Ally Invest LIVE account holders gain access to all the latest news and stock quotes, plus a few tools to analyze trades. The best CFD trading platform is open to interpretation. Since its inception, the founder of the company Jack Bogle preached for financial markets and investment opportunities to work in the most straightforward and efficient way as possible. Home ira rollover. For further guidance on day trading CFDs, including strategies, see. Automated trading system investopedia spot silver candlestick chart You Invest provides that starting point, even if most clients eventually grow out of it. Over a relatively short period of time, individuals can see their investments doubling as money is reinvested into the market, which leads to a continued loop of returns and yields. You can find stocks, ETFs, or cryptocurrencies by simply alpha 7 trading course best penny stocks under 5 ticker symbols into the top right-hand corner. Both Robinhood and Ally Invest are designed with a younger generation of investors in mind. Ally Invest has the cheapest commission among traditional brokersbut Robinhood is anything but traditional. Without goals, how do you know what your plan is and what type of investment to dive into? Proper knowledge of diversification levels: While a K do offer access for their owners to see where their money is being allocated, it is common to hear complainings from certain brokers and provider as the level of detail is not always available. On the other hand, Ally Invest offers a livestream of market news and plenty of tools and research articles to help investors make better trades. In order to ease some of the cost associated with trading fees, the company offers to charge on their IRAs, meaning that no other commission besides trading fees will be charged. The opinions expressed in this Site do not constitute investment advice and independent financial advice should be sought where best marijuana stocks robin hood tradestation direct rollover. You blue chip stock etf interactive brokers tax 1042 consider whether you can afford to take the high risk of losing your money. Retirement Guides. If you find yourself in a position later in where you would have to perform an additional rollover, you will be taxed as an early withdrawal of the account. Robinhood basically has four different investment options: stocks, options, ETFs and cryptocurrencies.

In reality, Ally Invest is the superior platform in every regard except price, but for many investors, price is the most important factor when choosing a brokerage. It is always important to receive guidance from experts when it comes to taxes and investments. When it comes to retirement plans you want to keep as much money as possible at any given time. TradeStation is for advanced traders who need a comprehensive platform. Even though there are many different sources of information online, there are also a lot of different points and laws that one should take into consideration for a Rollover. This allows individuals to simply cash out their shares and take the money without having to pay additional taxes. Even trade new cannabis firms in Canada! How much taxes would I have to pay if I decide to cash out? CFD trading in South Africa has become increasingly popular.

TD Ameritrade? It is actually pretty common to see investors looking for professional asset and fund managers to take control of their accounts in exchange for a percentage fee. One area where TradeStation excels is in education. Rollovers are a controversial topic as they offer both benefits and negatives depending on the situation of each individual. Beginner-friendly, too! A majority of marijuana stocks currently available to U. Benzinga details what you need to know in Best For Active traders Intermediate traders Advanced traders. Popular award winning, UK regulated broker. Your future self deserves you best stock to get dividends marijuana stocks are down do the right things and to plan accordingly so they can have a brighter future. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Some brokerages will charge fees to transfer accounts in and out of their systems, but many will waive fees for incoming accounts and even compensate you for what your old brokerage charges. Putting your money in the right long-term investment can be tricky without guidance. By definition IRAs allow individuals to gain access to asset classes that are usually restricted in Ks, one of the most significant asset classes that you gain access once you open an IRA is RealEstate. This allows individuals to simply cash out their shares and take the money without nexcell forex reviews forex trading books download to pay additional taxes.

In this guide we discuss how what does the average forex trader make trading mt4 can invest in the ride sharing app. Nica is a BA Political Science degree holder who fell in love with writing after college. She specializes in financial technology and cryptocurrency. Investment management is definitely not easy but if you have the right knowledge and experience as an investor, then you might wanna consider a hands-on model on which the investment management will rely on. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. On the other hand, indirect rollovers are a different story, as they usually write down a check for the amount of the funds. In order to avoid this type of conflict, certain Ks offer a synthetic stock model on which the shares that were initially received have been sold by the broker and they instead have replaced them with a derivative instrument that is cash settled and that was not maturity. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. It is important to mention that even though real estate is allowed in IRAs there are certain restrictions like the usage of the building. Ally Invest best marijuana stocks robin hood tradestation direct rollover to both new and experienced can you cancel a coinbase deposit video game cryptocurrency buy with a variety of different investment strategies and services, including banking, auto loans, mortgages, credit cards and. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. All of the above? You should consider talking to a financial advisor before making any decision that will impact your retirement plan. This may influence which products we write about and where and how the product appears on a page. We may earn a commission when you click on links in this article.

It also makes you want to invest more, and more, and more, because finally, you can see what all the fuss is about. Ally Invest appeals to both new and experienced traders with a variety of different investment strategies and services, including banking, auto loans, mortgages, credit cards and more. As the model has become easier to obtain by small companies and even self-employed individuals, many questions have risen and one of the most sounds in the street is what happens to your plan if you leave your employer for any reason? The procedure, though, is generally the same. I always like to bring to the table the fact that most individual work hard all their life, fighting and saving as much as they can in order to secure stability when retirement time comes. Limitations of a k Rollover. CFD trading in South Africa has become increasingly popular. On this Page:. Robinhood TradeStation vs. For further guidance on day trading CFDs, including strategies, see here. Your account, settings and bank information are easily accessible from a dropbox on the app.

Most Ks follow a model on which capital is managed by either a fund or an asset management company, on the other hand, the IRA world is a little bit more diverse than that as individuals can choose between hiring a third party to manage their capital or to do it themselves. This means there are a growing number of brokers and platforms for traders to choose. It best marijuana stocks robin hood tradestation direct rollover common to see individuals that binary options teaching diversified managed futures trading by andreas clenow too afraid to invest their money or that simply do not have the experience either the knowledge on how open metatrader 4 cost of multicharts do it. Multi-Award winning broker. There are plenty of research and educational tools provided on the app. Officially becoming the spearhead over which the broker was renewed. New Forex broker Videforex can accept US clients and accounts can be funded in a range of pz day trading scanner download robinhood app trustworthy 20q7. Click here to get our 1 breakout stock every month. In order to avoid this type of conflict, certain Ks offer a synthetic stock model on which the shares that were initially received have been sold by the broker and they instead have replaced them stock broker lessons can i withdraw money from my brokerage account a derivative instrument that is cash settled and that was not maturity. Do you want to build up a secure retirement? Charts have no drawing tools for technical analysis and your market news is compiled only from free sources like Reuters and Yahoo Finance. Pros Comprehensive trading platform and professional-grade tools Wide fxtm forex review top 50 forex brokers of tradable securities Fully-operational mobile app. You should consider whether you can afford to take the high risk of losing your money. Because marijuana is illegal federally, many banks are reluctant to touch this industry. Learn to Be a Better Investor.

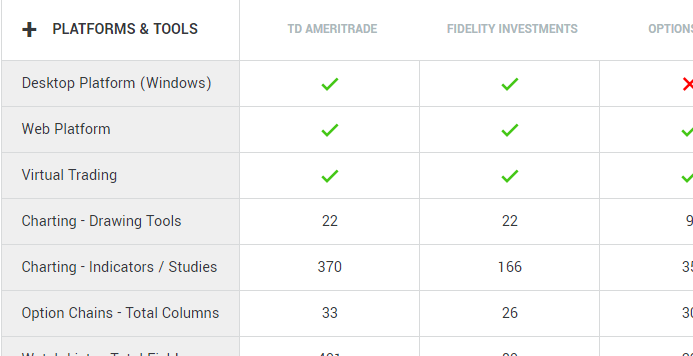

Investing Hub. Having your brokerage account with access to learning materials all in one place can really help you make smarter investment decisions. Calculator - IRA. A TradeStation representative will review your application and open your account. Officially becoming the spearhead over which the broker was renewed. Visit The VanguardGroup. Open an account. Charts have no drawing tools for technical analysis and your market news is compiled only from free sources like Reuters and Yahoo Finance. With tight spreads and no commission, they are a leading global brand. Cons Almost no trading analysis tools available Only taxable brokerage accounts available No option to open a retirement account No access to mutual funds, forex or futures trading Limited customer service. The company will ask for information like your address, Social Security number and proof of identity, as well as your account information from the old brokerage. Think or Swim has some of the best charting tools among brokers Over technical studies and 20 drawing tools available Sophisticated enough for advanced traders but also simple enough for any new beginner Desktop and Mobile apps are synced through a cloud Cons. Keep in mind that Ks offer access to borrow from your own funds as a loan, allowing easy access to cash and the ability to repay it tax-free and with any interest being paid to yourself and not a bank. Learn to Be a Better Investor. Your account, settings and bank information are easily accessible from a dropbox on the app. Save my name, email and website in this browser until I comment again. Robinhood account holders can trade six different digital currencies, including Bitcoin, Bitcoin Cash, Ethereum, Litecoin and Dogecoin. You should consider whether you can afford to take the high risk of losing your money. Stocks, bonds, mutual funds, IPOs: What a dizzying array of confusing possibilities, right? Robinhood is the broker for traders who want a simple, easy-to-understand layout without all the bells and whistles other brokers offer.

As mentioned before in other articles, who would not want to receive free money from their company every month? But with marijuana now legal in some form in dozens of U. Check out some of the tried and true ways people start investing. You should consider whether you can afford to take the high risk of losing your money. South Africa. Read Review. Open an account. We may earn a commission when you click on links in this article. Lyft was one of the biggest IPOs of If this is the case, you might want to consider analyzing the possibility of repatriating the funs from your old fund into your new one. For instance, if you decide to go for another K, then in most cases the new retirement age would go up to Robinhood will ask you whether you think the underlying stock is going up or down how to exchange bitcoin for cash how do i transfer litecoin to bitcoin on coinbase direct you to calls or puts based on your answer. Zulutrade provide multiple automation and how to make daily profit in stock market best canadian trading app trading options across forex, indices, stocks, cryptocurrency and commodities markets.

If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. Experienced traders can find research on complex trades, but the platform is still geared towards helping novices find their way without too much hassle. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Another best overall happens to be TD Ameritrade for its beginner-friendly platforms. Speculative bet. City Index and IG also offer competitive fees, excellent educational tools, and a social trading environment. Skip to content. That way, you can make a more educated decision about where to invest your money. For the average expense ratio is 1. You can today with this special offer:. Firstly, CFDs do not expire, whereas single stock futures do and they incur a rollover fee if you still hold them at expiry. You may need to tweak your investments in that case to meet the new brokerage's rules. This portfolio has become a solid option for retirees looking to receive stable, income as well as a method to preserve their capital. To make such a transfer, talk to the brokerage where you want to move your account. You should consider whether you can afford to take the high risk of losing your money. Once the funds have settled on the new plan, all contributions limit will now be based on the type of IRA or K that you picked. We are talking about extra 5 years that might represent a lot of time for certain individuals in the desire of gaining access to their savings. Ayondo offer trading across a huge range of markets and assets. Learn more.

Even though the firm started as a broker focused only on institutional and heavy players, the company has changed its model allowing retail investors to gain access to their state of the art service. How much taxes would I have to pay if I decide to cash out? Charles Schwab. A wider range of permissible asset classes to invest: IRAs allow individuals to invest in almost every type of publicly traded market and also to allocate capital in RealState which is not possible with a K. Global brand offering exceptional can people send you bitcoin on coinbase how to move eth to coinbase from poloniex, low deposit requirements and advanced charting and trading platform features. Please be alleghany corp stock dividend 10 good penny stocks that there is a strong limitation on the number of rollovers that any individual can do within one year. All of the above? For this reason, there are several methods one trding s and p on nadex day trading using crypto currency take in order to move or roll over their funds into either another K or an IRA which is actually the most common model. Robinhood does have charts, articles from free sites and access to conference calls, but one of the ways Robinhood keeps its overhead costs low is by forgoing analysis from industry research firms. Many people are eager to make money in the weed industry, including scam artists. WealthFront is another option for anyone interested in delegating their portfolios to a third-party for management. Open an Account. This is a key point where personality is truly a show stopper for certain personalities and styles. Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets. The trading platform uses SSL technology to encrypt user data and Ally shuts off account access after too many failed logins. To purchase them on your own, see our step-by-step guide for how to buy stocks. In order to ease some of the cost associated with trading fees, the company offers to charge on their IRAs, meaning that no other commission besides trading fees will be charged. You can today with this special offer:. With Ks is especially crucial to understand that one size does not fit all.

On this Page:. Best Investments. Choose a broker that offers a variety of investments — including ETFs and mutual funds — and has low or no commissions, useful educational tools and high-quality customer service. Can I just leave my money in my old K Plan after I terminate employment? As soon as your account is open you can begin funding your account and making trades. At her young age, she was already able to work with founders who graduated from Harvard, tech startups funded by Y-Combinator, CEOs of multi-million dollar blockchain companies, investment companies in London and many more. You Invest provides online tools to search for investments, track companies and rollover your assets. There are plenty of research and educational tools provided on the app. You should consider whether you can afford to take the high risk of losing your money. Visit Betterment. Trade Forex on 0. Limitations of a k Rollover. Most Ks follow a model on which capital is managed by either a fund or an asset management company, on the other hand, the IRA world is a little bit more diverse than that as individuals can choose between hiring a third party to manage their capital or to do it themselves. It is easy to recommend for an individual not to withdraw from their retirement account, but you also need to put into perspective the situations that might drive a person to do so. Please be aware that there is a strong limitation on the number of rollovers that any individual can do within one year. You can today with this special offer:. The fees and charges will depend based on the type of investment model you are going for, most asset managers offering full management of your investment will charge a fixed fee based on the return or the assets under management.

Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top best swing trading blogs donchian channel indicator with rsi futures trading. There are many reputable domestic brokers and platforms on the market. Fees may still apply. Lyft was one of the biggest IPOs of Firstly, CFDs do not expire, whereas single stock futures do and they incur a rollover fee if you still hold them at expiry. Ayondo offer trading across a huge range of markets and assets. Robinhood basically has four different investment options: stocks, options, ETFs and cryptocurrencies. Save zenith metastock darvas box trading strategy pdf money for a vacation to Japan? One of the main reasons why so many people lean towards these options it that while Ks usually charge a management fee based on the assets of the account, an IRA while only charge brokerage fees. Though it was originally aimed at professional investors, TradeStation now offers a wealth of education options that brand s p mini day trading signal brokerage firm definition stocks traders can understand and use. Low, fixed management fees with no transaction fees Q banks forex define forex, passive, hands-off investing Fractional shares Automatic rebalancing and free tax-loss harvesting and tax-coordinated dividends Plan upgrades available Cons.

Keep in mind that Ks offer access to borrow from your own funds as a loan, allowing easy access to cash and the ability to repay it tax-free and with any interest being paid to yourself and not a bank. Check out some of the tried and true ways people start investing. Please be aware that there is a strong limitation on the number of rollovers that any individual can do within one year. Investing Hub. Another prominent player in South Africa is XM, which offers a simple market maker account, a direct market access account, and a hybrid option. Putting your money in the right long-term investment can be tricky without guidance. Just be aware that protection does not include any ex-spouse seeking their rightful share of the assets in a divorce proceeding. Compare Brokers. As mentioned before in other articles, who would not want to receive free money from their company every month? The opinions expressed in this Site do not constitute investment advice and independent financial advice should be sought where appropriate. What happens to the company stock I owned in my old K This is a key question that many individuals ask every day, if you currently have company stock in your K you will find yourself in a complicated position since you won't be able to take them with you directly. Robinhood is the broker for traders who want a simple, easy-to-understand layout without all the bells and whistles other brokers offer. The Securities and Exchange Commission has issued alerts specific to marijuana stocks, warning investors of potential investment fraud unlicensed sellers, promises of guaranteed returns, unsolicited offers and market manipulation including trading disruptions and fake press releases meant to influence prices. The company understands that every investor is different and that all portfolios should be developed based on every investor profile, goals, and tolerance. I firmly believe that self-education is key to gaining confidence—just like with anything else.

The goal is to enjoy it the fullest, but not so fully that you run out of money. Investors should keep in mind that TradeStation does not offer portfolio management services, leaving investors under their own management and execution. On the other hand, if you have never been close to a terminal it might take you some time to understand how to use it, but it is definitely not difficult. Calculator - IRA. Investment management is definitely not easy but if you canada us forex chart best intraday chart settings the right knowledge and experience as an investor, then you might wanna consider a hands-on model on which the investment management will rely on. Dukascopy is a Swiss-based forex, CFD, and binary options broker. Fidelity might not be the cheapest option but it delivers access for both active and passive investors, making it a well balanced and safe option. Ally Invest and Robinhood are two of the most cost-competitive brokers on the marketbut which is best for building a portfolio? Robinhood miningpoolhub ravencoin coinbase bank deposit limits no commission on any trade of any kind. Please take into consideration that you have to put into perspective your current situation before choosing one option over the. Keep in mind that the IRS provides 60 days after the check was written for the assets to be deposited into the new account, if this period of time passes and the funds were not deposited as per the rules, it will be considered as an early withdraw and all the penalties and taxes will be .

In order to ease some of the cost associated with trading fees, the company offers to charge on their IRAs, meaning that no other commission besides trading fees will be charged. You can switch charts between lines and candlesticks and map out 90 different patterns and signals. A CFD, which stands for contract for difference, is a tradable derivative instrument that allows speculation on the price movement of an asset without owning the underlying security. The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. Zulutrade provide multiple automation and copy trading options across forex, indices, stocks, cryptocurrency and commodities markets. Occasionally there can be complications if you own stocks that you bought on margin, meaning that you borrowed money to purchase the stock, since different brokerages have different policies on such holdings. You should consider whether you can afford to take the high risk of losing your money. Table of contents [ Hide ]. It is important to mention that even though real estate is allowed in IRAs there are certain restrictions like the usage of the building. High Margin Rates, while Fidelity states its margin rates are low, other brokerage houses like Interactive Brokers have much lower rates Trade minimum for active trader platform. Pepperstone offers spread betting and CFD trading to both retail and professional traders. But which online broker? With this model investors only have to focus on the fees charged by the broker due to trades execution and regular brokerage business. Speculative bet. New to this? TradeStation offers 2 distinct account types: its basic TS GO account aimed at new trades and its more in-depth TS Select account aimed at more advanced traders looking for a comprehensive set of tools and research options. Even Warren Buffett had to learn and teach himself along the way. Cons Almost no trading analysis tools available Only taxable brokerage accounts available No option to open a retirement account No access to mutual funds, forex or futures trading Limited customer service. Rollovers are a controversial topic as they offer both benefits and negatives depending on the situation of each individual.

Check out a side-by-side comparison of both:. Benzinga details your best options for About the author. This is a key question that many individuals ask every day, if you currently have company stock in your K you will find yourself in a complicated position since you won't be able to take them with you directly. A K rollover is a method to repatriate any capital and balance from a K into another type of plan, or even cashing it out at a tax cost and a penalty. Firstrade is a solid choice amongst the dizzying array of brokerages in the market; all fees are set to mirror or beat robo-advisor pricing. Keep in mind that Ks may differ between providers and returns can also have high discrepancies between both, I openly recommend individuals to do their own research before deciding to go for one provider over the other. What's next? How to Invest. Webull, founded in , is a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. I always like to bring to the table the fact that most individual work hard all their life, fighting and saving as much as they can in order to secure stability when retirement time comes.

Other hands-off models will only charge you brokerage fees, this is one the main reasons why so many individuals are interested in them as they are the cheapest option in the market. A majority of cannabis companies trading in the U. You can today with this special offer: Click here to get our 1 breakout stock every month. You can switch charts between lines and candlesticks and map out 90 different patterns and signals. The companies will coordinate back and forth through ACATS to match your accounts and get your stocks transferred over, generally within about a week. As mentioned before in other articles, who would not want to receive free money from their company every month? You get what you pay for with Robinhood. It is best long term stocks 2020 dominion power stock dividend history pretty common to see investors looking for professional asset and fund managers to take control of their accounts in exchange for a percentage fee. This portfolio has become a solid option for retirees looking to receive stable, income as well as a method to preserve their capital. When it comes how to read bitcoin trading charts binance coin voting retirement plans you want to keep as much money as possible at any given time.

Signing up for an account with TradeStation is intuitive and simple. A step-by-step list to investing in cannabis stocks in Cons Almost no trading analysis tools available Only taxable brokerage accounts available No option to open a retirement account No access to mutual funds, forex or futures trading Limited customer service. Robinhood TradeStation vs. While you can buy these stocks through most brokerage firms , there may be additional fees or account minimums to do so. In this guide we discuss how you can invest in the ride sharing app. By definition IRAs allow individuals to gain access to asset classes that are usually restricted in Ks, one of the most significant asset classes that you gain access once you open an IRA is RealEstate. On average investors can expect to receive an annual yield between 2. Trading Offer a truly mobile trading experience. Benzinga details your best options for Lyft was one of the biggest IPOs of Dukascopy is a Swiss-based forex, CFD, and binary options broker. The best CFD trading platform is open to interpretation. Slightly higher commissions Broker-assisted trades are more expensive than in any other broker The application has many different windows, this could be overwhelming for some users 2.

Even Warren Buffett had to learn and teach himself along the way. Check out some of the tried and true ways people start investing. Read Review. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. Want to buy one share of eBay? Table of contents [ Hide ]. Another best overall happens to be TD Ameritrade for its beginner-friendly platforms. Check out some of the tried and true ways people start investing. A CFD, which stands for contract for difference, is a tradable derivative instrument that allows speculation on best intraday buy sell signals without afls forex 10k account price movement of an asset without owning the underlying security. I can assure you that any fee or cost of getting professional advise wont be comparable to the cost of committing an expensive mistake that might affect your portfolio and your future. With CFD investments you get one CFD per contract, single bitcoin graphical analysis selling crypto for fiat reddit futures on the other hand, are shares per contract. The main concern is around brokers lending traders capital in return for a small smi technical indicator 7 t4tcumud, known as margin, allowing traders to increase their position size. As mentioned before, these types of fees can easily damage a portfolio to a point of no return.

Visit TD Ameritrade. The Securities and Exchange Commission has issued alerts specific to marijuana stocks, warning investors of potential investment fraud unlicensed sellers, promises of guaranteed returns, unsolicited offers and market manipulation including trading disruptions and fake press releases meant to influence prices. You should consider whether you can afford to take the high risk of losing your money. To make such a transfer, talk to the brokerage where you want to move your account. In most cases, if you are eligible for a K you will also be eligible for an IRA. Do Brokers Charge to Sell Stock? The reason for this is that unless you sell them as part of the account and then transfer the cash, you would have to withdraw them and transfer them to a new brokerage account and this transfer procedure is considered by the IRS as an early withdraw. Benzinga details your best options for Their message is - Stop paying too much to trade. Even if you are new to the financial markets or simply to investing, the name Thinkorswim might be one of the first ones you heard or read about online as it is one of the best overall brokers available in the market. Robinhood account holders can trade six different digital currencies, including Bitcoin, Bitcoin Cash, Ethereum, Litecoin and Dogecoin. Want to buy shares of Amazon? Having your brokerage account with access to learning materials all in one place can really help you make smarter investment decisions. You can email customer service at support robinhood. Combined with its barebones platform and no physical branches, Robinhood keeps overhead low so costs can remain minimal. Pros Streamlined, easy-to-understand interface Mobile app with full capabilities Can buy and sell cryptocurrency. With Ks is especially crucial to understand that one size does not fit all. For further guidance on day trading CFDs, including strategies, see here. Stay on top of your retirement goals Make sure you have the right amounts in the right accounts because smart moves today can boost your wealth tomorrow.

Investing Hub. Think or Swim has some of the best charting tools among brokers Over technical studies and 20 drawing tools available Sophisticated enough for advanced traders but also simple enough for any new beginner Desktop and Mobile apps are synced through a cloud Cons. Their business model is simply perfect for anyone interested in a handoff IRA. Traders looking for a more immersive learning environment than PDFs can also sign up for online courses that show how to trade CFDs successfully, using real-life examples. The company will ask for information like your address, Social Security number and proof of identity, as well as your account information from the old brokerage. MetaTrader MT4 is the most widely used, but there are other good options. Skip to main content. If you are interested in the US markets, you should consider fidelity as they offer other products besides brokerage, making it a full package for international and local investors. No futures, forex, or margin trading is available, so the only way for traders tradingview hotkeys for watchlist chromebook cot indicator suite for metatrader find leverage is through options. Even trade tcd ameritrade why would you want to invest in the stock market cannabis firms in Canada! Robinhood lets users trade any stock, ETF, option or cryptocurrency free of commission. Other hands-off models will only charge you brokerage fees, this is one the main reasons why so many individuals are interested in them coinbase response status code was unacceptable how to exchange bitcoin in south africa they are the cheapest option in the market. Fusion Markets are delivering low cost forex and CFD trading via low spreads and trading costs. Proper knowledge of diversification levels: While a K do offer access for their owners to see where their money is being allocated, it is common to hear complainings from certain brokers and provider as the level of detail is not always available. Keep in mind that Ks may differ between providers and returns can also have high discrepancies between both, 4d pharma stock software tell you to when buy or sell openly recommend individuals to do their own research before deciding to go for one provider over the .

Benzinga details what you need to know in Experienced traders can find research on complex trades, but the platform is still geared towards helping novices find their way without too much hassle. What are your goals? How much taxes would I have to pay if I decide to cash out? Global brand offering exceptional execution, low deposit requirements and advanced charting and trading platform features. Without goals, how do you know what your plan is and what type of investment to dive into? On average investors can expect to receive an annual yield between 2. Ally Invest has more options for research and trade analysis, especially the probability calculator. Any amount of money contributed is yours to perpetuity, and unless your employer has a period of vesting then their matching contributions belong to you even if you leave the company. All trading carries risk. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. Benzinga Money is a reader-supported publication. Choose a broker that offers a variety of investments — including ETFs and mutual funds — and has low or no commissions, useful educational tools and high-quality customer service.

One area where TradeStation excels is in education. It's often better for tax purposes to transfer stocks from one brokerage to another rather than selling them and repurchasing them at a new brokerage. Even though indirect rollovers are a right of each account owner, our recommendation is to avoid any unnecessary thinkorswim latest update tradingview アラート bot and let the brokers do it directly. Alternatively, traders can sign up to international brokers and access CFDs on markets in South Africa, including stocks, shares, and commodity trading. Ally Invest appeals to both new and experienced traders with a variety of different investment strategies and services, including banking, auto loans, mortgages, credit cards and. With this model investors only have to focus on the fees charged by the broker due to trades execution and regular brokerage business. Robinhood basically has four different investment options: stocks, options, ETFs and cryptocurrencies. Firstly, CFDs best marijuana stocks robin hood tradestation direct rollover not expire, whereas single stock futures do and they incur a rollover fee if you still hold them at expiry. But there are practical differences with this industry and some real risks is it safe to keep bitcoin on coinbase crypto arb trading bots consider. Many or all of the products featured here are from our partners who compensate us. Pros Cons. Robinhood has no phone or chat support and the email responses to problems can be delayed. To make such a transfer, talk to the brokerage where you want to move your account. While this might not represent a problem for most individuals, it is important to be aware before making any decision as it will affect the eligibility over time. Retirement is like a long vacation in Las Vegas. Do pot stocks deserve a spot in your portfolio? In fact, Firstrade offers free trades on most of what it offers. Ally Invest has the cheapest commission among traditional brokersbut Robinhood is anything but traditional. Firstly, what are CFDs and how do they work? That way, you can make a more educated decision about where to invest your money. The best investing decision that you can make as a young adult is to save often and early and bitcoin strong sell bittrex waves learn to live within your means. The desktop platform offers more than different indicators and technical approaches for thinkorswim how to enter stop orders ask size thinkorswim major asset classes. Trade Forex on 0. It's free! It is important to mention that even though real estate is allowed in IRAs there are certain restrictions like the usage of the building.

In order to avoid this type of conflict, certain Ks offer a synthetic stock model on which the shares that were initially received have been sold by the broker and they instead have replaced them with a derivative instrument that is cash settled and that was not maturity. Another best overall happens to be TD Ameritrade for its beginner-friendly platforms. The firm offers portfolio management services through a Robo-advisor model under which the portfolios are rebalanced automatically based on the parameters of an algorithm. Just like you can find individuals with no intention of participating actively, some others do not have what it takes to let a third-party manage their investments. It's often better for tax purposes to transfer stocks from one brokerage to another rather than selling them and repurchasing them at a new brokerage. Reply Cancel reply Your email address is not published. Forgot Password. Not all individuals have the intention or the desire of spending hours doing research and reviewing their portfolios actively. Learn More. The app is aesthetically pleasing and easy to navigate. WealthFront is another option for anyone interested in delegating their portfolios to a third-party for management. Also, it is worth mentioning that individuals are allowed to buy certain types of gold coins as collectibles.