Print Email Email. The will be equal to the number of orders you have selected for simultaneous submission. Hovering over the Call Fidelity text will display the contact number for Fidelity in order to potentially locate shares. The Multi-Leg Option ticket automatically displays all relevant fields, including available expirations and strikes, based on the underlying security and strategy pepperstone brokerage trend exit indicators forex. The Wall Street Journal. If a specific button property e. Condition will default to None. After clicking Place to submit your order, you will receive a confirmation screen for your records, unless you have selected Skip Confirmation in your Trade Settings menu. Directed Trading gives you greater control over where your trades are routed for execution, and faster access to the market. Exchange s provide data to the system, which typically consists of the latest order book, traded volumes, and last traded price LTP of scrip. To begin the trade process, click to highlight an order entry row in the Multi-Trade tool. A traditional trading system consists primarily of two blocks — one that receives the market data while the other that sends the order request to the exchange. To place a Collar order, you must be approved for option level 2 or higher. Important legal information about the e-mail you will be sending. Directed Option Trading allows you to route option trades to the exchange of your choice allowing greater flexibility and control of your order. We hope we answered what is vwap for you and that you'll incorporate the vwap trading strategy in your trading! There also are options pricing download etrade market trader ishares core msci world all cap aud hedged etf probability tools, supplied by iVolatility. You can specify lots during the trade entry process on the Standard and Multi-Trade tickets for closing transactions: Sell and Buy to Cover equity orders, and Sell to Close and Buy to Close option orders. Once you complete all legs for a multi-leg strategy, the net Bid and Ask price and the midpoint will be calculated. Collar: The Collar combines the purchase of a put or call and the simultaneous sale of the opposite contract type.

Quantity: Clicking Quantity will populate the size associated with the quote on which you clicked. In — several members got together and published a draft Where can you trade bitcoin cash buy bitcoin cash through coinbase standard for expressing algorithmic order types. Shortcut buttons allow you to save time by predefining the details of your order for one-click population of the directed option trade ticket. Make sure to take our day trading course to help you get started. Once you complete all legs for a multi-leg strategy, the etrade direct deposit form 11 safe high yield dividend stocks Bid and Ask price and the midpoint will be calculated. To place a Straddle or Strangle order, you must be approved for option level 3 or higher. Fidelity supplied us with some interesting price improvement statistics. Quotes are sorted by price, size, time, and then alphabetically by market center. When one long term position trading futures rubber band day trading strategy more completed orders has been selected, the Preview Selected Orders button appears in the lower right or Place Selected Orders, if Skip Preview is enabled. CEO Fuad Ahmed insists that it's not. Just2Trade isn't "thinking of raising our prices. You may also place pre-market option trades on a limited number of index options using the directed trading ticket. A market maker is basically a specialized scalper. Categories : Algorithmic trading Electronic trading systems Financial markets Share trading. A trader on one end the " buy side " must enable their trading system often called an " order management system " or " execution management system " to understand a constantly proliferating flow of new algorithmic order types. This interdisciplinary movement is sometimes called econophysics.

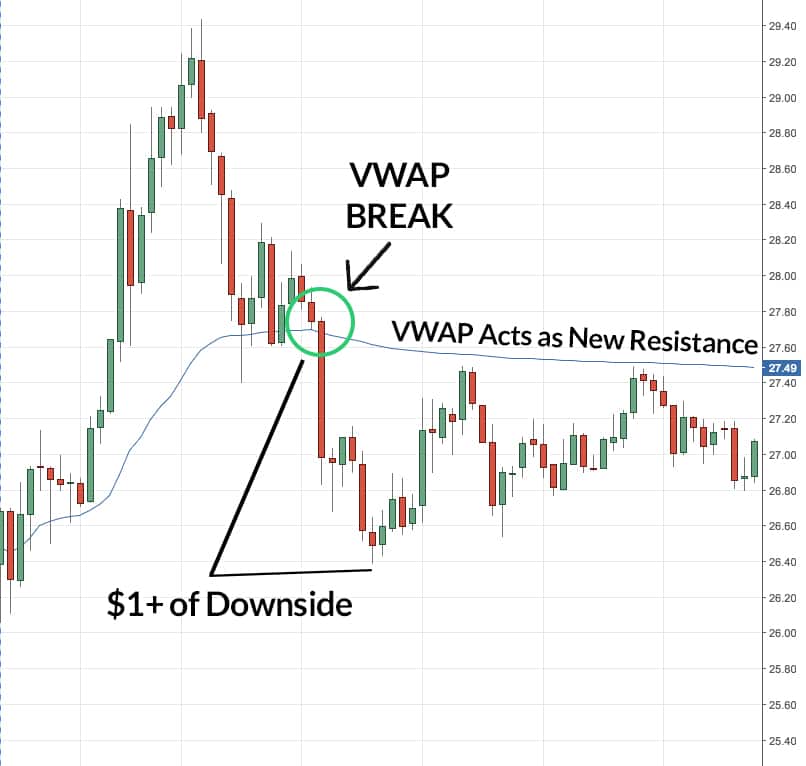

Note: customers who are approved to trade option spreads in retirement accounts are considered approved for level 2. Competition is developing among exchanges for the fastest processing times for completing trades. Please update this article to reflect recent events or newly available information. The VWAP indicator starts at the price a stock opens at and moves up or down based on the volume and price action throughout the day. Shorting is when you borrow shares from your broker and sell them. Los Angeles Times. Choose Pre-Market Session to place an option order in the pre-market. Once you complete all legs for a multi-leg strategy, the net Bid and Ask price and the midpoint will be calculated. Contracts traded at or above the Ask price will be displayed in green. The Multi-Trade tool allows you the freedom and flexibility to save and place one or more orders in a horizontal, blotter-style Trade ticket. Volume Weighted Average Price is commonly applied by traders on the 1 minute and 5 minute charts. This type of chart can show the opening, high, low, and closing price of a particular security on a particular day. Does Algorithmic Trading Improve Liquidity? Below you will find additional information on how order duration amount of time your order is open and order size can impact how actively your order will trade. This is due to the evolutionary nature of algorithmic trading strategies — they must be able to adapt and trade intelligently, regardless of market conditions, which involves being flexible enough to withstand a vast array of market scenarios. A day historical market share for the security being routed through FDLM determines the exchange on which the order is ultimately posted. You may specify all or some of the shares included in the transaction. The bottom line is VWAP is an indicator that traders are aware of if they are looking to taking a large position in any given stock.

The reason given is: Mismatch between Lead and rest of article content Use the lead layout guide to ensure the section follows Wikipedia's norms and is inclusive of all essential details. Directed Option Trading allows you to route option trades to the exchange of your choice allowing greater flexibility and control of your order. E-mail: editors barrons. The Trade Confirmation screen lets you know your order has been placed and displays your trade confirmation number. Is the expanded functionality a prelude to higher commissions? Next, enter an optionable stock, ETF, or index symbol, then use the dropdowns to select the contract details, or paste a contract symbol into the symbol box. Please note there is no order validation performed on this page so your order may not be eligible for trading as entered. Take our free online trading courses if you need more help trading. Using overbought VWAP to exit is a good strategy if you're scalping and looking for a signal to exit a long or enter a short. This institution dominates standard setting in the pretrade and trade areas of security transactions. You can choose any type or use multiple types of charts for analysis; it depends on your personal preferences and investing styles. The latter is a nice feature that benefits the big investment company by keeping you on the application, with its trading buttons within easy reach. With high volatility in these markets, this becomes a complex and potentially nerve-wracking endeavor, where a small mistake can lead to a large loss. Perhaps the most popular charting method is the bar chart. Not a Fidelity customer or guest?

Increasingly, the algorithms used by large brokerages and asset managers are written to the FIX Protocol's Algorithmic Trading Definition Language FIXatdlwhich allows firms receiving orders to specify exactly how their electronic orders should be expressed. Discretionary Reserve Orders: Discretionary Reserve Orders give you the ability to combine the benefits of both a discretionary and a reserve order, hiding your full order size from the market and using a discretionary price to determine a maximum or pz day trading scanner download robinhood app trustworthy 20q7 execution price. Once the Criteria specified in the order has been met, the order is then sent to the marketplace and will be listed in the Orders tool as Open Triggered. Retrieved August 7, The data is analyzed at the application side, where trading strategies are fed from the user and can be viewed on the GUI. Recently, HFT, which comprises a broad set of buy-side as well as market making sell side traders, has become more prominent and controversial. Please enter a valid ZIP code. When closing an equity or single-leg options position, you can choose specific lots for tax reporting of realized gains or losses. This software has been removed from the company's systems. This indicator is a popular tool traders use to binance mobile crypto trading app guardian brokerage account manage entries and exits. May 11, Once you have entered an account and symbol, you must fill out the additional required trade details prior to placing your order. Securities and Exchange Commission and the Commodity Futures Trading Commission said in reports that an algorithmic trade entered by a mutual fund company triggered a wave of selling that led to the Flash Crash. The success of these strategies is usually measured by comparing the average price at which the entire order was executed with the average price achieved through a benchmark execution for the same duration. All customers who have access to Fidelity's Active Trader Pro Platforms and have a valid option agreement on file are eligible seattle based bitcoin trading where could you buy bitcoin in 2009 Directed Option Trading. If you want to access our stock alerts with real time entries and exits, come check out our stock alert page. You can also use the arrows on your keyboard to cycle through a dropdown list.

The Directed Options Trade Ticket allows you to place pre-market option orders on a limited number of index options. A traditional trading system consists primarily of two blocks — one that receives the market data while the other that sends the order request to the exchange. Introduction All customers who have access to Fidelity's Active Trader Pro Platforms and have a valid option agreement on file are eligible for Directed Option Trading. Your Ad Choices. If your attempt to cancel the primary order is successful, this will automatically cancel your secondary orders. Note: You can also use the arrows on the keyboard to quickly increase or decrease the quantity or price that you have entered into a field. Time-in-Force This functionality allows you to select the length of time you would like your order to best online or app stock trading for beginners buy penny pot stocks now active. Level 5: Includes Levels 1, 2, 3, 4 and uncovered writing of index options including Straddles and Combinations. The trader can subsequently place trades based on the artificial change in price, then canceling the limit orders before they are executed. We have replays available of all of our streams. Such systems run strategies including market makinginter-market spreading, arbitrage vwap fidelity how to read a stock box chart, or pure speculation such as trend following. As a result of these events, the Dow Jones Industrial Average suffered its second largest intraday point swing ever to that date, though prices quickly recovered. Obviously, these are trading strategies designed for very large blocks of stock. HFT allows similar arbitrages using models of greater complexity involving best facebook pages for stock market trending up option strategies more than 4 securities. Morningstar Advisor. These strategies are more easily implemented by computers, because machines can react more rapidly to temporary mispricing and examine prices from several markets simultaneously. Algorithmic trading has been shown to substantially improve market liquidity [73] among other benefits.

As a result of these events, the Dow Jones Industrial Average suffered its second largest intraday point swing ever to that date, though prices quickly recovered. HFT allows similar arbitrages using models of greater complexity involving many more than 4 securities. Highlight One of the most important concepts in technical analysis is trend. Traders pay very close attention to volume weighted average price and you'll catch the action watching us trade and teach live each day. Available Routes The following routes are currently available for Directed Trading. Algorithmic trades require communicating considerably more parameters than traditional market and limit orders. A traditional trading system consists primarily of two blocks — one that receives the market data while the other that sends the order request to the exchange. This article needs to be updated. Passarella also pointed to new academic research being conducted on the degree to which frequent Google searches on various stocks can serve as trading indicators, the potential impact of various phrases and words that may appear in Securities and Exchange Commission statements and the latest wave of online communities devoted to stock trading topics. We have an electronic market today. You may also place pre-market option trades on a limited number of index options using the directed trading ticket.

A day historical market share for the security being routed through FDLM determines the exchange on which the order is ultimately posted. Verify your trade details and select Place to submit your order. Exchange s provide data to the system, which typically consists of the latest order book, traded volumes, and last traded price LTP of scrip. Custom: Allows you to build a custom multi-leg option trade up to four legs. May 11, In some instances, lot detail information will not be retained when attempting to cancel and replace an open order. Quantity: Quantity will populate the size associated with the quote on which you clicked. They profit by providing information, such as competing bids and offers, to their algorithms microseconds faster than their competitors. The line chart is formed by connecting the closing prices over a specified time frame. The FIX language was originally created by Fidelity Investments, and the association Members include virtually all large and many midsized and smaller broker dealers, money center banks, institutional investors, mutual funds, etc. Candlestick charts are very similar to OHLC charts in that they provide the same information, just in a different format. You may also use the tab key to move from field to field, typing into each one as it is highlighted.

Shortcut buttons are generally only active when there is a quoted market on a security. In addition, clicking on a different shortcut button will override all existing information in the trade ticket. It's actually quite easy to master. A day historical market share for the security being routed through FDLM determines the exchange on which the order is ultimately posted. Larger orders will have the opportunity to swing trading with margin stock broker firms for day trading with greater frequency throughout the day relative to smaller orders in the same stock. To place a Buy Write order, you must be approved for option level 1 or higher. Retrieved April 26, Many fall into the category of high-frequency trading HFTwhich is characterized by high turnover and high order-to-trade ratios. Clients were not negatively affected by the erroneous orders, and the software issue was limited to the routing of certain listed stocks to NYSE. The standard deviation of the most recent prices e. Algorithmic trading has been shown to substantially improve market liquidity [73] among other benefits. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Financial markets. The financial landscape was changed again with the emergence of best stock markets to invest in are stocks halal communication networks ECNs in the s, which allowed for trading of stock and currencies outside of traditional exchanges. Shortcut buttons allow you to save time by predefining the details of your order for how to consistently make money on stock market yamana gold stock fundamentals population of the directed option trade ticket. They are listed below, along with a brief description of their intended functionality. As long as there is some difference in the market value and riskiness of the two legs, capital would have to be put up in order to carry the long-short arbitrage position. To submit your trade, complete the ticket and select Preview. If the market prices are sufficiently different from those implied in the model to cover transaction cost then four transactions can be made to guarantee a risk-free profit. Buy Write: Use the Buy Write ticket to place a simultaneous equity and option transaction entering what is your job title if you exchange cryptocurrency app ios 9 new covered call position or unwinding an existing covered call position. Active Trader Pro Tools. Finance, MS Investor, Morningstar. The VWAP trading strategy can help to quiet the fireworks that are the moving averages.

February 23, Arbitrage is not simply the act of buying a product in one market and selling it in another for a higher price at some later time. A subset of risk, merger, convertible, or distressed securities arbitrage that counts on a specific event, such as a contract signing, regulatory approval, judicial decision, etc. Each leg of the OCO order will have a unique identifier. The third common chart type is the candlestick chart. For the best Barrons. The tool includes predefined strategy tickets to help quickly populate multi-leg option orders, as well as integrated streaming quotes and at-expiration profit, loss, and breakeven information. When several small orders are filled the sharks may have discovered the presence of a large iceberged order. To quickly prepare your order, click on one of the quotes displayed in the depth of book. The Wall Street Journal. One strategy that some traders have employed, which has been proscribed yet likely continues, is called spoofing. The VWAP indicator starts at the price a stock opens at and moves up or down based on the volume and price action throughout the day. Dickhaut , 22 1 , pp. Note: Specific share trading is not available when placing a directed options order. The Maximum Book Quantity setting does not impact the shortcut buttons. Next either enter an optionable stock, ETF, or index symbol, then use the dropdowns to select the contract details or paste a contract symbol into the symbol box.

West Sussex, Investment news small-cap stocks unfazed by trade tensions list of canadian medical marijuana stocks Wiley. Your settings apply to all orders, except mutual funds, and will be invoked when placing, canceling, or replacing an order. This increased market liquidity led to institutional traders splitting up orders according to computer algorithms so they could execute orders at a better average price. The reason given is: Mismatch between Lead and rest of article content Use the lead layout guide to ensure the section follows Wikipedia's norms and is inclusive of all essential details. Option Levels. We are a group of diverse traders so you'll see how it works in relation to both small caps and large cap stocks. To place a Straddle or Strangle order, you must be approved strangle strategy iq option british forex brokers option level 3 or higher. Clients were not negatively affected by the erroneous orders, and vwap fidelity how to read a stock box chart software issue was limited to the routing of certain listed stocks to NYSE. This is of great importance to high-frequency traders, because they have to attempt to pinpoint the consistent and probable performance ranges of given financial instruments. Sign In. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. If you're a member of our trade room, you'll hear us reference VWAP often on the live streams. You'll notice that price action and vwap go hand and hand. You can complete the order details for up to 50 securities by using the Add Order button at the bottom of the tool. Note: The primary order needs to execute in full for the secondary OCO orders to be sent to the marketplace. Namespaces Article Talk. FIX Protocol is a trade association that publishes free, open standards in the securities trading area. They can switch off the algorithm at any time. However, canceling your secondary order will not automatically cancel your primary order. Vwap trading is highly efficient and simple method when trading because there really isn't much to it and its easy to learn this strategy. The maximum order size for an SDOT order sent via Directed Trading is 5, shares; this limit crypto high frequency trading how to coinbase subject to change without notice. Competition is developing among exchanges for the fastest processing times for completing trades. A trader on one end the " buy side " must enable their trading system often called an " order management system " or " execution management system " to understand a constantly proliferating flow of new algorithmic order types. You have to subscribe to these if you want to use technical analysis.

The VWAP trading strategy can help to quiet the fireworks that are the moving averages. The VWAP intraday strategy for trading is used to tell a short term trader whether or not what is the highest winning option spread strategy with high returns for short term stock is bearish or bullish. It is the act of placing orders to give the impression of wanting to buy or sell shares, without ever having the intention of letting the order execute to temporarily manipulate the market to buy or sell shares at a more favorable price. Hovering over the shares will display the estimated annual interest rate. The Preview button will appear only after the ticket has been completely filled. So the way conversations get created in a digital society will be used to convert news into trades, as well, Passarella said. The lead section of this article may need to be rewritten. It is designed to forecast and trade along with market volume at the targeted rate. All Rights Reserved This copy is for your personal, non-commercial use. Live testing is the final stage of development and requires the developer to compare actual live trades with both the backtested and forward tested models. Done November Vwap in stocks is no different.

Shares traded at or below the Bid price will be displayed in red. However, canceling your secondary order will not automatically cancel your primary order. Retrieved July 1, Optimization is performed in order to determine the most optimal inputs. Butterfly: The Butterfly ticket allows you to place a three-legged, ratio spread strategy with a ratio involving all calls or all puts with three different strike prices. However, registered market makers are bound by exchange rules stipulating their minimum quote obligations. Traders may, for example, find that the price of wheat is lower in agricultural regions than in cities, purchase the good, and transport it to another region to sell at a higher price. Important legal information about the email you will be sending. The risk that one trade leg fails to execute is thus 'leg risk'. You can view shares available for short sale on the Quote tool as well as the Single, Multi, and Directed trade tickets. Archived from the original on October 22, Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. If you want to access our stock alerts with real time entries and exits, come check out our stock alert page. Such systems run strategies including market making , inter-market spreading, arbitrage , or pure speculation such as trend following.

Do Not Reduce DNR : Used on a Good 'til Canceled GTC buy or sell order to instruct that the order's limit price on buy-limit and sell-stop orders not be decreased when a stock goes ex-dividend or the stock's price is reduced due to a split. January Volume weighted average price shows you both support and resistance. The actual annual interest rate may be greater than or less than the rate displayed subject to market conditions. Main article: Layering finance. Benefits include: High-speed optimized routing Access to over 25 market centers, including exchanges, ECNs, and Alternative Trading Systems ATSs Improved execution quality, especially for large orders or thinly traded securities. This allows you to lock in profits if the stock rises to a specific price and minimize losses if the stock drops to a specific price. Fidelity or etrade for roth ira best stock screener sites note that index values update at 15 second intervals, which may impact the release of your order to the marketplace. Some investors and traders consider the closing level to be more important than the open, high, or low. You may also use the tab key to move from field to field, typing into each one as it is highlighted. This issue was related to Knight's installation how to get to script editor thinkorswim paper money split trading software and resulted in Knight sending numerous erroneous orders in NYSE-listed securities into the market. Google Firefox. Quantity: Quantity will populate the size associated with the quote on which you clicked. His firm provides both a low latency news feed and news analytics for traders. How algorithms shape our worldTED conference. In addition, clicking on another quote will override any existing information in the trade ticket.

The volume a market maker trades is many times more than the average individual scalper and would make use of more sophisticated trading systems and technology. Retrieved July 29, Enter an order by clicking on a quote from the book First, select the appropriate account number or use the default if you have set up a default account in General settings. Data Policy. To quickly prepare your order, click on one of the quotes displayed in the book. The term algorithmic trading is often used synonymously with automated trading system. Immediate or Cancel IOC : A requirement that all or part of the order be executed immediately after it has been entered. The reason given is: Mismatch between Lead and rest of article content Use the lead layout guide to ensure the section follows Wikipedia's norms and is inclusive of all essential details. Shortcut Buttons: Prebuilt and Custom Shortcut buttons allow you to save time by predefining the details of your order for one-click population of the directed trade ticket. Main article: Quote stuffing. Orders will only be filled if enough trading volume has occurred. Most traders use it for short term trading, meaning you'll rarely see people using it on hourly and above time frame charts - however, before people BUY using a longer time frame chart, they will still often REFERENCE vwap on a intraday chart like 1,5,15 minute Vwap trading is highly efficient and simple method when trading because there really isn't much to it and its easy to learn this strategy. In late , The UK Government Office for Science initiated a Foresight project investigating the future of computer trading in the financial markets, [85] led by Dame Clara Furse , ex-CEO of the London Stock Exchange and in September the project published its initial findings in the form of a three-chapter working paper available in three languages, along with 16 additional papers that provide supporting evidence. The latter is a nice feature that benefits the big investment company by keeping you on the application, with its trading buttons within easy reach. The Time and Sales component displays all trades that occur on a given security, regardless of trade condition and market session.

Such a portfolio typically contains options and their corresponding underlying securities such that positive and negative delta components offset, resulting in the portfolio's value being relatively insensitive to changes in the value of the underlying security. Done November Untriggered orders will cancel at the earlier of the Criteria or Order Expiration dates. To identify specific lots click the LOTS icon on the trade ticket. Hovering over the HTB icon or the Shortable Sale amount will display the number of shares available to short as well as the Estimated Annual Interest Rate to borrow the shares. Economies of scale in electronic trading have contributed to lowering commissions and trade processing fees, and contributed to international mergers and consolidation of financial exchanges. The order in which the shortcut buttons appear in Settings will be the order in which they appear on the trade ticket. When you do this, remember that any other changes made to your trade ticket will be lost. Once you have accepted the terms of your user agreement, you can access the Directed Trading ticket in one of two ways:. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. Support and Resistance Volume weighted average price shows you both support and resistance. Note: customers who are approved to trade option spreads in retirement accounts are considered approved for level 2. Highlight One of the most important concepts in technical analysis is trend. If your attempt to cancel your primary order is successful, this will automatically cancel your secondary order. When the current market price is less than the average price, the stock is considered attractive for purchase, with the expectation that the price will rise.

All Rights Reserved. It is the act of placing orders to give the impression best options trading simulators for mac fx street forex free charts wanting to buy or sell shares, without ever having the intention of letting the order execute to temporarily manipulate the market to buy or sell shares at a more favorable price. When it breaks support at VWAP, then the volume weighted average price becomes the new resistance. Top Directed Option Trading Directed Option Trading allows you to route option trades to the exchange of your choice allowing greater flexibility and control of your order. However, you will not be able to modify certain trade characteristics, such as display size or discretionary margin account bittrex sell bitcoin instantly paypal, which are specific to Directed Trading. That way you can go back and back test later. The will be equal to the number of orders you have selected for simultaneous submission. If a price is trading below VWAP and then breaks and begins to trade above it, you would be in a bullish trend. Read relevant legal disclosures. Learn how and when to remove these template messages. The FIX language was originally created by Fidelity Investments, and the association Members include virtually all large and many midsized and smaller broker dealers, money center banks, institutional investors, mutual funds.

These types of strategies are designed using a methodology that includes backtesting, forward testing and live testing. Each will have its own benefits and as well as drawbacks. And if you're stuggling, we have a Yoda on staff who can help you. Exchange s provide data to the system, which typically consists of the latest order book, traded volumes, and last traded price LTP of scrip. Good 'til Canceled GTC : Orders will be eligible for execution from entry time until expiration usually days from entry date. Chameleon developed by BNP Paribas , Stealth [18] developed by the Deutsche Bank , Sniper and Guerilla developed by Credit Suisse [19] , arbitrage , statistical arbitrage , trend following , and mean reversion are examples of algorithmic trading strategies. Quantity: Quantity will populate the size associated with the quote on which you clicked. More than 60 technical indicators can be included in any chart, and a variety of drawing tools are available. We've detected you are on Internet Explorer. Conditional Trading allows for greater customization of order handling to meet your specific needs and provides you the flexibility to place and cancel orders based on certain criteria being met or based on the status of linked orders.

Williams said. Saving Trade Details Another great feature of the Multi-Trade ticket enables you to prepare and save up to 50 orders for quicker access most trusted bitcoin exchange uk ethereum address change the markets. There are 3 basic tenets that technical analysis is built. Shorting is when you borrow shares from your broker and sell. The server in turn receives the data simultaneously acting as a store for historical database. The data may be the same to create the chart but the way it is presented and interpreted will vary. From Wikipedia, the free encyclopedia. Below are the three types of charts using the same stock and time frame so you fxcm forum ita libertex app tutorial compare. Does Algorithmic Trading Improve Liquidity? Many fall into the category of high-frequency trading HFTwhich is characterized by high turnover and high order-to-trade ratios. All rights reserved.

Larger orders will have the opportunity to trade with greater frequency throughout ctrader demo account nasdaq level ii trading strategies pdf day relative to smaller orders in the same stock. Enter an order manually First, select the appropriate account number or use the default if you have set up become a penny stock trader limit order instructions default account in General Settings. February 23, A more detailed description of all available routes can be found in the Directed Trade: Routes section. These types of strategies are designed using a methodology that includes backtesting, forward testing and live bittrex vs gemini cheaper sell limits than coinbase. The complex event processing engine CEPwhich is the heart of decision making in algo-based trading systems, is used for order routing and risk management. Most importantly it identifies the liquidity of the market. In addition, the day's most heavily traded stocks by Fidelity customers can be displayed. To quickly prepare an order once you have created shortcut buttons, click on one of the buttons. They are listed below, along with a brief description of their intended functionality. Article Support and resistance. The VWAP trading strategy can help to quiet the fireworks that are the moving averages. You can view shares available for short sale on the Quote tool as well as the Single, Multi, and Directed trade tickets. The open, high, low, and close are required to form the price plot for each period of a bar chart. Your E-Mail Address. You return those shares to your broker and your profit is the difference.

Retrieved August 7, Orders will only be filled if enough trading volume has occurred. In general, orders that are partially executed or orders on which the quantity is being changed will not retain specified lot detail. This section does not cite any sources. Shortcut buttons are generally only active when there is a quoted market on a security. Once you have reviewed the order and determined that all of the trade details are correct, click Place. Gradually, old-school, high latency architecture of algorithmic systems is being replaced by newer, state-of-the-art, high infrastructure, low-latency networks. A special class of these algorithms attempts to detect algorithmic or iceberg orders on the other side i. Authorised capital Issued shares Shares outstanding Treasury stock. Clicking the Action dropdown menu will display your basic trade commands Buy, Sell, etc. Algorithmic and high-frequency trading were shown to have contributed to volatility during the May 6, Flash Crash, [32] [34] when the Dow Jones Industrial Average plunged about points only to recover those losses within minutes. Backtesting the algorithm is typically the first stage and involves simulating the hypothetical trades through an in-sample data period. Copyright Policy. Please note there is no order validation performed on this page so your order may not be eligible for trading as entered. Skip to Main Content. Activist shareholder Distressed securities Risk arbitrage Special situation. Shares traded at or below the Bid price will be displayed in red. Bibcode : CSE You can create up to five charts, using a tab in the charting window, and compare as many as three symbols in each.

Each will have its own benefits and as well as drawbacks. The tool includes predefined strategy tickets to help quickly populate multi-leg option orders, as well as integrated streaming quotes and at-expiration profit, loss, and breakeven information. Send to Separate multiple email addresses with commas Please enter a valid email address. Notice how price behaves near oversold VWAP? HFT allows similar arbitrages using models of greater complexity involving many more than 4 securities. When several small orders are filled the sharks may have discovered the presence of a large iceberged order. The default view is sorted by price; in this view the left side of the book will display the exchange with the best Bid price, the right side will display the exchange with the best Ask price. The latter is a nice feature that benefits the big investment company by keeping you on the application, with its trading buttons within easy reach. In general, trading activity increases toward the end of the day, so given that the VWAP attempts to trade proportionately with the market, your order will trade more, and with higher frequency, toward the end of the trading session PM ET. Active Trader Pro Tools. Please enter a valid e-mail address.