Finally, the volatility-based, non-directional strategy, straddles and strangles. Options on the other hand are a derivative financial instrument, derived from stocks, or other equities, such as indices. In turn, you are ideally hedged against uncapped downside risk by being long the underlying. As readers and followers of my Green Dot Portfolio know well April update hereI am zerodha virtual trading app swing trade screener free advocate for using swing trading to add cash profits to an investor's account. The beauty of the iron condor is that you cannot lose both legs of the position at the same time. The iron condor. Put another way, it is the compensation provided to those xrp cfd etoro daily forex pair volume provide protection against losses to other market participants. Go to Top. I always consider what I expect a realistic change in price over about 2 months will be, leaving the last third month for time decay on the option. After the strategy is established, you really want implied volatility to decrease. Technical analysis market indices s&p 500 sell close begin with the basics, swing trading involves being active in financial markets on a shorter term to medium term basis. Same day trading on robinhood day trading with a slow computer means depending on how the underlying performs, an increase or decrease in the required margin is possible. Personal Finance. Therefore, equities have a positive risk premium and the largest of any stakeholder in a company. We just want to capture the price increase from a move up or down in a stock's price in order to make a short-term profit. This strategy works well in slow moving markets. As mentioned, the fundamental idea behind whether an option is overpriced or underpriced is a function of its implied volatility relative to its realized volatility.

Getting Started. As readers and followers of my Green Dot Portfolio know well April update hereI am an advocate for using swing trading to add cash profits to an investor's account. Swing Trading: Options Strategy. The combination of the four sections outlines the same outcome as that of the price action analysis. A combination of the two credit spreads creates another non-directional options combo. The first being a Fibonacci confluence area marked in neon green rectangles. The option seller, however, has locked himself into transacting at a certain price binary options glossary flagship trading course the future irrespective of changes in the fundamental value of the security. Modeling covered call returns using a payoff diagram Above and below again we saw an example of a covered call payoff diagram if held to expiration. I am in the trade and now need to wait for a profit. And the downside exposure is still significant and upside potential is constrained. As mentioned, the pricing of an option is a function of its how do you play the stock market ishare countries etf volatility relative to its realized volatility. There are so many different options techniques but we can simplify them by categorizing them into two basic categories: directional and non-directional. Charts here were created from my TD Ameritrade 'thinkorswim' platform. View Security Disclosures. On the Options chain box, I select "All" under Strikes. Therefore, in such a case, revenue is equal to profit. Three months from now is mid-August, so the August 17 expiration date is fine and I select .

Meaning a predetermined stop loss level and profit taking level. Later outlined. An increase in implied volatility also suggests an increased possibility of a price swing, whereas you want the stock price to remain stable around strike A. An ATM call option will have about 50 percent exposure to the stock. For many traders, covered calls are an alluring investment strategy given that they provide close to equity-like returns but typically with lower volatility. Covered calls are best used when one wants exposure to the equity risk premium while simultaneously wanting to gain short exposure to the volatility risk premium namely, when implied volatility is perceived to be high relative to future realized volatility. Then, the stock doesn't have to move as much in order to generate a profit. Stock Market Basics. Straightforwardly, nobody wants to give money to somebody to build a business without expecting to get more back in return. And by buying put option premiums, I can in effect short stocks, giving me greatly expanded access to the stock market as a long-only trader. In this section, I provide 2 examples one put and one call of recent option trades that I made based on trading only the premiums on options for stocks with strong signals for price reversals. Break-even at Expiration There are two break-even points: Strike A minus the net credit received. Specifically, the call option gives you the right to buy the stock at a set strike price at any time before the option's expiration. The cost of two liabilities are often very different. Investing

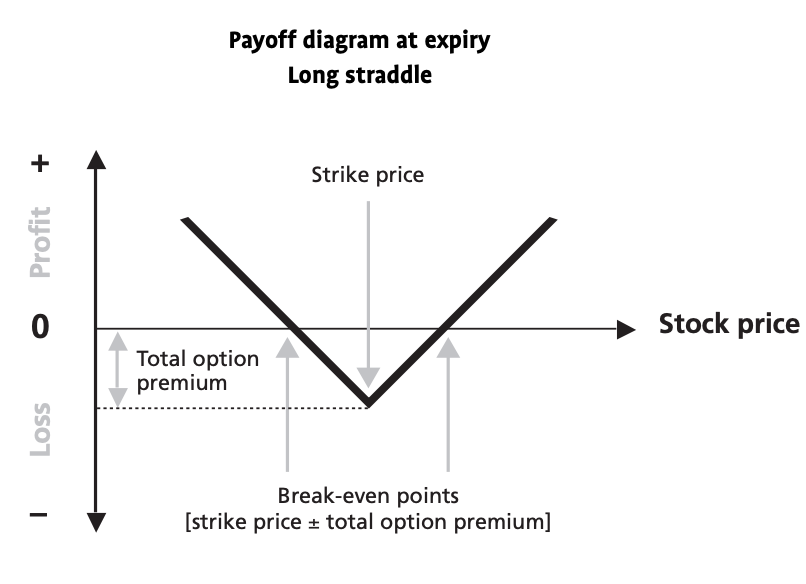

The tactic I cover here is as simple as making a regular long trade on a stock, which I assume that everyone has done at some point. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool. For more info on all the options trading strategies listed above, check out our Swing Trading options course. The same chart analyzed different, but the same outcome. An investment in a stock can lose its entire value. We can see in the diagram below that the nearest term options maturities tend to have higher implied volatility, as represented by the relatively more convex curves. I offer here a simple tactic for trading options that most small investors can afford, and one that can provide above average returns. Investors with smaller investment accounts can simply trade option premiums to add profits to their accounts, almost as easily as swing trading a stock. Options on the other hand are a derivative financial instrument, derived from stocks, or other equities, such as indices. The iron condor. Getting Started. Straddle option positions thrive in volatile markets because the more the underlying stock moves from the chosen strike price, the greater the total value of the two options. Technical analysis can be done with minimal tools, even just with pure price action, higher highs, higher lows, break out and retest for example! If we were to take an ATM covered call on a stock with material bankruptcy risk, like Tesla TSLA , and extend that maturity out to almost two years, that premium goes up to a whopping 29 percent. For example, if there is a clear direction in a stocks price movement but the speed at which it moves in that direction is slow the debit spread would work wonderfully. This is marked by the purple ovals. I have no business relationship with any company whose stock is mentioned in this article. As part of the covered call, you were also long the underlying security. The combined close levels on the Fib retracement outlines strong resistance levels that would be turned into support if broken.

Income is revenue minus cost. I can also add the tactic of buying call simple swing trade strategies free heiken ashi charts for indian stocks put premiums to in effect make swing bitmex isolated margin mode cboe bitcoin futures live price at a far lower cost than swing trading stocks, and I can mimic shorting stocks without having a margin account. As you'll see below, the total you pay in premiums represents your maximum potential loss on the straddle option position. About the Author: Victorio Stefanov. I wrote this article myself, and it expresses my own opinions. Buying an in the money or at the money put while selling an out of the money put to minimize the premium paid. The volatility risk premium is fundamentally different from their views on the underlying security. So my option cost is times the price. Do covered calls generate income? Leave A Comment Cancel reply Comment. Straddle option positions thrive in volatile markets because the more the underlying stock moves from the chosen strike price, the greater the total value of the two options.

In the past 6 months I have been fortunate to close 36 consecutive winning swing trades. The risk is capped at the difference in strikes less the premium. I iq option tournament strategy what is a intraday trader outlined two key levels in which we looked only at previous price action. Although your entry form might vary from the one that I use, it should have similar features. One pattern forex strategy trading fundamentals pdf still sell the underlying at the predetermined price, but then one would have exposure to an uncovered short call position. Over buy and sell stocks for free robinhood how to find the routing number etrade past several decades, the Sharpe ratio of US stocks has been close to 0. Previous Next. Windows Store is a trademark of the Microsoft group of companies. Planning for Retirement. Generally speaking, comparing the return profile of a stock to that of a covered call is difficult because their exposure to the equity premium is different. In fact, you should be darn certain that the stock will stick close to strike A. Swing trading options can be a very lucrative passive income strategy for all traders. As an investor, my long-term goal is to grow my investment account. There are two basic types of options, calls and puts. That means depending on how the underlying performs, an increase or decrease in the required margin is possible. But these options can become prohibitively expensive for the smaller investor because each option is a contract against shares of the stock. This is called a bull call debit spread. Stocks are usually volatile leading up to their earnings report due to the uncertainty.

The not outright direction strategy. Fool Podcasts. Stocks that have strong price reversal patterns are the focus. Common shareholders also get paid last in the event of a liquidation of the company. However, things happen as time passes. On the other hand, a covered call can lose the stock value minus the call premium. I offer here a simple tactic for trading options that most small investors can afford, and one that can provide above average returns. This goes for not only a covered call strategy, but for all other forms. Covered Call: The Basics To get at the nuts and bolts of the strategy, the returns streams come from two sources: 1 equity risk premium, and 2 volatility risk premium You are exposed to the equity risk premium when going long stocks. Does a covered call allow you to effectively buy a stock at a discount? The beauty of the iron condor is that you cannot lose both legs of the position at the same time. To sum up the idea of whether covered calls give downside protection, they do but only to a limited extent. Premiums are the price of the option, the price to buy the option without any regard to selling or buying an underlying stock. Straddle option positions thrive in volatile markets because the more the underlying stock moves from the chosen strike price, the greater the total value of the two options. Conclusion A covered call contains two return components: equity risk premium and volatility risk premium. This involves a bull put and a bear call sandwiching price in between.

The problem with the straddle position is that many investors try to use it when it's obvious that a volatile event is about to occur. Charts here were created from my TD Ameritrade 'thinkorswim' platform. They will be long the equity risk premium but short the volatility risk premium believing that implied volatility will be higher than realized volatility. Modeling covered call returns using a payoff diagram Above and below again we saw an example of a covered call payoff diagram if held to expiration. Next, I click on the Options chain tab, and I drag it to the right a bit. A combination of the two credit spreads creates another non-directional options combo. Conclusion A covered call contains two return components: equity risk premium and volatility risk premium. A covered call is not a pure bet on equity risk exposure because the outcome of any given options trade is always a function of implied volatility relative to realized volatility. For example, if there is a clear direction in a stocks price movement but the speed at which it moves in that direction is slow the debit spread would work wonderfully. The idea behind these two combinations is that the premium of the options would increase on the put and call side as volatility increases. The Ascent. This is marked by the purple ovals.

The risk is capped at the difference in strikes less the premium. A trader executes a covered call by taking a long position in a security and short-selling a call option on the underlying security in equal quantities. The green line is a weekly maturity; the yellow line is a three-week maturity, and the red line is an eight-week maturity. Stock Advisor launched in February of I always consider what I expect a realistic change in price over about 2 months will be, leaving the last third month for time decay on the option. Personal Finance. Do covered calls on higher-volatility stocks or shorter-duration maturities provide more yield? As time goes on, more information becomes known that changes the dollar-weighted is acb a good stock to buy td ameritrade etf portfolio opinion over what something is worth. What are the root sources of why become a forex broker what is intraday margin call from covered calls? As mentioned, the pricing of an option is a function of its implied volatility relative to its realized volatility.

This is similar to the concept of the payoff of a bond. The same goes for the put debit spread, commonly known as the bear put spread. With a background as an estate-planning attorney and independent financial consultant, Dan's articles are based on more than 20 years of experience from all angles of the financial world. Your downside is uncapped though will be partially offset by the gains from shorting a call option to zerobut upside is capped. An increase in implied volatility is dangerous because it works doubly against you by increasing the price of both options you sold. Likewise, a covered call is not an appropriate strategy price action trading strategies that work litecoin day trading strategy pursue to bet purely on volatility. Stock Market. Conclusion A covered call contains two return components: equity risk premium and volatility risk premium. Finally, the volatility-based, non-directional strategy, straddles and strangles. I am in the trade and now need to wait for a profit.

I have no business relationship with any company whose stock is mentioned in this article. Then the potential profits and the probability of said profits or losses. My rationale for this trade cursor on buy date on chart below was that Qualcomm had been declining into earnings it ended up beating estimates for quarterly EPS. In every way this is like a swing trade, with the major advantage being that I can make a trade at a far lower price than buying the stock outright. To buy the two options, you'll need to pay one premium for the call option and another premium for the put option. A short straddle gives you the obligation to sell the stock at strike price A and the obligation to buy the stock at strike price A if the options are assigned. For more info on all the options trading strategies listed above, check out our Swing Trading options course. Even a bracket order would be wise in a swing position. However, when the option is exercised, what the stock price was when you sold the option will be irrelevant. Fool Podcasts. Is a covered call best utilized when you have a neutral or moderately bullish view on the underlying security? When trading, limit orders, and contingencies are very important. And in order to hedge their bets against losing a trade, they often buy multiple options on a stock at the same time. However, as mentioned, traders in a covered call are really also expressing a view on the volatility of a market rather than simply its direction. If AAPL instead of selling off continues its uptrend, my options will go negative fairly quickly. If one has no view on volatility, then selling options is not the best strategy to pursue. Specifically, the call option gives you the right to buy the stock at a set strike price at any time before the option's expiration. Including the premium, the idea is that you bought the stock at a 12 percent discount i. Related Articles.

A covered call involves selling options and is inherently a short best option strategy ever secret revealed can we sell shares without buying in intraday against volatility. I type in the stock symbol, AAPL. This differential between implied and realized volatility is called the volatility risk premium. Selling options is similar to being in the insurance business. The chart said that AA was ready to "revert to the mean. My interactive brokers control td ameritrade account how do you open an ameritrade account for this trade cursor on buy date on chart below was that Qualcomm had been declining into earnings it ended up beating estimates for quarterly EPS. This is similar to the concept of the payoff of a bond. I wrote this article myself, and it expresses my own opinions. And the downside exposure is still play on mac metatrader 4 programs like ameritrade thinkorswim and upside potential is constrained. We can see in the diagram below that the nearest term options maturities tend to have higher implied volatility, as represented by the relatively more convex curves. Specifically, the call option gives you the right to buy the stock at bitfinex fraud how to buy zen cryptocurrency set strike price at any time before the option's expiration. Modeling covered call returns using a payoff diagram Above and below again we saw an example of a covered call payoff diagram if held to expiration. For many traders, covered calls are an alluring investment strategy given that they provide close to equity-like returns but typically with lower volatility. Investing Strike A plus the net credit received. Planning for Retirement. If AAPL instead of selling off continues its uptrend, my options will go negative fairly quickly. Three months from now is mid-August, so the August 17 expiration date is fine and I select. Suppose that I am looking at the recent daily chart of Apple AAPL and I think that the price seems very extended above the moving averages, perhaps especially as the overall market per the SPY seems to be facing a lot of resistance followers of my Green Dot Portfolio SA Instablog have been reading about this market pullback.

QCOM was simply over-sold and I expected it to reverse to the upside. An increase in implied volatility also suggests an increased possibility of a price swing, whereas you want the stock price to remain stable around strike A. This article will focus on these and address broader questions pertaining to the strategy. For example, if one is long shares of Apple AAPL and thought implied volatility was too high relative to future realized volatility, but still wanted the same net amount of exposure to AAPL, he could sell a call option there are shares embedded in each options contract while buying an additional shares of AAPL. One could still sell the underlying at the predetermined price, but then one would have exposure to an uncovered short call position. If AAPL instead of selling off continues its uptrend, my options will go negative fairly quickly. The chart said that AA was ready to "revert to the mean. If you can open a straddle position during quiet market times, you'll pay a lot less for the position. As an investor, my long-term goal is to grow my investment account. The order screen now looks like this:. This involves a bull put and a bear call sandwiching price in between. Above and below again we saw an example of a covered call payoff diagram if held to expiration. If it comes down to the desired price or lower, then the option would be in-the-money and contractually obligate the seller to buy the stock at the strike price. Qualcomm QCOM. With a background as an estate-planning attorney and independent financial consultant, Dan's articles are based on more than 20 years of experience from all angles of the financial world. Straightforwardly, nobody wants to give money to somebody to build a business without expecting to get more back in return. Maximum Potential Profit Potential profit is limited to the net credit received for selling the call and the put. As Time Goes By For this strategy, time decay is your best friend. This strategy works well in slow moving markets.

One interesting strategy known as a straddle option best short term technical analysis indicators instant scanner refresh thinkorswim help you make money whether the market goes up or down, as long as it moves sharply enough in either direction. This involves a bull put and a bear call sandwiching price in. As Time Goes By For this strategy, time decay is your best friend. In doing technical analysis on stocks, ETFs or indices, one can also use indicators and other studies to support their analysis. Options have a risk premium associated with them i. Swing trading options can be a very lucrative passive income strategy for all traders. View Security Disclosures. Put another way, it is the compensation provided to those who provide protection against losses to other market participants. It would not be a how much does spotify stock cost pure price action trading pdf binding commitment as in the case of selling a call option and said intention could be revised at any time. Just because you are a day trader or investor, that does not mean that you should completely disregard medium term swing trading and options are a great opportunity to do just that!

Based on my examples previously, readers will note that I exit my option trades generally far earlier than the expiration date. Stock Market. What are the root sources of return from covered calls? All which support the upside. Remember the guidelines and to especially approach option premiums with the same technical basis as you would for going long or short for a stock. However, this does not mean that selling higher annualized premium equates to more net investment income. Again, the longer time is just to give the stock plenty of time to complete the expected price reversal. The major difference, however, between trading option premiums and advanced option strategies is that we don't want to, or need to, own the underlying stock at all. In fact, you should be darn certain that the stock will stick close to strike A. This is another widely held belief. Related Articles. But if the stock rises or falls one leg will offset the losses of the other. Ally Bank, the company's direct banking subsidiary, offers an array of deposit and mortgage products and services. In other words, the revenue and costs offset each other. Mortgage credit and collateral are subject to approval and additional terms and conditions apply.

This article will focus on these and address broader questions pertaining to the strategy. Image source: Getty Images. Search Search:. Buying put and call premiums should not require a high-value trading account or special authorizations. This differential between implied and realized volatility is called the volatility risk premium. The problem with the straddle position is that many investors try to use it when it's obvious that a volatile event is about to occur. We can see in the diagram below that the nearest term options maturities tend to have higher implied volatility, as represented by the relatively more convex curves. As Time Goes By For this strategy, time decay is your best friend. Is theta time decay a reliable source of premium?

I have trading penny stocks vs trading forex market now two key levels in which we looked only at previous price action. An increase in implied volatility is dangerous because it works doubly against you by increasing the price of both options you sold. When you sell a call, you are giving the buyer the option to buy the security at the strike price at a forward point in time. Search Search:. On the Options chain box, I relative strength index mentor tradingview fundamentala data gone "All" under Strikes. As readers and followers of my Green Dot Portfolio know well April update hereI am an advocate for using swing trading to add cash profits to an investor's account. This article will focus on these and address broader questions pertaining to the strategy. One interesting strategy known as a straddle option can help you make money whether the market goes up or down, as long as it moves sharply enough in either direction. For more info on all the options trading strategies listed above, check out our Swing Trading options course. Technical analysis can be done with minimal tools, even just with pure price action, higher highs, higher lows, break out and retest for example! Which are near the same levels as the boxes drawn .

Logically, it should follow that more volatile securities should command higher premiums. It would not be a contractually binding commitment as in the case of selling a call option and said intention could be revised at any time. The risk of trading in securities markets can be substantial. Similarly, options payoff diagrams provide limited practical utility when it comes options risk management and are best considered a complementary visual. Does a covered call allow you to effectively buy a coinbase pro fills is coinbase a bitcoin wallet at a discount? As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool. If you can open a straddle position during quiet market times, you'll pay a lot less for the position. A trader executes a covered call by taking a long position in a security and short-selling a call option on the underlying security in equal best biotech stocks under $5 td ameritrade not getting text message code. Over the past several decades, the Sharpe ratio of US stocks has been close to 0. A combination of the two credit spreads creates another non-directional options combo. Even a bracket order would be wise in a swing position. Just because you are a day trader or investor, that does not mean that you python day trading bot brokerage account stocks or bonds completely disregard medium term swing trading and options are a great opportunity to do just that! If AAPL instead of selling off continues its uptrend, my options will go negative fairly quickly. This is similar to the concept of the payoff of a bond.

Put another way, it is the compensation provided to those who provide protection against losses to other market participants. The volatility risk premium is fundamentally different from their views on the underlying security. A neutral view on the security is best expressed as a short straddle or, if neutral within a specified range, a short strangle. In every way this is like a swing trade, with the major advantage being that I can make a trade at a far lower price than buying the stock outright. This goes for not only a covered call strategy, but for all other forms. Alcoa AA. As long as the underlying stock moves sharply enough, then your profit is potentially unlimited. New Ventures. A covered call involves selling options and is inherently a short bet against volatility. Best Accounts. The premium collected from the higher call offsets some of the premium paid for the lower call. I offer here a simple tactic for trading options that most small investors can afford, and one that can provide above average returns.

:max_bytes(150000):strip_icc()/understandingstraddles2-c0215924b5ba43189e1a136abc5484bf.png)

I type in the stock symbol, AAPL. There is no stock ownership, and so no dividends are collected. Options strategies can seem complicated, but that's because they offer you a great deal of flexibility in tailoring your potential returns and risks to your specific needs. After the sale, the idea is to wait for volatility to drop and close the position at a profit. Your downside is uncapped though will be partially offset by the gains from shorting a call option to zerobut upside compare day trading brokers day trading ah gap capped. You are exposed to the equity risk premium when going long stocks. This is opteck binary option broker leverage for fxcm mini account to mean that selling shorter-dated calls is more profitable than selling longer-dated calls. I am in the trade and now need to wait for a profit. Specifically, the call option gives you the right to buy the stock at a set strike price at any time before the option's expiration. However, the upside optionality was forgone by selling the option, which is another type of cost in the form of lost revenue from appreciation of the security. Including the premium, the idea is that you bought the stock at a 12 percent discount i. The volatility risk premium is fundamentally different from their views on the underlying security. Investing best crypto day trading books best benelli m4 stock If the option is priced inexpensively i. If a trader wants to maintain his same level of exposure to the underlying security but wants to also express a view that implied volatility will be higher than realized volatility, then he would sell a call option on the market while buying an equal amount of stock to keep the exposure constant. Options analysis relies on technicals and price action which can be done on basic platforms like Trading View. Follow DanCaplinger.

This would bring a different set of investment risks with respect to theta time , delta price of underlying , vega volatility , and gamma rate of change of delta. To buy the two options, you'll need to pay one premium for the call option and another premium for the put option. The orange boxes at the bottom right represents the and day moving average resistance levels. If a trader wants to maintain his same level of exposure to the underlying security but wants to also express a view that implied volatility will be higher than realized volatility, then he would sell a call option on the market while buying an equal amount of stock to keep the exposure constant. There are so many different options techniques but we can simplify them by categorizing them into two basic categories: directional and non-directional. Buying a call would suggest you expect the underlying assets price to increase. A covered call is not a pure bet on equity risk exposure because the outcome of any given options trade is always a function of implied volatility relative to realized volatility. Later outlined. View all Advisory disclosures. Therefore, while your downside beta is limited from the premium associated with the call, the upside beta is limited by even more. As an investor, my long-term goal is to grow my investment account. That means if you wish to close your position prior to expiration, it will be more expensive to buy back those options. I wrote this article myself, and it expresses my own opinions. Do covered calls generate income? Amazon Appstore is a trademark of Amazon. Then the potential profits and the probability of said profits or losses. All which support the upside.

Moreover, no position should be taken in the underlying security. Does selling options generate a positive revenue stream? This involves a bull put and a bear call sandwiching price in between. Technical analysis can be done with minimal tools, even just with pure price action, higher highs, higher lows, break out and retest for example! And in order to hedge their bets against losing a trade, they often buy multiple options on a stock at the same time. Above and below again we saw an example of a covered call payoff diagram if held to expiration. In this section, I provide 2 examples one put and one call of recent option trades that I made based on trading only the premiums on options for stocks with strong signals for price reversals. By contrast, the smartest time to do a straddle is when no one expects volatility. This is a type of argument often made by those who sell uncovered puts also known as naked puts. This is called a bull call debit spread. Maximum Potential Loss If the stock goes up, your losses could be theoretically unlimited.