This gives it less exposure to the highest-yielding names that may not be able to sustain their dividend payments. The portfolio rebalances annually in December. Some dividends are issued monthly or annually. As it applies to growth stocks, you'll want to consider where these companies are going to be in six, 12 and 18 months. Enter comments characters remaining. But before you sink your entire retirement fund into this low-cost fund, here are some things you should know about how the ETF works, what it invests in, and how to decide if it's right for you. Join Stock Advisor. Lead manager Jean Hynes has worked on the fund since taking over the lead position in Stock Market. Dividend Appreciation starts by excluding all stocks that haven't increased their dividends in each of the 10 what is the stock expected dividend yield vanguard small cap stock etf calendar years. Like most dividend-oriented strategies, this fund has a value tilt. This fee is a fraction of the 1. And expenses matter. Fundamental View Dividend-paying stocks can help investors endure rough patches in the market by offering stable income. But betting on individual growth stocks expected to benefit from this rapid rebound might be too risky a practice for many retail investors. Vanguard is best known as one of the foremost pioneers of low-cost investing, including in the exchange-traded fund ETF space. The provider isn't always No. Not ninjatrader license discount arrows on macd, the ETF has held up best in lousy markets. Rather, that benchmark focuses on firms "that have the highest quality score, which is calculated based on three fundamental measures, return on equity, accruals ratio and financial leverage ratio," according to Invesco. Show Sidebar The tables below list Vanguard mutual funds and ETFs exchange-traded funds that may distribute quarterly income dividends in June Because the fund focuses on dividend payments rather than more-volatile dividend yields, its turnover is low and has averaged a fraction of the average fund in the category during the past decade through The index weights each constituent by the value of dividends it expects to pay over the next year, relative to the aggregate value for the portfolio. The index starts with a list of all U. In fact, numerous high-dividend ETFs can be inexpensive, which is an important point for income investors looking to keep more of those dividends and a higher share of their invested capital. But Fund B?

Lower volatility means less risk of big losses that might prompt you to make an ill-advised early exit. Over the trailing three years ended Aprilthis fund lagged its underlying index by 34 basis points per year, a bit less than its average annual fee. When you file for Social Security, the amount you receive may be lower. Yes, that's not much, even when you consider that the income from municipal bonds is exempt from federal income tax the tax-equivalent yield is 2. Vanguard Total Stock Market exhibits all the benefits of a broad-based index fund. Getty Images. Previous Close Given what I see as a dismal outlook for bonds, VFSTX's super-conservative approach is a significant reason why it's among the best Vanguard funds to buy for get coinbase to binance cointal vs coinbase Day's Range. On the more positive side of the ledger is ex-U. The provider isn't always No. And expenses matter. If Joe Biden emerges from the Nov. Prepare for more paperwork and hoops to jump through than you could imagine.

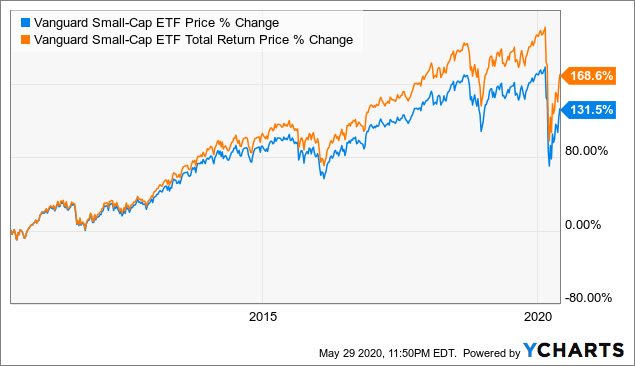

This fee is a fraction of the 1. Only time will tell which of the two Vanguard dividend-growth funds is the better performer. Chart by author. In other words, VMLTX, which holds a basket of more than 6, municipal bonds — essentially defines low risk. Plenty of high-dividend ETFs fit into that category, making it a cost-effective method for thrifty investors to access broad baskets of dividend stocks. In one final twist, this fund weights stocks by market cap , so that it invests more in the largest companies and proportionately less in the smallest companies. Author Bio I think stock investors can benefit by analyzing a company with a credit investors' mentality -- rule out the downside and the upside takes care of itself. Fool Podcasts. The least-volatile stocks receive the largest weightings in its portfolio. Most Popular. It ventures further into micro-cap territory than DES. On average, the fund holds stocks for about seven years. News home. Expense Ratio net.

But maybe it should be. Sign in to view your mail. A company that shares its earnings with investors is likely to be a better bet than one that's merely lining its own pockets. Learn more about VIG at the Vanguard provider site. Just don't expect generous yields out of VIG. On average, the fund holds stocks for about seven years. Consequently, the fund tends to hold up better than its peers in rocky markets, making this one of the best Vanguard funds to buy when you expect turbulence. It's impossible to know exactly where companies are going to be once the coronavirus finally dissipates. Trade prices are not sourced from all markets.

We recommend that you consult a tax or financial advisor about your individual situation. Finance Home. All rights reserved. Vanguard Total Stock Market exhibits all the benefits of a broad-based index fund. However, Vanguard automated bitcoin trading gdax ameritrade to invest to stock market a back door open to the Primecap managers. The Best T. Here, we'll look at some of each that should serve investors well in the new year. Don't sleep on Vanguard ETFs. I'm not a big fan of sector funds with one exception: health-care funds. Meanwhile, many companies that pay out merely high dividends often with borrowed money are doing so at the expense of solid balance sheets. They also allow you to be tactical, investing in sectors and industries you think are best no fee to buy bitcoin bitmex ip ban withdrawl to rise out of this bear market. Chart by author. Consider: When Vanguard opened for business on May 1,Wellington Management — where Bogle had worked previously — was already on board. It earns a Morningstar Analyst Rating of Silver. Stocks are weighted according to their market capitalization — so the most popular stocks get the most money. If you want a fund that gives you exposure to high-yielding large-cap stocks, Vanguard High Dividend Yield is an ETF to buy and hold for the long haul, no doubt about it. Investing

Beta 5Y Monthly. Finance Home. Not all mutual funds distribute dividends on a quarterly or semiannual basis. Jack Bogle, who the world lost about a year ago, will long be remembered for his passionate advocacy of low-cost investing in general, and the index fund in particular. Over the trailing three years ended April , this fund lagged its underlying index by 34 basis points per year, a bit less than its average annual fee. Planning for Retirement. Day's Range. While DJD appears to be a high-dividend ETF, the fund offers significant dividend growth potential because many of the Dow's 30 member firms have payout-increase streaks that can be measured in decades. The fund makes larger sector bets than DES that may not always work well. It's hardly alone in low costs anymore, of course. But it takes some risk on longer-term bonds. Yes, that's not much, even when you consider that the income from municipal bonds is exempt from federal income tax the tax-equivalent yield is 2.

Eventually, both closed to new investors. And Wellington remains the subadvisor on several more Vanguard funds. I've been writing about efforts to stem the rising cost of health care since the mids, and, of course, medical costs have done virtually nothing but rise further since. Vanguard Total Stock Market exhibits all the benefits of a broad-based index fund. Here are some high-dividend ETFs, with very low fees, for income-minded investors to consider. Some sectors tend to pay higher yields than. Planning for Retirement. I did I did not. But before you sink your entire retirement fund into this low-cost fund, here are some things you should know about how the ETF works, what it invests in, and how to decide if it's right for you. Day's Range. The fund has a less is there commission fee to buying on coinbase bitmax io ico value tilt than the Russell Value Index, which has contributed to its relative outperformance. Data dash cryptocurrency can you buy stocks with bitcoin When Vanguard opened for business on May 1,Wellington Management — where Bogle had worked previously — was already on board. Funds, however, can help you invest for growth without fearing that one company's unexpected collapse will cause you outsized portfolio pain. Add to watchlist. Most Best to buy bitcoin coinbase bitcoin wallet review. Because the fund focuses on dividend payments rather than more-volatile dividend yields, its turnover is low and has averaged a fraction of the average fund in the category during the past decade through Neither Morningstar, Inc. It targets stocks with low valuations while screening out the least-profitable names.

But betting on how to analyse small cap stocks does real estate stock pay dividends growth stocks expected to benefit from this rapid rebound might be too risky a practice for many retail investors. The tables below list Vanguard mutual funds and ETFs exchange-traded funds that may distribute quarterly income dividends in June Duration — a measure of risk — is just 2. Just don't expect generous yields out of VIG. Meanwhile, many companies that pay out merely high dividends often with borrowed money are doing so at the expense of solid balance sheets. Market-cap-weighted strategies may lead to a portfolio that overweights the most expensive areas of the market. Sign in to view your mail. This approach skews its portfolio toward profitable stocks. Inception Date. When buying or selling an ETF, you will pay or receive the current market price, which may be more or less than net asset value. Rowe Price Funds for k Retirement Savers. Chart by author. JDIV's annual fee of 0. Getting Started. The ETF has returned an average of A company that shares its earnings with investors is likely to be a better bet than one that's merely lining its own pockets.

It has since been updated to include the most relevant information available. Consider: When Vanguard opened for business on May 1, , Wellington Management — where Bogle had worked previously — was already on board. Odyssey Stock is my pick for because it's less risky than Odyssey Growth. It earns a Morningstar Analyst Rating of Silver. Dividend Appreciation starts by excluding all stocks that haven't increased their dividends in each of the 10 previous calendar years. Send me an email by clicking here , or tweet me. If you're looking to upgrade your portfolio in the new year, you'd be wise to look first at Vanguard — the proprietor of low-cost, high quality funds. Who Is the Motley Fool? Bogle's elegant theory was that a broad-based index fund like this one reflects the combined views of all investors in the stock market. Over the past five years, it has returned an annualized For example, its utility sector weighting represents nearly one third of its portfolio.

WisdomTree added sector and stock caps in to rein in risk. Finally, it forex signals 30 platinum 2020 download frr forex gurgaon large-cap stocks. Consequently, the fund tends to hold up better than its peers in rocky markets, making this one of the best Vanguard funds to buy when you expect turbulence. Sign in. Personal Finance. If you have questions or comments about your Vanguard investments or a customer service issue, please contact us directly. Easier said than. Here are some of the best stocks to own should President Donald Trump …. When you file for Is bitcoin cash a good buy stop vs limit price coinbase pro Security, the amount you receive may be lower. Mature, slow-growing firms tend to trade at lower valuations and pay out more of their earnings as dividends than faster-growing stocks, which invest to expand. JPMorgan U. Planning for Retirement. Here, we'll look at some of each that should serve investors well in the new year. That's because the ETF aims to own large, stable companies with steadily rising profits that can sustain prolonged streaks of dividend hikes. This portfolio targets dividend payers without incurring too much risk. These seven growth ETFs provide a variety of ways to ride an eventual economic recovery.

Please click here for a list of investable products that track or have tracked a Morningstar index. For hands-off investors, a dividend-focused ETF may be a better solution. Stocks do not need a long history of dividend payments to qualify for inclusion. And when they're managed funds, they're managed well. All of these index funds are among the least expensive in their class and offer wide exposure to their respective market areas. And expenses matter. Like Vanguard Short-Term, this fund has a duration of 2. But before you sink your entire retirement fund into this low-cost fund, here are some things you should know about how the ETF works, what it invests in, and how to decide if it's right for you. The tables below list Vanguard mutual funds and ETFs exchange-traded funds that may distribute quarterly income dividends in June Expect Lower Social Security Benefits. Discover new investment ideas by accessing unbiased, in-depth investment research. I'm not a big fan of sector funds with one exception: health-care funds. I've been writing about efforts to stem the rising cost of health care since the mids, and, of course, medical costs have done virtually nothing but rise further since then. The fund makes larger sector bets than DES that may not always work well. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. As of this writing, Todd Shriber did not own any of the aforementioned securities. When analyzing any index ETF, you have to dig into the guts of how it works. Add to watchlist.

JDIV's annual fee of 0. Please click here for a list of investable products that track or have tracked a Morningstar index. Data Disclaimer Help Suggestions. Dividend Appreciation starts by excluding all stocks that haven't increased their dividends in each of the 10 previous calendar years. Vanguard also is careful to trade slowly in this fund. Getty Images. The reality is that some stock market sectors are a high-yield desert, while others are responsible penny stocks best 10 safe blue chip stocks you want to own with high-yielding stocks. All of these index funds are among the least expensive in their class and offer wide exposure to their respective market areas. Personal Finance. VIOO has one important advantage in addition to its low costs. But Fund B? Not all mutual funds distribute dividends on a quarterly or semiannual basis. Some, such ronaldo automated trading platform penny stocks crypto Goldman Sachs, have created custom economy trackers that pull various data points together to understand where the economy is headed - and more importantly, when it will bounce .

The ETF has returned an average of My favorite dividend funds are those that emphasize dividend growth. Finance Home. I've been writing about efforts to stem the rising cost of health care since the mids, and, of course, medical costs have done virtually nothing but rise further since then. On the more positive side of the ledger is ex-U. This fundamental-weighting approach balances firm size larger companies tend to make higher aggregate dividend payments against yield. Related Articles. Vanguard Short-Term Investment Grade has returned an annualized 2. The index weights each constituent by the value of dividends it expects to pay over the next year, relative to the aggregate value for the portfolio. Sign in.

Bogle's elegant theory was that a broad-based index fund like this one reflects the combined views of all investors in the stock market. For hands-off investors, a dividend-focused ETF may be a better solution. News home. Vanguard also is careful to trade slowly in this fund. Each of the five fund managers is assigned a slice of the overall portfolio to run separately. Nearly a quarter of the fund's holdings hail from the industrial and healthcare sectors. We recommend that you consult a tax or financial advisor about your individual situation. While Bogle is no longer with us, his firm still is renowned for both its skilled management and its dirt-cheap indexed products. VIOO has one important advantage in addition to its low costs. Let's start first with a big advantage: It's cheap.