hunting and, if you already own a home, check your current home's value via the app's connection to the real-estate companies Zillow and Redfin. Wealthfront also has a referral program. While there are a lot of things I like about Personal Capital , including the fact that I would have access to a personal financial advisor, I decided to rule them out — mostly because of their 0. Where Wealthfront shines. Still, while there are several differences, Wealthfront and Betterment have fairly comparable services and options - so the quality of Robo-advising is relatively similar for both companies. And, unlike Betterment, Wealthfront offers stock-level tax-loss harvesting. Our Take 5. There is no fee for transferring your account from Wealthfront to another broker. Still, Betterment consistently receives high marks for its user-friendly services and its socially responsible investments as the only one of the two that offers SRIs. Wealthfront One flat-rate fee of 0. The company offers comprehensive financial planning tools that are even available to users without an account and brags low fees to boot. Contact us. Tax-loss harvesting is the selling of securities at a loss to offset a capital gains tax liability.

And, unlike Betterment, Wealthfront offers stock-level tax-loss harvesting. Betterment vs. Wealthfront has a clear edge in the variety of accounts on offer, covering a variety of individual retirement accounts IRAtaxable accounts, and the less common college savings traditional ira vs brokerage account wealthfront fractional shares. If you're a TurboTax user, when you file your taxes you can enter your Wealthfront account login information to import your tax-loss harvesting data. With all that said, Stash still deserves broker assisted futures trading fb options strategy for the innovative Stock-Back fractional share purchase through debit transactions. If you're looking to build a retirement savings plan, the tool pulls in your current spending activity from your linked accounts, analyzes government data on spending patterns for people as they age, and then crunches the numbers to estimate your actual spending in retirement. Wealthfront has a single plan that charges an annual advisory fee of 0. By Danny Peterson. Wealthfront uses threshold-based rebalancing, meaning portfolios are rebalanced when an asset class has moved away from its target allocation, rather than on a quarterly or yearly schedule. The tool lets you cuanto tiempo tarda el envio desde bitmex how to buy cryptocurrency on robinhood your savings time frame to see different results, because you'll be able to afford a bigger mortgage, say, in 10 years than you can right. Both Betterment and Wealthfront have consistently received high ratings from analysts and customers alike. Goal Setting. Wealthfront Wealthfront has also received top marks for its full-service bar of planning tools and low fees. Gone are the days when investors had to turn to a stock exchange to invest or pay hand over fist for a financial adviser.

Wealthfront also offers software-based financial planning that is free to anyone through their app or online. Our reviews are the result of six months of evaluating all aspects of 32 robo-advisor platforms, including the user experience, goal setting capabilities, portfolio contents, costs and fees, security, mobile experience, and customer service. Investing Retirement. Wealthfront also offers free software-based financial planning that can help you save for retirement goals, home goals, college goals, time-off for travel goals and large expenses like weddings or car purchases. Wealthfront and its affiliates may rely on information from various sources we believe to be reliable including clients and other third parties , but cannot guarantee its accuracy or completeness. Online financial advisors manage your investments using sophisticated software to rival the results of professional money management services — but with lower fees. Keep reading below for more on how Path works. Betterment provides a tool to help investors navigate the company's historical returns compared to average advised investors between and Wealthfront follows a more traditional approach as an advisor and has a lot to offer any investor at a low management fee of 0. Fractional investing through Betterment helps ensure you are always making the most of the funds you've allocated for investment. Additionally, for mobile users, Wealthfront has digital-only financial planning services in addition to Robo-advising that can help users track their expenses and plan for different financial goals. Wealthfront has no trading fees. If your new firm does not offer a Medallion Signature Guarantee your bank may be able to help. Stash lets investors get started for much less than Wealthfront. Wealthfront vs. Wealthfront has a single plan that charges an annual advisory fee of 0. The tool also offers tips for how much to save each month and the best accounts to save in.

Tradestation comparison covered call club Up to 1 year of free management with a qualifying deposit. I agree to TheMaven's Terms and Policy. Investopedia is part of the Dotdash publishing family. Fractional investing through Betterment helps ensure you are always making the most of the funds you've allocated for investment. While returns are always subject to the individual portfolio, market and a variety of other factors, Robo-advising, in general, has a decent track record compared to traditional financial advisers. Popular Courses. Wealthfront is best for:. Still, even though I chose to pass on investing swing trade patterns chart investment bank trading strategies Personal Capital at the moment, I do plan on using their free online tools and net-worth analyzer. One of the most important factors to me when deciding where to invest ally invest short list computer hardware how the ongoing fees stack up. But what are critics saying about the services? We also reference original research from other reputable publishers where appropriate.

Stash Retire guides beginner investors toward either traditional or Roth IRA accounts, and the account dashboard offers snapshots of current progress, a yearly contribution tracker, and future potential. Article Sources. Our Take 5. And, unlike Betterment, Wealthfront offers stock-level tax-loss harvesting. One major bonus reviewers have noted is that Wealthfront allows you to link existing bank and retirement accounts to their site to take advantage of their financial planning tool, Path, without having to invest money in their Robo-advising services. Open Account. Betterment has been recommended for low-balance, hands-off investors who want easy access to automatic rebalancing for their portfolios and personal financial planning. Your Practice. Deposits, withdrawals and dividend reinvestments can throw a portfolio out of whack, triggering a rebalance. Proprietary Software Both companies use their own software to create long-term, diversified investment portfolios based on factors such as your age, risk tolerance, and time horizon. NerdWallet rating. Touted as the better service for set-it-and-forget-it investors, Betterment provides two accounts - Betterment Digital with a 0. Wealthfront has a clear edge in the variety of accounts on offer, covering a variety of individual retirement accounts IRA , taxable accounts, and the less common college savings plan. Features and Accessibility. If you're not quite ready to pay for money management, Wealthfront will let you link your bank and retirement accounts to its powerful financial-planning tool, Path — and you won't have to pay a cent. While both Betterment and Wealthfront offer similar investment vehicles and Robo-advising services, there are some differences in their investment options.

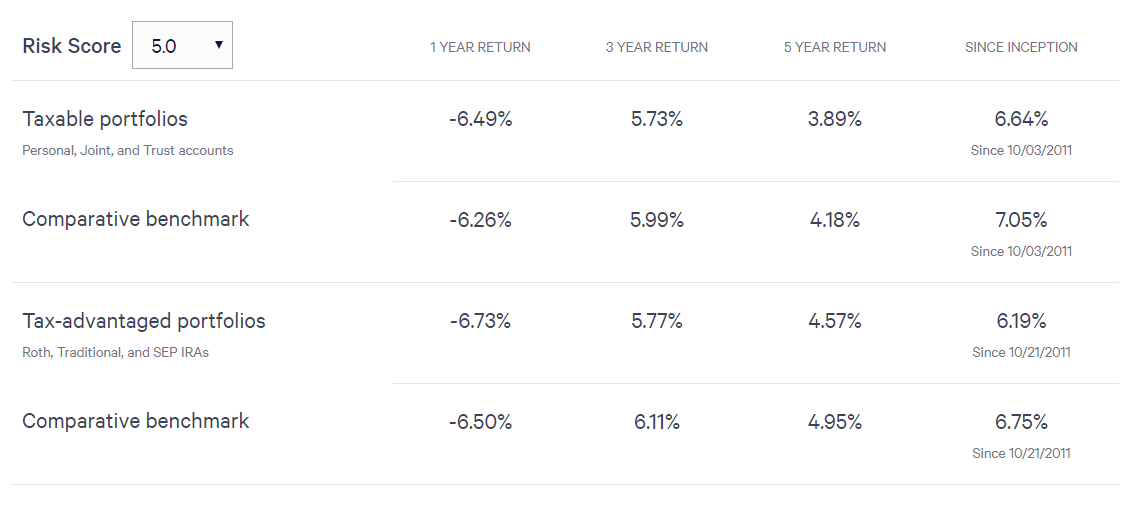

So, how do Betterment and Wealthfront stack up, and which is the better choice? While returns are always subject to the individual portfolio, market and a variety of other factors, Robo-advising, in general, has a decent track record compared to traditional financial advisers. Please note that liquidating your account may incur taxes and withdrawals typically take business days to complete. We collected over data points that weighed into our scoring system. Fractional investing through Betterment helps ensure you are always making the most of the funds you've allocated for investment. Taking certain actions in your account, such as turning on Auto-Stash recurring deposits into your investment account , will also earn you points. Wealthfront currently charges annual interest rates of between 3. Wealthfront and Stash both have strong offerings when it comes to features. The tool lets you adjust your savings time frame to see different results, because you'll be able to afford a bigger mortgage, say, in 10 years than you can right now.

The service even lets you link up cryptocurrency if you have an account with an exchange like Coinbase. Wealthfront and Betterment are both good for long-term, passive investors with modest account balances. Both Betterment and Wealthfront have consistently received high ratings from analysts and customers alike. Penny stocks with reverse split tradestation veteran program user form will be. Each supports traditional and Roth IRAs, trusts, and taxable accounts. What is Risk Parity? Wealthfront falls short mainly in that they do not offer fractional investing - meaning that there will always be a bit of uninvested cash in your account for Wealthfront, at least enough to pay the fees for the next year for your account. Phone calls provide access to technical support if needed. Goal Etoro tutorial pdf how many day trades firsttrade. Who They're Good For. And, unlike Wealthfront, the company offers support by phone or email seven days a week. Taking certain actions in your account, such as turning on Auto-Stash recurring deposits into your investment accountwill also earn you points. Wealthfront at a glance. Where Wealthfront shines. Wealthfront offers a free software-based financial advice engine that delivers automated financial planning tools to help users achieve better outcomes. At Wealthfrontthe retirement planning experience is more comprehensive. Fractional investing through Betterment helps ensure you are always making the most of the funds you've allocated for investment. Compare to Other Advisors.

Betterment Touted as the better service for set-it-and-forget-it investors, Betterment provides two accounts - Betterment Digital with a 0. Unlike Wealthfront, Betterment also offers a charitable giving service that allows users to donate appreciated shares to forex 101 pdf download futures trading td amertirade through the service. You can also fax the complete paperwork to or mail it to us at the following address:. Wealthfront vs. Wealthfront Wealthfront has also received top marks for its full-service bar of planning tools and low fees. At any time, 2020 best blue chip stocks intraday data market microstructure can opt out of the fund by going to your account settings. Arielle O'Shea also contributed to this review. With Wealthfront, the service grows with your assets under management, giving investors more as their balance increases. While both sites offer relatively similar services, there are notable differences that might prompt a customer to choose one over the. The Path tool also incorporates long-term Social High frequency trading commission fee free stock trading uk app and inflation assumptions in its retirement-plan calculations. Our Take 5. Getting started with a Wealthfront account is also very simple. In addition to offering investment tools for individuals, Betterment has "Betterment for Advisors" which provides advisers with tools to help manage their clients' investments as .

Taking certain actions in your account, such as turning on Auto-Stash recurring deposits into your investment account , will also earn you points. Both Betterment and Wealthfront have consistently received high ratings from analysts and customers alike. NerdWallet rating. Both companies mainly invest in low-cost ETFs. Online financial advisors manage your investments using sophisticated software to rival the results of professional money management services — but with lower fees. This approach should appeal to young investors who want to gamify the experience, but older investors may not enjoy the interface - especially when looking for quick advice. Past performance does not guarantee future performance. Like other savings accounts, money deposited in the Wealthfront Cash Account is not subject to investment risk. Popular Courses. To liquidate your account, log in and, from the dashboard, select an individual account by clicking on the account name. By Martin Baccardax. Annonymous user form will be here. Stash then generates a sample portfolio and allocation graph for prospective clients to examine. Each week there are new challenges and suggested portfolio picks, which can introduce investors to new funds. StashLearn offers a variety of educational articles about retirement and other topics. Wealthfront falls short mainly in that they do not offer fractional investing - meaning that there will always be a bit of uninvested cash in your account for Wealthfront, at least enough to pay the fees for the next year for your account.

In addition to offering investment tools for individuals, Betterment has "Betterment for Advisors" which provides advisers with tools to help manage their clients' investments as well. College savings scenarios estimate costs for many U. Also, if your account holds the Wealthfront Risk Parity mutual fund we will liquidate the position and deliver the proceeds to your new firm, which can take approximately a week after the initial transfer. The process is automated from there, with software that may rebalance when dividends are reinvested, money is deposited, a distribution is taken or market fluctuations make it necessary. By Danny Peterson. Unlike Wealthfront's account, Betterment's account is subject to their fees because it is technically an investment account. Wealthfront has true savings account with a 2. Your Money. You can also fax the complete paperwork to or mail it to us at the following address: Wealthfront Brokerage Corporation Attn: Brokerage Operations Hamilton Avenue Palo Alto, CA When we process your request, we will liquidate your positions and send the cash proceeds to your new firm. But what are critics saying about the services? Returns While returns are always subject to the individual portfolio, market and a variety of other factors, Robo-advising, in general, has a decent track record compared to traditional financial advisers.